IHH Healthcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHH Healthcare Bundle

IHH Healthcare operates in a dynamic sector, facing significant pressures from rivals and the constant threat of new entrants. Understanding the bargaining power of both its suppliers and buyers is crucial for navigating this competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IHH Healthcare’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The specialized nature and significant cost of advanced medical equipment, like MRI scanners and robotic surgical systems, grant considerable leverage to their manufacturers. IHH Healthcare's dependence on a select group of global suppliers for these vital technologies allows these suppliers to influence pricing and contract conditions, ultimately affecting IHH's operating expenses.

The pharmaceutical industry is characterized by a limited number of manufacturers holding patents for critical medications. This concentration of power means that companies like IHH Healthcare, which rely on a steady supply of these patented drugs, face suppliers who can exert significant influence over pricing. The absence of readily available substitutes for these essential medicines amplifies the suppliers' bargaining leverage.

The scarcity of highly skilled medical professionals, such as top surgeons and oncologists, significantly enhances their bargaining power. IHH Healthcare faces intense competition for this specialized talent, which can translate into increased salary and benefit expenses, directly impacting operational costs.

Dependence on Niche Technology Providers

IHH Healthcare's reliance on specialized technology providers, particularly for critical systems like electronic health records (EHR) and advanced diagnostic software, can grant these suppliers considerable bargaining power. The deep integration of these niche technologies into IHH's operations creates substantial switching costs, making it difficult and expensive to change providers. This dependence allows these technology firms to exert leverage during contract negotiations and influence pricing structures.

For instance, a provider of a proprietary hospital management system that has been customized over years for IHH could command higher prices or dictate terms due to the sheer effort and disruption involved in migrating to an alternative. This is particularly true in the healthcare sector where interoperability and data security are paramount, often favoring established, specialized vendors.

- High Switching Costs: Deep integration of niche technologies like EHR systems into IHH Healthcare's operational framework leads to significant costs and operational disruption if a change is attempted.

- Vendor Lock-in: Specialized software providers, especially in areas like advanced medical imaging analysis or unique patient management platforms, can create a de facto vendor lock-in scenario.

- Limited Alternatives: The scarcity of providers offering comparable, highly specialized technological solutions in the healthcare market further strengthens the bargaining position of existing suppliers.

- Pricing Leverage: The dependence on these niche providers allows them to negotiate favorable pricing terms and potentially increase costs for IHH Healthcare due to the essential nature of their services.

Influence of Medical Device Innovators

Innovators in the medical device sector wield significant bargaining power over healthcare providers like IHH Healthcare. These suppliers can dictate terms when their groundbreaking technologies are essential for maintaining a competitive edge and offering advanced patient care. For instance, a supplier introducing a novel robotic surgery system or an advanced diagnostic imaging tool can command premium pricing due to the unique value and competitive advantage it provides. IHH Healthcare’s need to adopt such innovations to stay at the forefront of medical treatment directly translates to increased supplier leverage.

The ability of medical device innovators to command higher prices is often tied to the significant research and development investment required to bring these cutting-edge products to market. This can lead to substantial cost implications for healthcare systems. For example, the initial rollout of new, patented surgical robots can involve upfront costs in the millions of dollars, plus ongoing maintenance and proprietary consumable expenses, directly impacting a hospital’s operational budget.

- Proprietary Technology: Suppliers offering unique, patented medical devices or treatment methods have a strong position.

- Competitive Necessity: Healthcare providers may be compelled to adopt these innovations to remain competitive and meet patient expectations for advanced care.

- Premium Pricing: This necessity allows suppliers to charge higher prices for their exclusive technologies.

- R&D Investment: High development costs for innovative devices justify premium pricing strategies by suppliers.

The bargaining power of suppliers to IHH Healthcare is significant, particularly for specialized medical equipment and pharmaceuticals. The limited number of manufacturers for critical, patented drugs and advanced technologies like MRI scanners and robotic surgical systems allows these suppliers to influence pricing and contract terms. This dependence, coupled with high switching costs for integrated systems, grants suppliers considerable leverage.

In 2024, the healthcare sector continued to see strong demand for advanced medical technologies. For example, the global market for robotic surgery systems was projected to reach approximately USD 10.5 billion by 2024, indicating substantial revenue potential for key suppliers and their pricing power.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on IHH Healthcare |

|---|---|---|

| Medical Equipment Manufacturers | Proprietary technology, high R&D costs, limited alternatives for advanced devices | Higher equipment acquisition costs, potential for increased maintenance fees |

| Pharmaceutical Companies | Patent protection for critical drugs, limited substitutability, high development costs | Increased drug procurement costs, potential for supply chain disruptions if negotiations fail |

| Specialized Software Providers (EHR, etc.) | Deep integration, high switching costs, vendor lock-in potential | Higher licensing and support fees, operational risks associated with system changes |

What is included in the product

This Porter's Five Forces analysis for IHH Healthcare dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes, providing a strategic roadmap for navigating the healthcare industry.

Instantly visualize the competitive landscape of IHH Healthcare with a clear, one-sheet summary of all five forces, enabling swift strategic decisions.

Customers Bargaining Power

While individual patients are numerous, their bargaining power against large healthcare providers like IHH Healthcare is typically low. This is largely due to the urgent nature of medical needs and the high perceived value placed on quality treatment and specialized care, which often outweighs price sensitivity for many.

However, the collective decisions of this fragmented patient base significantly shape IHH Healthcare's revenue streams and public image. For instance, in 2023, IHH Healthcare reported a revenue of RM23.7 billion, demonstrating the substantial impact of patient volume. Maintaining high patient satisfaction is therefore paramount, as positive experiences can lead to repeat business and strong word-of-mouth referrals, indirectly influencing IHH's market position.

Insurance companies and government payers hold substantial bargaining power, significantly influencing IHH Healthcare's revenue. In 2024, for instance, major insurance providers often negotiate discounted rates for their large member bases, directly impacting the pricing IHH Healthcare can command for its services.

This leverage is amplified by the sheer volume of patients these entities represent. When a significant portion of a hospital's patient flow comes from bulk agreements with insurers or corporate clients, IHH Healthcare faces pressure to align its service offerings and pricing to meet payer demands, potentially limiting its flexibility.

The bargaining power of customers for IHH Healthcare is significantly influenced by the availability of alternative healthcare providers. In many of IHH's operating regions, patients have a wide array of choices, including numerous other private hospitals, established public healthcare systems, and niche specialized clinics.

This abundance of options empowers patients to shop around for the best value, whether that means seeking more competitive pricing, specialized medical expertise, or a preferred patient experience. For instance, in Malaysia, IHH operates alongside other major private hospital groups like KPJ Healthcare, and a robust public healthcare system. This competitive landscape forces IHH to continually focus on service quality and cost-effectiveness to retain its patient base.

For example, in 2023, the Malaysian private healthcare sector saw continued growth, with patient choice being a key driver. IHH Healthcare's revenue for the full year 2023 reached RM23.7 billion, indicating its ability to compete effectively despite these customer options, by offering a strong value proposition across its network.

Increasing Patient Information and Transparency

The digital age has significantly amplified patient bargaining power by providing unprecedented access to information. Patients can now easily research treatment options, compare hospital quality ratings, and scrutinize pricing, making them more informed consumers.

This increased transparency directly translates to greater price and quality sensitivity. For instance, in 2024, platforms like Healthgrades and Vitals allowed patients to compare physician success rates and patient reviews, influencing their choice of healthcare provider. This empowers patients to seek out the best value, putting pressure on providers like IHH Healthcare to offer competitive pricing and superior service.

- Informed Decision-Making: Patients can access vast amounts of data on medical procedures, outcomes, and costs.

- Comparison Shopping: Online tools enable direct comparison of healthcare providers based on quality metrics and pricing.

- Price Sensitivity: Greater awareness of costs encourages patients to negotiate or seek more affordable alternatives.

- Quality Demands: Transparency in quality ratings pushes providers to maintain high standards to attract and retain patients.

Medical Tourism and International Patient Choices

International patients, especially those seeking medical tourism, possess significant bargaining power due to the wide array of global healthcare options available. This ability to compare and select destinations based on factors like cost-effectiveness, treatment quality, and specialized medical expertise forces providers like IHH Healthcare to vie for their business on an international stage.

For instance, in 2024, the global medical tourism market was projected to reach over $116 billion, indicating a substantial pool of discerning patients. This growth highlights the critical need for IHH Healthcare to offer competitive pricing and superior service to attract and retain these international clientele.

- Global Choices: Patients can choose from numerous countries and hospitals for procedures, increasing their leverage.

- Cost Sensitivity: Price plays a major role in destination selection, pushing hospitals to optimize their pricing strategies.

- Quality Focus: Patients seek out centers of excellence, giving well-regarded institutions more appeal.

- Information Accessibility: Online platforms and reviews provide easy access to comparative data, further empowering patients.

The bargaining power of customers for IHH Healthcare is multifaceted, with individual patients generally having low power due to urgent needs. However, collective patient decisions and the influence of large payers like insurance companies and government bodies significantly shape IHH's revenue. In 2024, insurance providers often negotiate discounted rates for their vast member bases, directly impacting IHH Healthcare's pricing flexibility.

The availability of numerous alternative healthcare providers in IHH's operating regions further empowers patients. For example, in Malaysia, IHH competes with other private hospital groups and a strong public healthcare system, necessitating a focus on quality and cost-effectiveness. IHH Healthcare's 2023 revenue of RM23.7 billion demonstrates its ability to attract patients despite this competitive pressure.

Digitalization has amplified patient bargaining power by providing easy access to information on treatment options, quality ratings, and pricing. This transparency makes patients more discerning consumers, seeking the best value and driving providers to maintain high standards. The global medical tourism market, projected to exceed $116 billion in 2024, further highlights how international patients leverage global choices and cost sensitivity.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Impact on IHH Healthcare |

|---|---|---|---|

| Individual Patients | Low to Moderate | Urgency of need, perceived quality, price sensitivity | Drives focus on patient satisfaction and service quality |

| Insurance Companies & Government Payers | High | Volume of patients, negotiated rates, contract terms | Significant impact on revenue and pricing strategies |

| Medical Tourists | High | Global healthcare options, cost-effectiveness, specialized care availability | Requires competitive pricing and superior service offerings |

| Corporate Clients | Moderate to High | Volume of employees, negotiated benefits packages | Influences service packages and pricing for employee health benefits |

What You See Is What You Get

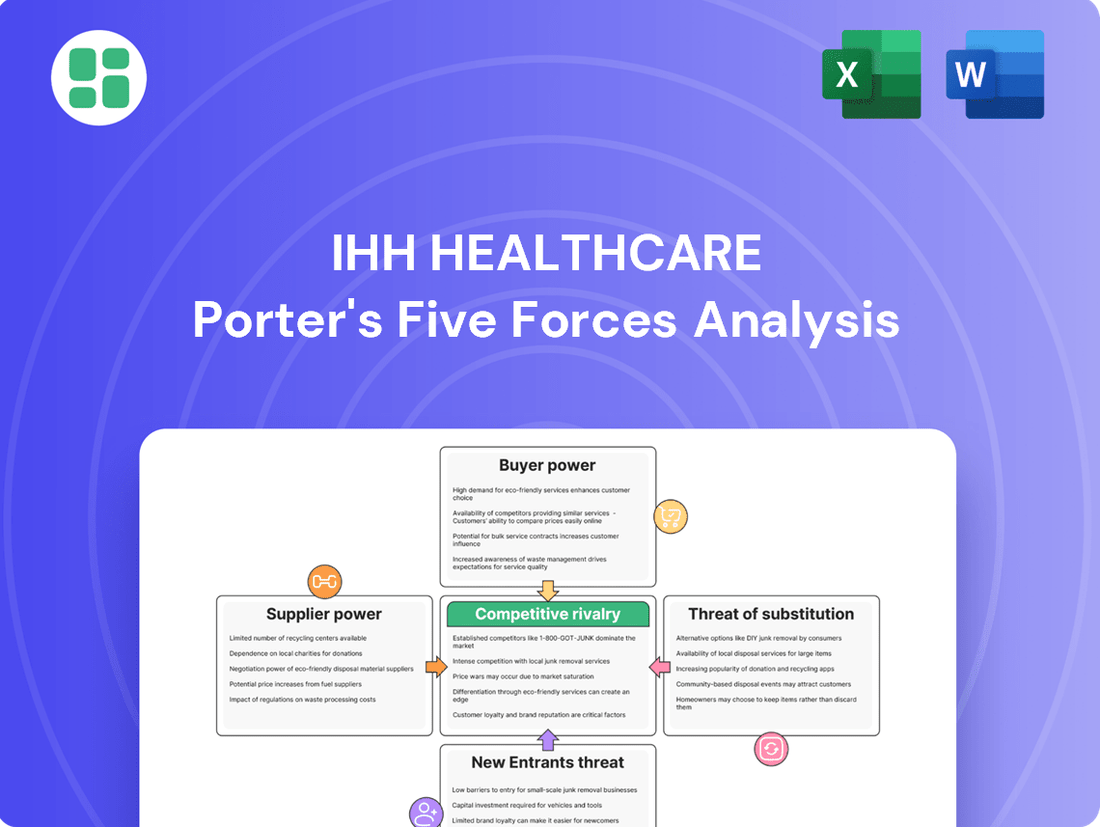

IHH Healthcare Porter's Five Forces Analysis

This preview displays the complete IHH Healthcare Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape. You're looking at the actual document; once your purchase is complete, you'll receive instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

IHH Healthcare faces significant competitive rivalry from established domestic and international private hospital chains. These competitors, such as Ramsay Health Care and Fortis Healthcare in certain markets, offer comparable high-quality medical services and possess strong brand loyalty, directly challenging IHH for patient volume and skilled medical professionals.

The presence of these large players intensifies competition for market share. For instance, in markets like Malaysia, IHH competes with entities like KPJ Healthcare, which has a substantial network. Globally, the healthcare landscape is fragmented but increasingly consolidated, meaning IHH must continually innovate and maintain service excellence to stand out against well-resourced international groups.

Public healthcare systems present a significant competitive force, particularly in markets where they offer subsidized or free services. These government-funded institutions, especially for basic and emergency care, can attract a substantial patient base, even impacting private providers like IHH Healthcare. For instance, in many Asian countries where IHH operates, public hospitals are the primary providers for the majority of the population, offering a baseline of care that can divert patients away from private facilities for less complex or routine treatments.

The healthcare landscape is seeing a surge in specialized clinics, focusing on areas like ophthalmology, fertility, and cosmetic surgery. This trend fragments the market, drawing patients who prioritize specific expertise. These niche providers intensify competition for IHH Healthcare's own specialized departments, as they cater to distinct patient needs.

Price-Based Competition in Certain Segments

In specific healthcare areas, especially for routine procedures and diagnostic services, price competition can intensify. IHH Healthcare, known for its premium services, may encounter pressure to align pricing with smaller, more nimble competitors while upholding its established quality benchmarks.

This price sensitivity is particularly evident in markets where healthcare services are viewed more as commodities. For instance, in 2023, the global diagnostic imaging market saw significant growth, with many regional players competing on cost for common scans. IHH Healthcare’s strategy involves balancing this price pressure by emphasizing its integrated care models and advanced medical technologies, which offer distinct value propositions beyond just the procedure cost.

- Price Sensitivity: Routine procedures and diagnostics are more susceptible to price-based competition.

- Competitive Landscape: Smaller, agile competitors can leverage lower cost structures.

- IHH Healthcare's Challenge: Maintaining premium quality while offering competitive pricing.

- Market Dynamics: The diagnostic imaging market, for example, highlights this competitive pressure.

Talent Acquisition and Retention Wars

The competition to attract and keep skilled medical professionals, from doctors and nurses to specialized allied health staff, is fierce. Rival healthcare organizations are actively seeking out top talent, often presenting attractive compensation and benefits packages. This aggressive recruitment directly impacts labor costs for IHH Healthcare, potentially creating hurdles in sustaining a high-caliber workforce.

The global shortage of healthcare professionals exacerbates this rivalry. For instance, in 2024, the World Health Organization projected a need for an additional 10 million healthcare workers by 2030, particularly in low- and middle-income countries where IHH Healthcare has a significant presence. This scarcity means that IHH Healthcare must continually invest in competitive remuneration and robust professional development to secure and retain its essential personnel.

- Intense Competition: Healthcare providers globally are locked in a battle for skilled medical staff.

- Rising Labor Costs: Aggressive recruitment by competitors drives up wages and benefits, impacting IHH Healthcare's operational expenses.

- Talent Shortages: Global and regional shortages of doctors, nurses, and allied health professionals intensify the demand for qualified individuals.

- Retention Challenges: Maintaining a stable and experienced workforce requires continuous investment in employee satisfaction and career growth.

IHH Healthcare faces intense competition from both large, established private hospital groups and a growing number of specialized clinics. This rivalry extends to attracting and retaining top medical talent, a challenge amplified by global healthcare professional shortages. For example, in 2024, the projected need for 10 million additional healthcare workers worldwide by 2030 underscores this competitive pressure on staffing.

| Competitor Type | Key Challenge for IHH | Example Competitors/Market Dynamics |

|---|---|---|

| Established Private Hospital Chains | Market share, patient volume, brand loyalty | Ramsay Health Care, Fortis Healthcare, KPJ Healthcare (Malaysia) |

| Specialized Clinics | Fragmented market, niche patient acquisition | Ophthalmology, fertility, cosmetic surgery clinics |

| Public Healthcare Systems | Attracting patients for basic/routine care | Government-funded hospitals in Asian markets |

| Skilled Medical Professionals | Talent acquisition and retention, rising labor costs | Global shortage of healthcare workers (WHO projection for 2030) |

SSubstitutes Threaten

The burgeoning field of telemedicine and virtual consultations presents a significant substitute threat to traditional in-person hospital services. As more patients become comfortable with remote healthcare, these digital platforms can effectively replace hospital visits for routine check-ups, minor health concerns, and even specialist consultations, thereby diminishing the reliance on physical infrastructure.

For instance, by mid-2024, the global telemedicine market was projected to reach over $200 billion, indicating a substantial shift in healthcare delivery preferences. This growth is fueled by convenience and accessibility, directly impacting the volume of patients that might otherwise seek care at IHH Healthcare's physical facilities.

The growing emphasis on preventive healthcare and wellness programs presents a significant substitute threat to IHH Healthcare. As individuals increasingly adopt healthier lifestyles and participate in proactive health screenings, the need for traditional, reactive medical treatments diminishes. This societal shift directly impacts demand for acute and tertiary care services, which form a core part of IHH Healthcare's revenue streams.

For instance, the global wellness market, valued at over $4.5 trillion in 2022, demonstrates this trend. Increased participation in fitness, nutrition, and mental well-being initiatives can lead to a reduction in chronic diseases like diabetes and heart conditions, thereby lowering patient volumes for hospitals. This focus on avoiding illness rather than treating it offers a compelling alternative to the services provided by large healthcare conglomerates like IHH.

The threat of substitutes for IHH Healthcare comes from alternative and traditional medicine practices. Options like acupuncture, homeopathy, and traditional Chinese medicine can be chosen by patients for certain conditions, offering different philosophies and often lower costs than conventional treatments. For instance, the global traditional medicine market was valued at over $150 billion in 2023, indicating a significant alternative choice for consumers.

Home Healthcare and Outpatient Care Expansion

The growing availability and sophistication of home healthcare services and outpatient facilities present a significant threat of substitution for traditional inpatient hospital care. Patients increasingly value the convenience and potential cost savings associated with receiving treatment outside of a hospital setting.

For instance, the global home healthcare market was valued at approximately USD 328.8 billion in 2023 and is projected to grow substantially. Similarly, the outpatient surgery market is expanding rapidly, with many procedures now safely and effectively performed in ambulatory surgical centers. This shift can reduce the demand for inpatient beds, impacting hospital revenue streams.

- Increased Patient Preference: Convenience and comfort at home or in specialized clinics are becoming more attractive to patients.

- Cost Efficiency: Home and outpatient care often come with lower overall costs compared to lengthy hospital stays.

- Technological Advancements: Innovations in medical technology, remote monitoring, and telehealth enable more complex treatments to be delivered outside traditional hospitals.

- Reduced Hospitalization Rates: The ability to manage chronic conditions and perform elective procedures in less intensive settings directly substitutes for inpatient services.

Self-Care and Over-the-Counter Solutions

The rise of self-care and readily available over-the-counter (OTC) solutions presents a significant threat of substitutes for IHH Healthcare. For minor health concerns or the ongoing management of chronic conditions, individuals increasingly turn to self-treatment, OTC medications, or digital health applications instead of consulting healthcare professionals. This trend directly diminishes the demand for basic primary care services that IHH Healthcare's extensive network of clinics provides.

This shift is driven by convenience, cost-effectiveness, and greater patient autonomy. For instance, the global market for OTC drugs was valued at approximately USD 150 billion in 2023 and is projected to grow steadily. Digital health apps, offering symptom checkers, remote monitoring, and wellness advice, further provide accessible alternatives. IHH Healthcare must therefore consider how these accessible substitutes impact patient volume for its more routine services.

Consider these key aspects of the threat:

- Accessibility of OTC Medications: A vast array of medications for common ailments like headaches, colds, and minor pain are available without a prescription, directly substituting for initial doctor visits.

- Growth of Digital Health Solutions: Telehealth platforms and health apps provide convenient and often lower-cost alternatives for advice, diagnosis, and management of certain conditions, bypassing traditional clinic visits.

- Patient Empowerment and Cost Sensitivity: Growing patient awareness and a desire to manage healthcare costs encourage self-directed care, especially for non-urgent issues.

- Impact on Primary Care Utilization: The increased adoption of these substitutes can lead to a reduction in patient traffic for IHH Healthcare's primary care services, potentially affecting revenue streams for these segments.

The threat of substitutes for IHH Healthcare is significant, stemming from the increasing accessibility and acceptance of alternative healthcare delivery models. Telemedicine and virtual consultations offer convenient, often lower-cost alternatives for routine care, directly impacting the demand for traditional in-person visits. Similarly, the robust growth of home healthcare services and specialized outpatient facilities allows patients to receive treatment outside of traditional hospital settings, reducing reliance on inpatient services. Furthermore, the expanding market for over-the-counter medications and digital health solutions empowers individuals to manage minor health concerns independently, bypassing the need for primary care consultations.

| Substitute Type | Market Value (Approx. 2023/2024) | Key Trend |

| Telemedicine | Over $200 billion (projected mid-2024) | Increasing patient comfort with remote consultations. |

| Home Healthcare | USD 328.8 billion (2023) | Growing preference for convenience and cost savings. |

| Wellness Market | Over $4.5 trillion (2022) | Focus on preventive health reducing need for reactive treatments. |

| OTC Medications | USD 150 billion (2023) | Accessibility for self-management of common ailments. |

| Traditional Medicine | Over $150 billion (2023) | Offers alternative philosophies and often lower costs. |

Entrants Threaten

The threat of new entrants in the private healthcare sector, particularly for specialized tertiary care, is significantly dampened by the colossal capital investment needed. Building and equipping a state-of-the-art hospital can easily run into hundreds of millions of dollars, with some advanced facilities exceeding the billion-dollar mark. This substantial financial hurdle makes it incredibly difficult for new players to establish a competitive foothold.

Furthermore, the ongoing infrastructure requirements, including advanced medical technology, specialized equipment, and stringent regulatory compliance, demand continuous and substantial capital expenditure. For instance, acquiring and maintaining cutting-edge diagnostic imaging equipment like MRI and CT scanners alone can cost millions. These high upfront and recurring costs act as a formidable barrier, effectively protecting established players like IHH Healthcare from new competition.

Stringent regulatory hurdles and licensing requirements significantly raise the barrier to entry in the healthcare sector. New entrants must navigate complex frameworks, including obtaining various accreditations and permits, which demand substantial investment and time. For instance, in many developed markets, establishing a new hospital can take years and require millions in compliance-related expenses before even seeing a patient.

Established healthcare providers like IHH Healthcare possess a significant advantage through their strong brand reputation and deeply ingrained patient trust. This trust is not built overnight; it's cultivated through years of consistent quality care and positive patient experiences, fostering long-standing relationships with both patients and medical professionals. For instance, IHH Healthcare's extensive network and commitment to patient outcomes have solidified its standing in key markets, making it a go-to choice for many.

Newcomers face a formidable challenge in replicating this level of credibility. In the healthcare sector, where life and well-being are at stake, trust is the most critical currency. Patients are often hesitant to switch to unfamiliar providers, especially for complex medical needs, making it difficult for new entrants to gain market share without a proven track record and demonstrable patient satisfaction. This inherent reluctance to trust unproven entities acts as a substantial barrier to entry.

Difficulty in Acquiring and Retaining Medical Talent

The difficulty in acquiring and retaining medical talent presents a significant barrier for new entrants aiming to compete with established healthcare providers like IHH Healthcare. New hospitals often face an uphill battle in attracting and keeping highly qualified doctors, nurses, and specialized medical staff. This scarcity of top-tier talent necessitates offering exceptionally competitive compensation and benefits packages, which can be a substantial upfront cost.

Even with attractive offers, new entrants may struggle to replicate the established networks and career progression opportunities that established players provide. For instance, in many markets, the demand for specialized surgeons and oncologists outstrips supply. In 2024, the global shortage of nurses alone was projected to reach over 10 million, a figure that highlights the intense competition for skilled medical professionals. This talent gap means new facilities must invest heavily in recruitment and retention strategies to build a competent workforce.

- Talent Scarcity: The limited availability of experienced medical professionals makes it challenging for new entrants to build a fully staffed and highly skilled medical team.

- Competitive Compensation: New hospitals are often forced to offer premium salaries and benefits to lure talent away from established institutions, increasing operational costs.

- Retention Challenges: Beyond initial recruitment, retaining this talent is difficult as experienced professionals may seek greater stability, better career paths, or more advanced facilities offered by incumbents.

- Impact on Quality: A persistent struggle to attract and retain the best medical talent can directly impact the quality of care provided, hindering a new entrant's ability to establish a strong reputation and patient base.

Established Supply Chains and Payer Relationships

IHH Healthcare benefits significantly from its established supply chains and robust payer relationships. These existing ties with key pharmaceutical companies, medical device manufacturers, and major insurance providers create substantial barriers for new entrants. Building these complex networks and securing favorable terms from scratch requires considerable time, capital, and negotiation expertise, which new players would lack.

For instance, IHH Healthcare’s scale allows for bulk purchasing and preferential pricing from suppliers, a cost advantage difficult for newcomers to match. In 2024, the healthcare industry continued to see consolidation, further strengthening the positions of established players like IHH in their supplier negotiations.

- Established Supplier Contracts: IHH Healthcare likely has long-term agreements with major medical suppliers, securing consistent access to critical equipment and pharmaceuticals at competitive rates.

- Payer Network Strength: Extensive contracts with insurance companies and government health programs ensure a steady stream of patients and predictable revenue, a network new entrants would struggle to replicate quickly.

- Economies of Scale: The sheer volume of IHH Healthcare’s operations translates into significant purchasing power, allowing them to negotiate better terms than smaller, newer organizations.

- Regulatory Navigation: Existing relationships can also smooth the often-complex regulatory processes involved in securing medical supplies and negotiating with payers.

The threat of new entrants into the private healthcare sector, particularly for specialized tertiary care, is significantly low due to immense capital requirements. Building a state-of-the-art hospital can cost hundreds of millions, with advanced facilities exceeding a billion dollars, making it a substantial financial barrier for new players.

Ongoing infrastructure needs, including advanced medical technology and stringent regulatory compliance, demand continuous capital expenditure. For example, acquiring cutting-edge diagnostic imaging equipment can cost millions, acting as a formidable barrier to entry.

Stringent regulatory hurdles and licensing requirements also raise the barrier to entry. New entrants must navigate complex frameworks, including obtaining accreditations and permits, which demand substantial investment and time, often taking years before operations can commence.

| Barrier Type | Description | Estimated Cost/Timeframe |

|---|---|---|

| Capital Investment | Building and equipping a hospital | $100M - $1B+ |

| Infrastructure | Advanced medical technology, specialized equipment | Millions per unit (e.g., MRI, CT scanners) |

| Regulatory Compliance | Licensing, accreditations, permits | Years and millions in expenses |

Porter's Five Forces Analysis Data Sources

Our IHH Healthcare Porter's Five Forces analysis is built on a foundation of reliable data, incorporating information from annual reports, industry-specific market research, and regulatory filings to capture the competitive landscape accurately.

We leverage a combination of primary and secondary sources, including financial statements, analyst reports, and government health statistics, to provide a comprehensive assessment of industry rivalry, supplier and buyer power, and the threat of new entrants and substitutes.