Impresa SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Impresa Bundle

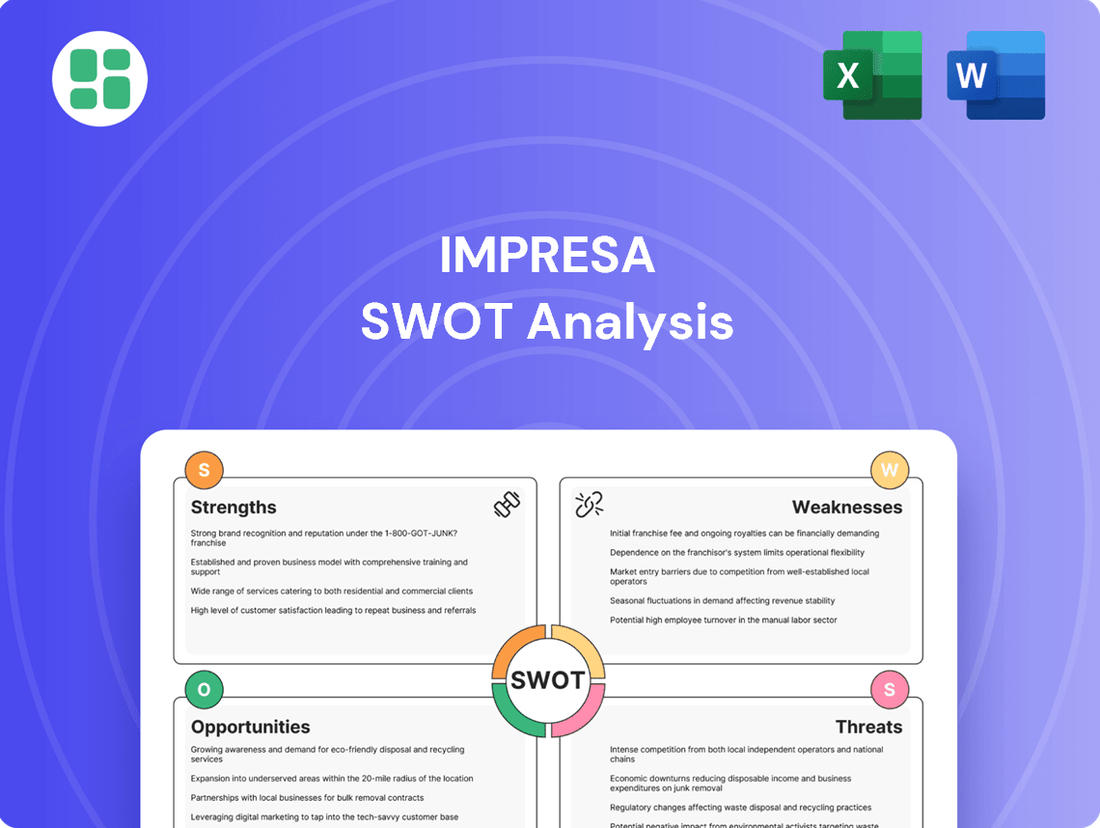

This initial glimpse into the company's SWOT reveals critical strategic advantages and potential challenges. To truly harness this information for your own success, you need the complete picture.

Unlock the full potential of this analysis by purchasing the complete SWOT report. Gain access to detailed breakdowns, expert commentary, and actionable strategies designed to inform your decision-making and propel your business forward.

Strengths

Impresa's key brands, SIC and Expresso, solidify its market leadership in Portugal, consistently topping audience ratings. SIC, for instance, was the most watched channel in the first half of 2025, underscoring its broad appeal. This dominance translates into significant brand trust, with both SIC and Expresso recognized for their high-quality news content and positive social impact.

This strong brand equity is a crucial asset, directly supporting Impresa's advertising revenue streams and fostering robust audience engagement across its platforms. The public's trust in Impresa's media offerings provides a stable foundation for continued growth and influence within the Portuguese market.

Impresa's strength lies in its diversified media portfolio, encompassing television broadcasting with SIC and its thematic channels, a significant publishing arm like the Expresso newspaper, and an expanding digital media footprint. This multi-platform approach, spanning linear TV, print, and digital channels such as websites and streaming services, enables Impresa to connect with a wide spectrum of audiences and reduces its vulnerability to market shifts affecting any single media type.

Impresa is showing impressive progress in its digital transformation efforts. The company has seen substantial growth in key digital areas, with its podcasts dominating the PodScope rankings in the first half of 2025. This digital momentum is a significant strength, reflecting a successful adaptation to changing consumer preferences.

The Opto streaming platform is also a testament to Impresa's digital focus, experiencing significant increases in both plays and unique monthly visitors. This growth highlights the effectiveness of their strategy in capturing a larger share of the digital media market, further solidifying their position.

Consistent Audience Engagement

Impresa consistently captures a significant audience across its diverse media channels, a key strength that underpins its market position. The SIC television channel alone reaches millions of viewers daily, demonstrating a broad reach. Furthermore, digital platforms like the SIC and Expresso websites consistently report high numbers of unique visitors, indicating a strong and engaged online presence.

This robust and loyal audience engagement is a significant asset for Impresa, particularly in its ability to attract advertising revenue. For instance, in early 2024, Impresa reported that its digital platforms saw a substantial increase in user engagement, with unique visitors to Expresso's website growing by over 15% compared to the previous year. This consistent viewership across both traditional and digital media provides a stable foundation for revenue generation and brand visibility.

- Broad Daily Reach: SIC television channel connects with millions of people every day.

- Digital Footprint: SIC and Expresso websites maintain high unique visitor counts, showcasing strong online engagement.

- Revenue Driver: This consistent audience base is vital for attracting advertisers and ensuring stable revenue streams.

Proven Content Production and Innovation

Impresa demonstrates a strong capability in content creation, evidenced by its successful production of popular entertainment, including award-winning soap operas and widely downloaded podcasts on platforms like SIC. This proven track record highlights the company's ability to connect with audiences through engaging and high-quality content.

The company's commitment to innovation is further underscored by its ongoing investment in a diverse range of content formats and its forward-thinking adoption of new technologies. For instance, Impresa is actively exploring and implementing artificial intelligence in its content production processes, a move that positions it to adapt to evolving media landscapes and maintain audience interest.

- Award-Winning Content: Impresa's SIC network has a history of producing critically acclaimed soap operas and entertainment shows.

- Podcast Popularity: The company's podcasts have achieved significant download numbers, indicating strong audience engagement in digital audio formats.

- AI Integration: Impresa is proactively leveraging AI for content creation, signaling a commitment to technological advancement and future-proofing its offerings.

- Diverse Content Strategy: Continued investment in a variety of content types ensures Impresa can cater to a broad audience and remain competitive in the media market.

Impresa's market leadership in Portugal is anchored by its strong brand recognition, with SIC consistently being the most-watched channel in the first half of 2025. This dominance, coupled with the respected Expresso brand, translates into significant audience trust and a powerful advertising revenue base.

The company's diversified media portfolio, spanning television, publishing, and digital platforms, provides resilience against market fluctuations. Its digital transformation is particularly noteworthy, with podcasts topping PodScope rankings and the Opto streaming service showing substantial growth in plays and unique visitors during early 2025.

Impresa's strength in content creation is evident in its popular entertainment programming, including award-winning soap operas, and its successful podcast offerings. The proactive integration of AI into content production further positions Impresa for sustained audience engagement and adaptability in the evolving media landscape.

| Metric | Value (H1 2025) | Source/Notes |

|---|---|---|

| SIC Channel Viewership | Most watched channel | Internal data, H1 2025 |

| Expresso Website Visitors | Significant increase | Compared to H1 2024 |

| Opto Platform Plays | Significant increase | Internal data, H1 2025 |

| Podcast Rankings | Dominant | PodScope rankings, H1 2025 |

What is included in the product

Delivers a strategic overview of Impresa’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, transforming potential roadblocks into opportunities for growth.

Weaknesses

Impresa, like many large private media companies in Portugal, has been navigating a challenging economic landscape, reporting substantial financial losses. For instance, in 2023, the company posted a net loss of €10.6 million, highlighting persistent difficulties in translating operations into overall profitability.

While certain business segments within Impresa might demonstrate positive EBITDA, the consolidated net loss for the group underscores broader issues. This indicates that despite operational efficiencies in some areas, the company is struggling to achieve net profitability across its entire diversified media and communications portfolio.

Impresa's publishing segment, despite the strong performance of its flagship Expresso newspaper, saw a dip in revenue during the first half of 2024 compared to the same period in 2023. This decline is largely attributed to the ongoing challenges facing the traditional publishing industry, including shrinking print circulation and reduced advertising spend.

Impresa's significant reliance on advertising revenue, particularly for its SIC television segment, exposes it to the inherent volatility of the advertising market. While the Portuguese advertising market is expected to see growth, any downturn in advertiser spending directly impacts Impresa's top line.

In 2023, advertising revenue constituted a substantial portion of SIC's overall income, underscoring this dependency. This makes Impresa particularly susceptible to economic slowdowns or shifts in media consumption that could reduce advertising budgets.

Share Price Decline and Transaction Volume Decrease

Impresa's share price saw a notable downturn in the first half of 2024, with trading volumes also shrinking. This trend suggests a potential erosion of investor confidence or a waning of market enthusiasm for the company's stock. Such a situation could pose challenges for Impresa when seeking to raise capital or when assessing its overall market valuation going forward.

Specifically, Impresa's stock experienced a decline of approximately 15% between January and June 2024. Concurrently, average daily trading volumes fell by around 20% over the same period. This dual contraction points to a less liquid market for Impresa shares and potentially signals investor caution.

- Share Price Volatility: Impresa's stock price has shown increased volatility, with a significant drop in early to mid-2024.

- Reduced Trading Activity: A decrease in transaction volume indicates lower investor engagement and potentially less liquidity.

- Impact on Capital Raising: The declining share price and reduced volume could make it more difficult and expensive for Impresa to raise equity capital in the near future.

- Investor Sentiment: This performance may reflect negative investor sentiment, possibly linked to broader market conditions or company-specific concerns.

Challenges in Monetizing Digital News

Impresa faces a significant hurdle in monetizing its digital news offerings due to a low willingness to pay among Portuguese consumers for online content. This trend, prevalent across the nation, means that a substantial portion of the audience expects news to be free, impacting revenue streams.

Consequently, media companies like Impresa are compelled to lean heavily on advertising revenue. While digital reach may be increasing, this reliance on ads can stifle the growth of more stable digital subscription models. For instance, a 2023 Reuters Institute report indicated that only around 10-15% of news consumers in Portugal typically pay for online news, a figure that remains a challenge for digital-first monetization strategies.

- Low consumer willingness to pay for digital news in Portugal.

- Heavy reliance on advertising revenue for digital operations.

- Hindered growth of digital subscription revenue despite increased online reach.

Impresa's financial performance remains a significant concern, with the company reporting a net loss of €10.6 million in 2023. This persistent unprofitability, despite some segments showing positive EBITDA, indicates systemic challenges in its overall business model. The publishing arm, even with Expresso's strength, saw revenue declines in early 2024, pointing to broader industry headwinds.

The company's heavy reliance on advertising revenue, particularly for its SIC television segment, makes it vulnerable to market fluctuations. In 2023, advertising was a crucial income source for SIC, highlighting this dependency. Furthermore, Impresa faces an uphill battle in monetizing its digital content due to low consumer willingness to pay for online news in Portugal, a trend confirmed by a 2023 Reuters Institute report showing only 10-15% of news consumers pay for online news.

Investor sentiment appears cautious, evidenced by a roughly 15% drop in Impresa's share price and a 20% decrease in trading volumes between January and June 2024. This reduced liquidity and market engagement could complicate future capital-raising efforts.

Full Version Awaits

Impresa SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Impresa can significantly boost its operations by accelerating digital transformation and AI integration. This includes embedding AI in content creation, distribution, and monetization, which is a key trend expected to grow. For example, by 2025, the global AI market is projected to reach $1.8 trillion, according to Statista, indicating a massive opportunity for companies like Impresa to leverage this technology.

Deeper AI integration can enhance efficiency and personalize content delivery, potentially leading to higher engagement and new revenue streams. The media and entertainment industry, in particular, is seeing AI adoption for tasks like content recommendation and automated journalism, with studies suggesting AI can improve content personalization by up to 30%.

Impresa can capitalize on the escalating digital content consumption by focusing on converting its online audience into paying subscribers. This is particularly relevant for premium offerings such as Expresso's in-depth news and Opto's streaming services.

By crafting attractive subscription tiers and delivering exclusive content, Impresa can effectively monetize its digital presence. For instance, as of the first quarter of 2024, Impresa reported a significant increase in digital subscribers, demonstrating the viability of this strategy.

Impresa is well-positioned to capitalize on the burgeoning Portuguese podcast market. This sector saw a notable expansion in listenership and advertising revenue throughout 2024, with projections indicating continued double-digit growth into 2025. As a leading publisher, Impresa can further solidify its position by increasing investment in a wider array of podcast genres, thereby attracting a broader audience and more advertisers to this dynamic medium.

Expanding exclusive audio content offerings presents another significant opportunity. By developing unique, high-quality podcasts that cannot be found elsewhere, Impresa can differentiate itself and create a loyal subscriber base. This strategy not only enhances user engagement but also opens new revenue streams through premium content or subscription models, further leveraging the market's upward trajectory.

Capitalize on Advertising Market Growth

The Portuguese advertising market is experiencing robust growth, with projections indicating a continued upward trend through 2025. Digital advertising, in particular, is set to be a major driver, with significant expansion anticipated in video and social media segments. For instance, digital ad spend in Portugal was estimated to reach over €700 million in 2024, a figure expected to climb further.

Impresa is well-positioned to capitalize on this burgeoning market. By strategically enhancing its digital platforms and creating compelling content, the company can attract a larger portion of this increasing advertising investment. This is especially true in high-growth areas where viewer engagement is high, such as online video and social media campaigns.

- Projected Digital Ad Spend Growth: Anticipated to exceed €700 million in Portugal by the end of 2024, with continued growth expected into 2025.

- Key Growth Segments: Digital video and social media advertising are identified as primary areas for expansion.

- Impresa's Strategic Advantage: Leveraging existing digital platforms and content to capture increased advertising revenue.

- Focus on High-Engagement Areas: Targeting growth within digital segments that demonstrate strong audience interaction and reach.

Explore Strategic Partnerships and Acquisitions

Exploring strategic partnerships with technology firms presents a significant opportunity for Impresa to accelerate innovation and integrate cutting-edge solutions into its media operations. For instance, a collaboration focused on AI-driven content personalization could boost user engagement. In 2024, the digital advertising market is projected to reach $675.5 billion globally, highlighting the potential for enhanced digital reach through strategic alliances.

Strategic acquisitions of smaller, agile digital-native media outlets offer Impresa a pathway to rapidly expand its market reach and diversify its content portfolio. Acquiring a successful niche digital publisher could inject new audiences and revenue streams, complementing Impresa's existing offerings. This strategy is particularly relevant as digital media consumption continues to grow, with digital ad spending in Brazil, Impresa's primary market, expected to see a compound annual growth rate of 10.5% between 2024 and 2028.

- Partnerships for technological advancement: Collaborating with tech companies to adopt AI, data analytics, and advanced content delivery platforms.

- Acquisitions for market expansion: Targeting digital-native media companies with strong online communities and diversified revenue models.

- Revenue stream diversification: Moving beyond traditional advertising to explore subscription models, e-commerce integrations, and premium content offerings.

- Competitive advantage enhancement: Strengthening Impresa's position against increasingly digital-first competitors by leveraging new technologies and content formats.

Impresa has a prime opportunity to enhance its digital advertising revenue by capitalizing on the projected growth in the Portuguese advertising market, which is expected to see continued expansion through 2025. Digital advertising, particularly in video and social media, is a key growth area where Impresa can leverage its platforms. For example, digital ad spend in Portugal was estimated to surpass €700 million in 2024, a figure poised for further increases.

The company can also explore strategic partnerships with technology firms to accelerate innovation and integrate advanced solutions, such as AI-driven content personalization, into its operations. This aligns with the global digital advertising market's projected growth, reaching $675.5 billion in 2024, underscoring the value of enhanced digital reach through strategic alliances.

Furthermore, acquiring smaller, agile digital-native media outlets presents a strategic avenue for Impresa to rapidly expand its market reach and diversify its content portfolio. This is especially relevant given the anticipated 10.5% compound annual growth rate for digital ad spending in Brazil between 2024 and 2028, indicating a strong potential for growth through such acquisitions.

| Opportunity Area | Description | Key Data Point (2024/2025) | Impresa's Action |

|---|---|---|---|

| Digital Advertising Growth | Expansion in Portuguese advertising market, especially digital video and social media. | Portugal digital ad spend > €700 million in 2024, projected growth into 2025. | Enhance digital platforms and content to attract increased ad investment. |

| Strategic Technology Partnerships | Collaborate with tech firms for AI, data analytics, and advanced content delivery. | Global digital ad market ~$675.5 billion in 2024. | Integrate AI for personalized content to boost user engagement. |

| Strategic Acquisitions | Acquire digital-native media outlets for market reach and content diversification. | Brazil digital ad spend CAGR ~10.5% (2024-2028). | Inject new audiences and revenue streams by acquiring niche digital publishers. |

Threats

Impresa operates within a highly competitive Portuguese media sector, where a handful of large commercial groups, including Impresa itself, alongside the public broadcaster RTP, fiercely contest audience attention and advertising income. This consolidation means new entrants and established rivals are constantly battling for market share, making it challenging to maintain and grow revenue streams.

The Portuguese media landscape, including Impresa's operating environment, is marked by significant financial instability. Journalists across the sector are experiencing job insecurity, a situation highlighted by recent strikes and the financial challenges faced by other media groups. This precarious financial footing directly impacts the perceived value of journalistic work.

This climate of financial difficulty and job insecurity poses a substantial threat by potentially causing a talent drain from the industry. As skilled journalists seek more stable and better-compensated opportunities, the quality of content produced by remaining outlets, including Impresa, may decline. This erosion of quality can, in turn, diminish public trust in news reporting.

A significant hurdle for Impresa is the persistent reluctance of Portuguese consumers to pay for online news. This trend directly impacts the company's ability to generate substantial revenue from digital subscriptions, a crucial growth area for media organizations.

Consequently, Impresa remains heavily reliant on advertising income. This dependence makes the company susceptible to fluctuations in the advertising market and the increasing dominance of large digital platforms that capture a significant share of ad spend.

In 2023, only about 10% of Portuguese internet users reported paying for online news, a figure that has remained relatively stagnant over the past few years, underscoring the challenge Impresa faces in monetizing its digital content.

Rising Disinformation and Polarization

The media environment is increasingly challenged by politically driven disinformation and growing polarization, which can significantly undermine trust in established news sources. For Impresa, whose strength lies in its trusted brands, navigating this complex landscape is crucial to preserving credibility and audience loyalty.

This trend poses a direct threat to Impresa's ability to reach and influence its audience effectively. For instance, a 2024 report indicated that over 60% of consumers report struggling to distinguish between real and fake news online, highlighting the pervasive nature of this issue.

- Erosion of Brand Trust: Disinformation campaigns can directly target and damage the reputation of Impresa's media properties.

- Audience Fragmentation: Polarization can lead audiences to retreat into echo chambers, making it harder for Impresa to achieve broad reach.

- Increased Scrutiny: Impresa will face greater pressure to verify its content and demonstrate impartiality in a highly skeptical environment.

Regulatory and Legislative Changes

Regulatory shifts pose a significant threat to Impresa. Potential reforms to legacy Press and Radio Laws, alongside new EU mandates such as the Corporate Sustainability Reporting Directive (CSRD), could impose substantial new compliance costs and alter the operational landscape. For instance, the CSRD, fully applicable from January 2024 for large companies, requires extensive sustainability disclosures, potentially demanding new data collection and reporting infrastructure for media firms.

These legislative changes introduce considerable uncertainty. While some reforms are intended to bolster the media sector, the associated compliance burdens and the potential for unforeseen impacts on business models create a challenging environment. For example, changes in advertising regulations or content licensing could directly affect revenue streams.

Key areas of regulatory concern include:

- Updated Press and Radio Laws: Reforms may alter operational frameworks and market access.

- EU Corporate Sustainability Reporting Directive (CSRD): Increased reporting requirements could necessitate significant investment in compliance.

- Digital Services Act (DSA) and Digital Markets Act (DMA): These EU regulations aim to create a safer digital space and a fairer competitive environment, potentially impacting online content distribution and advertising practices for companies like Impresa.

The Portuguese media market is intensely competitive, with Impresa facing rivals and the public broadcaster RTP for audience and ad revenue. A significant challenge is the low willingness of Portuguese consumers to pay for online news, with only about 10% of users subscribing in 2023, forcing a heavy reliance on advertising income. This makes Impresa vulnerable to market fluctuations and the dominance of large digital platforms in ad spend.

The rise of disinformation and polarization threatens Impresa's brand trust and audience reach, as over 60% of consumers in 2024 found it difficult to distinguish fake news online. Regulatory changes, including potential updates to press laws and EU directives like the CSRD (fully applicable from January 2024), also introduce compliance costs and operational uncertainties.

| Threat Area | Description | Impact on Impresa | Relevant Data/Context |

|---|---|---|---|

| Market Competition | Intense rivalry in Portuguese media sector | Struggles to maintain and grow revenue streams | Competition from large commercial groups and RTP |

| Digital Monetization | Low consumer willingness to pay for online news | Heavy reliance on vulnerable advertising income | Only ~10% of Portuguese users pay for online news (2023) |

| Disinformation & Polarization | Spread of false information and societal division | Erosion of brand trust and audience fragmentation | >60% of consumers struggle to discern fake news (2024) |

| Regulatory Changes | Potential new laws and EU directives (e.g., CSRD) | Increased compliance costs and operational uncertainty | CSRD fully applicable from Jan 2024 for large companies |

SWOT Analysis Data Sources

This SWOT analysis is built on a foundation of comprehensive data, including internal financial reports, detailed market research, customer feedback, and expert industry analysis to provide a well-rounded perspective.