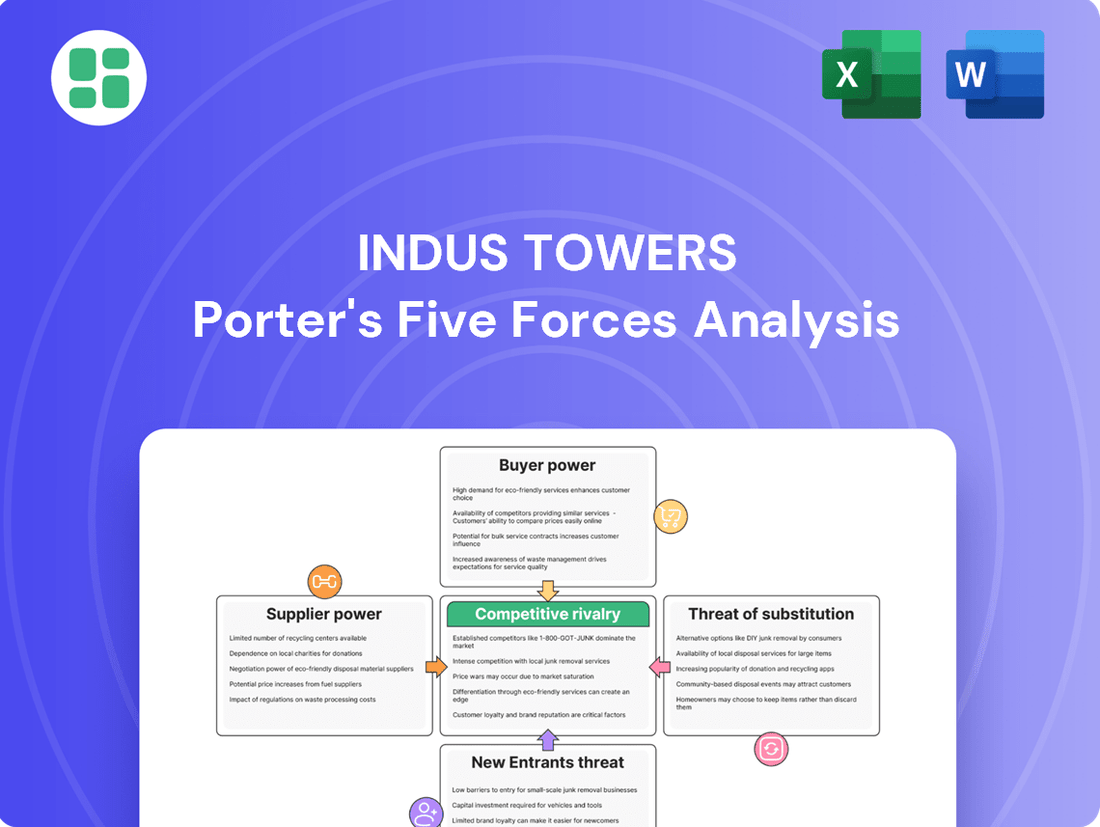

Indus Towers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

Indus Towers navigates a competitive landscape shaped by moderate buyer power from telecom operators and significant bargaining power from its suppliers, particularly for tower infrastructure and land leases. The threat of new entrants is relatively low due to high capital requirements and established infrastructure, while the threat of substitutes is minimal given the essential nature of mobile towers.

The complete report reveals the real forces shaping Indus Towers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Indus Towers is influenced by the concentration of key telecom equipment manufacturers. Companies producing specialized 5G-ready antennas and other advanced network infrastructure often operate within an oligopolistic market structure. This limited number of suppliers can grant them moderate leverage when negotiating with large entities like Indus Towers, particularly for critical, cutting-edge technology essential for network expansion and upgrades.

However, Indus Towers' substantial operational scale and its position as a major buyer provide a counterbalancing force. By engaging in bulk purchasing and establishing long-term supply agreements, Indus Towers can effectively mitigate the bargaining power of these concentrated suppliers. For instance, securing multi-year contracts for network equipment in 2024 can lock in favorable pricing and supply terms, reducing dependence on any single supplier and enhancing its negotiating position.

Indus Towers, like many infrastructure companies, has a significant reliance on energy suppliers for its operations. The company powers its extensive network of telecom towers primarily through electricity and diesel. This dependency means that fluctuations in energy prices or availability can directly impact operational costs and efficiency.

While Indus Towers is actively pursuing green energy solutions, including solar and hybrid systems, traditional power sources remain a substantial component of their energy mix. For instance, in fiscal year 2024, diesel consumption continued to be a key operational expense, although the company reported an increase in the deployment of solar power solutions across its sites, aiming to mitigate this reliance.

This ongoing dependence on energy suppliers, particularly in areas with less stable grid infrastructure or volatile fuel markets, grants these suppliers a degree of bargaining power. This leverage can manifest in pricing negotiations, especially when demand for fuel or electricity is high, potentially impacting Indus Towers' profitability and service continuity.

Indus Towers faces a fragmented but potentially powerful group of landlords and site owners across India. While individual owners may have limited sway, their collective action, particularly in high-demand urban centers, can influence lease renewals and new site acquisition costs. This scarcity of prime locations gives them leverage.

The ongoing negotiation for favorable lease terms remains a constant for Indus Towers. Securing and retaining tower sites involves continuous dialogue with these property owners, impacting operational expenses and expansion plans. This dynamic is a key factor in managing infrastructure costs.

However, the upcoming Right of Way (RoW) rules, slated for January 2025, are designed to standardize and cap charges. This regulatory intervention is expected to curb the bargaining power of landlords by setting clearer guidelines and limits on rental increases, potentially leading to more predictable site acquisition costs for Indus Towers.

Labor and Specialized Skills

The availability of skilled labor for crucial tasks like tower installation, ongoing maintenance, and intricate network management directly impacts the bargaining power of suppliers in this segment. A scarcity of specialized technicians or engineers, particularly those with expertise in 5G deployment and fiber optics, can significantly escalate labor costs and potentially hinder Indus Towers' operational efficiency.

Indus Towers, managing a vast and technologically advancing infrastructure, must proactively secure a consistent pipeline of well-trained and competent personnel to maintain its competitive edge and ensure service reliability. This involves strategic investments in training programs and partnerships with technical institutions.

- Skilled Labor Availability: A tight labor market for telecom technicians can increase wage demands, impacting Indus Towers' operational expenses.

- Specialized Expertise: The need for engineers with specific skills in areas like radio frequency optimization or fiber network deployment can give specialized labor pools greater leverage.

- Training Costs: Indus Towers may bear increased costs for training new hires or upskilling existing staff to meet evolving technological requirements.

- Impact on Efficiency: Shortages of qualified personnel can lead to project delays and affect the speed of network upgrades and maintenance, impacting service delivery.

Technology and Software Providers

Technology and software providers, particularly those offering specialized solutions for network management, monitoring, and optimization, wield significant bargaining power. This power stems from the proprietary nature of their offerings and the substantial costs associated with switching to alternative systems. For instance, as Indus Towers continues to integrate advanced technologies like AI for energy efficiency and smart tower functionalities, its dependence on these niche software partners grows, potentially increasing their leverage.

This reliance is further amplified by the increasing complexity and integration required in modern telecom infrastructure. Companies like Indus Towers need highly specialized software that seamlessly integrates with their existing network architecture. The development and maintenance of such sophisticated systems often involve significant upfront investment and ongoing support from the original providers, making a transition costly and disruptive. For example, a shift from a proprietary network monitoring suite to a new one could involve extensive data migration, re-training of personnel, and potential compatibility issues with hardware, leading to significant operational downtime and expense.

- Proprietary Solutions: Suppliers offering unique, patented software for network optimization create high barriers to entry for competitors.

- High Switching Costs: The expense and complexity of migrating data, retraining staff, and ensuring system compatibility make switching providers difficult for Indus Towers.

- Increasing Dependence: As Indus Towers adopts more advanced technologies, such as AI-driven energy management, its reliance on specialized software vendors intensifies.

- Integration Complexity: Telecom infrastructure requires deeply integrated software, making it challenging to replace specialized providers without impacting core operations.

The bargaining power of suppliers for Indus Towers is moderate, influenced by both concentration and scale. While specialized telecom equipment manufacturers in an oligopolistic market can exert some leverage, Indus Towers' significant purchasing volume and long-term contracts in 2024 help to counterbalance this. Energy suppliers also hold some power due to the company's reliance on diesel and grid electricity, though green energy initiatives aim to reduce this dependence.

Landlords and site owners present a fragmented but potentially influential supplier group, especially in prime locations, impacting lease renewals and acquisition costs. However, upcoming Right of Way (RoW) rules by January 2025 are expected to cap charges and standardize rental increases, thereby curbing their bargaining power.

Skilled labor and specialized technology/software providers also represent key supplier groups. A shortage of telecom technicians can drive up labor costs, while proprietary software with high switching costs grants significant leverage to technology vendors, especially as Indus Towers integrates advanced solutions like AI for network management.

| Supplier Group | Leverage Factors | Mitigation Strategies for Indus Towers |

|---|---|---|

| Telecom Equipment Manufacturers | Market concentration (oligopoly) for specialized 5G tech | Bulk purchasing, long-term supply agreements (e.g., 2024 contracts) |

| Energy Suppliers (Electricity, Diesel) | Dependence on traditional power sources, fuel price volatility | Increased deployment of solar/hybrid systems, green energy initiatives |

| Landlords/Site Owners | Scarcity of prime locations, collective action | Negotiating favorable lease terms, anticipation of RoW rules (Jan 2025) for standardization |

| Skilled Labor Providers | Scarcity of specialized technicians (5G, fiber optics) | Investment in training programs, partnerships with technical institutions |

| Technology & Software Providers | Proprietary solutions, high switching costs, integration complexity | Strategic vendor partnerships, phased technology adoption, internal expertise development |

What is included in the product

This analysis unpacks the competitive forces impacting Indus Towers, examining supplier power, buyer bargaining, the threat of new entrants and substitutes, and the intensity of rivalry within the telecom tower industry.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, offering a clear roadmap to navigate the telecom tower landscape.

Customers Bargaining Power

The Indian telecom landscape is heavily consolidated, with Reliance Jio, Bharti Airtel, and Vodafone Idea being the dominant players. This concentration of market share among a few large entities significantly amplifies their bargaining power when dealing with passive infrastructure providers such as Indus Towers.

These major telecom operators, due to their substantial customer base and revenue contribution, can effectively negotiate terms, pushing for more competitive pricing structures and stringent service level agreements. Their ability to influence tenancy ratios on towers also adds to their leverage.

For instance, in 2024, the top three operators commanded a vast majority of the Indian mobile subscriber base, giving them considerable sway in negotiations. This market structure inherently empowers them to demand favorable conditions from infrastructure partners.

While customers, primarily telecom operators, possess significant bargaining power, their ability to switch tower providers is constrained by high switching costs. These costs stem from the substantial infrastructure investment and intricate operational integration required to shift to a new tower company, making it a complex and expensive undertaking.

This inherent stickiness in existing tenancies provides a degree of revenue stability for Indus Towers. For instance, the company's business model relies heavily on long-term contracts with major telecom players, ensuring predictable income streams.

Furthermore, these contracts typically include annual price escalation clauses, which further enhance revenue visibility and predictability for Indus Towers, mitigating some of the customer bargaining power.

Vodafone Idea's (Vi) financial stability has been a significant factor influencing Indus Towers' receivables, granting Vi a degree of bargaining power regarding payment terms. While Vi has made strides in clearing outstanding dues and is investing in network upgrades, its ongoing financial performance remains a critical determinant of its leverage.

As of the first quarter of 2024, Vodafone Idea reported a consolidated revenue of ₹10,239.6 crore, indicating a continued need for capital. This financial backdrop means that Vi's ability to meet its payment obligations to Indus Towers directly impacts the latter's cash flow and, by extension, its own operational flexibility.

Demand for 5G Rollout and Densification

The aggressive 5G rollout by major telecom players like Bharti Airtel and Vodafone Idea directly fuels demand for Indus Towers' infrastructure. This expansion, requiring new tower sites and increased tenancies, strengthens Indus Towers' position by creating new revenue streams and mitigating some of the bargaining power customers might otherwise wield.

This demand surge is particularly evident in the need for densification, which involves deploying more cell sites, including small cells, to support the higher bandwidth and lower latency of 5G. For instance, as of Q4 FY24, Bharti Airtel reported over 300,000 sites deployed for its 5G network, indicating a substantial need for tower infrastructure.

- Increased Demand: Telecom operators' 5G expansion drives the need for new tower infrastructure and additional tenancies.

- Densification Requirement: 5G necessitates a denser network, including small cells, creating new deployment opportunities for tower companies.

- Revenue Opportunities: This infrastructure demand offers Indus Towers significant new revenue potential, partially offsetting customer bargaining power.

- Operator Investment: Bharti Airtel's significant investment in its 5G network, with hundreds of thousands of sites deployed, highlights the scale of this demand.

Emphasis on Infrastructure Sharing

Telecom operators are increasingly leaning towards shared infrastructure to manage their capital expenditures, which directly impacts Indus Towers' primary business model. This shift fuels demand for co-location services, but it also empowers customers to negotiate for the most economical sharing arrangements.

The bargaining power of customers is amplified as they actively seek cost-effective solutions. For instance, in 2023, the Indian telecom sector saw significant consolidation and a strong push for operational efficiencies, with sharing being a key strategy.

- Increased Demand for Co-location: Operators sharing towers reduces individual CAPEX, making co-location a preferred model.

- Price Sensitivity: Customers actively compare and negotiate pricing for shared infrastructure to minimize costs.

- Regulatory Influence: Proposals from bodies like TRAI to encourage active and passive infrastructure sharing further strengthen the customer's position in demanding competitive rates.

The bargaining power of customers, primarily major telecom operators like Reliance Jio, Bharti Airtel, and Vodafone Idea, is substantial due to the consolidated nature of the Indian telecom market. These large entities, controlling the vast majority of subscribers, can effectively negotiate pricing and service terms with infrastructure providers such as Indus Towers. Their ability to influence tenancy ratios on towers further enhances their leverage.

While customers hold significant power, high switching costs for tower infrastructure create a degree of stickiness, offering revenue stability for Indus Towers through long-term contracts with escalation clauses. However, Vodafone Idea's financial standing in early 2024, with consolidated revenues of ₹10,239.6 crore in Q1 2024, directly impacts its negotiation leverage regarding payment terms.

The aggressive 5G rollout by operators like Bharti Airtel, which had deployed over 300,000 sites for its 5G network by Q4 FY24, fuels demand for Indus Towers' infrastructure, creating new revenue streams and partially offsetting customer bargaining power through increased co-location needs.

| Customer | Subscriber Market Share (Approx. Q1 2024) | Key Leverage Point | 5G Site Deployments (Indicative) |

|---|---|---|---|

| Reliance Jio | ~40% | Largest subscriber base, driving demand for new sites | Significant ongoing rollout |

| Bharti Airtel | ~32% | Strong 5G investment, driving densification needs | >300,000 sites (Q4 FY24) |

| Vodafone Idea | ~20% | Financial performance impacting payment terms, 5G rollout | Increasing investment |

Preview the Actual Deliverable

Indus Towers Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Indus Towers' competitive landscape through a Porter's Five Forces analysis, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Understanding these forces is crucial for strategic decision-making within the telecommunications infrastructure sector.

Rivalry Among Competitors

The Indian telecom tower landscape is highly concentrated, with Indus Towers, a significant player, facing off against Brookfield's entities (Summit Digitel/Altius) and a few other smaller operators like GTL Infrastructure and Ascend Telecom. This oligopolistic structure means competition for securing new tenancies and expanding market share is fierce among these few dominant companies.

As Jio and Airtel push forward with their major 5G deployments, the race for new tower leases is heating up. This intensified competition means tower companies are increasingly focused on securing contracts for network densification and rural expansion, particularly from Vodafone Idea's ongoing 4G and 5G build-outs.

Indus Towers boasts an impressive pan-India tower portfolio, a significant advantage in the competitive landscape. This extensive footprint, covering over 400,000 towers as of early 2024, necessitates substantial capital expenditure for rivals aiming to replicate its reach, thereby creating a formidable barrier to entry and market share acquisition.

The strategic importance of a geographically diversified tower portfolio cannot be overstated for telecommunication operators seeking comprehensive network coverage. Indus Towers' ability to provide this widespread access across India directly supports telcos in achieving their coverage goals, making it a crucial partner in their expansion strategies.

Pricing Pressure and Rental Realization

The telecom sector's consolidation has significantly bolstered the bargaining power of mobile network operators (MNOs). This shift means tower companies like Indus Towers face increased pressure to offer discounts during contract renewals, directly impacting their rental income. For instance, in 2024, MNOs are pushing for more cost-effective solutions, leading to a moderation in the average rental rates tower companies can command.

This dynamic intensifies rivalry among tower providers, as they compete not only on network quality and coverage but also on price. The demand for leaner, more efficient tower infrastructure further exacerbates this pressure. Companies must balance the need to maintain profitability with the imperative to retain large MNO clients in a competitive landscape.

- Consolidation Impact: Telecom industry consolidation has shifted bargaining power towards MNOs.

- Rental Realization: Tower companies experience pressure on average rental realizations due to discounts.

- Pricing Pressure: Renewals and demand for leaner towers intensify price-based competition.

- Profitability Strain: Continuous pricing pressure directly affects the profitability of tower infrastructure providers.

Innovation and Operational Efficiency

Competitive rivalry in the telecom tower industry, including Indus Towers, is intensifying through innovation and operational efficiency. Companies are vying to implement cutting-edge technologies like hybrid power systems and AI-driven energy management to reduce operational expenditures. For instance, in 2024, the focus on green energy solutions for tower sites is a key differentiator, with many operators investing in solar power and battery storage to lower diesel consumption, which can represent a significant portion of operating costs.

This drive for efficiency also translates into offering advanced infrastructure solutions, such as smart tower technologies that enable remote monitoring and predictive maintenance. Companies that successfully integrate these innovations can offer more reliable and cost-effective services to mobile network operators. This technological race directly impacts market share, as clients increasingly favor tower providers who demonstrate a commitment to sustainability and operational excellence. In 2023, the global telecom tower market saw significant investments in upgrading existing infrastructure to support 5G, further highlighting the importance of innovation.

The ability to reduce operating costs through these advancements provides a substantial competitive edge. For example, a reduction in energy costs, a major component of tower operations, can be reinvested in further network expansion or passed on to clients as lower rental fees. Companies like Indus Towers are actively exploring these avenues to maintain their leadership position in a dynamic market. The ongoing development of energy-efficient solutions is crucial for long-term profitability and market competitiveness.

Key areas of innovation include:

- Energy Efficiency: Adoption of hybrid power systems, solar panels, and advanced battery storage solutions to reduce reliance on diesel generators.

- Smart Tower Technologies: Implementation of IoT sensors and AI for remote monitoring, predictive maintenance, and optimized resource allocation.

- 5G Infrastructure Upgrades: Enhancing existing towers to support higher bandwidth and lower latency requirements of 5G networks.

- Operational Cost Reduction: Streamlining maintenance processes and optimizing energy consumption to lower overall operating expenses.

The competitive rivalry within India's telecom tower sector is intense, driven by a few major players like Indus Towers, Summit Digitel, and others vying for contracts with mobile network operators (MNOs). This rivalry is further fueled by the ongoing 5G rollout by giants like Jio and Airtel, creating a high demand for tower leases and network expansion. In 2024, MNOs are leveraging industry consolidation to exert greater bargaining power, pushing for reduced rental rates and more cost-effective solutions, which directly impacts tower companies' profitability.

Companies are differentiating themselves through innovation and operational efficiency, focusing on technologies like hybrid power systems and AI for energy management to cut costs. For instance, the adoption of solar power at tower sites is a significant trend in 2024, aiming to reduce diesel consumption, a major operating expense. This technological race, including upgrades for 5G infrastructure, is crucial for securing market share and maintaining profitability in a dynamic market.

| Competitor | Tower Count (Approx. Early 2024) | Key Focus Areas |

|---|---|---|

| Indus Towers | >400,000 | Pan-India coverage, 5G readiness, energy efficiency |

| Summit Digitel (Brookfield) | Significant | Network expansion, 5G deployment support |

| Other Smaller Operators | Varying | Niche markets, specific telco partnerships |

SSubstitutes Threaten

The increasing adoption of small cells, especially for 5G networks, acts as a partial substitute for traditional macro towers, particularly in densely populated urban environments. These smaller, more localized base stations can offload traffic and improve coverage, potentially reducing the need for extensive macro tower infrastructure in certain areas.

While Indus Towers is actively involved in deploying small cells, a substantial migration towards this technology could impact the demand for its primary large tower assets. For instance, in 2024, the global small cell market was projected to grow significantly, indicating a tangible shift in network deployment strategies.

The increasing fiberization of towers and the expansion of direct fiber-to-the-home (FTTH) connections present a significant threat of substitutes for traditional wireless connectivity reliant on towers. While tower companies themselves are investing in fiber, widespread direct fiber deployments can diminish the necessity for mobile broadband services delivered wirelessly, potentially impacting demand for tower space.

For instance, in 2023, the global FTTH market was valued at approximately $100 billion, with projections indicating continued strong growth. This expansion means more consumers and businesses can access high-speed internet directly, bypassing the need for cellular data, which is a primary revenue driver for tower companies like Indus Towers.

Satellite internet services, such as Starlink, present a developing threat to traditional terrestrial mobile connectivity, particularly in areas lacking robust infrastructure. Bharti Airtel's exploration of partnerships in India highlights this emerging trend.

While currently a niche market, the expansion of satellite internet could reduce the need for new rural tower deployments over the long term, potentially impacting future revenue streams for companies like Indus Towers.

In-building Solutions (IBS) and Wi-Fi Hotspots

In-building solutions (IBS) and the proliferation of Wi-Fi hotspots present a significant threat of substitutes for traditional cellular tower services, particularly for indoor connectivity. As users increasingly expect seamless connectivity within buildings, these alternatives can bypass the need for robust cellular infrastructure. This trend is amplified by regulatory pushes, such as the Telecom Regulatory Authority of India’s (TRAI) efforts to rate properties on their digital connectivity, highlighting the growing emphasis on in-building solutions.

The availability of free or low-cost Wi-Fi in public spaces, offices, and even residential complexes directly competes with mobile data plans. For instance, a significant portion of data traffic is already offloaded to Wi-Fi networks. In 2023, it was estimated that Wi-Fi accounted for over 50% of all mobile data traffic in many regions, a figure that continues to climb. This substitution directly impacts the revenue streams of tower companies by reducing the demand for cellular data services indoors.

- Growing Wi-Fi Offload: Wi-Fi networks are increasingly handling a substantial share of mobile data, potentially reducing the need for cellular capacity indoors.

- In-Building Solutions (IBS): Dedicated IBS can provide superior indoor coverage, making cellular towers less critical for connectivity within large structures.

- TRAI's Digital Connectivity Ratings: Initiatives to rate properties based on digital infrastructure, including IBS and Wi-Fi, signal a shift in user preference towards integrated indoor solutions.

- User Preference for Convenience: Consumers often opt for readily available Wi-Fi over cellular data when both are present, especially in areas where cellular signal might be weaker.

Private 5G Networks for Enterprises

The increasing adoption of private 5G networks by enterprises presents a significant threat of substitutes for traditional tower infrastructure. Companies are exploring these dedicated networks to meet specific demands for IoT and enhanced operational control, thereby decreasing their dependence on public mobile network operators.

This shift is particularly evident as industries like manufacturing and logistics seek greater efficiency and security. For instance, by 2024, a substantial number of enterprises are expected to pilot or deploy private 5G solutions, potentially impacting the revenue streams of tower companies that rely on public network deployments. This trend could lead to a reduction in the number of small cells or macro sites required on towers for these specific enterprise use cases.

- Reduced Reliance: Enterprises building private 5G networks bypass the need for public network capacity, directly affecting tower tenants.

- IoT Driven Adoption: The proliferation of IoT devices in industrial settings is a key driver for private 5G, creating a self-contained network solution.

- Operational Control: Private networks offer enterprises greater control over data, latency, and security, making them attractive alternatives.

- Market Growth: The global private 5G market is projected to grow significantly, with estimates suggesting it could reach tens of billions of dollars by the mid-2020s, indicating a tangible shift away from reliance on public infrastructure.

The increasing adoption of small cells and private 5G networks by enterprises poses a significant threat of substitutes for traditional tower infrastructure. These solutions offer localized coverage and dedicated capacity, reducing reliance on public networks. For example, the global private 5G market was projected for substantial growth in 2024, indicating a tangible shift in enterprise network strategies.

Furthermore, the expansion of fiber-to-the-home (FTTH) and the prevalence of Wi-Fi hotspots directly compete with wireless data services. With the FTTH market valued around $100 billion in 2023 and Wi-Fi handling over 50% of mobile data traffic in many regions, these alternatives diminish the necessity for cellular connectivity, especially indoors.

Satellite internet is also emerging as a substitute, particularly for rural areas. While still a niche market, its growth could impact future rural tower deployments. These converging trends highlight how alternative technologies are reshaping the demand for traditional tower services.

| Substitute Technology | Impact on Tower Demand | Key Drivers | 2023/2024 Data Points |

|---|---|---|---|

| Small Cells | Partial reduction, especially in urban areas | 5G densification, urban coverage | Projected significant growth in the small cell market |

| Fiber-to-the-Home (FTTH) | Reduced demand for wireless broadband | High-speed internet access, bypassing cellular | Global FTTH market valued ~ $100 billion in 2023 |

| Wi-Fi Hotspots | Reduced indoor cellular data usage | Convenience, cost savings, data offload | Wi-Fi offloaded >50% of mobile data traffic in many regions (2023) |

| Private 5G Networks | Reduced need for public network capacity for enterprises | IoT, operational control, security | Substantial enterprise pilots/deployments expected by 2024 |

| Satellite Internet | Potential reduction in rural tower deployments | Infrastructure gaps, remote connectivity | Bharti Airtel exploring partnerships |

Entrants Threaten

The telecom tower industry demands substantial upfront capital, making it a significant barrier for new players. Establishing a nationwide network involves immense costs for land acquisition, tower construction, and essential equipment deployment. For instance, in 2024, building a single tower can cost upwards of $50,000 to $100,000, depending on location and specifications, with nationwide rollouts requiring billions.

The Indian telecom sector is a minefield of regulations, demanding extensive licenses and permits. Potential new entrants face a steep climb navigating these, alongside complex Right of Way (RoW) rules, which significantly deter new competition.

Existing players like Indus Towers leverage substantial economies of scale, a direct result of their extensive operational networks and high tenancy ratios, which significantly lower per-unit costs. For instance, Indus Towers operates over 210,000 towers across India as of early 2024, a scale that is incredibly difficult for newcomers to replicate.

New entrants face a formidable barrier in achieving comparable cost efficiencies and broad network coverage. Reaching a similar operational footprint would necessitate immense initial capital investment and considerable time, making it challenging to compete on price or service availability from the outset.

Strong Relationships with Incumbent Operators

Indus Towers benefits significantly from its established, long-standing relationships with major telecom operators. These deep-rooted client connections and existing, multi-year contracts create a substantial barrier to entry for potential new competitors.

New entrants would struggle to secure the anchor tenants necessary to build a viable tower portfolio, as most large operators are already committed to existing providers like Indus Towers. This makes it challenging for newcomers to gain market traction and establish a competitive presence.

- Incumbent Operator Lock-in: Major telecom players have existing agreements that are difficult and costly to break, securing Indus Towers' market share.

- High Switching Costs: The process of migrating infrastructure and services for operators is complex and expensive, deterring them from switching to new providers.

- Strategic Partnerships: Indus Towers has evolved beyond mere tenant relationships to form strategic alliances, further solidifying its position and making it harder for new entrants to compete.

Consolidation and Market Concentration

The Indian telecom tower market has seen substantial consolidation, leading to fewer independent players. This heightened market concentration creates significant hurdles for new companies aiming to enter and compete with established, large-scale incumbents.

For instance, the merger of Indus Towers with Bharti Infratel in 2020 significantly reduced the number of major tower operators. This trend means that potential new entrants face a landscape dominated by a few powerful entities, making it difficult to secure contracts or achieve economies of scale.

- Market Consolidation: Significant mergers and acquisitions have reduced the number of independent tower companies.

- Reduced Competition: Fewer players mean a more concentrated market, making entry harder.

- Incumbent Advantage: Established players benefit from existing infrastructure and scale.

- Barriers to Entry: High capital requirements and existing relationships create substantial entry barriers.

The threat of new entrants in the Indian telecom tower industry remains low, primarily due to immense capital requirements and regulatory complexities. Indus Towers, with its vast network of over 210,000 towers as of early 2024, exemplifies the scale advantage that deters newcomers. Established relationships with major telecom operators, locked in by high switching costs and strategic partnerships, further solidify the position of incumbents like Indus Towers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Building a nationwide tower network requires billions in investment for land, construction, and equipment. A single tower can cost $50,000-$100,000 in 2024. | Prohibitive upfront costs make it difficult for new players to match existing scale. |

| Regulatory Hurdles | Navigating licenses, permits, and Right of Way (RoW) rules is complex and time-consuming. | Significant administrative burden and potential delays deter new market participants. |

| Economies of Scale | Incumbents like Indus Towers benefit from lower per-unit costs due to their large operational footprint and high tenancy ratios. | New entrants struggle to achieve cost competitiveness without comparable scale. |

| Customer Lock-in | Long-term contracts and high switching costs for telecom operators make it difficult for new tower companies to secure anchor tenants. | Newcomers face challenges in gaining initial market traction and revenue streams. |

| Market Consolidation | Past mergers, such as Indus Towers and Bharti Infratel, have reduced the number of major players, increasing market concentration. | A consolidated market offers fewer opportunities and greater dominance for existing entities. |

Porter's Five Forces Analysis Data Sources

Our Indus Towers Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and financial disclosures. We supplement this with insights from reputable industry research firms and telecom sector publications to capture market dynamics.