Impresa Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Impresa Bundle

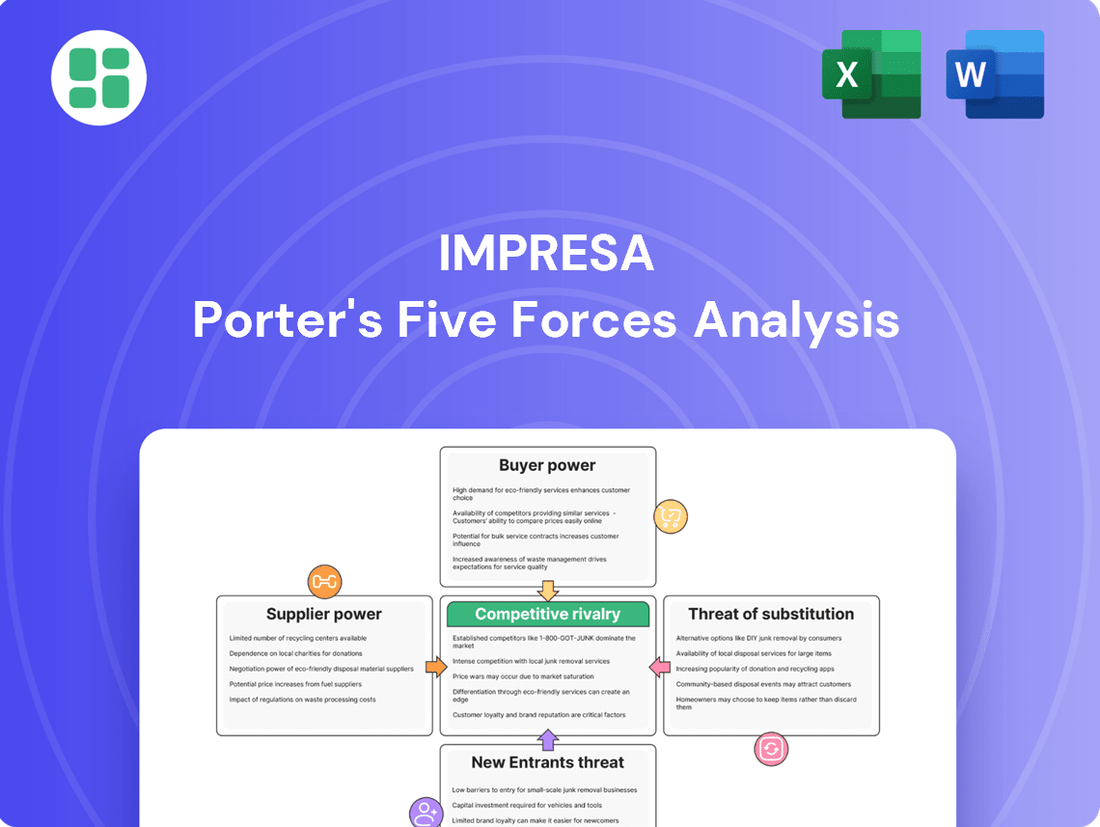

Understanding the competitive landscape is crucial for any business. Impresa's Porter's Five Forces Analysis reveals the underlying forces that shape its industry, from the bargaining power of buyers and suppliers to the threat of new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Impresa’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Content creators, including journalists and actors, represent a crucial supplier group for Impresa's media operations like SIC television and Expresso publishing. The bargaining power of these suppliers can significantly impact Impresa's costs and content quality.

A notable instance of this power was the general strike by Portuguese journalists in March 2024. This action underscored dissatisfaction with low salaries and precarious employment conditions, demonstrating a collective ability to disrupt operations and negotiate for better terms.

Impresa's reliance on technology for broadcasting, digital platforms, and IT infrastructure grants significant bargaining power to specialized technology and infrastructure providers. The rapid evolution of technologies like artificial intelligence and cloud computing means these providers can command higher prices or dictate terms, especially if Impresa requires cutting-edge solutions. For instance, the global market for cloud computing services, a critical component for digital platforms, was projected to reach over $1.3 trillion by 2024, indicating substantial vendor influence.

Impresa's reliance on external news sources, such as national and international agencies or syndicated content providers, can impact its bargaining power. The financial health of these suppliers is a key factor. For instance, the restructuring of Portugal's national news agency, Lusa, in 2023, signals potential shifts in content availability and pricing.

Furthermore, the financial struggles faced by other major media groups, like Global Media, which reported significant losses in 2023, could consolidate the news supply market. This consolidation might lead to fewer, but potentially more powerful, content providers, increasing their leverage over Impresa and other media outlets seeking syndicated content.

Advertising Technology Providers

The bargaining power of advertising technology (ad tech) providers is growing as digital advertising becomes more complex and data-driven. The increasing reliance on sophisticated tools, including those powered by artificial intelligence, makes these providers indispensable for media companies aiming to capture advertising revenue. For instance, in 2024, the global ad tech market was valued at approximately $70 billion and is projected to grow significantly, underscoring the critical role these companies play.

Strategic alliances with leading ad tech firms are no longer optional but a necessity for media organizations to maintain a competitive edge and optimize their advertising sales efforts. This trend is evident as many major publishers are investing heavily in first-party data solutions and advanced programmatic platforms, often developed in partnership with ad tech specialists. The ability of ad tech providers to offer unique data insights and efficient campaign management directly influences their leverage.

- Increasing reliance on AI in ad targeting and optimization.

- Partnerships with ad tech providers are crucial for media companies' revenue generation.

- The global ad tech market's substantial growth indicates rising provider importance.

Distributors and Platform Owners

For digital media companies like Impresa, distributors and platform owners, such as app stores and social media networks, wield considerable bargaining power. These platforms are essential gateways for content delivery and audience reach, meaning their policies on visibility, monetization, and data access directly influence Impresa's revenue streams and strategic options.

The dominance of major platforms means they can dictate terms, potentially limiting Impresa's ability to negotiate favorable revenue splits or control user data. For instance, in 2024, the digital advertising market saw platforms like Google and Meta capture a significant majority of ad spend, underscoring their leverage over content creators and distributors.

- Platform Fees: App stores typically charge a commission on sales, reducing the net revenue for publishers.

- Algorithmic Control: Platform algorithms determine content visibility, giving owners significant power over audience engagement.

- Data Access Restrictions: Platforms may limit the data shared with publishers, hindering targeted marketing and audience understanding.

- Policy Changes: Sudden changes in platform policies can drastically alter a media company's business model and profitability.

Impresa's suppliers, ranging from content creators to technology providers, possess significant bargaining power that can affect costs and operational flexibility. The reliance on specialized skills and platforms, coupled with market consolidation, amplifies this influence. For example, the significant global ad tech market valuation in 2024 highlights the leverage held by these essential service providers.

The bargaining power of Impresa's suppliers is a critical factor influencing its profitability and strategic agility. Key supplier groups include journalists and actors, technology providers, news agencies, and advertising technology firms. The collective actions of journalists, as seen in the March 2024 strike, demonstrate their ability to disrupt operations and negotiate for improved terms, directly impacting content acquisition costs.

Technology providers, particularly in areas like AI and cloud computing, wield substantial power due to the rapid evolution of these sectors and Impresa's dependence on advanced solutions. The projected over $1.3 trillion global cloud computing market for 2024 underscores the significant influence of these vendors. Similarly, the growing ad tech market, valued at approximately $70 billion in 2024, signifies the indispensable role of these partners in revenue generation.

The bargaining power of suppliers is further amplified by market dynamics such as consolidation and the essential nature of their services. For instance, the financial struggles of other media groups could lead to fewer, more powerful content providers. Moreover, distributors and platform owners like app stores and social media networks hold considerable sway due to their control over content delivery and audience access, with platforms like Google and Meta dominating digital advertising spend in 2024.

| Supplier Group | Evidence of Bargaining Power | Impact on Impresa |

| Content Creators (Journalists, Actors) | March 2024 journalist strike over pay and conditions | Increased labor costs, potential content disruption |

| Technology Providers (AI, Cloud) | Projected $1.3T+ global cloud market (2024), rapid tech evolution | Higher technology acquisition costs, potential vendor lock-in |

| News Agencies/Syndicated Content | Restructuring of Lusa (2023), financial struggles of competitors | Potential for increased content costs, limited sourcing options |

| Ad Tech Providers | Approx. $70B global ad tech market (2024), AI reliance | Negotiation leverage on ad platform fees and data insights |

| Distributors/Platforms (App Stores, Social Media) | Dominance in digital advertising market (Google, Meta) | Reduced revenue share, algorithmic control over audience reach |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Impresa's specific context.

Instantly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Individual viewers and readers wield significant bargaining power, largely fueled by the sheer volume of readily available content. With the proliferation of free digital news, active social media feeds, and an ever-expanding universe of streaming services, consumers have more choices than ever before. This fragmentation of audience attention places immense pressure on media companies like Impresa to constantly innovate and deliver highly engaging content simply to keep viewers and readers invested.

Advertisers wield considerable influence over Impresa, as they represent a crucial revenue stream for its television and publishing operations. The Portuguese advertising landscape is evolving, with a notable migration towards digital channels. This trend provides advertisers with a broader array of choices and consequently strengthens their position to negotiate favorable terms for digital ad placements, potentially impacting Impresa's pricing power.

Digital platform users, especially younger demographics, increasingly rely on social media for news, with platforms like TikTok and Instagram becoming significant sources. This shift means Impresa's digital content must be engaging and easily digestible on these channels to capture attention. For instance, in 2024, over 60% of Gen Z reported using social media as their primary news source, underscoring the need for adaptable content strategies.

The growing preference for streaming services over traditional media further amplifies user bargaining power. Consumers can readily switch between platforms like Netflix, Disney+, or Amazon Prime Video based on content availability and pricing. Impresa's digital offerings must therefore offer compelling value propositions and unique content to retain subscribers in a competitive streaming landscape.

Subscription-Based Customers

For Impresa's subscription-based services, customer bargaining power is a significant consideration. While the company offers free-to-air content, any premium or subscription tiers, such as specific digital content subscriptions, are subject to customer evaluation of their perceived value. This is particularly relevant given trends in the Portuguese market.

In 2024, the subscription video-on-demand (SVoD) market in Portugal has shown signs of saturation, with subscription rates plateauing. This indicates that consumers are becoming more discerning about which services they pay for, increasing their bargaining power. For instance, reports from late 2023 and early 2024 suggest that average household spending on entertainment subscriptions might be consolidating rather than expanding, forcing providers to demonstrate clear, ongoing value.

- Customer Selectivity: Consumers are increasingly scrutinizing the value proposition of subscription services, demanding clear benefits for their money.

- Market Saturation: The Portuguese SVoD market's plateauing subscription rates in 2024 highlight a shift towards customer selectivity.

- Price Sensitivity: Customers are more likely to switch providers or cancel subscriptions if they don't perceive consistent value or if competitive alternatives emerge.

Bundled Service Subscribers

In Portugal, the bargaining power of customers is significantly influenced by bundled service offerings from telecommunications providers. This practice often ties consumer loyalty to the entire package, diminishing their ability to negotiate terms for individual media components like SIC.

For instance, a substantial portion of Portuguese households subscribe to bundled telecom packages that include pay-TV. This means a customer's decision to switch or demand better terms for their television service is often constrained by the desire to maintain their internet, mobile, or landline services, thereby lowering their individual bargaining leverage over the media provider.

- Bundled services in Portugal reduce individual customer bargaining power over specific media components like SIC.

- Customer loyalty is often tied to the overall telecom package rather than individual services.

- This dynamic limits the ability of customers to negotiate terms for specific media offerings.

Customers in the Portuguese media market, especially for digital content and streaming, possess substantial bargaining power. This is driven by the sheer abundance of content options and a growing price sensitivity among consumers, as evidenced by the plateauing subscription rates in Portugal's SVoD market in 2024. The ability for consumers to easily switch between services or cancel subscriptions if value is not consistently perceived directly pressures media companies like Impresa to offer compelling and differentiated content.

The trend of bundling telecommunication services in Portugal further impacts customer bargaining power. When media access is part of a larger package, individual customers have less leverage to negotiate terms for specific media components, as their primary loyalty is often to the bundled telecom provider. This dynamic can limit the perceived bargaining power of individual users when it comes to media-specific offerings.

| Factor | Impact on Impresa | Supporting Data (2024 Trends) |

|---|---|---|

| Content Abundance | Increases customer choice, reduces switching costs | Proliferation of free digital news and streaming services |

| Price Sensitivity | Demands for value, risk of subscription cancellation | Plateauing SVoD subscription rates in Portugal |

| Bundled Services (Portugal) | Reduces individual media negotiation leverage | High household penetration of bundled telecom packages |

Preview the Actual Deliverable

Impresa Porter's Five Forces Analysis

This preview showcases the complete Impresa Porter's Five Forces Analysis, offering a detailed examination of competitive forces within your industry. The document you see is the exact, professionally formatted report you will receive instantly upon purchase, ensuring you get all the insights without any alterations or missing sections.

Rivalry Among Competitors

Impresa's SIC faces formidable competition from other major private broadcasters, notably Media Capital Group, which operates TVI. This rivalry is further intensified by the presence of the public service broadcaster, RTP, which also commands a significant audience share. While SIC has historically been a dominant force, often holding the position of the most-watched channel, recent audience shifts highlight the ongoing and intense nature of this competitive landscape.

The publishing market, including Impresa's Expresso, is highly competitive. It faces pressure from established rivals like Público and Diário de Notícias, as well as a growing number of nimble digital-first news outlets. This fragmented landscape means Impresa must constantly innovate to capture and retain audience attention.

Financial strains are evident throughout the Portuguese media sector, as exemplified by the difficulties faced by Global Media. This situation intensifies the battle for advertising revenue and readership, forcing all players, including Impresa, to operate in a challenging economic environment where every reader and advertiser counts.

The digital media landscape in Portugal is intensely competitive, featuring a multitude of online news portals, social media platforms, and content aggregators all vying for user engagement. Impresa, through its digital assets like SIC's website, faces this crowded market where many players are rapidly expanding their reach and influence. For instance, as of early 2024, platforms like YouTube and Instagram continue to see robust user growth in Portugal, presenting a constant challenge for traditional media outlets to capture and retain audience attention online.

Competition for Advertising Revenue

The competition for advertising revenue is intense, as businesses increasingly shift their marketing budgets towards digital platforms. Impresa, like other traditional media companies, faces this challenge head-on.

This rivalry isn't just with other print or broadcast outlets; the real pressure comes from global digital behemoths. Companies like Google, Meta (Facebook), and Amazon are capturing a massive share of the digital advertising market. For instance, in 2024, digital advertising spending was projected to reach over $600 billion globally, with these major players holding substantial portions of that pie. This migration means Impresa must innovate to retain and attract advertising clients in a landscape dominated by data-driven, highly targeted digital campaigns.

- Digital Dominance: Global digital ad spend in 2024 is expected to exceed $600 billion, highlighting the shift away from traditional media.

- Key Competitors: Google, Meta (Facebook), and Amazon are leading the charge in digital advertising revenue capture.

- Revenue Migration: Advertising spend is steadily moving from traditional channels to digital platforms, intensifying competition for Impresa.

Innovation and Content Differentiation

The media landscape is a hotbed of innovation, with companies relentlessly pursuing differentiation. This is evident in the surge of new content formats, such as the booming podcast industry and increased investment in original fiction. For instance, in 2024, the global podcast advertising revenue was projected to reach over $2 billion, highlighting the format's growing appeal and commercial viability. Media firms are also adapting to emerging technologies, with artificial intelligence playing an increasingly significant role in content creation and distribution.

Impresa, a key player in this dynamic market, actively engages in strategies to maintain its competitive edge. The company's participation in initiatives like the audited podcast ranking demonstrates a commitment to transparency and industry standards, fostering trust among listeners and advertisers. Furthermore, Impresa's strategic focus on national fiction, a genre with enduring audience appeal, underscores its dedication to creating unique and engaging content that resonates with its target demographic.

- Podcast Growth: Global podcast advertising revenue is expected to surpass $2 billion in 2024.

- Content Investment: Media companies are increasing their investment in original fiction to stand out.

- AI Adoption: Artificial intelligence is becoming a crucial tool for content creation and personalization.

- Impresa's Strategy: Participation in audited rankings and focus on national fiction are key differentiators.

The competitive rivalry within Impresa's media operations is intense, driven by established broadcasters like Media Capital Group and the public broadcaster RTP, alongside a proliferation of digital-first news outlets. This pressure is amplified by the global dominance of digital advertising platforms such as Google and Meta, which are capturing significant market share. For instance, global digital ad spend in 2024 was projected to exceed $600 billion, a clear indicator of revenue migration away from traditional media.

| Competitor Type | Key Players | Impact on Impresa |

|---|---|---|

| Private Broadcasters | Media Capital Group (TVI) | Direct competition for audience and advertising revenue. |

| Public Broadcaster | RTP | Significant audience share, influencing market dynamics. |

| Publishing Rivals | Público, Diário de Notícias | Competition for readership and advertising in the print sector. |

| Digital-First Outlets | Various online news portals | Fragmented market, requiring constant innovation for engagement. |

| Global Digital Platforms | Google, Meta (Facebook), Amazon | Dominance in digital advertising, capturing substantial revenue. |

SSubstitutes Threaten

Social media platforms such as Instagram, YouTube, and TikTok are emerging as potent substitutes for traditional news and entertainment sources, particularly among younger demographics. This shift means that Impresa, like many established media companies, faces a direct threat to its audience engagement as these platforms capture attention and viewing time. For instance, in 2024, a significant portion of Gen Z and Millennials reported getting a substantial amount of their news from social media, bypassing traditional outlets.

Global Subscription Video-on-Demand (SVoD) services like Netflix, Disney+, and Amazon Prime Video present a significant threat of substitution to traditional television, including SIC. These platforms offer extensive content libraries and on-demand viewing, directly competing with scheduled broadcast programming.

The appeal of these SVoD services has led to a noticeable plateauing and even decline in traditional pay-TV subscriptions across many markets, including Portugal. For instance, by the end of 2023, the global SVoD market was estimated to have surpassed 1.5 billion subscribers, indicating a substantial shift in consumer viewing habits.

The proliferation of independent digital content creators, including bloggers and podcasters, presents a significant threat of substitution for traditional media outlets. These creators often provide highly specialized or niche content that can directly compete with established news and entertainment offerings.

While individual creators may have smaller audiences, their cumulative reach and the dedicated engagement they foster can erode the market share of larger, traditional players. For instance, in 2024, the creator economy continued its rapid expansion, with platforms like YouTube and Spotify seeing millions of independent creators generating substantial content across diverse genres.

User-Generated Content (UGC)

The rise of user-generated content (UGC) presents a significant threat of substitutes for Impresa. Platforms like YouTube, TikTok, and Instagram offer a vast and constantly updated stream of free entertainment and information, directly competing with professionally produced content. This abundance of UGC means consumers have readily available alternatives, often at no cost, diminishing the perceived value of paid or premium content. For example, by the end of 2023, YouTube creators were uploading over 500 hours of video content every minute, illustrating the sheer scale of this substitute supply.

Impresa must therefore focus on differentiating its offerings to counter this threat. This involves creating unique value propositions that UGC cannot easily replicate, such as high-quality production, exclusive insights, or curated experiences. The challenge lies in demonstrating a clear advantage over the free, readily accessible content generated by millions of individuals worldwide. In 2024, the continued growth in influencer marketing and the creator economy further amplifies this competitive pressure, as more individuals are incentivized to produce content.

- Vast Availability: Digital platforms host an almost limitless volume of UGC, providing consumers with constant, free alternatives.

- Cost-Effectiveness: UGC is typically free for consumers, making it a highly attractive substitute for paid or subscription-based content.

- Content Diversity: The sheer variety of UGC covers nearly every niche and interest, directly challenging Impresa's ability to capture audience attention.

- Creator Economy Growth: In 2024, the creator economy continues to expand, with more individuals producing and monetizing content, intensifying the substitute threat.

Alternative Information Sources

The threat of substitutes for traditional news and information providers like Impresa is significant and growing. Consumers now have a vast array of alternative channels to access information, moving beyond established media houses.

Specialized online forums, social media groups, and direct communication platforms allow individuals to gather insights and discuss current events without relying on traditional news outlets. This fragmentation of information consumption diminishes the exclusive hold that companies like Impresa once had.

For instance, in 2024, the percentage of adults who get news from social media in the US reached approximately 50%, a stark contrast to the pre-internet era. This shift highlights how readily available and often free substitutes can erode the customer base of traditional information sources.

- Diversified Information Channels: Consumers access news via social media, blogs, podcasts, and niche online communities.

- Reduced Reliance on Traditional Media: Direct access to information bypasses established news organizations.

- Cost-Effectiveness of Substitutes: Many alternative sources are free or significantly cheaper than traditional subscriptions.

- Personalized Content: Niche platforms often offer tailored information that traditional outlets may not cover.

The threat of substitutes for Impresa is substantial, driven by the widespread availability of alternative content sources. Digital platforms and independent creators offer diverse, often free, content that directly competes with traditional media offerings.

The rise of user-generated content (UGC) on platforms like YouTube and TikTok provides consumers with an endless stream of entertainment and information, often at no cost. This accessibility challenges the value proposition of professionally produced content. By the end of 2023, YouTube creators were uploading over 500 hours of video content every minute, showcasing the immense scale of this substitute supply.

Subscription video-on-demand (SVoD) services such as Netflix and Disney+ have also significantly impacted traditional television viewing habits. The global SVoD market surpassed 1.5 billion subscribers by the end of 2023, indicating a major shift in consumer preferences towards on-demand, curated content.

Furthermore, social media platforms are increasingly becoming primary news sources, especially for younger demographics. In 2024, around 50% of US adults reported getting their news from social media, highlighting a reduced reliance on traditional news outlets.

| Substitute Type | Key Characteristics | Impact on Impresa | 2024 Data/Trend |

|---|---|---|---|

| User-Generated Content (UGC) | Free, vast volume, diverse niches | Erodes perceived value of premium content | Continued rapid expansion of creator economy |

| SVoD Services | On-demand, extensive libraries, competitive pricing | Decreased traditional pay-TV subscriptions | Global SVoD market exceeded 1.5 billion subscribers (end of 2023) |

| Social Media News | Immediate, accessible, often free | Reduced audience for traditional news outlets | ~50% of US adults get news from social media (2024) |

Entrants Threaten

The sheer cost of setting up a traditional media operation, like a new TV network or a major newspaper, is a huge hurdle. Think about building studios, buying broadcast licenses, and producing high-quality content. For instance, launching a new national broadcast network in 2024 could easily run into hundreds of millions, if not billions, of dollars, making it incredibly difficult for newcomers to compete with established players.

Impresa, through its well-known brands like SIC and Expresso, has cultivated deep-seated brand loyalty and a dominant position within the Portuguese media landscape. This established trust and recognition, built over many years, presents a significant barrier for any new player attempting to enter the market.

For instance, in 2024, SIC consistently held a strong viewership share, often competing for the top spot in prime time, demonstrating the enduring appeal of its programming and brand. Similarly, Expresso remains a leading newspaper, with its digital platforms also showing robust engagement, indicating continued reader preference.

Consequently, new entrants would need to invest heavily in marketing and content to even begin to chip away at Impresa's entrenched market share. Overcoming decades of consumer habit and brand association is a formidable challenge, making the threat of new entrants relatively low in this segment.

The media sector, particularly broadcasting in Portugal, faces significant regulatory hurdles and licensing requirements. These complex legal and administrative frameworks can be a substantial barrier, making it difficult and time-consuming for new companies to enter the market.

For instance, obtaining broadcasting licenses involves rigorous application processes, often requiring substantial investment in infrastructure and adherence to strict content regulations. This complexity deters many potential entrants who may lack the resources or expertise to navigate such requirements.

Access to Talent and Content Creation Ecosystem

Building a robust media presence, like that of Impresa, hinges on securing skilled journalists, producers, and creative professionals. Newcomers often face significant hurdles in attracting this caliber of talent, especially when competing against established players with strong brand recognition and resources.

The content creation ecosystem itself presents a barrier. Established media companies have cultivated networks and workflows that streamline production and distribution. For instance, in 2024, major media conglomerates continued to invest heavily in in-house production capabilities and exclusive talent deals, making it difficult for new entrants to replicate this infrastructure.

- Talent Acquisition Costs: New media ventures may face substantially higher recruitment and retention costs to lure experienced personnel away from established firms.

- Established Networks: Impresa likely benefits from pre-existing relationships with content creators, distributors, and technology providers, which are time-consuming and expensive to build.

- Brand Reputation: A strong brand reputation, often built over years, attracts talent and can be a significant deterrent for new entrants attempting to poach key personnel.

- Training and Development: Existing companies often have mature training programs that develop talent internally, creating a loyal and skilled workforce that is hard for new entrants to match quickly.

Digital First Entrants with Low Overheads

Digital-first entrants, unburdened by the substantial infrastructure costs of traditional media, present a significant threat. These agile companies can launch with minimal overheads by concentrating exclusively on online content creation and distribution through social media platforms. For instance, in 2024, the global digital advertising market reached an estimated $600 billion, demonstrating the scale of opportunity for new online players.

These new entrants often leverage innovative digital strategies to bypass established distribution channels, directly reaching audiences with lower operational expenses. Their ability to adapt quickly and target niche demographics effectively disrupts legacy business models. By 2024, social media platforms were projected to account for over 50% of all digital ad spending, highlighting their power as a low-cost entry and growth mechanism.

The threat is amplified by their capacity to attract specific, digitally-native audiences who may be less engaged with traditional media. This can lead to market share erosion for incumbent firms. Consider that in 2024, over 4.9 billion people were active social media users worldwide, representing a vast potential customer base accessible with relatively low marketing investment.

- Low Overhead Advantage: Digital-first companies avoid the capital-intensive requirements of physical infrastructure, such as printing presses or broadcast studios.

- Social Media Leverage: These entrants utilize platforms like TikTok, Instagram, and YouTube for cost-effective content distribution and audience engagement, bypassing traditional media gatekeepers.

- Market Disruption: By offering tailored digital content and experiences, they challenge established players and capture audience attention, impacting revenue streams.

- Audience Acquisition: Their focus on digital channels allows them to efficiently target and acquire specific demographic groups, often at a lower cost per acquisition than traditional methods.

The threat of new entrants for Impresa is generally low due to high capital requirements for traditional media, strong brand loyalty, and regulatory barriers. However, digital-first companies pose a growing challenge by leveraging low overheads and social media for audience acquisition.

New entrants face significant capital investment hurdles in traditional media, with launching a national broadcast network in 2024 potentially costing hundreds of millions to billions. Impresa's established brands like SIC and Expresso have cultivated deep loyalty, making it difficult for newcomers to gain traction against their strong 2024 viewership and reader engagement.

Regulatory complexities and licensing requirements for broadcasting further deter new entrants, demanding substantial investment and adherence to strict content rules. Attracting top talent is also a challenge, as established firms like Impresa have strong brand recognition and resources to secure skilled professionals, making it hard for new ventures to compete for talent in 2024.

Digital-first competitors, however, bypass these traditional barriers. With minimal overheads and effective use of social media, which saw over 4.9 billion global users in 2024, they can efficiently reach audiences and disrupt established players. The global digital advertising market, estimated at $600 billion in 2024, highlights the significant opportunity for these agile entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and reputable financial news outlets to capture the competitive landscape.