IHH Healthcare PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHH Healthcare Bundle

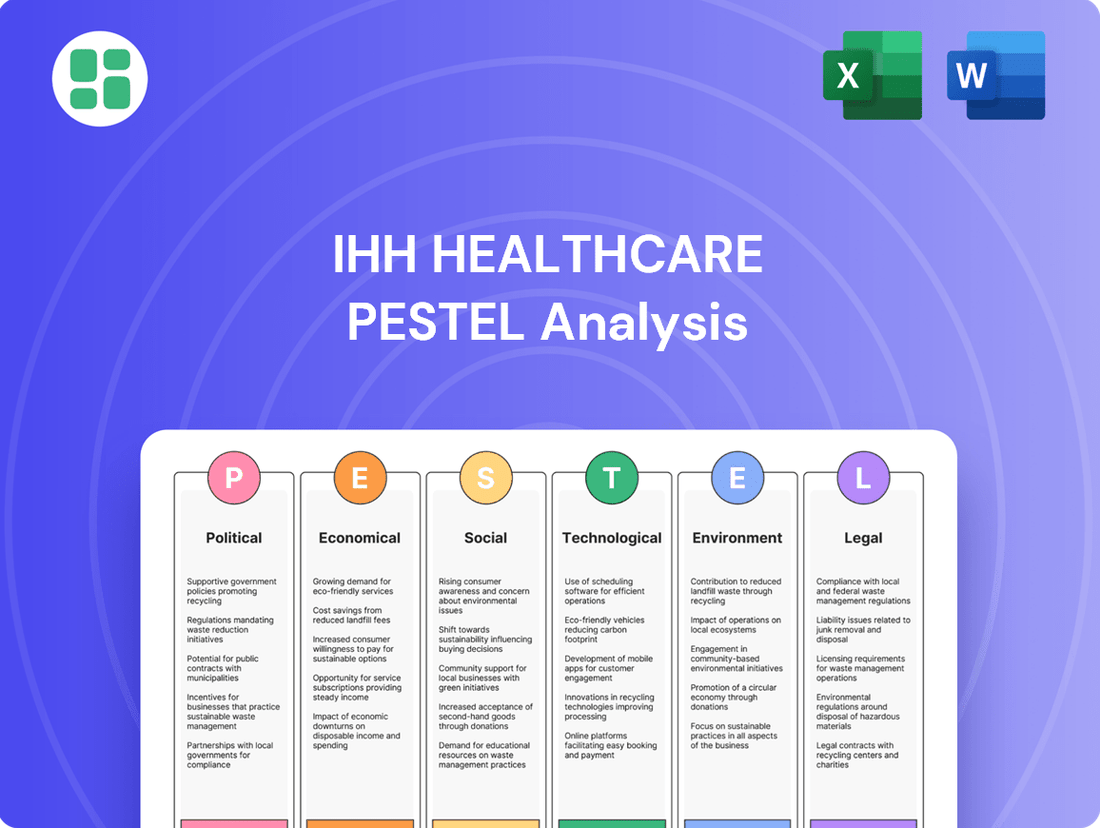

Navigate the complex global landscape affecting IHH Healthcare. Our PESTLE analysis dissects the political, economic, social, technological, legal, and environmental factors shaping its trajectory. Gain a crucial understanding of these external forces to inform your strategic decisions and identify potential opportunities or threats. Download the full analysis now for actionable intelligence.

Political factors

Government healthcare policies are a major driver for IHH Healthcare. Initiatives like Singapore's 'Healthier SG' push for preventive care, prompting IHH to bolster its out-of-hospital services. This strategic shift aligns with a broader trend of governments focusing on wellness rather than just treatment.

Increased government healthcare spending in key markets like Malaysia and Turkey offers significant growth avenues for private players such as IHH. For example, Malaysia's healthcare expenditure grew by an estimated 7.5% in 2024, reaching approximately RM 35 billion, signaling a positive environment for expanding private healthcare capacity.

Political stability across IHH Healthcare's diverse operating regions, spanning Asia and Europe, is a critical determinant of its ongoing business success and future growth initiatives. Regions experiencing political upheaval or frequent policy shifts can introduce significant regulatory uncertainty and potential disruptions to healthcare service delivery, directly impacting IHH's market penetration and financial performance.

For instance, in 2024, IHH's presence in markets like Malaysia, Singapore, and Turkey means it must continually monitor and adapt to evolving governmental healthcare policies and economic development plans. The company's strategy involves localized approaches to navigate these varying political landscapes, ensuring continued access and operational efficiency.

Governments across IHH Healthcare's operating regions are prioritizing healthcare accessibility and affordability. This focus often translates into potential pricing regulations or the development of public-private partnerships, impacting how healthcare services are delivered and financed. For instance, in Malaysia, the government's Health White Paper aims to reform the healthcare system, potentially influencing private sector involvement and pricing structures.

IHH Healthcare is proactively aligning with these national health objectives by embracing value-based care models. This strategic shift supports government efforts to manage rising healthcare expenditures and enhance patient outcomes. By focusing on value, IHH aims to demonstrate cost-effectiveness and improved quality of care, which is increasingly a benchmark for public and private healthcare collaborations.

International Medical Tourism Policies

Policies governing medical tourism in key IHH Healthcare markets like Singapore and Malaysia significantly influence its international patient revenue. For instance, Singapore's government has actively promoted medical tourism, aiming to attract a substantial share of the global market. In 2023, Singapore's healthcare sector, buoyed by medical tourism, saw continued growth, with medical tourism receipts contributing significantly to the nation's economy, though specific figures for IHH's direct benefit are proprietary.

Favorable government initiatives, such as streamlined visa processes and investment in advanced medical infrastructure, directly benefit IHH's specialized tertiary care services by increasing patient inflow. Malaysia also actively supports medical tourism, with initiatives aimed at enhancing its appeal as a destination for quality and affordable healthcare. These policies are crucial for IHH's strategy to attract and retain foreign patients seeking specialized treatments.

Conversely, any shift towards restrictive policies, such as increased visa complexities or new taxation on medical tourism services, could negatively impact patient volume and IHH's revenue streams. Geopolitical tensions or global health crises can also disrupt international travel, directly affecting the number of foreign patients seeking treatment at IHH facilities.

- Government Support: Policies promoting medical tourism in Singapore and Malaysia boost IHH Healthcare's international patient numbers.

- Revenue Impact: Favorable policies enhance revenue from specialized tertiary care services, while restrictive ones can reduce patient flow.

- Geopolitical Sensitivity: International patient volume is susceptible to global health events and geopolitical stability.

Regulatory Oversight and Compliance

Government scrutiny in healthcare is intensifying, with a focus on quality of care, patient safety, and operational standards. This requires IHH Healthcare to maintain robust compliance frameworks across its diverse markets. Failure to adhere to these evolving regulations in 2024 and beyond could lead to significant penalties and damage its reputation.

IHH Healthcare actively addresses these challenges. For instance, the company held a dedicated Risk and Compliance Forum in 2024, underscoring its commitment to strengthening governance and ensuring adherence to regulatory requirements across its global operations. This proactive approach is vital for maintaining its standing as a trusted healthcare provider.

- Increased Regulatory Scrutiny: Healthcare sectors globally are experiencing heightened government oversight.

- Focus Areas: Key concerns include quality of care, patient safety, and adherence to operational standards.

- Compliance Imperative: Robust frameworks are essential for IHH to navigate these evolving regulations.

- Risk Mitigation: The 2024 Risk and Compliance Forum highlights IHH's focus on governance and regulatory adherence.

Government healthcare policies significantly shape IHH Healthcare's operational landscape, influencing everything from service delivery to revenue streams. For example, Singapore's 'Healthier SG' initiative, promoting preventive care, drives IHH to expand its out-of-hospital services, aligning with national health priorities.

Increased government healthcare spending in markets like Malaysia, where expenditure was projected to reach approximately RM 35 billion in 2024, presents growth opportunities for private providers. IHH's strategy involves adapting to diverse political landscapes and evolving healthcare reforms, such as Malaysia's Health White Paper, which aims to reshape the sector.

Policies supporting medical tourism, a key revenue driver for IHH in Singapore and Malaysia, are crucial. While specific figures for IHH's benefit are proprietary, Singapore's continued promotion of medical tourism in 2023, contributing significantly to its economy, underscores the positive impact of such government backing.

Heightened government scrutiny on quality of care and patient safety necessitates robust compliance frameworks. IHH's 2024 Risk and Compliance Forum demonstrates a commitment to navigating these evolving regulations and maintaining operational integrity across its global network.

| Factor | Impact on IHH Healthcare | Supporting Data/Example |

|---|---|---|

| Government Health Policies | Drives expansion into preventive and out-of-hospital services. | Singapore's 'Healthier SG' initiative. |

| Healthcare Spending | Creates growth opportunities in key markets. | Malaysia's projected RM 35 billion healthcare expenditure in 2024. |

| Medical Tourism Policies | Boosts international patient revenue and specialized care demand. | Singapore's continued promotion of medical tourism in 2023. |

| Regulatory Scrutiny | Requires strong compliance and governance. | IHH's 2024 Risk and Compliance Forum. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting IHH Healthcare, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within IHH Healthcare's operating landscape.

A clear, actionable PESTLE analysis for IHH Healthcare, transforming complex external factors into easily digestible insights for strategic decision-making.

This PESTLE analysis for IHH Healthcare offers a concise, visually segmented overview of external influences, simplifying risk assessment and market opportunity identification for enhanced strategic planning.

Economic factors

Global healthcare expenditure is on a strong upward trajectory, with forecasts indicating continued growth through 2025 and beyond. This expansion is fueled by demographic shifts, particularly aging populations, and the constant innovation in medical technologies, leading to higher demand for advanced treatments and services.

IHH Healthcare's key operating regions, including Singapore, India, and Malaysia, are all experiencing this rise in healthcare spending. For instance, India's healthcare market alone is projected to reach $372 billion by 2022, and is expected to continue its rapid expansion. This robust market environment directly benefits IHH by creating a substantial and growing customer base for its extensive range of medical offerings.

This secular trend of increasing healthcare expenditure translates into tangible benefits for IHH. The company is well-positioned to capitalize on this, expecting higher inpatient admissions and an improved revenue intensity per patient as demand for its sophisticated medical services escalates across its operational footprint.

IHH Healthcare, like many in the healthcare sector, is navigating significant inflationary pressures. These include escalating energy expenses and increased staffing costs, which directly impact operational budgets. Furthermore, medical inflation, the rise in healthcare service and supply costs, presents a persistent challenge.

To counter these headwinds, IHH Healthcare is actively implementing strategic price adjustments across its services. Simultaneously, a strong emphasis on operational efficiencies, driven by its ACE Framework, is crucial for cost management. For instance, in 2023, IHH reported that its focus on operational efficiencies contributed to improved margins despite these cost pressures.

Disposable income is a huge driver for private healthcare demand. In 2023, for instance, countries like Malaysia and Singapore, key markets for IHH Healthcare, saw their GDP per capita grow, indicating a potential rise in disposable income. This increased affluence often translates to greater spending on premium healthcare services and elective procedures, which directly benefits providers like IHH.

However, economic downturns can quickly change this. If disposable incomes shrink, as seen in some emerging markets experiencing inflation in late 2024, consumers might defer non-essential medical treatments or opt for more cost-effective public healthcare options. IHH's diversified geographic footprint, spanning Southeast Asia and beyond, helps mitigate the impact of localized economic slowdowns by balancing performance across different regional economies.

Currency Fluctuations and Exchange Rate Risks

IHH Healthcare's international operations, especially in markets like Turkey, mean it's directly affected by currency fluctuations. These shifts can significantly alter the value of revenue earned and costs incurred in different countries, impacting overall profitability. For instance, a weakening Turkish Lira against stronger currencies could reduce the reported value of IHH's Turkish earnings when consolidated.

To manage this, IHH Healthcare employs financial strategies to hedge against currency risks. This involves using financial instruments to lock in exchange rates, thereby creating more predictable financial outcomes. The company actively works to minimize its exposure to the volatility of foreign exchange markets.

- Exposure: IHH Healthcare's revenue and costs are subject to exchange rate volatility across its global operations.

- Impact: Fluctuations can affect reported earnings, particularly in markets like Turkey where currencies may experience significant swings.

- Mitigation: The company utilizes financial hedging strategies to protect against adverse currency movements.

- Objective: To ensure stable financial performance and predictable revenue streams despite global economic uncertainties.

Strategic Acquisitions and Capacity Expansion

IHH Healthcare's economic strategy centers on aggressive capacity expansion and strategic acquisitions to capitalize on rising healthcare demand. For instance, their acquisition of Island Hospital in Penang exemplifies this approach, aiming to bolster their presence in key markets. This growth is further evidenced by significant expansion plans in rapidly developing economies like India and Turkey.

This strategic investment in infrastructure and market consolidation is underpinned by robust financial performance. In 2024, IHH Healthcare reported strong revenue growth, demonstrating the effectiveness of their expansionary economic policies. This financial health provides the necessary capital for continued strategic acquisitions and capacity enhancements, positioning IHH to benefit from favorable economic trends in the healthcare sector.

- Strategic Acquisitions: IHH Healthcare actively pursues acquisitions to expand its network and service offerings, as seen with Island Hospital in Penang.

- Capacity Expansion: Significant investments are being made in increasing hospital beds and facilities, particularly in high-growth markets like India and Turkey.

- Financial Performance: The company's strong financial results in 2024 provide the foundation for these ambitious growth initiatives.

- Market Position: These economic strategies are designed to strengthen IHH's competitive advantage and capture increasing healthcare demand.

Global healthcare expenditure continues its upward trend, with projections indicating sustained growth through 2025, driven by aging populations and medical advancements. IHH Healthcare benefits from this, especially in markets like India, where the healthcare sector is expanding rapidly, projected to reach significant figures by the mid-2020s, creating a larger patient base.

Inflationary pressures, including rising energy, staffing, and medical costs, directly impact IHH's operational budgets. The company counters this through strategic price adjustments and a focus on operational efficiencies, as demonstrated by margin improvements in 2023 despite these cost increases.

Disposable income growth in key IHH markets like Malaysia and Singapore, evidenced by rising GDP per capita in 2023, fuels demand for premium healthcare services. However, economic downturns and inflation in emerging markets can lead consumers to defer elective treatments, a risk IHH mitigates through its diversified geographic presence.

Currency fluctuations, particularly in markets like Turkey, significantly affect IHH's reported earnings and costs. The company actively manages this risk through financial hedging strategies to ensure more predictable financial outcomes.

Full Version Awaits

IHH Healthcare PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of IHH Healthcare delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the critical external forces shaping the global healthcare landscape for IHH.

Sociological factors

The world is experiencing a significant demographic shift, with the United Nations projecting that by 2030, one in every six people globally will be aged 60 years or over. This growing elderly population naturally leads to an increased demand for healthcare services, particularly those requiring specialized and complex care.

IHH Healthcare, with its extensive network and focus on tertiary care services like oncology, cardiology, and neurology, is strategically positioned to meet the evolving health needs of this expanding demographic. The company's comprehensive service offerings align directly with the rising requirements for advanced medical treatments and chronic disease management.

To effectively serve this segment, IHH Healthcare, like other major healthcare providers, must maintain a commitment to investing in cutting-edge medical technologies and attracting highly skilled medical professionals. This continuous investment is crucial for delivering the high-quality, specialized care that an aging population demands.

Growing health consciousness worldwide, particularly in IHH Healthcare's key markets like Southeast Asia, is a significant sociological driver. This trend is amplified by the increasing incidence of lifestyle-related illnesses such as diabetes, heart disease, and obesity. For instance, the World Health Organization reported in 2023 that non-communicable diseases, largely lifestyle-driven, account for approximately 74% of all deaths globally, a figure projected to rise.

IHH Healthcare's strategic emphasis on preventive health, early detection, and robust chronic disease management directly addresses this societal shift. Their comprehensive service offerings, ranging from general wellness check-ups to specialized cardiac and oncology units, are designed to meet the growing demand for proactive healthcare solutions. In 2024, IHH continued to expand its screening programs, with a notable increase in participation for cardiovascular and cancer screenings across its network.

Modern patients, influenced by their experiences in other digitalized sectors, are now demanding greater accessibility, convenience, and highly personalized healthcare. This shift means they expect seamless interactions and readily available information, much like they experience with online retail or banking.

IHH Healthcare is actively addressing these evolving patient expectations by significantly investing in its digital health infrastructure. For instance, their expansion of telemedicine services and patient portals aims to create a more convenient and responsive healthcare journey. By mid-2024, IHH reported a substantial increase in digital engagement, with over 30% of routine consultations conducted via virtual channels across its key markets, demonstrating a tangible response to patient preferences.

Furthermore, there's a discernible trend towards patients preferring a consolidated point of contact for all their healthcare needs, from appointments to billing and follow-up care. IHH is strategically positioning itself to meet this preference by developing and promoting its integrated service offerings, aiming to be a single, trusted touchpoint for comprehensive health management.

Healthcare Workforce Shortages and Talent Management

The global healthcare sector, including IHH Healthcare's operating regions, grapples with significant workforce shortages. For instance, the World Health Organization projected a global shortfall of 10 million health workers by 2030, with a disproportionate impact on low- and middle-income countries. This scarcity directly affects service delivery and operational capacity.

IHH Healthcare actively combats this by prioritizing talent management. In 2023, the company reported investing in extensive training and development programs, aiming to upskill its existing workforce and attract new talent. Their focus on employee well-being and promoting gender equality in leadership roles, with women holding approximately 40% of senior management positions in 2024, are key strategies to foster a stable and motivated workforce.

- Global Health Worker Shortage: WHO estimates a deficit of 10 million by 2030, impacting service availability.

- IHH Talent Strategy: Focus on employee well-being, comprehensive training, and career advancement.

- Gender Diversity: Approximately 40% of IHH's senior leadership roles were held by women in 2024, enhancing talent pool utilization.

- Retention Focus: Initiatives aim to reduce staff turnover and ensure continuity of high-quality patient care.

Shift Towards Value-Based and Outcome-Focused Care

Societies are increasingly demanding healthcare that focuses on results and affordability, moving away from the old pay-per-service model. This shift emphasizes better patient outcomes and smarter spending. IHH Healthcare is actively embracing this by developing its Value-Driven Outcomes (VDO) programs, which meticulously track various quality metrics. This proactive approach positions IHH to meet growing public and governmental pressure for more cost-effective and impactful healthcare delivery.

This transition is reflected in the growing adoption of value-based purchasing (VBP) initiatives by payers. For instance, in the United States, Medicare's VBP programs have shown a trend towards rewarding providers for quality and efficiency. While specific IHH VDO program outcome data for 2024/2025 isn't publicly detailed yet, the strategic direction indicates a commitment to aligning with these broader healthcare reforms. The global healthcare market is seeing an estimated growth in value-based care spending, projected to reach significant figures in the coming years, underscoring the importance of this societal trend.

- Growing Societal Demand: Patients and governments are pushing for healthcare that delivers better outcomes at a lower cost.

- IHH's VDO Programs: IHH Healthcare is implementing Value-Driven Outcomes programs to monitor and improve quality indicators.

- Alignment with Policy: This move aligns with global trends and policy directives favoring cost-efficient and effective healthcare solutions.

- Market Shift: The global healthcare sector is increasingly prioritizing value-based care models over traditional fee-for-service.

Societal expectations are shifting towards more accessible and personalized healthcare, driven by digital advancements. IHH Healthcare is responding by enhancing its digital infrastructure, including telemedicine and patient portals, to provide a more convenient patient experience.

The increasing demand for integrated care, where patients can manage all their health needs through a single provider, is a key sociological trend. IHH is strategically developing its services to become a comprehensive health management partner for its patients.

A growing global health consciousness, particularly concerning lifestyle-related diseases, is fueling demand for preventive and chronic disease management services. IHH's focus on these areas, evidenced by expanded screening programs in 2024, directly addresses this societal shift.

The aging global population is a significant demographic driver, increasing the need for specialized tertiary care services. IHH Healthcare's established expertise in areas like oncology and cardiology positions it well to serve this growing segment.

| Sociological Factor | Impact on IHH Healthcare | 2024/2025 Data/Trends |

|---|---|---|

| Aging Population | Increased demand for specialized and complex care. | UN projects 1 in 6 people globally will be 60+ by 2030. |

| Health Consciousness & Lifestyle Diseases | Demand for preventive care and chronic disease management. | WHO: Non-communicable diseases account for 74% of global deaths (2023). IHH expanded screening programs in 2024. |

| Digitalization & Patient Expectations | Demand for accessibility, convenience, and personalization. | IHH saw over 30% of routine consultations via virtual channels by mid-2024. |

| Integrated Care Preference | Patients prefer a single point of contact for all health needs. | IHH is developing integrated service offerings. |

Technological factors

IHH Healthcare is heavily investing in digital transformation, aiming to upgrade its digital infrastructure across Singapore, Malaysia, and India through multi-year partnerships. This strategic move focuses on modernizing clinical workflows, hospital operations, and billing systems, ensuring a more efficient and integrated patient experience.

The company is significantly expanding its telemedicine services and patient portals, enhancing accessibility and convenience for patients. For instance, by the end of 2024, IHH aims to see a 20% increase in telemedicine consultations compared to 2023, reflecting a growing reliance on digital health solutions.

The healthcare sector is experiencing a significant transformation driven by the integration of Artificial Intelligence (AI), enhancing diagnostic accuracy and operational workflows. IHH Healthcare is actively adopting AI technologies, notably in imaging, which has shown potential to cut reporting times by up to 30% in pilot programs, allowing for faster patient care decisions.

Furthermore, IHH is exploring AI for financial counseling and advanced fall prevention systems, aiming to improve patient experience and reduce adverse events. The growing impact of AI is also anticipated in streamlining benefits management and optimizing care delivery models throughout 2024 and into 2025.

IHH Healthcare's commitment to clinical excellence is heavily reliant on continuous advancements in medical technology. Innovations like robotic-assisted surgery, exemplified by systems such as the da Vinci Surgical System, and advanced treatments like proton therapy for cancer, are key components of their strategy. These technologies enable IHH to provide highly specialized tertiary care, leading to improved patient outcomes and a stronger competitive position in the healthcare market.

Data Management, Analytics, and Cybersecurity

The healthcare sector is awash in data, and IHH Healthcare recognizes the critical need for advanced data management and analytics to drive better decision-making. By leveraging these capabilities, they aim to unlock actionable insights that enhance both operational efficiency and clinical outcomes. This focus is particularly relevant as the global healthcare analytics market was projected to reach USD 49.5 billion by 2025, indicating a significant industry-wide push towards data-driven strategies.

Protecting the vast amounts of sensitive patient information is a non-negotiable priority. IHH is actively investing in robust cybersecurity measures to safeguard data privacy and maintain the trust of its patients and stakeholders. This commitment is essential, especially considering the escalating sophistication of cyber threats targeting healthcare organizations. For instance, ransomware attacks on healthcare providers saw a substantial increase in 2023, underscoring the urgency of these defenses.

- Data Modernization: IHH is upgrading its data infrastructure to handle the growing volume and complexity of healthcare information, enabling more sophisticated analytics.

- Actionable Insights: The goal is to transform raw data into practical insights that improve patient care, streamline operations, and support strategic planning.

- Cybersecurity Investment: Significant resources are being allocated to fortify defenses against cyber threats, ensuring the confidentiality and integrity of patient data.

- Regulatory Compliance: Adherence to stringent data protection regulations, such as GDPR and HIPAA, remains a core component of their data management strategy.

Innovation in Healthcare Delivery Models

Technology is a key driver for IHH Healthcare to reimagine how healthcare is delivered. For instance, in Singapore, a land-scarce environment, IHH is actively developing an out-of-hospital strategy. This involves expanding its network of primary clinics, ambulatory care centers, and home-based care services, all facilitated by technological advancements.

These technological enablers are crucial for creating a more integrated and seamless patient journey, extending care beyond the confines of traditional hospitals. By leveraging technology, IHH can optimize the use of its existing facilities and significantly enhance the overall efficiency and quality of its service delivery.

- Telemedicine Growth: The global telemedicine market was valued at approximately USD 110 billion in 2023 and is projected to grow substantially, supporting IHH's out-of-hospital strategy.

- Digital Health Investments: IHH Healthcare has been investing in digital health solutions, aiming to improve patient engagement and operational efficiency.

- Ambulatory Care Expansion: The company's focus on ambulatory care centers, supported by technology for appointment scheduling and patient management, reflects a shift towards more accessible and efficient care models.

Technological advancements are central to IHH Healthcare's strategy, driving efficiency and expanding patient access. The company is heavily investing in digital infrastructure across its key markets, aiming to upgrade clinical workflows and patient billing systems by the end of 2024.

AI integration is a significant focus, with pilot programs in medical imaging showing up to a 30% reduction in reporting times. IHH is also leveraging AI for financial counseling and patient safety initiatives, anticipating broader applications in care delivery throughout 2024 and 2025.

The expansion of telemedicine services is a key technological enabler, supporting an out-of-hospital care strategy. This aligns with the global telemedicine market, valued at approximately USD 110 billion in 2023, with substantial projected growth.

IHH is also enhancing its data management and analytics capabilities, recognizing the critical need for data-driven decision-making in healthcare. This is particularly relevant as the global healthcare analytics market was projected to reach USD 49.5 billion by 2025.

| Technology Area | IHH Healthcare Initiative | Impact/Goal | Relevant Market Data (2023/2024) |

|---|---|---|---|

| Digital Transformation | Upgrading digital infrastructure (Singapore, Malaysia, India) | Modernize clinical workflows, operations, billing | Ongoing multi-year partnerships |

| Telemedicine | Expanding patient portals and consultations | Increase accessibility, convenience | Targeting 20% telemedicine consultation increase by end of 2024 (vs 2023); Global market ~USD 110 billion (2023) |

| Artificial Intelligence (AI) | AI in medical imaging, financial counseling, fall prevention | Enhance diagnostic accuracy, operational efficiency, patient safety | Pilot programs show up to 30% reduction in imaging reporting times |

| Data Analytics | Leveraging advanced data management and analytics | Improve operational efficiency, clinical outcomes | Global healthcare analytics market projected to reach USD 49.5 billion by 2025 |

Legal factors

IHH Healthcare navigates a complex web of healthcare regulations and compliance standards across its global operations. This necessitates strict adherence to local licensing, medical practice laws, and financial reporting frameworks such as MFRS and IFRS, ensuring operational integrity and legal standing in each market.

The company's dedication to strong corporate governance is evident in its annual reports, which detail its compliance efforts and strategic initiatives. For instance, in its 2023 annual report, IHH Healthcare emphasized its ongoing work towards International Sustainability Standards Board (ISSB) compliance, signaling a commitment to transparent and standardized sustainability reporting.

The increasing digitalization of healthcare services means that patient rights and data privacy laws are paramount for IHH Healthcare. Regulations similar to the EU's General Data Protection Regulation (GDPR) are being implemented globally, requiring robust data protection frameworks. In 2024, the global cybersecurity market, a key component of data privacy, was valued at approximately $271.8 billion and is projected to grow significantly, underscoring the importance of IHH's investment in these areas to maintain patient trust and avoid substantial legal penalties.

IHH Healthcare operates within diverse legal landscapes concerning medical malpractice and professional liability. These laws differ considerably across its global markets, requiring a nuanced approach to compliance and risk management.

Navigating these varying legal frameworks is crucial for IHH. The company must secure robust insurance policies and consistently implement stringent best practices in patient care to effectively mitigate potential legal risks and associated financial liabilities.

In 2023, the global medical malpractice insurance market was valued at approximately $15 billion, highlighting the significant financial implications of these liabilities. IHH's commitment to maintaining high clinical excellence serves as a primary strategy to reduce the incidence of claims and maintain a strong legal standing.

Antitrust and Competition Laws

Antitrust and competition laws significantly influence IHH Healthcare's global operations, particularly its growth through mergers and acquisitions. As a major player, its strategic moves are scrutinized to prevent market monopolization and ensure fair competition. For instance, the proposed acquisition of a significant stake in Fortis Healthcare in 2018 faced regulatory reviews in India, highlighting the need for compliance.

These regulations aim to safeguard consumer interests by preventing practices that could lead to higher prices or reduced service quality. IHH Healthcare must navigate a complex web of national and international competition authorities, such as the European Commission and the Competition and Consumer Commission of Singapore, when planning market expansions or integrating new facilities. Failure to comply can result in substantial fines and divestment orders.

Key considerations for IHH Healthcare include:

- Merger Control Filings: Ensuring all significant acquisitions meet mandatory notification requirements with relevant competition authorities before completion.

- Market Dominance Assessment: Understanding how its market share in specific geographies might be perceived as dominant and the implications for future growth.

- Anti-competitive Agreements: Prohibiting any arrangements with competitors that could fix prices, limit output, or divide markets.

Employment and Labor Laws

IHH Healthcare, a global healthcare provider with a workforce exceeding 70,000 individuals, navigates a complex web of employment and labor regulations across its international operations. These laws dictate crucial aspects such as minimum wages, health and safety standards in the workplace, employee benefits packages, and the framework for industrial relations. For instance, in 2024, compliance with evolving labor laws in countries like Malaysia, Singapore, and Turkey is paramount.

Failure to adhere to these diverse legal mandates can lead to significant repercussions, including hefty fines, operational disruptions, and damage to the company's reputation. Maintaining a positive and legally compliant work environment is not just a matter of good practice; it's essential for operational stability and employee morale.

Key areas of focus for IHH Healthcare in 2024-2025 include:

- Wage and Hour Laws: Ensuring compliance with statutory minimum wages and overtime regulations in all operating regions.

- Working Conditions and Safety: Adhering to occupational health and safety standards to provide a secure environment for all employees.

- Employee Benefits and Entitlements: Meeting legal requirements for leave, health insurance, retirement contributions, and other statutory benefits.

- Industrial Relations and Collective Bargaining: Managing relationships with employee unions and complying with regulations governing collective agreements and dispute resolution.

IHH Healthcare must meticulously adhere to evolving healthcare legislation globally, covering everything from medical licensing to patient data privacy, as seen with GDPR-like regulations. The company's 2023 report highlighted its move towards ISSB compliance, demonstrating a commitment to standardized sustainability reporting. In 2024, the global cybersecurity market, crucial for data protection, was valued at approximately $271.8 billion, underscoring the legal imperative for robust data security.

Environmental factors

IHH Healthcare is actively working to shrink its environmental impact, aiming for Net-Zero carbon emissions by 2050. This commitment translates into concrete interim goals, including capping its Scope 1 and Scope 2 emissions at the 2022 baseline levels by the year 2025. They are also focused on reducing carbon intensity per patient bed-day, demonstrating a serious dedication to environmental responsibility.

IHH Healthcare is actively pursuing renewable energy adoption as a core environmental strategy. A significant initiative is the development of a large-scale solar farm in Turkey, projected to supply as much as 80% of its Turkish operations' annual energy requirements by 2025. This move is complemented by the installation of rooftop solar panels across its Malaysian hospitals, aiming to reduce dependence on traditional fossil fuels.

IHH Healthcare is actively tackling waste, particularly single-use plastics, in its non-clinical operations. This initiative is crucial given the healthcare sector's significant environmental footprint.

The company has seen notable success, achieving over a 90% reduction in single-use plastics in certain locations like Hong Kong, Turkey, Malaysia, and Singapore. This demonstrates a tangible commitment to sustainability.

These efforts directly support global environmental objectives by mitigating the substantial waste generated by healthcare facilities, contributing to a more sustainable industry.

Reduction of Environmentally Harmful Anesthetic Gases

IHH Healthcare is actively addressing the environmental impact of anesthetic gases, which are known potent greenhouse gases. Recognizing this, the company has initiated programs to decrease their usage in clinical settings.

A key achievement in this area was the significant reduction in desflurane use, reaching up to 55% by 2024. This targeted initiative directly contributes to lowering IHH Healthcare's overall greenhouse gas emissions.

- Greenhouse Gas Reduction: Anesthetic gases like desflurane have a high global warming potential.

- Desflurane Use Reduction: IHH Healthcare achieved a reduction of up to 55% in desflurane usage in 2024.

- Sustainable Practices: This reduction demonstrates a commitment to environmentally responsible clinical operations.

Climate Resilience and Environmental Stewardship

IHH Healthcare acknowledges the intrinsic link between human well-being and the health of our planet, actively pursuing environmental stewardship. This commitment is central to their strategy for a healthier future.

As a global healthcare leader, IHH Healthcare understands its significant role in reducing environmental impact and preserving natural resources. Their sustainability efforts encompass not only their direct operations but also broader ecological concerns.

- Resource Conservation: IHH Healthcare is focused on minimizing waste and optimizing the use of resources like water and energy across its facilities.

- Emissions Reduction: The company is implementing strategies to lower its carbon footprint, aligning with global climate goals.

- Sustainable Procurement: IHH Healthcare is increasingly prioritizing suppliers who demonstrate strong environmental practices.

- Ecosystem Protection: Beyond its own footprint, the organization considers the wider impact of its activities on natural ecosystems.

IHH Healthcare is actively working to shrink its environmental impact, aiming for Net-Zero carbon emissions by 2050. This commitment translates into concrete interim goals, including capping its Scope 1 and Scope 2 emissions at the 2022 baseline levels by the year 2025. They are also focused on reducing carbon intensity per patient bed-day, demonstrating a serious dedication to environmental responsibility.

IHH Healthcare is actively pursuing renewable energy adoption as a core environmental strategy. A significant initiative is the development of a large-scale solar farm in Turkey, projected to supply as much as 80% of its Turkish operations' annual energy requirements by 2025. This move is complemented by the installation of rooftop solar panels across its Malaysian hospitals, aiming to reduce dependence on traditional fossil fuels.

IHH Healthcare is actively tackling waste, particularly single-use plastics, in its non-clinical operations. The company has seen notable success, achieving over a 90% reduction in single-use plastics in certain locations like Hong Kong, Turkey, Malaysia, and Singapore by 2024, demonstrating a tangible commitment to sustainability.

The company has initiated programs to decrease the usage of anesthetic gases, known potent greenhouse gases, with a significant reduction in desflurane use, reaching up to 55% by 2024, directly contributing to lowering IHH Healthcare's overall greenhouse gas emissions.

| Environmental Goal | Target Year | Progress/Status |

|---|---|---|

| Net-Zero Carbon Emissions | 2050 | Ongoing |

| Cap Scope 1 & 2 Emissions | 2025 | Capped at 2022 baseline |

| Renewable Energy (Turkey) | 2025 | Solar farm to supply up to 80% of annual energy needs |

| Single-Use Plastic Reduction | 2024 | Over 90% reduction in select locations |

| Desflurane Use Reduction | 2024 | Up to 55% reduction achieved |

PESTLE Analysis Data Sources

Our PESTLE analysis for IHH Healthcare draws from a comprehensive suite of data sources, including reports from the World Health Organization, national health ministries, and leading market research firms specializing in the healthcare sector. We also incorporate data from financial institutions and economic forecasting agencies to ensure a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the organization.