IMCD Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

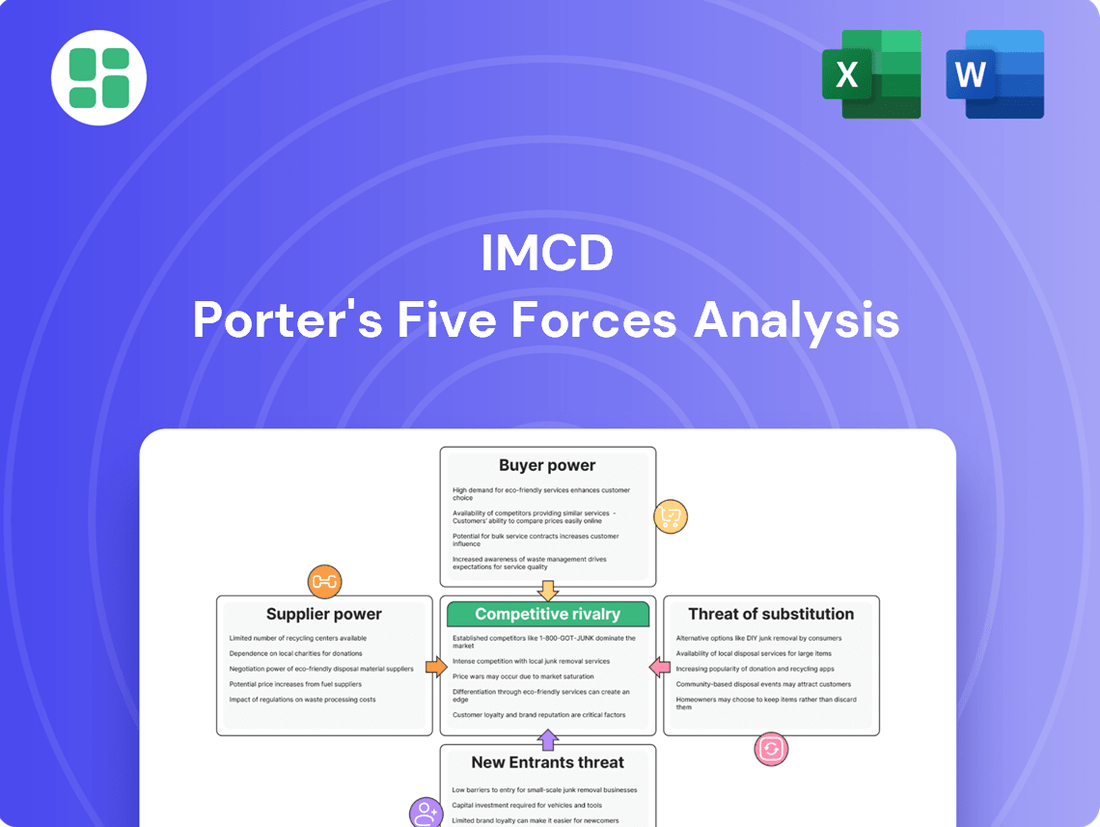

IMCD navigates a landscape shaped by intense buyer power and the constant threat of substitutes, influencing their pricing and product innovation. Understanding the bargaining power of their suppliers and the competitive rivalry within the specialty chemicals distribution sector is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IMCD’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized or patented chemicals possess considerable leverage. Even with its substantial market presence, IMCD may find few alternative sources for unique or proprietary ingredients, making these suppliers particularly influential.

This limited supplier pool restricts IMCD's ability to switch providers without facing significant costs or potential disruptions to its customers' product development. The company's success in offering a wide and varied product range is therefore intrinsically linked to its relationships with these critical suppliers.

Switching costs for IMCD can be substantial, particularly with specialty chemicals. These chemicals often require rigorous technical approvals and adherence to strict regulatory compliance, making a change in supplier a complex undertaking. For instance, if a customer's product formulation relies on a specific chemical from a particular supplier, re-qualifying a new chemical can involve significant time and investment in testing and validation.

These high switching costs inherently reduce IMCD's bargaining power with its suppliers. Customers may be hesitant to switch suppliers due to the potential for reformulation challenges and the associated costs. This stickiness means IMCD has less leverage to negotiate better terms or prices when a supplier's product is critical to their clients' operations.

Furthermore, IMCD's own value proposition, which often includes providing formulation expertise, can further entrench them with specific suppliers. When IMCD helps customers develop or optimize formulations using particular chemicals, it naturally creates a dependency on those same suppliers, diminishing their ability to easily switch to alternatives.

Large chemical manufacturers could theoretically integrate forward into distribution, bypassing intermediaries like IMCD. This would allow them to capture more of the value chain and directly serve end customers. For instance, a major producer of polymers might consider establishing its own logistics and sales network to reach manufacturers using those polymers.

However, IMCD's established global infrastructure, deep technical sales knowledge, and strong customer relationships present a significant barrier to entry. Building a comparable distribution network requires substantial capital investment and time to cultivate the necessary expertise and market penetration. In 2023, IMCD reported revenue of €4.4 billion, highlighting the scale of operations that a supplier would need to replicate.

While the threat of forward integration by suppliers exists, it is generally considered low to moderate for specialty chemicals. The specialized nature of many products and the value-added services provided by distributors like IMCD make it challenging for manufacturers to replicate these capabilities cost-effectively. This complexity helps to preserve IMCD's role in the supply chain.

Importance of IMCD to Suppliers

As a global leader in specialty chemical distribution, IMCD offers suppliers a vital gateway to diverse markets, significantly impacting their sales volumes and reach. This access is a key factor in their relationship.

IMCD's expansive distribution network and specialized technical sales teams effectively lower suppliers' own sales and marketing expenses. This efficiency grants IMCD a degree of leverage.

For instance, in 2023, IMCD reported net sales of €4.7 billion, demonstrating the substantial market access it provides to its supplier base. This scale means suppliers rely on IMCD for significant portions of their business.

- Significant Market Access: IMCD's global presence opens new avenues for suppliers to reach customers they might otherwise struggle to access.

- Reduced Costs: By outsourcing sales and marketing efforts to IMCD, suppliers can decrease their operational overheads.

- Volume and Reach: The sheer volume of business IMCD handles and its extensive market coverage provide tangible value, strengthening its bargaining position.

Availability of Substitute Inputs

The availability of substitute raw materials or ingredients for the specialty chemicals IMCD distributes can indirectly influence supplier power. If IMCD's customers can achieve similar end-product performance using different, more readily available ingredients, it might pressure IMCD to seek alternative suppliers or formulations, thereby reducing the power of existing suppliers.

For instance, if a key ingredient in a particular cosmetic formulation has readily available synthetic alternatives that offer comparable efficacy and cost, IMCD's reliance on a single supplier for that ingredient diminishes. This is particularly relevant in sectors like personal care and food ingredients, where innovation often leads to new material possibilities. In 2024, the chemical industry saw continued investment in bio-based and recycled feedstocks, potentially offering more substitutes for traditional petrochemical-derived ingredients, thereby impacting supplier leverage.

- Impact of Substitutes: The presence of viable substitute inputs weakens the bargaining power of existing suppliers by providing IMCD with alternative sourcing options.

- Customer Flexibility: Customers' ability to switch to alternative ingredients, if they offer comparable performance and cost-effectiveness, limits the pricing power of IMCD's current suppliers.

- Industry Trends: The ongoing development of bio-based and recycled materials in the chemical sector in 2024 presents a growing landscape of potential substitutes, influencing supplier-customer dynamics.

- Formulation Adaptability: IMCD's capacity to reformulate products using different ingredients, should their primary suppliers exert undue pressure, further mitigates supplier power.

Suppliers of highly specialized or patented chemicals possess considerable leverage over IMCD. Even with its substantial market presence, IMCD may find few alternative sources for unique or proprietary ingredients, making these suppliers particularly influential.

This limited supplier pool restricts IMCD's ability to switch providers without facing significant costs or potential disruptions to its customers' product development. The company's success in offering a wide and varied product range is therefore intrinsically linked to its relationships with these critical suppliers.

The bargaining power of suppliers is moderated by IMCD's role as a vital gateway to diverse markets, significantly impacting suppliers' sales volumes and reach. IMCD's expansive distribution network and specialized technical sales teams effectively lower suppliers' own sales and marketing expenses, granting IMCD a degree of leverage.

For instance, in 2023, IMCD reported net sales of €4.7 billion, demonstrating the substantial market access it provides to its supplier base, meaning suppliers rely on IMCD for significant portions of their business.

| Factor | IMCD's Position | Impact on Supplier Bargaining Power |

| Supplier Concentration (Specialty Chemicals) | High for unique/patented chemicals | Increases supplier power |

| Switching Costs for IMCD | High due to technical approvals/compliance | Increases supplier power |

| IMCD's Market Access & Sales Efficiency | Significant global network, reduced supplier costs | Decreases supplier power |

| Availability of Substitutes | Growing with bio-based/recycled materials (2024) | Decreases supplier power |

What is included in the product

This analysis dissects the competitive landscape for IMCD by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Gain immediate clarity on competitive pressures with a visually intuitive spider chart, simplifying complex market dynamics for faster strategic adjustments.

Customers Bargaining Power

IMCD's customer base is incredibly diverse, spanning industries like food, nutrition, pharmaceuticals, and coatings. This means they deal with a wide spectrum of customer sizes, from global giants to smaller, specialized firms. While a few very large customers might have some leverage due to their purchase volume, the sheer number of smaller, niche clients generally dilutes the overall bargaining power of any single customer or even a group of them.

For instance, in 2023, IMCD reported serving over 100,000 customers globally. This vast and fragmented customer base significantly limits the ability of any individual customer to dictate terms. The company's strategy of serving many smaller, specialized markets rather than relying on a few massive accounts is a key factor in managing customer bargaining power.

Customers face significant switching costs when considering alternatives to IMCD. The company's integrated approach, offering formulation expertise and robust technical sales support, makes it challenging for clients to simply find a new distributor. For instance, a customer relying on IMCD's tailored chemical solutions would need to invest considerable time and resources in re-evaluating and re-testing new product formulations with a different supplier.

These value-added services create substantial customer stickiness. Beyond formulation, IMCD's efficient supply chain solutions are deeply embedded in their clients' operations. Switching would necessitate a complete overhaul of logistics, potentially impacting production schedules and inventory management, a process that is both costly and disruptive.

IMCD's strength as a solutions provider, offering deep technical expertise and customized formulations, significantly reduces customer bargaining power. Customers aren't just purchasing raw materials; they're acquiring specialized knowledge and tailored solutions, making price a less dominant factor. For example, in 2024, IMCD's focus on specialty chemicals, which represent a substantial portion of their portfolio, inherently commands higher value and is less susceptible to commoditization pressures that would empower price-sensitive buyers.

Customer Price Sensitivity

Customer price sensitivity for IMCD's specialty ingredients is a nuanced factor. While buyers naturally look for competitive pricing, their focus often shifts when the ingredients are critical to the end product's quality and performance. For instance, in high-value sectors like pharmaceuticals or advanced materials, the cost of a specific chemical distributed by IMCD might represent a very small percentage of the final product's overall cost. In these cases, factors such as consistent quality, reliable supply chains, and expert technical support from IMCD become far more important than minor price variations. This means that while price is a consideration, it's often secondary to the assurance of product integrity and supplier partnership.

This dynamic is reflected in market trends. For example, the global specialty chemicals market, where IMCD operates, is projected to grow significantly, driven by innovation and demand for high-performance products. Reports from 2024 indicate that while cost optimization remains a goal for many manufacturers, the value proposition of specialty ingredients in enhancing product differentiation and meeting stringent regulatory requirements often outweighs a purely price-driven decision. IMCD's ability to provide tailored solutions and technical expertise further reduces customer price sensitivity, as they are seen as partners in product development rather than just suppliers.

- Price vs. Performance: Customers prioritize ingredient performance and reliability, especially in sectors like pharmaceuticals and personal care, where these factors are paramount.

- Low Cost Contribution: The cost of specialty ingredients often represents a small fraction of the final product's total cost, diminishing the impact of price alone.

- Value-Added Services: IMCD's technical support, regulatory guidance, and supply chain reliability enhance its value proposition, often justifying a premium over lower-priced alternatives.

- Market Trends: The growing demand for innovative and high-performance products in specialty chemical markets reinforces the importance of quality and expertise over price.

Threat of Backward Integration by Customers

The threat of customers integrating backward, meaning they would produce chemicals themselves or handle distribution internally, is generally low for IMCD. While theoretically possible, the significant capital investment and specialized knowledge required to replicate IMCD's global sourcing network and technical support are substantial barriers. For instance, a customer would need to establish relationships with numerous chemical manufacturers worldwide and build complex logistics infrastructure, a task far beyond the core competencies of most end-users.

IMCD's strength lies in its ability to aggregate demand from many customers and offer a vast array of products from a diverse supplier base. This scale and breadth are difficult for individual customers to match. In 2024, IMCD continued to expand its supplier relationships, boasting partnerships with over 3,000 suppliers, a testament to the complexity of recreating such a network.

- Significant Capital Outlay: Replicating IMCD's global sourcing and distribution network requires immense financial resources, often exceeding the strategic priorities of most customers.

- Technical Expertise Gap: IMCD provides specialized technical support and formulation expertise, which is challenging and costly for customers to develop in-house.

- Supplier Diversification Advantage: IMCD's access to a wide range of chemicals from thousands of suppliers provides customers with flexibility and risk mitigation that is hard to replicate independently.

- Focus on Core Competencies: Most customers are focused on their primary manufacturing or product development activities, making backward integration into chemical distribution a diversion from their core business.

IMCD's bargaining power with customers is generally low due to its vast, fragmented customer base and the significant switching costs associated with its value-added services. In 2023, IMCD served over 100,000 customers, diluting the power of any single entity. Furthermore, the company's provision of specialized technical support and tailored formulations makes it difficult and costly for clients to switch to alternative distributors, fostering customer loyalty.

The price sensitivity of IMCD's customers is often tempered by the critical role of its specialty ingredients in end-product performance and quality. For instance, in 2024, the company's focus on high-value specialty chemicals meant that ingredient costs were a small fraction of the final product's total price, making reliability and technical expertise more important than minor price differences.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Customer Base Size & Fragmentation | Low | Over 100,000 customers globally (2023 data) |

| Switching Costs | Low | Integrated services (formulation, technical sales) create stickiness. |

| Customer Price Sensitivity | Moderate to Low | Focus on specialty chemicals where performance outweighs price. |

| Threat of Backward Integration | Low | High capital and expertise required to replicate IMCD's network. |

Preview the Actual Deliverable

IMCD Porter's Five Forces Analysis

This preview showcases the complete IMCD Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the specialty chemicals and ingredients distribution sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability. This comprehensive breakdown will equip you with a thorough understanding of the industry's dynamics, allowing for strategic decision-making.

Rivalry Among Competitors

The specialty chemical distribution arena is quite crowded, with major global players like Brenntag and Azelis setting a high bar. IMCD, as a leader in this space, finds itself in direct competition with these giants as well as numerous smaller, specialized companies that focus on specific market segments or product types. This creates a dynamic environment where staying ahead requires constant adaptation.

In 2024, the market continues to reflect this diversity. For instance, Brenntag reported revenues exceeding €20 billion in recent years, highlighting the scale of the largest distributors. Azelis, another significant competitor, has also been actively expanding its global footprint through strategic acquisitions, demonstrating the ongoing consolidation and competitive pressure. This mix of large, established entities and agile niche players means IMCD must continually innovate and clearly define its unique value proposition to maintain its market leadership.

The global chemical distribution market, encompassing specialty chemicals, is on a robust growth trajectory. Projections indicate a compound annual growth rate (CAGR) exceeding 5% from 2025 through 2034. This expansion offers a larger pie for all participants, potentially softening some competitive intensity by creating new avenues for business.

Despite the overall growth, the industry is witnessing significant consolidation. Major companies, such as IMCD, are strategically acquiring smaller, specialized firms. These acquisitions aim to bolster market share, broaden product portfolios, and enhance service capabilities, thereby intensifying the rivalry among the larger, consolidated entities that remain.

Competitive rivalry within the specialty chemicals and ingredients distribution sector, where IMCD operates, is tempered by the company's deliberate emphasis on value-added services. These services, including expert formulation support, specialized technical sales teams, and sophisticated supply chain management, move the competitive landscape beyond mere price comparisons. This focus creates a distinct advantage, nurturing robust relationships with both customers and suppliers.

IMCD's investment in its global network of over 80 technical centers underscores this differentiation strategy. These centers provide crucial technical expertise and application development, which are vital for customers seeking to innovate and optimize their product formulations. This commitment to technical support fosters loyalty and embeds IMCD deeper within its clients' value chains, thereby reducing direct price-based competition.

Exit Barriers for Competitors

High fixed costs are a significant factor creating substantial exit barriers for competitors in the specialty chemicals and ingredients distribution sector. These costs stem from substantial investments in global supply chain infrastructure, advanced technical laboratories for formulation support, and the need for a highly specialized and skilled workforce. For instance, maintaining a network of warehouses and logistics capabilities across multiple continents requires considerable capital outlay.

These significant upfront and ongoing investments mean that companies face considerable financial penalties if they attempt to exit the market. Consequently, competitors are often compelled to remain operational and compete intensely, even when market conditions are challenging or profit margins are squeezed. This persistence fuels a high level of competitive rivalry, as firms are reluctant to abandon their invested capital.

The implications for the industry are clear: expect sustained competitive pressure. Companies are incentivized to fight for market share rather than withdraw, leading to a more dynamic and potentially aggressive competitive landscape. This environment necessitates strategic agility and a deep understanding of cost structures for any player looking to succeed.

- High Fixed Costs: Investments in global supply chains, technical labs, and specialized talent create significant barriers to exit.

- Persistence in Competition: Competitors are less likely to leave the market during downturns due to these sunk costs, leading to continued rivalry.

- Industry Dynamics: This situation fosters an environment where firms are motivated to maintain operations and compete fiercely for market share.

Brand Identity and Reputation

IMCD's robust brand identity as a premier global distributor in specialty chemicals and ingredients significantly dampens competitive rivalry. This strong reputation, built on technical prowess and dependable service, fosters loyalty among both suppliers and customers.

The company's commitment to sustainability further enhances its market position, making it a preferred partner and lessening the inclination for aggressive, price-driven competition. For instance, in 2023, IMCD reported a revenue of €4.5 billion, reflecting the trust and value placed in its brand by the market.

- Brand Strength: IMCD is recognized globally as a leader and trusted partner.

- Reputation Benefits: Technical expertise, reliability, and sustainability attract and retain key relationships.

- Reduced Rivalry: Strong brand equity mitigates direct price competition.

- Market Validation: €4.5 billion in revenue for 2023 underscores brand value and market trust.

The competitive rivalry for IMCD is intense due to a crowded market with large players like Brenntag and Azelis, alongside numerous niche specialists. This dynamic requires continuous adaptation and differentiation. In 2024, Brenntag's revenue surpassed €20 billion, and Azelis has been actively expanding, highlighting the scale and consolidation pressures IMCD faces.

IMCD differentiates itself through value-added services, such as formulation support and technical sales, moving beyond simple price competition. Its network of over 80 technical centers provides essential expertise, fostering customer loyalty and embedding the company deeper within client value chains. This strategy, evidenced by €4.5 billion in revenue for 2023, strengthens its market position and mitigates aggressive price-based rivalry.

High fixed costs associated with global infrastructure and specialized talent create significant exit barriers, compelling competitors to persist even in challenging conditions. This persistence fuels sustained rivalry, as companies fight for market share rather than withdraw, necessitating strategic agility and cost management.

SSubstitutes Threaten

Customers, particularly large ones with established relationships, might consider sourcing specialty chemicals directly from manufacturers. This bypasses distributors like IMCD. For instance, in 2024, major automotive manufacturers often negotiate directly with chemical producers for bulk materials, reducing their reliance on intermediaries for certain product lines.

However, the logistical and technical complexities of managing numerous direct supplier relationships often outweigh the perceived benefits for many buyers. IMCD's ability to consolidate supply chains, manage inventory, and provide tailored technical support makes its integrated service model a more efficient and cost-effective solution for a significant portion of the market.

The threat of substitutes for specialty chemicals, while generally lower than for commodities, is a factor IMCD must consider. As certain specialty chemicals mature, they can approach commoditization. This means more suppliers might offer similar products, potentially reducing the perceived value of a specialized distributor's role in sourcing and technical support. For instance, if a previously niche additive becomes widely available from multiple manufacturers, customers might opt for the lowest-cost provider, bypassing the need for IMCD's expertise.

IMCD actively counters this by its strategic focus on innovation and R&D, aiming to stay ahead of any commoditization trends. By emphasizing highly differentiated and novel solutions, they ensure their value proposition remains strong. Their commitment to developing new applications and providing deep technical expertise helps maintain customer loyalty even as the underlying chemical landscape evolves. This proactive approach is crucial, especially as the global specialty chemicals market continues to grow, projected to reach over $900 billion by 2027, according to some market analyses.

Advances in chemical science and evolving customer demands, particularly for sustainable options, are driving the creation of novel ingredients and formulations. These innovations can directly replace existing products, posing a significant threat of substitution.

IMCD is proactively managing this threat by championing sustainable solutions and fostering collaborative innovation with both suppliers and customers. This approach ensures they remain at the forefront of new product development, mitigating the impact of potential substitutes.

In-house Technical Capabilities of Customers

Large customers, particularly those with significant scale, may consider developing their own in-house technical and formulation expertise. This could potentially reduce their dependence on IMCD's specialized distribution and technical support services. For instance, a major food manufacturer might invest in its own flavor development lab.

However, the cost and complexity of maintaining in-house capabilities across a broad spectrum of specialty chemicals is often a significant barrier. The need for specialized equipment, skilled personnel, and continuous training for diverse product lines makes it economically challenging for most companies. IMCD's model offers access to a wide range of shared expertise and formulation knowledge, which is difficult and expensive to replicate internally.

- Cost Barrier: Developing and maintaining in-house technical expertise for a wide array of specialty chemicals can be prohibitively expensive for most customers.

- Complexity: The sheer diversity of specialty chemicals and their applications makes it difficult and resource-intensive for individual customers to build comprehensive internal knowledge.

- IMCD's Value Proposition: IMCD provides a cost-effective solution by offering centralized, shared technical expertise and formulation support that customers can leverage.

Shift to Digital Platforms for Direct Sales

The increasing prevalence of digital platforms presents a significant threat of substitution for traditional distributors like IMCD. E-commerce channels can empower manufacturers to bypass intermediaries and engage directly with end-users. This disintermediation trend, accelerated by the digital transformation across industries, could erode the market share of distributors by offering a more streamlined and potentially cost-effective route to market for some products.

IMCD is actively addressing this threat by investing in and enhancing its own digital capabilities. By developing robust digital platforms and integrating digital solutions into its service model, IMCD aims to provide added value that online marketplaces may not easily replicate. This includes offering enhanced customer experiences, greater supply chain transparency, and specialized digital tools for product selection and technical support, thereby reinforcing its position as an indispensable partner.

- Digital Sales Growth: Global e-commerce sales are projected to reach approximately $7.4 trillion by the end of 2024, highlighting the growing consumer and business preference for online purchasing channels.

- IMCD's Digital Investment: IMCD has been actively expanding its digital footprint, evidenced by its ongoing development of customer portals and digital tools designed to improve efficiency and engagement.

- Supply Chain Transparency: In 2023, 65% of businesses reported that improved supply chain visibility was a key driver for adopting digital technologies, a trend IMCD is leveraging.

- Value-Added Services: By focusing on technical expertise and customized solutions, IMCD aims to differentiate its offering beyond simple product delivery, making direct manufacturer-to-customer sales less appealing for complex chemical and ingredient applications.

The threat of substitutes for IMCD’s offerings stems from customers potentially bypassing distributors to source chemicals directly from manufacturers, especially for larger volume, less specialized products. This trend is amplified by digital platforms enabling direct sales, though the logistical and technical complexities often favor distributors like IMCD for many clients.

Moreover, as specialty chemicals mature and approach commoditization, alternative suppliers offering similar products at lower prices can emerge, reducing the need for specialized distribution and technical support. IMCD counters this by focusing on innovation, R&D, and highly differentiated solutions to maintain its value proposition.

Customers might also develop in-house technical and formulation expertise, reducing reliance on IMCD. However, the substantial cost and complexity of replicating IMCD's broad range of shared expertise and specialized knowledge across diverse product lines presents a significant barrier for most companies.

| Threat of Substitutes | Description | IMCD's Mitigation Strategy | Example/Data Point (2024/2025) |

|---|---|---|---|

| Direct Sourcing by Large Customers | Major clients may negotiate directly with chemical manufacturers, bypassing distributors. | Focus on value-added services, technical support, and supply chain consolidation. | In 2024, large automotive manufacturers continued direct sourcing for certain bulk chemicals. |

| Commoditization of Specialty Chemicals | Mature specialty chemicals can become widely available, leading to price-based competition. | Emphasis on innovation, R&D, and developing novel, differentiated solutions. | The global specialty chemicals market is projected to grow, with innovation being a key differentiator. |

| In-house Technical Expertise Development | Customers building their own formulation and technical capabilities. | Highlighting cost-effectiveness and breadth of shared expertise compared to in-house investment. | Developing in-house labs is costly; IMCD offers access to a wide range of shared formulation knowledge. |

| Digital Platforms & E-commerce | Online channels allowing manufacturers to sell directly to end-users. | Investing in robust digital platforms and integrated digital solutions for enhanced customer experience. | Global e-commerce sales are expected to reach approximately $7.4 trillion by the end of 2024. |

Entrants Threaten

Entering the global specialty chemical distribution market demands significant capital investment. Establishing a robust logistical network, extensive warehousing facilities, and advanced technical laboratories can easily run into hundreds of millions of dollars. For instance, companies often need to invest in specialized temperature-controlled storage and advanced IT systems for inventory management, adding to the upfront costs.

Existing, established players like IMCD already leverage substantial economies of scale. This scale allows them to negotiate better prices with suppliers due to higher purchasing volumes and optimize their logistics operations for greater efficiency. Consequently, new entrants face a considerable challenge in matching the cost advantages enjoyed by incumbents, making it difficult to compete effectively on price from the outset.

The chemical industry is a minefield of regulations, from how chemicals are handled and stored to how they're transported and used. These rules vary significantly by region and industry sector, creating a complex web for any newcomer to untangle.

New entrants must invest heavily in understanding and complying with these intricate regulatory frameworks and securing the required certifications. For instance, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, a comprehensive chemical management regulation, imposes substantial data submission and compliance burdens, potentially costing millions for initial registration.

New entrants face a significant hurdle due to the necessity of deep technical expertise and established relationships in specialty chemical distribution. Success hinges on understanding complex formulations and fostering trust with both suppliers and customers, a process that takes considerable time and investment.

IMCD’s extensive network, boasting over 5,100 employees and more than 80 technical centers globally, signifies a substantial barrier. This accumulated human capital and the trust built over years are not easily replicated by newcomers, making it difficult to compete effectively.

Supplier and Customer Loyalty/Switching Costs

Supplier loyalty to established distributors like IMCD is significant. Suppliers often favor partners with extensive market reach and proven technical expertise, ensuring their products are effectively promoted and supported. This preference creates a barrier for new entrants seeking to secure reliable supply chains.

Customer switching costs are also a major deterrent. IMCD's customers often rely on the company's integrated services, including formulation support and regulatory guidance. Changing distributors would mean re-qualifying ingredients and reformulating products, a time-consuming and expensive process. For instance, in the specialty chemicals sector, a single product reformulation can cost tens of thousands of dollars and take months to complete.

These combined factors of supplier preference and customer switching costs significantly raise the threat of new entrants. New players must overcome established relationships and invest heavily to demonstrate comparable value and reliability. For example, in 2024, the average time for a new chemical distributor to establish a comparable market presence to a major player like IMCD is estimated to be 5-7 years, with substantial upfront investment required.

- Supplier Preference: Suppliers often prioritize established distributors with proven track records in market penetration and technical support.

- Customer Switching Costs: High costs associated with reformulating products and re-qualifying ingredients make customers hesitant to switch.

- Integrated Services: IMCD's provision of formulation and regulatory support creates strong customer dependency.

- Market Entry Barriers: The combined loyalty and switching costs present a substantial hurdle for new entrants aiming to gain market share.

Brand Reputation and Trust

IMCD's established brand reputation and the deep trust it has cultivated over years act as a formidable barrier to new entrants. In the specialty chemicals and ingredients distribution sector, where product quality, consistent supply, and expert technical support are non-negotiable, this ingrained credibility is a significant competitive advantage. Newcomers struggle to replicate the years of relationship-building and proven reliability that IMCD offers its customers.

The company's consistent performance, exemplified by its revenue growth, further solidifies its market position. For instance, IMCD reported a revenue of €4.7 billion for the fiscal year 2023, demonstrating its substantial market presence and the trust placed in it by suppliers and customers alike. This financial strength underpins its ability to invest in customer relationships and technical expertise, making it harder for new players to gain traction.

- Established Trust: IMCD's long history of reliable service and product delivery builds a strong foundation of trust that new entrants find difficult to match.

- Critical Ingredient Sector: The nature of the specialty chemicals and ingredients market demands high levels of assurance regarding product integrity and supply chain security, favoring established players.

- Credibility Gap: New entrants inherently face a credibility gap, lacking the track record and proven performance that IMCD leverages to maintain customer loyalty.

The threat of new entrants in the specialty chemical distribution market is significantly mitigated by IMCD's strong competitive advantages. High capital requirements for logistics and technical infrastructure, coupled with stringent regulatory compliance, create substantial barriers. Furthermore, established relationships with suppliers and customers, built on trust and integrated services, make it challenging for newcomers to gain a foothold.

| Barrier Type | Description | Example/Data Point |

| Capital Requirements | Significant investment needed for logistics, warehousing, and technical centers. | Hundreds of millions of dollars for a robust network. |

| Economies of Scale | Established players benefit from lower costs due to higher purchasing volumes. | Difficulty for new entrants to match incumbent cost advantages. |

| Regulatory Complexity | Navigating diverse and stringent chemical handling, storage, and transport regulations. | REACH compliance can cost millions for initial registration. |

| Technical Expertise & Relationships | Need for deep formulation knowledge and established trust with suppliers and customers. | IMCD's 5,100+ employees and 80+ technical centers represent accumulated human capital. |

| Supplier Loyalty | Suppliers often prefer established distributors with proven market reach and technical support. | New entrants struggle to secure reliable supply chains. |

| Customer Switching Costs | High costs for customers to reformulate products and re-qualify ingredients. | A single product reformulation can cost tens of thousands of dollars and take months. |

| Brand Reputation & Trust | Years of reliable service build credibility that is hard for newcomers to replicate. | IMCD's 2023 revenue of €4.7 billion reflects market trust. |

Porter's Five Forces Analysis Data Sources

Our IMCD Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, investor presentations, and industry-specific market research reports from leading firms.