Incyte SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Incyte Bundle

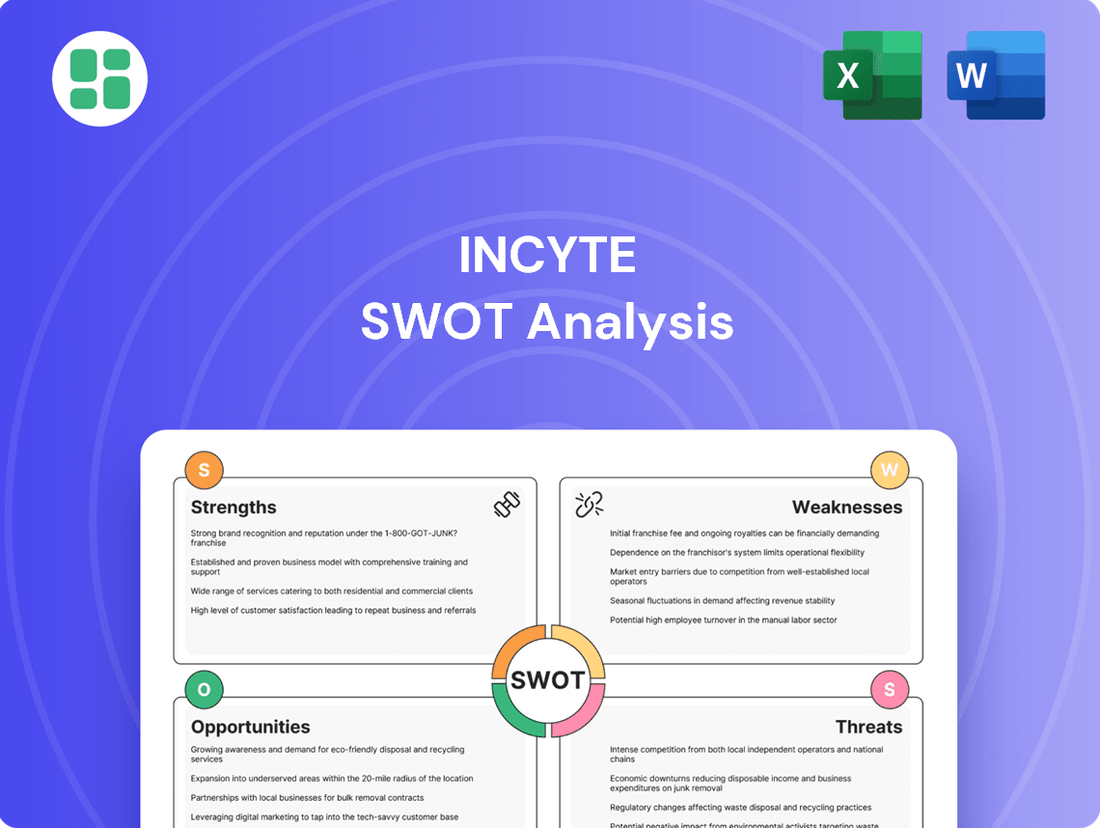

Incyte's innovative pipeline and strong market presence in hematology/oncology present significant strengths, but also highlight potential competitive threats and regulatory hurdles. Understanding these dynamics is crucial for informed strategic decisions.

Want the full story behind Incyte's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Incyte's leading products are a major engine for its revenue growth. The company's flagship drug, Jakafi (ruxolitinib), consistently shows robust sales figures, making it a cornerstone of Incyte's financial performance. In 2024, Jakafi generated $2.8 billion in net revenues, marking an 8% increase from the previous year, and this upward trend is expected to continue into 2025.

Another significant contributor to Incyte's revenue expansion is Opzelura (ruxolitinib cream). This product experienced remarkable growth in 2024, with net revenues climbing 50% to reach $508 million. This surge is largely attributed to strong patient uptake for its approved indications in atopic dermatitis and vitiligo.

Incyte boasts a strong and varied research and development pipeline, primarily targeting hematology/oncology, inflammation, and autoimmune diseases. The company has a significant number of important milestones planned for 2025, indicating robust innovation.

The company anticipates achieving at least 18 key milestones in 2025. This includes plans for four new product launches, four crucial study results, the commencement of at least three Phase 3 studies, and seven proof-of-concept study results.

This broad pipeline diversifies Incyte's portfolio, lessening its dependence on current products and paving the way for expanded market reach and future growth.

Incyte demonstrates a robust financial position, underscored by significant cash and marketable securities totaling $2.4 billion as of March 31, 2025. This substantial liquidity provides a strong buffer and enables strategic investments in research and development or potential acquisitions.

The company experienced impressive revenue growth, with total revenues climbing 15% in 2024 to reach $4.2 billion. This upward trajectory continued into early 2025, with total revenues showing a notable 20% increase year-over-year for the first quarter.

Recent Regulatory Successes and Product Launches

Incyte has demonstrated significant momentum with recent regulatory successes and strategic product launches. The company secured FDA approval and initiated the commercial launch of Niktimvo (axatilimab-csfr) in January 2025, targeting chronic graft-versus-host disease. This was followed by the May 2025 approval and launch of Zynyz (retifanlimab-dlwr) for squamous cell anal carcinoma.

These key approvals in late 2024 and early 2025 are pivotal for Incyte's commercial expansion. They not only broaden the company's product portfolio but also address critical unmet needs within specific patient populations.

- January 2025: FDA approval and commercial launch of Niktimvo (axatilimab-csfr) for chronic graft-versus-host disease.

- May 2025: FDA approval and commercial launch of Zynyz (retifanlimab-dlwr) for squamous cell anal carcinoma.

- Market Expansion: These launches enhance Incyte's market presence and revenue streams.

Strategic Focus on Unmet Medical Needs

Incyte's core strength lies in its strategic focus on identifying and developing novel therapeutics for areas with significant unmet medical needs, particularly in hematology/oncology and inflammation/autoimmunity. This targeted approach allows for efficient resource allocation where their scientific expertise can make the greatest impact.

The company's commitment to these high-need areas is evident in its R&D pipeline, aiming to address patient populations with limited or no effective treatment options. For instance, Incyte's development of JAK inhibitors like povorcitinib underscores this dedication to tackling challenging diseases.

- Targeted R&D: Focus on hematology/oncology and inflammation/autoimmunity addresses critical patient needs.

- Resource Allocation: Efficiently directs capital to areas with high scientific impact and market potential.

- Pipeline Prioritization: Strategic realignment in 2024 emphasized high-impact programs like povorcitinib, a JAK inhibitor.

- Innovation Drive: Commitment to novel therapeutics for diseases with limited treatment alternatives.

Incyte's robust financial health is a key strength, evidenced by substantial liquidity. As of March 31, 2025, the company held $2.4 billion in cash and marketable securities, providing a solid foundation for continued investment and strategic flexibility.

The company's flagship product, Jakafi, continues to be a significant revenue driver, with 2024 net revenues reaching $2.8 billion, an 8% increase year-over-year. Opzelura also demonstrated remarkable growth, achieving $508 million in net revenues in 2024, a 50% jump.

Incyte's strategic focus on developing novel therapeutics for unmet medical needs, particularly in hematology/oncology and inflammation/autoimmunity, fuels its innovation. The company is set to achieve at least 18 key milestones in 2025, including new product launches and crucial study results, diversifying its portfolio and driving future growth.

| Product | 2024 Net Revenue (Billions USD) | Year-over-Year Growth | Key Milestones |

|---|---|---|---|

| Jakafi | 2.8 | 8% | Continued sales growth |

| Opzelura | 0.508 | 50% | Strong patient uptake |

| Niktimvo | N/A (Launched Jan 2025) | N/A | FDA approval and launch |

| Zynyz | N/A (Launched May 2025) | N/A | FDA approval and launch |

What is included in the product

Delivers a strategic overview of Incyte’s internal and external business factors, highlighting its strengths in oncology, potential weaknesses in pipeline diversification, opportunities for pipeline expansion, and threats from competition.

Offers a clear, actionable framework to identify and address Incyte's strategic challenges and opportunities.

Weaknesses

Incyte faces a significant weakness due to its heavy reliance on Jakafi. In 2024, Jakafi generated $2.8 billion, representing a substantial 67% of Incyte's total revenue of $4.2 billion. This concentration means that any adverse developments impacting Jakafi, such as heightened competition or regulatory hurdles, could disproportionately affect the company's overall financial health.

While Jakafi's continued growth is positive, this dependency creates a vulnerability. The long-term sustainability of Incyte's revenue stream is contingent on successfully navigating potential challenges to Jakafi and establishing new, robust revenue drivers. The company must ensure a smooth transition beyond 2029, when Jakafi's patent exclusivity may be challenged.

In 2024, Incyte made a significant move by discontinuing five early-stage investigational therapies. This decision was part of a broader strategic realignment of its research and development efforts. While the intention is to concentrate resources on programs with greater potential, it also highlights past inefficiencies or hurdles encountered in the early stages of drug development.

This pipeline trimming can lead to concerns about the diversity of Incyte's future growth avenues and may be viewed as a short-term setback for the company's innovation pipeline.

Incyte's commitment to innovation necessitates substantial investment in research and development, with R&D expenses reaching $2.49 billion in 2024. This significant outlay, while crucial for future product pipelines, directly impacts short-term profitability and can compress operating margins. Effectively managing these high costs to ensure a strong return on investment remains a key operational challenge for the company.

Regulatory Review Delays and Uncertainties

Regulatory review processes inherently carry uncertainties and can lead to significant delays, impacting Incyte's product launch schedules and financial forecasts. For instance, the FDA's decision in June 2025 to extend the review for Opzelura's pediatric atopic dermatitis application by three months highlights this challenge.

These extended review periods can directly affect revenue generation by pushing back market entry dates. Furthermore, prolonged regulatory scrutiny often translates into increased development and operational costs, potentially squeezing profit margins.

- Extended FDA Review: The June 2025 extension for Opzelura's pediatric atopic dermatitis SNDA exemplifies potential regulatory hurdles.

- Impact on Revenue: Delays in approval can postpone anticipated revenue streams from key products.

- Increased Development Costs: Longer review times often correlate with higher expenditures in clinical trials and regulatory affairs.

Competitive Market Landscape

The biopharmaceutical arena, particularly in oncology and inflammation/autoimmunity, is intensely competitive. Incyte's portfolio, including its JAK inhibitors like Jakafi and Opzelura, faces significant rivalry from other JAK inhibitors and novel therapeutic approaches. For instance, competitors such as Pfizer with Cibinqo and AbbVie with Rinvoq are active in the JAK inhibitor space, directly challenging Incyte's market position.

This crowded market environment can lead to considerable pressure on pricing strategies and market share retention. Companies must continually invest in research and development to bring forth innovative treatments, as seen with the ongoing advancements in PD-1 inhibitors and other cutting-edge therapies that could potentially disrupt existing treatment paradigms.

- Intense Competition: The oncology and inflammation/autoimmunity sectors are crowded with both established pharmaceutical giants and agile biotech startups.

- JAK Inhibitor Rivalry: Incyte's key products like Jakafi and Opzelura compete with other JAK inhibitors from major players.

- Emerging Therapies: Novel treatments, including advanced PD-1 inhibitors and other innovative modalities, pose a continuous threat to existing market positions.

- Pricing and Innovation Pressure: The competitive landscape necessitates aggressive pricing strategies and a constant drive for innovation to maintain market relevance and growth.

Incyte's heavy reliance on Jakafi presents a significant weakness, as this single product accounted for 67% of its $4.2 billion revenue in 2024. This concentration makes the company vulnerable to any setbacks affecting Jakafi, such as increased competition or regulatory issues. The company's long-term revenue stability hinges on successfully managing Jakafi's lifecycle and developing new revenue streams, especially with potential patent challenges looming after 2029.

The discontinuation of five early-stage investigational therapies in 2024, while aimed at resource optimization, also signals potential past inefficiencies in R&D. This pipeline trimming raises concerns about the diversity of future growth avenues and could be seen as a short-term impediment to innovation. Furthermore, substantial R&D investments, totaling $2.49 billion in 2024, while crucial for future growth, directly impact current profitability by compressing operating margins.

Regulatory review processes introduce inherent uncertainties and can cause significant delays, impacting product launch timelines and financial projections. The FDA's decision in June 2025 to extend the review for Opzelura's pediatric atopic dermatitis application by three months exemplifies this challenge, potentially delaying revenue generation and increasing development costs.

The biopharmaceutical market, particularly in oncology and inflammation, is fiercely competitive. Incyte's JAK inhibitors face strong rivalry from competitors like Pfizer's Cibinqo and AbbVie's Rinvoq, creating pressure on pricing and market share. Emerging therapies, such as advanced PD-1 inhibitors, also pose a continuous threat to Incyte's established market positions.

| Weakness | Description | Impact |

| Revenue Concentration | 67% of 2024 revenue ($2.8B) from Jakafi. | High vulnerability to Jakafi-specific challenges. |

| R&D Investment vs. Profitability | $2.49B R&D spend in 2024. | Compresses short-term operating margins. |

| Pipeline Uncertainty | Discontinuation of 5 early-stage therapies in 2024. | Concerns about future growth diversity and innovation pace. |

| Regulatory Delays | Opzelura pediatric review extended by FDA in June 2025. | Potential delays in revenue generation and increased costs. |

| Market Competition | Rivalry in JAK inhibitors and emerging therapies. | Pressure on pricing, market share, and need for continuous innovation. |

Preview Before You Purchase

Incyte SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of Incyte's strategic positioning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of Incyte's internal strengths and weaknesses, as well as external opportunities and threats.

Opportunities

Incyte has a clear path to growth by expanding the approved uses for its successful drugs, Opzelura and Jakafi. This strategy aims to capture new patient populations and increase market penetration.

A key opportunity lies in the anticipated H2 2025 approval of Opzelura for pediatric atopic dermatitis, a significant market. Additionally, ongoing clinical trials for prurigo nodularis and hidradenitis suppurativa could unlock further indications, broadening Opzelura's therapeutic reach.

Geographic expansion, especially in Europe, presents another substantial growth avenue. Continued international adoption of Incyte's products is expected to drive increased revenue streams, capitalizing on global demand for innovative treatments.

Incyte is poised for a significant year in 2025, with at least 18 anticipated pipeline catalysts. This includes the potential for four new product launches, which could open up substantial new revenue avenues.

The company also expects four pivotal study readouts, particularly within its strong oncology and immunology segments. These readouts are crucial inflection points that could validate ongoing research and development efforts.

These numerous upcoming milestones in 2025 represent critical opportunities for Incyte to solidify its market presence and drive future financial growth.

Incyte's late-stage pipeline presents significant growth opportunities, particularly with povorcitinib, a JAK1 inhibitor. This asset is projected to have multi-billion dollar revenue potential, targeting indications such as hidradenitis suppurativa, vitiligo, and chronic spontaneous urticaria.

Positive Phase 3 results for povorcitinib in hidradenitis suppurativa are expected to fuel global regulatory submissions in 2026. Further data readouts for vitiligo and prurigo nodularis are also anticipated in 2026, paving the way for potential approvals in 2027.

Strategic Collaborations and Business Development

Incyte's proactive approach to strategic collaborations is a key driver for pipeline expansion and market penetration. For instance, its partnership with Syndax Pharmaceuticals for Niktimvo exemplifies this strategy, aiming to leverage combined expertise for broader therapeutic application. This focus on business development is further evidenced by new development collaborations initiated in 2025, signaling a commitment to innovation and growth.

These alliances are crucial for de-risking the complex drug development process and expediting the path to market for novel treatments. By sharing resources and expertise, Incyte can accelerate clinical trials and regulatory approvals, ultimately bringing potentially life-saving therapies to patients faster. Such collaborations also provide access to complementary technologies and scientific insights, fostering a more robust and diverse product portfolio.

The financial implications of these collaborations are significant. While specific deal terms are often confidential, these partnerships can involve upfront payments, milestone achievements, and royalty streams, all contributing to Incyte's revenue diversification and long-term financial stability. For example, the Syndax collaboration for Niktimvo, which gained FDA approval in 2024 for certain melanoma indications, provides a clear revenue stream and potential for expansion into new patient populations.

Key aspects of Incyte's collaboration strategy include:

- Pipeline Enhancement: Accessing external innovation to fill portfolio gaps and explore new therapeutic areas.

- Risk Mitigation: Sharing development costs and timelines with partners to reduce financial exposure.

- Market Access Acceleration: Leveraging partner networks and expertise to expedite regulatory submissions and commercial launches.

- Synergistic Growth: Combining complementary strengths to unlock new commercial opportunities and maximize the value of existing assets.

Development of Next-Generation Formulations and Novel Drug Classes

Incyte's commitment to developing next-generation formulations, like the extended-release version of ruxolitinib (Jakafi), offers a significant opportunity. This strategy not only enhances patient convenience by reducing dosing frequency but also presents a pathway to potentially extend the commercial life of key products. For instance, the successful launch and uptake of ruxolitinib XR in 2024 are crucial for maintaining market share.

Beyond formulation improvements, Incyte is actively pursuing novel drug classes that could unlock substantial new revenue streams. Their work on a first-in-class CDK2 inhibitor for ovarian cancer, with clinical trials showing promising results in 2024, targets a significant unmet medical need. Furthermore, the development of mutant CALR inhibitors for myeloproliferative neoplasms (MPNs) represents another frontier, potentially addressing patient populations with limited treatment options.

- Next-Generation Formulations: Extended-release versions of existing drugs, such as ruxolitinib XR, aim to improve patient adherence and prolong product exclusivity.

- Novel Drug Classes: Incyte is advancing first-in-class therapies, including a CDK2 inhibitor for ovarian cancer and mutant CALR inhibitors for MPNs, targeting new market segments.

- Market Expansion: These innovative approaches have the potential to address unmet medical needs, thereby expanding Incyte's therapeutic reach and revenue opportunities.

Incyte's robust pipeline, featuring at least 18 anticipated catalysts in 2025, including potential new product launches and pivotal study readouts in oncology and immunology, presents a significant opportunity for growth. The company's late-stage asset, povorcitinib, a JAK1 inhibitor, has multi-billion dollar revenue potential targeting indications like hidradenitis suppurativa and vitiligo, with global regulatory submissions anticipated in 2026.

Strategic collaborations, such as the one with Syndax Pharmaceuticals for Niktimvo, are crucial for pipeline expansion and market penetration, de-risking development and accelerating market access. Incyte is also focused on next-generation formulations, like the extended-release version of Jakafi, to enhance patient convenience and extend product life, alongside developing first-in-class therapies like a CDK2 inhibitor for ovarian cancer.

| Opportunity Area | Key Developments/Products | Potential Impact |

|---|---|---|

| Pipeline Expansion | 18+ catalysts in 2025, 4 potential new launches | Significant revenue diversification and market presence |

| Late-Stage Assets | Povorcitinib (JAK1 inhibitor) | Multi-billion dollar revenue potential in HS, vitiligo |

| Strategic Collaborations | Syndax (Niktimvo), new development partnerships | Accelerated development, market access, risk mitigation |

| Product Innovation | Ruxolitinib XR, CDK2 inhibitor, CALR inhibitors | Enhanced patient adherence, new therapeutic areas, extended product life |

Threats

Incyte operates in intensely competitive markets, particularly in oncology and inflammation/autoimmunity, where numerous biopharmaceutical companies are actively developing and launching new treatments. This dynamic environment means Incyte's flagship products, such as Jakafi, are not only challenged by existing JAK inhibitors but also by novel therapies entering the market, potentially affecting future market share and pricing flexibility.

For example, in the treatment of diffuse large B-cell lymphoma (DLBCL), Incyte's Monjuvi contends with established therapies like Roche's Polivy, highlighting the crowded competitive space. The ongoing influx of innovative treatments from competitors poses a significant threat, requiring continuous investment in research and development to maintain a competitive edge.

Incyte's reliance on clinical trial success presents a significant threat. The company's pipeline hinges on positive results and timely approvals from regulatory agencies. For instance, delays in the review process for Opzelura, which received FDA approval for atopic dermatitis in 2021, highlight the potential for extended timelines and additional data requirements.

Unfavorable trial outcomes or unexpected safety concerns can derail even the most promising drug candidates. Such setbacks can lead to substantial delays, outright rejections, or the complete discontinuation of development programs, impacting Incyte's future revenue streams and market position.

As Incyte’s key products mature, the eventual expiration of patent protection poses a significant threat, opening the door to generic competition. While not an immediate threat for Jakafi in the 2024-2025 period, the company acknowledges the 'nontrivial challenge' of transitioning to new durable growth drivers beyond 2029, a long-term risk that demands continuous innovation and pipeline replenishment.

Pricing Pressures and Reimbursement Challenges

The pharmaceutical sector is under intense scrutiny regarding drug pricing. This could lead to legislative or regulatory actions that might restrict reimbursement or coverage for Incyte's offerings, potentially affecting net revenues and profitability, particularly for high-cost, innovative treatments.

In 2024, the ongoing debate around drug affordability is expected to intensify, with policymakers focusing on measures to control healthcare spending. This environment presents a significant threat to companies like Incyte, whose advanced therapies often come with substantial price tags.

- Pricing Scrutiny: Increased public and governmental pressure to lower drug costs.

- Reimbursement Risk: Potential for reduced coverage or payment rates from insurers and government programs.

- Profitability Impact: Higher development costs for innovative drugs may be harder to recoup if pricing power is diminished.

- Competitive Landscape: Other companies facing similar pressures could lead to a broader industry trend of price adjustments.

Dependence on Collaborations and External Factors

Incyte's reliance on collaborations presents a significant threat. For instance, the development and commercialization of Niktimvo are tied to its partnership with Syndax Pharmaceuticals, and tafasitamab involves collaboration with MorphoSys. The success of these ventures hinges on the collaborators' performance and strategic direction, which are outside Incyte's direct control.

External factors also pose a risk. Unforeseen macroeconomic shifts, such as volatile foreign currency exchange rates, can negatively impact Incyte's financial results. For example, a strengthening US dollar could reduce the value of international revenue when reported in USD. This dependency on external partners and market conditions creates inherent vulnerabilities.

- Partnership Dependencies: Incyte's success with key assets like Niktimvo and tafasitamab is directly linked to the performance and strategic alignment of its collaborators, Syndax Pharmaceuticals and MorphoSys, respectively.

- Macroeconomic Vulnerabilities: Fluctuations in foreign currency exchange rates represent a tangible threat, potentially impacting Incyte's reported financial performance.

- Regulatory and Market Risks: Delays or failures in regulatory approvals for partnered products, or shifts in market demand for collaborative therapies, directly affect Incyte's revenue streams.

Incyte faces intense competition in its key therapeutic areas, particularly oncology and inflammation, with new treatments constantly emerging. This competitive pressure, exemplified by Monjuvi's challenge from Roche's Polivy in DLBCL, necessitates ongoing R&D investment to maintain market share and pricing power.

The company's pipeline is vulnerable to clinical trial outcomes and regulatory approvals; delays like those experienced with Opzelura highlight the potential for extended timelines. Unfavorable results or safety issues could halt development, impacting future revenue.

Patent expirations loom as a long-term threat, with generic competition expected after 2029 for products like Jakafi. The ongoing scrutiny of drug pricing by governments and the public could also lead to reduced reimbursement rates, impacting profitability, especially for high-cost therapies.

Incyte's reliance on collaborations, such as those with Syndax Pharmaceuticals for Niktimvo and MorphoSys for tafasitamab, introduces dependency risks, as their success is tied to partner performance. Furthermore, macroeconomic factors like currency fluctuations can negatively affect financial results.

| Threat Category | Specific Example/Risk | Potential Impact | Relevant Period |

|---|---|---|---|

| Competitive Landscape | New JAK inhibitors, novel therapies in oncology/inflammation | Reduced market share, pricing pressure | 2024-2025 and beyond |

| Clinical & Regulatory Risk | Unfavorable trial data, regulatory delays (e.g., Opzelura) | Development halt, delayed revenue | Ongoing |

| Patent Expiration & Pricing | Generic competition post-2029 (Jakafi), pricing scrutiny | Revenue decline, lower profitability | Long-term (post-2029), ongoing pricing pressure |

| Collaboration Dependencies | Partner performance (Syndax, MorphoSys), currency fluctuations | Revenue volatility, project failure | Ongoing |

SWOT Analysis Data Sources

This Incyte SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses. These sources provide a well-rounded view of Incyte's operational landscape and competitive positioning.