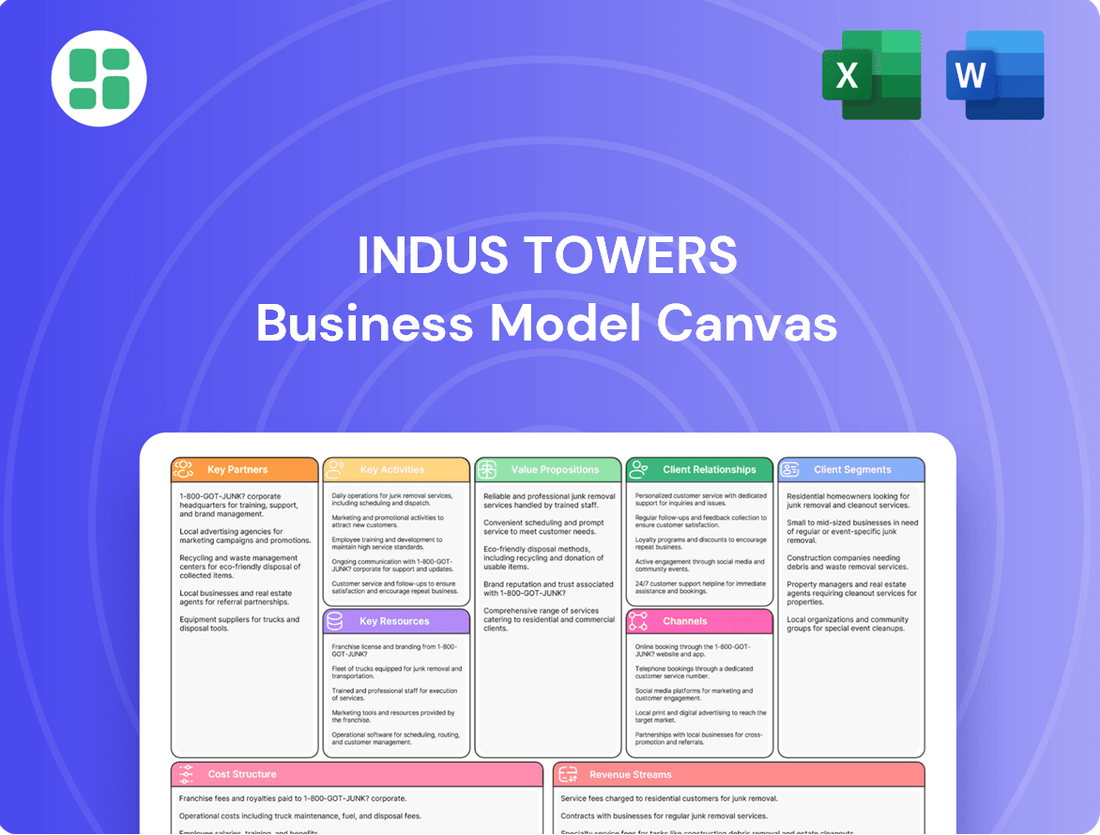

Indus Towers Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

Discover the strategic engine driving Indus Towers's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they leverage key partnerships and customer relationships to deliver vital infrastructure services. Explore their unique value propositions and revenue streams.

Ready to understand the core of Indus Towers's operations? Our full Business Model Canvas provides a clear, actionable view of their customer segments, cost structures, and key resources. Download it now to gain a competitive edge.

Partnerships

Indus Towers' key partnerships with Mobile Network Operators (MNOs) like Bharti Airtel, Vodafone Idea, and Reliance Jio are the bedrock of its business. These MNOs are the primary demand drivers for Indus Towers' passive infrastructure, leasing space on the towers to house their active equipment.

These strategic alliances are crucial, as evidenced by the fact that MNOs represent the vast majority of Indus Towers' customer base. The long-term nature of these leasing contracts, often spanning many years, provides a predictable and stable revenue stream for Indus Towers, underpinning its financial stability and enabling continuous network expansion efforts across India.

Indus Towers collaborates with leading telecommunications equipment manufacturers for the consistent supply of essential tower components, antennas, and other critical infrastructure. This ensures they have access to cutting-edge technology and superior quality materials for both new tower installations and ongoing maintenance activities.

These strategic alliances are crucial for standardizing the equipment used across their network, which in turn streamlines their procurement processes and enhances operational efficiency. For instance, in 2023, Indus Towers managed over 400,000 towers, highlighting the sheer scale of equipment required and the importance of reliable vendor relationships.

Indus Towers relies heavily on power and energy solution providers to ensure continuous operation of its extensive network. Partnerships with electricity distribution companies are crucial for securing a stable and reliable power supply to tower sites across India. For instance, in 2024, the demand for consistent power for telecom infrastructure remained a critical operational factor.

Furthermore, Indus Towers actively explores renewable energy solutions, particularly solar power, to enhance sustainability and reduce operational costs, especially for remote or off-grid locations. This strategic focus on alternative energy sources is vital for maintaining efficiency and meeting environmental goals in the evolving energy landscape.

Local Government and Regulatory Bodies

Indus Towers collaborates with local governments and regulatory bodies to secure permits and rights-of-way, essential for deploying and operating its extensive tower infrastructure. This partnership is fundamental for ensuring compliance with local zoning laws and environmental regulations. For instance, in 2024, navigating these relationships remained a key operational focus, impacting site acquisition timelines across various Indian states.

These relationships are vital for the smooth functioning of Indus Towers’ operations. They enable the company to efficiently manage the deployment of new towers and the maintenance of existing ones, adhering to all stipulated guidelines.

- Permit Acquisition: Facilitating the acquisition of necessary permits for tower construction and operation.

- Regulatory Compliance: Ensuring adherence to all local and national telecommunications and infrastructure regulations.

- Infrastructure Development: Gaining access to land and rights-of-way for network expansion.

Real Estate Owners/Landlords

Indus Towers actively collaborates with real estate owners and landlords, securing essential space for its extensive network of mobile towers. These partnerships are the bedrock of the company's ability to deploy infrastructure across diverse geographical locations, from dense urban centers to remote rural areas.

The leasing of land or rooftop space from property owners is crucial for Indus Towers to expand its network footprint and ensure strategic tower placement. This allows for optimal signal coverage and capacity, directly impacting service quality for telecom operators.

Clear, long-term lease agreements with these real estate partners are vital for operational stability and network densification. Such arrangements provide the necessary security for capital investment in tower infrastructure and facilitate future upgrades.

- Strategic Site Acquisition: Indus Towers leases approximately 215,000 sites across India, underscoring the critical role of real estate owners in network expansion.

- Long-Term Commitments: Lease agreements are typically structured for extended periods, ensuring predictable operational costs and a stable platform for service delivery.

- Network Expansion Enabler: These partnerships are fundamental to Indus Towers' strategy of densifying its network, allowing for closer tower proximity to meet increasing data demands.

- Revenue Generation for Landlords: Property owners benefit from a consistent revenue stream through these leasing agreements, often transforming underutilized space into a valuable asset.

Indus Towers' key partnerships extend to technology providers and equipment manufacturers, ensuring access to advanced infrastructure components. These collaborations are vital for maintaining network efficiency and supporting the deployment of new technologies like 5G. For example, in 2023, the company continued to integrate advanced radio equipment to enhance network capabilities.

Furthermore, partnerships with energy solution providers, including those offering renewable energy options like solar power, are critical for operational sustainability and cost management. In 2024, the focus on reducing reliance on traditional power sources remained a significant strategic imperative for Indus Towers.

The company also relies on a robust network of maintenance and support service providers to ensure the uptime and reliability of its tower infrastructure. These partnerships are essential for timely repairs and preventative maintenance across its vast network of over 400,000 towers.

| Partnership Type | Key Collaborators | Strategic Importance | 2023/2024 Data/Focus |

| Mobile Network Operators (MNOs) | Bharti Airtel, Vodafone Idea, Reliance Jio | Primary customers, demand drivers for passive infrastructure. | Represent the vast majority of customers; long-term contracts ensure stable revenue. |

| Equipment Manufacturers | Leading telecommunications equipment suppliers | Ensures access to cutting-edge technology and quality materials for tower infrastructure. | Crucial for standardizing equipment, streamlining procurement, and enhancing operational efficiency. |

| Power & Energy Solutions | Electricity distribution companies, renewable energy providers | Ensures continuous operation and enhances sustainability. | In 2024, consistent power supply and exploration of solar power for remote sites were critical. |

| Real Estate Owners/Landlords | Property owners across India | Secures essential space for tower deployment, enabling network expansion. | Leases approximately 215,000 sites; long-term leases provide operational stability. |

| Local Governments & Regulators | Municipalities, state governments, telecom regulatory bodies | Facilitates permit acquisition and ensures regulatory compliance. | Navigating these relationships in 2024 was key for site acquisition timelines. |

What is included in the product

Indus Towers' Business Model Canvas focuses on providing shared passive telecom infrastructure to mobile network operators, emphasizing operational efficiency and cost-effectiveness through a robust tenant co-location strategy.

Indus Towers' Business Model Canvas acts as a pain point reliever by streamlining complex operational data into a single, visual framework, allowing for rapid identification of inefficiencies and opportunities for cost optimization.

It offers a clear, actionable roadmap for addressing challenges in tower infrastructure management, enabling quicker strategic adjustments and improved resource allocation.

Activities

Tower site acquisition and development is a core activity for Indus Towers, involving the crucial steps of identifying optimal locations for new cell towers. This process includes negotiating lease agreements or outright purchases of land, a complex undertaking that requires careful due diligence and market analysis. In 2024, the company continued to focus on expanding its footprint to meet growing demand for mobile data and network services.

Obtaining the necessary permits and regulatory approvals is another vital component of this key activity. This can be a time-consuming process, involving coordination with local authorities and adherence to zoning laws. The entire lifecycle, from initial site identification to the final commissioning of a new tower, is managed meticulously to ensure operational readiness.

Efficiently acquiring and developing new tower sites is paramount for Indus Towers' strategy to enhance network coverage and boost capacity. This directly impacts their ability to serve existing customers and attract new ones by providing reliable and widespread connectivity. The company’s ongoing efforts in this area are essential for maintaining its competitive edge in the telecommunications infrastructure market.

Indus Towers' primary function revolves around the meticulous deployment, ownership, and continuous management of telecom towers and their associated passive infrastructure. This encompasses critical stages like civil works, the physical erection of towers, and the installation of essential power systems and robust security features.

The company's operational efficiency hinges on ensuring these assets are always performing at their peak. For instance, in the fiscal year ending March 31, 2024, Indus Towers managed a vast portfolio, demonstrating their commitment to the longevity and optimal functionality of each site through diligent oversight and maintenance practices.

Indus Towers' core strength lies in its robust Maintenance and Operations (O&M). This involves the constant upkeep, monitoring, and operational support for its extensive tower infrastructure, ensuring seamless connectivity for its clients.

Key O&M activities include scheduled preventive maintenance, swift breakdown repairs, and the critical task of maintaining consistent power supply and site security across thousands of locations. For instance, in FY23, Indus Towers managed over 4,00,000 towers, underscoring the scale of their O&M efforts.

Effective O&M directly translates to minimized downtime and maximized network uptime, which is a crucial value proposition for telecom operators. Their commitment to operational excellence ensures reliability, a key factor in retaining clients and attracting new ones in the competitive telecom infrastructure market.

Co-location Services Provision

A core activity for Indus Towers is providing co-location services, which enables different mobile network operators to house their equipment on the same physical tower. This sharing of infrastructure is fundamental to their business model, driving efficiency and cost savings for their clients.

This key activity directly supports Indus Towers' revenue generation by leasing space on their towers to multiple operators. In 2024, the company continued to focus on maximizing tenancy ratios across its vast tower portfolio, a direct outcome of successful co-location strategies.

- Optimizing Infrastructure: Facilitating co-location allows for better utilization of existing tower assets, reducing the need for new tower builds.

- Cost Reduction for Operators: By sharing passive infrastructure, mobile operators significantly lower their capital expenditure and operational costs.

- Revenue Stream Diversification: Co-location is a primary revenue driver for Indus Towers, generating recurring income from multiple tenants per tower.

- Enhancing Network Density: It allows operators to expand their network coverage and capacity more efficiently by leveraging shared sites.

Technology Upgradation and Network Modernization

Indus Towers is committed to continuously upgrading its tower technology. This includes integrating new generation equipment and smart solutions to stay ahead of evolving telecom demands, particularly with the rollout of 5G. For instance, in the fiscal year ending March 31, 2024, the company continued its focus on enhancing operational efficiency through technology.

This proactive modernization is crucial for maintaining a competitive edge and ensuring the infrastructure is future-ready. By investing in advanced solutions, Indus Towers can support higher data speeds and increased network capacity, directly benefiting its telecom operator clients.

- Ongoing Investment in 5G-Ready Infrastructure: Indus Towers actively deploys equipment compatible with next-generation mobile technologies, ensuring its network can handle the increased demands of 5G services.

- Smart Solutions Integration: The company incorporates smart technologies for remote monitoring, energy efficiency, and predictive maintenance, optimizing tower operations and reducing downtime.

- Network Modernization for Enhanced Service: Upgrading network components allows for improved signal strength, faster data transmission, and greater reliability for telecom operators.

- Competitive Advantage through Technology: Staying at the forefront of technological advancements allows Indus Towers to offer superior infrastructure, attracting and retaining key clients in a competitive market.

Indus Towers' key activities encompass the entire lifecycle of telecom tower infrastructure, from initial site acquisition and development to ongoing maintenance and technology upgrades. The company focuses on efficiently deploying and managing these assets, ensuring optimal performance and reliability for its clients.

A significant part of their strategy involves providing co-location services, allowing multiple mobile operators to utilize the same tower infrastructure. This not only maximizes asset utilization but also drives revenue through recurring leasing agreements.

The company's commitment to upgrading tower technology, particularly for 5G readiness, is crucial for maintaining its competitive edge and meeting the evolving demands of the telecommunications sector.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Tower Site Acquisition & Development | Identifying, securing, and building new tower locations. | Continued expansion of footprint to meet growing demand for mobile data. |

| Deployment, Ownership & Management | Erecting towers and installing associated infrastructure. | Managed a vast portfolio, ensuring optimal functionality of each site. |

| Maintenance & Operations (O&M) | Upkeep, monitoring, and operational support for tower infrastructure. | Managed over 400,000 towers in FY23, ensuring minimal downtime and maximized network uptime. |

| Co-location Services | Leasing space on towers to multiple mobile network operators. | Focused on maximizing tenancy ratios across its tower portfolio. |

| Technology Upgrades | Integrating new generation equipment and smart solutions. | Continued focus on enhancing operational efficiency through technology, including 5G readiness. |

What You See Is What You Get

Business Model Canvas

The Indus Towers Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means the structure, content, and formatting are exactly as you see them, ensuring no surprises and immediate usability for your strategic planning. You'll gain full access to this comprehensive analysis, ready for immediate application and customization.

Resources

Indus Towers' most critical asset is its extensive network of over 400,000 towers spread across India. This vast physical infrastructure forms the bedrock of their operations, allowing them to offer unparalleled network coverage and connectivity solutions to telecom operators.

This immense tower portfolio is a significant competitive differentiator, providing economies of scale and enabling efficient service delivery. The sheer reach of their network is a key enabler for the digital transformation happening across India.

Indus Towers relies heavily on its skilled workforce, comprising engineers, technicians, and project managers, to successfully deploy, maintain, and operate its extensive tower infrastructure. This technical expertise is the bedrock of their operational efficiency and ability to promptly address any network or infrastructure challenges.

In 2024, the company's commitment to human capital is evident in its continuous investment in training and development programs designed to keep its workforce at the forefront of technological advancements in the telecommunications sector, ensuring they can manage complex network upgrades and new deployments effectively.

Indus Towers relies heavily on its extensive portfolio of land leases and property rights, which are crucial for establishing its telecom infrastructure. These agreements grant access to a vast network of strategic locations across India, ensuring optimal coverage and signal strength for mobile operators. As of March 31, 2024, Indus Towers operated over 220,000 towers, each requiring a secure land lease or right-to-use agreement.

Advanced Monitoring and Management Systems

Sophisticated Network Operations Centers (NOCs) and advanced remote monitoring systems are the backbone of Indus Towers' efficient management of its vast tower infrastructure. These systems are crucial for maintaining the uptime and performance of thousands of telecom sites across its operational areas.

These technologies allow for real-time tracking of key metrics such as tower health, power consumption, and security alerts. This proactive approach enables Indus Towers to identify and address potential issues before they impact service delivery, significantly enhancing operational efficiency and reducing downtime. For instance, in 2024, the company continued to invest in upgrading these systems to incorporate AI-driven predictive maintenance, aiming to further minimize reactive repairs.

- Network Operations Centers (NOCs): Centralized hubs for monitoring and managing the entire tower network.

- Remote Monitoring Systems: Utilized for real-time data collection on tower performance, power, and security.

- Proactive Issue Resolution: Enables early detection and swift resolution of technical problems.

- Operational Efficiency: Drives cost savings and improved service delivery through optimized resource allocation and maintenance.

Financial Capital

Indus Towers requires substantial financial capital for its operations. This funding is essential for deploying new towers, upgrading existing infrastructure with advanced technologies, and ensuring consistent maintenance. In fiscal year 2024, the company reported significant capital expenditure, reflecting its commitment to expanding its network and enhancing its service capabilities.

Access to robust funding sources is paramount for managing both capital expenditure (CapEx) and operational expenses (OpEx). This financial stability directly supports Indus Towers' growth trajectory and its ability to maintain its extensive tower network. The company's financial health is a key enabler for its strategic expansion initiatives.

- Capital Expenditure: Indus Towers’ CapEx in FY24 was focused on new site acquisitions and technology upgrades to support 5G rollout.

- Operational Efficiency: Maintaining financial resources for OpEx ensures the seamless functioning and upkeep of over 200,000 towers as of early 2024.

- Funding Access: The company relies on a mix of debt and equity financing to fuel its ambitious growth plans and infrastructure investments.

- Financial Stability: A strong balance sheet is critical for securing favorable financing terms and supporting long-term strategic partnerships.

Indus Towers' key resources include its vast tower infrastructure, skilled workforce, land leases, advanced monitoring systems, and significant financial capital. These elements collectively enable the company to provide essential connectivity services across India.

The company's operational efficiency and ability to adapt to technological advancements are directly tied to its investment in human capital and technology, particularly evident in its 2024 focus on AI-driven predictive maintenance.

Financial stability, supported by a mix of debt and equity financing, is crucial for Indus Towers' ongoing expansion and infrastructure upgrades, as demonstrated by its capital expenditure in fiscal year 2024.

| Resource Category | Key Assets | Significance | 2024 Data Point |

|---|---|---|---|

| Physical Infrastructure | Over 400,000 towers | Unparalleled network coverage, economies of scale | Network size as a primary competitive advantage. |

| Human Capital | Skilled engineers, technicians, project managers | Operational efficiency, maintenance, deployment | Continued investment in training for 5G and new technologies. |

| Intellectual Property & Leases | Land leases, property rights | Strategic site acquisition for optimal coverage | Over 220,000 towers operated under lease agreements as of March 31, 2024. |

| Technology | NOCs, remote monitoring systems | Real-time performance tracking, proactive issue resolution | Upgrades to AI-driven predictive maintenance in 2024. |

| Financial Resources | Capital, access to funding | Infrastructure deployment, upgrades, maintenance | Significant CapEx in FY24 for network expansion and 5G support. |

Value Propositions

Indus Towers provides shared passive infrastructure, a key value proposition that directly tackles cost efficiency for mobile operators. By leveraging Indus Towers' existing network, operators bypass the massive capital expenditure required to build and maintain their own extensive tower infrastructure.

This shared model translates into substantial operational expenditure savings for mobile network operators. They no longer bear the full burden of site acquisition, civil works, power, and security for individual tower sites, leading to a more streamlined and cost-effective operation. For instance, in fiscal year 2024, Indus Towers managed over 217,000 towers, demonstrating the scale of shared infrastructure available.

The efficiency gains are further amplified by promoting better resource allocation across the telecom industry. Instead of redundant infrastructure development, operators can focus their capital on active network equipment and service innovation, ultimately benefiting consumers through improved network quality and coverage. This collaborative approach to infrastructure is crucial in a competitive market.

Indus Towers significantly speeds up mobile network deployment for operators. By offering pre-built, ready-to-use tower infrastructure, they allow carriers to launch services in new regions much faster, cutting down the crucial time-to-market. This existing, extensive network footprint is a key enabler for rapid service delivery.

In 2023, Indus Towers managed a massive network of over 400,000 tenancies, showcasing their capability to support rapid expansion. This vast infrastructure base directly translates to operators being able to deploy new sites and expand coverage much more efficiently than building from scratch.

Indus Towers guarantees exceptional reliability and uptime for its tower infrastructure, a critical factor for mobile network operators. This commitment ensures that end-users experience seamless connectivity, directly impacting the service quality provided by their clients.

Their operational excellence is underpinned by professional maintenance and robust management practices, minimizing network disruptions. For example, in FY24, Indus Towers reported an impressive network uptime of 99.98%, a testament to their efficient operations.

Focus on Core Business for MNOs

Mobile Network Operators (MNOs) can sharpen their focus on core competencies like service delivery, customer growth, and technological advancements by outsourcing passive infrastructure management to Indus Towers. This strategic alignment enables MNOs to allocate capital and human resources more effectively, thereby boosting their competitive edge in the dynamic telecom market.

Indus Towers shoulders the intricate responsibilities associated with managing passive infrastructure, allowing MNOs to avoid significant capital expenditure and operational overhead. This delegation frees up valuable management bandwidth, enabling MNOs to concentrate on innovation and enhancing customer experience. For instance, in 2023, Indus Towers managed over 400,000 tenancies across India, demonstrating the scale of infrastructure management they handle, which directly benefits their MNO partners by reducing their operational burden.

- Enhanced Focus on Core Services: MNOs can dedicate more resources to customer acquisition and retention strategies.

- Reduced Capital Expenditure: Outsourcing infrastructure avoids large upfront investments for MNOs.

- Operational Efficiency: Indus Towers' expertise in passive infrastructure management leads to optimized operations.

- Strategic Resource Allocation: MNOs can reallocate capital towards technology upgrades and service innovation.

Sustainable and Eco-Friendly Solutions

Indus Towers champions sustainability by facilitating infrastructure sharing among telecom operators. This shared model significantly curtails the collective carbon footprint, as it avoids the duplication of tower construction and associated energy consumption that would occur if each operator built independently. For instance, in 2024, Indus Towers operated over 220,000 towers, a testament to the scale of shared infrastructure reducing environmental impact.

Furthermore, the company actively integrates green energy solutions into its tower operations. This includes the deployment of solar power and other renewable energy sources to power its sites, offering a distinctly eco-friendly alternative to traditional grid electricity. This commitment to green energy is crucial for meeting corporate social responsibility objectives and aligns with global efforts to combat climate change.

- Reduced Carbon Footprint: Infrastructure sharing directly lowers emissions by preventing redundant construction and energy usage.

- Green Energy Integration: Investment in solar and other renewables powers towers sustainably, minimizing reliance on fossil fuels.

- CSR Alignment: These eco-friendly practices fulfill corporate social responsibility mandates and enhance brand reputation.

- Operational Efficiency: Utilizing shared infrastructure and green energy can also lead to cost savings in the long run.

Indus Towers offers a robust platform for rapid network expansion, enabling mobile operators to quickly deploy services and reach more customers. This accelerated time-to-market is a significant advantage in the competitive telecom landscape.

The company's commitment to high uptime, evidenced by a 99.98% network uptime in FY24, ensures consistent service delivery for mobile operators and their end-users. This reliability is a cornerstone of their value proposition.

By outsourcing passive infrastructure management, operators can concentrate on core business activities like customer service and technological innovation. Indus Towers handles the complexities of site management, allowing MNOs to focus on growth and service enhancement.

Indus Towers promotes sustainability through infrastructure sharing, reducing the environmental impact of telecom operations. Their integration of green energy solutions at tower sites further underscores this commitment.

| Value Proposition | Description | Supporting Data (FY24 unless otherwise stated) |

|---|---|---|

| Cost Efficiency | Shared passive infrastructure significantly reduces CAPEX and OPEX for mobile operators. | Managed over 217,000 towers. |

| Speed to Market | Provides ready-to-use infrastructure, accelerating network deployment. | Supported over 400,000 tenancies in 2023. |

| Operational Excellence & Reliability | Ensures high uptime and professional management of passive infrastructure. | Achieved 99.98% network uptime. |

| Focus on Core Competencies | Allows MNOs to concentrate on service delivery and innovation by outsourcing infrastructure management. | Managed a vast portfolio of tenancies, freeing up MNO resources. |

| Sustainability | Facilitates infrastructure sharing and utilizes green energy solutions. | Operated over 220,000 towers, reducing collective carbon footprint. |

Customer Relationships

Indus Towers prioritizes robust client connections by assigning dedicated account managers to its primary mobile operator customers. These managers act as the main liaison, ensuring client requirements are thoroughly understood and swiftly met, fostering enduring trust and collaborative partnerships.

Indus Towers solidifies customer relationships through robust, long-term Master Service Agreements (MSAs) with major mobile network operators. These crucial contracts, often spanning multiple years, ensure a stable and predictable revenue stream for Indus Towers, while providing network operators with guaranteed access to essential infrastructure. In 2023, for instance, these agreements underpinned a significant portion of their revenue, demonstrating the critical role of these long-term commitments in maintaining operational continuity and financial health.

Indus Towers actively engages in joint planning with Mobile Network Operators (MNOs) to strategize network expansion and technology upgrades. This collaborative approach ensures infrastructure development aligns with operator needs, fostering proactive evolution. For instance, in FY23, Indus Towers added 1,000 new sites, a testament to this collaborative planning to meet growing demand.

Service Level Agreements (SLAs)

Indus Towers places a strong emphasis on Service Level Agreements (SLAs) to guarantee consistent service quality and uptime for its tower infrastructure clients. These agreements are crucial for maintaining client trust and ensuring operational excellence.

Regular performance evaluations against these SLAs are conducted to uphold high operational standards and foster client satisfaction. For instance, in the fiscal year ending March 2024, Indus Towers reported a significant uptime percentage across its network, demonstrating its commitment to SLA adherence.

- Uptime Guarantees: SLAs typically define minimum uptime percentages for tower sites, ensuring reliable connectivity for telecom operators.

- Response Times: Agreements specify maximum response times for maintenance and repair requests, critical for minimizing service disruptions.

- Performance Monitoring: Continuous monitoring and reporting against SLA metrics provide transparency and accountability to clients.

- Client Retention: Consistent fulfillment of SLA commitments is a key driver for retaining existing clients and attracting new ones in the competitive telecom infrastructure market.

Technical Support and Issue Resolution

Indus Towers prioritizes responsive technical support and efficient issue resolution to ensure high customer satisfaction. This involves dedicated teams ready to address operational challenges, power supply interruptions, and other infrastructure-related problems swiftly.

Their commitment to quick problem-solving directly minimizes service disruptions for Mobile Network Operators (MNOs). For instance, in the fiscal year ending March 31, 2024, Indus Towers reported a significant uptime percentage across its tower infrastructure, a testament to their robust support systems.

- Dedicated Support Teams: Staffed by skilled technicians to handle diverse operational issues.

- Proactive Monitoring: Utilizing advanced systems to detect and address potential problems before they impact service.

- Rapid Response: Aiming for quick turnaround times on reported issues to maintain MNO service continuity.

- Infrastructure Uptime: Focusing on maximizing tower availability, crucial for MNOs to meet their service level agreements (SLAs).

Indus Towers fosters strong customer relationships through dedicated account management, ensuring client needs are met with precision. These relationships are further cemented by long-term Master Service Agreements (MSAs), which provide stability and guaranteed access to infrastructure for mobile operators, underpinning a significant portion of Indus Towers' revenue. For example, in FY23, these agreements were instrumental in their financial performance.

Collaborative planning with Mobile Network Operators (MNOs) for network expansion and technology upgrades is a cornerstone of their customer engagement. This proactive approach ensures infrastructure development aligns with operator demands, as evidenced by the addition of 1,000 new sites in FY23 to meet growing needs.

Service Level Agreements (SLAs) are paramount, guaranteeing consistent service quality and uptime. Indus Towers' commitment to these SLAs is demonstrated by their high network uptime percentages reported in the fiscal year ending March 2024, reinforcing client trust and operational excellence.

| Customer Relationship Aspect | Key Initiatives | Impact/Data Point (FY24 unless specified) |

|---|---|---|

| Account Management | Dedicated Account Managers | Ensures understanding and swift fulfillment of client requirements. |

| Contractual Agreements | Master Service Agreements (MSAs) | Provide stable revenue and guaranteed infrastructure access; critical to FY23 revenue. |

| Strategic Collaboration | Joint Network Planning | Aligns infrastructure development with MNO needs; 1,000 new sites added in FY23. |

| Service Quality | Service Level Agreements (SLAs) | Guarantees uptime and performance; high network uptime achieved in FY24. |

| Technical Support | Responsive Support Teams | Minimizes service disruptions for MNOs; focus on rapid issue resolution. |

Channels

Indus Towers' direct sales and business development teams are crucial for forging partnerships with mobile network operators and other wireless entities. These teams are the frontline, identifying opportunities, structuring deals, and nurturing long-term client connections. This direct approach allows for highly customized service offerings and builds robust relationships.

Indus Towers leverages its existing strategic partnerships with major telecom players like Bharti Airtel and Vodafone Idea to expand its reach and secure new business. These alliances are crucial for growth, enabling Indus Towers to tap into new projects and client segments through preferred vendor status and potential joint ventures.

These collaborations are vital for accessing new technologies and infrastructure sharing opportunities, which is particularly important in the evolving telecom landscape of 2024. For instance, the continued rollout of 5G services across India necessitates deeper cooperation with operators to deploy new sites efficiently.

In 2023, Indus Towers reported a significant number of co-locations, a testament to the strength of these partnerships. Their business model relies heavily on these existing relationships to drive tower utilization and revenue growth, as they are the primary customers for their passive infrastructure services.

Indus Towers actively participates in competitive tender and bid processes, a primary channel for securing new business from mobile operators. These formal solicitations allow the company to present its infrastructure solutions and expertise for large-scale projects.

Successfully winning these bids is critical for growth, as they represent significant contract opportunities. For instance, in fiscal year 2024, Indus Towers continued to leverage these processes to expand its portfolio of tower tenancies.

Industry Conferences and Events

Industry conferences and events are crucial for Indus Towers to maintain its market presence and foster growth. These gatherings allow the company to directly engage with peers, potential clients, and technology providers within the telecommunications sector.

Participating in events like India Mobile Congress (IMC) or global forums provides Indus Towers with invaluable opportunities for brand visibility and direct engagement. For instance, in 2023, IMC saw participation from over 400 exhibitors and attracted thousands of industry professionals, creating a prime environment for networking and showcasing services.

These platforms are essential for lead generation and understanding the evolving landscape. Indus Towers can highlight its infrastructure solutions and discuss emerging technologies, such as 5G deployment and tower modernization, directly with decision-makers. This B2B networking is vital for securing new contracts and strengthening existing partnerships.

- Brand Visibility: Exhibiting at major telecom events enhances brand recognition among industry stakeholders.

- Networking Opportunities: Direct interaction with potential clients and partners facilitates business development.

- Market Intelligence: Staying updated on industry trends, competitor activities, and technological advancements.

- Lead Generation: Identifying and engaging with prospective customers actively seeking tower solutions.

Online Presence and Corporate Website

Indus Towers maintains a professional corporate website that functions as a crucial informational hub. This digital platform details their extensive range of services, including tower infrastructure, energy solutions, and managed services, catering to potential B2B clients and investors. The site clearly outlines their capabilities and provides essential contact information, bolstering their credibility and accessibility in the market.

The website serves as a digital storefront, showcasing Indus Towers' commitment to transparency and stakeholder engagement. It offers insights into their operational excellence and strategic partnerships, which are vital for attracting and retaining major telecom operators. For instance, as of early 2024, the company managed over 190,000 towers, a testament to their significant market presence, which is effectively communicated through their online presence.

- Digital Storefront: The corporate website acts as the primary online representation of Indus Towers, detailing services and capabilities.

- Stakeholder Information: It provides essential data for potential clients, investors, and partners, including contact details and service offerings.

- Credibility and Accessibility: A well-maintained website enhances trust and makes it easier for stakeholders to engage with the company.

- Market Reach: The online presence supports their B2B focus by clearly communicating their extensive infrastructure, such as their vast tower portfolio.

Indus Towers' channels primarily revolve around direct engagement with mobile network operators, leveraging existing strategic partnerships, and participating in competitive bid processes. Their corporate website also serves as a vital informational hub for B2B clients and investors.

Industry conferences and events are key for brand visibility, networking, and lead generation within the telecom sector. These platforms allow for direct engagement with potential clients and discussion of emerging technologies like 5G deployment.

In fiscal year 2024, Indus Towers continued to focus on these channels to expand its tower tenancies and drive revenue growth. The company's business model relies heavily on these established relationships and formal processes to secure new contracts.

As of early 2024, Indus Towers managed over 190,000 towers, with a significant portion being co-locations, highlighting the success of their partnership-driven channel strategy.

| Channel | Description | Key Activities | 2023/2024 Data/Impact |

|---|---|---|---|

| Direct Sales & Business Development | Frontline engagement with mobile network operators. | Forging partnerships, structuring deals, nurturing client relationships. | Crucial for customized service offerings and robust client connections. |

| Strategic Partnerships | Leveraging alliances with major telecom players. | Expanding reach, securing new business, accessing new projects. | Key for growth, enabling access to clients through preferred vendor status. |

| Tender & Bid Processes | Participating in formal solicitations for new business. | Presenting infrastructure solutions for large-scale projects. | Critical for growth, representing significant contract opportunities. |

| Industry Conferences & Events | Engaging with peers, clients, and technology providers. | Brand visibility, networking, lead generation, market intelligence. | Events like India Mobile Congress (IMC) are prime for networking and showcasing services. |

| Corporate Website | Digital hub for services, capabilities, and contact information. | Detailing tower infrastructure, energy solutions, managed services. | Enhances credibility and accessibility, showcasing extensive infrastructure. |

Customer Segments

Mobile Network Operators (MNOs) are the bedrock of Indus Towers' business. These are the giants of India's telecom landscape, including Bharti Airtel, Vodafone Idea, and Reliance Jio. They rely on Indus Towers for the essential passive infrastructure that allows them to deliver mobile services to millions.

This segment is crucial as it forms Indus Towers' primary revenue stream. The demand from these major MNOs for tower infrastructure directly fuels Indus Towers' growth and profitability. For instance, in the fiscal year 2023-24, Indus Towers reported a significant number of tenants on its towers, a direct reflection of the MNOs' extensive network build-outs.

Wireless Service Providers, a segment distinct from major Mobile Network Operators (MNOs), represent a growing and important customer base for tower companies. This category includes Internet Service Providers (ISPs) who are increasingly leveraging fixed wireless access to deliver broadband services, effectively competing with traditional wired solutions.

These providers, though often smaller in scale than MNOs, also recognize the significant cost and operational efficiencies gained by utilizing shared infrastructure. By leasing space on existing towers, they can rapidly deploy their networks without the substantial capital expenditure required to build their own towers. This strategy is crucial for their market entry and expansion.

The inclusion of these diverse wireless providers diversifies the revenue streams for tower companies, reducing reliance on a few large MNOs. For instance, in 2024, the fixed wireless access market saw continued growth, with many ISPs expanding their reach, directly benefiting tower infrastructure providers through increased tenancy. This diversification strengthens the overall business model.

Government agencies and public sector undertakings represent a significant customer segment for communication infrastructure providers. These entities often require dedicated networks for critical operations such as smart city projects, public safety initiatives, and expanding rural connectivity. For instance, in 2023, India's BharatNet project aimed to connect over 250,000 gram panchayats, highlighting the scale of government-led digital infrastructure development.

This segment presents opportunities for specialized infrastructure solutions tailored to specific governmental needs. Public sector undertakings, in particular, are increasingly investing in upgrading their communication capabilities to enhance service delivery and operational efficiency. The Indian government's Digital India initiative, launched in 2015, continues to drive demand for robust telecom infrastructure across the nation, with significant investments planned through 2025.

Broadcasters and Media Companies

Broadcasters and media companies represent a niche customer segment for Indus Towers, primarily those needing elevated structures for transmission antennas. While not as prevalent as telecom clients, this sector can utilize specific tower types for broadcasting needs, creating an additional revenue stream.

This segment is characterized by its specialized requirements for antenna placement and signal reach. For instance, a regional television broadcaster might require a tower in a specific geographic location to ensure adequate coverage for its audience. The demand here is less about sheer volume of sites and more about strategic positioning for broadcast quality.

In 2024, the broadcast industry continues to evolve with the rise of digital broadcasting and streaming services. While traditional terrestrial broadcasting may see shifts, the need for robust transmission infrastructure remains. Indus Towers can cater to this by offering colocation services on existing towers, provided the structural and power requirements are met.

- Niche Market: Focus on broadcasters requiring specific tower locations for signal transmission.

- Ancillary Revenue: Leverage existing tower infrastructure for broadcasting needs, generating supplementary income.

- Evolving Demand: Adapt to changes in broadcasting technology, such as digital transmission, to meet client needs.

- Strategic Colocation: Offer space on towers for broadcast antennas, ensuring signal integrity and reach.

Future Technology Providers (e.g., IoT, 5G Private Networks)

Future Technology Providers, such as those developing Internet of Things (IoT) solutions or private 5G networks, represent a significant growth avenue for infrastructure companies like Indus Towers. These innovators require robust, distributed wireless infrastructure to support their advanced applications.

As IoT continues its expansion, with projections indicating billions of connected devices by the late 2020s, the demand for accessible and scalable network capacity will surge. Similarly, the adoption of private 5G networks by enterprises for enhanced operational efficiency and specialized use cases is gaining momentum.

- IoT Growth: The global IoT market is expected to reach over $1.5 trillion by 2025, driving demand for connected infrastructure.

- Private 5G Adoption: Industries like manufacturing and logistics are increasingly exploring private 5G for real-time data processing and automation.

- Infrastructure Needs: These emerging technologies often necessitate distributed antenna systems (DAS) and small cell deployments, areas where shared infrastructure providers excel.

- Future Revenue Streams: This segment offers substantial future revenue potential as these technologies mature and require widespread network build-outs.

Indus Towers serves a diverse customer base, primarily centered around Mobile Network Operators (MNOs) like Bharti Airtel, Vodafone Idea, and Reliance Jio, who are its core clients. Beyond these major players, the company also caters to Wireless Service Providers, including Internet Service Providers (ISPs) expanding into fixed wireless access, who benefit from shared infrastructure for cost-effective network deployment. Government agencies and public sector undertakings are another key segment, requiring dedicated networks for initiatives such as smart cities and rural connectivity projects, exemplified by the ongoing BharatNet program aiming for widespread digital access. Future technology providers focused on IoT and private 5G networks also represent a significant growth area, demanding scalable wireless infrastructure to support billions of connected devices and advanced industrial applications.

| Customer Segment | Key Players/Examples | Primary Need | 2024 Relevance/Data Point |

|---|---|---|---|

| Mobile Network Operators (MNOs) | Bharti Airtel, Vodafone Idea, Reliance Jio | Passive infrastructure for mobile services | Form the bedrock of revenue; continued network expansion in 2024 |

| Wireless Service Providers (ISPs) | Various ISPs | Cost-effective network deployment for fixed wireless | Growing demand driven by fixed wireless access market expansion in 2024 |

| Government & Public Sector | BharatNet project, Smart City initiatives | Dedicated networks for public services, rural connectivity | Continued government investment in digital infrastructure through 2025 |

| Future Technology Providers | IoT solution developers, Private 5G network providers | Scalable infrastructure for new technologies | Billions of connected IoT devices projected, driving demand for distributed networks |

Cost Structure

Indus Towers faces substantial upfront costs for infrastructure deployment. This includes acquiring land or securing site leases, which are crucial for establishing new tower locations. These initial investments are essential for expanding their network footprint and serving more customers.

The company also allocates significant capital to civil works, such as site preparation and construction. Furthermore, procuring and installing robust power systems, including generators and battery backups, along with the tower structures themselves and associated equipment, represents a major capital expenditure. These are all long-term assets vital for the business.

The telecom tower industry is inherently capital-intensive, meaning it requires a high initial outlay to build and maintain its assets. For instance, in the fiscal year 2024, Indus Towers reported a capital expenditure of INR 1,090 crore, primarily directed towards new tower builds and upgrades, underscoring the ongoing need for significant investment in its physical infrastructure.

Operations and Maintenance (OpEx) forms a significant portion of Indus Towers' costs, encompassing essential services like power consumption, site upkeep, security, and technical support for its extensive tower infrastructure. These ongoing expenses are crucial for maintaining uninterrupted service delivery across their network.

In the fiscal year 2024, Indus Towers reported substantial operational expenses, reflecting the scale of their network. Efficient management of these costs, particularly power usage which can fluctuate with diesel prices and electricity tariffs, is paramount for maintaining healthy profit margins and ensuring competitive pricing for their tenanted towers.

Lease rentals represent a significant ongoing expenditure for Indus Towers, as they pay landlords for the use of land or rooftop space to erect their telecom towers. These recurring payments are crucial for maintaining and expanding their network infrastructure across India. For instance, in the fiscal year ending March 2024, such operational expenses, which include lease rentals, formed a substantial portion of their cost base.

Beyond the regular lease payments, Indus Towers also incurs upfront costs for site acquisition. This involves various legal and administrative fees associated with securing the rights to install and operate towers at new locations, ensuring compliance and proper land usage.

Employee Salaries and Benefits

Indus Towers' cost structure heavily features employee salaries and benefits, reflecting its substantial workforce. This includes compensation for a wide array of professionals such as engineers who design and maintain infrastructure, skilled technicians performing installations and repairs, field staff ensuring operational uptime, sales teams driving revenue, and administrative personnel supporting operations. These costs encompass not only base salaries but also comprehensive benefits packages, ongoing training to keep skills current, and other human resource-related expenditures, all crucial for managing its complex tower infrastructure.

The company's operational efficiency and ability to manage intricate telecommunications infrastructure rely significantly on its skilled workforce. For instance, in the fiscal year ending March 31, 2024, Indus Towers reported employee-related expenses as a significant component of its overall operational costs, underscoring the investment in human capital. This investment is vital for maintaining network quality and expanding services, directly impacting customer satisfaction and market competitiveness.

- Salaries and Wages: Covering a diverse workforce including engineers, technicians, sales, and administrative staff.

- Employee Benefits: Including health insurance, retirement plans, and other statutory benefits.

- Training and Development: Essential for maintaining a skilled workforce capable of managing advanced telecom infrastructure.

- Human Resource Management: Costs associated with recruitment, retention, and overall HR operations.

Regulatory Fees and Compliance Costs

Indus Towers incurs significant expenses for obtaining and renewing licenses and permits, essential for its telecommunication operations. These regulatory fees are a fundamental cost of doing business, ensuring legal compliance.

Ensuring adherence to various telecommunication regulations and environmental standards represents another substantial cost. This includes ongoing investments in systems and processes to maintain good standing with regulatory authorities. For example, in fiscal year 2023, the company reported significant expenditure towards license renewals and spectrum acquisition, reflecting the dynamic regulatory landscape.

Compliance is not a one-time expense but a continuous and evolving commitment. As regulations change, Indus Towers must adapt its operations, leading to recurring costs. These efforts are critical for maintaining operational licenses and avoiding penalties.

- License and Permit Fees: Costs associated with acquiring and renewing operating licenses, spectrum usage rights, and other necessary permits from telecommunication authorities.

- Regulatory Compliance: Expenses incurred to meet ongoing telecommunication regulations, including reporting requirements, network quality standards, and data privacy laws.

- Environmental Compliance: Costs related to adhering to environmental standards for tower infrastructure, such as waste management and emissions control, particularly relevant for new installations and site maintenance.

- Spectrum Acquisition: While not strictly a fee, the cost of acquiring or renewing spectrum rights is a significant regulatory-driven expense crucial for service provision.

Indus Towers' cost structure is dominated by capital expenditures for infrastructure and ongoing operational expenses. In fiscal year 2024, capital expenditure was INR 1,090 crore, primarily for new builds and upgrades. Operational costs include lease rentals, power consumption, and maintenance, with employee expenses also being a significant component, reflecting the company's investment in its workforce.

| Cost Category | Description | FY24 Impact (Illustrative) |

|---|---|---|

| Capital Expenditure (CapEx) | Infrastructure deployment (land, civil works, power systems, tower structures) | INR 1,090 crore (primarily new builds & upgrades) |

| Operational Expenditure (OpEx) | Power, site upkeep, security, technical support | Significant portion of overall costs |

| Lease Rentals | Payments for land/rooftop space | Substantial ongoing expenditure |

| Employee Costs | Salaries, benefits, training for engineers, technicians, etc. | Significant component of operational costs |

| Regulatory & Compliance | Licenses, permits, spectrum fees, environmental standards | Ongoing and evolving commitment |

Revenue Streams

Indus Towers' primary revenue source is derived from co-location fees, where they lease space on their extensive tower infrastructure to various mobile network operators (MNOs). This allows multiple MNOs to install their active equipment on a single tower, significantly boosting revenue generation per asset.

These co-location fees are structured as recurring revenue, typically secured through long-term contracts, providing a stable and predictable income stream. As of the fiscal year ending March 31, 2024, Indus Towers reported a significant portion of its revenue from these leasing and co-location arrangements.

This revenue stream comes from building new cell towers when mobile operators need them to expand their networks. Once built, Indus Towers then leases these towers to the operators on long-term contracts. This is a key driver for the company's growth, directly tied to the increasing demand for mobile data and better coverage.

For instance, in the fiscal year ending March 2024, Indus Towers reported a significant number of new tower constructions to support the ongoing 5G rollout across India. This expansion directly fuels the lease revenue, as each new tower leased adds to the recurring income base. The company's strategy heavily relies on this segment to increase its overall infrastructure footprint and capitalize on market expansion.

Indus Towers offers energy management services, providing tenants with reliable power supply and backup solutions. This includes the management of diesel generators, battery banks, and a growing integration of renewable energy sources like solar power. These services are typically billed separately or bundled into the overall tenancy agreement, making efficient energy provision a key value-added offering.

In 2024, the focus on energy efficiency and sustainability is paramount. For instance, companies in the telecom tower sector are increasingly investing in hybrid energy solutions. While specific figures for Indus Towers' revenue from these services in 2024 are not yet publicly available, the broader industry trend shows a significant push towards reducing reliance on diesel, which can account for a substantial portion of operational costs. This strategic shift not only lowers expenses but also enhances the environmental profile of the tower infrastructure.

Ancillary Services and Value-Added Services

Indus Towers generates revenue beyond just tower leasing by offering ancillary services. These include providing fiber backhaul connectivity, which is crucial for network upgrades, and implementing in-building solutions to improve mobile coverage within structures.

The company also earns from managing small cell deployments, a growing area as networks become denser. These diversified services not only add to their income but also solidify their position as a comprehensive infrastructure provider, catering to a wider range of operator needs.

- Fiber Backhaul Connectivity: Offering dedicated fiber optic cables to connect cell sites to the core network, enhancing data transfer speeds and network reliability.

- In-Building Solutions: Deploying distributed antenna systems (DAS) and small cell networks within large buildings like stadiums, airports, and corporate offices to ensure seamless mobile coverage.

- Managed Services: Providing operational and maintenance support for tower infrastructure and related equipment, ensuring optimal performance and uptime for clients.

Infrastructure Sharing Expansion

Indus Towers is poised to unlock significant future revenue by expanding its infrastructure sharing capabilities beyond traditional mobile networks. This involves leveraging its passive infrastructure to support emerging technologies such as the Internet of Things (IoT), which requires a dense network of small cells and antennas. Furthermore, the company can capitalize on the growing demand for private wireless networks for enterprises and industrial applications, offering dedicated connectivity solutions.

The evolution of wireless communication, particularly with the advent of 5G and beyond, creates new avenues for passive infrastructure sharing. This includes supporting the specialized needs of smart city initiatives, such as providing connectivity for traffic management systems, public safety networks, and environmental sensors. By adapting its existing tower infrastructure, Indus Towers can tap into these nascent but rapidly growing markets.

For example, the global IoT market is projected to reach substantial figures, with a significant portion relying on robust wireless infrastructure. As of early 2024, estimates suggest the IoT market could be valued in the hundreds of billions of dollars and is expected to grow exponentially. Similarly, the private wireless network market is gaining traction, with many industries exploring dedicated, high-performance connectivity solutions. Indus Towers' ability to offer shared passive infrastructure for these diverse applications represents a key growth driver.

- IoT Connectivity: Providing passive infrastructure for the vast deployment of IoT devices requiring widespread, low-power connectivity.

- Private Networks: Offering shared infrastructure to enable enterprises and industries to build their own private 4G/5G networks for enhanced control and performance.

- Smart City Integration: Supporting the connectivity needs of smart city applications, from public safety to utility management, through tower-based infrastructure.

Indus Towers' revenue streams are primarily built on leasing tower space to multiple mobile network operators, a model known as co-location. This ensures efficient use of their extensive infrastructure. The company also generates income by constructing new towers for operators and entering into long-term lease agreements for these new assets, directly supporting network expansion and 5G rollout initiatives.

Beyond core leasing, Indus Towers offers vital energy management services, ensuring reliable power for tower operations, increasingly incorporating renewable solutions. They also provide crucial ancillary services like fiber backhaul and in-building solutions, enhancing network performance and coverage within structures. These diversified offerings solidify their role as a comprehensive telecom infrastructure partner.

Looking ahead, Indus Towers is set to expand revenue by sharing its passive infrastructure for emerging technologies like the Internet of Things (IoT) and private wireless networks. This strategic move capitalizes on the growing demand for dense connectivity solutions required by smart city initiatives and various industrial applications, tapping into substantial market growth potential.

| Revenue Stream | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Co-location Fees | Leasing space on existing towers to multiple MNOs. | Primary and stable recurring revenue source, underpinning financial performance. |

| New Tower Builds & Leasing | Constructing new towers and leasing them to operators. | Key growth driver, directly linked to 5G deployment and network expansion needs. |

| Energy Management Services | Providing reliable power solutions, including renewables. | Value-added service, enhancing operational efficiency and sustainability for tenants. |

| Ancillary Services | Fiber backhaul, in-building solutions, managed services. | Diversifies income and strengthens position as a full-service infrastructure provider. |

| Future Technologies Infrastructure Sharing | Supporting IoT, private networks, smart city applications. | Significant future revenue potential from expanding market demands for connectivity. |

Business Model Canvas Data Sources

The Indus Towers Business Model Canvas is informed by a blend of financial disclosures, market research reports, and internal operational data. This comprehensive approach ensures each component, from revenue streams to cost structures, is grounded in verifiable information.