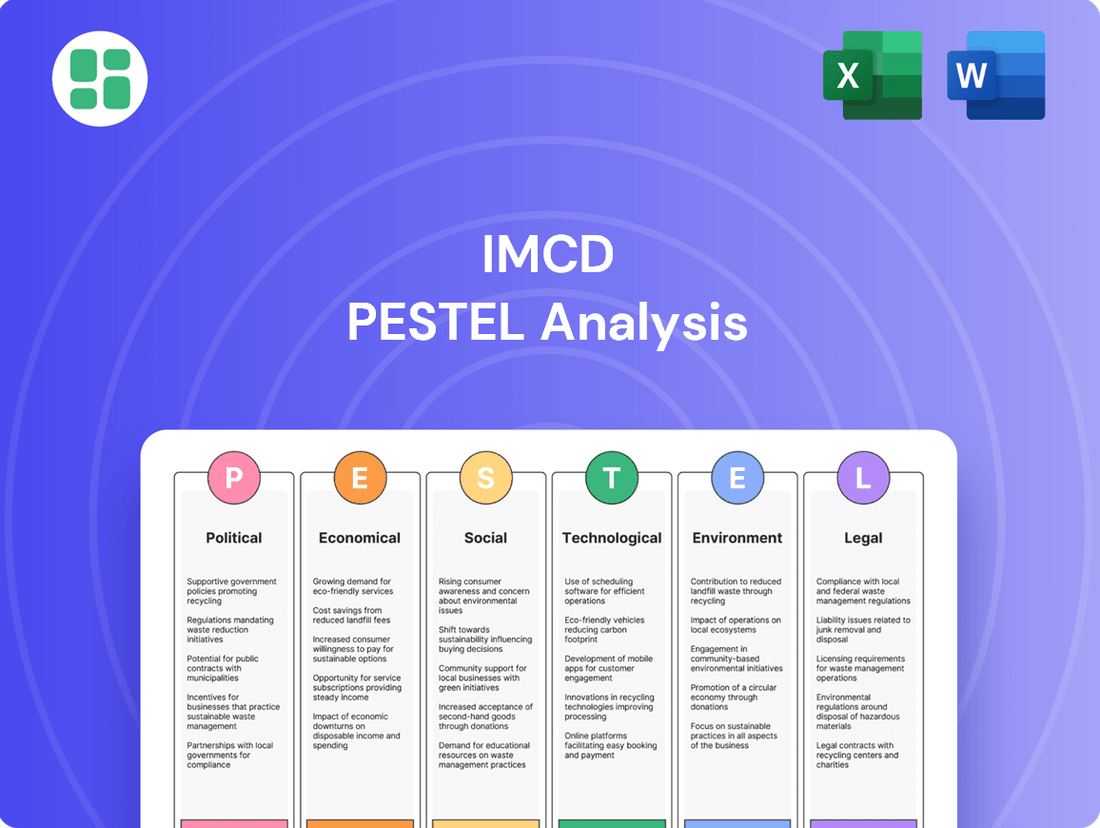

IMCD PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping IMCD's strategic landscape. Our meticulously researched PESTLE analysis provides the essential intelligence you need to anticipate market shifts and capitalize on opportunities. Don't guess about the future; download the full version now and gain a decisive advantage.

Political factors

IMCD's global operations mean it's highly sensitive to changes in international trade policies, including tariffs and protectionism. For example, the ongoing trade tensions between major economies in 2024 could lead to increased import duties on specialty chemicals, impacting IMCD's cost of goods sold and potentially reducing demand in affected regions.

Shifts in trade agreements, such as renegotiations of existing pacts or the implementation of new ones, can directly affect IMCD's supply chain efficiency and market access. A new trade deal in Southeast Asia, for instance, might open up new opportunities or create new hurdles for sourcing raw materials or distributing finished products.

Geopolitical events and trade disputes introduce significant uncertainty. The conflict in Eastern Europe, which continued into 2024, has already disrupted global chemical supply chains and energy markets, creating volatility that IMCD must navigate. This instability can lead to unexpected cost increases and operational challenges.

Governmental regulations on chemical safety are a significant political factor for IMCD. The specialty chemicals sector is subject to stringent and evolving rules globally, impacting everything from manufacturing processes to product disposal. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, continually updated, requires extensive data submission for chemical substances, directly affecting IMCD's product portfolio and market access.

Navigating these complex compliance requirements, including product registrations, safety data sheets, and adherence to environmental standards, is paramount for IMCD's operational legitimacy and continued market presence. Failure to comply can lead to substantial fines and reputational damage, underscoring the critical importance of staying abreast of regulatory changes and ensuring robust internal compliance frameworks.

Governments worldwide are increasingly rolling out targeted policies to boost specific sectors, including incentives for green chemistry and local production. For instance, the European Union's Green Deal, with its ambitious sustainability targets, is driving demand for eco-friendly chemical solutions, a key area for IMCD.

These initiatives directly impact IMCD by potentially opening new market avenues for its sustainable product lines and influencing consumer and industrial demand for specific ingredients. Staying ahead of these policy shifts, such as the 2024 US Inflation Reduction Act's clean energy tax credits, is crucial for IMCD's strategic planning and competitive positioning.

Political risk in key operating regions

Political instability, shifts in government leadership, or civil unrest within regions where IMCD has substantial operations or sources materials pose a direct threat to its supply chains and overall business continuity. For instance, in 2023, geopolitical tensions in Eastern Europe, a region where IMCD has a presence, led to increased logistical complexities and raw material price volatility, impacting distribution networks.

Effectively assessing and proactively mitigating these political risks is paramount for IMCD to sustain dependable distribution channels and guarantee uninterrupted service delivery to its diverse customer base. The company's 2024 strategy explicitly outlines enhanced due diligence processes for new market entries, factoring in political stability metrics. For example, IMCD's expansion into Southeast Asia in late 2023 involved a thorough analysis of the political landscape in Vietnam and Indonesia, leading to a phased market penetration approach.

These political considerations significantly shape IMCD's strategic investment decisions and its approach to entering new markets. The company's 2024 capital expenditure plan reflects a cautious allocation towards regions with stable political environments, while simultaneously investing in robust risk management frameworks for emerging markets. IMCD reported in its 2024 investor relations update that its exposure to high-risk political zones was managed through diversified sourcing and localized partnerships, minimizing potential disruptions.

- Geopolitical Tensions Impact: In 2023, geopolitical events in Eastern Europe caused supply chain disruptions and price fluctuations for specialty chemicals, affecting IMCD's operational efficiency.

- Risk Mitigation Strategies: IMCD's 2024 strategy emphasizes enhanced political risk assessment for new market entries, particularly in Southeast Asia, as seen in its Vietnam and Indonesia market entry.

- Investment Decision Influence: Political stability is a key determinant in IMCD's 2024 capital allocation, favoring stable regions while strengthening risk management in emerging markets.

- Diversification Benefits: IMCD's 2024 investor update highlighted how diversified sourcing and local partnerships helped mitigate the impact of political risks in certain operating regions.

International relations and supply chain security

Geopolitical shifts significantly impact the global specialty chemicals market, directly influencing supply chain stability for companies like IMCD. For instance, ongoing trade disputes and regional conflicts in 2024-2025 have led to increased shipping costs and lead times for critical chemical intermediates. This necessitates proactive strategies for IMCD to ensure uninterrupted product flow and maintain market access.

Sanctions and export controls, particularly those implemented in response to international tensions, can create substantial hurdles. These measures can restrict access to essential raw materials sourced from specific countries or limit IMCD's ability to serve certain end markets. As of early 2025, several key chemical-producing regions are under varying degrees of trade restrictions, underscoring the need for IMCD to maintain a diversified supplier base and robust contingency plans.

- Diversified Sourcing: IMCD's strategy to reduce reliance on single-source suppliers for key raw materials is crucial in mitigating risks associated with international relations.

- Risk Management: Implementing advanced supply chain risk assessment tools helps IMCD identify and address potential disruptions arising from geopolitical events.

- Market Access: Navigating export control regulations and diplomatic sensitivities is vital for IMCD to maintain its global market presence and serve its diverse customer base.

- Resilience Planning: Building resilience involves exploring alternative logistics routes and regional production capabilities to counter the effects of international instability.

Political stability and government policies are critical for IMCD's operations, influencing everything from trade agreements to regulatory compliance. Shifts in international trade policies and geopolitical tensions, such as those observed in 2024, directly impact supply chains and costs for specialty chemicals. For example, the ongoing trade friction between major economic blocs in 2024 could lead to higher import duties, affecting IMCD's profitability and market access in affected regions.

Stringent chemical safety and environmental regulations, like the EU's REACH, continually shape IMCD's product portfolio and market access strategies. Furthermore, government incentives for sectors like green chemistry, as seen with the EU's Green Deal and the US's 2024 Inflation Reduction Act, present opportunities for IMCD's sustainable product lines. Proactive engagement with evolving political landscapes and regulatory frameworks is essential for IMCD's sustained growth and competitive edge in the global market.

| Political Factor | Impact on IMCD | Example (2024-2025) |

|---|---|---|

| Trade Policies & Tariffs | Affects cost of goods, market access, and demand. | Increased import duties due to trade tensions between major economies. |

| Geopolitical Instability | Disrupts supply chains, creates price volatility, and impacts business continuity. | Regional conflicts leading to higher shipping costs and extended lead times for chemical intermediates. |

| Chemical Regulations (e.g., REACH) | Dictates product compliance, data submission, and market entry. | Ongoing updates to REACH require continuous adaptation of IMCD's product portfolio. |

| Government Incentives (e.g., Green Chemistry) | Drives demand for sustainable solutions and opens new market avenues. | EU Green Deal and US IRA tax credits boost demand for eco-friendly chemical ingredients. |

What is included in the product

This IMCD PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise, actionable summary of external factors, streamlining strategic decision-making and reducing the mental burden of sifting through extensive data.

Economic factors

Global economic growth significantly influences IMCD's performance, as its business directly mirrors the health of industrial sectors like food, pharma, and coatings. A slowdown in global GDP, for instance, can dampen demand across these key markets. The IMF projected global growth to be 3.2% in 2024, a slight decrease from 3.1% in 2023, indicating a stable but not booming economic environment.

Industrial output is a critical driver for IMCD. When manufacturing and production levels rise, so does the demand for the specialty chemicals and ingredients IMCD distributes. For example, increased construction activity boosts demand for coatings, while a rise in pharmaceutical production necessitates greater ingredient supply. The OECD reported industrial production in its member countries rose by 0.1% in April 2024 compared to the previous month.

Inflationary pressures continue to be a significant economic factor for IMCD. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, indicating broader cost escalations that can impact IMCD's operational expenses like logistics and energy. This environment necessitates agile pricing strategies and robust supplier negotiations to safeguard profit margins.

Raw material costs present another critical challenge. The price of key chemical feedstocks, such as ethylene and propylene, has experienced volatility. For example, European naphtha prices, a primary feedstock, fluctuated significantly throughout 2023 and into early 2024, directly affecting procurement costs for specialty chemical producers and, consequently, IMCD's supply chain economics.

As a global distributor of specialty chemicals and ingredients, IMCD's financial performance is directly influenced by currency exchange rate fluctuations. For instance, in 2023, the company operated across numerous countries, meaning revenues and expenses generated in local currencies are translated into its reporting currency, the Euro. Significant shifts in major currency pairs, such as the USD/EUR or GBP/EUR, can materially alter these reported figures, impacting profitability and the perceived value of its products in different regions.

These currency movements can affect IMCD's competitiveness. If the Euro strengthens against a key trading partner's currency, IMCD's products might become more expensive for buyers in that country, potentially leading to reduced sales volume or pressure on profit margins. Conversely, a weaker Euro could make its offerings more attractive. For example, a 5% appreciation of the Euro against the US Dollar in a reporting period would effectively reduce the Euro-denominated value of its US sales.

To manage this inherent risk, IMCD employs hedging strategies, such as forward contracts, to lock in exchange rates for anticipated transactions. Furthermore, its diversified geographical footprint, with operations spanning Europe, the Americas, and Asia-Pacific, naturally helps to offset some of these currency impacts. This diversification means that while one region's currency might weaken against the Euro, another's might strengthen, creating a natural hedge across its global operations.

Interest rates and capital availability

Changes in global interest rates directly impact IMCD's cost of capital. For instance, the European Central Bank's key interest rates, which influence borrowing costs across the Eurozone, saw significant increases throughout 2023 and into early 2024 to combat inflation. This means IMCD's expenses for financing acquisitions or expanding its distribution network could be higher.

Capital availability is equally critical for IMCD's strategic growth. A robust economy with accessible credit markets allows the company to pursue acquisition opportunities and invest in new market entries more readily. Conversely, tighter credit conditions can constrain these expansion efforts, potentially slowing down IMCD's growth trajectory.

- Impact on Borrowing Costs: Rising benchmark rates, such as the US Federal Funds Rate, directly increase the cost of any debt financing IMCD undertakes for its operations or strategic acquisitions.

- Acquisition Financing: Higher interest rates make it more expensive for IMCD to borrow funds for potential acquisitions, a key growth driver for the company.

- Working Capital Management: Increased borrowing costs can also affect the expense of managing day-to-day working capital needs, impacting overall profitability.

- Investment Attractiveness: The availability and cost of capital influence the attractiveness of new investment projects, potentially delaying or accelerating strategic initiatives.

Consumer spending and market demand shifts

Even though IMCD operates in a business-to-business (B2B) environment, the demand for its specialty chemicals and ingredients is ultimately tied to what consumers are buying. For instance, if consumers start favoring natural and sustainable personal care products, this directly impacts the demand for specific ingredients that IMCD supplies to manufacturers in that sector. This means IMCD needs to stay keenly aware of consumer spending habits and preferences, as these ripple effects significantly shape market demand for its offerings.

Consumer spending patterns, whether it's a move towards premiumization or a focus on value, directly influence the types of specialty ingredients that end-product manufacturers seek. For example, in 2024, reports indicated continued consumer interest in wellness and health-focused products, which translates to higher demand for functional food ingredients and specialized cosmetic actives that IMCD distributes.

IMCD's ability to adapt its product portfolio to these evolving consumer demands is crucial for maintaining its market position. The company must anticipate shifts, such as the growing demand for plant-based alternatives in the food industry or the increasing preference for eco-friendly formulations in home care, and ensure it has the right ingredients available for its B2B customers.

- Consumer spending in the US grew by an annualized rate of 2.0% in Q1 2024, indicating continued, albeit moderate, demand.

- The global specialty chemicals market is projected to reach over $900 billion by 2028, with consumer-driven segments like personal care and food & nutrition showing strong growth potential.

- Surveys in early 2024 highlighted that over 60% of consumers are willing to pay more for products perceived as sustainable or healthier, directly impacting ingredient sourcing.

Economic factors significantly shape IMCD's operating environment, influencing demand, costs, and financial strategies. Global economic growth, industrial output, inflation, raw material costs, currency fluctuations, interest rates, and capital availability are all key considerations. The company's performance is intrinsically linked to the health of the industries it serves, making it sensitive to macroeconomic trends. Staying agile in pricing, managing supply chain costs, and employing financial hedging are crucial for navigating these economic complexities.

Preview the Actual Deliverable

IMCD PESTLE Analysis

The preview shown here is the exact IMCD PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting IMCD. You can trust that the insights and structure you see now are precisely what you'll be working with.

Sociological factors

Consumers are increasingly prioritizing sustainability, seeking out products with natural and ethically sourced ingredients. This shift is evident across various sectors, with food, personal care, and home care showing particularly strong demand for eco-friendly options. For instance, a 2024 report indicated that over 60% of consumers globally are willing to pay more for sustainable products.

IMCD can capitalize on this trend by highlighting its portfolio of green chemistry solutions and championing sustainable sourcing practices. By aligning with these evolving consumer values, IMCD can not only meet market demand but also drive growth for its specialty ingredients. This focus on sustainability directly influences how products are developed and marketed.

The growing consumer focus on health and wellness significantly shapes purchasing decisions across food and pharmaceutical sectors. This translates into a heightened demand for functional ingredients, reduced sugar content, and plant-based options. For instance, the global functional food market was valued at approximately $260 billion in 2023 and is projected to grow substantially, driven by these trends.

IMCD's strategic advantage lies in its capacity to supply ingredients that align with these evolving health preferences, such as those promoting gut health or bolstering immunity. This capability is vital for IMCD to remain competitive and tap into emerging market opportunities. The company's R&D efforts are increasingly directed towards sourcing and developing such specialized ingredients, as evidenced by their portfolio expansion in 2024 to include more natural and health-oriented solutions.

Demographic shifts are fundamentally reshaping consumer needs. For instance, the global population aged 65 and over is projected to reach 1.5 billion by 2050, a significant increase that will likely fuel demand for health-focused ingredients and nutraceuticals. This aging trend, coupled with increasing urbanization, which saw over half the world's population living in urban areas in 2023, creates a dual demand for both specialized health solutions and convenient food options.

Lifestyle changes, particularly evolving dietary habits, present further opportunities. Growing consumer interest in plant-based diets, for example, is a major trend, with the global plant-based food market expected to reach $162 billion by 2030. IMCD needs to stay attuned to these evolving preferences, such as the rise in demand for clean label products and functional foods, to effectively tailor its ingredient solutions and identify new market niches.

Workforce demographics and talent pool

The availability of skilled professionals, particularly chemists, technical sales experts, and supply chain specialists, is fundamental to IMCD's success. For instance, in 2024, the global demand for chemical engineers was projected to grow by 4% annually, highlighting the competitive landscape for specialized talent.

Demographic shifts, such as an aging workforce in developed nations and a potential shortage of individuals with advanced technical skills, present challenges for talent acquisition and retention. Reports from 2024 indicated that over 30% of the scientific workforce in some European countries were nearing retirement age, creating a need for proactive succession planning.

To address these trends and secure its human capital, IMCD must continue to invest in robust training and development programs, alongside fostering attractive workplace cultures. This strategic focus on human capital directly influences operational capacity and the company's ability to drive innovation in the specialty chemicals sector.

- Talent Scarcity: The global shortage of specialized scientific and technical talent, particularly in areas like advanced materials and sustainable chemistry, impacts recruitment efforts.

- Aging Workforce: In key markets, a significant portion of the experienced workforce is approaching retirement, necessitating knowledge transfer and new talent pipelines.

- Skills Gap: A mismatch between available skills and industry needs, especially in digital and data analytics within the chemical sector, requires targeted upskilling initiatives.

- Diversity and Inclusion: Building a diverse workforce is crucial for innovation and market understanding, with companies like IMCD increasingly focusing on inclusive hiring practices to broaden their talent pool.

Corporate social responsibility and ethical consumption

Stakeholders, from customers to investors and employees, are increasingly prioritizing companies with robust corporate social responsibility (CSR) and ethical operations. For IMCD, demonstrating commitment to responsible sourcing, fair labor, and transparent dealings is crucial for building trust and enhancing its brand reputation. This focus on ethics is no longer just good practice; it's a significant competitive advantage in today's market.

The demand for ethical consumption is a powerful sociological force shaping business practices. Consumers are more informed and willing to support brands that align with their values. This translates into a growing market for products and services that are produced sustainably and ethically. Companies like IMCD that can clearly articulate and demonstrate their commitment to these principles are better positioned to attract and retain customers, as well as investors who are increasingly incorporating ESG (Environmental, Social, and Governance) factors into their decision-making.

- Reputation Enhancement: Strong CSR practices can significantly boost IMCD's public image.

- Customer Loyalty: Ethical operations foster trust and encourage repeat business.

- Investor Attraction: ESG-focused investors are drawn to companies with demonstrable social responsibility.

- Talent Acquisition: Employees prefer to work for organizations with strong ethical foundations.

Sociological factors significantly influence consumer behavior and market trends. The increasing demand for sustainable and ethically sourced products, driven by heightened environmental awareness, is a key driver. For instance, a 2024 survey indicated that 65% of consumers consider sustainability when making purchasing decisions, a notable increase from previous years.

Health and wellness remain paramount, with a growing preference for functional ingredients and plant-based alternatives. The global market for nutraceuticals, valued at over $200 billion in 2023, demonstrates this trend. IMCD's ability to supply innovative ingredients that cater to these evolving health consciousnesses is critical for its market position.

Demographic shifts, such as an aging global population and increasing urbanization, necessitate tailored solutions. By 2025, it's projected that over 60% of the world's population will reside in urban areas, creating demand for convenient yet healthy food options. IMCD must adapt its product offerings to meet these diverse and changing consumer needs.

| Sociological Factor | Impact on IMCD | 2024/2025 Data/Trend |

|---|---|---|

| Sustainability & Ethics | Increased demand for eco-friendly and responsibly sourced ingredients. | 65% of consumers consider sustainability in purchasing (2024). |

| Health & Wellness | Growth in functional ingredients, plant-based options, and reduced sugar products. | Nutraceutical market exceeded $200 billion (2023). |

| Demographic Shifts | Demand for convenient, health-focused solutions for aging populations and urban dwellers. | Over 60% global urban population projected by 2025. |

Technological factors

Continuous innovation in chemical synthesis and formulation is a significant technological driver. Companies are developing novel specialty chemicals and advanced materials, alongside more efficient ways to combine ingredients. This means IMCD needs to constantly refresh its product offerings and technical skills to provide customers with the latest solutions, ensuring they remain competitive and deliver greater value.

The digitalization of supply chains, driven by technologies like IoT, AI, and blockchain, is a major technological factor impacting IMCD. These advancements offer IMCD the potential to significantly boost efficiency and transparency throughout its logistics network. For instance, by 2024, the global supply chain management market was projected to reach over $33 billion, highlighting the widespread investment in these digital solutions.

Implementing sophisticated inventory management and demand forecasting systems can lead to substantial cost reductions and faster delivery times for IMCD. This operational enhancement is critical for maintaining a competitive edge. By 2025, AI-powered forecasting is expected to improve accuracy by up to 20%, directly benefiting companies like IMCD in optimizing stock levels and meeting customer demand more effectively.

Automation is significantly streamlining IMCD's operations. For instance, advancements in automated warehousing and order fulfillment are projected to increase efficiency by up to 20% in the chemical distribution sector by 2025, while also minimizing costly errors. This allows IMCD to process orders faster and more accurately, freeing up resources for more strategic initiatives.

The integration of big data analytics and artificial intelligence is a game-changer for IMCD. By analyzing vast datasets, IMCD can gain unparalleled insights into emerging market trends and subtle shifts in customer behavior. This data-driven approach empowers more precise forecasting and the development of highly personalized customer service strategies, ultimately enhancing competitive positioning.

Emerging biotechnologies and green chemistry

Breakthroughs in biotechnology and the increasing emphasis on green chemistry are paving the way for more sustainable and environmentally conscious ingredients. These advancements present a significant opportunity for companies like IMCD to innovate and adapt.

IMCD can leverage these emerging biotechnologies and green chemistry principles by actively sourcing and distributing bio-based or eco-efficient chemical solutions. This strategic move directly addresses the escalating consumer and regulatory demand for sustainable products, thereby broadening IMCD's market presence and appeal.

- Biotechnology Advancements: The global industrial biotechnology market was valued at approximately $170 billion in 2023 and is projected to reach over $300 billion by 2030, indicating substantial growth and innovation.

- Green Chemistry Adoption: A 2024 survey revealed that 75% of consumers are willing to pay more for products made with sustainable ingredients, highlighting a clear market driver for green chemistry solutions.

- Market Expansion: By integrating these sustainable offerings, IMCD can tap into niche markets and strengthen its position in sectors prioritizing environmental responsibility, potentially capturing a larger share of the specialty chemicals distribution market.

E-commerce platforms and digital customer engagement

The shift towards e-commerce platforms is fundamentally reshaping B2B sales, including the chemical distribution sector where IMCD operates. Digital channels are no longer optional; they are essential for customer interaction and transaction efficiency. For instance, in 2024, the global B2B e-commerce market was projected to reach over $20 trillion, highlighting the immense scale of this digital transformation.

IMCD can significantly elevate its customer experience by implementing robust online portals. These platforms can streamline the ordering process, provide instant access to technical documentation and support, and facilitate efficient information sharing. This not only improves accessibility for customers but also enhances operational efficiency for IMCD. By 2025, it's expected that over 80% of B2B buyers will conduct most of their research and purchasing online.

- Digital Sales Growth: B2B e-commerce is a rapidly expanding channel, with significant growth anticipated through 2025.

- Customer Portal Benefits: Online portals offer enhanced convenience, faster access to information, and improved service for B2B clients.

- Efficiency Gains: Digitalization of sales and support processes reduces manual effort and speeds up response times.

- Market Expectations: Customers increasingly expect seamless digital interactions and self-service options from their suppliers.

Technological advancements are rapidly transforming the chemical industry, impacting everything from product development to customer engagement for companies like IMCD. Key areas include the development of novel specialty chemicals and more efficient formulation techniques, demanding continuous innovation in product portfolios and technical expertise.

The digitalization of supply chains through IoT, AI, and blockchain is a significant trend, promising enhanced efficiency and transparency. By 2024, the global supply chain management market was valued at over $33 billion, underscoring the widespread adoption of these technologies.

Automation in warehousing and order fulfillment is streamlining operations, with projections suggesting a 20% efficiency increase in chemical distribution by 2025. Furthermore, the integration of big data analytics and AI offers deeper market insights and improved forecasting capabilities.

| Technology Area | Impact on IMCD | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Chemical Synthesis & Formulation | Need for continuous product innovation and technical skill upgrades. | Ongoing R&D investment across the sector. |

| Supply Chain Digitalization | Increased efficiency and transparency via IoT, AI, blockchain. | Global SCM market > $33 billion (2024 projection). |

| Automation | Streamlined operations, reduced errors, faster order fulfillment. | Projected 20% efficiency gain in chemical distribution by 2025. |

| Data Analytics & AI | Enhanced market insights, precise forecasting, personalized service. | AI forecasting accuracy improvement up to 20% by 2025. |

Legal factors

IMCD's extensive global operations are deeply intertwined with a complex array of international trade laws, customs regulations, and various bilateral and multilateral trade agreements. Navigating this intricate legal landscape is paramount for facilitating the seamless cross-border movement of its specialty chemicals and ingredients, thereby avoiding costly tariffs and securing consistent market access.

For instance, the World Trade Organization (WTO) agreements, such as the Trade Facilitation Agreement, aim to streamline customs procedures, which directly impacts IMCD's logistics efficiency. As of early 2024, ongoing discussions and potential shifts in major trade blocs, like the European Union's trade policies or the United States' approach to global trade, could introduce new compliance burdens or opportunities for IMCD.

Changes in these trade agreements, such as new protectionist measures or the formation of new economic partnerships, can significantly influence IMCD's operational costs by altering import duties and can necessitate a strategic recalibration of its market entry and expansion plans across different geographies.

The chemical and product safety regulations are a critical legal factor for IMCD. Frameworks like Europe's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and the US's TSCA (Toxic Substances Control Act) demand rigorous compliance for chemical substances. For instance, REACH compliance costs for companies can range from tens of thousands to millions of euros depending on the tonnage and hazard profile of the substance.

IMCD must navigate these complex and evolving legal requirements, ensuring every product distributed meets specific safety, labeling, and registration standards in its respective market. This necessitates substantial investment in legal and technical expertise to manage compliance across diverse jurisdictions. Failure to adhere to these regulations can result in substantial fines and reputational damage, impacting market access and profitability.

Intellectual property rights (IPR) are paramount for IMCD, safeguarding its own innovations and those of its suppliers in the specialty chemicals sector. This involves meticulous navigation of patent, trademark, and trade secret laws crucial for unique formulations and application technologies.

In 2024, the global intellectual property market continued its robust growth, with significant investment in R&D for specialty chemicals. IMCD's commitment to IPR protection directly supports this, preventing infringement and preserving the competitive edge for its partners, fostering a stable market.

Antitrust and competition laws

As a significant player in the chemical distribution market, IMCD must navigate a complex web of antitrust and competition laws across its global operations. These regulations are designed to foster fair market practices and prevent monopolies. For instance, in 2024, the European Commission continued its scrutiny of market concentration, with significant fines levied against companies for cartel activities. Failure to comply can lead to substantial penalties, impacting profitability and operational freedom.

Adherence to these laws is critical for IMCD's sustained growth and market leadership. This involves careful consideration of:

- Mergers and Acquisitions: Ensuring that any acquisitions do not unduly reduce competition in relevant markets.

- Pricing Practices: Avoiding price-fixing or predatory pricing strategies that could harm competitors or consumers.

- Market Dominance: Preventing the abuse of any dominant market position through exclusionary or exploitative conduct.

In 2025, regulatory bodies worldwide are expected to maintain a proactive stance on competition enforcement, particularly in sectors undergoing consolidation. IMCD's commitment to ethical business practices and compliance with these legal frameworks is therefore paramount to safeguarding its reputation and avoiding costly legal battles.

Labor laws and employment regulations

IMCD navigates a complex web of labor laws across its global operations, impacting everything from hiring practices to employee compensation. For instance, in 2024, the European Union continued to strengthen worker protections, with directives focusing on fair wages and transparent working conditions, which IMCD must integrate into its HR strategies. These regulations directly influence human resource management and can significantly affect operational costs.

Compliance with these varied employment regulations is paramount for IMCD to manage its workforce effectively and avoid costly legal disputes. For example, differing minimum wage laws and regulations around overtime in countries like the Netherlands versus the United States require tailored approaches to payroll and benefits administration. Failure to adhere to these can lead to fines and damage to the company's reputation.

The company's approach to union relations also falls under these legal frameworks. In regions where collective bargaining is prevalent, such as parts of Germany, IMCD's engagement with works councils and unions is governed by specific labor laws. Maintaining positive employee relations through diligent compliance is key to operational stability and employee morale.

- Global Workforce Management: IMCD must adapt its HR policies to comply with diverse national labor laws regarding employment contracts, working hours, and termination procedures.

- Wage and Benefit Compliance: Adherence to varying minimum wage laws, overtime regulations, and mandated employee benefits across different operating countries is critical for cost management and legal standing.

- Employee Relations and Unions: Navigating regulations on unionization, collective bargaining, and employee representation is essential for maintaining a harmonious work environment and avoiding industrial disputes.

- Operational Cost Impact: Labor laws directly influence payroll, benefits, training, and potential severance costs, impacting IMCD's overall operational expenses and profitability.

IMCD's global operations are subject to a complex web of international trade laws, customs regulations, and trade agreements. Navigating these is crucial for the smooth cross-border movement of specialty chemicals, avoiding tariffs, and securing market access. For instance, the World Trade Organization's Trade Facilitation Agreement impacts IMCD's logistics. As of early 2024, shifts in trade blocs like the EU or US could introduce new compliance burdens or opportunities.

Chemical and product safety regulations, such as Europe's REACH and the US's TSCA, demand rigorous compliance for chemical substances. REACH compliance costs can range from tens of thousands to millions of euros, depending on the chemical's tonnage and hazard profile. IMCD must invest in legal and technical expertise to ensure compliance across diverse jurisdictions, as failure to do so can result in substantial fines and reputational damage.

Intellectual property rights (IPR) are vital for IMCD, protecting its innovations and those of its suppliers. This involves navigating patent, trademark, and trade secret laws for unique formulations. The global IP market saw robust growth in R&D for specialty chemicals in 2024. IMCD's IPR protection supports this by preventing infringement and preserving competitive edges.

Antitrust and competition laws are critical for IMCD's global operations, ensuring fair market practices. In 2024, the European Commission continued its scrutiny of market concentration, with significant fines for cartel activities. In 2025, regulatory bodies are expected to maintain proactive competition enforcement, especially in consolidating sectors, making IMCD's commitment to ethical practices paramount.

IMCD must adhere to diverse labor laws impacting hiring, compensation, and employee relations globally. In 2024, the EU strengthened worker protections, focusing on fair wages and transparent conditions, influencing IMCD's HR strategies and operational costs. For example, differing minimum wage laws between the Netherlands and the US require tailored payroll approaches. Compliance is key to avoiding disputes and maintaining operational stability.

| Legal Factor | Key Aspects for IMCD | 2024/2025 Relevance | Potential Impact |

|---|---|---|---|

| Trade Regulations | WTO agreements, customs procedures, trade blocs | Ongoing discussions on EU/US trade policies (early 2024) | Affects cross-border movement, tariffs, market access |

| Product Safety & Chemical Regulations | REACH, TSCA compliance | Significant compliance costs (tens of thousands to millions of euros per substance) | Requires investment in expertise, risk of fines/reputational damage |

| Intellectual Property Rights (IPR) | Patents, trademarks, trade secrets for formulations | Robust global IP market growth in specialty chemicals R&D (2024) | Protects competitive edge, prevents infringement |

| Antitrust & Competition Law | Mergers, pricing, market dominance | Continued scrutiny by EC, potential fines for non-compliance (2024) | Ensures fair market practices, avoids penalties, maintains reputation |

| Labor Laws | Hiring, wages, working conditions, unions | Strengthened worker protections in EU (2024), varying minimum wage laws | Influences HR strategy, operational costs, employee relations |

Environmental factors

Global pressure to address climate change is intensifying, leading to more stringent rules on carbon emissions and energy use. For companies like IMCD, operating within the chemical distribution sector, this translates to a need to lower their carbon footprint across logistics and operations. This might involve investing in greener energy sources and optimizing transportation for efficiency.

Compliance with these evolving environmental regulations is increasingly becoming a critical measure of a company's performance and its commitment to sustainability. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly impacting supply chains and operational choices within the chemical industry.

Regulatory landscapes are increasingly emphasizing responsible waste management and the adoption of circular economy principles. For instance, the European Union's Circular Economy Action Plan aims to boost recycling rates and reduce waste generation, impacting businesses operating within or supplying to the EU market. IMCD's role might involve assisting its partners in navigating these evolving requirements, potentially through offering more sustainable product alternatives or advisory services on waste reduction strategies.

Growing environmental concerns are pushing companies like IMCD to prioritize sustainable sourcing of raw materials. This means ensuring that the chemicals and ingredients they provide have a minimal environmental footprint, which is becoming increasingly important for both customers and regulators. For instance, the chemical industry's reliance on fossil fuels for many feedstocks presents a significant challenge, driving innovation towards bio-based alternatives. A 2024 report by the European Chemicals Agency (ECHA) highlighted increasing scrutiny on the origin and environmental impact of chemical components across various sectors.

Pollution control and environmental compliance

Environmental regulations are becoming increasingly stringent globally, impacting how companies like IMCD manage their operations and product portfolios. For IMCD, this means a constant focus on adhering to pollution control standards across air, water, and soil. Failure to comply can lead to significant penalties, with environmental fines in the EU alone often running into millions of euros for major breaches. For instance, in 2024, several chemical distributors faced substantial fines for improper waste disposal, highlighting the critical nature of these regulations.

IMCD’s commitment to environmental compliance is not just about avoiding fines; it's a fundamental aspect of its license to operate and its reputation. This involves diligent product stewardship, ensuring the safe handling and distribution of chemicals, and managing waste streams responsibly. The company's investment in robust environmental management systems, such as ISO 14001 certification, demonstrates its proactive approach. In 2025, the focus will likely intensify on reducing greenhouse gas emissions and promoting circular economy principles within the chemical supply chain.

- Global regulatory landscape: Increasing enforcement of air, water, and soil pollution laws worldwide.

- Operational necessity: Strict adherence to discharge limits and chemical handling protocols is crucial for business continuity.

- Financial implications: Non-compliance can result in substantial fines, impacting profitability and investor confidence; for example, environmental penalties in the chemical sector can reach millions of Euros per incident.

- Strategic imperative: Robust environmental management systems are key to maintaining operational licenses and enhancing corporate reputation in 2024-2025.

Biodiversity preservation and ecological impact

There's a growing focus on how chemical production and usage affect the environment, particularly biodiversity. This means companies like IMCD must carefully consider the ecological footprint of their offerings. For instance, in 2023, the UN highlighted that over 1 million species are at risk of extinction due to human activities, a significant concern for industries reliant on natural resources or those with potential environmental impacts.

IMCD will likely need to evaluate and reduce the environmental impact of its products across their entire lifespan, from creation to eventual disposal. This involves promoting solutions that are gentler on ecosystems. This trend directly shapes product stewardship efforts and broader corporate responsibility programs, pushing for more sustainable chemical solutions.

- Increased regulatory pressure on chemical companies regarding environmental impact, with a focus on biodiversity loss.

- Consumer and investor demand for demonstrably sustainable products and supply chains.

- Supply chain risks associated with biodiversity decline, potentially impacting raw material availability and cost.

- Opportunities for IMCD to lead in offering and distributing eco-friendly chemical solutions that minimize ecological harm.

The global push for sustainability is reshaping the chemical industry, with environmental regulations becoming more stringent. For IMCD, this means a heightened focus on reducing its carbon footprint, particularly in logistics and operational energy use, as exemplified by the EU's Fit for 55 package targeting a 55% emissions reduction by 2030.

Circular economy principles and responsible waste management are also gaining traction, influencing how companies like IMCD handle their product lifecycles and supply chains. The EU's Circular Economy Action Plan, aiming to boost recycling and cut waste, directly impacts businesses operating within or supplying to the European market.

Sustainable sourcing of raw materials is becoming paramount, with increasing scrutiny on the environmental impact of chemical components. A 2024 ECHA report underscored this growing concern, pushing for innovation in bio-based alternatives to traditional fossil fuel feedstocks.

| Environmental Factor | Regulatory Driver | IMCD Impact/Action | 2024-2025 Data/Trend |

| Climate Change & Emissions | EU Fit for 55 (55% GHG reduction by 2030) | Reduce operational carbon footprint, optimize logistics | Intensified focus on Scope 1 & 2 emissions reduction targets. |

| Waste Management & Circularity | EU Circular Economy Action Plan | Promote sustainable product alternatives, advise on waste reduction | Increased demand for recyclable and biodegradable chemical solutions. |

| Biodiversity & Ecosystem Impact | Growing global awareness of extinction risks | Evaluate product lifecycle impact, promote eco-friendly solutions | Greater scrutiny on sourcing and potential ecological harm from chemical use. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a comprehensive blend of official government data, reputable economic indicators, and leading industry research. We meticulously gather information on political stability, economic forecasts, social trends, technological advancements, environmental regulations, and legal frameworks to provide a robust overview.