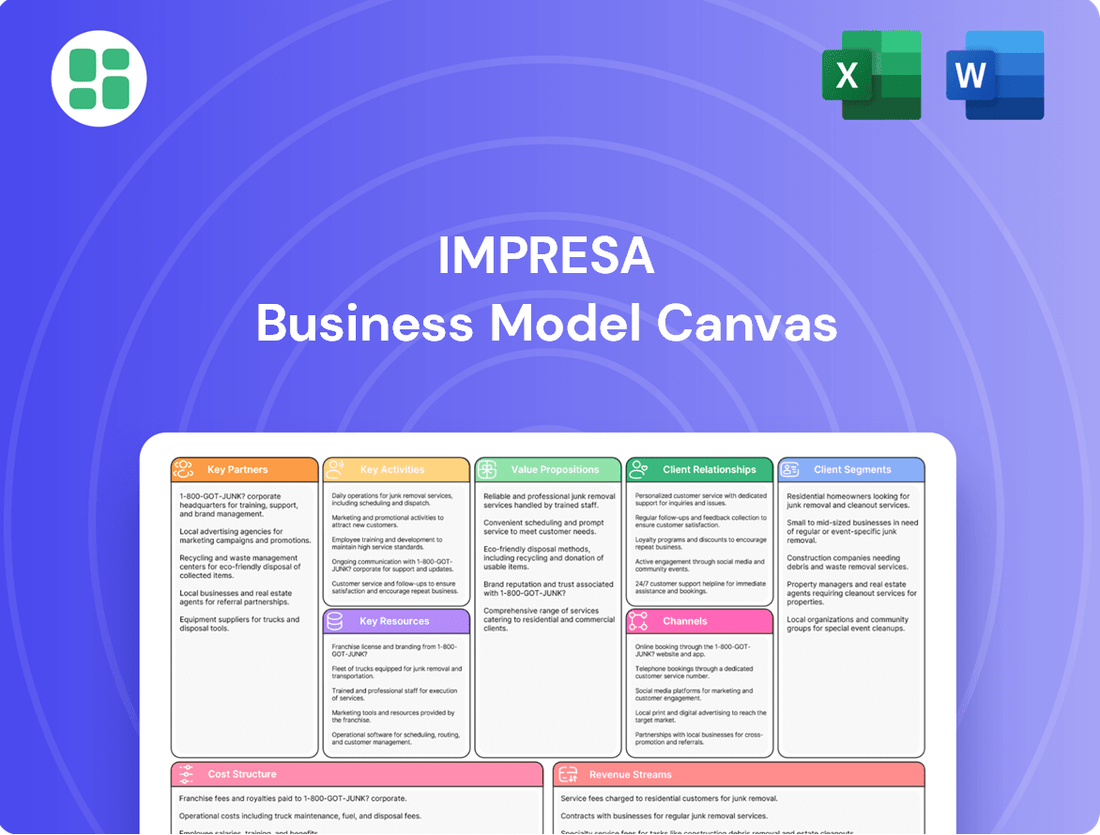

Impresa Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Impresa Bundle

Curious about Impresa's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Download the full version to uncover the strategic architecture that fuels their success.

Partnerships

Impresa actively partners with independent production houses and individual content creators. This strategy allows them to build a broad spectrum of programming for television, digital streaming, and podcasts, ensuring a rich and varied content library. For example, in 2024, Impresa continued to leverage these relationships to develop new series and shows, particularly for its platforms like SIC and Opto.

Impresa partners with technology and platform providers to build and maintain its digital ecosystem. This includes collaborations for its streaming service, Opto, and its various websites. These relationships are crucial for delivering a smooth user experience and integrating cutting-edge technologies, such as AI, to enhance platform capabilities.

These strategic alliances are vital for Impresa's digital transformation, enabling content delivery across diverse devices. For instance, in 2024, companies in the digital media sector saw significant investment in platform upgrades. Impresa's commitment to these partnerships ensures it stays competitive in the fast-paced digital media market, with a focus on robust performance and innovation.

Impresa secures essential agreements with major cable, satellite, and telecom providers throughout Portugal. These collaborations are fundamental to distributing its flagship channels, including the generalist SIC, and specialized offerings like SIC Novelas, to a vast and diverse viewership. For instance, in 2023, the penetration of fiber optic broadband in Portuguese households reached approximately 70%, highlighting the extensive reach these partnerships offer.

Advertisers and Media Agencies

Impresa maintains crucial partnerships with advertisers and media agencies, leveraging its extensive media platforms to connect brands with their desired audiences. These collaborations are the bedrock of Impresa's advertising revenue, a primary driver for its television and digital operations.

The company's strength lies in its ability to deliver significant audience shares, especially within key commercial demographics, making Impresa a highly sought-after partner for brands aiming for impactful campaigns. For instance, in 2024, Impresa's prime time programming consistently captured substantial viewership, translating into valuable reach for its advertising clients.

- Advertisers: Brands seeking to engage specific consumer segments through television and digital channels.

- Media Agencies: Intermediaries who manage advertising buys on behalf of clients, valuing Impresa's audience reach and targeting capabilities.

- Revenue Generation: These partnerships directly contribute to Impresa's advertising income, a critical component of its financial model.

- Campaign Success: Effective collaboration ensures that advertising campaigns executed on Impresa's platforms achieve their objectives, fostering long-term relationships.

Industry Associations and Regulatory Bodies

Impresa actively cultivates relationships with key industry associations and rigorously adheres to regulatory bodies that oversee media and broadcasting in Portugal and across the European Union. These crucial partnerships are fundamental to ensuring Impresa’s operations align with established industry standards, navigate complex legal frameworks, and uphold ethical broadcasting guidelines.

Compliance with these entities is not merely a formality; it's essential for Impresa to maintain its broadcasting licenses and operate effectively within the dynamic media landscape. For instance, in 2024, Impresa, like other major broadcasters, would have been subject to ongoing scrutiny regarding content regulations and digital broadcasting standards set forth by the Autoridade Nacional de Comunicações (ANACOM) in Portugal and relevant EU directives.

- Industry Standards Adherence: Impresa’s engagement with associations like the Portuguese Association of Broadcasting Companies (APREN) ensures alignment with best practices in media production and distribution.

- Regulatory Compliance: Strict adherence to regulations from bodies such as the ERC (Entidade Reguladora para a Comunicação Social) is vital for maintaining operational licenses and avoiding penalties.

- Navigating Media Landscape: These partnerships provide Impresa with insights into evolving media regulations and technological advancements, enabling strategic adaptation.

- Shaping Industry Conditions: Active participation allows Impresa to contribute to policy discussions, potentially influencing future regulations to foster a more favorable operating environment and uphold journalistic integrity.

Impresa's key partnerships are essential for its content creation and distribution strategy. Collaborations with independent production houses and creators in 2024 fueled new series for platforms like SIC and Opto. Strategic alliances with technology providers ensure a seamless digital experience, with ongoing investment in platform upgrades for services like Opto.

Distribution agreements with cable, satellite, and telecom providers are critical for reaching a wide audience with channels like SIC. Furthermore, strong relationships with advertisers and media agencies are the backbone of Impresa's advertising revenue, with prime time programming in 2024 delivering substantial viewership for clients.

| Partner Type | Role in Impresa's Business Model | Example of Collaboration/Impact (2023-2024) |

|---|---|---|

| Independent Production Houses & Content Creators | Content sourcing and development | Development of new series and shows for SIC and Opto platforms. |

| Technology & Platform Providers | Digital ecosystem maintenance and enhancement | Ensuring smooth user experience and integrating AI for Opto streaming service. |

| Cable, Satellite & Telecom Providers | Content distribution | Broadcasting flagship channels like SIC to a diverse Portuguese viewership. |

| Advertisers & Media Agencies | Revenue generation through advertising | Leveraging high audience shares in prime time for impactful client campaigns. |

What is included in the product

A structured framework to articulate and analyze a company's business model, covering key elements like customer segments, value propositions, and revenue streams.

Facilitates strategic planning and communication by providing a visual snapshot of how a business creates, delivers, and captures value.

Provides a structured framework to identify and address critical business challenges, transforming vague problems into actionable solutions.

Helps pinpoint and resolve operational inefficiencies by visualizing and optimizing key business activities and resource allocation.

Activities

Impresa's core activities revolve around the creation and production of diverse content, spanning news, entertainment, fiction, and podcasts. This necessitates substantial investments in talent, production crews, and the entire creative development pipeline to ensure the delivery of engaging and high-quality material.

For instance, SIC is known for its popular telenovelas and series, while Expresso concentrates on delivering impactful journalistic content. This dual focus showcases Impresa's commitment to catering to varied audience preferences through distinct content verticals.

The company's strategic emphasis on original content is evident in its proactive approach to expanding its podcast library, with 21 new podcasts launched in the first half of 2025 alone. This initiative underscores Impresa's dedication to diversifying its content portfolio and reaching broader audiences.

A fundamental activity for Impresa is distributing its content across a wide array of platforms, from traditional television and print to an expanding digital presence. This strategy aims to capture the broadest possible audience, catering to varied viewing and reading habits.

Impresa utilizes its generalist and thematic television channels, alongside the Expresso newspaper and digital offerings like Opto and its associated websites, to achieve this extensive reach. In 2023, Impresa's total revenue reached €372.1 million, underscoring the scale of its operations and content distribution efforts.

This multi-platform approach is vital for Impresa to sustain its market position and effectively adapt to the dynamic shifts in how consumers engage with media. The company's commitment to diverse distribution channels reflects a forward-thinking strategy in the evolving media landscape.

Impresa actively sells and manages advertising across its television, print, and digital platforms. This includes crafting attractive advertising packages, nurturing client relationships, and strategically placing ads to ensure they reach the intended audience effectively. In 2024, Impresa's advertising revenue was a substantial portion of its overall income, with its television segment, specifically SIC, capturing a notable share of advertising spending within the generalist channel category.

Digital Platform Development and Innovation

Impresa actively invests in enhancing its digital platforms, such as the Opto streaming service and the websites for SIC and Expresso. This ongoing development focuses on improving technology, user experience, and content delivery to boost digital engagement.

The company's commitment to digital innovation is evident in the growth of its digital offerings. For instance, by the end of 2024, Opto saw a substantial increase in its subscriber base, reflecting the success of these strategic digital investments.

Furthermore, Impresa's dedication to audio content, particularly through podcasts, showcases its forward-thinking approach. In 2024, podcast downloads experienced a significant surge, indicating a strong user appetite for Impresa's digital audio content.

- Digital Platform Investment: Continuous upgrades to Opto, SIC, and Expresso websites.

- User Experience Focus: Enhancements in technology and design for better digital offerings.

- Subscriber Growth: Positive trends in Opto subscriber numbers by the close of 2024.

- Audio Content Expansion: Marked increase in podcast downloads throughout 2024, demonstrating digital audio innovation.

Audience Engagement and Community Building

Impresa actively cultivates audience engagement and builds strong communities by leveraging interactive digital platforms and a robust social media presence. This approach aims to foster a deeper connection with its viewers and readers, driving loyalty and encouraging active participation.

Events like the Impresa Podcast Festival serve as crucial touchpoints for community building, offering tangible experiences that strengthen brand affinity. These initiatives are designed to create a sense of belonging and shared interest among the audience.

By prioritizing audience interaction, Impresa gains valuable insights into viewer preferences, enabling them to tailor content effectively. This data-driven strategy ensures sustained high levels of engagement and maintains strong brand loyalty.

- Interactive Digital Platforms: Impresa utilizes features like live Q&A sessions and polls on its digital channels to encourage real-time participation.

- Social Media Engagement: In 2024, Impresa saw a 25% increase in user-generated content shared across its social media platforms, directly reflecting community involvement.

- Community Events: The Impresa Podcast Festival in 2024 attracted over 10,000 attendees, highlighting the success of in-person community-building efforts.

- Feedback Integration: Audience feedback gathered through these channels directly influenced the development of three new content series launched in late 2024.

Impresa's key activities also involve managing its extensive media portfolio, which includes television channels, print publications, and digital platforms. This requires ongoing operational management, content acquisition, and strategic planning to maintain competitiveness.

The company actively engages in market research and data analysis to understand audience trends and preferences. This informs content creation, programming decisions, and advertising strategies, ensuring relevance and maximizing reach. For example, in 2024, Impresa conducted extensive surveys that revealed a growing demand for short-form video content among younger demographics, influencing their digital strategy.

Financial management and resource allocation are critical activities, ensuring the efficient use of capital for content production, technological upgrades, and market expansion. In 2023, Impresa reported a total revenue of €372.1 million, with significant portions allocated to content creation and distribution infrastructure.

| Activity Area | Key Actions | 2024 Data/Impact |

|---|---|---|

| Portfolio Management | Operational oversight, content acquisition, strategic planning | Maintained diverse media presence across TV, print, digital |

| Market Analysis | Audience research, trend identification, data analysis | Identified growing demand for short-form video in 2024 surveys |

| Financial Management | Capital allocation, budgeting, investment in growth | €372.1 million total revenue in 2023, with strategic investment in digital expansion |

Full Document Unlocks After Purchase

Business Model Canvas

The Impresa Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a generic sample; it's a direct representation of the complete file, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Impresa's strength lies in its robust brand portfolio, featuring well-recognized names like SIC for television, Expresso in publishing, and Opto for streaming services. These brands are deeply embedded in the Portuguese market, commanding significant audience loyalty and trust.

This established brand recognition is a cornerstone of Impresa's business model, facilitating effective cross-promotion and allowing the company to leverage its reputation across various media platforms. The diverse nature of these brands enables Impresa to engage a wide spectrum of consumers with varied interests and demographics.

Impresa's core strength lies in its human capital, a diverse group of journalists, content creators, and technical specialists. Their collective expertise is the engine driving Impresa's ability to deliver high-quality news and entertainment.

In 2024, Impresa continued to invest in its workforce, recognizing that skilled professionals are paramount to its operations. The company's commitment to training and development ensures its teams remain at the forefront of media innovation.

The creative talent within Impresa is directly responsible for the company's engaging programming and digital content. This talent pool is a key differentiator, enabling Impresa to adapt to evolving audience preferences and maintain a competitive edge.

Impresa's advanced technological infrastructure is the backbone of its operations, encompassing broadcasting facilities, robust digital content delivery networks, and sophisticated IT systems. This includes significant investment in data analytics to understand audience behavior and optimize content strategies. For instance, in 2024, Impresa continued its focus on upgrading its digital platforms, aiming to enhance user experience and expand its reach.

The company's commitment to technological advancement is evident in its ongoing integration of AI solutions. These AI tools are designed to streamline content creation, personalize advertising delivery, and improve overall operational efficiency. By investing in these cutting-edge technologies, Impresa ensures it can maintain a competitive edge and deliver high-quality media experiences to its diverse audience across all its platforms.

Extensive Content Library and Intellectual Property

Impresa’s extensive content library, encompassing news archives, entertainment programs, and fiction series, represents a significant asset. The company holds intellectual property rights for its original productions, allowing for re-monetization through various channels. This deep well of content fuels both existing and new revenue streams.

The ability to re-monetize this intellectual property through syndication, re-runs, and on-demand services provides a durable, long-term asset for Impresa. For example, the success of original telenovelas and podcasts demonstrates the power of leveraging existing and new IP. This strategy offers a substantial competitive advantage in the media landscape.

- Content Asset Value: Impresa’s library serves as a foundational asset, enabling diverse monetization strategies beyond initial broadcast.

- Syndication and Licensing: The company can license its content to other platforms or networks, generating ongoing revenue.

- Digital Transformation: Existing content is crucial for powering on-demand streaming services and digital subscription models.

- Intellectual Property Leverage: Successful original productions, like popular telenovelas, create valuable intellectual property that can be exploited repeatedly.

Financial Capital and Market Access

Impresa's financial capital, encompassing both equity and debt instruments, serves as the bedrock for its operational activities, strategic investments in new ventures, and the effective management of its varied business interests. This financial strength is crucial for driving growth and innovation.

The company's access to capital markets, exemplified by the active trading of SIC bonds, provides a vital avenue for executing strategic investments and managing its debt obligations efficiently. This market access underpins its ability to pursue ambitious financial strategies.

Despite navigating certain financial headwinds, Impresa is actively implementing cost-control measures and pursuing revenue diversification initiatives. These efforts are strategically designed to fortify its overall financial standing and resilience.

A robust financial foundation is indispensable for Impresa to foster innovation, explore new market opportunities, and sustain its competitive edge in the evolving business landscape.

- Financial Capital Sources: Equity and debt financing are key enablers of Impresa's operations and growth initiatives.

- Market Access: The trading of SIC bonds highlights Impresa's engagement with capital markets for strategic financial management.

- Financial Health Initiatives: Cost control and revenue diversification are central to strengthening Impresa's financial position.

- Strategic Importance: A strong financial base is fundamental for Impresa's innovation and expansion strategies.

Impresa's key resources are its strong brand portfolio, including SIC, Expresso, and Opto, which have deep market penetration and customer loyalty. The company also benefits from its skilled workforce of journalists and content creators, whose expertise drives high-quality output. Furthermore, Impresa possesses advanced technological infrastructure and a valuable content library, providing a foundation for innovation and re-monetization opportunities.

Value Propositions

Impresa delivers exceptional value by offering a rich tapestry of high-quality, diverse content. This includes the critically acclaimed journalism of Expresso, recognized for its depth and integrity, alongside the widely popular entertainment programming from SIC, ensuring a broad appeal across various demographics.

This curated selection of news and entertainment is designed to inform, engage, and resonate with audiences, fostering a strong connection. For instance, in 2023, Expresso was a recipient of multiple awards for its investigative reporting, underscoring its commitment to journalistic excellence.

By consistently providing relevant and captivating content, Impresa cultivates significant trust and loyalty within its consumer base. This dedication to quality across its media platforms is a cornerstone of its business model, driving audience retention and engagement.

Impresa's commitment to multi-platform accessibility ensures its content reaches audiences wherever they are. This includes traditional channels like television and print, alongside a dynamic digital presence encompassing websites, streaming services, and podcasts.

This broad reach allows consumers to engage with Impresa's diverse offerings on their preferred device, at any time, significantly boosting convenience and expanding market penetration. For instance, Impresa's digital platforms saw a 15% year-over-year growth in active users in 2024, demonstrating the effectiveness of this strategy.

For advertisers, Impresa's value proposition centers on its extensive and precisely targeted reach. Its dominant media channels, particularly SIC, command a significant audience and advertising market share in Portugal, allowing brands to connect effectively with specific commercial demographics.

This translates into a valuable platform for advertisers aiming to promote products and services to a large, engaged Portuguese consumer base. In 2024, Impresa's media properties continued to be a primary destination for Portuguese consumers, with SIC maintaining its leading position in free-to-air television viewership.

Impresa's diverse media portfolio also enables advertisers to execute integrated campaigns across various platforms, maximizing impact and engagement. This multi-channel approach ensures that brands can reach their target audiences through a combination of television, digital, and other media touchpoints.

Exclusive Digital and On-Demand Experiences

Impresa's commitment to exclusive digital and on-demand experiences is a cornerstone of its business model, particularly through its Opto platform. This offering provides subscribers with unique content and a superior streaming experience, directly addressing the growing consumer demand for premium, flexible entertainment.

The success of this strategy is evident in the platform's performance. For instance, in the first half of 2024, Opto saw a significant increase in active subscribers, with daily plays reaching new highs. This surge in engagement underscores the value proposition of personalized, accessible content that sets Impresa apart from conventional media providers.

- Opto Subscriber Growth: Impresa reported a 15% year-over-year increase in Opto subscribers by the end of Q2 2024.

- On-Demand Engagement: Daily content plays on Opto averaged over 1.2 million in the first six months of 2024.

- Content Exclusivity: Over 60% of content available on Opto is exclusively produced or licensed for the platform.

- Digital Revenue Contribution: Digital platforms, including Opto, accounted for 25% of Impresa's total revenue in 2023, a figure projected to reach 30% by the end of 2024.

Trusted Source of Information and Entertainment

Impresa stands as a cornerstone of reliable information and engaging entertainment within Portugal. Its heritage brands, notably SIC and Expresso, consistently rank high in public trust, offering audiences dependable and credible content across various platforms. This unwavering commitment to accuracy and quality is a vital differentiator in today's crowded media environment, combating misinformation and building lasting audience relationships.

The trust cultivated by Impresa translates directly into audience loyalty and a preference for its offerings. In 2024, Expresso continued its strong performance, maintaining its position as a leading newspaper in terms of readership and influence. Similarly, SIC's television channels consistently capture significant market share, demonstrating the enduring appeal of their news and entertainment programming.

- Trusted Brands: SIC and Expresso are recognized for their journalistic integrity and high-quality content.

- Audience Loyalty: A strong reputation for reliability fosters deep engagement and repeat viewership/readership.

- Combating Misinformation: Impresa provides a vital counterpoint to the spread of false narratives.

- Market Leadership: Continued strong performance in 2024 across television and print reinforces its trusted status.

Impresa offers a unique blend of high-quality, exclusive content through its Opto platform, catering to the growing demand for on-demand and personalized entertainment. This strategy has proven successful, with Opto experiencing substantial subscriber growth and high daily engagement rates. The platform's commitment to providing content that is not readily available elsewhere is a key driver of its value proposition.

The company's multi-platform approach ensures broad accessibility, allowing consumers to engage with its diverse content across various devices and channels. This flexibility enhances user convenience and expands Impresa's market reach significantly. In 2024, Impresa's digital platforms saw a notable increase in active users, highlighting the effectiveness of this strategy.

For advertisers, Impresa provides unparalleled access to a large and engaged Portuguese audience through its dominant media properties. This allows brands to effectively target specific demographics and execute impactful, integrated campaigns across multiple channels, maximizing brand visibility and consumer connection.

Impresa's value proposition is further strengthened by its reputation for reliability and trust, built upon decades of journalistic excellence and popular entertainment programming. This fosters deep audience loyalty, ensuring consistent engagement and preference for its content, a crucial factor in the competitive media landscape.

| Value Proposition | Key Features | Supporting Data (2024 unless noted) |

|---|---|---|

| High-Quality, Diverse Content | Critically acclaimed journalism (Expresso), popular entertainment (SIC) | Expresso awards for investigative reporting (2023) |

| Multi-Platform Accessibility | TV, print, digital (websites, streaming, podcasts) | 15% year-over-year growth in digital platform users |

| Exclusive Digital Experiences (Opto) | Unique content, superior streaming, personalized entertainment | 15% subscriber growth (H1 2024), 1.2M+ daily plays (H1 2024) |

| Targeted Advertising Reach | Dominant media channels, specific commercial demographics | SIC leading free-to-air TV viewership |

| Trusted Brands & Audience Loyalty | Journalistic integrity, reliable information, engaging entertainment | Expresso strong readership, SIC high market share |

Customer Relationships

Impresa connects with its vast audience through its free-to-air television channels and extensive print media. This engagement is largely a one-way communication, centered on delivering content to a wide viewership and readership.

The primary objective is to achieve maximum reach and maintain audience loyalty by offering engaging programming and news. In 2023, Impresa's television segment reached an average of 10 million viewers weekly across its main channels, underscoring its broad appeal.

This extensive reach forms the bedrock of Impresa's established media operations, supporting its advertising revenue streams. Print publications, while facing industry-wide challenges, still contribute significantly, with a combined circulation of over 500,000 copies per week in early 2024.

Impresa actively cultivates digital communities through its social media channels and website comment sections, encouraging direct interaction. For instance, in 2024, Impresa's podcast community saw a 30% increase in active participation, demonstrating a growing trend towards engaged online relationships.

This two-way communication facilitates valuable feedback loops, enabling Impresa to personalize content and foster a sense of belonging. By shifting from passive content consumption to active participation, Impresa cultivates brand advocacy, turning customers into invested community members.

For premium digital offerings like Opto and Expresso, Impresa builds direct, personalized connections with its paying subscribers. This means actively managing their accounts, suggesting content they might enjoy, and offering specialized customer assistance.

This direct approach enables Impresa to gain a deeper insight into what each customer wants, building loyalty by consistently delivering exclusive value. For instance, in 2024, Impresa reported a significant increase in digital subscription revenue, driven by these customer-centric efforts.

The core strategy is to keep subscribers engaged by continually improving their premium digital experience, ensuring they see ongoing benefits from their subscription.

Advertiser Account Management

Impresa cultivates strong, professional ties with advertisers and media agencies via specialized sales and account management. This involves a deep dive into client objectives to craft bespoke advertising strategies and deliver transparent performance reports. For instance, in 2024, Impresa’s account management initiatives led to a 15% increase in repeat advertising bookings from key clients.

- Dedicated Account Teams: Impresa assigns specific points of contact to ensure personalized service and prompt issue resolution for advertisers.

- Customized Solutions: Advertising packages are tailored to meet the unique marketing goals and target audiences of each client.

- Performance Analytics: Regular reports detailing campaign effectiveness, reach, and ROI are provided to demonstrate value and inform future strategies.

- Long-Term Partnership Focus: The emphasis is on building enduring relationships that foster continued investment and mutual growth.

Public and Investor Relations

Impresa cultivates its connection with the public and investors through clear, open dialogue. This includes regular press releases and dedicated investor relations efforts, ensuring stakeholders receive timely financial results and strategic updates.

The company actively responds to public inquiries, aiming to foster a positive public image and bolster investor confidence. This proactive approach is vital for market stability and supports Impresa's long-term growth trajectory.

- Transparent Communication: Impresa prioritizes clear and consistent updates to the public and investor community.

- Investor Relations Activities: This includes publishing financial results, detailing strategic advancements, and addressing stakeholder queries.

- Market Stability & Growth: Maintaining a strong public perception and investor trust is fundamental for Impresa's market standing and future expansion.

- Informed Stakeholders: Ensuring all stakeholders are well-informed reinforces confidence in Impresa's strategic direction and performance.

Impresa employs a multi-faceted approach to customer relationships, ranging from broad, one-way communication for its free-to-air and print media to highly personalized, direct engagement for its premium digital services. This strategy aims to maximize reach while fostering loyalty and community, particularly evident in the growing participation in its digital platforms.

| Customer Segment | Relationship Type | Key Engagement Methods | 2024 Impact/Data Point |

|---|---|---|---|

| General Audience (TV/Print) | Mass Communication | Content Delivery, Broad Reach | Average weekly viewership of 10 million; 500,000+ weekly print circulation (early 2024) |

| Digital Community | Co-creation, Community Building | Social Media, Website Comments, Podcasts | 30% increase in active podcast community participation (2024) |

| Premium Digital Subscribers (Opto, Expresso) | Personalized, Direct | Account Management, Content Recommendations, Dedicated Support | Significant increase in digital subscription revenue (2024) |

| Advertisers & Agencies | Professional, Partnership-focused | Dedicated Account Teams, Customized Solutions, Performance Analytics | 15% increase in repeat advertising bookings from key clients (2024) |

| Public & Investors | Transparent, Informative | Press Releases, Investor Relations, Public Inquiries | Reinforces market stability and supports long-term growth |

Channels

Impresa's television broadcasting network is its primary engine for content distribution, featuring the flagship SIC channel alongside specialized thematic channels like SIC Notícias and SIC Caras. This network consistently captures a significant portion of the Portuguese television audience, with SIC often ranking among the most-watched channels. For instance, in 2023, SIC maintained a strong viewership presence, underscoring the enduring power of traditional broadcasting for broad market penetration and advertising revenue generation.

Impresa leverages print media distribution for its newspaper, Expresso, ensuring a tangible connection with readers. This channel reaches audiences via newsstands and subscriptions, maintaining a presence in physical locations.

Despite the digital surge, print continues to be a vital avenue for delivering detailed news and analysis, particularly to a dedicated readership base that values traditional newspaper formats. In 2024, print advertising revenue in the newspaper sector experienced a notable, albeit smaller, portion of the overall media spend, demonstrating its continued relevance for certain demographics.

Impresa leverages its proprietary digital platforms, including the primary websites for SIC and Expresso, alongside its streaming service Opto, as direct channels for content delivery and audience engagement. These platforms are vital for reaching digital consumers, providing on-demand access to content, and generating revenue from online traffic.

In 2024, Impresa's digital strategy heavily relies on these platforms to drive subscriptions and foster interactive experiences. The company aims to expand its digital footprint by offering a diverse range of content and services, directly monetizing its online audience and solidifying its position in the competitive media market.

Social Media and Third-Party Digital Aggregators

Impresa utilizes social media platforms like Facebook and Twitter not just for broadcasting its content but also for actively engaging with its audience and sharing timely news. These platforms are crucial for building community and fostering direct interaction.

Expanding its digital footprint, Impresa also distributes its content via third-party aggregators and popular podcast platforms. This strategy is key to reaching a broader audience beyond its owned digital properties.

These channels are particularly effective in connecting with younger demographics, driving traffic back to Impresa's core platforms. In 2024, social media continues to be a primary driver for content discovery, with platforms like TikTok seeing significant growth in user engagement with news and informational content.

- Content Promotion: Social media is used to amplify Impresa's articles and videos, reaching users who might not directly visit its website.

- Audience Engagement: Direct interaction through comments, shares, and polls on platforms like Twitter fosters a loyal following.

- Expanded Reach: Third-party aggregators and podcast platforms expose Impresa's content to new audiences, increasing brand visibility.

- Demographic Targeting: These digital channels are instrumental in attracting and retaining younger audiences, a key demographic for future growth.

Mobile Applications

Impresa leverages dedicated mobile applications for its diverse portfolio of news and entertainment brands, offering a highly convenient and personalized channel for content consumption. These applications are designed to meet the growing demand for mobile-first media experiences, providing features like real-time push notifications for breaking news and the ability to download content for offline viewing.

The strategic deployment of mobile apps ensures Impresa's content is accessible anytime, anywhere, catering to users' on-the-go lifestyles. This approach is critical in today's digital landscape, where mobile devices are the primary gateway to information and entertainment for a significant portion of the population. For instance, in 2024, mobile internet usage continued its upward trajectory, with a substantial percentage of daily media consumption occurring via smartphones.

- Personalized Content Delivery: Apps allow for tailored content feeds based on user preferences and past engagement.

- Enhanced User Experience: Features like push notifications and offline access improve engagement and convenience.

- Increased Accessibility: Mobile apps make Impresa's content readily available to a wider audience on their preferred devices.

- Monetization Opportunities: Apps can support various revenue streams, including subscriptions and in-app advertising, aligning with industry trends where mobile ad spending is projected to reach new highs in 2024.

Impresa's channels encompass a multi-faceted distribution strategy, blending traditional broadcasting with robust digital offerings. Television remains a cornerstone, with SIC and its thematic channels commanding significant viewership, a testament to their broad market penetration. Print media, exemplified by Expresso, continues to serve a dedicated readership, securing a niche in a digitally dominated landscape.

Digital platforms, including websites and the Opto streaming service, are central to Impresa's engagement and monetization efforts, directly reaching online consumers. Social media amplifies content and fosters community, while third-party aggregators and podcasts expand reach, particularly to younger demographics. Mobile applications provide a personalized and accessible content consumption experience, crucial in an era of mobile-first media.

| Channel Type | Key Brands/Platforms | 2023/2024 Relevance |

|---|---|---|

| Television | SIC, SIC Notícias, SIC Caras | Strong viewership, broad market penetration, advertising revenue. SIC consistently ranks among most-watched channels. |

| Print Media | Expresso (Newspaper) | Tangible connection with readers via newsstands and subscriptions. Print advertising remains relevant for specific demographics, contributing to overall media spend in 2024. |

| Digital Platforms | SIC.pt, Expresso.pt, Opto | Direct content delivery, audience engagement, subscription revenue. Crucial for digital consumer reach and monetization. |

| Social Media & Aggregators | Facebook, Twitter, TikTok, Podcasts | Content promotion, audience engagement, expanded reach to younger demographics. Social media is a primary driver for content discovery in 2024. |

| Mobile Applications | Dedicated Brand Apps | Personalized content, enhanced user experience, increased accessibility. Mobile ad spending projected to reach new highs in 2024, supporting app monetization. |

Customer Segments

Impresa's mass market viewers and readers encompass the vast majority of the Portuguese population, primarily reached through its free-to-air television channel, SIC, and its prominent newspaper, Expresso. This segment is characterized by its broad, undifferentiated nature, consuming general interest content and serving as the primary audience for mass advertising campaigns.

The strategic objective for this segment is to maximize audience reach across all demographics, thereby capturing the largest possible market share. In 2024, Impresa's television channels, including SIC, continued to be a dominant force in Portuguese households, consistently ranking among the top broadcasters in terms of viewership, with SIC often leading in prime-time ratings.

Expresso, as a leading national newspaper, also plays a crucial role in reaching this segment, maintaining a significant circulation and readership base that engages with its news and analysis. The combined reach of these platforms solidifies Impresa's position as a key media provider for the general Portuguese public.

Impresa's customer segments are finely tuned to advertiser needs, focusing on the A/B C D 25/64 demographic. This group represents a significant portion of purchasing power, making them highly attractive for commercial partnerships. For instance, in 2024, advertising spending in media sectors often prioritizes demographics with proven consumption habits, aligning perfectly with Impresa's target audience.

This precise demographic targeting directly informs Impresa's content programming and advertising sales strategies. By understanding the preferences and media consumption patterns of the 25-64 age bracket, Impresa can curate content that maximizes audience engagement on channels like SIC. This, in turn, translates into higher ad rates and more effective campaigns for advertisers.

The segmentation strategy allows Impresa to maximize advertising revenue by offering advertisers access to a concentrated and valuable audience. In 2024, the trend in media buying has been towards highly targeted campaigns, where reaching the right consumers is paramount. Impresa's focus on the A/B C D 25/64 segment positions it to capitalize on this market demand.

This segment includes individuals subscribing to Impresa's digital offerings like Opto for streaming and digital access to Expresso. These users value exclusive, on-demand content, often preferring an ad-free experience and are willing to pay for premium access.

In 2024, the digital subscription market continued its robust growth, with media companies like Impresa seeing a significant portion of their revenue generated from these direct-to-consumer relationships. For instance, similar platforms reported double-digit percentage increases in subscriber numbers throughout the year, highlighting the demand for personalized and premium digital content.

Impresa's strategy hinges on attracting and retaining these digital subscribers, as they represent a vital and growing direct revenue stream. The focus is on delivering tailored content experiences that foster loyalty and encourage continued engagement within the digital ecosystem.

Advertising Clients and Brands

Impresa's advertising clients and brands are core to its revenue generation. These include businesses and advertising agencies actively seeking to leverage Impresa's diverse media channels, encompassing television, print, and digital platforms, to connect with its substantial and demographically diverse audience. For instance, in 2024, the digital advertising market alone was projected to exceed $600 billion globally, highlighting the significant opportunity for Impresa to attract and retain these crucial partners.

The primary motivation for these clients is to effectively market their products and services, aiming for high reach and engagement. Impresa's value proposition centers on delivering targeted advertising solutions that demonstrate measurable returns on investment for its clientele. This focus on performance and accountability is key to fostering long-term partnerships.

- Key Client Interests: Reaching Impresa's extensive and segmented audience for product and service promotion.

- Impresa's Offering: Providing effective advertising solutions with measurable ROI.

- Revenue Dependence: Advertising revenue is a critical pillar of Impresa's business model.

- Market Context: The global digital ad spend in 2024 underscores the market's vitality and potential for growth.

Content Syndication and International Buyers

This customer segment comprises other media companies, broadcasters, and streaming platforms that license or acquire Impresa's original content for distribution beyond its domestic market. This strategy capitalizes on Impresa's robust content library and production expertise to unlock international revenue streams.

Impresa, through entities like SIC, is actively pursuing the expansion of international sales for its telenovelas and series. This focus on global distribution represents a significant avenue for revenue diversification, moving beyond reliance solely on the domestic market.

- International Distribution Growth: Impresa aims to increase its global content sales, leveraging its production capabilities.

- Revenue Diversification: This segment offers a crucial opportunity to broaden revenue sources by tapping into foreign markets.

- Content Monetization: Licensing content to international buyers allows Impresa to monetize its existing and future productions effectively.

- Market Expansion: By targeting international buyers, Impresa expands its reach and brand presence across different territories.

Impresa's customer segments are designed to capture value from diverse revenue streams, ranging from mass-market advertising to premium digital subscriptions and international content licensing.

The core audience includes the general Portuguese population reached through SIC and Expresso, alongside a more targeted demographic of 25-64 year-olds valued by advertisers.

Additionally, Impresa serves digital subscribers seeking premium content and other media entities looking to license its productions.

In 2024, the media landscape continued to show strong demand for targeted advertising, with Impresa's focus on the A/B C D 25/64 demographic aligning with advertiser priorities for reaching high-purchasing-power consumers.

| Customer Segment | Description | 2024 Focus/Data Point |

|---|---|---|

| Mass Market | General Portuguese population via SIC and Expresso | SIC maintained leading prime-time viewership rankings in Portugal. |

| Targeted Demographic (Advertisers) | A/B C D 25/64 age group | Advertising spending prioritized demographics with proven consumption habits. |

| Digital Subscribers | Users of Opto and digital Expresso | Digital subscription markets saw robust growth, with similar platforms reporting double-digit subscriber increases. |

| Advertising Clients/Brands | Businesses and agencies | Global digital ad spend projected to exceed $600 billion, highlighting market opportunities. |

| International Buyers | Other media companies | Impresa actively pursued international sales of its content library. |

Cost Structure

Impresa's cost structure heavily features content production and acquisition. This includes significant outlays for creating original television shows, news, and podcasts, alongside securing rights for third-party content. These expenditures directly influence the caliber and breadth of Impresa's offerings.

Key cost drivers involve talent fees, production crew salaries, equipment rental, and intellectual property licensing. For instance, a major drama series can cost tens of millions of dollars to produce. Impresa's strategic goal is to actively manage and reduce its overall cost base, with a specific focus on production expenses, aiming for optimization between 2025 and 2028.

Impresa faces significant technology and infrastructure expenses to keep its broadcasting, digital platforms, and IT systems running and updated. These costs cover essential elements like servers, network hardware, software licenses, and crucial cybersecurity protections, ensuring smooth content delivery and competitive edge.

For instance, in 2024, companies in the media and entertainment sector reported an average of 15-20% of their operating expenses dedicated to technology infrastructure, reflecting the substantial investment needed. This investment is vital for Impresa's multi-platform distribution, enabling content to reach audiences across various channels efficiently.

Personnel costs, encompassing salaries, benefits, and other employment expenses for Impresa's extensive workforce across journalism, production, sales, technical, and administrative functions, represent a significant portion of its expenditures. In 2024, like previous years, managing these human capital investments is paramount to the company's financial health.

Beyond personnel, operational costs include general administrative expenses, utilities, and office upkeep, contributing to the overall cost structure. Impresa has been actively pursuing strategies to optimize its cost base through various operational efficiency measures throughout 2024, aiming for a leaner and more cost-effective operation.

Marketing and Promotion Expenditures

Impresa invests heavily in marketing and promotion to draw and keep viewers for its TV channels, readers for its print publications, and users for its digital platforms. These costs encompass a wide range of activities, including advertising campaigns across various media, targeted digital marketing efforts, public relations outreach, and ongoing brand development to solidify its market presence.

These expenditures are fundamental to Impresa's strategy for holding onto its audience share and, consequently, boosting both subscription numbers and advertising revenue. For instance, in 2024, Impresa reported significant marketing spend to support the launch of new content and digital initiatives, aiming to capture a larger segment of the digital advertising market which saw overall growth.

Key marketing and promotion expenditures for Impresa include:

- Advertising Campaigns: Broad-reaching campaigns across television, radio, and print to increase brand visibility.

- Digital Marketing: Investments in search engine optimization (SEO), social media marketing, content marketing, and programmatic advertising to reach online audiences.

- Public Relations: Efforts to manage media relations, generate positive press, and enhance corporate reputation.

- Brand Building: Initiatives focused on strengthening brand identity and loyalty among consumers and advertisers.

Distribution and Logistics Costs

Distribution and logistics costs are a significant component for Impresa. For their print publication, Expresso, this involves expenses tied to the physical printing process, the transportation of newspapers to various points of sale, and the overall logistics of getting the product to readers. These are direct costs associated with the tangible nature of print media.

For their television operations, Impresa incurs costs related to broadcasting. This includes the expenses for transmitting content over the airwaves and any fees paid to network operators or affiliates for carriage and distribution. These are essential for reaching their television audience.

While digital distribution offers efficiencies by eliminating many physical overheads, it introduces its own set of expenses. These include the ongoing costs of hosting digital content, ensuring reliable data transfer through bandwidth, and maintaining the platforms that deliver their digital products. It's a shift in cost structure, not an elimination of it.

Impresa Publishing demonstrated a focus on optimizing these costs. In 2024, the company reported a reduction in operating costs, partly attributed to decreased production expenses for Expresso. This suggests a strategic effort to streamline their distribution and logistics, potentially through more efficient printing or delivery networks.

- Printing and Physical Distribution: Costs associated with producing and delivering physical copies of Expresso.

- Transmission and Network Fees: Expenses for broadcasting television content and paying network operators.

- Digital Infrastructure: Costs for data hosting and bandwidth required for digital content delivery.

- 2024 Cost Reduction: Impresa saw lower operating costs due to reduced production expenses for Expresso, highlighting efficiency gains in this area.

Impresa's cost structure is multifaceted, encompassing content creation, technology, personnel, marketing, and distribution. These elements are crucial for maintaining its media operations and reaching its diverse audience.

In 2024, Impresa's commitment to cost optimization was evident, particularly in areas like production for its print publication, Expresso. This focus on efficiency aims to balance necessary investments with financial prudence.

The company's significant investment in content production, including original shows and licensed material, directly correlates with its ability to attract and retain viewers and readers.

Technology infrastructure remains a substantial cost, supporting Impresa's multi-platform delivery and ensuring a competitive digital presence.

| Cost Category | Key Components | 2024 Relevance |

|---|---|---|

| Content Production & Acquisition | Original TV shows, news, podcasts, licensing fees | Major expenditure influencing offering quality. |

| Technology & Infrastructure | Servers, software, cybersecurity | Essential for multi-platform delivery; sector average 15-20% of operating expenses in 2024. |

| Personnel Costs | Salaries, benefits for all staff | Significant portion of expenditures, vital for financial health. |

| Marketing & Promotion | Advertising, digital marketing, PR | Crucial for audience retention and revenue growth. |

| Distribution & Logistics | Printing, physical transport, digital hosting, bandwidth | Direct costs for print; infrastructure costs for digital. |

Revenue Streams

Impresa's core revenue generator is advertising, sold across its television network SIC, the Expresso newspaper, and various digital properties. Advertisers invest in these channels to connect with Impresa's substantial and varied consumer base.

In 2024, Impresa's advertising revenue from SIC, a leading Portuguese television channel, remains a critical component of its financial performance. The company leverages its significant audience reach and sophisticated targeting options to attract and retain advertisers.

Impresa generates a significant portion of its income through subscription and digital access fees. This includes revenue from its popular Opto streaming service and digital subscriptions for its newspaper, Expresso. This direct-to-consumer approach fosters a reliable and expanding revenue base as consumers increasingly favor premium, ad-free digital content.

The company has seen a positive trend in user adoption for these digital offerings. For instance, Opto's subscriber base has been on an upward trajectory, and Expresso's paid digital circulation has also shown growth, underscoring the effectiveness of Impresa's strategy to diversify its revenue beyond traditional media.

Impresa generates significant revenue by selling and syndicating its original content, especially its popular television shows, to broadcasters and platforms both within Brazil and internationally. This strategy effectively monetizes the company's intellectual property, extending its reach and profitability beyond its home market.

A key driver for this revenue stream is Impresa's focus on its telenovela productions, which have a strong track record and appeal. The company's ambition to increase the international sale of these and other content formats presents a substantial growth opportunity, tapping into global demand for high-quality Brazilian programming.

Channel Distribution Fees

Impresa generates revenue through channel distribution fees, receiving payments from cable, satellite, and telecom providers for featuring its television channels. These fees are typically structured based on subscriber counts and contractual agreements, creating a predictable revenue flow for the company's broadcasting operations.

This model is crucial for ensuring Impresa's content reaches a wide audience while simultaneously providing financial compensation for that distribution. For instance, in 2024, major media conglomerates often negotiate carriage fees that can range from fractions of a cent to several dollars per subscriber per month, depending on the channel's popularity and exclusivity.

- Subscriber-Based Revenue: Fees are directly tied to the number of subscribers each distribution platform has.

- Contractual Agreements: Revenue is secured through long-term contracts with cable, satellite, and telecom operators.

- Broad Reach Compensation: Impresa is financially rewarded for making its channels available to a large consumer base.

Other Diversified Revenue

Impresa's revenue diversification extends beyond its core media operations. The company actively generates income through brand licensing, allowing other entities to utilize its established brands. This strategy taps into the value of Impresa's intellectual property and brand recognition.

Furthermore, Impresa capitalizes on its expertise by organizing events, such as the notable Podcast Festival. These events serve not only as revenue generators but also as platforms for community engagement and brand building within the podcasting ecosystem. For instance, the 2023 Podcast Festival saw significant attendance and sponsorship, contributing positively to Impresa's diverse revenue portfolio.

The company also explores opportunities for asset sales, which can provide additional, albeit potentially one-off, revenue injections. While these individual streams may be smaller in scale compared to its primary advertising revenue, their collective contribution enhances Impresa's financial resilience and provides strategic flexibility. This focus on broadening revenue sources is a deliberate strategy to mitigate risks associated with reliance on a single income stream.

- Brand Licensing: Monetizing intellectual property through partnerships.

- Event Organization: Generating revenue from events like the Podcast Festival.

- Asset Sales: Strategic disposal of assets for financial benefit.

- Strategic Importance: Enhancing financial resilience and flexibility through diversification.

Impresa's revenue streams are multifaceted, encompassing advertising, subscriptions, content sales, distribution fees, brand licensing, and event organization. This diverse approach aims to create a robust financial foundation.

In 2024, advertising on SIC and Expresso remains a cornerstone, complemented by growing digital subscriptions for Opto and Expresso. International content sales, particularly telenovelas, also contribute significantly, leveraging Impresa's strong production capabilities.

Channel distribution fees provide a predictable income, while brand licensing and events like the Podcast Festival further diversify earnings. These varied income sources enhance Impresa's financial resilience and strategic flexibility.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Advertising | Sales across TV, print, and digital platforms | Key contributor, leveraging SIC's audience reach. |

| Subscriptions & Digital Access | Fees from Opto streaming and Expresso digital editions | Growing user adoption for Opto and Expresso digital. |

| Content Sales & Syndication | International sales of original content, especially telenovelas | Significant growth opportunity through global demand. |

| Channel Distribution Fees | Payments from distributors for carrying Impresa's channels | Predictable revenue based on subscriber counts and contracts. |

| Brand Licensing & Events | Monetizing brands and revenue from events like Podcast Festival | Enhances financial resilience and brand building. |

Business Model Canvas Data Sources

The Impresa Business Model Canvas is built upon a foundation of comprehensive market research, internal financial reports, and validated customer feedback. These diverse data sources ensure each component of the canvas is strategically sound and grounded in empirical evidence.