IHH Healthcare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHH Healthcare Bundle

IHH Healthcare's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of healthcare services. Understand which segments are driving growth and which require careful management to optimize resource allocation.

This glimpse into IHH Healthcare's BCG Matrix is just the beginning. Purchase the full report to unlock a detailed quadrant-by-quadrant analysis, actionable strategies for each business unit, and a clear roadmap for future investment and divestment decisions.

Stars

IHH Healthcare's investment in specialized tertiary care, such as oncology with proton therapy in Singapore, positions these services as stars in its BCG matrix. As the first private provider in Asia to offer proton therapy, IHH is tapping into high-growth, high-acuity segments. This advanced treatment caters to specialized demand, indicating strong potential for market leadership and significant returns.

IHH Healthcare's strategic acquisitions, like the addition of Island Hospital in Penang, have cemented its dominance in Malaysia's thriving medical tourism market. Island Hospital alone is a major draw for international patients, showcasing IHH's commanding presence in this lucrative and expanding sector. This growth trajectory highlights IHH's strategic foresight and its ability to leverage key assets for market leadership.

IHH Healthcare is aggressively expanding its bed capacity, with plans to add around 4,000 beds by 2028. A significant portion of this expansion is focused on India and Malaysia, reflecting a strategic push into markets demonstrating robust healthcare demand. For instance, IHH's Indian operations are set to see substantial growth, including the development of new facilities such as Fortis Hospital Manesar, contributing to this ambitious capacity increase.

Digital Health and AI Integration

IHH Healthcare's commitment to digital health and AI integration is a significant driver of its future growth. The company is investing heavily in technologies that enhance diagnostics, improve operational efficiency, and elevate the patient experience. For instance, AI-powered diagnostic tools are being implemented to assist clinicians in interpreting medical images more accurately and swiftly.

These advancements are not just about technology adoption; they are strategically designed to position IHH at the vanguard of healthcare innovation. By leveraging AI, IHH aims to streamline workflows, from patient registration to treatment planning, ultimately leading to better clinical outcomes and a more seamless patient journey. The company's focus on these high-growth areas reflects a clear understanding of the evolving healthcare landscape.

- AI in Diagnostics: IHH is exploring AI for image analysis in radiology and pathology, aiming to reduce diagnostic errors and turnaround times.

- Operational Efficiency: Investments in AI-driven scheduling and resource management systems are expected to optimize hospital operations.

- Patient Experience: Digital platforms and AI-powered chatbots are being developed to enhance patient engagement and access to information.

- Market Growth: The global digital health market is projected to reach over $600 billion by 2026, indicating substantial growth potential for IHH's initiatives.

High-Growth Emerging Market Ventures (e.g., Acibadem Kartal Hospital in Turkey)

IHH Healthcare's strategic expansion into high-growth emerging markets is exemplified by ventures like the Acibadem Kartal Hospital in Turkey. This new facility, alongside other ongoing expansions in these dynamic regions, underscores IHH's commitment to capturing market share in rapidly developing healthcare landscapes. While these new operations may start with a smaller market share, their presence in expanding economies positions them for substantial future growth.

The opening of Acibadem Kartal Hospital, a significant investment, reflects IHH's proactive approach to tapping into the burgeoning healthcare demand in Turkey. This move is part of a broader strategy to establish a strong foothold in emerging markets, which often present higher growth rates compared to more mature economies.

- Acibadem Kartal Hospital's opening represents a key investment in Turkey's healthcare sector.

- IHH Healthcare aims to leverage high-growth potential in emerging markets.

- New facilities in these regions may initially have lower market share but offer significant future upside.

IHH Healthcare's investments in advanced medical technologies, such as proton therapy, and its strategic acquisitions, like Island Hospital, position these as Stars in its BCG matrix. These ventures are in high-growth, high-acuity segments, demonstrating strong market potential and significant returns. The company’s aggressive expansion, including adding approximately 4,000 beds by 2028, particularly in India and Malaysia, further solidifies its leading position in rapidly expanding markets.

| Business Segment | Market Growth | Relative Market Share | BCG Classification |

|---|---|---|---|

| Specialized Tertiary Care (e.g., Proton Therapy) | High | High | Star |

| Medical Tourism (e.g., Island Hospital) | High | High | Star |

| Capacity Expansion (India, Malaysia) | High | Growing | Star |

| Digital Health & AI Integration | High | Emerging | Potential Star / Question Mark |

What is included in the product

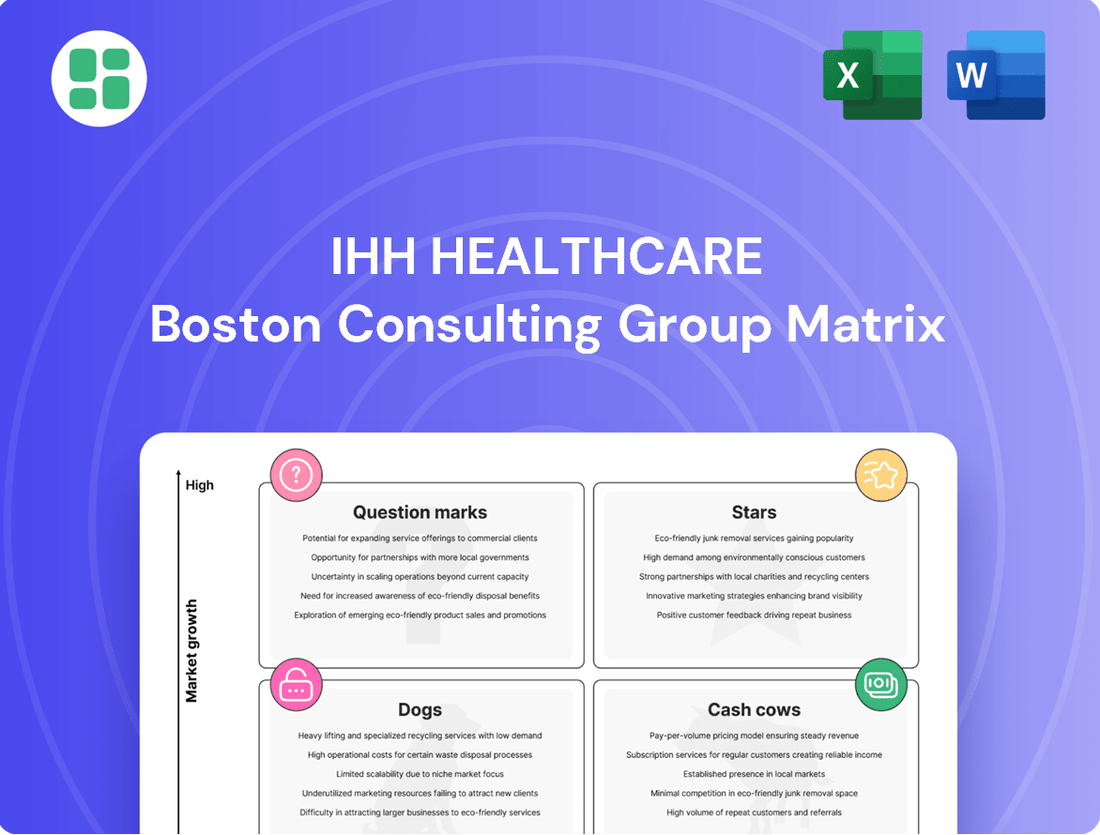

The IHH Healthcare BCG Matrix analyzes its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic guidance on resource allocation for growth, divestment, or maintenance.

IHH Healthcare's BCG Matrix offers a clear, actionable overview of its business units, easing the pain of strategic resource allocation.

Cash Cows

IHH Healthcare's established hospital networks in Singapore, including renowned brands like Mount Elizabeth and Gleneagles, represent significant cash cows. These facilities operate within a mature but highly lucrative market, consistently delivering robust cash flows.

The high revenue intensity, driven by complex medical treatments and a loyal patient base, underpins their strong financial performance. While these operations require continued investment for maintenance and upgrades, the need for aggressive market expansion or promotional spending is considerably lower.

In 2024, IHH Healthcare reported strong revenue contributions from its Singaporean operations, reflecting the sustained demand for its premium healthcare services. The group's Singapore hospitals are key contributors to its overall profitability, demonstrating the enduring value of these mature, cash-generating assets.

The Pantai and Gleneagles hospital operations in Malaysia are firmly positioned as Cash Cows within IHH Healthcare's portfolio. This segment boasts a significant market share in a mature healthcare market, consistently generating substantial profits. In 2024, IHH Healthcare reported that its Malaysian operations, which heavily feature these brands, contributed significantly to the group's overall revenue, demonstrating their enduring financial strength.

These established hospitals benefit from strong brand loyalty and a consistent influx of patients, making them a reliable engine for cash flow. This steady revenue stream is crucial, providing the financial backbone that allows IHH Healthcare to fund growth initiatives in other business areas. For instance, the group's consistent reinvestment in these Malaysian facilities underscores their importance as stable profit generators.

Premier Integrated Labs, a key component of IHH Healthcare's diagnostic services, has established itself as a robust cash cow. Its significant market share and consistent profitability underscore its strong cash-generating ability within the stable diagnostics sector.

In 2024, IHH Healthcare reported a substantial revenue contribution from its laboratory and diagnostics segment, with Premier Integrated Labs being a major driver. This segment's consistent test volumes and established market presence allow it to generate significant free cash flow, supporting other ventures within the group.

Mature Tertiary Services Portfolio (e.g., established cardiology, neurology centers)

IHH Healthcare's established tertiary services, such as general cardiology and neurology centers in mature markets, function as cash cows. These aren't necessarily cutting-edge but are high-volume specialties that consistently bring in significant, high-margin revenue. The demand for these services remains strong, bolstered by IHH's established reputation for excellent patient care, ensuring a reliable and steady stream of cash flow.

These mature tertiary service lines are critical to IHH's financial stability. For instance, in 2023, IHH Healthcare reported a revenue of approximately RM23.7 billion. A substantial portion of this revenue is likely attributable to these well-established, high-demand service lines that benefit from economies of scale and optimized operational efficiencies.

- Steady Revenue Generation: High patient volumes in specialties like general cardiology and neurology contribute to predictable and consistent revenue streams.

- High Profit Margins: Mature services often benefit from optimized cost structures and established pricing power, leading to strong profit margins.

- Brand Reputation: IHH's recognized quality of care in these established fields attracts a steady flow of patients, reinforcing their cash cow status.

- Contribution to Overall Profitability: These services provide the necessary cash flow to fund investments in newer, high-growth areas of the business.

Parkway Life REIT Operations

Parkway Life REIT, a real estate investment trust linked to IHH Healthcare, functions as a significant cash cow. It generates a steady, predictable income through rental payments from its portfolio of healthcare properties. This segment is characterized by a mature, low-growth market but holds a dominant position in healthcare real estate, ensuring consistent cash flow for the broader IHH group.

In 2024, Parkway Life REIT's operational performance continued to underscore its cash cow status. The REIT's strategy of owning and managing high-quality healthcare facilities in stable markets provided a reliable revenue stream. For instance, its occupancy rates remained robust, reflecting the consistent demand for healthcare services, which translates into stable rental income for IHH.

- Stable Rental Income: Parkway Life REIT's long-term leases with IHH Healthcare and other operators provide predictable revenue.

- High Market Share: Dominant presence in key healthcare real estate markets ensures consistent demand and occupancy.

- Low Growth, High Stability: Operates in a mature but stable sector, offering reliable cash generation with minimal volatility.

- Contribution to IHH: Acts as a consistent financial contributor, supporting IHH Healthcare's overall financial health and investment capacity.

IHH Healthcare's established hospital networks in Singapore, including renowned brands like Mount Elizabeth and Gleneagles, represent significant cash cows. These facilities operate within a mature but highly lucrative market, consistently delivering robust cash flows. The high revenue intensity, driven by complex medical treatments and a loyal patient base, underpins their strong financial performance. In 2024, IHH Healthcare reported strong revenue contributions from its Singaporean operations, reflecting the sustained demand for its premium healthcare services.

The Pantai and Gleneagles hospital operations in Malaysia are firmly positioned as Cash Cows within IHH Healthcare's portfolio. This segment boasts a significant market share in a mature healthcare market, consistently generating substantial profits. In 2024, IHH Healthcare reported that its Malaysian operations contributed significantly to the group's overall revenue, demonstrating their enduring financial strength.

Premier Integrated Labs, a key component of IHH Healthcare's diagnostic services, has established itself as a robust cash cow. Its significant market share and consistent profitability underscore its strong cash-generating ability within the stable diagnostics sector. In 2024, IHH Healthcare reported a substantial revenue contribution from its laboratory and diagnostics segment, with Premier Integrated Labs being a major driver.

IHH Healthcare's established tertiary services, such as general cardiology and neurology centers in mature markets, function as cash cows. These high-volume specialties consistently bring in significant, high-margin revenue. In 2023, IHH Healthcare reported a revenue of approximately RM23.7 billion, with these mature service lines being critical to its financial stability.

Parkway Life REIT, a real estate investment trust linked to IHH Healthcare, functions as a significant cash cow. It generates a steady, predictable income through rental payments from its portfolio of healthcare properties. In 2024, Parkway Life REIT's operational performance continued to underscore its cash cow status, with robust occupancy rates reflecting consistent demand.

Delivered as Shown

IHH Healthcare BCG Matrix

The IHH Healthcare BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This detailed analysis, designed for strategic decision-making, will be delivered in its final, ready-to-use format. You can confidently use this preview as an accurate representation of the comprehensive report that will be yours to download and implement. It's professionally formatted and packed with insights, ensuring you get exactly what you need for IHH Healthcare's strategic planning.

Dogs

Underperforming smaller clinics or outdated facilities within IHH Healthcare's portfolio likely fall into the Dogs quadrant of the BCG matrix. These could be older facilities with limited capacity or specialized services that are no longer in high demand, operating in saturated local markets with minimal growth potential.

These units often require significant capital investment for upgrades or modernization, yet their low market share and limited revenue generation make such investments difficult to justify. For instance, a smaller clinic in a mature, highly competitive urban area might struggle to attract new patients, becoming a drain on resources without a clear path to profitability.

Certain ancillary services within IHH Healthcare, perhaps those not directly supporting core high-acuity medical treatments or niche offerings that haven't resonated with patients, could be categorized as Dogs. These services would likely show minimal patient uptake and stagnant or declining demand, indicating a low market share in their respective segments.

For instance, if IHH Healthcare had a specialized wellness program that saw less than 1% of its patient base participate in 2024, and market research indicated no significant projected growth for such services, it would fit this Dog quadrant. These offerings, while potentially existing, are not contributing meaningfully to revenue or strategic growth, representing a drain on resources without substantial return.

While IHH Healthcare's core strength lies in dynamic growth markets, some smaller regional operations may encounter stagnation. In these instances, IHH might hold a modest market share with limited avenues for expansion, often due to intense competition. For example, a hypothetical presence in a mature European market might see growth rates below 2%, with IHH's share hovering around 5% against several established local players.

Legacy or Inefficient Internal Processes

Legacy or inefficient internal processes at IHH Healthcare, beyond physical assets, can be considered 'dogs' when they consume resources without contributing to growth. These are often administrative or operational workflows that haven't been fully digitized or optimized, acting as a drag on overall efficiency and profitability.

IHH's strategic transformation initiatives are specifically targeting these areas to improve performance. For instance, in 2024, the company continued its focus on digitalizing patient management systems and supply chain operations to streamline workflows and reduce manual intervention.

- Digitalization of administrative tasks: Reducing time spent on manual data entry and processing.

- Streamlining patient onboarding: Implementing digital solutions for faster patient registration and check-in.

- Optimizing supply chain management: Enhancing inventory tracking and procurement processes through technology.

- Improving internal communication platforms: Ensuring efficient information flow across departments.

Divested Non-Strategic Assets (e.g., International Medical University)

The divestment of non-strategic assets, such as the International Medical University (IMU) in 2023, highlights IHH Healthcare's proactive portfolio management. This move signals a strategic pruning of assets that no longer aligned with core growth objectives or presented limited market potential. IHH's decision to sell the IMU, which was reportedly sold for RM1.3 billion (approximately USD 275 million at the time of sale), exemplifies its commitment to focusing resources on higher-performing segments.

This strategic divestment aligns with the BCG Matrix concept of 'Dogs' – business units or products with low market share and low growth potential. By shedding such assets, IHH aims to improve overall portfolio efficiency and capital allocation. The sale of IMU demonstrates a clear understanding of its own portfolio's strengths and weaknesses, prioritizing investments in areas with greater strategic value and higher anticipated returns.

- Divestment of IMU: IHH Healthcare divested the International Medical University in 2023.

- Strategic Rationale: The sale aimed to shed non-core and low-growth assets.

- Financial Impact: The IMU was reportedly sold for RM1.3 billion (approx. USD 275 million).

- BCG Matrix Alignment: This action reflects the identification and removal of 'Dog' assets from the portfolio.

Units categorized as Dogs within IHH Healthcare's portfolio represent areas with low market share and minimal growth prospects, often requiring significant investment without clear returns. These could be older, underutilized facilities or specialized services with declining patient interest. For instance, a small, legacy diagnostic lab in a saturated market with a less than 3% market share and projected annual growth of under 1% would fit this description.

IHH Healthcare actively manages its portfolio to address these 'Dogs.' A key strategy involves divesting non-core or underperforming assets. The sale of the International Medical University (IMU) in 2023 for approximately USD 275 million exemplifies this approach, allowing IHH to reallocate capital towards more promising ventures.

Operational inefficiencies and outdated internal processes can also be considered 'Dogs' if they consume resources without contributing to growth. IHH's 2024 focus on digitalizing administrative tasks and optimizing supply chain management aims to eliminate these drags on efficiency and profitability.

By identifying and addressing these 'Dog' segments, IHH Healthcare seeks to enhance overall portfolio performance and capital allocation, ensuring resources are directed towards areas with higher strategic value and greater potential for returns.

| Asset/Service Type | Market Share (Estimated) | Market Growth (Estimated) | Strategic Action |

| Small Regional Clinic (Mature Market) | 5% | 1.5% | Divestment or Modernization |

| Niche Wellness Program | 2% | 0.5% | Phased Exit or Repurposing |

| Legacy IT System | N/A (Internal) | N/A (Internal) | Replacement/Upgrade |

| International Medical University (IMU) | N/A (Divested) | N/A (Divested) | Divested (2023) |

Question Marks

IHH Healthcare's new Ambulatory Care Centres (ACCs) in Singapore and Hong Kong are positioned as stars in its BCG matrix. This expansion taps into the high-growth segment of outpatient healthcare services, reflecting a strategic move to capture a larger share of the evolving healthcare landscape.

These ACCs, while promising, are in their nascent stages, necessitating significant capital outlay for market penetration and brand building. In 2024, IHH continued to invest in these facilities, aiming to establish them as key players in their respective markets, though their profitability is yet to be fully realized.

IHH Healthcare is strategically eyeing Indonesia and Vietnam as potential growth engines, recognizing their substantial populations and burgeoning healthcare needs. These markets represent classic question marks in the BCG matrix, where IHH's current market share is nascent, demanding considerable investment to build brand presence and operational capacity.

Indonesia, with its estimated population exceeding 279 million in 2024, presents a vast untapped market. Similarly, Vietnam's growing middle class and increasing healthcare expenditure, projected to reach over $20 billion in 2024, offer compelling opportunities for expansion. These investments are crucial for IHH to transition these ventures from question marks to stars.

IHH Healthcare's commitment to early-stage adoption of cutting-edge, niche medical technologies signifies a strategic move into high-growth potential areas. Beyond established treatments like proton therapy, the company actively invests in novel and specialized emerging treatments. These represent areas with initially low market penetration but significant future upside, contingent on patient adoption and proven clinical efficacy. For example, the global market for robotic surgery, a prime example of such niche technology, was projected to reach $12.9 billion in 2024, with a compound annual growth rate (CAGR) of 15.3% expected through 2030, highlighting the substantial investment required for market capture and future returns.

AI-Driven Patient Experience and Operational Transformation Initiatives

IHH Healthcare is investing in AI to improve patient journeys, with initiatives like AI-driven financial counseling and advanced fall prevention systems. These are groundbreaking but still in their early stages, aiming to revolutionize patient interaction and safety within their facilities.

These AI-driven patient experience and operational transformation initiatives are positioned in a high-growth sector of healthcare technology. While promising, they necessitate significant investment in development and widespread implementation before realizing their full market potential. For instance, the global AI in healthcare market was projected to reach USD 100.46 billion in 2024, showcasing the immense growth trajectory.

- AI-powered financial counseling aims to simplify billing and insurance processes for patients.

- Advanced fall prevention systems leverage AI to monitor patients and alert staff to potential risks.

- These initiatives represent a strategic move into a rapidly expanding market segment within healthcare.

- Substantial investment in R&D and infrastructure is crucial for these nascent AI programs to achieve market leadership.

Recent Acquisitions Requiring Integration and Market Share Capture

Recent acquisitions, such as the planned integration of Shrimann Superspeciality Hospital in India by 2025, represent IHH Healthcare's strategic move into potentially high-growth markets. These entities are currently in a phase where significant effort is required to fully integrate them into IHH's operational and management systems. The success of these acquisitions hinges on their ability to capture and expand market share within their respective geographies, a crucial step towards them evolving into Stars or Cash Cows within the BCG matrix.

- Shrimann Superspeciality Hospital Acquisition: Expected to finalize in 2025, this Indian acquisition positions IHH in a rapidly expanding healthcare market.

- Integration Challenges: The primary focus for these acquired assets is seamless integration into IHH's established operational framework and brand standards.

- Market Share Capture: Successful market share growth is critical for these new ventures to transition from Question Marks to more mature portfolio categories.

- Strategic Importance: These acquisitions are vital for IHH's long-term growth strategy, aiming to leverage new market opportunities and diversify its geographical footprint.

IHH Healthcare's ventures in Indonesia and Vietnam are classic question marks, requiring substantial investment to build brand and operational capacity in these high-potential markets.

Indonesia's population of over 279 million in 2024 and Vietnam's healthcare expenditure exceeding $20 billion in the same year highlight the significant opportunities for IHH to establish a strong market presence.

The success of these emerging markets is contingent on effective capital allocation and strategic execution to transform them into future stars within IHH's portfolio.

Similarly, the integration of recent acquisitions, like Shrimann Superspeciality Hospital in India, also falls into the question mark category, demanding focused efforts on market share capture and operational alignment to drive future growth.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, incorporating financial statements, industry growth rates, and competitor analysis to provide strategic insights.