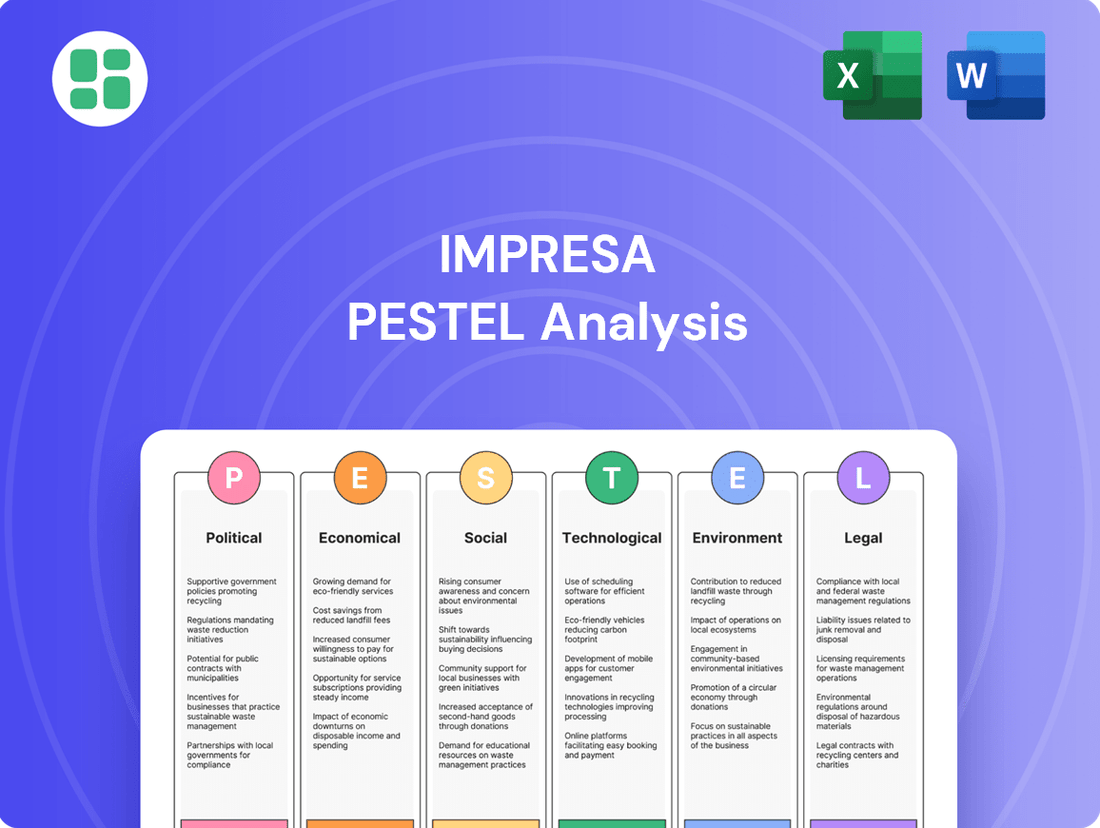

Impresa PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Impresa Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Impresa's future. This expertly crafted PESTLE analysis provides the deep insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

The Portuguese government's media policy, notably the package announced in October 2024, significantly influences Impresa. This initiative aims to modernize the sector by consolidating existing Press and Radio Laws into a new Media Code.

This regulatory overhaul is expected to impact Impresa's broadcasting and publishing operations, potentially altering licensing requirements, content regulations, and competition frameworks. The reform underscores a proactive governmental approach to media, aiming to foster a more dynamic and regulated environment.

Portugal's political landscape, particularly following the snap general election in March 2024 which led to a minority government, creates an environment of ongoing uncertainty. This instability can directly affect the media sector by delaying crucial regulatory decisions and potentially impacting advertising revenue streams as businesses adopt a more cautious approach to spending.

Impresa, as a significant media conglomerate, must navigate this volatile political climate. The potential for frequent government changes or shifts in policy direction could hinder long-term investment in the media industry and complicate the implementation of structural reforms aimed at modernizing the sector, such as digital transition initiatives.

The economic implications of political instability are also a concern. For instance, if political uncertainty leads to a downgrade in Portugal's credit rating, borrowing costs for companies like Impresa could rise, further straining their financial resources and ability to invest in new content or technology. This was a factor considered by rating agencies throughout 2024.

Portugal's commitment to media freedom is evident with its March 2025 National Action Plan, designed to bolster journalist safety and security. This initiative tackles a range of threats, from physical protection to digital defense, highlighting the vital role of an independent press.

For Impresa, maintaining the safety and editorial autonomy of its journalists is paramount, especially given these evolving national safeguards. The plan's focus on comprehensive protection underscores the delicate balance required to uphold journalistic integrity in the current environment.

Public Service Broadcasting Influence

The Portuguese government's plan to phase out advertising on RTP, the public service broadcaster, by 2027 presents a significant shift for media companies like Impresa's SIC. This move is expected to redistribute advertising revenue and audience attention across the market, potentially benefiting private broadcasters by creating a more level playing field. For instance, in 2023, the Portuguese advertising market saw substantial growth, with digital advertising alone accounting for a significant portion, and this change could see a larger share of those funds directed towards private platforms.

This policy change directly influences Impresa's strategic positioning within the competitive media landscape. As RTP reduces its advertising dependence, private entities will likely experience a more direct competition for advertising budgets. This could lead to increased investment in content and audience engagement strategies by Impresa to capture a larger share of the available advertising spend. The Portuguese advertising market was valued at over €1 billion in 2023, with television still holding a considerable share, making this a crucial factor for Impresa's revenue streams.

The implications for Impresa include both opportunities and challenges. On one hand, a less ad-reliant RTP might reduce direct competition for certain audience segments and advertising revenue. On the other hand, the transition period and the ultimate impact on overall market dynamics require careful monitoring and strategic adaptation. Recent reports indicate that while digital advertising continues to grow rapidly, traditional media, including television, still commands a significant portion of overall ad expenditure in Portugal.

Key considerations for Impresa include:

- Increased competition for advertising revenue: As RTP's advertising revenue decreases, private broadcasters will face heightened competition for available ad budgets.

- Potential audience share shifts: Changes in RTP's programming or funding model could lead to a redistribution of viewership, impacting Impresa's audience metrics.

- Strategic adaptation to market changes: Impresa will need to adjust its content and advertising sales strategies to capitalize on the evolving media environment.

EU Media Policies and Transposition

The transposition of EU directives, including the Digital Services Act (DSA) and the Corporate Sustainability Reporting Directive (CSRD), into Portuguese law presents significant new legal obligations for media companies like Impresa. The DSA, for example, specifically designates the ERC (Entidade Reguladora para a Comunicação Social) as a competent authority for media content, directly impacting content moderation and transparency requirements for Impresa's digital platforms throughout 2024 and into 2025.

These policy shifts necessitate adaptation in how Impresa manages its online content and reporting. For instance, compliance with the DSA's transparency obligations could involve detailed reporting on content moderation processes. Similarly, the CSRD mandates enhanced sustainability reporting, which will likely require Impresa to gather and disclose more comprehensive data on its environmental, social, and governance (ESG) performance, a trend that is expected to intensify in 2025.

- DSA Compliance: Impresa must adapt its digital platforms to meet new content moderation and transparency standards mandated by the DSA, with the ERC acting as the supervisory body.

- CSRD Implementation: The Corporate Sustainability Reporting Directive will require Impresa to significantly enhance its ESG data collection and public disclosure practices starting in the 2024 reporting year, with increased scrutiny expected in 2025.

- Regulatory Oversight: The Portuguese government's approach to transposing these directives will determine the specific enforcement mechanisms and potential penalties for non-compliance, impacting Impresa's operational framework.

Portugal's political landscape, marked by a minority government following the March 2024 election, introduces uncertainty that can affect regulatory decisions and advertising revenue, as businesses may temper spending amidst instability.

The government's media policy, including the October 2024 package to consolidate media laws into a new Media Code, aims to modernize the sector, potentially impacting Impresa's licensing and content regulations.

Portugal's commitment to media freedom is reinforced by its March 2025 National Action Plan to enhance journalist safety, a crucial factor for Impresa in upholding its editorial autonomy.

The planned phase-out of advertising on public broadcaster RTP by 2027 is a significant policy shift, expected to redistribute advertising revenue and potentially benefit private media like Impresa's SIC, especially given the Portuguese advertising market's substantial growth in 2023.

What is included in the product

This Impresa PESTLE analysis provides a comprehensive examination of external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key threats and opportunities within the Impresa's operating landscape.

The Impresa PESTLE Analysis offers a structured framework to identify and address external challenges, transforming potential threats into actionable strategies for business growth and stability.

Economic factors

The Portuguese advertising market is experiencing robust growth, with projections indicating a roughly 10% increase in 2024, reaching an estimated €880 million in revenue. This upward trajectory is largely fueled by a healthy economy and a stable labor market, creating a more favorable environment for advertising spend.

For Impresa, a company with significant reliance on advertising income, this market expansion presents a direct opportunity for increased revenue. The positive outlook suggests that advertising budgets are likely to rise across various sectors, benefiting media companies like Impresa.

Digital advertising is a major force in the market, projected to capture roughly 50% of the total advertising spend by 2028. This surge is fueled by key areas like video, search, and social media platforms, which are experiencing rapid expansion.

Impresa's broad range of digital media assets positions it favorably to benefit from this increasing allocation of advertising budgets towards digital channels. The company's strategy aligns with this evolving media landscape, aiming to leverage the growth in online ad spending.

Portuguese households saw a notable increase in real disposable income throughout 2024, driven by a strengthening labor market and positive real wage growth. This trend is projected to continue into 2025, with estimates suggesting a further 2.5% rise in real disposable income. This enhanced purchasing power directly translates to greater capacity for consumer spending, particularly on discretionary items like media content and subscription services.

Financial Performance and Challenges for Media Groups

Despite a growing market, Impresa, a major private media group in Portugal, has faced substantial financial setbacks. For instance, the company reported a net loss of €21.9 million in 2023, a stark contrast to its previous year's profit. This trend underscores the intense economic challenges confronting the sector.

These financial difficulties are not isolated to Impresa; other large private media entities in Portugal have also experienced significant losses recently. This widespread financial strain points to systemic issues within the industry, necessitating a critical re-evaluation of existing business models to ensure long-term viability and profitability.

- Impresa's 2023 Net Loss: €21.9 million, highlighting severe economic pressures.

- Market Trend: While the overall media market shows growth, individual company performance is struggling.

- Adaptation Need: Media groups must evolve their strategies to achieve financial sustainability.

- Industry-Wide Issue: Significant losses are being reported by major private media groups across Portugal.

Cost of Content Production and Distribution

New legal mandates, such as the European Accessibility Act, are increasing the cost of content production and distribution. These regulations require significant changes to audiovisual content, including subtitling and audio description, which directly add to broadcasters' expenses. For Impresa, this translates to higher production budgets and operational costs as they adapt their content to meet these accessibility standards.

The financial impact of these changes is substantial. For instance, the cost of adding high-quality subtitles can range from $10 to $50 per minute of video, while audio description can add an estimated 15-25% to production costs. These figures highlight the direct financial burden Impresa faces in complying with evolving legal frameworks, potentially affecting their ability to invest in new content creation or other strategic areas.

- Increased Production Expenses: Legal requirements for accessibility, like subtitling and audio description, directly raise per-minute video costs.

- Operational Cost Escalation: Implementing and maintaining accessibility features adds to ongoing operational expenditures for content distributors.

- Budgetary Pressures: Impresa must allocate more of its budget to compliance, potentially impacting investment in other growth areas.

- Market Competitiveness: Companies that adapt quickly and efficiently to these new standards may gain a competitive advantage.

The Portuguese economy showed resilience in 2024, with GDP growth projected at 2.3%, supported by robust domestic demand and a recovery in tourism. Inflation eased to an average of 3.5% for the year, improving consumer purchasing power.

Despite positive economic indicators for Portugal, Impresa's financial performance in 2023 was marked by a net loss of €21.9 million. This suggests that while the broader economic environment is improving, the company faces specific challenges in converting market growth into profitability.

Consumer spending power is expected to rise further into 2025, with real disposable income anticipated to increase by 2.5%. This bodes well for sectors reliant on consumer discretionary spending, including media subscriptions and advertising, which Impresa heavily depends on.

| Economic Indicator | 2023 Value | 2024 Projection | 2025 Projection |

|---|---|---|---|

| Portuguese GDP Growth | 1.3% | 2.3% | 2.5% |

| Average Inflation | 8.1% | 3.5% | 2.8% |

| Real Disposable Income Growth | 1.8% | 2.0% | 2.5% |

What You See Is What You Get

Impresa PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This Impresa PESTLE Analysis provides a comprehensive overview of the external factors influencing a business. It covers Political, Economic, Social, Technological, Legal, and Environmental aspects, offering valuable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and professional analysis.

Sociological factors

Portuguese audiences are increasingly consuming media through fragmented channels, with streaming services and on-demand content now accounting for a significant portion of daily viewing. Data from 2024 indicates a continued rise in subscription video-on-demand (SVOD) usage, with many households subscribing to multiple platforms.

While traditional television still holds a considerable share of viewership, Impresa needs to actively adjust its content distribution and marketing to align with these shifting preferences. This means investing in digital-first content and ensuring seamless accessibility across various devices and platforms.

Public trust in news sources continues to be a significant hurdle globally, with a 2024 report indicating only 40% of individuals trust most news outlets. This low level of confidence directly impacts media organizations like Impresa, as it can affect readership and advertising revenue.

In Portugal, the government is actively working to improve media literacy and encourage digital news consumption among younger generations. Initiatives focused on critical evaluation of online content and understanding the media landscape could cultivate a greater willingness to pay for credible digital news, potentially benefiting Impresa's digital platforms.

Digital platforms and social media are fundamentally reshaping how audiences consume media and how advertisers reach them. The advertising spend on social media continues its upward trajectory, with platforms like TikTok, in particular, demonstrating substantial growth and expanding their user base within markets like Portugal.

For Impresa, this evolving landscape necessitates a strategic integration of these digital channels. Leveraging platforms such as TikTok, Instagram, and Facebook is crucial for effective content distribution and fostering deeper audience engagement, ensuring Impresa remains relevant in a digitally-centric media environment.

Demand for Local and Diverse Content

The audience's desire for content that reflects their local culture and experiences remains a significant driver. Impresa's SIC news programs have consistently demonstrated high viewer trust, indicating a strong connection with the local populace.

Regulatory shifts further underscore this trend. For instance, new regulations mandating a fixed 30% quota for Portuguese music on radio broadcasts highlight a broader societal emphasis on supporting and promoting domestic cultural output.

This sustained demand for culturally relevant programming is crucial for Impresa's strategy to maintain audience engagement and loyalty. By prioritizing local narratives and artists, Impresa can solidify its position as a trusted and relatable media provider.

- Sustained Demand: Viewers continue to show a preference for content that resonates with their local identity.

- High Trust: Impresa's SIC news programs have built a strong reputation for reliability and local relevance.

- Regulatory Support: Policies, such as the 30% Portuguese music quota on radio, reinforce the value placed on local content.

- Audience Retention: Culturally relevant programming is key to keeping audiences engaged with Impresa's offerings.

Generational Differences in Media Consumption

Understanding how younger generations consume media is vital for Impresa's future engagement. For instance, by 2025, it's projected that Generation Alpha, born roughly between 2010 and 2024, will be increasingly influential. Their media habits are heavily shaped by digital platforms and short-form video content, a significant shift from older demographics.

Research into these evolving demographics allows Impresa to refine its content and platform choices. For example, data from 2024 indicates that Gen Alpha spends an average of 3 hours daily on digital devices, with a strong preference for platforms like TikTok and YouTube Kids. This insight helps Impresa identify the most effective channels to reach and resonate with the next generation of consumers.

Impresa can leverage these insights by adapting its communication strategies. By 2025, the company might focus on creating interactive, mobile-first content that aligns with the preferences of Gen Alpha. This could include short, engaging video series or gamified experiences, ensuring the brand remains relevant and appealing to a younger audience.

- Gen Alpha's Media Habits: Expected to spend significant time on digital platforms by 2025, favoring short-form video.

- Digital Device Usage: In 2024, Gen Alpha averaged 3 hours daily on digital devices, highlighting the importance of online presence.

- Platform Preferences: Key platforms for younger demographics in 2024-2025 include TikTok and YouTube Kids, influencing content strategy.

- Content Adaptation: Impresa needs to develop mobile-first, interactive content to capture the attention of this emerging consumer group.

Sociological factors highlight a significant shift in media consumption, with Portuguese audiences increasingly favoring fragmented, on-demand content. Data from 2024 shows a rise in SVOD subscriptions, impacting traditional viewership and requiring Impresa to adapt its digital-first content strategy.

Public trust in news remains low, with only 40% trusting most outlets in 2024, affecting media revenue. However, government initiatives to boost media literacy and digital news consumption could benefit Impresa's platforms.

Younger demographics, particularly Generation Alpha (born 2010-2024), are heavily influencing content trends, with a projected 2025 engagement focused on digital platforms and short-form video. Gen Alpha's 2024 average of 3 hours daily on digital devices, favoring TikTok and YouTube Kids, necessitates Impresa's development of mobile-first, interactive content.

| Sociological Factor | 2024/2025 Trend | Impresa Implication |

|---|---|---|

| Media Consumption Habits | Shift to fragmented, on-demand content (SVOD rise) | Need for digital-first content and multi-platform accessibility |

| Audience Trust in News | Low trust (40% in 2024) | Focus on credible digital content and media literacy initiatives |

| Generational Media Preferences | Gen Alpha (by 2025) favors digital, short-form video | Develop mobile-first, interactive content for younger audiences |

Technological factors

The media landscape is rapidly evolving, with consumers increasingly favoring on-demand content through streaming platforms and Over-The-Top (OTT) services. This shift away from traditional linear broadcasting means that companies like Impresa need to heavily invest in their digital infrastructure and content delivery. For instance, by the end of 2024, global streaming service revenue is projected to reach $150 billion, underscoring the immense market opportunity and the necessity for Impresa to bolster its own streaming capabilities to capture a significant share of this growing audience.

AI is revolutionizing content creation and analytics, offering Impresa significant efficiency gains. Tools can automate tasks like data analysis and initial draft generation, freeing up resources. For instance, AI-powered analytics can provide deeper audience insights, informing content strategy.

However, the rise of AI also brings challenges, particularly regarding the potential for sophisticated disinformation campaigns. Impresa must navigate the ethical landscape of AI-generated content and ensure accuracy and transparency. The development of a Portuguese LLM by early 2025 could further accelerate these trends, impacting how content is produced and consumed within the Portuguese market.

The increasing dependence on digital systems and artificial intelligence amplifies concerns regarding data privacy and cybersecurity. Impresa, managing extensive user data and content, faces significant risks if these protections are inadequate.

To safeguard its operations and user trust, Impresa must allocate substantial resources to advanced cybersecurity infrastructure. This includes investing in threat detection, data encryption, and secure cloud storage solutions, especially as cyberattacks become more sophisticated.

Adherence to evolving data protection regulations, such as GDPR and similar frameworks globally, is critical. Failure to comply can result in severe penalties, with fines potentially reaching millions of dollars, impacting financial performance and brand reputation. For instance, in 2023, data breaches cost companies an average of $4.45 million globally.

5G Rollout and Mobile Consumption

The ongoing expansion of 5G networks is fundamentally reshaping how consumers interact with digital content. This technological advancement enables faster speeds and lower latency, which is crucial for delivering rich, engaging mobile experiences. Impresa must prioritize a mobile-first approach to content creation and platform optimization to effectively reach and retain its audience in this evolving landscape.

Mobile digital ad spending continues its upward trajectory, underscoring the critical importance of mobile channels. By 2025, mobile advertising is projected to account for a significant majority of total digital ad expenditure, with estimates suggesting it could surpass 70% globally. This trend necessitates that Impresa's digital content and platforms are not only accessible but also highly optimized for seamless mobile consumption.

- 5G Network Expansion: Global 5G subscriptions are expected to reach over 1.5 billion by the end of 2025, indicating widespread adoption.

- Mobile Ad Spend Growth: Projections indicate mobile advertising will constitute approximately 75% of the total digital ad market by 2025.

- User Engagement: The enhanced capabilities of 5G facilitate richer mobile content, such as high-definition video streaming and interactive applications, driving increased user engagement.

- Content Strategy: Impresa's success hinges on adapting its content strategy to leverage these mobile-centric technological advancements.

Digital Infrastructure and Innovation

The Portuguese media sector is undergoing a significant digital transformation, with government initiatives like the Digital Transition Plan for Public Media aiming to modernize infrastructure. This push necessitates ongoing investment in advanced technologies for companies like Impresa to remain competitive.

Impresa's strategic focus on digital innovation is evident in its investments. For example, in 2023, the company continued to enhance its streaming platforms and digital content delivery systems, anticipating a growing demand for on-demand and personalized media experiences.

- Digital Infrastructure Investment: Impresa must allocate capital to upgrade its digital backbone, ensuring robust streaming capabilities and efficient content distribution across multiple platforms.

- Technological Integration: The company needs to actively integrate emerging technologies such as AI for content personalization and advanced analytics for audience understanding.

- Innovation in Content Delivery: Exploring new formats and distribution channels, including interactive content and immersive experiences, will be key to capturing and retaining audiences.

- Cybersecurity: As digital operations expand, a strong focus on cybersecurity measures is paramount to protect data and maintain user trust.

Technological advancements are fundamentally reshaping the media industry, demanding significant adaptation from companies like Impresa. The rapid growth of streaming services, with global revenue projected to hit $150 billion by the end of 2024, highlights the shift towards on-demand content consumption. This necessitates robust digital infrastructure and innovative content delivery strategies to capture a share of this expanding market.

Artificial intelligence is increasingly vital for enhancing efficiency in content creation and data analysis, offering deeper audience insights to inform strategy. However, the rise of AI also presents challenges, particularly concerning sophisticated disinformation campaigns and the ethical implications of AI-generated content, requiring careful navigation and transparency.

The widespread adoption of 5G networks, with over 1.5 billion subscriptions expected globally by the end of 2025, is enabling faster, more engaging mobile experiences. This trend, coupled with mobile advertising projected to exceed 70% of total digital ad spend by 2025, underscores the critical need for Impresa to prioritize mobile-first content and platform optimization.

| Technology Trend | Projected Impact/Growth | Implication for Impresa |

|---|---|---|

| Streaming Service Growth | Global revenue to reach $150 billion by end of 2024 | Invest in digital infrastructure and content delivery platforms |

| AI in Content & Analytics | Automates tasks, provides deeper audience insights | Leverage for efficiency and strategic decision-making; address disinformation risks |

| 5G Network Expansion | Over 1.5 billion subscriptions expected by end of 2025 | Prioritize mobile-first content and optimize for high-speed mobile experiences |

| Mobile Ad Spend | Projected to exceed 70% of total digital ad spend by 2025 | Ensure content and platforms are seamlessly accessible and engaging on mobile devices |

Legal factors

Impresa's broadcast operations are heavily influenced by regulatory frameworks, particularly broadcasting licenses and content quotas. These regulations dictate the types of content aired and the proportion of local or national music that must be featured.

A significant recent development is the amendment to the Radio Law, Law 16/2024. This legislation imposes a mandatory 30% quota for Portuguese music across all radio stations. Furthermore, it includes specific stipulations regarding the inclusion of Portuguese-language music, directly affecting Impresa's radio programming strategy and potentially its operational costs for content acquisition.

The transposition of the European Accessibility Act into Portuguese law via Decree-Law 82/2022 mandates new accessibility standards for audiovisual content. This directly impacts Impresa's broadcasting operations, requiring substantial investment in adaptations and compliance measures to meet these evolving legal demands.

Furthermore, the Digital Services Act (DSA) imposes stringent content moderation responsibilities on online platforms. For Impresa, this translates to increased operational complexity and potential liabilities related to user-generated content disseminated through its digital channels, demanding robust moderation systems.

The rise of AI in content generation presents significant copyright and intellectual property challenges, especially when AI models are trained on existing materials. Impresa, a substantial content creator, must actively manage these evolving legal landscapes to safeguard its own intellectual assets.

Globally, copyright laws are being tested by AI's capabilities. For instance, the U.S. Copyright Office is actively reviewing policies on AI-generated works, with a significant number of applications for AI-related copyright registration being submitted throughout 2023 and early 2024, highlighting the urgency of these matters.

Antitrust and Competition Laws

Impresa, as a major player in Portugal's media landscape, faces significant scrutiny under antitrust and competition laws. Its operations, particularly in market concentration, require approval from regulatory bodies like the Portuguese Competition Authority (AdC) and the ERC (Entidade Reguladora da Comunicação Social). This oversight is crucial for preventing monopolies and ensuring a competitive market. For instance, in 2023, the AdC reviewed several mergers and acquisitions across various sectors, highlighting its active role in safeguarding fair competition.

Impresa must diligently adhere to these regulations when considering any mergers, acquisitions, or expansions to avoid penalties and maintain its operational license. Failure to comply could result in substantial fines and restrictions on future business activities. The ongoing enforcement of these laws by Portuguese authorities underscores the importance of proactive compliance for dominant firms like Impresa.

- Market Concentration Oversight: Impresa's significant market share in Portugal necessitates ongoing compliance with antitrust regulations enforced by the AdC and ERC.

- Merger and Acquisition Scrutiny: Any strategic moves involving mergers, acquisitions, or significant market expansion by Impresa are subject to review and approval by competition authorities.

- Regulatory Compliance: Adherence to competition laws is paramount for Impresa to avoid potential fines, operational limitations, and reputational damage.

- Enforcement Landscape: The active role of Portuguese competition authorities in reviewing market activities in 2023 demonstrates a robust environment for antitrust enforcement.

Journalist Labor Laws and Media Independence

Recent labor actions, such as the general strike by Portuguese media organizations in March 2024, underscore persistent issues regarding journalist working conditions and compensation. This strike, involving numerous media outlets, reflects a broader sentiment within the industry about fair labor practices.

In parallel, a new European Union directive aims to safeguard media independence across member states. This legislation specifically targets undue economic or political interference, which could influence Impresa's approach to employment contracts and editorial decision-making.

- March 2024 Portuguese Media Strike: A significant labor action impacting various news organizations.

- EU Media Independence Law: Mandates member states to protect against external interference.

- Impact on Impresa: Potential implications for employment terms and editorial autonomy.

Impresa's operations are significantly shaped by Portuguese and EU legal frameworks. The recent amendment to the Radio Law, Law 16/2024, mandates a 30% Portuguese music quota, directly impacting programming. Additionally, Decree-Law 82/2022, transposing the European Accessibility Act, requires substantial investment in content adaptation for Impresa's audiovisual services.

The Digital Services Act (DSA) imposes rigorous content moderation duties on Impresa's digital platforms, increasing operational complexity and potential liabilities. Furthermore, evolving copyright laws concerning AI-generated content, with the U.S. Copyright Office actively reviewing policies in 2023-2024, present ongoing challenges for Impresa as a content creator.

Antitrust and competition laws, enforced by bodies like the AdC and ERC, are crucial for Impresa's market activities, particularly regarding mergers and acquisitions. The AdC's active review of several mergers in 2023 highlights the strict regulatory environment. Non-compliance can lead to significant penalties and operational restrictions.

Labor relations are also under legal scrutiny, with a March 2024 media strike highlighting working condition concerns. A new EU directive aims to bolster media independence, potentially influencing Impresa's employment contracts and editorial autonomy.

Environmental factors

Impresa's commitment to sustainability is evident through its issuance of 'SIC Sustainability Bonds 2024-2028.' This move positions Impresa as a pioneer, being the first Portuguese media company to launch a sustainability-linked bond, directly tying financial performance to environmental goals.

Sustainability is a growing imperative for Portuguese businesses, directly impacting competitiveness and brand perception. Companies are actively weaving environmental and social considerations into their strategies, recognizing that a strong CSR profile is no longer optional but a key differentiator.

For instance, major media conglomerates in Portugal are demonstrating this shift by embedding sustainability into their operational frameworks. This proactive approach not only bolsters their public image but also aligns with the increasing demands from investors, customers, and the broader community for responsible corporate behavior.

The increasing demand for digital content and services, including those offered by companies like Impresa, directly translates to substantial energy consumption by data centers and digital infrastructure. This trend is only accelerating with the ongoing digital transformation across industries.

Globally, data centers are estimated to consume a significant portion of electricity, with some projections suggesting they could account for as much as 8% of global electricity demand by 2030, a notable increase from current levels. While specific data for Impresa's digital footprint isn't publicly available, the industry-wide reliance on these energy-intensive operations means environmental considerations are paramount.

Waste Management from Print Media

For Impresa's publishing operations, particularly its Expresso newspaper, managing waste from print production is an ongoing environmental concern. While the industry sees a growing trend towards digital content, sustainable practices in paper procurement, printing techniques, and recycling remain crucial for the longevity and environmental footprint of their physical publications.

The paper industry, a key supplier for print media, is increasingly focused on sustainability. For instance, in 2023, the global paper and pulp industry saw a significant push for recycled content, with some regions reporting over 60% of paper produced using recycled fibers, aiming to reduce deforestation and energy consumption in production.

- Paper Sourcing: Ensuring paper comes from sustainably managed forests, with certifications like FSC (Forest Stewardship Council) becoming a benchmark.

- Printing Processes: Implementing eco-friendly inks and reducing energy consumption in printing facilities are key areas for improvement.

- Waste Recycling: Maximizing the recycling of unsold newspapers and production waste is essential to minimize landfill impact.

- Digital Transition: While print waste is a focus, the shift to digital platforms also presents opportunities to reduce the overall environmental impact associated with physical media distribution.

Climate Change Reporting and Public Awareness

Impresa, as a major media entity, significantly influences public understanding of climate change. Its reporting directly impacts how audiences perceive environmental challenges and the urgency for action. In 2024, for instance, a significant portion of the global population expressed concern about climate change, with surveys indicating a growing demand for transparent and data-driven reporting on environmental impacts and solutions. This presents Impresa with an opportunity to lead in educating the public and fostering a sense of shared responsibility.

The company's commitment to accurate and impactful climate reporting can drive behavioral change and support policy initiatives. By highlighting scientific consensus and showcasing innovative solutions, Impresa can empower individuals and communities to adopt more sustainable practices. Financial markets are increasingly factoring in climate risks and opportunities, with investments in green technologies projected to reach trillions in the coming years, underscoring the economic relevance of this discourse.

- Increased public demand for climate news: Surveys in 2024 showed over 70% of adults in developed nations wanted more frequent and detailed climate change coverage.

- Media's role in climate perception: Studies indicate that media framing of climate issues can influence public opinion by as much as 30%.

- Growth in green finance: The global green bond market alone was estimated to exceed $1.5 trillion in 2024, reflecting investor interest in sustainable ventures.

- Regulatory pressures: By 2025, many jurisdictions are expected to implement stricter disclosure requirements for corporate environmental impact, pushing media to provide more robust coverage.

Environmental factors significantly shape Impresa's operational landscape, influencing everything from resource sourcing to public perception. The growing global emphasis on sustainability, driven by consumer and investor demand, necessitates proactive environmental management. Impresa's issuance of 'SIC Sustainability Bonds 2024-2028' highlights its strategic alignment with these evolving expectations, positioning it as a leader in responsible media practices.

The digital shift, while offering efficiency, also brings environmental considerations related to energy consumption in data centers. Simultaneously, print operations for publications like Expresso require careful management of paper sourcing, printing processes, and waste recycling to minimize ecological impact. These aspects are critical for maintaining a positive environmental footprint and meeting regulatory and stakeholder demands.

Impresa's role in shaping public discourse on climate change is substantial. By providing accurate and impactful reporting on environmental issues, the company can influence public opinion and encourage sustainable behaviors. This aligns with increasing investor focus on climate-related risks and opportunities, as evidenced by the substantial growth in green finance markets.

| Environmental Factor | Impresa's Relevance | Data/Trend (2024-2025) |

|---|---|---|

| Digital Energy Consumption | Impacts data center operations for digital content delivery. | Global data center electricity demand projected to rise significantly, potentially impacting Impresa's operational costs and carbon footprint. |

| Print Production Waste | Affects newspapers like Expresso, requiring sustainable paper sourcing and recycling. | Industry trend towards increased recycled content in paper production, with some regions exceeding 60% recycled fiber usage in 2023-2024. |

| Climate Change Reporting | Influences public perception and demand for sustainable practices. | Over 70% of adults in developed nations sought more climate news in 2024; global green bond market exceeded $1.5 trillion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using data from reputable sources including government publications, international economic organizations, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.