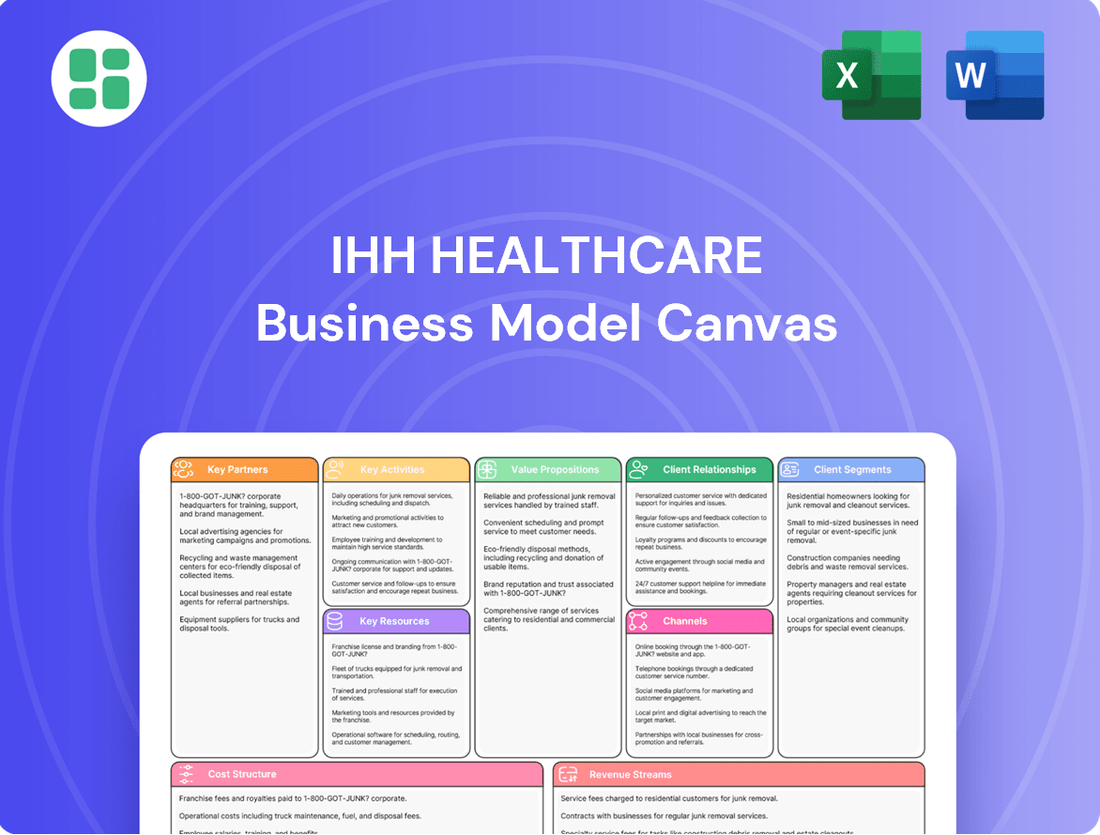

IHH Healthcare Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHH Healthcare Bundle

Discover the strategic framework behind IHH Healthcare's global success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights for aspiring healthcare leaders. Get the full picture and unlock actionable strategies.

Partnerships

IHH Healthcare's strategy heavily relies on key partnerships formed through strategic hospital acquisitions and consolidations. In 2024, significant moves included the acquisition of Island Hospital and Timberland Medical Centre, bolstering its presence in Malaysia and expanding bed capacity. These transactions are crucial for integrating new facilities and tapping into established patient networks, thereby deepening its market penetration.

These value-accretive mergers and acquisitions are designed to fortify IHH's leadership in its core markets while simultaneously paving the way for entry into emerging healthcare landscapes such as Indonesia and Vietnam. By strategically consolidating its operations, IHH aims to achieve greater economies of scale and enhance its overall service delivery capabilities across its expanding geographic footprint.

IHH Healthcare actively partners with premier medical technology and equipment providers to ensure its hospitals are equipped with the most advanced diagnostic and treatment capabilities. These collaborations are crucial for maintaining a competitive edge and delivering superior patient care.

Key collaborations include access to sophisticated surgical systems like the da Vinci robotic platform, which facilitates minimally invasive procedures, and specialized equipment such as the Gamma Knife for precise radiosurgery. For instance, IHH's Parkway Pantai hospitals in Singapore have been at the forefront of adopting such technologies, enhancing surgical outcomes.

These strategic alliances allow IHH to integrate cutting-edge innovations, ensuring patients benefit from the latest medical advancements. By securing access to state-of-the-art solutions, IHH reinforces its position as a leader in medical excellence and patient safety.

IHH Healthcare's strategic alliances with pharmaceutical giants and drug suppliers are foundational to its operations. These partnerships guarantee a steady flow of high-quality medicines and medical supplies, which is paramount for delivering excellent patient care. For instance, in 2023, IHH Healthcare's procurement strategy heavily emphasized bulk purchases of generic drugs and consumables, a move critical for cost management in a competitive healthcare landscape.

By leveraging its scale, IHH negotiates favorable terms with these key partners, thereby mitigating the impact of escalating drug prices. This focus on cost-efficiency through strategic sourcing directly contributes to the organization's financial resilience and its ability to offer competitive healthcare services. The reliability of these supply chains is a direct enabler of IHH's commitment to both patient well-being and its own fiscal stability.

Insurance Providers and Payors

IHH Healthcare's business model heavily relies on robust relationships with insurance providers and payors. These partnerships are crucial for ensuring consistent revenue flow and making their extensive healthcare services accessible to a wider population. By collaborating with a variety of public and private insurers, IHH can streamline the reimbursement process, which is vital for operational efficiency and financial stability.

These collaborations directly impact patient accessibility. For instance, in 2023, IHH Healthcare reported that a significant portion of its revenue was derived from patients utilizing insurance coverage, highlighting the importance of these payor relationships. Effectively managing payor negotiations and optimizing reimbursement rates are ongoing strategic priorities for IHH, directly influencing their profitability and market competitiveness.

- Revenue Generation: Partnerships with insurers are a primary driver of IHH's revenue, covering a substantial percentage of patient treatments.

- Patient Access: Collaborations broaden the patient demographic by accommodating various insurance plans, increasing service utilization.

- Reimbursement Optimization: IHH actively manages payor relationships to ensure fair and timely reimbursements, a critical factor in financial health.

- Market Reach: Strong ties with payors enhance IHH's ability to attract and serve a larger patient base across its network.

Academic Institutions and Research Bodies

IHH Healthcare actively partners with academic institutions and research bodies to bolster medical education and training programs. These collaborations are crucial for advancing clinical research and staying at the forefront of medical innovation. For instance, in 2023, IHH continued its commitment to nurturing future medical professionals through various educational outreach programs, though specific partnership funding details for that year are not publicly itemized.

These strategic alliances are instrumental in driving medical advancements and ensuring IHH Healthcare remains a preferred employer for leading medical professionals. By fostering an environment of continuous learning and research, IHH attracts and retains top-tier talent, which is vital for delivering high-quality patient care. The organization’s engagement in research directly contributes to global healthcare improvements.

Key benefits of these partnerships include:

- Enhanced Medical Education: Providing platforms for medical students and professionals to gain practical experience and specialized training.

- Clinical Research Advancement: Collaborating on studies that lead to new treatments and improved patient outcomes.

- Talent Acquisition and Retention: Offering attractive opportunities for medical professionals interested in research and academic pursuits.

- Innovation in Healthcare: Driving the adoption of cutting-edge medical technologies and practices.

IHH Healthcare's key partnerships are vital for its operational success and strategic growth. These include collaborations with medical technology providers, ensuring access to advanced equipment, and strong relationships with pharmaceutical companies for a steady supply of medicines, critical for patient care and cost management. Furthermore, partnerships with insurers and payors are fundamental for revenue generation and patient accessibility, with a significant portion of revenue in 2023 coming from insured patients.

These alliances extend to academic institutions for medical education and research, fostering talent and driving innovation. The strategic acquisitions in 2024, like Island Hospital and Timberland Medical Centre, also represent key partnerships that integrate new facilities and patient networks, enhancing market penetration and economies of scale across its growing footprint.

| Partnership Type | Key Activities | Impact | 2023/2024 Relevance |

|---|---|---|---|

| Medical Technology Providers | Access to advanced diagnostic and treatment equipment (e.g., da Vinci robotic platform, Gamma Knife) | Competitive edge, superior patient care, enhanced surgical outcomes | Continued integration of cutting-edge innovations |

| Pharmaceutical Companies | Ensuring steady supply of high-quality medicines and medical supplies; bulk purchasing of generics | Cost management, financial resilience, competitive service offering | Critical for cost efficiency and supply chain reliability |

| Insurers and Payors | Streamlining reimbursement processes, negotiating rates | Consistent revenue flow, wider patient accessibility, operational efficiency | Significant portion of 2023 revenue derived from insured patients |

| Academic Institutions | Medical education, training programs, clinical research | Advancing medical innovation, talent acquisition and retention, improved patient outcomes | Ongoing commitment to nurturing future medical professionals |

| Acquired Hospitals (e.g., Island Hospital, Timberland Medical Centre) | Integration of facilities, tapping into established patient networks | Deepened market penetration, economies of scale, enhanced service delivery | Bolstered presence in Malaysia in 2024 |

What is included in the product

This IHH Healthcare Business Model Canvas outlines a comprehensive strategy for providing integrated healthcare services across diverse patient segments and geographies, leveraging a robust network of hospitals, diagnostic centers, and digital platforms.

It details key partnerships, revenue streams from medical tourism and insurance, and cost structures associated with advanced medical technology and skilled human capital.

The IHH Healthcare Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, enabling quick identification of inefficiencies and areas for strategic improvement.

It simplifies the understanding of IHH Healthcare's value proposition and customer segments, thereby relieving the pain of deciphering intricate healthcare delivery networks.

Activities

IHH Healthcare's primary activity revolves around delivering a complete range of healthcare services. This spans from initial primary and secondary care to advanced tertiary and quaternary treatments, including specialized areas like oncology, cardiology, and neurology across its extensive network of hospitals and clinics.

In 2024, IHH Healthcare continued to emphasize enhancing clinical outcomes and patient experiences. This commitment is underscored by their focus on quality and safety protocols that govern the delivery of care across all their facilities, aiming to set benchmarks in patient satisfaction and medical efficacy.

IHH Healthcare actively manages and grows its extensive global network of hospitals, clinics, and medical centers, spanning key markets in Asia and Europe. This involves ensuring operational excellence and strategic development across its diverse facilities.

A core activity is the continuous enhancement of facility infrastructure, including upgrades and the strategic expansion of capacity. For instance, IHH Healthcare has committed to adding thousands of new beds across its network in the coming years to meet growing healthcare demands.

The management focus is on achieving seamless coordination and implementing standardized treatment protocols across all its healthcare facilities. This standardization is crucial for maintaining consistent quality of care and operational efficiency throughout the network.

IHH Healthcare actively engages in medical education and training, offering programs for continuous professional development. This commitment ensures a highly skilled workforce, adept in advanced medical procedures and cutting-edge technologies. For instance, in 2023, IHH reported significant investment in talent development, with over 10,000 staff members participating in various training programs, including specialized medical courses.

Digital Health and Technology Integration

IHH Healthcare is actively implementing digital health technologies to boost patient care and operational efficiency. This involves integrating telemedicine platforms, AI for diagnostics, and remote monitoring systems to improve accessibility and outcomes.

A key focus is automating routine tasks, such as patient monitoring, which frees up valuable nursing time for more direct patient interaction and care. This strategic shift aims to enhance the overall quality and delivery of healthcare services across their network.

For instance, in 2023, IHH Healthcare reported a significant increase in the adoption of digital tools, with a substantial portion of consultations being conducted via telemedicine. This digital push is expected to contribute to a projected 15% improvement in operational efficiency by 2025.

Key activities in this area include:

- Developing and deploying AI-driven diagnostic tools to support clinical decision-making.

- Expanding telemedicine services to reach a wider patient base and offer convenient consultations.

- Implementing remote patient monitoring solutions for chronic disease management and post-operative care.

- Automating administrative and clinical workflows to enhance efficiency and reduce human error.

Strategic Growth and Market Expansion

IHH Healthcare is actively pursuing strategic growth and market expansion through a multi-pronged approach. This includes focusing on organic growth, which means building out existing facilities and services, alongside brownfield expansion, essentially upgrading and enlarging current operations. The company also actively seeks value-accretive mergers and acquisitions to bolster its market presence and capabilities.

A key element of this strategy is identifying and entering new geographical markets, thereby broadening its global footprint. Simultaneously, IHH aims to expand its continuum of care by developing and integrating ambulatory care centers and primary care clinics. This comprehensive approach is designed to ensure sustained double-digit growth and solidify its position as a global leader in the healthcare sector.

- Organic Growth: Continued investment in existing hospitals and services.

- Brownfield Expansion: Upgrading and expanding current facilities to increase capacity and service offerings.

- Mergers & Acquisitions: Pursuing strategic acquisitions to enter new markets or enhance existing capabilities.

- Continuum of Care: Expanding into ambulatory care centers and primary care clinics to offer a wider range of services.

IHH Healthcare's key activities are centered on delivering comprehensive healthcare services across its global network. This involves managing and expanding its hospital and clinic footprint, with a focus on enhancing clinical outcomes and patient safety. The company also invests heavily in digital health technologies and talent development to improve efficiency and care delivery.

In 2024, IHH Healthcare's strategic growth efforts continued, emphasizing organic expansion, facility upgrades, and potential mergers and acquisitions. They are also broadening their service offerings by integrating ambulatory and primary care centers to create a more complete continuum of care.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Healthcare Service Delivery | Providing a full spectrum of medical treatments from primary to quaternary care. | Enhancing clinical outcomes and patient experience through quality protocols. |

| Network Management & Expansion | Operating and growing a global network of hospitals and clinics. | Strategic development and operational excellence across diverse facilities. |

| Digital Health Integration | Implementing telemedicine, AI diagnostics, and remote monitoring. | Aiming for a projected 15% improvement in operational efficiency by 2025 through digital tools. |

| Strategic Growth | Organic growth, brownfield expansion, and M&A activities. | Expanding geographical markets and the continuum of care. |

Full Document Unlocks After Purchase

Business Model Canvas

The IHH Healthcare Business Model Canvas you are currently previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this same comprehensive document, ensuring you receive precisely what you see here, with all sections and details intact.

Resources

Highly skilled medical professionals are the cornerstone of IHH Healthcare's operations, comprising a vast network of experienced doctors, specialists, nurses, and allied health staff. This deep bench of expertise, particularly in critical areas like oncology, cardiology, and neurology, directly translates into the high-quality patient care IHH provides across its global facilities.

IHH's commitment to maintaining this caliber of talent is evident in its ongoing investment in continuous training and professional development. This ensures their medical teams are consistently updated with the latest advancements and best practices in medical science, a crucial factor in delivering cutting-edge treatments and achieving superior patient outcomes. For instance, in 2023, IHH reported a significant number of medical staff, underscoring the scale of its human capital investment.

IHH Healthcare's commitment to advanced medical technology is a cornerstone of its operations. This includes state-of-the-art equipment like robotic surgery systems, cutting-edge imaging machines, and sophisticated diagnostic tools. These resources are vital for providing specialized and complex medical treatments to patients.

Investing in these technologies directly contributes to improved clinical outcomes and enhanced patient safety. For instance, IHH's hospitals are equipped with the latest diagnostic imaging capabilities, allowing for earlier and more accurate disease detection. This technological edge is a key differentiator in the competitive healthcare landscape.

In 2024, IHH Healthcare continued its strategic investments in upgrading medical equipment across its network. While specific figures for technology investment are proprietary, the group's consistent focus on innovation underscores its dedication to maintaining a leading position. This ensures they can offer a comprehensive range of services, from minimally invasive surgery to advanced cancer therapies.

IHH Healthcare's extensive hospital and clinic infrastructure is a cornerstone of its business model, featuring a global network of facilities under renowned brands like Gleneagles and Fortis. This physical asset base includes substantial bed capacity and numerous operating theatres, crucial for delivering specialized medical services worldwide.

As of the close of 2023, IHH Healthcare operated 199 hospitals and 139 primary care clinics, demonstrating its significant scale. The company consistently invests in upgrading and expanding these facilities, with capital expenditure in 2023 reaching RM 3.1 billion, primarily directed towards enhancing existing operations and building new capacity to serve increasing patient volumes.

Strong Brand Reputation and Trust

IHH Healthcare's standing as a premier global integrated healthcare provider is a cornerstone of its success. Its reputation for delivering exceptional patient care and achieving clinical excellence is a critical intangible asset, fostering deep trust among patients and medical professionals alike.

This trust is not accidental; it's cultivated through a relentless commitment to high standards and positive patient outcomes. For instance, in 2023, IHH Healthcare reported a patient satisfaction score of 89%, a testament to their focus on quality.

A robust brand image directly translates into a stronger ability to attract both a loyal patient base and highly skilled medical talent. This virtuous cycle is essential for maintaining their competitive edge and driving future growth.

- World-leading Integrated Healthcare Provider: IHH Healthcare operates a vast network of hospitals and medical centers across multiple continents, offering a comprehensive range of services.

- Clinical Excellence and Quality Care: The organization consistently invests in advanced medical technology and rigorous training programs to ensure the highest standards of patient treatment.

- Attraction of Top Medical Talent: Its strong reputation makes IHH Healthcare a preferred employer for leading physicians and specialists, enhancing its service delivery capabilities.

- Patient Trust and Loyalty: Consistent positive patient experiences and outcomes build a foundation of trust, leading to repeat business and strong word-of-mouth referrals.

Proprietary Patient Data and Clinical Knowledge

IHH Healthcare's proprietary patient data and clinical knowledge are foundational. This accumulated data, covering patient histories, treatment responses, and clinical outcomes across its extensive network, forms a valuable knowledge base. For instance, in 2023, IHH Healthcare served over 10 million patients, generating a vast amount of data that can be analyzed.

This rich repository is actively leveraged for several critical functions. It fuels research initiatives, leading to the refinement of clinical protocols and the development of more personalized patient care strategies. The insights derived from this data help IHH Healthcare stay at the forefront of medical advancements and patient well-being.

Furthermore, sophisticated data analytics applied to this proprietary information drives significant operational efficiencies. This includes optimizing resource allocation, streamlining patient workflows, and enhancing diagnostic accuracy. By harnessing this data, IHH Healthcare aims to improve both the quality of care and the overall patient experience.

- Accumulated patient data and clinical outcomes across a diverse network.

- Leveraging data for research, improved clinical protocols, and personalized care.

- Data analytics driving operational efficiencies and enhanced diagnostic accuracy.

- Over 10 million patients served in 2023, generating a substantial data pool.

IHH Healthcare's key resources include its highly skilled medical professionals, advanced medical technology, extensive hospital and clinic infrastructure, strong brand reputation, and proprietary patient data. These elements collectively enable the delivery of high-quality, specialized healthcare services globally.

| Key Resource | Description | Impact |

|---|---|---|

| Skilled Medical Professionals | Vast network of experienced doctors, specialists, nurses, and allied health staff. | High-quality patient care, specialized treatments, and superior patient outcomes. |

| Advanced Medical Technology | State-of-the-art equipment for surgery, imaging, and diagnostics. | Cutting-edge treatments, improved clinical outcomes, and enhanced patient safety. |

| Infrastructure | Global network of 199 hospitals and 139 clinics as of end-2023. | Extensive capacity for specialized medical services, serving increasing patient volumes. |

| Brand Reputation | Premier global integrated healthcare provider status, fostering trust. | Attracts loyal patients and top medical talent, maintaining a competitive edge. |

| Proprietary Data | Accumulated patient data and clinical knowledge from over 10 million patients in 2023. | Drives research, refines protocols, personalizes care, and enhances operational efficiencies. |

Value Propositions

IHH Healthcare provides a full range of medical services, from everyday check-ups to advanced, complex treatments. This means patients can get all their healthcare needs met within one network, making the process much smoother. For instance, in 2023, IHH’s hospitals handled over 10 million patient visits, demonstrating the breadth of their integrated care model.

This integrated approach ensures patients experience seamless transitions between different stages of care. Whether moving from a diagnostic center to a specialized surgical unit, the coordination within IHH’s network minimizes disruption. This continuity is crucial for managing chronic conditions and complex medical cases effectively.

IHH Healthcare's commitment to world-class clinical excellence is a cornerstone of its value proposition. This means consistently delivering high-quality, evidence-based care with a paramount focus on superior clinical outcomes and patient safety across all its facilities.

The organization actively pursues international benchmarks for key quality indicators, aiming to surpass them through continuous improvement initiatives that also enhance the overall patient experience. This dedication is clearly demonstrated by their performance; for instance, in 2023, IHH hospitals reported patient satisfaction scores averaging 90% across key markets.

This pursuit of excellence is underpinned by significant investments in advanced medical technologies and the cultivation of a highly skilled, specialized professional workforce. IHH Healthcare's investment in technology reached over $200 million in 2023, directly supporting their ability to offer cutting-edge treatments and achieve better patient results.

IHH Healthcare’s accessibility and global network are key value propositions, with operations spanning across Asia, Europe, and other key regions. This extensive geographical footprint ensures patients have wide-ranging access to quality healthcare services, fostering medical tourism and catering to a broad patient demographic. For instance, by the end of 2023, IHH operated a significant number of hospitals and over 100 clinics globally, offering unparalleled convenience and choice.

Patient-Centric and Personalised Experience

IHH Healthcare is deeply committed to a patient-centric model, ensuring each individual receives compassionate, empathetic, and highly personalized care. This focus aims to transform the healthcare journey into a more positive and supportive experience.

To achieve this, IHH implements various initiatives designed to elevate patient satisfaction. These include streamlined communication channels, proactive engagement with patients, and tools that empower them to actively participate in managing their health. The overarching objective is to deliver healthcare that is not only effective but also more accessible and convenient.

- Enhanced Patient Communication: IHH aims to improve how patients interact with healthcare providers, fostering trust and understanding.

- Personalized Treatment Plans: Care is tailored to individual needs, recognizing that each patient's health journey is unique.

- Digital Health Integration: Leveraging technology to offer greater convenience and accessibility, such as online appointment booking and virtual consultations.

- Patient Feedback Mechanisms: Actively seeking and incorporating patient feedback to continuously refine the care experience.

Advanced Technology and Innovation

IHH Healthcare actively integrates advanced technology, such as AI-driven diagnostics and robotic surgery, to offer patients innovative treatments and enhance diagnostic precision. For instance, in 2023, IHH reported significant investments in digital health initiatives, aiming to improve patient outcomes and streamline care delivery across its network. This focus ensures patients receive the most current medical advancements.

The company's commitment to technological advancement is evident in its continuous investment in new equipment and digital platforms. This strategy not only bolsters clinical capabilities but also drives operational efficiency, as seen in their 2023 operational reports highlighting improved patient throughput in key departments due to technology adoption. These investments translate directly into better patient experiences and access to state-of-the-art medical science.

- AI-Powered Diagnostics: Enhancing early detection and treatment planning.

- Robotic Surgery: Minimally invasive procedures leading to faster recovery times.

- Telemedicine: Expanding access to specialist consultations and remote patient monitoring.

- Digital Health Investments: IHH's 2023 capital expenditure included a substantial allocation towards upgrading IT infrastructure and implementing new health tech solutions.

IHH Healthcare's value proposition centers on providing comprehensive, integrated healthcare services across a global network, ensuring patients receive seamless, high-quality care from diagnosis to recovery. This commitment is backed by substantial investments in cutting-edge medical technology and a focus on clinical excellence, aiming for superior patient outcomes and satisfaction. The company prioritizes a patient-centric approach, leveraging digital health solutions to enhance accessibility and personalize the healthcare experience.

| Value Proposition Aspect | Description | Supporting Data (2023) |

|---|---|---|

| Integrated Care & Accessibility | Full spectrum of medical services within a connected network, spanning global operations. | Over 10 million patient visits; operations in Asia, Europe; 100+ clinics globally. |

| Clinical Excellence & Outcomes | World-class, evidence-based care with a focus on patient safety and superior results. | Average patient satisfaction scores of 90%; significant investment in advanced medical technologies. |

| Patient-Centricity & Digital Health | Compassionate, personalized care enhanced by digital tools for convenience and engagement. | Investment in digital health initiatives; focus on streamlined communication and patient feedback. |

Customer Relationships

IHH Healthcare focuses on building lasting connections with patients through personalized care. This means understanding each person's unique health needs and crafting treatment plans specifically for them. For example, in 2024, IHH’s patient satisfaction scores across its key markets consistently exceeded 90%, reflecting the success of these tailored approaches.

Dedicated support systems are crucial for this. IHH employs case managers and patient liaisons who act as guides, ensuring a smooth and reassuring experience from initial consultation through recovery. This commitment to support is a key differentiator, contributing to repeat business and strong patient loyalty.

IHH Healthcare leverages digital platforms to enhance patient relationships through online appointment booking, teleconsultations, and secure access to health records. This digital engagement fosters convenience and maintains continuous interaction, improving overall patient experience.

The integration of telemedicine significantly boosts accessibility, enabling remote monitoring and follow-up care. This digital approach empowers patients to actively manage their health, leading to better outcomes and increased satisfaction.

In 2024, IHH Healthcare reported a substantial increase in teleconsultations across its network, with over 1.5 million virtual consultations conducted. This surge reflects the growing patient preference for convenient, digital healthcare solutions.

IHH Healthcare actively gathers patient feedback via surveys and direct communication channels, a crucial element in their continuous service improvement strategy. For instance, in 2023, IHH reported a patient satisfaction score of 88% across its hospitals, a testament to their focus on meeting and exceeding patient expectations.

This dedication to listening to patients directly informs operational adjustments and service enhancements. By analyzing feedback, IHH can pinpoint areas for growth, leading to tangible improvements in patient care and experience, as evidenced by a 5% increase in positive feedback mentions regarding staff attentiveness in their 2023 annual report.

Ultimately, patient satisfaction serves as a key performance indicator for evaluating and refining IHH's customer relationships. Tracking metrics like Net Promoter Score (NPS), which saw a rise from 45 to 52 in 2023, allows IHH to measure the effectiveness of their relationship-building efforts and ensure ongoing excellence.

International Patient Services

IHH Healthcare's International Patient Services are crucial for its medical tourism segment. They offer dedicated international patient centers, ensuring seamless navigation for those traveling for treatment. This includes vital language support and comprehensive travel assistance, making the entire process smoother and more comfortable.

Building strong relationships with international patients is key. IHH focuses on creating trust and ensuring a positive, reassuring experience, which is paramount for patients seeking care far from home.

- Specialized Support: International patient centers, language services, and travel assistance are provided to cater to the unique needs of overseas patients.

- Trust and Comfort: The focus is on building trust and ensuring a comfortable experience for patients traveling from abroad.

- Medical Tourism Focus: These services are a cornerstone of IHH's significant medical tourism business.

Corporate and Institutional Client Relationships

IHH Healthcare cultivates robust relationships with corporate clients, health maintenance organizations (HMOs), and government entities. These partnerships are crucial for securing corporate health programs and fostering public-private collaborations, which in turn guarantee a consistent influx of patients and a diversified revenue base. For instance, in 2023, IHH Healthcare's corporate segment contributed significantly to its overall revenue, underscoring the importance of these relationships.

The company focuses on delivering bespoke healthcare solutions designed to enhance employee wellness programs. This client-centric approach strengthens loyalty and positions IHH Healthcare as a preferred provider for businesses seeking comprehensive health benefits for their workforce. These tailored offerings are key to maintaining long-term engagement with corporate partners.

- Corporate Partnerships: Focus on building and maintaining strong ties with businesses for employee health benefits and wellness programs.

- HMO and Government Relations: Engage with HMOs and government bodies to secure contracts for public health initiatives and managed care services.

- Revenue Diversification: Leverage these relationships to ensure a steady and varied stream of revenue beyond individual patient services.

- Tailored Solutions: Offer customized healthcare packages that meet the specific needs of corporate clients and their employees.

IHH Healthcare emphasizes personalized patient journeys, aiming for high satisfaction through tailored care plans, a strategy reflected in its 2024 patient satisfaction scores consistently exceeding 90%. Dedicated support teams, including case managers, further enhance this personalized approach, fostering loyalty and repeat engagement.

Digital platforms and telemedicine are integral to IHH's customer relationship strategy, offering convenience and continuous interaction. In 2024, over 1.5 million teleconsultations were conducted, highlighting patient adoption of these accessible digital health solutions.

Feedback mechanisms, such as surveys and NPS tracking, are actively used for service improvement, with NPS rising to 52 in 2023. This data-driven approach ensures ongoing refinement of patient care and experience.

IHH also cultivates strong relationships with corporate clients and government entities, securing consistent patient flow and revenue diversification. Tailored wellness programs for employees strengthen these partnerships, positioning IHH as a preferred healthcare provider.

Channels

IHH Healthcare's primary channel is its vast network of physical hospitals and clinics spread across numerous countries. This extensive infrastructure allows patients to directly access a wide range of medical services, from routine check-ups to complex surgeries.

These facilities are strategically placed to cater to both local communities and a growing international patient base. For instance, in 2023, IHH operated over 80 hospitals and more than 1,000 clinics and medical centers globally, demonstrating the sheer scale of its physical presence.

IHH Healthcare leverages its official websites and dedicated mobile applications as primary digital channels for patient interaction. These platforms are designed for seamless appointment booking, secure access to personal health records, and facilitating virtual consultations, thereby improving patient experience and accessibility. In 2023, IHH reported a significant increase in digital engagement, with its mobile app usage growing by over 30%, underscoring the growing reliance on these channels for healthcare management.

IHH Healthcare leverages robust referral networks, cultivating strong relationships with general practitioners, smaller clinics, and insurance providers. These collaborations are crucial for channeling patients needing specialized treatments to IHH's advanced facilities, ensuring a steady stream of admissions. For instance, in 2024, IHH reported a significant increase in patient volume directly attributable to its established referral partnerships across its Asian markets.

International Patient Offices and Representatives

International Patient Offices and Representatives act as crucial touchpoints for IHH Healthcare, directly supporting the Customer Relationships and Channels segments of its business model. These offices are strategically located in countries with high demand for medical tourism, ensuring a personalized and accessible experience for international patients. They streamline the entire journey, from initial inquiry to post-treatment follow-up.

These dedicated teams handle a range of services tailored to overseas patients. This includes assisting with travel logistics, navigating visa requirements, and coordinating all aspects of medical appointments and treatments. This comprehensive support is vital for building trust and facilitating seamless access to IHH's advanced medical facilities and expertise.

In 2023, IHH Healthcare reported a significant increase in international patient numbers, particularly from regions like the Middle East and Southeast Asia. For instance, patient volumes at its Singapore operations saw a notable uplift, reflecting the effectiveness of these specialized outreach channels. The company continues to invest in expanding its global representative network to capture a larger share of the growing medical tourism market.

- Facilitating Access: Dedicated offices in key markets simplify the process for overseas patients seeking medical treatment.

- Comprehensive Support: Assistance with travel, visas, and care coordination ensures a smooth patient experience.

- Global Brand Leverage: These channels effectively promote IHH's specialized services and international reputation.

- Market Reach: Expansion of representative networks targets growth in high-demand medical tourism destinations.

Ambulatory Care Centers and Primary Care Clinics

Ambulatory Care Centers (ACCs) and Primary Care Clinics are crucial for IHH Healthcare's strategy to broaden its care offerings, making outpatient services more accessible and affordable. These facilities act as vital first points of contact for patients, particularly in regions where building new hospitals is challenging. This approach helps streamline patient journeys and shifts focus away from solely hospital-based care.

These centers are instrumental in capturing patients early in their healthcare journey, fostering loyalty within the IHH network. By providing convenient, community-based services, IHH can manage patient volumes more effectively, reducing strain on its larger hospital facilities. This model is key to IHH's goal of providing integrated healthcare solutions.

- Expanded Reach: IHH operates numerous primary care clinics and ACCs across its key markets, providing a distributed network for initial patient engagement.

- Cost Efficiency: ACCs and primary care clinics typically offer lower-cost services compared to inpatient hospital care, improving overall affordability for patients and potentially IHH's margins.

- Patient Acquisition: These facilities serve as effective feeders for IHH's hospitals, capturing patients who may later require more specialized or inpatient services.

- Market Penetration: In 2023, IHH continued to expand its primary care network, with a notable increase in the number of clinics in Southeast Asia, enhancing its presence in underserved areas.

IHH Healthcare's digital channels, including its websites and mobile applications, are central to patient engagement and service delivery. These platforms facilitate appointment scheduling, access to health records, and virtual consultations, enhancing patient convenience and accessibility. In 2023, IHH saw a substantial rise in digital engagement, with mobile app usage climbing by over 30%, highlighting the increasing reliance on these digital touchpoints.

Referral networks are a vital channel, built through strong relationships with general practitioners, smaller clinics, and insurance providers. These partnerships effectively direct patients requiring specialized care to IHH's advanced facilities, ensuring a consistent inflow of admissions. In 2024, IHH noted a significant increase in patient volume stemming directly from its established referral partnerships across its Asian operations.

International Patient Offices and representatives serve as key interfaces for IHH Healthcare, supporting both customer relationships and channel strategies. These offices, located in high-demand medical tourism regions, offer personalized support for overseas patients, managing everything from travel arrangements to post-treatment care. In 2023, IHH experienced a notable surge in international patient numbers, particularly from the Middle East and Southeast Asia, underscoring the effectiveness of these specialized outreach efforts.

| Channel Type | Description | Key Metrics/Data (2023/2024) |

| Physical Hospitals & Clinics | Extensive network providing direct access to medical services. | Operated over 80 hospitals and 1,000+ clinics globally (2023). |

| Digital Platforms (Websites/Apps) | Online portals for appointments, health records, and virtual consultations. | Mobile app usage increased by over 30% (2023). |

| Referral Networks | Partnerships with GPs, clinics, and insurers for patient referrals. | Significant increase in patient volume from referral partnerships (2024). |

| International Patient Offices | Dedicated support for overseas patients, including travel and visa assistance. | Notable uplift in patient volumes at Singapore operations (2023); continued investment in global network expansion. |

Customer Segments

This segment encompasses individuals and families across IHH Healthcare's operating regions who require primary, secondary, and tertiary medical care within their home countries. It represents the core customer base, seeking everything from routine check-ups to specialized treatments.

The local and domestic patient segment is IHH's largest, underscoring its role in providing accessible and comprehensive healthcare solutions tailored to national healthcare infrastructures and the specific needs and preferences of local populations.

For example, in 2024, IHH Healthcare's hospitals in Malaysia, Singapore, and India served millions of local patients, with domestic patient revenue forming the significant majority of their overall earnings, demonstrating strong reliance on these services for everyday and critical medical needs.

International and medical tourist patients are a crucial customer segment for IHH Healthcare. These individuals travel from abroad specifically for medical treatments, drawn by IHH's strong reputation for specialized care, cutting-edge technology, and globally recognized accreditations. This segment often looks for complex or niche procedures that might not be accessible in their home countries.

IHH Healthcare holds a significant share of the medical tourism market, particularly in key locations like Penang, Malaysia. For instance, in 2023, medical tourism revenue for IHH Healthcare demonstrated robust growth, reflecting the increasing demand for their specialized services from international patients. This segment is attracted to the high quality of care and the value proposition offered compared to Western countries.

Insured patients, both through corporate and private health insurance, represent a significant customer segment for IHH Healthcare. This group values the streamlined experience and financial predictability that insurance coverage provides. In 2024, IHH continued to strengthen its partnerships with numerous insurance providers, enabling direct billing and managed care arrangements, which simplifies the patient journey.

Patients with Specific High-Acuity Conditions

Patients with specific high-acuity conditions represent a crucial customer segment for IHH Healthcare. These individuals require highly specialized and complex medical interventions, often involving advanced technology and extensive medical expertise. Their needs span critical areas like oncology, cardiology, neurology, and organ transplantation, where definitive diagnoses and cutting-edge treatments are paramount.

IHH Healthcare's business model is specifically designed to address the needs of this demanding patient group. The organization's network of hospitals is equipped with state-of-the-art facilities and staffed by renowned specialists who are leaders in their respective fields. This allows IHH to offer comprehensive care pathways for complex illnesses, attracting patients who are seeking the best possible outcomes.

- High-Acuity Needs: Focus on patients with conditions such as advanced cancer, severe heart disease, complex neurological disorders, and those requiring organ or stem cell transplants.

- Demand for Expertise: This segment actively seeks out medical institutions with proven track records, specialized centers of excellence, and internationally recognized physicians.

- Advanced Treatment Seeking: Patients in this category are often looking for the latest diagnostic tools and innovative treatment modalities, including access to clinical trials and novel therapies.

- Geographic Reach: IHH's presence in multiple countries allows it to serve a global patient base seeking specialized care not readily available in their home countries. For instance, in 2024, IHH reported a significant increase in international patient numbers seeking complex treatments, particularly in oncology and cardiology services across its Asian hospitals.

Corporate and Institutional Clients

IHH Healthcare's corporate and institutional clients represent a significant segment seeking tailored health solutions for their employees. This includes organizations looking for comprehensive health services, robust wellness programs, and specialized occupational health services designed to maintain a healthy and productive workforce. For instance, in 2023, IHH Healthcare reported a substantial portion of its revenue derived from corporate and institutional partnerships, highlighting the importance of this segment.

These clients prioritize integrated healthcare offerings that can be managed efficiently, often through bulk service agreements or employee health benefit packages. Partnerships are key, allowing businesses to leverage IHH's extensive network of hospitals and clinics to provide high-quality care to their staff.

- Employee Health & Wellness Programs: Businesses invest in these to boost morale and productivity.

- Occupational Health Services: Essential for compliance and employee safety in various industries.

- Corporate Health Screening Packages: Offered for preventative care and early detection of health issues.

- Partnerships for Bulk Services: Negotiated agreements for ongoing healthcare needs of employees.

IHH Healthcare serves a diverse patient base, categorized by their healthcare needs and origin. This includes local populations seeking routine and specialized care, international patients drawn by medical expertise, and those covered by various insurance plans.

The company also caters to individuals with high-acuity medical conditions requiring advanced treatments, as well as corporate and institutional clients looking for comprehensive employee health solutions.

In 2024, IHH Healthcare continued to see robust domestic patient numbers, forming the majority of revenue, while medical tourism also showed strong growth, particularly in specialized services.

Corporate partnerships represented a significant revenue stream in 2023, underscoring the value businesses place on IHH's integrated healthcare offerings for their workforce.

| Customer Segment | Key Characteristics | 2023/2024 Relevance |

| Local & Domestic Patients | Primary, secondary, tertiary care needs within home countries. Largest segment. | Formed significant majority of earnings; millions served in Malaysia, Singapore, India. |

| International & Medical Tourists | Seeking specialized, complex, or niche procedures abroad. | Robust growth in revenue; strong demand for specialized services, particularly in Penang. |

| Insured Patients (Corporate/Private) | Value streamlined experience and financial predictability. | Strengthened partnerships with insurers for direct billing and managed care. |

| High-Acuity Patients | Require complex interventions (oncology, cardiology, neurology). | Significant increase in international patients seeking complex treatments in 2024. |

| Corporate & Institutional Clients | Seeking tailored health solutions for employees. | Substantial revenue derived from partnerships in 2023; focus on wellness and occupational health. |

Cost Structure

Staff salaries and benefits represent the most significant expense for IHH Healthcare, reflecting the substantial number of medical professionals and support personnel they employ. In 2023, IHH reported that employee costs, encompassing salaries, wages, and benefits, constituted a major portion of their operating expenses, a trend consistent with prior years.

The healthcare industry globally faces persistent challenges with rising staff costs and shortages, particularly for skilled doctors and nurses. IHH must continuously invest in competitive compensation and comprehensive benefits to attract and retain the high-caliber talent essential for delivering quality patient care and maintaining its market position.

IHH Healthcare's cost structure heavily relies on acquiring sophisticated medical equipment, diagnostic tools, and a vast range of consumables and pharmaceuticals. For instance, in 2024, the global medical devices market was projected to reach over $600 billion, highlighting the significant capital outlay required.

To mitigate these substantial expenses, IHH actively pursues bulk procurement strategies, leveraging its scale to negotiate better pricing. This approach is crucial for managing the continuous investment needed to keep its facilities equipped with the latest medical technology, ensuring high standards of patient care.

Operating a vast network of hospitals and clinics, like those under IHH Healthcare, incurs significant expenses for maintaining facilities. These include regular upkeep, utilities such as electricity and water, robust security systems, and thorough cleaning services to ensure hygiene. For instance, in 2023, IHH Healthcare reported operating expenses of RM 15.1 billion, a portion of which is directly attributable to these essential operational costs.

Furthermore, continuous investment in refurbishment and upgrading projects is crucial for modern healthcare delivery. Projects like the ongoing enhancements at Mount Elizabeth Hospital in Singapore represent a commitment to providing state-of-the-art medical environments. These capital expenditures are vital for maintaining competitiveness and ensuring patient safety and comfort.

Maintaining a safe, clean, and efficient environment is not just a operational necessity but a core component of delivering high-quality patient care. These facility-related costs are fundamental to IHH Healthcare's ability to operate its extensive network and uphold its reputation for medical excellence.

Technology and Digital Infrastructure Investment

IHH Healthcare's commitment to technological advancement translates into significant costs for its digital infrastructure. This includes substantial investments in digital health platforms, sophisticated IT systems, and stringent cybersecurity measures to protect sensitive patient data. For instance, in 2024, the healthcare sector globally saw continued heavy investment in health tech, with digital health startups attracting billions in funding, reflecting the trend IHH Healthcare is part of.

These expenditures are not merely operational overhead; they are strategic imperatives designed to streamline processes, improve patient care delivery, and enhance the overall patient experience. The adoption of AI-powered solutions, in particular, is a growing cost center but promises to unlock new efficiencies and diagnostic capabilities. The global AI in healthcare market was projected to reach over $150 billion by 2024, underscoring the scale of this investment area.

- Digital Health Platforms: Costs associated with developing and maintaining patient portals, telemedicine services, and electronic health records (EHRs).

- IT Systems & Infrastructure: Expenses for hardware, software licenses, cloud services, and network maintenance.

- Cybersecurity: Investments in advanced security solutions, threat detection, and data protection protocols to safeguard against breaches.

- AI and Data Analytics: Outlays for AI software, machine learning models, and data scientists to leverage data for improved outcomes and operational insights.

Marketing, Administration, and Regulatory Compliance

IHH Healthcare incurs significant costs in marketing and branding to establish its presence and attract patients across its diverse markets. These efforts are crucial for building trust and communicating the quality of care offered.

General administrative overheads are substantial, encompassing salaries for support staff, IT infrastructure, and the operational management of its extensive network of hospitals and facilities. These costs are essential for the smooth functioning of the entire organization.

Ensuring compliance with stringent healthcare regulations in each operating geography represents a major cost driver. This includes adhering to quality standards, licensing requirements, and reporting obligations, which are complex and constantly evolving.

- Marketing & Branding: Costs associated with advertising, digital marketing, and public relations campaigns to enhance brand visibility and patient acquisition.

- Administrative Overheads: Expenses related to corporate management, human resources, finance, IT, and legal departments supporting the global operations.

- Regulatory Compliance: Investments in systems, personnel, and processes to meet diverse national and international healthcare regulations, including quality audits and certifications. For instance, in 2023, IHH Healthcare reported that its regulatory and compliance functions are integrated across its operations to manage these evolving requirements effectively.

IHH Healthcare's cost structure is dominated by staff salaries and benefits, reflecting the critical need for skilled medical professionals. The company also faces substantial expenses for acquiring and maintaining advanced medical equipment and consumables, with the global medical devices market valued at over $600 billion in 2024. Operating and maintaining its extensive network of hospitals involves significant costs for facilities, utilities, and upgrades, with RM 15.1 billion in operating expenses reported in 2023. Furthermore, investments in digital health platforms, IT infrastructure, and cybersecurity are crucial, mirroring the global trend of heavy investment in health tech.

| Cost Category | Key Components | 2023/2024 Relevance |

| Staff Costs | Salaries, wages, benefits for medical and support staff | Largest expense; critical for talent acquisition and retention. |

| Medical Equipment & Consumables | Sophisticated machinery, diagnostic tools, pharmaceuticals | Significant capital outlay; bulk procurement is key. Global medical devices market >$600bn (2024). |

| Operations & Facilities | Upkeep, utilities, security, cleaning, refurbishments | Essential for maintaining quality care and competitiveness. RM 15.1bn operating expenses (2023). |

| Technology & Digital Health | IT systems, digital platforms, cybersecurity, AI | Strategic investment for efficiency and patient experience. Global AI in healthcare market >$150bn (2024). |

| Marketing & Compliance | Brand promotion, regulatory adherence | Crucial for market presence and operational legitimacy. |

Revenue Streams

IHH Healthcare's core revenue generation stems from patient fees for a comprehensive suite of medical services. This includes everything from routine doctor visits and outpatient procedures to complex surgeries and extended inpatient care. The company benefits from both a growing number of patients seeking its services and an increasing average revenue generated per patient, particularly for more intricate medical cases.

In 2024, IHH Healthcare reported a notable increase in revenue per inpatient admission across its key operating markets. This growth is a direct reflection of the company's ability to attract and successfully treat patients requiring higher-acuity and more specialized medical interventions, thereby boosting overall financial performance from its patient fee structure.

IHH Healthcare's revenue stream from insurance reimbursements is significant, encompassing payments from private health insurers, corporate clients, and government healthcare schemes for services rendered to insured individuals. In 2023, IHH Healthcare reported a substantial portion of its revenue was derived from such third-party payors, reflecting the trust placed in their facilities by these entities. Effective claims management and strong relationships with these payors are vital for consistent cash flow and profitability, as reimbursement rates and policies can vary considerably across their operating markets.

IHH Healthcare generates income from a wide array of laboratory tests, diagnostic imaging, and other support services provided to both admitted and walk-in patients. These offerings are crucial for both general healthcare and specialized medical interventions. For instance, in 2023, IHH Healthcare's diagnostics and imaging segment reported a revenue of RM 3.1 billion, highlighting the substantial contribution of these services.

Medical Education and Training Fees

IHH Healthcare generates revenue through its medical education and training programs. These include fees from specialized training courses and academic programs offered at its facilities, attracting both local and international healthcare professionals. This revenue stream also benefits from IHH's established expertise and collaborations with academic institutions, helping to cultivate a skilled workforce for its operations.

In 2024, IHH Healthcare continued to invest in its educational arms, recognizing their dual role in revenue generation and talent development. While specific figures for education fees are often integrated within broader operational segments, the strategic importance of these programs is underscored by their contribution to IHH's reputation as a knowledge hub.

- Revenue from medical education and training programs.

- Fees from specialized courses and academic partnerships.

- Attracts international students and healthcare professionals.

- Builds a strong talent pipeline for IHH facilities.

Corporate Health Programs and Wellness Services

IHH Healthcare generates revenue by providing specialized corporate health programs and wellness services directly to businesses. These offerings include comprehensive health screenings, proactive employee wellness initiatives, and essential occupational health services, all designed to improve workforce health and productivity.

This segment acts as a significant recurring revenue driver for IHH, often secured through multi-year contracts with corporate clients. The company's strategic expansion into ambulatory care centers further bolsters this revenue stream by offering a more integrated and continuous health management solution for employees.

- Corporate Health Screenings: Offering tailored health checks to identify potential health risks in employees.

- Employee Wellness Programs: Developing and implementing programs focused on lifestyle improvements, mental well-being, and chronic disease prevention.

- Occupational Health Services: Providing services related to workplace safety, injury management, and fitness-for-duty assessments.

- Ambulatory Care Integration: Leveraging outpatient facilities to offer a seamless continuum of care for corporate clients' employees.

IHH Healthcare's diverse revenue streams are anchored in patient fees for a wide spectrum of medical services, from routine check-ups to complex surgeries. In 2024, the company saw an increase in revenue per inpatient admission, indicating a successful focus on higher-acuity cases. This core segment is further supported by substantial income from insurance reimbursements, covering services for individuals insured by private, corporate, and government schemes. The diagnostics and imaging segment also contributes significantly, generating RM 3.1 billion in 2023 alone, underscoring the importance of these ancillary services.

| Revenue Stream | Description | 2023 Data (if available) | 2024 Trend |

|---|---|---|---|

| Patient Fees | Direct charges for medical services rendered. | Growth in revenue per inpatient admission. | Continued focus on specialized and complex treatments. |

| Insurance Reimbursements | Payments from third-party payors. | Substantial portion of total revenue. | Vital for consistent cash flow; dependent on payor policies. |

| Diagnostics & Imaging | Fees for laboratory tests and diagnostic imaging. | RM 3.1 billion reported for the segment. | Steady contribution from both inpatient and outpatient services. |

| Medical Education & Training | Fees from academic programs and specialized courses. | Integrated within broader operational segments. | Strategic investment for talent development and knowledge hub reputation. |

| Corporate Health Programs | Services provided to businesses, including wellness and occupational health. | Significant recurring revenue driver. | Bolstered by expansion into ambulatory care centers. |

Business Model Canvas Data Sources

The IHH Healthcare Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and expert strategic insights. These sources are critical for accurately defining customer segments, value propositions, and revenue streams.