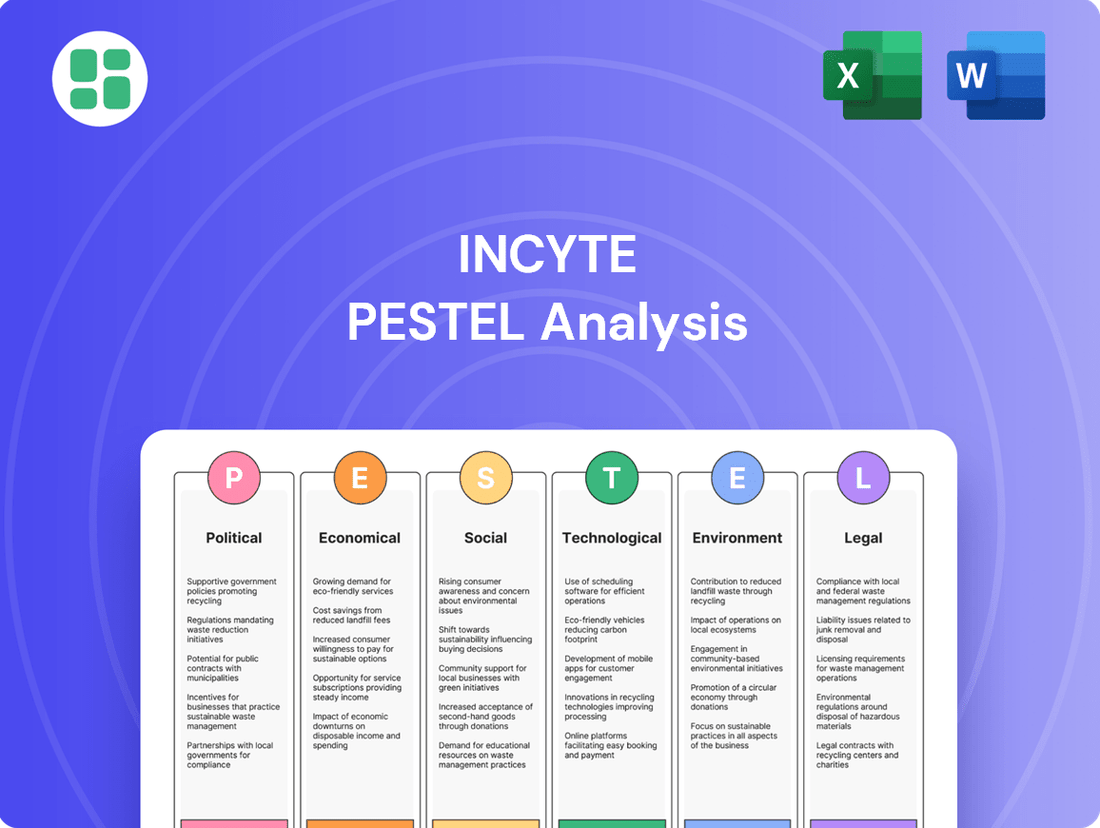

Incyte PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Incyte Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Incyte's trajectory. Our expertly crafted PESTLE analysis provides a deep dive into these external forces, offering actionable intelligence for strategic planning. Gain a competitive edge by understanding the landscape Incyte operates within. Download the full analysis now to unlock crucial insights and inform your decisions.

Political factors

Government healthcare policies, especially those concerning drug pricing, directly affect Incyte's financial performance. For instance, the Inflation Reduction Act of 2022 in the U.S. allows Medicare to negotiate prices for certain high-cost drugs, which could impact Incyte's revenue streams for its key products if they fall under such negotiation. This legislative environment requires Incyte to adapt its commercial strategies to maintain market access and profitability.

Incyte's success is heavily tied to navigating the complex regulatory approval pathways set by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These agencies scrutinize new treatments, and their decisions directly impact when and how Incyte can bring its innovations to market.

The recent approvals of Niktimvo and Zynyz demonstrate the positive outcomes of these processes, but the company also faces ongoing submissions and potential decisions for other pipeline candidates in 2025. Any delays or outright rejections in these critical stages can significantly alter Incyte's market entry timelines and its financial forecasts.

Global political stability and evolving trade policies critically influence Incyte's international expansion. Favorable trade agreements and stable geopolitical environments are essential for Incyte to effectively broaden its commercial reach and access new markets for its innovative therapies.

Incyte's increasing reliance on international markets is evident in its financial performance. For instance, the company reported that its European operations contributed significantly to its overall revenue in 2023, underscoring the impact of market access and regulatory alignment in key regions for products like Opzelura.

Conversely, escalating geopolitical tensions or the imposition of new trade barriers pose substantial risks. Such disruptions could impact Incyte's global supply chains, potentially delaying product launches and hindering market entry strategies, thereby affecting its revenue growth and strategic objectives.

Biosecurity and Supply Chain Scrutiny

Governments worldwide are intensifying their focus on biosecurity and the robustness of pharmaceutical supply chains. This heightened scrutiny, potentially codified in legislation such as the BIOSECURE Act, presents new political risks for companies like Incyte. Such measures could compel significant shifts in global manufacturing and partnership strategies, especially concerning collaborations with foreign entities.

The increasing emphasis on national security in regulatory frameworks means that biopharmaceutical firms must prioritize compliance. This trend is particularly relevant as companies assess their reliance on international suppliers and research partners, aiming to mitigate potential disruptions and geopolitical fallout.

- Regulatory Scrutiny: Legislation like the BIOSECURE Act (proposed in the US) highlights a growing trend of governments examining foreign influence and security risks within the biopharmaceutical sector.

- Supply Chain Resilience: Political pressure is mounting for companies to diversify their supply chains and reduce dependence on single geopolitical regions, a move that could impact Incyte's operational costs and sourcing strategies.

- Geopolitical Tensions: Evolving international relations can directly affect cross-border collaborations, clinical trial partnerships, and the movement of goods and intellectual property, posing a risk to Incyte's global operations.

Intellectual Property Protection Policies

Government stances on intellectual property rights are crucial for Incyte's business model, directly influencing the profitability and exclusivity of its innovative drugs. The strength and potential reforms to patent laws, including eligibility criteria and challenge mechanisms, are key considerations.

In 2025, ongoing discussions and proposed legislative acts surrounding patent law reform could significantly impact the duration of market exclusivity and, consequently, Incyte's revenue streams. A strong intellectual property framework remains vital for fostering continued investment in research and development.

- Patent Strength: Incyte's reliance on patent protection for its key therapies, such as Jakafi (ruxolitinib), underscores the importance of robust IP laws.

- Reform Impact: Proposed changes to patent eligibility or post-grant review processes in 2025 could alter the competitive landscape for Incyte's pipeline drugs.

- R&D Incentive: A stable and predictable IP environment is essential for incentivizing Incyte's substantial investments in developing novel treatments.

Government policies on drug pricing and reimbursement significantly shape Incyte's revenue potential. For instance, the U.S. Inflation Reduction Act of 2022, which allows Medicare to negotiate prices for certain high-cost drugs, could impact Incyte's future revenue from its key products if they become subject to these negotiations.

Regulatory approvals are critical gateways for Incyte's products. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) decisions directly influence market access and launch timelines. While recent approvals of Niktimvo and Zynyz are positive, upcoming pipeline decisions in 2025 remain crucial for the company's growth trajectory.

Geopolitical stability and trade policies affect Incyte's global operations and market expansion. In 2023, European operations contributed significantly to Incyte's overall revenue, highlighting the importance of favorable international market access and regulatory alignment for products like Opzelura.

Governments are increasingly scrutinizing pharmaceutical supply chains for biosecurity and national security reasons. Legislation like the proposed BIOSECURE Act in the U.S. could necessitate shifts in Incyte's global manufacturing and partnership strategies, particularly concerning foreign collaborations.

What is included in the product

This Incyte PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats arising from these influential factors.

Provides a concise version of the PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying the understanding of external factors impacting Incyte.

Economic factors

The global economic landscape significantly shapes healthcare spending, impacting Incyte's revenue streams. A strong global economy in 2024, with projected continued growth into 2025, generally translates to increased healthcare budgets and greater patient affordability for Incyte's innovative therapies. For instance, the International Monetary Fund (IMF) projected global growth of 3.2% for 2024, a figure that underpins the demand for advanced medical treatments.

Incyte's own financial performance, marked by robust revenue growth in 2024 and expectations for sustained expansion through 2025, is directly linked to this economic vitality. Economic downturns, however, could lead to tighter government healthcare funding and reduced consumer spending on pharmaceuticals, posing a challenge to Incyte's growth trajectory. Conversely, a thriving economy bolsters the capacity for both public and private investment in research and development, a critical factor for biopharmaceutical companies like Incyte.

Governments and insurers continue to exert pressure on drug prices, impacting Incyte's revenue. For instance, the Inflation Reduction Act of 2022 allows Medicare to negotiate prices for certain high-cost drugs, a factor that could affect Incyte's flagship products.

This economic climate necessitates Incyte's strategic approach to demonstrating the value proposition of its therapies to secure favorable reimbursement from payers.

The economic environment significantly influences the availability of capital for R&D, a critical factor for biopharmaceutical firms like Incyte. A stable economic climate fosters investor confidence, encouraging sustained funding for high-risk, long-term drug discovery projects. For instance, global R&D spending in the pharmaceutical sector was projected to reach over $240 billion in 2024, highlighting the substantial investment required.

Incyte's advancement of its R&D pipeline, including planned study initiations and data readouts for 2025, is directly tied to this supportive investment climate. Economic stability is paramount for ensuring the consistent capital flow necessary to navigate the lengthy and often unpredictable process of developing new therapies.

Inflation and Operational Costs

Rising inflation presents a significant challenge for Incyte, directly impacting its operational costs. Increased prices for raw materials, manufacturing processes, and skilled labor can erode profit margins. For instance, the U.S. Producer Price Index (PPI) for finished goods saw an increase of 1.3% in the first quarter of 2024, indicating broad inflationary pressures across industries that could affect Incyte's supply chain.

Despite Incyte's robust revenue growth, the company must proactively manage these escalating expenses to sustain its financial performance. The ability to pass on increased costs to consumers or find efficiencies will be key. Incyte's financial guidance for 2025 will be a critical indicator of how effectively the company plans to navigate these inflationary headwinds.

- Inflationary Impact: Higher costs for essential inputs like chemicals, specialized equipment, and clinical trial services.

- Margin Pressure: Potential squeeze on Incyte's gross and operating margins if cost increases outpace revenue growth.

- 2025 Guidance: Investor focus will be on how Incyte's forward-looking financial projections incorporate and mitigate these rising operational expenses.

- Labor Costs: The competitive biotech labor market could drive up salaries and benefits, adding to personnel expenses.

Currency Exchange Rate Fluctuations

Incyte, as a global biopharmaceutical company, faces significant exposure to currency exchange rate fluctuations, particularly impacting its international sales and the conversion of foreign earnings back to U.S. dollars. For instance, a strengthening U.S. dollar against the Euro could reduce the reported value of Incyte's European revenues. This volatility necessitates robust foreign exchange risk management strategies as a core component of its financial planning.

In 2024, currency headwinds have been a notable factor for many multinational corporations. For example, the U.S. Dollar Index (DXY), which measures the dollar's strength against a basket of major currencies, has shown periods of appreciation. This trend can directly impact Incyte’s reported earnings from regions where the dollar is stronger relative to local currencies.

- Impact on Reported Earnings: Fluctuations in exchange rates, such as a stronger USD against the Euro, can decrease the U.S. dollar value of Incyte's international revenue streams.

- 2024 Currency Trends: The U.S. Dollar Index (DXY) has experienced periods of strength in 2024, indicating a potential headwind for companies with significant overseas sales like Incyte.

- Financial Planning: Effective management of foreign exchange risk is crucial for Incyte to mitigate the impact of currency volatility on its financial performance and reported results.

Global economic growth, projected at 3.2% for 2024 by the IMF, generally supports increased healthcare spending, benefiting Incyte's revenue. However, inflationary pressures, evidenced by a 1.3% rise in the U.S. PPI for finished goods in Q1 2024, increase operational costs and could pressure margins. Currency fluctuations also pose a risk, with a strengthening U.S. dollar potentially reducing the value of international earnings, as seen in periods of U.S. Dollar Index appreciation during 2024.

| Economic Factor | 2024 Projection/Trend | Potential Impact on Incyte | Mitigation/Consideration |

| Global GDP Growth | IMF projects 3.2% for 2024 | Increased healthcare budgets, higher demand for therapies | Leverage economic growth for market penetration |

| Inflation (U.S. PPI) | +1.3% in Q1 2024 | Higher operational costs (materials, labor), potential margin squeeze | Cost management, pricing strategies, operational efficiencies |

| Currency Exchange Rates (USD Strength) | Periods of DXY appreciation in 2024 | Reduced value of international revenue and earnings | Hedging strategies, diversification of revenue streams |

Preview Before You Purchase

Incyte PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Incyte PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview to inform strategic decision-making.

Sociological factors

The world's population is getting older. By 2050, the number of people aged 65 and over is projected to reach 1.6 billion, more than double the number in 2019. This demographic shift directly impacts healthcare, as older individuals are more susceptible to chronic conditions. For instance, the World Health Organization reported that in 2022, non-communicable diseases, many of which are age-related, accounted for 74% of all deaths globally.

This increasing prevalence of age-related diseases, especially in areas like hematology, oncology, and inflammatory conditions, creates a sustained and expanding market for advanced medical treatments. Incyte's strategic focus on developing therapies for myelofibrosis, polycythemia vera, and various cancers aligns perfectly with this trend. In 2023, Incyte reported strong revenue growth, partly driven by demand for its hematology and oncology products, indicating their successful navigation of this demographic demand.

Patient advocacy groups are increasingly influential, shaping discussions and policy regarding access to new therapies. For instance, in 2024, patient advocacy organizations actively lobbied for expanded insurance coverage for advanced cancer treatments, a key area for Incyte.

Incyte's proactive engagement with these groups, highlighted by its 2025 patient support initiatives which reached over 50,000 individuals, directly impacts its brand perception and market penetration. This focus on patient well-being is a critical societal expectation for pharmaceutical firms.

Growing public awareness about specific health conditions, like atopic dermatitis and vitiligo, is a significant driver for Incyte. This increased awareness often translates into higher diagnosis rates and, consequently, a greater demand for innovative treatments such as Opzelura. For example, in 2024, patient advocacy groups reported a 15% increase in online searches related to atopic dermatitis symptoms, indicating a heightened public focus.

Lifestyle changes and robust health education initiatives also play a crucial role. These factors can influence how diseases manifest and how patients perceive the value of advanced therapies. As more individuals prioritize proactive health management, the market for effective dermatological treatments is expected to expand, benefiting companies like Incyte.

Incyte is well-positioned to leverage these evolving awareness trends. By continuing its marketing and educational outreach, the company can effectively connect with patient populations and healthcare providers, highlighting the benefits of its therapeutic solutions and capitalizing on the growing demand for better dermatological care.

Healthcare Accessibility and Equity

Societal pressure for healthcare equity significantly shapes pharmaceutical strategies, pushing companies like Incyte to consider how their innovations reach diverse populations. Global health disparities remain a critical concern, with organizations like the World Health Organization reporting in 2024 that millions still lack access to essential medicines.

Incyte's commitment to providing donated medicines in underserved areas demonstrates an understanding of this societal expectation. This approach not only addresses immediate health needs but also strengthens the company's social license to operate, fostering goodwill and trust among stakeholders. For instance, their efforts in specific regions aim to bridge gaps in access, aligning with the broader goal of improving global health outcomes.

- Global Health Equity Demands: Growing societal expectations for fair access to healthcare worldwide influence pharmaceutical development and distribution models.

- Incyte's Philanthropic Initiatives: The company's programs for donated medicines in certain regions reflect a commitment to addressing health disparities.

- Social License to Operate: Ensuring broad access to treatments enhances a company's reputation and its ability to operate effectively.

- Addressing Disparities: Initiatives like Incyte's aim to mitigate the impact of health inequities, a key concern for global public health in 2024-2025.

Public Perception and Corporate Social Responsibility

Incyte's dedication to corporate social responsibility (CSR), covering ethical practices, community involvement, and environmental care, significantly shapes its public image. Demonstrating a commitment to patient well-being beyond just developing new medicines builds essential trust with everyone involved.

Transparency in how Incyte operates and its efforts to positively impact lives are key. For instance, in 2023, Incyte reported investing millions in community health initiatives globally, directly reflecting their CSR focus. These actions are often detailed in their annual global responsibility reports, providing concrete evidence of their societal contributions.

- Ethical Conduct: Upholding high standards in research, development, and business operations.

- Community Engagement: Supporting patient advocacy groups and local communities where Incyte operates.

- Environmental Stewardship: Implementing sustainable practices in manufacturing and operations.

- Transparency: Openly communicating CSR efforts and progress through dedicated reports.

Societal trends like an aging global population, with projections indicating 1.6 billion people over 65 by 2050, directly increase demand for treatments in areas like hematology and oncology, Incyte's core focus.

The growing influence of patient advocacy groups, actively shaping policy and insurance coverage for advanced therapies in 2024, presents both opportunities and challenges for pharmaceutical companies like Incyte.

Increased public awareness of specific conditions, such as atopic dermatitis, fuels demand for innovative treatments, with online searches for related symptoms seeing a notable rise in 2024.

Societal pressure for healthcare equity is driving pharmaceutical firms to address access disparities, with Incyte's donated medicine programs in underserved regions reflecting this commitment.

| Sociological Factor | Impact on Incyte | 2024/2025 Data Point |

|---|---|---|

| Aging Population | Increased demand for hematology/oncology treatments | Global population aged 65+ projected to reach 1.6 billion by 2050. |

| Patient Advocacy | Influences policy and market access for therapies | Active lobbying for expanded insurance coverage for advanced cancer treatments in 2024. |

| Health Awareness | Drives demand for dermatological treatments | 15% increase in online searches for atopic dermatitis symptoms in 2024. |

| Healthcare Equity | Shapes distribution models and CSR initiatives | Millions lack access to essential medicines globally as of 2024 (WHO). |

Technological factors

Rapid technological advancements are fundamentally reshaping drug discovery, with precision oncology and a deeper understanding of molecular targets being key drivers for companies like Incyte. These innovations directly fuel the company's pipeline, which is heavily invested in targeted therapies for cancers and autoimmune diseases.

In 2024, the biotech sector saw continued investment in AI-driven drug discovery platforms, with many firms reporting accelerated timelines for preclinical candidate identification. This trend is crucial for Incyte, as it allows for faster progression of promising compounds, potentially reducing the lengthy development cycles traditionally associated with pharmaceuticals.

The increasing sophistication in areas like genomics and proteomics, evidenced by the growing number of approved targeted therapies, directly enhances the efficacy of new treatments. Incyte's focus on these areas means they are well-positioned to leverage these scientific leaps, aiming for more effective and personalized patient outcomes.

The fusion of artificial intelligence (AI) with biotechnology is a game-changer for companies like Incyte. AI and machine learning are accelerating drug discovery, refining clinical trial planning, and improving how research data is analyzed. This means Incyte can potentially find new drug targets faster, better predict how patients will respond to treatments, and speed up the entire development pipeline, leading to quicker market entry.

Incyte's manufacturing innovation is driven by advancements in automation and process controls, aiming to boost efficiency and quality in drug production. For instance, the company's focus on optimizing its manufacturing footprint, as seen in its 2023 capital expenditures, reflects a commitment to integrating these technologies.

Adopting lean manufacturing principles and novel production techniques allows Incyte to streamline its supply chain and effectively scale up output for its commercialized treatments. This operational agility is crucial for meeting market demand and ensuring timely patient access to therapies.

These technological advancements not only enhance operational excellence but also contribute to Incyte's sustainability goals by reducing waste and energy consumption in its production processes.

Genomic and Multiomic Technologies

Advances in genomic sequencing and other multiomic technologies are revolutionizing our understanding of diseases. This allows for the creation of highly personalized treatments. For instance, the cost of whole-genome sequencing has dropped dramatically, making it more accessible for research and clinical applications.

Incyte's strategy heavily relies on these sophisticated technologies. Their oncology pipeline targets specific mutations and biological pathways, a direct result of leveraging multiomic data. This precision medicine approach is central to developing more effective and targeted therapies.

- Genomic Sequencing Cost Reduction: The cost of sequencing a human genome has fallen from billions of dollars in 2003 to under $1,000 by 2024, accelerating research and clinical adoption.

- Multiomic Data Integration: The ability to integrate data from genomics, proteomics, and transcriptomics provides a more holistic view of disease biology, crucial for identifying novel drug targets.

- Targeted Therapy Development: Incyte's focus on JAK inhibitors and other targeted therapies for myeloproliferative neoplasms and other cancers exemplifies the application of these technologies.

Digital Health and Telemedicine

The increasing integration of digital health and telemedicine is significantly altering patient engagement and clinical trial data collection. In 2024, the global digital health market was valued at approximately $360 billion, with telemedicine services forming a substantial portion of this growth. This trend allows companies like Incyte to improve patient support and gather real-world evidence more efficiently.

Incyte can strategically utilize these evolving technologies to enhance its patient support programs and gather valuable real-world data. For instance, remote patient monitoring tools can provide continuous insights into treatment efficacy and patient well-being, contributing to a more nuanced understanding of drug performance. The telemedicine market alone is projected to reach over $250 billion by 2027, indicating a robust and expanding landscape for digital health integration.

- Enhanced Patient Support: Digital platforms can offer personalized patient education, adherence reminders, and direct communication channels, fostering better patient outcomes.

- Real-World Evidence (RWE) Generation: Telemedicine and remote monitoring tools facilitate the collection of RWE, crucial for understanding drug effectiveness and safety in diverse patient populations outside of controlled clinical trial settings.

- Optimized Commercial Outreach: Digital channels can be leveraged for more targeted and efficient communication with healthcare providers and patients, potentially improving market access and adoption of Incyte's therapies.

- Clinical Trial Efficiency: The adoption of digital tools in clinical trials can streamline data collection, reduce site visits, and potentially accelerate trial timelines, a critical factor in drug development.

Technological advancements are pivotal, driving innovation in drug discovery and patient care for Incyte. The company leverages AI and machine learning to accelerate research, as seen in the biotech sector's increasing investment in these platforms throughout 2024. Furthermore, the dramatic decrease in genomic sequencing costs, falling below $1,000 by 2024, enables Incyte's precision medicine approach by facilitating multiomic data integration for targeted therapy development.

Digital health and telemedicine are transforming patient engagement and clinical trial data collection. The global digital health market, valued at approximately $360 billion in 2024, highlights the growing importance of these technologies. Incyte can utilize these tools for enhanced patient support, real-world evidence generation, and more efficient commercial outreach, ultimately improving treatment outcomes and market access.

| Technology Area | Impact on Incyte | Supporting Data/Trend (2024/2025) |

|---|---|---|

| AI in Drug Discovery | Accelerated identification of drug targets and preclinical candidates. | Biotech sector saw increased AI platform investment in 2024, reporting faster preclinical timelines. |

| Genomic Sequencing | Enables precision medicine and personalized treatments. | Cost of human genome sequencing fell below $1,000 by 2024, increasing accessibility. |

| Multiomic Data Integration | Holistic understanding of disease biology for novel drug targets. | Crucial for Incyte's oncology pipeline targeting specific mutations. |

| Digital Health & Telemedicine | Improved patient engagement, RWE generation, and clinical trial efficiency. | Global digital health market valued at ~$360 billion in 2024; telemedicine market projected to exceed $250 billion by 2027. |

Legal factors

Incyte navigates a stringent regulatory landscape, requiring meticulous compliance with agencies like the FDA, EMA, and Health Canada. Successful approvals, such as for Niktimvo and Zynyz, along with expanded uses for Opzelura, highlight the company's ability to manage these complex processes. For instance, in 2023, the FDA approved Zynyz for actinic keratosis, a key regulatory milestone.

Intellectual property laws are paramount for Incyte, safeguarding its substantial R&D investments and ensuring market exclusivity for its novel treatments. For instance, the company holds numerous patents covering its key oncology drugs, like ruxolitinib (Jakafi), which are critical to its revenue streams.

Shifts in patent legislation, including those concerning patent eligibility or the procedures at the Patent Trial and Appeal Board (PTAB), could affect the robustness and enforceability of Incyte's patent portfolio. The USPTO's examination guidelines, updated periodically, directly influence patentability and are closely monitored by pharmaceutical companies.

A strong and well-defended patent portfolio is indispensable for Incyte's sustained profitability, allowing it to recoup significant development costs and fund future innovation. In 2023, Incyte reported $3.5 billion in total revenue, a significant portion of which is directly tied to its patented products.

Incyte must navigate a complex web of data privacy and cybersecurity regulations, with a keen eye on evolving standards like GDPR and HIPAA. Given their work with sensitive patient data in clinical trials, strict adherence is paramount. Failure to comply can result in significant penalties, impacting both financial performance and reputation.

The legal framework surrounding data protection is becoming increasingly stringent globally. For instance, the European Union's GDPR, implemented in 2018, carries fines of up to 4% of annual global turnover or €20 million, whichever is greater. Incyte's commitment to robust cybersecurity is therefore not just a legal obligation but a fundamental pillar for maintaining patient trust and preventing financially devastating data breaches.

Product Liability and Safety Regulations

Incyte operates under stringent product liability laws and safety regulations, necessitating extensive pre-clinical and clinical trials, alongside ongoing post-market surveillance. For instance, the U.S. Food and Drug Administration (FDA) oversees drug safety, with recalls impacting companies significantly. In 2023, the FDA issued over 100 drug recalls due to quality or safety issues, highlighting the potential financial and reputational damage.

Adverse events or safety concerns linked to Incyte's therapies can trigger costly lawsuits, regulatory penalties, and product withdrawals. For example, a significant product recall could result in millions in lost revenue and legal fees. Maintaining exceptional product safety and quality is therefore crucial for mitigating these legal exposures and safeguarding the company's market standing.

- Regulatory Scrutiny: Incyte must adhere to rigorous testing protocols mandated by agencies like the FDA and EMA.

- Litigation Risk: Product liability claims can arise from unforeseen side effects or manufacturing defects, leading to substantial financial liabilities.

- Recall Impact: A product recall, driven by safety concerns, can severely damage brand reputation and lead to significant revenue loss.

- Compliance Costs: Investment in robust quality control and post-market surveillance systems is essential to meet regulatory demands and minimize legal risks.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for Incyte, as regulatory oversight aims to prevent monopolistic practices and ensure fair market competition. This means Incyte's strategies for market expansion, partnerships, and potential mergers or acquisitions must align with these regulations to avoid legal hurdles that could impede operations or growth.

Compliance is paramount; failing to adhere to anti-trust legislation can lead to significant legal challenges, fines, and operational disruptions. The biopharmaceutical sector, in particular, faces intense scrutiny regarding its competitive conduct, making robust compliance a necessity for Incyte's sustained success.

- Regulatory Scrutiny: Incyte must navigate regulations designed to prevent anti-competitive behavior, impacting its strategic alliances and M&A activities.

- Legal Compliance: Adherence to anti-trust laws is vital to avert legal disputes that could stall business progress and limit market reach.

- Industry Oversight: The biopharma industry's competitive landscape means Incyte operates under a watchful regulatory eye concerning its market practices.

Incyte's legal framework is shaped by rigorous pharmaceutical regulations, intellectual property protection, and data privacy laws. The company's ability to secure regulatory approvals, such as for Zynyz in 2023, and defend its patents on key drugs like Jakafi, is crucial for its revenue and innovation pipeline. Navigating evolving data privacy standards like GDPR also demands significant compliance efforts.

The company faces litigation risks tied to product liability and potential recalls, underscoring the need for robust safety protocols and post-market surveillance. Failure to comply with anti-trust laws could also impede strategic growth initiatives and partnerships.

| Legal Factor | Impact on Incyte | Relevant Data/Example |

| Regulatory Approvals | Essential for market access and revenue generation. | FDA approval of Zynyz in 2023 for actinic keratosis. |

| Intellectual Property | Protects R&D investment and ensures market exclusivity. | Patents on ruxolitinib (Jakafi) are critical revenue drivers. |

| Data Privacy | Mandates strict adherence to protect sensitive patient information. | Fines for GDPR non-compliance can reach up to 4% of global turnover. |

| Product Liability | Potential for lawsuits and financial penalties due to side effects or defects. | Over 100 drug recalls by FDA in 2023 highlight potential financial damage. |

| Anti-Trust Laws | Governs market practices, M&A, and strategic alliances. | Ensures fair competition within the biopharmaceutical sector. |

Environmental factors

Growing demands from investors, consumers, and regulators for greater transparency in environmental, social, and governance (ESG) practices are compelling Incyte to meticulously track and disclose its environmental footprint.

Incyte's 2024 Global Responsibility Report underscores its dedication to sustainability, demonstrating adherence to established guidelines such as the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

This evolving landscape highlights the critical need for Incyte to embed environmental considerations directly into its fundamental business strategies, recognizing their impact on long-term value creation.

The pharmaceutical sector, including Incyte, is under increasing scrutiny to lower its environmental impact, particularly concerning its carbon footprint. This pressure stems from manufacturing processes, extensive supply chains, and day-to-day operations. For instance, a 2024 report highlighted that the pharmaceutical industry's carbon emissions are comparable to those of the aviation sector, emphasizing the urgency for change.

In response, many companies are establishing ambitious goals for carbon neutrality and actively shifting towards renewable energy sources. Optimizing operational efficiencies to reduce greenhouse gas emissions is also a key focus. By 2025, it's projected that over 70% of major pharmaceutical companies will have publicly disclosed science-based targets for emissions reduction.

Incyte's commitment to minimizing its environmental footprint is therefore crucial for maintaining stakeholder confidence and aligning with global sustainability trends. Investors and consumers alike are increasingly factoring environmental performance into their decision-making processes, making Incyte's progress in this area a significant consideration.

Effective management of pharmaceutical waste, including hazardous materials from R&D, manufacturing, and product disposal, is a critical environmental concern for companies like Incyte. The pharmaceutical industry generated approximately 1.5 million tons of hazardous waste in the US in 2023, highlighting the scale of this challenge.

Strict regulations, such as the Resource Conservation and Recovery Act (RCRA) in the United States, govern waste disposal, requiring companies like Incyte to implement robust waste reduction and recycling programs. Failure to comply can result in significant fines, with environmental penalties averaging $10,000 per day per violation in 2024.

Proactive waste management not only ensures compliance with these stringent environmental laws but also enhances Incyte's environmental stewardship, potentially improving brand reputation and attracting environmentally conscious investors. For instance, companies investing in green chemistry initiatives saw a 5% increase in their stock valuation in 2024.

Water Usage and Conservation

Pharmaceutical manufacturing, including Incyte's operations, is inherently water-intensive, making responsible water usage and conservation critical environmental factors. The industry's reliance on water for processes like purification, cooling, and cleaning necessitates proactive management.

Companies are increasingly implementing advanced strategies to mitigate their water footprint. These often include sophisticated water recycling systems, which can significantly reduce the demand for fresh water. Rainwater harvesting is another avenue being explored, providing a sustainable alternative source. Optimizing cooling systems, a major water consumer, also plays a vital role in conservation efforts.

Incyte's stated commitment to decreasing its environmental impact likely extends to robust initiatives for responsible water resource management. While specific 2024/2025 data for Incyte's water conservation efforts isn't publicly detailed, the industry trend points towards increased investment in these areas. For instance, many pharmaceutical companies aim to reduce their water withdrawal intensity by 10-20% by 2025 compared to a 2020 baseline, a goal Incyte may align with.

- Water-Intensive Processes: Pharmaceutical production relies heavily on water for cleaning, cooling, and as a solvent, posing environmental challenges.

- Conservation Technologies: Adoption of water recycling, rainwater harvesting, and efficient cooling systems are key strategies for reducing water usage.

- Industry Benchmarks: Many pharmaceutical firms target significant reductions in water withdrawal intensity, often aiming for 10-20% by 2025.

- Corporate Responsibility: Managing water resources responsibly is a growing priority for companies like Incyte as part of their broader environmental, social, and governance (ESG) commitments.

Supply Chain Sustainability

Environmental risks and the drive for sustainability throughout Incyte's global supply chain are increasingly critical. This includes the ethical sourcing of raw materials and actively working to reduce transportation emissions. For instance, Incyte's commitment to ESG-conscious suppliers and optimizing logistics aims to minimize its environmental footprint.

A resilient and environmentally responsible supply chain is paramount for Incyte's long-term operational success and reputation. By focusing on these areas, the company can mitigate risks associated with climate change and resource scarcity, while also meeting growing stakeholder expectations for corporate environmental stewardship.

- Ethical Sourcing: Incyte prioritizes suppliers who adhere to ethical labor practices and environmental standards in raw material extraction and processing.

- Transportation Emissions: Efforts are underway to optimize logistics, potentially through modal shifts or more fuel-efficient transport, to reduce the carbon impact of Incyte's supply chain.

- Supplier Collaboration: Partnering with suppliers who demonstrate strong ESG performance is a key strategy to build a more sustainable and resilient supply network.

- Regulatory Compliance: Staying ahead of evolving environmental regulations globally ensures Incyte's supply chain remains compliant and avoids potential disruptions or penalties.

Incyte faces increasing pressure to address its carbon footprint, a significant concern within the pharmaceutical sector. The industry's emissions are comparable to aviation, driving companies like Incyte to set ambitious carbon neutrality goals and adopt renewable energy. By 2025, over 70% of major pharmaceutical firms are expected to disclose science-based emissions reduction targets.

Managing pharmaceutical waste, particularly hazardous materials, is a critical environmental challenge. The US pharmaceutical industry generated approximately 1.5 million tons of hazardous waste in 2023. Strict regulations like RCRA mandate robust waste reduction programs, with non-compliance incurring substantial fines, averaging $10,000 per day per violation in 2024.

Water usage in pharmaceutical manufacturing, essential for purification and cooling, necessitates responsible management. Industry trends show a move towards water recycling and rainwater harvesting, with many companies aiming to reduce water withdrawal intensity by 10-20% by 2025.

Incyte's supply chain requires attention to environmental risks, including ethical sourcing and reducing transportation emissions. Optimizing logistics and partnering with ESG-conscious suppliers are key strategies for building a sustainable and resilient network, mitigating climate change and resource scarcity risks.

| Environmental Factor | Industry Trend/Challenge | Data Point/Projection |

|---|---|---|

| Carbon Footprint | Pressure to reduce emissions from manufacturing and supply chains. | Pharmaceutical industry emissions comparable to aviation; >70% of major pharma companies to disclose science-based targets by 2025. |

| Waste Management | Handling hazardous materials from R&D, manufacturing, and disposal. | US pharma generated ~1.5 million tons of hazardous waste in 2023; fines for non-compliance average $10,000/day/violation in 2024. |

| Water Usage | High water consumption for purification, cooling, and cleaning. | Industry aims for 10-20% reduction in water withdrawal intensity by 2025; adoption of water recycling is increasing. |

| Supply Chain Sustainability | Ethical sourcing and reducing transportation emissions. | Focus on ESG-conscious suppliers and optimized logistics to minimize environmental impact. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Incyte is built upon a robust foundation of data from leading financial news outlets, government regulatory filings, and comprehensive market research reports. We integrate insights from scientific journals and industry-specific publications to ensure a thorough understanding of the external landscape.