Incyte Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Incyte Bundle

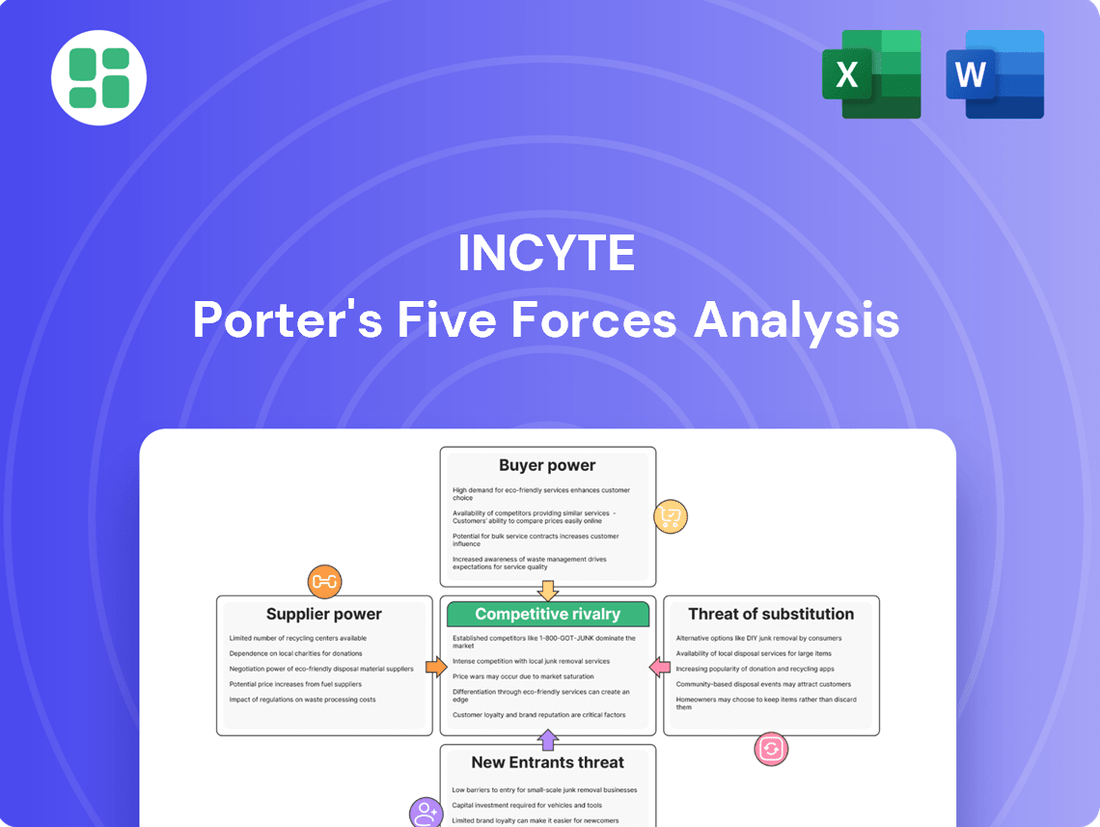

Incyte's competitive landscape is shaped by intense rivalry, the significant bargaining power of buyers, and the constant threat of new entrants. Understanding these forces is crucial for navigating the biopharmaceutical market.

The complete report reveals the real forces shaping Incyte’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Incyte's reliance on highly specialized chemical compounds and biological materials for its drug development means suppliers of these unique inputs hold considerable bargaining power. The scarcity of alternative sources, coupled with the rigorous and time-consuming qualification processes required for new suppliers, further strengthens their position. For instance, in 2024, the global market for specialized pharmaceutical intermediates saw consolidation, with a few key players controlling a significant portion of the supply chain for novel drug synthesis components.

The extensive and costly nature of clinical trials means Incyte frequently partners with Contract Research Organizations (CROs). In 2023, the global CRO market was valued at approximately $50 billion, demonstrating the significant reliance of pharmaceutical companies on these specialized service providers.

If specific CROs possess unique expertise, advanced technology, or a strong track record in niche therapeutic areas, their bargaining power increases. This can directly impact trial timelines and Incyte's overall drug development costs, as demonstrated by the increasing demand for specialized oncology CROs.

Incyte’s reliance on specialized manufacturing for complex biologic drugs and novel small molecules can grant significant leverage to Contract Manufacturing Organizations (CMOs) possessing advanced capabilities. The scarcity of facilities equipped for such intricate production processes means CMOs can dictate terms, impacting Incyte’s production timelines and costs. For instance, the global biologics manufacturing market, a key area for Incyte, was valued at approximately $14.7 billion in 2023 and is projected to grow substantially, indicating high demand for these specialized services.

Intellectual Property Licensors

Intellectual property licensors can wield considerable bargaining power over Incyte. This is particularly true when Incyte relies on external entities, such as universities or other biotechnology companies, for crucial drug targets or foundational platform technologies. The exclusivity and uniqueness of these licensed assets directly impact Incyte's ability to innovate and bring new therapies to market, giving licensors leverage in negotiating terms and royalty rates.

The dependence on these proprietary assets means Incyte often faces terms dictated by the licensor. For instance, if a licensor possesses a highly sought-after gene-editing technology essential for Incyte's pipeline, they can command higher upfront payments and more favorable royalty structures. This power dynamic is exacerbated if alternative sources for the intellectual property are scarce or non-existent.

- Licensor Dependence: Incyte's reliance on licensed IP for core research and development activities grants licensors significant leverage.

- Asset Uniqueness: The proprietary nature and scarcity of licensed drug targets or platform technologies strengthen the licensor's bargaining position.

- Contractual Terms: Licensors can influence royalty percentages, milestone payments, and usage restrictions, directly impacting Incyte's profitability and operational flexibility.

- Market Impact: The successful development and commercialization of drugs based on licensed IP amplify the value and, consequently, the bargaining power of the original licensor.

Skilled Scientific and Medical Talent

The biopharmaceutical sector, including companies like Incyte, relies heavily on a highly specialized workforce. This includes research scientists, clinical development specialists, and regulatory affairs experts. The demand for these skilled professionals often outstrips supply, giving them significant leverage.

This scarcity directly impacts recruitment and retention costs for biopharma companies. For instance, in 2024, the average salary for a senior research scientist in the biotech sector could range from $120,000 to $180,000 annually, reflecting the high value placed on their expertise. Furthermore, the institutions that train these individuals, such as top universities with strong life sciences programs, also wield considerable influence.

- High Demand for Specialized Skills: The biopharmaceutical industry requires deep expertise in areas like molecular biology, pharmacology, and clinical trial management.

- Talent Scarcity Drives Costs: Competition for top scientific and medical talent can significantly increase labor expenses for companies.

- Impact on Innovation: Access to and retention of skilled personnel is crucial for driving research and development, directly affecting a company's innovative capacity.

- Negotiating Power of Experts: Highly sought-after scientists and medical professionals can negotiate favorable compensation and working conditions.

Suppliers of highly specialized chemical compounds and biological materials for Incyte's drug development hold significant bargaining power due to the scarcity of alternative sources and rigorous qualification processes. The 2024 consolidation within the specialized pharmaceutical intermediates market, where a few key players control significant supply chains, exemplifies this leverage. This concentration means Incyte may face limited options and potentially higher costs for critical development components.

What is included in the product

This analysis unpacks the competitive forces shaping Incyte's market, assessing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly visualize competitive intensity across all five forces to pinpoint strategic vulnerabilities and opportunities.

Customers Bargaining Power

Major health insurers, government programs like Medicare and Medicaid, and pharmacy benefit managers (PBMs) hold considerable sway over drug pricing and what medications get included on their approved lists, known as formularies. Their sheer purchasing power and the ability to limit patient access to specific treatments directly impact Incyte's sales. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) announced a 3.2% increase for the inpatient prospective payment system (IPPS) for fiscal year 2025, a move that indirectly influences reimbursement rates for pharmaceuticals.

Hospitals and Group Purchasing Organizations (GPOs) wield significant bargaining power due to their consolidated purchasing volume. These entities leverage this power to negotiate substantial discounts and rebates on pharmaceuticals, directly impacting Incyte's pricing and profitability. For instance, a major GPO might represent hundreds of hospitals, giving them immense leverage in contract discussions.

The availability of therapeutic alternatives significantly impacts Incyte's bargaining power with its customers. When multiple drugs, including generics and biosimilars, provide similar efficacy for specific medical conditions, patients, physicians, and payers gain more options. This increased choice directly erodes Incyte's ability to command premium pricing, as customers can easily opt for more cost-effective or equally effective treatments.

Patient Access and Reimbursement Policies

Patient access and reimbursement policies significantly shape the bargaining power of customers in the pharmaceutical industry, directly impacting Incyte's market penetration. While patients may not directly negotiate prices, their adherence to treatment and advocacy for access can indirectly influence demand. Incyte's novel therapies, like those for myelofibrosis or polycythemia vera, rely heavily on favorable insurance coverage and manageable out-of-pocket expenses for patient uptake.

Payer policies are a critical determinant of patient access to Incyte's innovative treatments. These policies, including formulary placement, prior authorization requirements, and co-payment structures, can create substantial barriers. For instance, in 2024, the average annual cost of specialty drugs in the US continued to be a major concern for payers and patients alike, often exceeding $50,000, which can limit market access for new, high-cost therapies.

- Insurance Coverage: The breadth and depth of insurance coverage for Incyte's products directly influence patient affordability and, consequently, demand.

- Out-of-Pocket Costs: High co-pays or deductibles can deter patients from initiating or continuing treatment, even with insurance.

- Payer Negotiations: Pharmaceutical companies often engage in negotiations with payers to secure favorable reimbursement terms, impacting list prices and net revenue.

- Market Access Challenges: In 2023, approximately 10% of new drugs launched in the US faced significant market access hurdles due to payer restrictions, a trend that continued into 2024.

Clinical Efficacy and Safety Data

Physicians and healthcare providers are critical gatekeepers, heavily influenced by a drug's clinical efficacy and safety. For Incyte, demonstrating superior outcomes in clinical trials is paramount to securing prescribing preference. For instance, Incyte's Jakafi (ruxolitinib) has shown significant improvements in spleen volume and symptom burden in myelofibrosis patients, a key factor in its market adoption.

While patients themselves may not directly negotiate prices with Incyte, their physicians’ reliance on compelling clinical data effectively translates into a form of customer power. If Incyte's data isn't robust, prescribers might opt for competitor drugs with more established or favorable profiles, indirectly limiting Incyte's pricing flexibility. Incyte reported Jakafi net sales of approximately $2.3 billion in 2023, underscoring the importance of continued clinical success in maintaining such revenue streams.

- Clinical Efficacy: Physicians favor treatments that demonstrably improve patient outcomes, such as reduced tumor size or prolonged survival.

- Safety Profile: A favorable safety profile, with manageable side effects, is crucial for long-term patient adherence and physician confidence.

- Treatment Guidelines: Inclusion in established treatment guidelines validates a drug's efficacy and broadens its prescribing base.

- Prescribing Preference: Strong clinical evidence directly influences a physician's willingness to prescribe a particular therapy over alternatives.

The bargaining power of customers is a significant force for Incyte, primarily driven by large payers like insurance companies and government programs. These entities can dictate terms through formulary placement and reimbursement rates, directly impacting Incyte's revenue. For example, in 2024, the Centers for Medicare & Medicaid Services (CMS) adjusted reimbursement policies, influencing the financial landscape for pharmaceutical companies.

Consolidated purchasing groups, such as Group Purchasing Organizations (GPOs), also exert considerable pressure by negotiating volume discounts. This collective buying power allows them to secure lower prices, which can limit Incyte's pricing flexibility. The competitive environment, with available therapeutic alternatives including generics and biosimilars, further empowers customers by providing cost-effective options.

Physician preference, shaped by clinical efficacy and safety data, acts as an indirect form of customer power. Strong clinical trial results, like those demonstrating Jakafi's benefits in myelofibrosis, are crucial for Incyte to gain prescribing preference and maintain market share. In 2023, Incyte's Jakafi achieved approximately $2.3 billion in net sales, highlighting the importance of this factor.

| Customer Type | Source of Bargaining Power | Impact on Incyte |

|---|---|---|

| Major Payers (Insurers, PBMs, Government) | Purchasing volume, formulary control, reimbursement policies | Price negotiation, market access, net revenue |

| Hospitals & GPOs | Consolidated purchasing volume, contract negotiation | Discount and rebate demands, pricing pressure |

| Physicians & Healthcare Providers | Clinical efficacy, safety profile, treatment guidelines | Prescribing preference, market adoption, demand generation |

| Patients | Treatment adherence, advocacy, out-of-pocket cost sensitivity | Indirect influence on demand and payer decisions |

Full Version Awaits

Incyte Porter's Five Forces Analysis

This preview showcases the complete Incyte Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the biopharmaceutical industry. You're viewing the exact, professionally crafted document you'll receive, providing actionable insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. Once your purchase is complete, you'll gain instant access to this comprehensive analysis, ready for immediate use and strategic decision-making.

Rivalry Among Competitors

The biopharmaceutical industry, especially in fields like oncology and immunology where Incyte operates, sees fierce rivalry fueled by substantial and ongoing research and development spending. Companies are locked in a constant pursuit of groundbreaking treatments, making a strong pipeline of new therapies essential for survival and growth.

Incyte's competitive landscape is defined by this R&D intensity. For instance, in 2023, the global biopharmaceutical R&D spending was projected to exceed $240 billion, with oncology alone accounting for a significant portion. This highlights the immense pressure to innovate and bring novel drug candidates to market, creating an ongoing arms race for scientific breakthroughs and market share.

Incyte faces intense rivalry in its core therapeutic areas, including hematology, oncology, and inflammation. Major pharmaceutical and biotechnology firms constantly compete for patient populations, driving aggressive marketing and anticipation of new drug approvals.

For instance, in the myelofibrosis market, Incyte's Jakafi competes with drugs from companies like Pfizer and Bristol Myers Squibb. The oncology space, in particular, is a battleground where numerous players are developing and launching new therapies, making it challenging to maintain and grow market share.

Incyte faces intense competition as companies actively pursue product differentiation, often by developing novel mechanisms of action or demonstrating superior efficacy and safety profiles in their therapies. This drive for innovation creates a dynamic market where breakthrough science is a key differentiator.

For instance, in the oncology space, where Incyte has a significant presence, the pace of innovation is rapid. In 2024, the pharmaceutical industry saw substantial investment in R&D, with companies like Bristol Myers Squibb and Merck continuing to advance their immuno-oncology pipelines, directly challenging established players and new entrants alike. This constant pursuit of a competitive edge means that even a truly innovative therapy can quickly face a wave of similar or even more advanced treatments.

Global Presence and Commercialization Capabilities

Competitive rivalry in the pharmaceutical sector significantly hinges on global commercialization prowess. This encompasses not just product development but also navigating complex regulatory landscapes across different countries, establishing robust sales and marketing infrastructures, and securing effective market access. Companies must contend with established multinational corporations that have honed these capabilities over decades, possessing deep pockets for drug launches and worldwide market penetration.

Incyte, for instance, faces intense competition from global giants like Pfizer and Roche, who leverage their vast commercial networks to rapidly scale new therapies. In 2023, Pfizer reported over $58 billion in revenue, a testament to its extensive global reach and commercialization engine, which Incyte must actively counter.

Key aspects of this rivalry include:

- Regulatory Expertise: Successfully obtaining approvals from agencies like the FDA, EMA, and PMDA is critical for global market access.

- Sales Force Reach: A well-trained and geographically dispersed sales force is essential for promoting products effectively in diverse markets.

- Market Access Strategies: Negotiating pricing and reimbursement with payers in various countries is a complex but vital component of commercialization.

- Established Global Players: Companies with existing infrastructure and brand recognition in multiple regions have a significant advantage in launching new treatments.

Patent Expirations and Biosimilar/Generic Threats

The pharmaceutical industry, including companies like Incyte, faces intense competitive rivalry stemming from patent expirations. When a drug's patent protection ends, it opens the door for generic and biosimilar manufacturers to enter the market with much lower-priced alternatives. This significantly impacts the revenue streams of the original innovator. For instance, the expiration of patents on blockbuster drugs often leads to a rapid and substantial decline in sales for the originator company.

Companies like Incyte must continuously invest in research and development to bring new, innovative therapies to market. This proactive approach is crucial for offsetting the anticipated revenue losses from their existing products as patents expire. The pressure to innovate is constant, as failure to do so can lead to a weakened market position and reduced profitability when faced with cheaper competition.

The threat of biosimil and generic competition is a significant driver of strategic decisions in the pharmaceutical sector. Companies are focused on building robust pipelines and exploring new therapeutic areas to maintain a competitive edge. For example, in 2024, the market continued to see significant shifts as more biologics and small-molecule drugs faced patent cliffs, intensifying the need for innovation and portfolio diversification.

- Patent Cliffs Drive Competition: The expiration of patents for key drugs directly invites lower-cost generic and biosimilar competitors, eroding market share and revenue for the original manufacturer.

- Innovation as a Countermeasure: Pharmaceutical companies must consistently develop and launch new, patent-protected drugs to compensate for revenue declines from products losing exclusivity.

- Market Dynamics in 2024: The ongoing trend of patent expirations in 2024 highlights the critical importance of a strong R&D pipeline and strategic portfolio management to navigate competitive pressures.

Competitive rivalry within the biopharmaceutical sector, where Incyte operates, is exceptionally intense. This stems from the high stakes of developing life-saving therapies and the substantial investments required for research and development. Companies are in a perpetual race to innovate, leading to a dynamic market where differentiation through scientific breakthroughs is paramount.

The oncology market, a key focus for Incyte, exemplifies this fierce competition. In 2024, R&D spending in the pharmaceutical industry continued its upward trajectory, with major players like Bristol Myers Squibb and Merck actively advancing their immuno-oncology portfolios. This constant pursuit of novel treatments means even successful drugs can face rapid challenges from emerging therapies.

Incyte's competitive landscape is further shaped by the global commercialization capabilities of its rivals. Established pharmaceutical giants leverage extensive sales forces and market access expertise to quickly penetrate diverse geographical markets. For instance, Pfizer's 2023 revenue exceeding $58 billion underscores its vast commercial reach, a significant factor Incyte must contend with when launching its own therapies.

The threat of patent expirations also intensifies rivalry. As key drugs lose patent protection, lower-cost generics and biosimil versions enter the market, pressuring originator companies. Incyte, like others in the industry, must continuously innovate and diversify its pipeline to offset anticipated revenue declines, a trend particularly evident in 2024 as more biologics faced patent cliffs.

SSubstitutes Threaten

Once Incyte's key drug patents expire, the market faces a significant threat from generic and biosimilar versions, which are typically much cheaper. For instance, the U.S. market for biologics alone is projected to reach $400 billion by 2024, with biosimil competition expected to capture a substantial portion of this as patents lapse.

This can rapidly erode market share and pricing power, forcing Incyte to rely on newer, patented therapies for revenue growth. The average price reduction for biosimil entry in the U.S. has been observed to be around 20-30%, impacting profitability for originator products.

Beyond traditional pharmaceutical drugs, Incyte faces substitutes like surgery, radiation therapy, and emerging gene or cell therapies for its target indications. For instance, advancements in CAR T-cell therapy, which saw significant investment and clinical trial progress throughout 2024, offer alternative treatment pathways for certain hematologic malignancies, potentially impacting demand for Incyte's myelosuppressive agents.

The threat of substitutes for Incyte's products is significant, particularly as new classes of pharmaceuticals emerge even within the same disease areas. These novel drugs often feature different mechanisms of action, providing patients and physicians with alternative treatment pathways. For instance, advancements in gene therapy or immunotherapy could offer entirely new ways to treat conditions currently managed by Incyte's small molecule drugs.

When these new approaches are perceived as superior, offering better efficacy, fewer side effects, or greater convenience, they can effectively draw patients away from Incyte's existing portfolio. This dynamic was highlighted in 2024 with the increasing adoption of CAR T-cell therapies in certain hematological malignancies, an area where Incyte has a presence. Such shifts in treatment paradigms represent a direct substitute threat, potentially impacting Incyte's market share and revenue streams if its pipeline and existing products cannot compete effectively on therapeutic value or innovation.

Prevention and Early Detection Advances

Significant advancements in disease prevention, such as the development of new vaccines or widespread public health campaigns, could directly impact Incyte's market. For instance, a highly effective preventative measure for myelofibrosis, a condition Incyte treats with Jakafi, would naturally reduce the number of patients needing the drug. Early detection technologies that allow for less intensive interventions also pose a threat by potentially decreasing the need for Incyte's more advanced therapies.

Consider the impact of early detection in oncology. If a breakthrough allows for the identification and successful management of certain blood cancers at much earlier, less severe stages, the demand for Incyte's treatments designed for more advanced disease could diminish. This trend is already observable in some areas of medicine where proactive screening and lifestyle interventions have lowered the incidence of chronic diseases.

- Reduced Patient Pool: Advances in prevention and early detection directly shrink the addressable market for Incyte's therapies.

- Lower Treatment Intensity: Successful early interventions may necessitate less aggressive and costly treatments, bypassing the need for Incyte's current offerings.

- Example Impact: A novel vaccine for a target disease could render Incyte's treatment obsolete for new diagnoses.

Lifestyle and Dietary Interventions

The threat of substitutes for Incyte's pharmaceutical products, particularly in areas like inflammatory and autoimmune diseases, is influenced by the growing adoption of lifestyle and dietary interventions. While not direct replacements for advanced treatments, these non-drug approaches can impact patient adherence and the perceived necessity of Incyte's therapies.

For instance, a significant portion of patients with conditions like rheumatoid arthritis or psoriasis explore dietary changes, such as anti-inflammatory diets, alongside or even instead of medication. A 2024 survey indicated that over 60% of individuals managing chronic inflammatory conditions reported incorporating dietary modifications into their treatment plans. This trend can reduce the overall demand for prescription drugs if patients perceive sufficient benefit from these lifestyle changes alone.

- Growing Patient Interest: A substantial number of patients with chronic inflammatory conditions are actively seeking and implementing lifestyle and dietary changes as part of their management strategy.

- Impact on Adherence: These interventions can influence patient adherence to prescribed Incyte medications, potentially leading to reduced dosage or discontinuation if perceived as effective substitutes.

- Market Share Erosion: While not a complete replacement, the increasing efficacy and accessibility of certain dietary and lifestyle protocols can chip away at the market share of pharmaceutical treatments, especially for less severe manifestations of diseases.

- Complementary Use: In many cases, these interventions are used as adjuncts rather than direct substitutes, but their perceived success can still moderate the demand for more aggressive pharmaceutical interventions.

The threat of substitutes for Incyte's products remains a critical consideration, especially as advancements in treatment modalities continue to emerge. These substitutes can range from generic and biosimilar versions of existing drugs to entirely new therapeutic approaches and even preventative measures.

The increasing prevalence of biosimil competition, particularly in the biologics market projected to reach substantial figures by 2024, directly challenges the market share and pricing power of originator products. Furthermore, innovative therapies like CAR T-cell treatments, which saw significant progress and investment in 2024, offer alternative treatment pathways for conditions like hematologic malignancies, potentially impacting demand for Incyte's current offerings.

Beyond direct pharmaceutical competition, lifestyle and dietary interventions are gaining traction among patients managing chronic conditions, potentially moderating the demand for prescription drugs. A 2024 survey indicated over 60% of patients with chronic inflammatory diseases incorporate dietary changes, highlighting a trend that could influence adherence and the perceived necessity of pharmaceutical treatments.

| Substitute Type | Impact on Incyte | Key Drivers | 2024 Market Context |

| Generic/Biosimilar Drugs | Price erosion, market share loss | Patent expiry, lower manufacturing costs | Biosimilar market growth, ~20-30% price reduction observed |

| Alternative Therapies (e.g., CAR T-cell) | Reduced demand for existing treatments | Improved efficacy, new treatment paradigms | Increased investment and clinical trial progress in 2024 |

| Preventative Measures (Vaccines, Early Detection) | Shrinking patient pool | Public health initiatives, technological advancements | Focus on proactive health management |

| Lifestyle/Dietary Interventions | Lower treatment intensity, potential adherence impact | Patient empowerment, perceived benefits | Over 60% of chronic inflammatory patients adopting dietary changes (2024 survey) |

Entrants Threaten

Developing a new drug, particularly in specialized fields like oncology and immunology, can cost billions of dollars in research and development over extended periods. For instance, the average cost to bring a new drug to market was estimated to be around $2.6 billion in 2023, with a significant portion attributed to R&D. This immense capital outlay serves as a substantial barrier, discouraging many potential new players from entering the biopharmaceutical sector.

The path to market for new drugs is incredibly long and demanding. Companies must navigate arduous, multi-phase clinical trials, which are both time-consuming and expensive. For instance, bringing a new drug to market can cost upwards of $2.6 billion, with a significant portion of that attributed to clinical development and regulatory hurdles.

Rigorous reviews by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) add further layers of complexity. This lengthy, uncertain, and costly approval process, often spanning a decade or more, presents a formidable barrier to entry for potential new competitors in the pharmaceutical sector.

Incyte's robust intellectual property and patent protection significantly deter new entrants. Established biopharmaceutical firms like Incyte possess extensive patent portfolios covering their current drug therapies and those in development. This strong intellectual property acts as a substantial barrier, making it difficult for new companies to create or market comparable molecules without the risk of costly infringement litigation.

Need for Specialized Expertise and Infrastructure

The biopharmaceutical industry presents a formidable barrier to new entrants due to the immense need for specialized expertise and significant capital investment in infrastructure. Companies must possess deep scientific knowledge, navigate complex clinical trial processes, and understand intricate regulatory pathways. For instance, bringing a new drug to market can cost upwards of $2.6 billion, a figure that deters many potential new players.

Established biopharma firms have already made these substantial investments, creating a significant advantage. This includes state-of-the-art research laboratories, advanced manufacturing facilities capable of producing biologics, and robust distribution networks. Building these capabilities from the ground up requires not only vast financial resources but also years of experience and a proven track record.

- High R&D Costs: The average cost to develop a new drug is estimated at $2.6 billion, according to a 2023 study.

- Complex Regulatory Hurdles: Navigating FDA approval processes involves extensive preclinical and clinical trials, which can take over a decade.

- Specialized Infrastructure: Biologics manufacturing, for example, requires highly specialized and expensive facilities.

- Intellectual Property: Patents and proprietary knowledge held by existing companies create further barriers.

Established Brand Reputation and Market Access

Established brand reputation and market access present a significant barrier for new entrants in the biopharmaceutical sector, especially for companies like Incyte. Existing players benefit from deep-rooted relationships with healthcare providers, payers, and crucial patient advocacy groups. These established connections translate into a recognized brand name and easier navigation of complex market dynamics.

Newcomers face considerable hurdles in building the necessary trust to gain formulary access for their drugs and establish robust distribution networks. Incyte, for example, has cultivated strong market presence over years, making it difficult for emerging biotechs to compete directly. By 2024, the average time for a new drug to gain formulary acceptance can extend beyond 18 months, a significant challenge for any new entrant seeking rapid market penetration.

- Established Relationships: Incumbent biopharmaceutical firms maintain strong ties with physicians, hospitals, and insurance providers, facilitating drug adoption.

- Brand Recognition: Years of successful product launches and marketing have built trust and familiarity with Incyte's brand among healthcare professionals and patients.

- Market Access Challenges: New entrants must overcome significant obstacles in securing favorable reimbursement and formulary placement against established competitors.

- Distribution Networks: Building a reliable and efficient supply chain and distribution infrastructure is a costly and time-consuming endeavor for new companies.

The threat of new entrants for Incyte is significantly mitigated by the immense capital required for drug development and the lengthy, complex regulatory approval processes. For instance, bringing a new drug to market can cost upwards of $2.6 billion, a figure that deters many potential entrants. These high upfront costs, coupled with the decade-long journey through clinical trials and FDA reviews, create substantial barriers.

Incyte's strong intellectual property portfolio, including numerous patents on its therapies, acts as a formidable deterrent. New companies would face the risk of costly infringement lawsuits if they attempted to replicate Incyte's patented molecules. This robust IP protection shields Incyte's market position from direct imitation.

Furthermore, the need for specialized expertise in areas like oncology and immunology, along with the requirement for advanced manufacturing facilities, presents another significant hurdle. Building these capabilities from scratch demands not only vast financial resources but also years of accumulated scientific knowledge and operational experience, which new entrants typically lack.

Established brand reputation and existing market access further solidify Incyte's defense against new competitors. Years of successful product launches and cultivation of strong relationships with healthcare providers and payers make it challenging for newcomers to gain formulary acceptance and establish distribution networks. By 2024, securing formulary placement can take over 18 months, a considerable delay for any new player.

| Barrier to Entry | Estimated Cost/Timeframe (as of 2023-2024) | Impact on New Entrants |

| Research & Development Costs | ~$2.6 billion per new drug | Extremely high capital requirement |

| Regulatory Approval Process | 10+ years (clinical trials & FDA review) | Long, uncertain, and expensive path to market |

| Intellectual Property Protection | Patent lifespans vary, but typically 20 years from filing | Risk of litigation for imitation |

| Market Access & Brand Reputation | 18+ months for formulary acceptance; established relationships | Difficult to gain trust and distribution |

Porter's Five Forces Analysis Data Sources

Our Incyte Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Incyte's annual reports, SEC filings, and investor presentations. We also incorporate insights from reputable industry research firms and market intelligence platforms to provide a comprehensive view of the competitive landscape.