IMCD Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

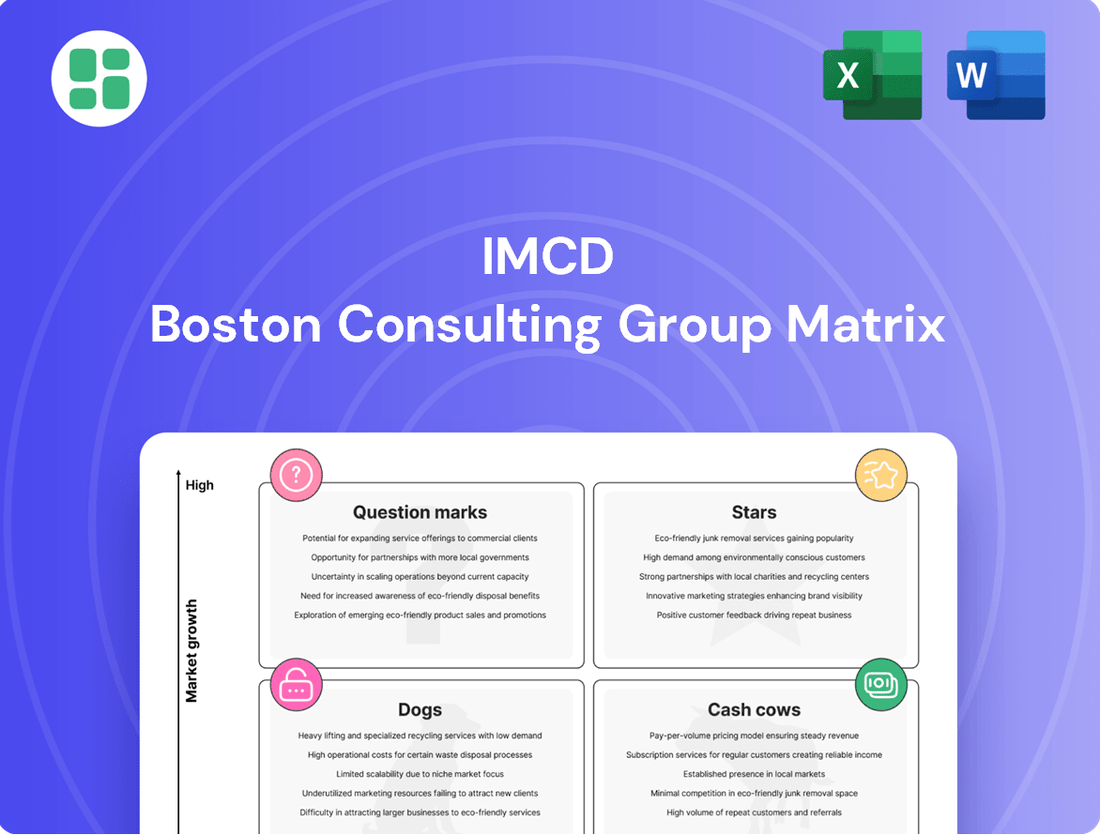

Uncover the strategic positioning of key products within the IMCD portfolio. This initial glimpse into their BCG Matrix highlights potential Stars, Cash Cows, Dogs, and Question Marks, offering a foundational understanding of their market performance.

To truly unlock IMCD's strategic roadmap and make informed decisions about resource allocation and future investments, purchase the full BCG Matrix report. It provides a comprehensive, quadrant-by-quadrant analysis, complete with actionable insights and tailored recommendations for each product category.

Stars

IMCD's strong commitment to the pharmaceutical sector, reinforced by strategic acquisitions such as Cobapharma and Trichem Pharmascience in 2024-2025, solidifies its leadership in this dynamic market. This focus aligns with the global pharmaceutical market's consistent expansion, projected to reach over $2 trillion by 2027, driven by ongoing innovation and aging populations.

The increasing demand for specialized pharmaceutical ingredients, a key area for IMCD, is a direct result of this market growth. IMCD's robust technical capabilities and extensive international network enable it to secure substantial market share and effectively leverage these growth opportunities.

The Food & Nutrition segment represents a significant growth engine for IMCD, bolstered by strategic acquisitions like Joli Foods, Bretano, Ferrer, and Tecom during 2024-2025. This expansion solidifies their market position in a sector increasingly shaped by consumer demand for healthier, sustainable, and specialized food options.

Consumer preferences are a key driver, pushing demand for innovative ingredients that cater to wellness and environmental consciousness. IMCD's proactive approach in broadening its ingredient portfolio and enhancing its formulation expertise allows it to maintain a competitive edge in this rapidly evolving market.

Within the Beauty & Personal Care sector, IMCD is strategically focusing on sustainable solutions, a move supported by acquisitions like Valuetree and YCAM, and their motto of 'shaping tomorrow's Beauty.' This area is experiencing robust growth driven by consumer preference for eco-friendly and health-conscious products.

The demand for sustainable beauty products is a significant market driver. For instance, the global green beauty market was valued at approximately $25.1 billion in 2023 and is projected to reach $57.2 billion by 2030, growing at a CAGR of 12.6%. This trend directly benefits IMCD's investment in this segment.

IMCD's investment in technical centers and R&D plays a crucial role in accelerating the adoption of these high-value sustainable offerings. Their expertise helps formulators create innovative products that meet evolving consumer expectations for both performance and environmental responsibility.

Strategic Expansion in Asia-Pacific

IMCD is actively pursuing a robust inorganic growth strategy across the Asia-Pacific region. This expansion is exemplified by key acquisitions, such as RBD in China and Reschem in Australia and New Zealand, signaling a clear intent to penetrate high-growth emerging markets within the specialty chemicals and ingredients sector.

These strategic moves are designed to bolster IMCD's presence in markets offering significant growth potential. While precise market share data fluctuates, the underlying trend points to substantial opportunities for expansion and market penetration in these dynamic economies.

The company's objective is to leverage its established global leadership by systematically expanding its operational footprint and enhancing its local expertise throughout the Asia-Pacific. This approach aims to mirror its success in other mature markets by building strong regional capabilities.

- Acquisition of RBD in China: Strengthens IMCD's position in the vital Chinese market, a key driver of growth in specialty chemicals.

- Acquisition of Reschem in Australia/New Zealand: Expands IMCD's reach into the Oceania region, tapping into its growing demand for specialized ingredients.

- Focus on High-Growth Emerging Markets: Asia-Pacific represents a strategic priority due to its rapidly developing economies and increasing consumption of specialty chemical products.

- Replicating Global Leadership: IMCD aims to build a dominant regional presence by combining its international expertise with localized market understanding and service offerings.

Advanced Materials for Emerging Technologies

IMCD's Advanced Materials business group is strategically positioned to capitalize on high-growth industrial sectors driving technological advancement. These areas, such as materials for sustainable packaging, cutting-edge electronics, and next-generation energy solutions, are experiencing robust expansion. For instance, the global advanced materials market was valued at approximately $230 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of over 7% through 2030.

IMCD is actively bolstering its technical expertise and forging strategic alliances to solidify its leadership in these dynamic markets. This proactive approach ensures they can offer innovative solutions that meet the evolving demands of emerging technologies. By focusing on these innovation-driven segments, IMCD aims to capture substantial market share and drive future revenue growth.

- Focus on High-Growth Sectors: Targeting areas like sustainable packaging, advanced electronics, and new energy solutions.

- Market Potential: The advanced materials market is projected for strong growth, with a CAGR exceeding 7% through 2030.

- Strategic Investments: Enhancing technical capabilities and partnerships to secure market leadership.

Stars in the IMCD BCG Matrix represent business units with high market share in high-growth markets. These are the growth engines of the company, requiring significant investment to maintain their leading positions and capitalize on future opportunities. Their success is often driven by innovation and strategic acquisitions, as seen in IMCD's focus on pharmaceuticals and food ingredients.

IMCD's pharmaceutical segment, bolstered by 2024-2025 acquisitions like Cobapharma and Trichem Pharmascience, exemplifies a Star. This sector is experiencing robust growth, projected to exceed $2 trillion by 2027, driven by innovation and an aging global population. IMCD's investment in specialized ingredients and its strong technical capabilities are key to its leadership in this high-growth area.

Similarly, the Food & Nutrition segment, strengthened by 2024-2025 acquisitions such as Joli Foods and Bretano, also functions as a Star. This segment benefits from increasing consumer demand for healthier, sustainable, and specialized food options, a trend IMCD actively supports through portfolio expansion and formulation expertise.

The Beauty & Personal Care sector, particularly with its focus on sustainable solutions, is another Star. Acquisitions like Valuetree and YCAM underscore this focus. The global green beauty market's projected growth from $25.1 billion in 2023 to $57.2 billion by 2030, at a 12.6% CAGR, highlights the significant potential IMCD is tapping into.

| Business Segment | Market Growth | IMCD's Position | Strategic Focus |

|---|---|---|---|

| Pharmaceuticals | High (>$2 trillion by 2027) | Leading | Specialized ingredients, innovation, acquisitions |

| Food & Nutrition | High (consumer demand for health/sustainability) | Strong | Portfolio expansion, formulation expertise, acquisitions |

| Beauty & Personal Care | High (green beauty market CAGR 12.6%) | Growing | Sustainable solutions, technical centers, acquisitions |

What is included in the product

This matrix categorizes business units by market share and growth rate, guiding strategic decisions.

The IMCD BCG Matrix provides a clear, visual overview of your portfolio's strategic positioning, alleviating the pain of uncertainty about where to invest.

Cash Cows

IMCD's extensive European distribution network, its largest revenue generator, functions as a prime cash cow. This mature infrastructure, built on decades of experience, fosters stable and predictable cash flows from its extensive customer and supplier base.

In 2023, IMCD reported a substantial portion of its revenue originating from Europe, underscoring the network's consistent performance. While European market growth might be more moderate, the sheer efficiency and scale of IMCD's operations in this region translate into robust profitability and a reliable source of cash.

IMCD's Home Care and Industrial & Institutional (I&I) ingredients segments function as its cash cows. These markets, while not experiencing explosive growth, provide a reliable and steady stream of income. The consistent demand for essential cleaning and hygiene products ensures a stable revenue base for the company.

IMCD's strong market position and efficient operations within these mature segments are key drivers of their cash-generating power. This stability allows IMCD to fund investments in higher-growth areas. For instance, in 2023, IMCD reported significant revenue contributions from its specialty chemicals distribution, with Home & Personal Care and Industrial Solutions being substantial pillars.

Certain mature sub-segments within Coatings & Construction, particularly in developed markets, function as cash cows for IMCD. These areas benefit from established product lines and predictable demand, ensuring a steady stream of revenue. For instance, the global coatings market, projected to reach $200 billion by 2027, still sees substantial demand for conventional ingredients, which IMCD efficiently distributes.

Proven Supply Chain Solutions

IMCD's proven supply chain solutions are a significant cash cow, underpinning its value proposition. These optimized systems drive operational efficiency and foster strong customer loyalty, minimizing costs while maximizing service reliability for a broad range of clients.

The company’s commitment to continuous improvement in supply chain management was notably recognized with several industry awards in 2024, reinforcing its ability to generate consistent cash flow across all business segments.

- Operational Efficiency: IMCD's supply chain solutions streamline logistics, reducing lead times and inventory holding costs.

- Customer Retention: High service reliability and cost-effectiveness foster long-term customer relationships.

- Cost Minimization: Strategic sourcing and efficient warehousing contribute to lower operational expenses.

- Award Recognition: Industry accolades in 2024 highlight the excellence and effectiveness of their supply chain operations.

Diversified Portfolio Management

IMCD's strategy of maintaining a highly diversified portfolio across various business groups and geographies, as highlighted in its 2024 and H1 2025 results, provides a resilient and stable revenue base.

This diversification mitigates risks associated with market fluctuations in any single segment, ensuring a consistent inflow of cash from a broad range of mature and stable product offerings.

- Diversified Revenue Streams: IMCD's business model spans multiple end markets, including coatings, food and nutrition, pharmaceuticals, and advanced materials, providing a buffer against downturns in any one sector.

- Geographic Spread: Operations across Europe, the Americas, and Asia-Pacific reduce reliance on any single regional economy, contributing to stable cash generation.

- Mature Product Focus: A significant portion of IMCD's portfolio consists of established products with consistent demand, acting as reliable cash cows that fund growth initiatives in other areas.

- Resilience Demonstrated: For instance, in 2024, despite varied performance across sectors, IMCD's overall financial stability was maintained due to this broad diversification.

IMCD's established distribution networks, particularly in mature European markets, serve as significant cash cows. These operations benefit from economies of scale and long-standing customer relationships, generating consistent and predictable cash flows. For example, in 2023, IMCD's European segment remained its largest revenue contributor, highlighting the enduring strength of these mature assets.

The company's focus on essential ingredients within segments like Home Care and Industrial & Institutional (I&I) also represents a cash cow strategy. These markets, characterized by stable demand, ensure a reliable revenue stream that supports IMCD's broader strategic investments. In 2023, these specialty chemical distribution areas continued to show robust performance, underscoring their cash-generating capabilities.

IMCD's efficient supply chain solutions are a core cash cow, driving operational excellence and customer loyalty. This optimized infrastructure minimizes costs and maximizes service reliability, leading to sustained profitability. Industry recognition in 2024 for these supply chain operations further validates their role as consistent cash generators for the company.

Furthermore, IMCD's diversified business portfolio across various end markets and geographies acts as a significant cash cow. This broad market presence, evident in its 2024 and H1 2025 financial reports, mitigates sector-specific risks and ensures a stable overall cash inflow, allowing for strategic reinvestment.

| Business Segment | Cash Cow Characteristics | 2023 Revenue Contribution (Illustrative) | Growth Outlook |

|---|---|---|---|

| European Distribution Network | Mature market, economies of scale, strong customer base | Largest revenue contributor | Moderate |

| Home Care & I&I Ingredients | Stable demand, essential products, consistent revenue | Substantial pillar | Steady |

| Supply Chain Solutions | Operational efficiency, cost minimization, customer retention | Underpins overall profitability | Consistent |

| Diversified Portfolio | Mitigates risk, broad market exposure, stable cash inflow | Overall financial stability | Resilient |

Full Transparency, Always

IMCD BCG Matrix

The preview you are seeing is the complete and final IMCD BCG Matrix document you will receive upon purchase. This means you're getting the exact same professionally formatted and analysis-ready report, free from any watermarks or demo content. Once purchased, this comprehensive tool will be immediately available for your strategic planning, enabling you to effectively categorize IMCD's business units and guide future investment decisions.

Dogs

Legacy product lines, often absorbed through acquisitions, can become underperforming "dogs" within IMCD's portfolio if they haven't aligned with the company's strategic shift towards high-value specialties. These might be found in niche markets with limited growth potential or possess a small market share even after revitalization attempts. For instance, if a historical acquisition brought in a line focused on basic commodity chemicals, and the market has since moved towards advanced performance materials, this line could be a prime example of a dog. Such products often drain valuable resources without delivering commensurate returns, signaling a need for careful consideration regarding their future within the company.

Small, non-strategic regional operations within IMCD's portfolio, often characterized by limited growth prospects or a lack of substantial market penetration, can be categorized as Dogs in the BCG Matrix. These might represent legacy ventures or unsuccessful expansion efforts. For instance, a small distribution hub in a mature, low-demand region might fit this description, potentially contributing minimally to IMCD's overall revenue but still demanding resources.

While IMCD is strategically moving towards higher-value specialty chemicals, any lingering presence in traditional, low-margin commodity chemical distribution, especially in intensely competitive sectors, could be categorized as 'dogs' within the BCG matrix. These areas often present minimal differentiation and are prone to significant price fluctuations.

For instance, if IMCD's 2024 revenue from commodity chemicals, which typically operate on thinner margins, remained a substantial portion of their business without clear growth prospects, it would align with the 'dogs' profile. Such segments usually offer little sustainable competitive advantage.

The company's stated strategy aims to reduce or exit these low-return commodity activities to bolster overall profitability and focus resources on more lucrative specialty markets. This proactive divestment or de-emphasis is key to improving IMCD's financial performance.

Ineffective Digital Transformation Initiatives

Ineffective digital transformation initiatives at IMCD, if they fail to achieve widespread internal adoption or deliver anticipated operational efficiencies, would be categorized as 'dogs' within the IMCD BCG Matrix. These are investments that, despite the company's dedication to digital advancement, do not translate into tangible benefits.

Such underperforming technology projects could consume valuable resources, including capital and personnel, without fostering operational enhancements or bolstering IMCD's competitive edge. For instance, a new AI-powered customer relationship management system that proves too complex for sales teams to integrate into their workflows, or a data analytics platform that doesn't yield actionable insights, would represent a 'dog' investment.

- Resource Drain: Initiatives that fail to gain traction can divert funds and human capital from more promising ventures.

- Lack of ROI: Investments in technology that don't improve efficiency or create competitive advantage offer no return.

- Stagnation Risk: Continued investment in 'dogs' can hinder the company's ability to innovate and adapt to market changes.

Outdated Formulation Expertise

Segments within IMCD's portfolio that depend on outdated formulation expertise risk becoming dogs in the BCG matrix. This occurs when their technologies or product offerings no longer meet evolving market needs, particularly concerning sustainability and enhanced functionality. For instance, a reliance on older chemical processes without incorporating bio-based alternatives could alienate environmentally conscious customers.

If IMCD's technical teams do not actively innovate or adapt within specific market niches, these product lines will inevitably lose their market relevance and, consequently, their market share. This decline is often exacerbated by competitors who are quicker to adopt new, more efficient, or environmentally friendly technologies. For example, a specialty chemical segment focused solely on traditional plasticizers might see its market shrink as demand shifts towards biodegradable or recycled content solutions.

- Market Shift: In 2024, the global specialty chemicals market saw a significant push towards sustainable solutions, with demand for bio-based ingredients growing by an estimated 8-10% year-over-year, according to industry reports.

- Innovation Lag: Segments failing to integrate these sustainable alternatives, or advanced functional properties like enhanced UV resistance or antimicrobial capabilities, face potential obsolescence.

- R&D Investment: IMCD's commitment to R&D, with significant investments in its global technical centers, is crucial to proactively identify and pivot away from such declining niches, ensuring continued market relevance and preventing its offerings from becoming dogs.

Dogs represent business units or product lines within IMCD that have a low market share in a low-growth market. These segments typically generate low profits or even losses, consuming resources without significant returns. For IMCD, this could manifest as legacy product lines acquired through past mergers that no longer align with the company's strategic focus on high-value specialty chemicals. These "dogs" often require significant management attention and investment to maintain, diverting resources from more promising areas of the business.

The challenge with "dogs" is their tendency to drain capital and management bandwidth. For example, a distribution agreement for a declining industrial chemical in a saturated market might represent a dog. Despite efforts to revitalize sales, its low market share and the market's lack of growth potential mean it contributes minimally to IMCD's overall performance. In 2024, IMCD's strategic divestment of non-core assets, particularly those in lower-margin segments, highlights the company's proactive approach to managing its portfolio and shedding such underperforming units.

| BCG Category | Market Growth | Market Share | Profitability | IMCD Relevance |

| Dogs | Low | Low | Low/Negative | Low, often legacy or non-strategic |

Question Marks

IMCD's strategy in 2024 and H1 2025 has seen a flurry of smaller acquisitions, notably targeting new niche markets and emerging geographies like certain Latin American countries. These moves are classic question marks in the BCG matrix: they operate in markets with high growth potential, but IMCD's current market share within them is relatively low. For instance, their acquisition of a specialty chemicals distributor in Colombia, a region showing robust GDP growth projections for 2025, fits this profile.

IMCD is actively investing in new sustainable product development pipelines, focusing on eco-friendly ingredients and circular economy solutions. This strategic push involves substantial research and development, aiming to capture a growing market segment.

These innovative pipelines, while targeting a rapidly expanding market, may currently hold a low market share as they work towards broader adoption. Success for these initiatives will depend heavily on gaining market acceptance and achieving scalable production.

For instance, in 2024, IMCD reported a significant increase in its sustainability-focused product portfolio, with new offerings contributing to a noticeable uptick in revenue from these segments, though specific market share figures for individual new pipelines are still emerging.

Even in mature markets like Europe and North America, IMCD can identify highly specialized, untapped segments. For instance, consider the growing demand for sustainable, bio-based ingredients in the personal care sector, an area where IMCD might have a nascent presence but substantial future growth. In 2024, the European market for bio-based chemicals alone was projected to reach over €100 billion, highlighting the significant potential within these niche areas.

These opportunities often arise from evolving consumer preferences or new regulatory landscapes, creating specific chemical demands that are not yet fully addressed by existing market players. IMCD's strategy here would involve targeted investment in market penetration and deep relationship building within these specialized niches to effectively capture growth.

Early-Stage Digital Service Offerings

As IMCD pushes forward with its digital strategy, emerging digital services are currently positioned as question marks within the BCG matrix. These initiatives, often in pilot or early adoption stages, are designed to improve how IMCD connects with its customers and suppliers. For instance, their investment in digital platforms aims to streamline order processing and provide enhanced technical support, but broad market acceptance and substantial revenue contributions are still developing.

These early-stage offerings require ongoing investment and careful adjustments to gain traction. The success of these digital services hinges on their ability to demonstrate clear value and achieve wider adoption. By 2024, IMCD reported significant progress in its digital capabilities, with a stated goal of increasing digital engagement by 20% across key customer segments.

- Digital Platforms: Services like enhanced online portals for product information and order tracking are in development.

- Customer Interaction Tools: Pilot programs for AI-driven customer support are being tested.

- Supplier Integration: Efforts to digitize supplier onboarding and collaboration are underway.

- Data Analytics: Investments in data analytics to personalize customer experiences are in their initial phases.

Expansion into New Application-Specific Laboratories

IMCD's strategic investment in new application-specific laboratories, like the Coatings & Construction lab launched in Dubai in March 2025, underscores a deliberate push to deepen technical expertise in targeted, high-growth sectors and geographies. This expansion is a key element of their strategy to move beyond distribution into value-added services, aiming to foster innovation and provide bespoke solutions for clients.

These specialized labs are designed to be engines for future growth, enabling IMCD to offer precisely tailored technical support and product development assistance. While the long-term potential is significant, the immediate market share in these newly established, niche application areas is naturally expected to be low as the labs build their track record and client base.

- Investment in Specialized Expertise: IMCD's commitment to application laboratories demonstrates a focus on building deep technical knowledge in specific market segments.

- Targeted Growth Strategy: The establishment of labs like the Dubai Coatings & Construction facility in March 2025 aims to unlock growth in high-potential, specialized applications.

- Value-Added Services: These labs position IMCD to offer more than just distribution, providing tailored solutions and technical support to customers.

- Initial Market Share Dynamics: In newly developed, niche laboratory areas, initial market share is typically low, reflecting the early stages of market penetration and service development.

Question Marks represent areas with high growth potential but low current market share for IMCD. These are strategic bets on future success, requiring significant investment to gain traction.

Examples include emerging markets targeted through acquisitions and new sustainable product lines still seeking broad adoption.

IMCD's digital initiatives and specialized application labs also fall into this category, as they are in early stages of development and market penetration.

The success of these Question Marks hinges on effective market entry, customer acceptance, and scaling operations.

| Business Area | Market Growth | IMCD Market Share | Strategic Focus | Key Initiatives |

|---|---|---|---|---|

| Emerging Geographies (e.g., Latin America) | High | Low | Market Penetration | Targeted Acquisitions, Localized Sales Teams |

| Sustainable Product Pipelines | High | Low | Product Development & Market Adoption | R&D Investment, Partnerships for Scale |

| Digital Services & Platforms | High | Low | Customer Engagement & Efficiency | Pilot Programs, AI Integration, Data Analytics |

| Specialized Application Labs (e.g., Coatings & Construction) | High | Low | Technical Expertise & Value-Added Services | Lab Establishment, Tailored Client Solutions |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of internal financial data, comprehensive market research reports, and industry-specific growth projections to ensure accurate strategic positioning.