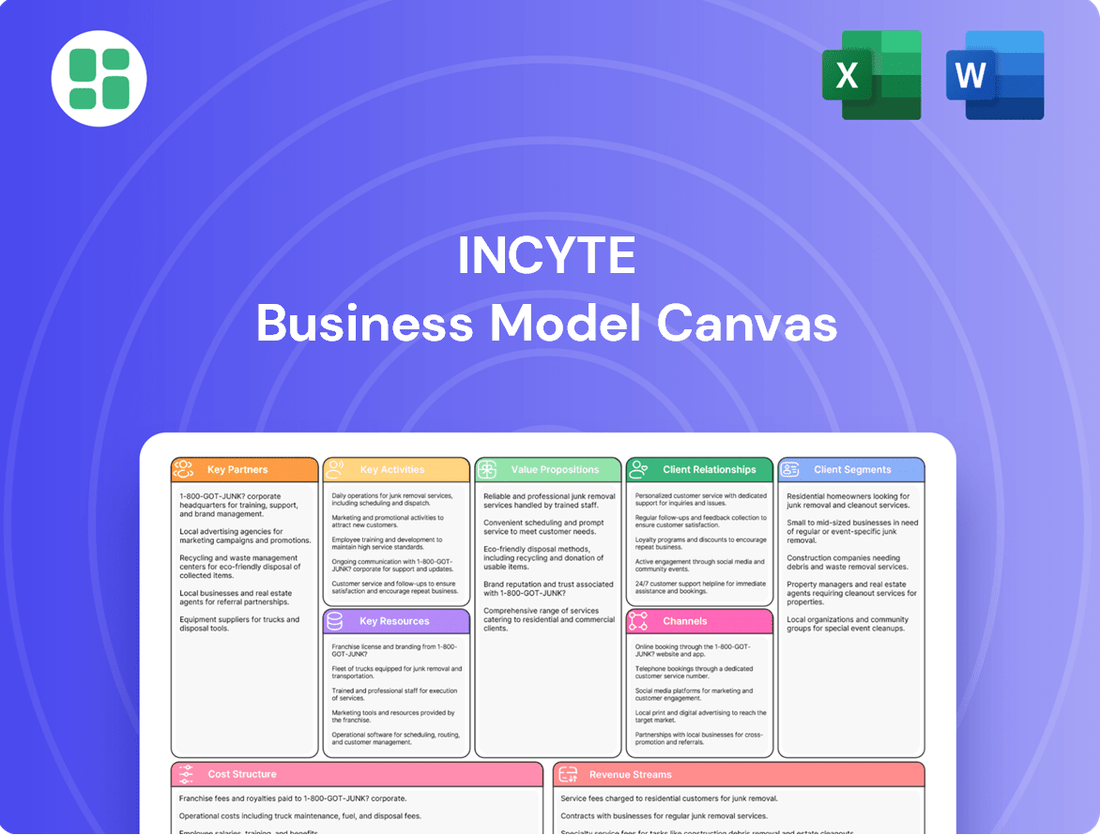

Incyte Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Incyte Bundle

Discover the strategic engine behind Incyte's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with key customer segments and deliver unique value propositions in the competitive biotech landscape. Ready to dissect their approach?

Unlock the full strategic blueprint behind Incyte's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Incyte actively pursues strategic research and development collaborations to broaden its drug pipeline and tap into specialized external expertise. This approach allows the company to innovate more efficiently and explore promising new therapeutic avenues.

A prime example of this strategy is Incyte's AI-focused partnership with Genesis Therapeutics. This collaboration is specifically designed to speed up the identification and development of innovative small molecule medicines, leveraging advanced artificial intelligence capabilities.

Through these strategic alliances, Incyte gains access to cutting-edge technologies and scientific insights, significantly enhancing its drug discovery and development processes. These partnerships are crucial for exploring novel treatment modalities and maintaining a competitive edge in the biopharmaceutical industry.

Incyte strategically leverages co-development and commercialization agreements to distribute the inherent risks associated with drug development and expand the market penetration of its innovative therapies. This approach is crucial for managing the substantial capital and time investments required in the pharmaceutical industry.

A prime example is the collaboration with Syndax Pharmaceuticals for the clinical development of axatilimab (Niktimvo) in graft-versus-host disease (GVHD). This partnership underscores a shared dedication to advancing novel treatments for patients facing this serious post-transplant complication.

Furthermore, Incyte secured exclusive worldwide rights to develop and commercialize tafasitamab (Monjuvi) via an agreement with MorphoSys. This deal highlights Incyte's ability to identify and acquire promising assets, thereby broadening its product portfolio and therapeutic reach.

Incyte's strategic alliances with academic and clinical research institutions are foundational to its drug development pipeline, particularly for advancing clinical trials and building robust evidence for novel therapeutics. These collaborations are essential for the rigorous testing and validation of investigational compounds, ensuring their safety and efficacy.

A prime example of this partnership is Incyte's work with UPMC Hillman Cancer Center. This collaboration has been instrumental in conducting crucial clinical trials, such as the Phase 1b trial of elraglusib. This trial investigated elraglusib in combination with retifanlimab and mFOLFIRINOX, specifically targeting advanced pancreatic cancer, underscoring the importance of these research partnerships in exploring new treatment avenues.

Manufacturing and Supply Chain Alliances

Incyte’s manufacturing and supply chain alliances are critical for ensuring its innovative medicines reach patients reliably. These partnerships guarantee the consistent production and timely distribution of Incyte's therapies, a cornerstone of its business model.

The company strategically sources drug substances and finished products from a network of facilities located in both the U.S. and Europe. This geographical diversification of its supply chain is a key element in mitigating risks and ensuring uninterrupted product availability, supporting Incyte's global commercialization strategies.

- Diversified Sourcing: Incyte leverages manufacturing sites in the U.S. and Europe for drug substances and products, reducing single-point-of-failure risks.

- Global Reach: This robust supply network is essential for supporting Incyte's expanding global commercialization efforts for its key therapies.

- Production Consistency: Reliable alliances ensure the consistent quality and availability of Incyte's medicines, crucial for patient access and trust.

Patient Advocacy and Support Organizations

Incyte actively collaborates with patient advocacy and support organizations to improve access to its therapies and offer robust patient support services. These partnerships are crucial for navigating complex healthcare systems and ensuring patients receive the necessary assistance.

A prime example of this commitment is Incyte's partnership with the Max Foundation. This collaboration facilitates the donation of Iclusig to patients in regions where the medication would otherwise be inaccessible, highlighting Incyte's dedication to global patient well-being.

- Enhanced Patient Access: Partnerships streamline access to Incyte's treatments, particularly for rare or underserved populations.

- Comprehensive Support Programs: Collaborations enable the development and delivery of vital patient support services, including educational resources and financial assistance navigation.

- Real-world Impact: The donation of Iclusig through the Max Foundation exemplifies how these alliances directly address unmet patient needs.

- Commitment Beyond Development: These relationships demonstrate Incyte's focus on patient welfare extending beyond the research and development phases of its medicines.

Incyte's key partnerships are a cornerstone of its innovation and market strategy. These collaborations span R&D, co-development, manufacturing, and patient support, crucial for bringing novel therapies to market and ensuring patient access.

| Partner Type | Key Collaborators | Purpose | Example |

|---|---|---|---|

| R&D/AI | Genesis Therapeutics | Accelerate small molecule drug discovery | AI-driven drug identification |

| Co-development/Commercialization | Syndax Pharmaceuticals, MorphoSys | Share development risks, expand market reach | Axatilimab (GVHD), Tafasitamab (Monjuvi) |

| Clinical Research Institutions | UPMC Hillman Cancer Center | Advance clinical trials, validate therapeutics | Phase 1b trial of elraglusib |

| Manufacturing/Supply Chain | Various U.S. and European facilities | Ensure reliable production and distribution | Geographically diversified sourcing |

| Patient Advocacy/Support | Max Foundation | Improve therapy access, provide support services | Iclusig donation program |

What is included in the product

A detailed Incyte Business Model Canvas that outlines its focus on innovative oncology and inflammation treatments, targeting specific patient populations and healthcare providers through specialized channels.

This model highlights Incyte's core value proposition of developing targeted therapies, supported by robust research and development, strategic partnerships, and a clear go-to-market strategy.

The Incyte Business Model Canvas efficiently addresses the pain point of complex strategic planning by providing a clear, visual overview of their core operations and value propositions.

It serves as a powerful tool for Incyte to quickly identify and articulate their key activities and customer segments, simplifying the process of communicating their strategy.

Activities

Incyte's central mission revolves around the discovery and research of innovative small molecule drugs, particularly targeting areas with significant unmet medical needs like hematology/oncology and inflammation/autoimmunity. This dedication to finding new treatments is a cornerstone of their business.

To achieve this, Incyte harnesses its deep internal scientific knowledge and actively integrates cutting-edge external technologies, including artificial intelligence, through strategic partnerships. This dual approach allows them to explore new biological pathways and push the boundaries of medical science.

For instance, in 2023, Incyte reported significant progress in its R&D pipeline, with a substantial portion of its operating expenses dedicated to the discovery and development of these novel therapeutics, underscoring the capital-intensive nature of this key activity.

Incyte's core operations involve the meticulous clinical development of its drug candidates, progressing them through all phases of trials, from initial safety assessments to large-scale efficacy studies. This critical phase includes designing robust trial protocols, managing study execution, and rigorously analyzing the collected data to build a strong case for regulatory approval.

The company is actively preparing and submitting comprehensive documentation to global health authorities, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). These submissions are crucial for gaining marketing authorization for new therapies. Incyte is projecting significant milestones in 2025, anticipating numerous pivotal study readouts and the potential for new product launches, which will drive future growth.

Incyte's commercialization efforts are centered on bringing its approved therapies to patients worldwide, supported by robust global product launch strategies. This involves meticulous planning for marketing, sales team allocation, and building efficient distribution networks for crucial treatments such as Jakafi, Opzelura, and the newly introduced Niktimvo.

The company has set an ambitious target of over 10 significant product introductions by the year 2030. This strategic expansion is designed to broaden Incyte's revenue base and solidify its market presence across various therapeutic areas.

Intellectual Property Management and Protection

Incyte's core operations heavily rely on its ability to manage and protect its intellectual property. This is a fundamental activity that underpins its entire business model, ensuring that its groundbreaking discoveries remain exclusive and commercially viable.

Securing patents for its proprietary therapeutics is paramount. For instance, Incyte has actively pursued patent protection for its key products, a strategy essential for recouping its substantial research and development investments. The company's approach involves a proactive stance in identifying patentable inventions and navigating the complex global patent application processes.

Defending these patents against infringement is equally critical. Incyte has been involved in legal proceedings to safeguard its market exclusivity. The ongoing discussions and potential challenges surrounding the patent expiration of products like Jakafi highlight the constant need for vigilance and strategic defense of its IP portfolio. This ensures continued revenue streams and market leadership.

- Patent Filings: Incyte consistently invests in filing new patent applications globally to cover its pipeline of novel drug candidates and therapeutic approaches.

- Litigation and Enforcement: The company actively monitors the market for potential patent infringements and engages in legal actions when necessary to protect its exclusive rights.

- Portfolio Management: Strategic management of its IP portfolio involves prioritizing key patents, managing their lifecycle, and making decisions about prosecution and defense based on commercial potential and competitive landscape.

- Freedom to Operate: Incyte also conducts thorough freedom-to-operate analyses to ensure its development and commercialization activities do not infringe on existing third-party patents.

Corporate Strategy and Capital Allocation

Incyte's corporate strategy and capital allocation are central to its operations, focusing on strategic planning and disciplined resource deployment to foster long-term growth. This approach is crucial for navigating the complex biopharmaceutical landscape and ensuring financial sustainability.

Under the new leadership of CEO Bill Meury, Incyte is undertaking a comprehensive review of its research and development (R&D) pipeline, operating expenses, and overall capital allocation strategy. This 'fresh look' aims to identify opportunities for acceleration and optimize the company's investment portfolio.

- Strategic Planning: Developing and refining long-term plans to guide R&D, commercialization, and business development efforts.

- Capital Allocation: Disciplined decision-making regarding investments in internal R&D, potential acquisitions, and partnerships to maximize shareholder value.

- R&D Evaluation: A critical assessment of the current R&D portfolio to prioritize promising drug candidates and streamline resource allocation.

- Operational Efficiency: Identifying and implementing measures to control operating expenses without compromising strategic objectives or innovation.

The company is actively evaluating potential acquisitions and optimizing existing investments to drive future sales growth and enhance its competitive position in the market. This strategic re-evaluation is designed to ensure Incyte remains agile and focused on delivering value to patients and shareholders.

Incyte's key activities encompass the rigorous discovery and development of novel small molecule drugs, with a strategic focus on hematology/oncology and inflammation/autoimmunity. This involves leveraging internal expertise and external technologies, including AI, to explore new therapeutic avenues. The company is committed to advancing its pipeline through all phases of clinical trials, preparing comprehensive submissions for regulatory approval from agencies like the FDA and EMA, and executing global commercialization strategies for its approved therapies.

Furthermore, Incyte places significant emphasis on intellectual property management, including patent filings, litigation, and portfolio defense, to secure its innovations and market exclusivity. The company's corporate strategy and capital allocation are driven by a disciplined approach to planning, R&D evaluation, and operational efficiency, aiming to optimize investments and drive long-term growth.

| Key Activity | Description | 2023 Financial Impact (Illustrative) | 2024 Focus | 2025 Outlook |

| Drug Discovery & Development | Researching and clinically testing new small molecule drugs. | Significant R&D expenses, e.g., $1.5 billion in 2023. | Advancing pipeline candidates, exploring new targets. | Anticipated pivotal study readouts. |

| Regulatory Submissions & Approvals | Preparing and submitting data to health authorities for marketing authorization. | Costs associated with trial data compilation and submission processes. | Continued submissions for ongoing trials. | Potential for new product approvals. |

| Commercialization & Sales | Launching and marketing approved therapies globally. | Revenue from products like Jakafi, Opzelura; marketing and sales investments. | Expanding market reach for existing products. | Continued revenue growth from established and new products. |

| Intellectual Property Management | Securing, defending, and managing patents for proprietary drugs. | Legal and filing costs for patent protection. | Active patent defense and freedom-to-operate analyses. | Maintaining exclusivity for key products. |

| Corporate Strategy & Capital Allocation | Strategic planning, R&D pipeline review, and resource deployment. | Operational expenses, investment in strategic initiatives. | Optimizing R&D portfolio and capital deployment. | Executing strategic growth initiatives. |

What You See Is What You Get

Business Model Canvas

The Incyte Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the complete, ready-to-use file in its entirety, not a simplified sample or mockup. Upon completing your order, you'll gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately begin strategizing and refining your business plan.

Resources

Incyte's most critical resource is its strong pipeline of investigational drugs, complemented by its established proprietary therapeutics such as Jakafi and Opzelura. These valuable assets are shielded by robust intellectual property, notably patents, which are crucial for securing market exclusivity and maintaining a competitive edge.

The company is diligently progressing numerous drug candidates across oncology and inflammation/autoimmunity. Incyte has a significant number of anticipated milestones, particularly in 2025, underscoring the dynamic nature of its development efforts.

Incyte's scientific expertise and robust R&D capabilities are foundational to its business model. This internal strength, powered by highly skilled researchers and advanced laboratory facilities, is crucial for identifying and developing innovative therapies. The company's dedication to scientific rigor is evident in its pursuit of solutions for significant unmet medical needs.

In 2023, Incyte reported $3.7 billion in revenue, a testament to the success of its R&D-driven pipeline. The company's commitment to 'Solve On' underscores its reliance on deep scientific understanding and cutting-edge research to bring novel treatments to patients, particularly in areas like oncology.

Incyte's success hinges on its experienced management and skilled workforce. A team of seasoned scientists, clinical development experts, and commercial professionals fuels the company's innovation and market presence. For instance, the appointment of Bill Meury as CEO in early 2024 underscores strong leadership guiding strategic execution.

Financial Capital and Marketable Securities

Incyte's financial capital and marketable securities are a cornerstone of its business model, providing the fuel for innovation and growth. As of December 31, 2024, the company reported substantial liquidity, with cash, cash equivalents, and marketable securities totaling $2.2 billion.

This robust financial standing directly supports Incyte's commitment to extensive research and development, which is critical for discovering and advancing new therapies. It also underpins strategic initiatives, such as the acquisition of Escient Pharmaceuticals, which expanded its pipeline in autoimmune and inflammatory diseases. Furthermore, this capital allows for flexible capital allocation, including share repurchase programs, enhancing shareholder value.

- Financial Strength: $2.2 billion in cash, cash equivalents, and marketable securities as of December 31, 2024.

- R&D Investment: Enables sustained funding for ongoing research and development activities.

- Strategic Acquisitions: Facilitates key acquisitions, like Escient, to bolster the drug pipeline.

- Capital Allocation: Supports share repurchases and opportunistic business development.

Global Commercial Infrastructure and Networks

Incyte's global commercial infrastructure is a cornerstone of its business model, enabling the effective reach and sale of its pharmaceutical products. This includes established sales forces, dedicated marketing teams, and robust distribution networks strategically positioned across key markets such as North America, Europe, and Asia.

This extensive infrastructure is critical for both the ongoing commercialization of existing approved therapies and the successful introduction of new treatments into diverse international markets. It directly supports Incyte's ability to connect with a wide patient base, thereby driving substantial product revenues.

- Global Reach: Presence in North America, Europe, and Asia facilitates international product launches and sales.

- Commercialization Engine: Sales and marketing teams are essential for driving product adoption and revenue generation.

- Distribution Networks: Efficient supply chains ensure product availability to patients worldwide.

- Revenue Driver: This infrastructure directly underpins Incyte's ability to generate significant product revenues by reaching broad patient populations.

Incyte's key resources include its robust drug pipeline, protected by patents, and its scientific expertise driving R&D. The company's financial strength, with $2.2 billion in cash and marketable securities as of December 31, 2024, fuels innovation and strategic acquisitions. Its global commercial infrastructure ensures product reach and revenue generation.

| Resource Type | Description | Key Data Point |

| Intellectual Property | Patents protecting investigational and established drugs | Proprietary therapeutics include Jakafi and Opzelura |

| Human Capital | Experienced management and skilled R&D workforce | CEO Bill Meury appointed early 2024 |

| Financial Capital | Cash, cash equivalents, and marketable securities | $2.2 billion as of December 31, 2024 |

| Physical/Infrastructure | Global commercialization infrastructure | Presence in North America, Europe, and Asia |

Value Propositions

Incyte's core mission centers on tackling diseases where current treatments fall short, especially in blood cancers, inflammatory conditions, and autoimmune disorders. This strategic focus means their research is concentrated on patients who desperately need new and better therapeutic options.

By prioritizing these challenging areas, Incyte aims to deliver truly transformative treatments that can significantly improve patient lives. For instance, their JAK inhibitor, Jakafi (ruxolitinib), has been a groundbreaking therapy for myelofibrosis, a rare blood cancer with limited prior treatment avenues.

In 2024, Incyte continued to advance its pipeline, with a significant portion of its research and development spending allocated to these high unmet need areas. This commitment underscores their dedication to innovation in fields where patient outcomes can be dramatically enhanced.

Incyte focuses on developing innovative, often first-in-class, medicines, providing novel therapeutic avenues for patients with significant unmet medical needs. Their commitment to groundbreaking research translates into treatments that can fundamentally alter disease progression and patient well-being.

Products like Jakafi and Opzelura exemplify this value proposition, showcasing substantial clinical efficacy that directly improves patient outcomes and enhances their overall quality of life. These therapies represent a significant advancement in treating specific conditions.

The company's robust pipeline is strategically designed to identify and advance differentiated molecules, aiming to offer distinct clinical advantages compared to currently available treatment options. This forward-looking approach ensures a continuous stream of potentially superior therapies.

Incyte's core mission is to enhance patient lives by creating innovative treatments for rare and challenging conditions. These therapies aim to alleviate symptoms, prolong life, and significantly improve a patient's ability to function daily. For example, Incyte's JAK inhibitor, Jakafi, has demonstrated significant improvements in spleen volume and symptom burden for patients with myelofibrosis, a serious blood cancer.

The tangible impact of Incyte's work is seen in the measurable improvements to patient health and overall quality of life. By focusing on unmet medical needs, the company strives to offer hope and better outcomes for individuals facing debilitating diseases. In 2023, Incyte reported net product sales of $3.4 billion, a testament to the market's recognition of their value-driven approach to patient care.

Commitment to Scientific Rigor and Breakthroughs

Incyte's core philosophy of 'Solve On' embodies a steadfast dedication to scientific exploration, aiming to uncover truly impactful therapeutic advancements. This commitment ensures that their drug development pipeline is built on a foundation of robust scientific evidence, directly influencing the quality and effectiveness of their potential treatments.

For medical professionals and the patients they serve, Incyte's rigorous scientific approach fosters a high degree of confidence in the underlying science of their therapies. This trust is crucial, especially in the competitive biopharmaceutical landscape where innovation and proven efficacy are paramount.

In 2023, Incyte reported total revenue of $3.75 billion, a testament to the market's acceptance of their science-driven innovations. Their substantial investment in research and development, which amounted to $1.5 billion in 2023, underscores their commitment to pushing the boundaries of scientific discovery and delivering breakthrough treatments.

- Scientific Foundation: Incyte's 'Solve On' ethos prioritizes deep scientific investigation to develop novel therapies.

- Efficacy and Quality: This rigor directly translates into the high quality and proven efficacy of their therapeutic candidates.

- Stakeholder Trust: Healthcare providers and patients place trust in Incyte's products due to their strong scientific backing.

- Financial Commitment: A significant R&D investment of $1.5 billion in 2023 highlights their dedication to scientific breakthroughs.

Expanding Access and Patient Support

Beyond just developing new medicines, Incyte actively works to make sure patients can actually get and use their treatments. This involves more than just the science; it's about practical support.

Programs like IncyteCARES and Opzelura On Trac are key here. They help patients navigate the complexities of affording their medications and accessing necessary services. For instance, in 2023, Incyte reported significant patient engagement with these support programs, demonstrating a commitment to overcoming access barriers.

This comprehensive strategy is vital. It ensures that when a medicine is approved, it doesn't just sit on a shelf but reaches the people who can benefit from it. This support also encourages patients to stick with their treatment plans, which is crucial for achieving the best health outcomes.

- Patient Assistance Programs: IncyteCARES and Opzelura On Trac offer financial aid and co-pay assistance, helping to reduce out-of-pocket costs for eligible patients.

- Access Support Services: These programs also provide assistance with insurance navigation and access to essential services, streamlining the patient journey.

- Treatment Adherence: By addressing financial and logistical hurdles, Incyte aims to improve patient adherence to prescribed therapies, maximizing treatment efficacy.

- Commitment to Patient Well-being: This focus on access and support underscores Incyte's dedication to patient well-being beyond the initial drug discovery phase.

Incyte's value proposition centers on delivering innovative, often first-in-class, medicines to patients with significant unmet medical needs, particularly in areas like blood cancers and inflammatory diseases. Their rigorous scientific approach, exemplified by their 'Solve On' ethos, ensures the development of high-quality, effective therapies that build trust with healthcare providers and patients.

The company's commitment extends to ensuring patient access through robust support programs, aiming to improve treatment adherence and overall well-being. This focus on both scientific advancement and practical patient support drives their market acceptance and financial success.

In 2023, Incyte reported $3.75 billion in total revenue, with $1.5 billion invested in R&D, showcasing their dedication to scientific breakthroughs and delivering tangible value to patients facing challenging conditions.

Customer Relationships

Incyte cultivates robust relationships with key healthcare professionals, such as oncologists, hematologists, and dermatologists. This is primarily achieved through dedicated medical science liaisons and commercial teams who engage directly with these prescribers.

These direct interactions are vital for educating physicians on Incyte's innovative therapies, disseminating critical clinical trial data, and actively soliciting feedback on unmet patient needs and treatment landscape evolution. For instance, Incyte's commitment to scientific exchange was evident in its extensive presence at major oncology conferences throughout 2024, presenting data on its portfolio.

This consistent, data-driven engagement is instrumental in fostering prescriber confidence, driving the adoption of Incyte's products, and ensuring their appropriate and effective use in patient care. In 2024, Incyte reported significant growth in its sales force dedicated to direct physician engagement, reflecting the strategic importance of this customer relationship.

Incyte cultivates strong patient ties through dedicated support and access initiatives, exemplified by programs like IncyteCARES and Opzelura On Trac. These services are designed to assist patients in managing their treatment journey, including navigating co-payment assistance and ensuring access to prescribed medications.

These patient-centric programs underscore Incyte's commitment to enhancing patient well-being, extending support beyond the initial prescription. For instance, Incyte's patient assistance programs have historically played a crucial role in ensuring affordability for eligible patients, a critical factor in treatment adherence.

Incyte actively partners with patient advocacy groups to gain crucial insights into patient needs and to boost disease awareness. These collaborations are vital for improving treatment accessibility. For instance, Incyte's ongoing support for the Max Foundation highlights their commitment to global patient communities.

Medical Information and Scientific Exchange

Incyte cultivates strong relationships by offering comprehensive medical information and actively participating in scientific exchange with healthcare professionals and researchers. This commitment ensures that the medical community has access to the latest data and insights regarding Incyte's innovative therapies.

Key activities include presenting clinical trial results at major medical conferences and publishing peer-reviewed research in scientific journals. For instance, Incyte consistently presents data at events like the American Society of Hematology (ASH) Annual Meeting, showcasing advancements in myeloproliferative neoplasms and other hematologic malignancies. In 2024, Incyte presented numerous abstracts and posters, highlighting its ongoing research and development efforts.

- Medical Information: Providing detailed, evidence-based responses to unsolicited medical inquiries from healthcare professionals.

- Scientific Exchange: Engaging with key opinion leaders and researchers to share scientific data and foster collaboration.

- Conference Presentations: Disseminating research findings and clinical data at national and international medical congresses.

- Publication Strategy: Publishing study results in high-impact, peer-reviewed journals to contribute to the scientific literature.

Pharmacovigilance and Post-Market Surveillance

Incyte actively cultivates ongoing relationships by prioritizing pharmacovigilance and post-market surveillance, ensuring the continued safety and efficacy of its marketed therapies. This diligent monitoring of adverse events and the systematic collection of real-world data are fundamental to upholding patient safety.

- Ongoing Monitoring: Incyte's commitment to pharmacovigilance involves continuous tracking of potential side effects and safety signals for its approved products, a crucial aspect of patient care.

- Real-World Data Collection: Gathering real-world evidence through post-market surveillance provides valuable insights into product performance and patient outcomes beyond clinical trials, supporting evidence-based decision-making.

- Trust Building: This unwavering dedication to patient safety fosters significant trust among healthcare professionals and patients, reinforcing Incyte's reputation as a reliable partner in healthcare.

Incyte prioritizes building strong connections with healthcare providers through dedicated medical science liaisons and commercial teams. These interactions are crucial for educating them on new treatments and gathering feedback on patient needs, as seen in their robust presence at 2024 oncology conferences.

The company also focuses on patient support with programs like IncyteCARES and Opzelura On Trac, aiding in treatment access and affordability. Collaborations with patient advocacy groups further enhance their understanding of patient needs and improve treatment accessibility.

Incyte maintains relationships by providing comprehensive medical information and engaging in scientific exchange, including presenting clinical trial data at major meetings like the American Society of Hematology (ASH) Annual Meeting in 2024.

Furthermore, Incyte emphasizes pharmacovigilance and real-world data collection to ensure ongoing product safety and efficacy, building trust with both healthcare professionals and patients.

Channels

Incyte leverages specialized distribution networks to ensure its advanced therapies, like Jakafi and Opzelura, reach patients effectively. These networks include specialty pharmacies and distributors adept at managing complex, often temperature-sensitive, medications.

In 2023, Incyte reported net product sales of $3.7 billion, with Jakafi and Opzelura being significant contributors. The efficiency of these specialty distribution channels is crucial for maintaining the integrity of these high-value treatments and ensuring patient access.

Incyte utilizes a direct sales force to directly engage with healthcare providers, such as oncologists and dermatologists. This channel is vital for educating these professionals on Incyte's products, including their benefits and supporting clinical trial data. In 2024, Incyte's sales force played a key role in driving the adoption of its therapies.

Incyte utilizes its corporate website and dedicated investor relations portals as primary channels for disseminating crucial financial results, pipeline advancements, and company news, reaching investors and media effectively.

Social media platforms like LinkedIn, X, Instagram, Facebook, and YouTube broaden Incyte's reach, allowing for dynamic communication of company updates and engagement with a wider audience, including healthcare professionals and patients.

In 2024, Incyte reported a significant increase in website traffic for its investor relations section, driven by strong interest in its JAK inhibitor portfolio and upcoming clinical trial data, demonstrating the effectiveness of these digital channels in engaging stakeholders.

Medical Conferences and Scientific Meetings

Incyte leverages major medical conferences and scientific meetings as a crucial channel to disseminate its research and engage with the global scientific and medical community. These events are instrumental in presenting pivotal clinical trial data, offering updates on the company's innovative pipeline, and fostering discussions with key opinion leaders and potential collaborators.

Participation in high-profile gatherings such as the J.P. Morgan Healthcare Conference and the American Society of Hematology (ASH) Annual Meeting provides Incyte with essential platforms. Here, the company can effectively showcase its scientific advancements and therapeutic innovations, thereby reinforcing its position as a leader in the field of oncology and inflammation.

- Data Dissemination: Presenting Phase 3 data for drugs like Pemigatinib at conferences such as ASCO in 2024.

- Pipeline Visibility: Highlighting early-stage pipeline assets and their potential at scientific symposia.

- Key Opinion Leader Engagement: Facilitating direct interaction with leading researchers and clinicians to gather feedback and build advocacy.

- Investor Relations: Utilizing investor-focused conferences to communicate strategic progress and financial outlook to the investment community.

Partnerships for International Market Access

Incyte strategically utilizes partnerships to unlock international market access, employing local commercial teams to navigate varied regulatory environments and market dynamics. This approach was particularly evident in 2024, with Europe demonstrating significant growth in Opzelura sales, underscoring the success of these international collaborations.

These vital partnerships are instrumental in Incyte's global expansion strategy, ensuring broader patient reach and facilitating the successful introduction of its therapies across diverse geographies. By working with local experts, Incyte can more effectively address the unique challenges and opportunities present in each market.

- Strategic Alliances: Incyte forms alliances with local entities to gain entry into new international markets.

- Local Expertise: Partnerships provide essential knowledge of regional regulations and market nuances.

- Sales Growth: Europe's increased contribution to Opzelura sales in 2024 validates the effectiveness of these channel strategies.

- Global Reach: Collaborations are fundamental to extending patient access to Incyte's innovative treatments worldwide.

Incyte's channels are multifaceted, encompassing direct engagement with healthcare professionals via its sales force and broad dissemination of information through digital platforms and investor relations portals. These channels are critical for educating physicians and informing stakeholders about the company's advancements.

The company also actively participates in major medical conferences, providing a vital venue for presenting clinical data and engaging with key opinion leaders, which is crucial for scientific validation and market adoption. Furthermore, strategic international partnerships are leveraged to navigate diverse regulatory landscapes and expand global market access for its therapies.

In 2024, Incyte's digital channels saw increased engagement, particularly its investor relations section, reflecting strong interest in its pipeline. European sales of Opzelura also grew significantly in 2024, highlighting the success of its partnership-driven international expansion strategy.

Customer Segments

Patients diagnosed with myeloproliferative neoplasms (MPNs), including myelofibrosis and polycythemia vera, represent a crucial customer segment for Incyte. These conditions are serious blood cancers, and Incyte's flagship drug, Jakafi (ruxolitinib), is a primary treatment option, significantly improving patient outcomes by addressing key unmet medical needs.

Incyte's commitment to this patient group is evident through ongoing research and development. For instance, in 2024, the company continued to advance investigational agents like INCA033989, aiming to offer even more targeted and effective therapies for MPN patients, underscoring a long-term dedication to this therapeutic area.

Incyte also serves patients dealing with graft-versus-host disease (GVHD), a serious complication following stem cell transplants. This segment specifically includes individuals with chronic GVHD who haven't found success with previous treatments. The recent U.S. approval of Niktimvo (axatilimab-csfr) highlights Incyte's commitment to this challenging patient population, offering a much-needed therapeutic advancement.

Incyte's core customer base includes patients battling inflammatory and autoimmune skin diseases, with a particular focus on atopic dermatitis and vitiligo. These conditions significantly impact quality of life, creating a substantial need for effective treatments.

The success of Opzelura (ruxolitinib) cream in these dermatological areas underscores the demand from this patient segment. In 2023, Opzelura achieved $340 million in net sales, with a significant portion attributed to its dermatological indications, reflecting strong patient adoption and continued prescription refills.

Furthermore, Incyte is actively working to broaden its reach within this customer segment by exploring new indications for Opzelura. This includes seeking approval for pediatric atopic dermatitis and investigating its potential for treating hidradenitis suppurativa, aiming to address a wider range of unmet needs in autoimmune dermatology.

Oncology Patients with Specific Solid Tumors and Lymphomas

Incyte's primary customer segment consists of oncology patients diagnosed with specific solid tumors and lymphomas. This includes individuals battling conditions like squamous cell anal carcinoma (SCAC) and those with relapsed or refractory follicular lymphoma. Their therapeutic offerings, such as Zynyz (retifanlimab) and Monjuvi (tafasitamab), are specifically designed to treat these challenging hematological and solid tumor indications.

The company's strategic focus extends to other critical areas within oncology, with a robust pipeline targeting unmet needs. For instance, Incyte is actively developing treatments for ovarian cancer, showcasing a commitment to expanding its reach. Furthermore, their research efforts are directed towards novel targets like KRASG12D and TGFßR2×PD-1, aiming to bring innovative solutions to patients with various solid tumors.

- Targeted Cancer Types: Squamous cell anal carcinoma (SCAC) and relapsed/refractory follicular lymphoma.

- Key Therapies: Zynyz (retifanlimab) and Monjuvi (tafasitamab).

- Pipeline Focus: Ovarian cancer, KRASG12D, and TGFßR2×PD-1 in solid tumors.

Healthcare Providers and Institutions

Healthcare providers, including physicians and specialists, along with institutions like hospitals and clinics, represent critical indirect customer segments for Incyte. These professionals are the key decision-makers who prescribe and administer Incyte's innovative therapies to patients. In 2024, the pharmaceutical industry continued to emphasize strong physician engagement, with companies investing heavily in medical education and scientific exchange programs to ensure the appropriate use of advanced treatments.

Building robust relationships with these healthcare stakeholders is paramount. This involves providing comprehensive educational resources and ongoing support to ensure that patients are correctly identified for Incyte's treatments and that therapies are administered effectively. For instance, data from 2023 showed that targeted educational initiatives for oncologists significantly improved the uptake of new targeted cancer therapies, a trend expected to persist and grow in 2024.

- Physicians and Specialists: The primary prescribers of Incyte's pharmaceuticals.

- Hospitals and Clinics: Key institutions for therapy administration and patient access.

- Medical Education: Crucial for ensuring appropriate patient selection and treatment protocols.

- Scientific Exchange: Fostering understanding of Incyte's product benefits and value proposition.

Incyte's customer base extends to patients with myeloproliferative neoplasms (MPNs) like myelofibrosis and polycythemia vera, where Jakafi (ruxolitinib) is a leading treatment. The company also serves patients with graft-versus-host disease (GVHD), particularly those with chronic GVHD who have not responded to other therapies, as evidenced by the 2024 approval of Niktimvo (axatilimab-csfr).

Another significant segment includes patients with inflammatory and autoimmune skin conditions, such as atopic dermatitis and vitiligo, benefiting from Opzelura (ruxolitinib) cream. In 2023, Opzelura generated $340 million in net sales, highlighting its strong market penetration in dermatology.

Oncology patients with specific solid tumors and lymphomas, including squamous cell anal carcinoma and follicular lymphoma, are also key customers, treated with drugs like Zynyz and Monjuvi. Incyte's pipeline also targets ovarian cancer and novel pathways such as KRASG12D.

Healthcare providers, including physicians and institutions like hospitals and clinics, are essential indirect customers. In 2024, the industry continued to prioritize physician engagement through medical education and scientific exchange to ensure optimal use of advanced treatments.

| Customer Segment | Key Conditions Treated | Primary Incyte Therapies | 2023 Net Sales (Selected) |

| MPN Patients | Myelofibrosis, Polycythemia Vera | Jakafi (ruxolitinib) | N/A (Jakafi global sales $2.4B in 2023) |

| GVHD Patients | Chronic GVHD | Niktimvo (axatilimab-csfr) | N/A (Newly approved) |

| Dermatology Patients | Atopic Dermatitis, Vitiligo | Opzelura (ruxolitinib) cream | $340 million (Opzelura net sales in 2023) |

| Oncology Patients | SCAC, Follicular Lymphoma, Ovarian Cancer | Zynyz, Monjuvi | N/A (Zynyz and Monjuvi sales combined $124M in 2023) |

| Healthcare Providers | N/A | N/A | N/A |

Cost Structure

Research and Development (R&D) expenses are a cornerstone of Incyte's cost structure, underscoring its dedication to innovative drug discovery and development. These costs are substantial, reflecting the significant investment required to bring new therapies from the lab to patients.

In 2024, Incyte's R&D expenditures saw an increase and are projected to stay high, potentially around 40% of its revenue. This sustained investment is driven by ongoing progress in late-stage clinical trials for key assets and strategic efforts to broaden the company's drug pipeline.

These R&D costs encompass a wide range of activities, including the extensive and often lengthy process of conducting clinical trials, the intricate work of drug discovery, and the crucial preclinical research that lays the groundwork for future treatments.

Selling, General, and Administrative (SG&A) expenses are a significant component of Incyte's business model, encompassing all costs associated with commercializing its products and running the corporate enterprise. These include substantial investments in sales force compensation, extensive marketing campaigns targeting both healthcare professionals and patients, and the broad range of administrative functions required to manage global operations.

In 2024, Incyte's SG&A expenses reflected strategic growth initiatives, with a notable increase driven by the timing of consumer marketing activities for key products and ongoing investments in infrastructure to support its expanding pipeline and commercial footprint.

The cost of product revenues, a significant expense for Incyte, includes manufacturing, distribution, and partner royalty payments. These costs are directly influenced by sales volume and can shift with sales expansion and evolving profit-sharing arrangements.

For instance, Incyte's cost of revenues for the nine months ended September 30, 2023, was $1.2 billion, a notable increase from $917.5 million in the same period of 2022, reflecting higher sales of key products and increased manufacturing expenses.

The introduction of new products, such as Niktimvo, also contributes to rising manufacturing costs and profit-sharing obligations, directly impacting this cost structure component.

Acquisition-Related Costs and Milestone Payments

Incyte's cost structure includes significant acquisition-related expenses and milestone payments. These are crucial for pipeline expansion and portfolio diversification. For example, the company made a substantial upfront payment to Genesis Therapeutics as part of their collaboration agreement, demonstrating a commitment to external innovation.

These strategic moves, while necessary for long-term growth, represent a considerable initial investment. The acquisition of Escient Pharmaceuticals, for instance, was a key step in bolstering Incyte's oncology pipeline, highlighting the financial commitment required for such strategic advancements.

- Acquisition of Escient Pharmaceuticals: A strategic move to enhance the oncology pipeline.

- Upfront Payment to Genesis Therapeutics: Part of a collaboration to advance drug development.

- Milestone Payments: Incurred as development targets are met with collaboration partners.

- Pipeline Expansion & Diversification: The primary strategic drivers for these significant costs.

Legal and Regulatory Compliance Costs

Operating in the biopharmaceutical sector, like Incyte, incurs substantial legal and regulatory compliance costs. These expenses are critical for navigating the complex landscape of drug development and market approval.

Key cost drivers include:

- Intellectual Property Protection and Litigation: Safeguarding patents and defending against infringement claims represent a significant outlay.

- Regulatory Filings and Approvals: Costs associated with preparing and submitting extensive documentation to agencies like the FDA for new drug applications and ongoing compliance.

- Adherence to Healthcare Laws: Expenses for ensuring compliance with a myriad of regulations, including those related to clinical trials, manufacturing, marketing, and pricing.

Incyte's cost structure was notably affected by a contract dispute settlement with Novartis in 2023, which is expected to reduce future royalty payments. This settlement, while impacting current financials, aims to create a more favorable long-term cost profile.

Incyte's cost structure is heavily weighted towards Research and Development (R&D), reflecting its core strategy of innovation. In 2024, R&D expenditure is projected to remain substantial, potentially reaching around 40% of revenue, to support ongoing clinical trials and pipeline expansion.

Selling, General, and Administrative (SG&A) costs are also significant, driven by commercialization efforts and corporate operations. In 2024, SG&A saw an increase due to marketing activities and infrastructure investments supporting growth.

The cost of product revenues, including manufacturing and distribution, directly correlates with sales volume, as seen in the increase from $917.5 million in the first nine months of 2022 to $1.2 billion in the same period of 2023.

Acquisitions and milestone payments are crucial for pipeline diversification, with notable investments in companies like Genesis Therapeutics and Escient Pharmaceuticals.

| Cost Component | 2023 (Nine Months Ended Sep 30) | Key Drivers |

| Cost of Revenues | $1.2 Billion | Sales volume, manufacturing, distribution, royalties |

| R&D Expenses | Projected ~40% of Revenue (2024) | Clinical trials, drug discovery, preclinical research |

| SG&A Expenses | Increased in 2024 | Marketing, sales force, administration, infrastructure |

| Acquisitions/Milestones | Significant Investments | Pipeline expansion, strategic partnerships |

Revenue Streams

Jakafi, also known as ruxolitinib, is Incyte's leading product and the main source of its income. It brings in significant net product sales from treating myelofibrosis, polycythemia vera, and graft-versus-host disease. In 2024, Jakafi's net revenues reached $2.79 billion, and this figure is projected to keep growing into 2025.

The demand for Jakafi across its approved uses fuels this substantial revenue stream. This consistent paid demand underscores its importance as Incyte's flagship product.

Opzelura's net product sales are a significant and expanding revenue source for Incyte. This growth is fueled by robust demand from patients seeking treatment for atopic dermatitis and vitiligo, leading to consistent refills.

In 2024, Opzelura achieved net product revenues of $508 million, marking a substantial 50% increase compared to the previous year. This impressive growth is evident across both the United States and European markets.

The strong performance of Opzelura underscores its importance as a cornerstone of Incyte's strategy to diversify its revenue streams beyond its established oncology franchise.

Incyte's portfolio extends beyond its flagship products with other oncology offerings like Niktimvo, Monjuvi, and Zynyz, which are crucial for revenue diversification. These products represent a strategic effort to broaden market reach and capture value in different oncology segments.

Niktimvo (axatilimab-csfr), a recent addition, demonstrated robust commercial uptake, generating $36 million in net product revenues in the second quarter of 2025 following its early 2025 launch. This early success indicates strong market acceptance and a positive trajectory for incremental revenue growth.

Monjuvi (tafasitamab) and Zynyz (retifanlimab) also play a significant role in this revenue stream, contributing to Incyte's overall financial performance. As these therapies gain further market penetration and clinician adoption, they are poised to drive continued revenue expansion for the company.

Royalty Income from Licensed Products

Incyte earns revenue through royalty income generated from its licensed intellectual property. A prime example is the royalties received from Novartis on Jakafi sales conducted outside the United States. This stream, while impacted by a May 2025 contract dispute settlement that adjusted future U.S. royalty rates, continues to be a recognized part of Incyte's overall revenue generation.

The royalty income from licensed products is a significant, albeit evolving, revenue stream for Incyte. For instance, the agreement with Novartis for Jakafi outside the U.S. demonstrates how Incyte capitalizes on its innovations through partnerships. Despite a settlement in May 2025 that modified royalty percentages within the U.S., the underlying principle of earning from licensed IP remains a consistent element of their business model.

- Royalty Income Source: Licensing of intellectual property, notably Jakafi sales by Novartis outside the U.S.

- Impact of Contract Dispute: A May 2025 settlement reduced future U.S. Jakafi royalty rates.

- Revenue Component: Royalty income remains a contributing factor to Incyte's total revenue despite adjustments.

Milestone and Collaboration Payments

Incyte secures substantial revenue through milestone and collaboration payments, a key component of its business model. For instance, a notable upfront payment of $30 million was received from Genesis Therapeutics, highlighting the value placed on these strategic alliances.

These payments are directly tied to the progress and success of drug development and commercialization efforts within these partnerships. They represent critical financial injections that bolster Incyte's ability to fund its ongoing research and development activities.

- Upfront Payments: Initial payments received at the commencement of collaboration agreements.

- Milestone Payments: Payments triggered by the achievement of specific development or commercial targets.

- Collaboration Revenue: Income generated from jointly funded research and development projects.

- Strategic Partnerships: Agreements with other pharmaceutical or biotechnology companies to advance drug candidates.

Incyte's revenue streams are primarily driven by its flagship oncology product, Jakafi, which generated $2.79 billion in net product sales in 2024. The company also sees significant growth from Opzelura, reaching $508 million in net product revenues in 2024, a 50% increase year-over-year. Other oncology products like Monjuvi, Zynyz, and the recently launched Niktimvo contribute to revenue diversification.

Beyond product sales, Incyte benefits from royalty income, particularly from Novartis for Jakafi sales outside the U.S., though a May 2025 settlement adjusted future U.S. royalty rates. Milestone and collaboration payments, such as a $30 million upfront payment from Genesis Therapeutics, also form a crucial part of their financial model, supporting ongoing R&D.

| Product/Revenue Stream | 2024 Net Revenue (Billions USD) | Year-over-Year Growth (Approx.) | Key Indications/Notes |

|---|---|---|---|

| Jakafi | 2.79 | N/A (Established Product) | Myelofibrosis, Polycythemia Vera, Graft-versus-Host Disease |

| Opzelura | 0.51 | 50% | Atopic Dermatitis, Vitiligo |

| Niktimvo | N/A (Launched Early 2025) | N/A | $36M in Q2 2025 |

| Royalty Income | Varies | Adjusted by May 2025 Settlement | Primarily from Novartis (Jakafi outside U.S.) |

| Milestone & Collaboration Payments | Varies | Transaction-Dependent | e.g., $30M upfront from Genesis Therapeutics |

Business Model Canvas Data Sources

The Incyte Business Model Canvas is informed by a blend of internal financial data, extensive market research reports, and competitive intelligence. This multi-faceted approach ensures a comprehensive and data-driven understanding of Incyte's strategic positioning and operational framework.