Indus Towers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

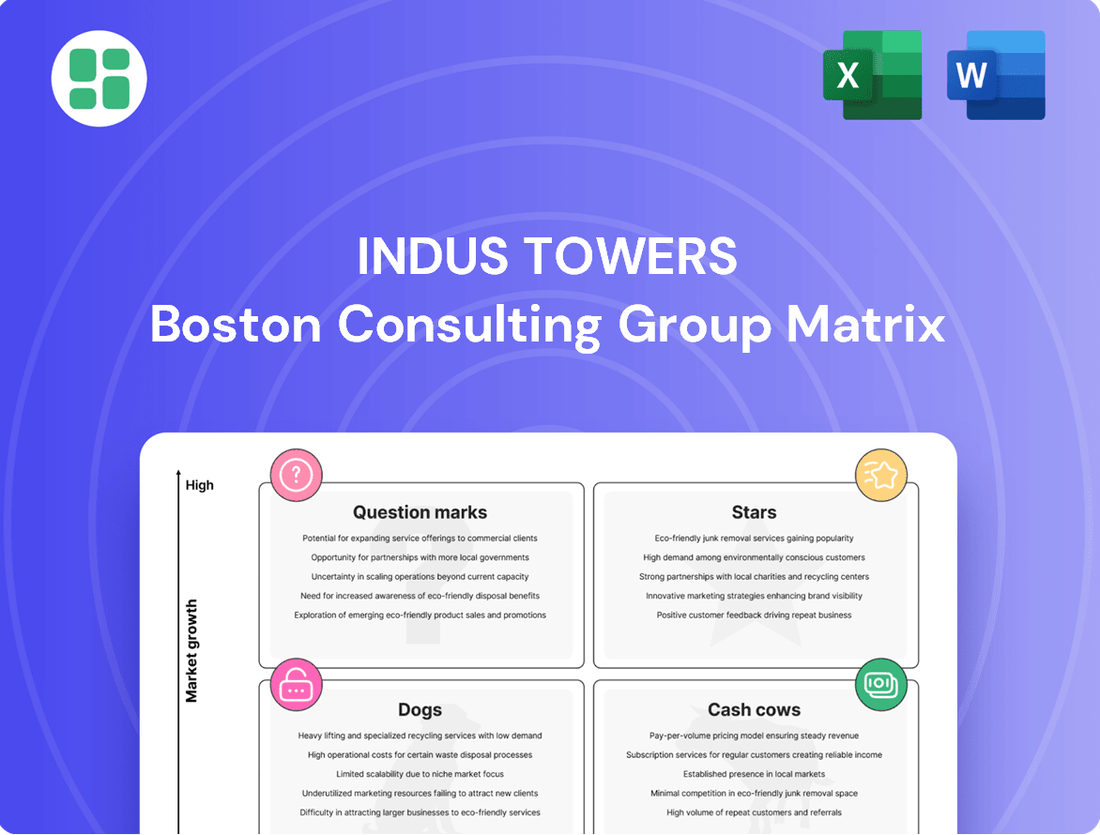

Curious about Indus Towers' market position? Our BCG Matrix preview hints at its strategic landscape, but to truly understand where its towers stand as Stars, Cash Cows, Dogs, or Question Marks, you need the full picture.

Unlock a comprehensive breakdown of Indus Towers' portfolio, complete with data-backed recommendations for optimizing investments and maximizing growth. Purchase the full BCG Matrix for actionable insights that will drive your strategic decisions.

Stars

Indus Towers is a pivotal player in India's fast-paced 5G infrastructure build-out, a segment experiencing significant growth. The company is seeing a substantial increase in demand for new sites and fiberized backhaul solutions as 5G networks expand nationwide.

To meet this surge, Indus Towers is actively deploying new towers and expanding co-location services, solidifying its position as a frontrunner in this vital, high-growth area. By the end of fiscal year 2024, Indus Towers had over 444,000 tenancies, demonstrating its extensive reach and capacity to support the evolving telecom landscape.

The fiberization of telecom towers is a key growth driver for Indus Towers, especially with the rollout of 5G. This involves connecting towers with optical fiber cables, which are essential for the high bandwidth and low latency required by next-generation mobile networks.

India's fiber penetration to towers is improving, with the government aiming for 70% fiberization by 2024-25. This ambitious target, coupled with the accelerated pace of optical fiber cable deployment across the country, creates a substantial opportunity for Indus Towers to grow its fiber backhaul services.

Rural Connectivity Expansion represents a significant growth opportunity for Indus Towers. Government initiatives like the Digital India mission are fueling demand for new tower installations in previously underserved areas. This focus on expanding digital access directly translates into a need for more robust telecom infrastructure.

Indus Towers is strategically capitalizing on this trend. In FY24, the company installed over 60% of its new towers in rural India, underscoring its commitment to these high-growth regions. This aggressive expansion highlights the company's role in bridging the digital divide and capturing market share in a rapidly developing segment.

Small Cells and Urban Densification

The increasing need for robust wireless connectivity in densely populated urban areas makes small cells a vital component for 5G network expansion. Indus Towers' strategic focus on deploying these compact infrastructure solutions aligns with the ongoing trend of urban densification, where traditional macro towers are insufficient.

This segment represents a significant growth opportunity for Indus Towers, leveraging their extensive experience in site acquisition and management. By facilitating denser networks, Indus Towers supports enhanced mobile broadband and low-latency applications essential for smart cities.

- Urban Densification Driver: Small cells are critical for delivering 5G's high bandwidth and low latency in crowded city environments, supporting the increasing data demands of urban populations.

- Market Growth Potential: The global small cell market was projected to reach over $10 billion by 2024, with significant growth driven by 5G deployments in urban centers.

- Indus Towers' Advantage: Indus Towers can capitalize on its existing infrastructure and operational expertise to efficiently deploy and manage these distributed sites, offering a competitive edge.

Emerging Technologies & Smart Infrastructure

Indus Towers is actively investing in emerging technologies like Artificial Intelligence and digital solutions. This strategic move aims to enhance operational efficiency and tap into future growth avenues. For instance, in 2024, the company continued its focus on leveraging AI for predictive maintenance of its tower infrastructure, reducing downtime and operational costs.

The company plays a crucial role in enabling India's Smart City projects by providing advanced infrastructure. This includes supporting next-generation technologies essential for various government services. By powering these initiatives, Indus Towers is positioning itself in a high-growth, though still developing, market for smart infrastructure solutions.

- Investment in AI and Digital Solutions: Indus Towers is channeling resources into AI for predictive maintenance and operational optimization.

- Smart City Infrastructure: The company is a key enabler for India's Smart City initiatives, providing foundational technology.

- Government Service Support: Their infrastructure facilitates the deployment of various government services through advanced technology.

- Market Positioning: This focus places Indus Towers in a nascent but rapidly expanding market for smart infrastructure.

Stars in the BCG matrix represent high-growth, high-market-share business segments. For Indus Towers, the 5G infrastructure build-out and rural connectivity expansion clearly fall into this category. The company's aggressive deployment of new sites and fiberization efforts in these areas demonstrate its strong position in a rapidly expanding market. This strategic focus is crucial for capturing future revenue streams as digital adoption continues to accelerate across India.

| Segment | Growth Rate | Market Share | Indus Towers' Position |

|---|---|---|---|

| 5G Infrastructure | High | High | Leading Player |

| Rural Connectivity | High | High | Key Contributor |

| Fiberization | High | Growing | Strategic Focus |

What is included in the product

Indus Towers' BCG Matrix analyzes its tower portfolio, identifying Stars (high growth/share), Cash Cows (low growth/high share), Question Marks (high growth/low share), and Dogs (low growth/low share).

This framework guides strategic decisions on investment, divestment, and resource allocation for each tower segment.

The Indus Towers BCG Matrix simplifies complex business unit performance, offering a clear roadmap for strategic resource allocation and growth investment.

Cash Cows

Indus Towers boasts an unparalleled telecom tower infrastructure across India, a true Cash Cow. As of March 31, 2025, their portfolio spanned an impressive 251,773 towers and 411,212 co-locations, reaching every corner of the nation's 22 telecom circles.

This vast network translates into a dominant and stable market share, consistently generating substantial rental revenues from major mobile network operators. The sheer scale ensures ongoing, predictable income streams, solidifying its position as a strong performer.

Indus Towers' long-term contracts with major Indian telecom operators like Bharti Airtel, Vodafone Idea, and Reliance Jio are the bedrock of its cash cow status. These agreements, often spanning many years, provide a predictable and stable revenue stream, a hallmark of a cash cow business. This ensures high tenancy ratios on their towers, maximizing the return on their infrastructure investments.

In fiscal year 2024, Indus Towers reported a robust performance, with its core tower leasing segment continuing to be the primary driver of its financial strength. The company's ability to maintain strong relationships with these leading operators, who collectively represent a significant portion of India's mobile subscriber base, underscores the resilience and cash-generating power of this segment. This consistent demand for tower infrastructure translates directly into reliable cash flows for Indus Towers.

Indus Towers exhibits robust operating leverage, consistently achieving EBITDA margins exceeding 50%. This high profitability stems from efficient cost structures inherent in its tower infrastructure model.

The company's ability to generate significant cash flow from its existing operations, with minimal incremental capital expenditure, solidifies its position. For instance, in the fiscal year ending March 2024, Indus Towers reported an EBITDA of ₹10,029 crore, showcasing its strong cash-generating capabilities.

Strategic Co-location Services

Strategic co-location services represent a significant cash cow for Indus Towers. This model allows multiple telecom operators to share the same tower infrastructure, dramatically increasing asset utilization and profitability. For instance, by the end of fiscal year 2024, Indus Towers reported a tenancy ratio of approximately 1.75, indicating that each tower, on average, serves more than one operator.

This high tenancy ratio, coupled with ongoing co-location additions, allows Indus Towers to generate substantial cash flow. The efficiency stems from maximizing the use of existing towers, minimizing the need for proportional capital expenditure increases. This strategy directly translates into strong returns and a stable cash-generating business for the company.

- High Tenancy Ratio: Indus Towers benefits from a robust tenancy ratio, maximizing the revenue generated per tower.

- Efficient Asset Utilization: Co-location services enable the sharing of infrastructure, reducing costs and increasing profitability.

- Strong Cash Flow Generation: Continuous co-location additions drive consistent and high cash flow without significant incremental capital investment.

- Profitability Driver: This service is a key contributor to Indus Towers' financial strength and market position.

Energy Management and Green Initiatives

Indus Towers demonstrates a strong commitment to energy efficiency and sustainability within its operations. The company's strategic focus on optimizing power management, particularly through the integration of green energy solutions, directly impacts its financial performance. By adopting technologies like solar power and advanced lithium-ion batteries, Indus Towers is not only reducing its reliance on costly traditional fuel sources but also significantly lowering operational expenditures.

These proactive environmental initiatives translate into tangible financial benefits, enhancing the company's profitability and contributing to improved margins. For instance, in the fiscal year ending March 2024, Indus Towers reported a notable reduction in energy costs, a direct consequence of its investment in greener alternatives. This strategic shift aligns with broader sustainability objectives while simultaneously bolstering the company's bottom line.

- Reduced Operational Costs: Investments in solar power and lithium-ion batteries directly cut expenses related to traditional fuel consumption.

- Enhanced Profitability: Lower energy expenses contribute to improved profit margins for the company.

- Sustainability Alignment: Initiatives support environmental goals and corporate social responsibility.

- Energy Independence: Decreased dependence on conventional fuels offers greater operational stability.

Indus Towers' extensive tower network, with over 251,000 towers as of March 31, 2025, serves as a prime example of a Cash Cow. Its dominant market share and long-term contracts with major operators ensure stable, predictable revenue streams.

The company's ability to generate substantial cash flow from its existing, well-utilized infrastructure, evidenced by a tenancy ratio of approximately 1.75 in FY2024, highlights its Cash Cow status. This efficient asset utilization minimizes the need for significant new capital expenditure, directly contributing to strong returns.

With EBITDA margins consistently exceeding 50% and a reported EBITDA of ₹10,029 crore in FY2024, Indus Towers demonstrates exceptional profitability from its core operations. This financial strength is a direct result of its mature, high-demand tower leasing business.

The strategic focus on co-location services further solidifies its Cash Cow position by maximizing revenue per tower. This approach ensures a consistent and robust cash flow, reinforcing its status as a stable, high-performing segment within the BCG Matrix.

Delivered as Shown

Indus Towers BCG Matrix

The Indus Towers BCG Matrix preview you are viewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by strategy professionals, will be delivered without any watermarks or demo content, ensuring you get a polished and actionable document ready for immediate strategic deployment.

Dogs

Legacy infrastructure in declining markets, like older cell towers in regions with stagnant subscriber growth, often fall into the Dogs category of the BCG Matrix. These assets, perhaps those built for 2G or early 3G networks, may require significant capital to upgrade to current 4G or 5G standards, while generating diminishing returns. For instance, in markets where mobile penetration has peaked and is even declining, the revenue potential from these older sites is limited.

Towers or sites with low tenancy ratios and minimal new co-location interest, particularly in regions with limited telecom growth forecasts, can be classified as 'Dogs' within the BCG matrix. These assets represent capital that isn't generating substantial returns or driving growth.

For instance, if a tower in a declining rural area has only one tenant and no prospective co-locations, it falls into this category. In 2024, a significant portion of older, less strategically located towers might exhibit these characteristics, impacting overall portfolio efficiency.

Non-core, divested assets for Indus Towers would represent business segments or holdings that no longer align with its primary focus on telecom tower infrastructure. These could include legacy investments or ventures that proved unprofitable or were deemed a distraction from core operations. For instance, in 2023, Indus Towers divested its stake in a non-telecom related venture, allowing it to concentrate capital on its core tower business.

High-Cost, Low-Return Power Solutions

These are the high-cost, low-return power solutions within Indus Towers' portfolio. Think of them as the older, less efficient equipment that’s expensive to run and doesn’t give much back in terms of reliable power.

These often involve diesel generators, especially in remote areas where getting power from the grid is tough. The cost of diesel, maintenance, and the inefficiency of these older systems all add up, making them a drain on resources without providing a strong return on investment.

For example, in 2024, a significant portion of Indus Towers’ operational expenditure was still tied to managing these legacy power systems, particularly in regions with challenging terrain and limited grid access. The company is actively working to phase these out.

- High Operational Costs: Primarily driven by diesel fuel expenses and frequent maintenance needs for older generator sets.

- Low Energy Efficiency: Legacy systems often consume more fuel than newer, more advanced power solutions.

- Limited Grid Connectivity: Reliance on standalone power in remote locations exacerbates costs and inefficiencies.

- Strategic Focus on Green Energy: Indus Towers is prioritizing the transition away from these solutions towards more sustainable and cost-effective alternatives.

Segments with Intense Local Competition

In certain localized markets, Indus Towers might encounter fierce competition from smaller, agile local players. These regions could be characterized by aggressive pricing strategies from these competitors, leading to lower market share and reduced profitability for Indus Towers in those specific segments, aligning them with the 'Dog' category in the BCG Matrix.

For instance, in 2024, reports indicated pockets of intense competition in tier-2 and tier-3 cities across India, where local tower companies leveraged lower overheads and customized solutions. This pressure can dilute market share and impact the profitability of sites within these specific micro-markets.

- Intense Localized Competition: Specific geographical areas may see numerous small tower providers, fragmenting market share.

- Pricing Pressures: Aggressive pricing by local competitors can significantly reduce margins in these segments.

- Low Market Share & Profitability: Segments with high competition and price sensitivity often exhibit both low market share and low profitability for Indus Towers.

Assets classified as Dogs in Indus Towers' portfolio represent legacy infrastructure in declining markets or sites with very low tenancy. These towers, often older and requiring significant investment for upgrades, generate diminishing returns and are characterized by high operational costs and low energy efficiency, especially when relying on older power solutions like diesel generators. In 2024, the company continued efforts to phase out these less efficient systems and divest non-core assets to improve overall portfolio performance and focus on growth areas.

Question Marks

New 6G technology infrastructure, while still in its infancy, presents a classic question mark for Indus Towers within the BCG matrix. As 5G deployment continues, the groundwork for 6G is being laid, representing a significant future growth opportunity where Indus Towers currently holds minimal to no market share. This necessitates strategic consideration for investment in research and early-stage infrastructure trials to secure a future foothold in this high-potential market.

Integrating edge computing at tower sites represents a nascent, high-growth frontier. While Indus Towers has a strong foundation in traditional tower infrastructure, its current market share in edge computing deployment is likely minimal. This segment is poised for expansion, driven by the increasing demand for low-latency data processing for applications like IoT and 5G services.

Capturing this burgeoning market necessitates substantial capital expenditure. Indus Towers would need to invest significantly in developing and deploying specialized edge computing hardware and software solutions at its numerous tower locations. For instance, the global edge computing market was projected to reach over $100 billion by 2024, indicating the scale of the opportunity.

Diversifying into adjacent digital infrastructure, like data centers or IoT networks, positions Indus Towers in high-growth sectors. These are areas where the company would likely begin with a nascent market share, necessitating significant strategic investment to establish a strong foothold. For instance, the global data center market was projected to reach over $300 billion by 2024, presenting a substantial opportunity for expansion.

International Expansion Initiatives

International expansion for Indus Towers, targeting other developing markets, would likely position these ventures as Stars or Question Marks in the BCG matrix. These are high-growth prospects, but with an initially very low market share and significant investment requirements, making them capital intensive.

For instance, if Indus Towers were to enter a market like Vietnam or Indonesia, which are experiencing rapid mobile data growth, these would be considered high-growth areas. However, establishing a significant footprint against incumbent players would require substantial upfront capital for site acquisition, fiber deployment, and power solutions. The initial market share would be negligible, necessitating a strategic, long-term investment approach.

- High Growth Potential: Developing markets often exhibit strong GDP growth and increasing mobile penetration, driving demand for tower infrastructure.

- Low Market Share: Entering established markets means competing with existing players, resulting in a small initial market share.

- High Investment Needs: Building new infrastructure or acquiring existing assets in these markets requires significant capital outlay.

- Strategic Importance: These ventures are crucial for long-term diversification and capturing future growth opportunities beyond the Indian market.

Advanced Predictive Maintenance and AI Solutions as a Service

Indus Towers is leveraging its AI capabilities beyond internal use. While they currently employ AI for network optimization and predictive maintenance within their own operations, a significant growth opportunity lies in offering these advanced solutions as a service to external clients. This B2B service model could tap into a burgeoning market for AI-driven infrastructure management.

By externalizing their AI expertise, Indus Towers can position itself as a key player in the Infrastructure-as-a-Service (IaaS) domain, specifically focusing on intelligent operations. This strategic move allows them to monetize their technological advancements and build market share in a sector ripe for digital transformation.

The demand for such services is substantial, with the global AI in telecom market projected to reach USD 32.4 billion by 2027, growing at a CAGR of 23.6%. Indus Towers could capitalize on this trend by offering:

- Predictive Maintenance: Offering AI-powered solutions to predict equipment failures, reducing downtime and operational costs for other tower companies or large enterprises with critical infrastructure.

- Network Optimization: Providing AI algorithms to enhance network performance, improve signal quality, and manage traffic efficiently for telecom operators and other connectivity providers.

- AI-Driven Energy Management: Developing and deploying AI systems to optimize energy consumption across infrastructure assets, leading to significant cost savings and environmental benefits for clients.

The development of 6G infrastructure represents a significant future opportunity for Indus Towers. Currently, the company holds a minimal market share in this emerging technology. Significant investment in research and early trials will be crucial for establishing a competitive position in this high-growth area.

Indus Towers' foray into offering AI-driven network optimization and predictive maintenance as a service to external clients is a prime example of a Question Mark. This B2B service model taps into a rapidly expanding market for intelligent infrastructure management, a segment where Indus Towers is likely to start with a low market share but possesses strong potential for growth.

The global AI in telecom market was projected to reach USD 32.4 billion by 2027, highlighting the substantial opportunity. Indus Towers can leverage its internal AI expertise to provide predictive maintenance, network optimization, and AI-driven energy management solutions to other companies.

These ventures require substantial capital investment and carry inherent risks due to their nascent stage. Success hinges on strategic execution and the ability to build market share against potential competitors in these new service areas.

| Area | Current Market Share | Growth Potential | Investment Required | Strategic Focus |

|---|---|---|---|---|

| 6G Infrastructure | Minimal | High | High | Research & Development, Early Trials |

| AI as a Service (Network Optimization, Predictive Maintenance) | Low (External Offering) | High | Moderate to High | Service Development, Sales & Marketing |

| Edge Computing Deployment | Minimal | High | High | Infrastructure Development, Partnerships |

| Adjacent Digital Infrastructure (Data Centers, IoT Networks) | Minimal | High | High | Strategic Investment, Market Entry |

| International Expansion (Developing Markets) | Low | High | High | Market Entry Strategy, Site Acquisition |

BCG Matrix Data Sources

Our Indus Towers BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market share analysis, and industry growth forecasts to provide strategic clarity.