IMCD SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

IMCD's market position is strong, but understanding the nuances of its competitive landscape and potential vulnerabilities is crucial for strategic decision-making. Our comprehensive SWOT analysis delves deep into these areas, revealing actionable insights that can shape your investment or business strategy.

Want the full story behind IMCD's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IMCD commands a leading position in the global sales, marketing, and distribution of specialty chemicals and ingredients. This is underscored by their strong 2024 performance, which saw revenues reach €4.7 billion, reflecting ongoing growth and market penetration.

This global leadership translates into substantial market share and robust brand recognition. It also grants IMCD significant economies of scale, enabling preferential relationships with both suppliers and customers across the globe.

Their well-established footprint in numerous diverse geographical regions is a key competitive advantage. This widespread presence enhances their resilience and ability to navigate fluctuating market dynamics effectively.

IMCD's strength lies in its extensive technical expertise, positioning it as a comprehensive solutions provider rather than just a distributor. With over 80 technical centers and labs worldwide, the company offers specialized formulation expertise and value-added services that go beyond basic product supply.

This deep technical knowledge allows IMCD to address complex customer needs and optimize product applications, fostering strong, sticky relationships. For instance, during their 2024 Investor Day, the company emphasized how this solutions-oriented approach differentiates them in the market, driving customer loyalty and supplier partnerships.

IMCD's diverse end-market exposure is a significant strength, with operations spanning crucial sectors like food & nutrition, pharmaceuticals, personal care, and coatings. This broad reach across both life sciences and industrial markets creates a well-balanced portfolio that inherently reduces reliance on any single industry, thereby lowering overall business risk.

This diversification is particularly valuable because the essential nature of these end markets ensures a consistent and stable demand for IMCD's specialty chemicals and ingredients. For instance, the food and pharmaceutical sectors, which are less cyclical, provide a resilient revenue stream, contributing to stable business performance even when other industries face economic headwinds. This resilience was evident in their 2023 performance, where their life science segments generally outperformed industrial ones, showcasing the benefit of this varied exposure.

Robust Acquisition Strategy and Growth through M&A

IMCD's strength lies in its consistently effective acquisition strategy, driving significant growth. In 2024 alone, the company successfully integrated 12 acquisitions, with an additional six completed in the first half of 2025. This aggressive inorganic growth plan is a cornerstone of their expansion, bolstering their global presence and diversifying their market offerings.

These strategic M&A activities are meticulously chosen to broaden IMCD's product portfolio and deepen its technical expertise. Each acquisition not only adds new product lines but also brings in valuable talent and market insights. This approach has demonstrably contributed to substantial increases in annualized revenues and employee headcount, reinforcing their competitive advantage.

- Strategic M&A: 12 acquisitions in 2024, 6 in H1 2025.

- Global Expansion: Broadens geographic footprint and market access.

- Portfolio Enhancement: Increases product diversity and technical capabilities.

- Revenue Growth: Drives significant annualized revenue increases through inorganic means.

Commitment to Digital Transformation and Operational Excellence

IMCD is making significant strides in its digital transformation, pouring resources into a unified global IT infrastructure. This includes the rollout of integrated ERP and CRM systems, alongside AI-powered tools designed to elevate customer service and streamline operations. For instance, by the end of 2023, IMCD had successfully implemented its new ERP system across a substantial portion of its global operations, aiming for full integration by late 2024.

Their commitment to an omnichannel distribution strategy, prominently featuring the MyIMCD e-commerce platform, is a key strength. This digital-first approach not only simplifies the customer journey but also demonstrably boosts satisfaction. The MyIMCD portal saw a 25% increase in user engagement in the first half of 2024 compared to the same period in 2023, reflecting its growing importance.

- Accelerated Digital Investment: IMCD's ongoing investment in its global IT platform, ERP, and CRM systems underpins its digital transformation.

- AI-Enabled Enhancements: The integration of AI tools is geared towards improving service quality and operational efficiency across the board.

- Omnichannel Customer Experience: The MyIMCD e-commerce portal exemplifies their strategy to provide a seamless and satisfying customer interaction.

- Market Responsiveness: This dedication to digital excellence and continuous operational improvement enhances IMCD's agility in dynamic market conditions.

IMCD's extensive global network, encompassing over 80 technical centers and labs, provides a significant competitive edge. This widespread infrastructure allows for localized technical support and formulation expertise, fostering deep customer relationships. Their ability to offer tailored solutions, rather than just products, is a key differentiator, as highlighted by their emphasis on this approach during their 2024 Investor Day.

The company's diverse end-market exposure, spanning food & nutrition, pharmaceuticals, personal care, and industrial sectors, creates a resilient business model. This diversification, particularly in less cyclical markets like life sciences, ensures stable revenue streams. For example, their 2023 performance showed life science segments generally outperforming industrial ones, demonstrating the benefit of this varied exposure.

IMCD's strategic acquisition strategy is a powerful growth engine, evidenced by 12 acquisitions in 2024 and six in the first half of 2025. These carefully selected acquisitions expand their product portfolio and technical capabilities, driving substantial revenue growth and market penetration. This inorganic growth complements their organic expansion, solidifying their market leadership.

Their commitment to digital transformation, including investments in unified IT infrastructure, ERP, CRM, and AI tools, enhances operational efficiency and customer service. The MyIMCD e-commerce platform, which saw a 25% increase in user engagement in H1 2024, exemplifies their successful omnichannel strategy, improving customer satisfaction and market responsiveness.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Global Network & Technical Expertise | Extensive network of technical centers and labs offering specialized formulation and solutions. | Over 80 technical centers worldwide; emphasis on solutions-driven approach (2024 Investor Day). |

| End-Market Diversification | Broad exposure across life sciences and industrial sectors reduces reliance on single markets. | Resilient performance in food & nutrition and pharmaceuticals (2023 results); less cyclical segments provide stable revenue. |

| Strategic Acquisition Strategy | Consistent execution of M&A to expand portfolio, expertise, and geographic reach. | 12 acquisitions in 2024; 6 in H1 2025; drives significant annualized revenue increases. |

| Digital Transformation & Omnichannel | Investment in IT infrastructure, AI, and e-commerce for enhanced customer experience and efficiency. | MyIMCD platform user engagement up 25% in H1 2024; ongoing ERP and CRM integration. |

What is included in the product

This SWOT analysis provides a comprehensive view of IMCD's internal capabilities and external market dynamics, identifying key strengths and weaknesses alongside significant opportunities and threats.

Offers a clear, actionable framework to identify and address strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

IMCD's extensive global footprint means it's susceptible to currency fluctuations. When major currencies weaken, like the US dollar did in the first half of 2025, it directly impacts IMCD's reported revenue and gross margin. This can create volatility in financial results, even if the core business operations remain robust.

While IMCD has demonstrated robust revenue growth, its profitability has faced headwinds. For instance, the first half of 2025 saw a 7% decline in the net result. This suggests that translating increased sales into higher profits isn't always straightforward.

Several factors could be contributing to this pressure on profitability. Higher net finance costs, a potential increase in inventory levels, or shifts in the product mix could all be impacting the bottom line. The operating EBITA margin has also seen a decrease in certain segments, highlighting the challenge of maintaining margins amidst growth.

IMCD's financial position shows a notable increase in net debt, reaching €1.5 billion by the first half of 2025, a rise of €260 million. This escalation in borrowing, driven partly by strategic acquisitions and the need to maintain higher inventory levels, has pushed the leverage ratio to 2.6 times EBITDA.

This heightened leverage could be a point of concern for investors, potentially signaling reduced financial flexibility for future investments or unexpected economic downturns. Effectively managing these debt levels will be paramount for sustaining IMCD's financial stability and operational capacity.

Susceptibility to Market Volatility and Demand Uncertainty

IMCD's business model is inherently exposed to the ebb and flow of global markets, making it vulnerable to unexpected shifts in economic conditions. This susceptibility means that periods of market downturn or uncertainty can lead to a noticeable cooling of customer demand. For instance, during the latter half of 2023 and into early 2024, many industries experienced a slowdown, impacting the purchasing patterns of IMCD's clients.

This volatility creates a challenging environment for forecasting. Customers, facing their own demand uncertainties, are increasingly adopting lean inventory strategies and prioritizing just-in-time deliveries. This reduces the lead time for orders and significantly limits IMCD's visibility into future sales, making it difficult to provide accurate near-term trading outlooks. This trend was evident in IMCD's Q4 2023 earnings call, where management highlighted the shorter order books compared to previous periods.

The direct consequence of this market unpredictability is a potential impact on sales volumes. When demand softens and visibility is low, IMCD must be adept at managing its working capital efficiently. This includes careful inventory management and ensuring strong receivables collection to maintain financial flexibility amidst fluctuating sales. For example, a sudden drop in demand for specialty chemicals could tie up significant capital in inventory if not managed proactively.

- Market Volatility: IMCD operates in sectors sensitive to economic cycles, meaning demand can fluctuate significantly.

- Demand Uncertainty: A shift towards just-in-time inventory by customers reduces visibility and complicates sales forecasting.

- Working Capital Management: Unpredictable sales volumes necessitate robust strategies for managing inventory and receivables.

- Short-Term Focus: Limited visibility beyond immediate periods hinders the ability to provide reliable longer-term trading outlooks.

Integration Challenges with Frequent Acquisitions

IMCD's aggressive acquisition strategy, while fueling growth, presents significant integration hurdles. Merging diverse operational frameworks, distinct corporate cultures, and disparate IT infrastructures can prove complex and resource-intensive. These challenges, if not managed effectively, can lead to unforeseen expenses and temporary operational inefficiencies, impacting the immediate financial performance of the acquired entities.

The potential for integration friction is a notable weakness. For instance, while IMCD reported a strong 2023 with revenue growth, the successful assimilation of its 2023 acquisitions, such as the acquisition of IMCD Canada and the addition of three new businesses in the Americas in Q4 2023, will be crucial for realizing projected synergies and maintaining momentum into 2024 and beyond. Failure to smoothly integrate these new operations could dilute the strategic benefits and introduce unexpected costs.

Key integration challenges include:

- Cultural Mismatch: Bridging differing organizational values and work styles.

- IT System Consolidation: Harmonizing legacy IT platforms with IMCD's core systems.

- Operational Synergies: Achieving expected cost savings and revenue enhancements from combined operations.

IMCD's reliance on acquisitions, while a growth driver, introduces integration risks. Successfully merging different company cultures, IT systems, and operational processes can be challenging and costly. For example, the integration of its 2023 acquisitions, including IMCD Canada and three new Americas businesses, requires careful management to realize expected synergies and avoid operational disruptions.

What You See Is What You Get

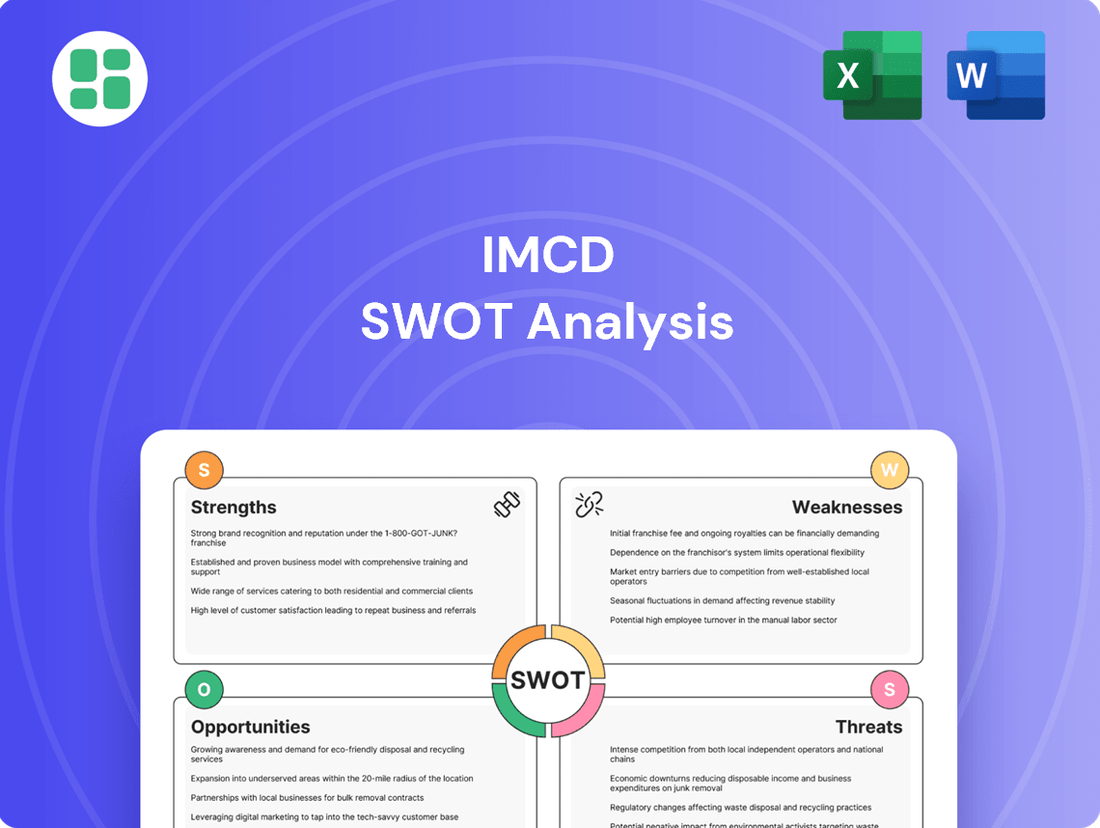

IMCD SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of IMCD's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning. You'll gain access to the complete, professionally structured analysis immediately after completing your purchase.

Opportunities

IMCD is well-positioned to boost its presence in rapidly expanding sectors like pharmaceuticals, personal care, and specialized nutrition. The company's acquisition of Ferrer Alimentación in early 2024, for instance, is a strategic move to bolster its food and beverage segment in the Iberian region, demonstrating a commitment to organic and inorganic growth in key markets.

The global push for sustainability presents a prime opportunity for IMCD to broaden its offerings in eco-friendly and bio-based specialty chemicals. This aligns perfectly with their strategic direction to provide more environmentally sound ingredients and formulations.

IMCD's strong sustainability credentials, evidenced by their EcoVadis platinum rating and a dedicated 'State of Sustainability' report, equip them to effectively navigate increasing regulatory demands and shifting consumer desires for greener products.

IMCD has significant opportunities to expand its global reach, with a particular emphasis on emerging markets that offer substantial growth potential. This strategic move aims to tap into new customer bases and capitalize on developing economies.

The company's recent acquisition of Bretano in Latin America and Trichem in India clearly signals its commitment to this geographic expansion strategy. These moves are designed to establish a stronger presence in regions poised for rapid economic development.

By entering these new markets, IMCD can unlock diverse revenue streams and create a more resilient and geographically balanced business. This diversification is crucial for long-term stability and maximizing global market share.

Leveraging Digitalization for Enhanced Customer Solutions

IMCD can seize the opportunity to deepen customer engagement and streamline operations by continuing its investment in digital infrastructure and AI-powered tools. This strategic focus on digitalization is crucial for staying competitive in the evolving chemical distribution landscape.

The company's successful launch of its AI-driven sales assistant for product recommendations demonstrates the tangible benefits of digital transformation in improving service delivery and operational efficiency. This tool not only aids customers in finding the right solutions but also enhances the productivity of IMCD's sales teams.

Further embracing digital transformation opens avenues for developing innovative business models and optimizing the entire supply chain. This could involve leveraging data analytics for better inventory management, predictive maintenance for logistics, and creating more seamless digital interactions for clients.

For instance, in 2023, IMCD reported a 10% increase in digital sales interactions, highlighting the growing reliance on digital channels for customer solutions. Continued investment in these areas is expected to yield further growth, with projections indicating a potential 15% uplift in efficiency gains by 2025 through advanced digital integration.

- Digital Infrastructure Investment: Continued focus on enhancing IT systems and AI capabilities to support advanced customer solutions.

- AI-Enabled Tools: Expanding the use of AI, like the sales assistant, to improve product recommendations and customer service.

- New Business Models: Exploring digital-first approaches to product sourcing, delivery, and customer support.

- Supply Chain Optimization: Utilizing digital technologies for greater visibility, efficiency, and resilience in logistics and inventory management.

Value Creation through Continuous Improvement and Innovation

IMCD's dedication to continuous improvement, embedded as a core cultural value, drives the ongoing refinement of its operational processes and the advancement of its solution offerings. This proactive approach ensures they are constantly adapting and enhancing their services to meet evolving market demands.

By fostering a culture of innovation and leveraging its extensive network of technical centers, IMCD actively collaborates with partners to co-develop pioneering solutions. This collaborative spirit is crucial for staying at the forefront of industry advancements and delivering novel applications.

This commitment to innovation directly translates into sustained value creation for both suppliers and customers. For instance, in 2023, IMCD reported a 14% increase in revenue, partly attributed to its ability to introduce new, value-added solutions to its customer base, demonstrating the tangible impact of their innovation strategy.

- Cultural Integration: Continuous improvement is actively promoted as a company-wide value.

- Collaborative Development: Innovation is fostered through partnerships and the utilization of technical centers.

- Market Responsiveness: This focus allows IMCD to anticipate and adapt to emerging market trends.

- Value Proposition: The emphasis on innovation ensures ongoing delivery of enhanced value to all stakeholders.

IMCD is strategically positioned to capitalize on growing demand in key sectors like pharmaceuticals and personal care. The company's 2024 acquisition of Ferrer Alimentación in the Iberian region highlights its commitment to expanding its food and beverage segment through both organic and inorganic growth.

The global shift towards sustainability presents a significant opportunity for IMCD to expand its portfolio of eco-friendly and bio-based specialty chemicals, aligning with market trends and customer preferences for greener products. IMCD's platinum rating from EcoVadis underscores its strong sustainability credentials, enabling it to navigate evolving regulations and consumer expectations effectively.

Emerging markets offer substantial growth potential, and IMCD is actively pursuing geographic expansion with acquisitions like Bretano in Latin America and Trichem in India. This strategy aims to establish a stronger foothold in regions poised for rapid economic development, diversifying revenue streams and enhancing global market share.

Continued investment in digital infrastructure and AI-powered tools presents an opportunity for IMCD to deepen customer engagement and streamline operations. The successful launch of its AI-driven sales assistant, which improved product recommendations, demonstrates the tangible benefits of digital transformation in enhancing service delivery and operational efficiency.

A culture of continuous improvement, coupled with the utilization of its extensive network of technical centers, allows IMCD to foster innovation through collaboration. This approach enables the co-development of pioneering solutions, as evidenced by a 14% revenue increase in 2023, partly driven by the introduction of new, value-added offerings.

| Opportunity Area | Key Action/Strategy | Supporting Data/Example |

|---|---|---|

| Sector Expansion | Focus on high-growth sectors (Pharma, Personal Care) | Acquisition of Ferrer Alimentación (2024) to boost F&B in Iberia |

| Sustainability Focus | Expand eco-friendly and bio-based chemical offerings | EcoVadis platinum rating supports alignment with market trends |

| Geographic Growth | Target emerging markets | Acquisitions in Latin America (Bretano) and India (Trichem) |

| Digital Transformation | Invest in IT and AI for customer solutions | AI sales assistant improved product recommendations; 10% increase in digital sales interactions (2023) |

| Innovation & Collaboration | Co-develop solutions via technical centers | 14% revenue increase (2023) linked to new solution introductions |

Threats

A significant global economic slowdown or recessionary pressures represent a substantial threat to IMCD. Such downturns can shrink industrial output and consumer spending, directly dampening demand for the specialty chemicals IMCD distributes across various end markets. This could translate into lower sales volumes and heightened pricing competition, impacting the company's profitability.

The ongoing macroeconomic and political uncertainty further complicates demand forecasting, creating a persistent challenge for IMCD's financial planning and performance. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting the fragile economic environment.

The specialty chemicals distribution landscape is a crowded arena, featuring formidable global and regional competitors, alongside manufacturers increasingly opting for direct sales channels. This heightened competition directly translates into intensified pricing pressure on IMCD's offerings, potentially squeezing gross profit margins and impacting conversion rates.

For instance, in 2024, the average gross profit margin for distributors in similar sectors has seen a slight contraction due to these competitive dynamics. IMCD must therefore continue to invest in value-added services and maintain a clear differentiation strategy to navigate this challenging market effectively and preserve its profitability.

Despite IMCD's sophisticated logistics, the company faces significant risks from global supply chain disruptions, often fueled by geopolitical tensions and trade barriers. For instance, the ongoing conflicts and trade disputes in various regions in 2024 continue to create volatility, potentially increasing shipping costs and limiting access to key chemical raw materials.

These instabilities can directly impact IMCD's operational efficiency and profitability by raising the cost of sourcing essential products and potentially hindering its ability to serve certain markets. The company's broad international presence, a strategic advantage, also means it's more exposed to these widespread external shocks.

Evolving Regulatory Landscape and Compliance Costs

The specialty chemicals sector faces a constantly shifting regulatory environment, with new environmental, health, and safety rules emerging globally. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, impacting chemical manufacturers and distributors. Compliance with these increasingly stringent standards necessitates significant investment in updated processes and potentially limits the scope of available products.

These regulatory demands translate directly into higher operational expenses for companies like IMCD. The need for rigorous testing, documentation, and adherence to new safety protocols can substantially increase overhead. Failure to navigate this complex web of regulations effectively can lead to severe financial penalties and damage to a company's reputation, creating a persistent risk factor.

- Increased compliance costs: In 2024, the chemical industry globally is projected to spend billions on meeting evolving environmental and safety standards, a trend expected to continue into 2025.

- Potential product restrictions: New regulations, such as those concerning PFAS (per- and polyfluoroalkyl substances), could restrict the use of certain chemicals in specific applications, impacting product portfolios.

- Reputational and financial risks: Non-compliance can result in substantial fines, as seen in past cases where companies faced multi-million dollar penalties for regulatory breaches.

Technological Advancements and Product Substitution

Rapid advancements in areas like green chemistry and biotechnology present a significant threat, as they could introduce novel, sustainable alternatives that displace traditional specialty chemicals IMCD distributes. For instance, the growing demand for bio-based polymers, projected to reach over $100 billion globally by 2030, could directly impact IMCD's petrochemical-based product segments.

New scientific breakthroughs in material science might also lead to the creation of advanced materials with superior performance characteristics, rendering IMCD's current offerings less competitive. The increasing pace of innovation means IMCD must continuously invest in understanding emerging technologies and be agile in adapting its product portfolio to avoid obsolescence.

Consider these potential impacts:

- Development of bio-alternatives: Competitors could leverage biotechnology to create bio-based chemicals that offer similar or enhanced functionality at a lower environmental cost, potentially eroding market share for IMCD's conventional products.

- Emergence of disruptive manufacturing processes: New, more efficient or cost-effective production methods for chemicals could emerge, making IMCD's existing supply chain and product mix less attractive.

- Shifting customer demands: As end-users become more aware of sustainability and performance, they may actively seek out newer, technologically superior materials, forcing IMCD to quickly pivot its distribution strategy.

The competitive landscape for specialty chemicals distribution is intensifying, with both global and regional players, as well as manufacturers pursuing direct sales, increasing pressure on IMCD. This heightened competition leads to greater pricing challenges, potentially impacting IMCD's profit margins. For instance, in 2024, average gross profit margins in similar sectors saw a slight contraction due to these dynamics, underscoring the need for IMCD to maintain its differentiation and value-added services.

SWOT Analysis Data Sources

This IMCD SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry insights. These diverse data sources ensure a thorough and accurate assessment of IMCD's strategic position.