Icahn Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Icahn Enterprises navigates a complex market, leveraging its diversified holdings and activist investor approach. However, understanding the full scope of its competitive advantages, potential vulnerabilities, market opportunities, and emerging threats is crucial for informed decision-making.

Want the full story behind Icahn Enterprises' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Icahn Enterprises L.P. boasts a significantly diversified business portfolio, encompassing investments, energy, automotive, food packaging, real estate, home fashion, and pharmaceuticals. This wide range of operations acts as a natural hedge against sector-specific downturns, fostering stability and multiple revenue channels for the company.

This diversification is a key strength, as evidenced by the company's varied performance across segments. For instance, while the energy sector might face volatility, other areas like home fashion or pharmaceuticals could provide offsetting stability. This broad operational base allows Icahn Enterprises to weather economic fluctuations more effectively than a more concentrated business.

Icahn Enterprises has maintained a consistent quarterly distribution of $0.50 per depositary unit, even through periods of financial difficulty. This unwavering commitment signals a strong focus on shareholder returns, aiming to bolster investor confidence. Such consistent payouts can be interpreted as a testament to management's belief in the company's underlying value and its dedication to rewarding its investors.

Icahn Enterprises' activist investment strategy is a core strength, allowing it to directly engage with and influence management of target companies to unlock shareholder value. This hands-on approach, a hallmark of Carl Icahn's investing philosophy, aims to drive significant operational improvements and strategic shifts in businesses it believes are undervalued.

Historically, this strategy has proven effective in generating substantial returns. For instance, Icahn's successful activist campaigns have often led to significant stock price appreciation for the targeted companies, demonstrating the power of direct intervention to enhance performance and shareholder value.

Strong Holding Company Liquidity

Icahn Enterprises boasts a very strong financial foundation, with its holding company liquidity standing at approximately $3.532 billion as of June 30, 2025. This significant cash reserve, part of a total liquidity of $4.584 billion, offers considerable flexibility. It allows the company to navigate economic downturns, pursue new investment opportunities, and manage any unexpected operational demands effectively.

- Robust Liquidity: As of June 30, 2025, Icahn Enterprises held $3.532 billion in holding company liquid assets, contributing to a total liquidity of $4.584 billion.

- Financial Flexibility: This substantial cash position provides the company with the means to absorb market shocks and fund strategic initiatives.

- Operational Resilience: Strong liquidity acts as a crucial buffer, enabling Icahn Enterprises to manage ongoing operational needs even amidst economic uncertainty.

Improved Recent Operational Performance

Icahn Enterprises has demonstrated an improved operational performance recently. In the second quarter of 2025, the company reported a narrowed net loss of $165 million, a significant improvement from the $331 million net loss recorded in the same period of 2024. This positive trend is further supported by an enhanced Adjusted EBITDA loss, which decreased to $43 million in Q2 2025, down from $155 million year-over-year. These figures suggest that operational efficiency initiatives are starting to take hold.

The company's financial health also saw a boost, with its indicative net asset value rising by $252 million. As of June 30, 2025, the net asset value stood at $3.3 billion, signaling some positive momentum in the overall valuation of its assets.

- Narrowed Net Loss: Q2 2025 net loss of $165 million versus $331 million in Q2 2024.

- Improved Adjusted EBITDA Loss: Decreased to $43 million in Q2 2025 from $155 million year-over-year.

- Increased Net Asset Value: Indicative net asset value rose by $252 million to $3.3 billion as of June 30, 2025.

Icahn Enterprises' diversified business model provides a significant advantage, spreading risk across various sectors like energy, automotive, and pharmaceuticals. This broad operational base, as seen in its Q2 2025 performance, allows for greater resilience against sector-specific downturns, ensuring multiple revenue streams. The company's commitment to consistent quarterly distributions, such as the $0.50 per depositary unit, also underscores its dedication to shareholder value, fostering investor confidence through predictable returns.

| Metric | Q2 2025 | Q2 2024 | Change |

|---|---|---|---|

| Net Loss | $165 million | $331 million | Improved |

| Adjusted EBITDA Loss | $43 million | $155 million | Improved |

| Indicative Net Asset Value | $3.3 billion | N/A | Increased by $252 million |

| Holding Company Liquidity | $3.532 billion | N/A | Strong |

What is included in the product

Offers a full breakdown of Icahn Enterprises’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Uncovers hidden opportunities and mitigates potential threats, simplifying complex strategic challenges for Icahn Enterprises.

Weaknesses

Icahn Enterprises has been grappling with persistent net losses, posting a substantial $422 million loss in the first quarter of 2025. While the second quarter of 2025 saw a reduction in losses to $165 million, this still indicates ongoing financial challenges.

Adding to these concerns, the company has witnessed a concerning trend of revenue decline. Icahn Enterprises missed its revenue estimates for the first quarter of 2025 and has experienced a 13.5% annual revenue decrease over the past two years, underscoring difficulties in generating consistent top-line growth.

The Investment segment has been a significant drag on Icahn Enterprises' performance, reporting a substantial $224 million loss in the first quarter of 2025. This downturn was primarily fueled by challenges within the healthcare sector, highlighting a key area of vulnerability.

Although the second quarter of 2025 offered some signs of recovery for this segment, its persistent volatility and negative financial contributions underscore a fundamental weakness. This directly impacts the company's overall results and its indicative net asset value, raising questions about the efficacy of current investment strategies and asset allocation.

Icahn Enterprises faces a significant challenge with its operating margins, which averaged a mere 2.1% for the industrials sector. This is particularly concerning given that Q1 2025 reported a negative operating profit margin of 10.7%, signaling a substantial increase in operational inefficiencies.

These declining margins suggest that the company is struggling to effectively manage its expenses, including areas like marketing, research and development, and general administrative overhead. The high cost base across its varied business segments appears to be a persistent impediment to achieving stronger financial performance.

Challenges in Key Operating Segments

Icahn Enterprises faces significant challenges within its key operating segments, impacting overall financial health. The Energy segment, for instance, reported an $84 million loss in the second quarter of 2025. This downturn was largely due to planned refinery maintenance and less favorable valuations for Renewable Identification Numbers (RINs).

Similarly, the Automotive segment is not performing as expected, with a net loss of $25 million also recorded in the second quarter of 2025. These persistent difficulties in core business areas are a notable weakness, contributing to the company's broader financial performance concerns.

- Energy Segment Headwinds: Faced an $84 million loss in Q2 2025 due to refinery turnarounds and unfavorable RINs valuation.

- Automotive Segment Struggles: Reported a $25 million net loss in Q2 2025.

- Impact on Overall Performance: Ongoing challenges in these significant operating segments negatively affect the company's financial results.

High Debt Burden

Icahn Enterprises faces a significant challenge with its high debt burden. As of March 31, 2025, the company reported total liabilities amounting to $11.739 billion. This substantial financial obligation is further highlighted by a reported $6.625 billion debt load preceding its Q2 2025 earnings announcement.

The company's strategy to redeem existing senior notes, while necessary, underscores the weight of this debt. The necessity of issuing new senior notes to partially cover these redemptions clearly indicates the ongoing pressure from its leverage. This persistent debt load poses a considerable risk to Icahn Enterprises' long-term financial stability, especially if the company experiences sustained operational losses.

- Total Liabilities: $11.739 billion (as of March 31, 2025)

- Reported Debt Burden: $6.625 billion (ahead of Q2 2025 earnings)

- Redemption Strategy: Issuing new senior notes to partially redeem existing ones

Icahn Enterprises' financial performance is significantly hampered by persistent net losses, with a $422 million loss in Q1 2025 and a reduced $165 million loss in Q2 2025, indicating ongoing financial strain and a need for strategic adjustments.

Revenue generation remains a challenge, evidenced by missed Q1 2025 estimates and a 13.5% annual revenue decrease over the past two years, pointing to difficulties in achieving consistent top-line growth across its diverse business segments.

The Investment segment, particularly its healthcare holdings, posted a substantial $224 million loss in Q1 2025, highlighting a critical vulnerability and the segment's persistent volatility, which directly impacts the company's overall net asset value and strategic effectiveness.

Operating margins are a notable weakness, with industrial sector averages at a mere 2.1% and a negative 10.7% operating profit margin in Q1 2025, suggesting inefficiencies in expense management and a struggle to translate revenue into profitability across its operations.

| Segment | Q1 2025 Loss | Q2 2025 Loss | Key Issues |

|---|---|---|---|

| Investment | $224 million | N/A (volatility noted) | Healthcare sector challenges, overall volatility |

| Energy | N/A | $84 million | Refinery maintenance, unfavorable RINs valuation |

| Automotive | N/A | $25 million | Underperformance |

Preview Before You Purchase

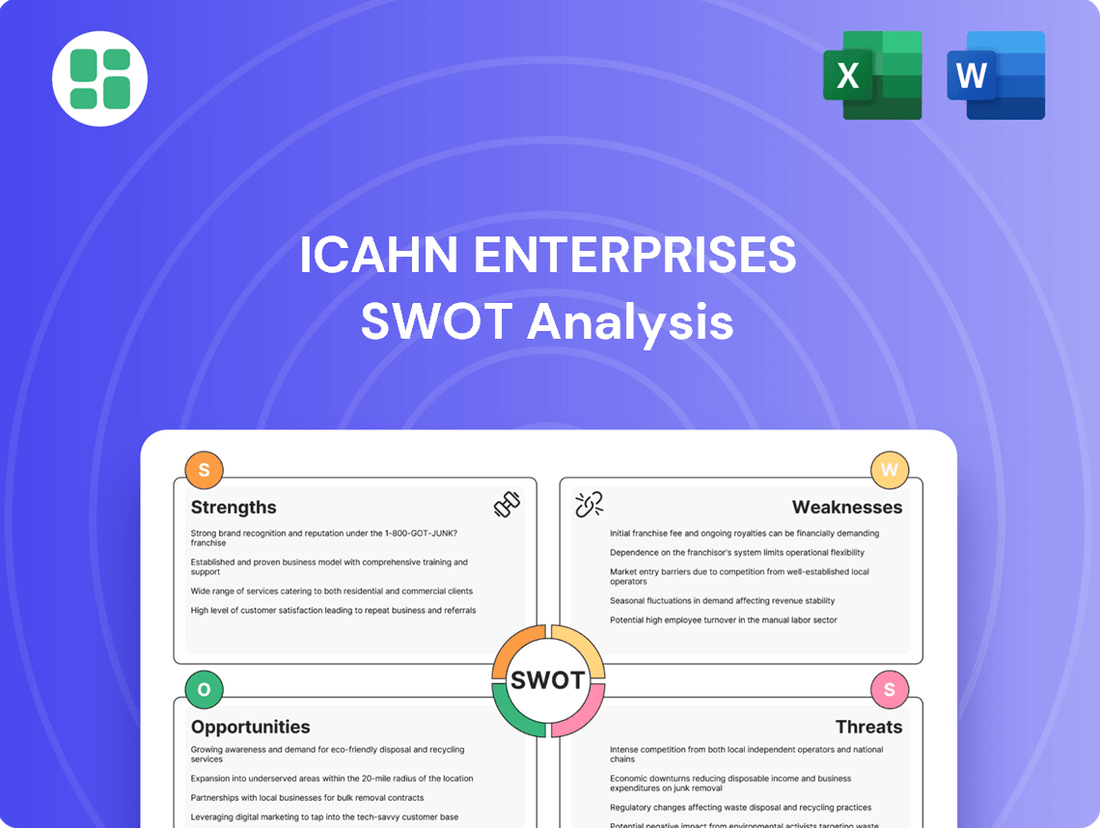

Icahn Enterprises SWOT Analysis

The preview you see is the actual Icahn Enterprises SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive look at the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. It's designed to offer actionable insights for strategic planning.

Opportunities

Icahn Enterprises has a significant opportunity to boost its financial health by selling off underperforming or non-essential assets. For instance, the company has been actively divesting real estate holdings, a move that can free up considerable capital. This strategy allows for a more focused approach on core businesses and can directly impact debt reduction, a key area for improving financial stability.

The capital generated from these strategic divestitures, such as the sale of specific real estate properties or less critical segments like some food packaging units, can be strategically redeployed. This could mean paying down existing debt, which is crucial for strengthening the balance sheet, or reinvesting in growth areas within the company. Such actions are designed to optimize the overall asset portfolio and enhance shareholder value.

Recent actions, like the agreement to sell certain real estate properties, underscore Icahn Enterprises' commitment to this strategy. This proactive approach to asset management is expected to unlock latent value within the company, improve its financial flexibility, and potentially fund share repurchases, further benefiting investors by increasing earnings per share.

A significant opportunity for Icahn Enterprises lies in the potential resolution of litigation surrounding small refinery exemptions, often referred to as RINs liability. This legal cloud has represented a substantial potential financial obligation, with estimates of this liability ranging from $438 million to $548 million.

A favorable outcome in this litigation would be a major boon for the company. It would not only remove a significant financial overhang but also provide much-needed clarity and stability for Icahn Enterprises' energy operations. This resolution could unlock considerable capital and substantially reduce regulatory uncertainty.

Icahn Enterprises is actively working to revitalize its automotive segment. This includes a strategic move to close underperforming locations, a decisive step to streamline operations and cut losses. Simultaneously, the company has plans to open new service locations, indicating a forward-looking approach to capture market share and enhance customer accessibility.

These strategic adjustments are designed to boost sales and profitability, with expectations for improved cash flows in the near future. The focus on operational efficiency and optimizing its physical footprint presents a significant opportunity for a turnaround in this historically challenging sector.

Real Estate Development and Sales Growth

Icahn Enterprises' real estate segment is poised for significant growth, driven by strategic development projects. The company anticipates substantial sales increases, notably from its Country Club project, with single-family home sales slated to begin by the close of 2025. This initiative is expected to be a key revenue driver and contribute to the overall appreciation of Icahn Enterprises' real estate assets.

Favorable market conditions further bolster this opportunity. Icahn Enterprises is well-positioned to capitalize on the current real estate climate, potentially enhancing its financial performance. Beyond the Country Club development, other ongoing real estate ventures are also expected to contribute positively to the company's top-line growth and asset value.

- Projected Sales Commencement: Single-family home sales from the Country Club project are expected to start by the end of 2025.

- Revenue Growth Driver: The Country Club project and other real estate developments are anticipated to significantly increase sales and revenue.

- Asset Value Appreciation: These initiatives are expected to lead to a notable appreciation in the value of Icahn Enterprises' real estate holdings.

- Market Opportunity: The company is strategically positioned to leverage favorable market conditions within the real estate sector.

Operational Efficiency in Food Packaging and Pharma Growth

Icahn Enterprises is actively pursuing operational efficiencies within its food packaging segment. A significant restructuring plan, set to conclude by late 2025, involves consolidating facilities and integrating advanced manufacturing lines. This initiative is projected to boost operational efficiency and improve profit margins.

The Pharma segment presents substantial long-term growth prospects, driven by advancements in drug development and ongoing clinical trials. A notable example is VIVUS's pivotal trial for VI-106, which, if successful, could unlock significant new revenue streams for Icahn Enterprises.

- Food Packaging Restructuring: Facility consolidation and new manufacturing lines aim to enhance efficiency and margins by late 2025.

- Pharma Growth Drivers: New drug trials, like VIVUS's VI-106, represent key opportunities for revenue expansion.

- Strategic Focus: Icahn Enterprises is leveraging operational improvements and R&D advancements for future growth.

Icahn Enterprises has a clear opportunity to improve its financial standing through strategic asset divestitures, particularly in real estate. This move allows for capital redeployment to reduce debt and reinvest in core operations, enhancing overall financial flexibility.

The resolution of the RINs liability litigation presents a significant upside, potentially eliminating a substantial financial overhang estimated between $438 million and $548 million, thereby reducing regulatory uncertainty.

Revitalizing the automotive segment through store closures and new openings, alongside operational efficiencies in food packaging by late 2025, offers a path to improved sales and profit margins.

The real estate segment's growth is bolstered by the Country Club project, with single-family home sales expected to commence by the end of 2025, driving revenue and asset value appreciation amidst favorable market conditions.

Long-term growth prospects in the Pharma segment, particularly with VIVUS's VI-106 trial, could unlock significant new revenue streams.

| Opportunity Area | Key Action/Driver | Expected Impact | Timeline/Data Point |

| Asset Divestitures | Sale of non-essential assets | Capital generation, debt reduction | Ongoing |

| Litigation Resolution | Favorable outcome for RINs liability | Eliminate financial overhang | Liability estimated $438M - $548M |

| Automotive Segment | Streamlining operations, new openings | Improved sales, cash flow | Ongoing |

| Real Estate Development | Country Club project sales | Revenue growth, asset appreciation | Sales start by end of 2025 |

| Pharma Segment | VIVUS VI-106 trial success | New revenue streams | Pivotal trial ongoing |

Threats

Icahn Enterprises' diversified nature, while a strength, also exposes it to the pervasive risks of market volatility and economic downturns. As a significant player in securities markets and various industries, the company is inherently susceptible to broad economic shifts. For instance, the company reported a net loss of $1.3 billion for the first quarter of 2024, partly attributed to declines in its investment portfolio, underscoring this vulnerability.

Icahn Enterprises faces significant threats from regulatory scrutiny and potential litigation. The company is still dealing with the substantial RINs liability in its energy sector, a complex and ongoing issue.

Adding to these concerns, the SEC recently filed charges against Carl Icahn and Icahn Enterprises L.P. for failing to properly disclose information about pledged IEP securities. This action resulted in civil penalties, highlighting the importance of transparent financial reporting.

These regulatory challenges and the possibility of future legal battles could lead to considerable financial costs, damage the company's reputation, and impose operational limitations, impacting overall business performance.

Icahn Enterprises faces intense competition in its diverse operating segments like automotive, energy, and food packaging. For instance, in the energy sector, the company's refining operations contend with major integrated oil companies and independent refiners, many of whom possess greater scale and lower cost structures. This dynamic pressured Icahn's refining segment, contributing to a reported net loss of $171 million for the segment in the first quarter of 2024.

The automotive sector, particularly its aftermarket parts business, sees pressure from both large, well-funded competitors and smaller, specialized players. Rapid technological shifts and changing consumer preferences necessitate significant ongoing investment to remain competitive, impacting overall profitability. Similarly, the food packaging segment operates in a market with numerous global and regional players, leading to constant pricing pressures and the need for innovation to maintain market share.

Challenges in Managing Diversified Operations

The sheer breadth of Icahn Enterprises' operations across multiple, distinct industries creates significant management complexities. This wide diversification can strain resources and dilute focus, making consistent oversight and performance across all segments a considerable challenge.

Icahn Enterprises' Q1 2025 results underscore these difficulties, with the company reporting a substantial net loss of $47 million and a notable decline in revenue. This performance, particularly within the Investment segment, highlights ongoing struggles in effectively navigating and managing its diverse portfolio.

- Broad Operational Scope: Managing a wide array of businesses, from automotive to energy, requires specialized expertise and significant coordination.

- Q1 2025 Financial Strain: A net loss of $47 million in Q1 2025 and declining revenues signal potential inefficiencies in managing diversified assets.

- Segment Performance Variability: Inconsistent performance across different segments, as seen in the Investment segment's struggles, can drag down overall company results.

Execution Risk of Strategic Initiatives

Icahn Enterprises faces significant execution risk with its outlined strategic initiatives. For instance, the company's plans to restructure its food packaging segment and implement automotive turnaround strategies carry the inherent challenge of translating plans into tangible operational improvements. Delays in these complex processes, such as those seen in large-scale real estate developments which can face permitting hurdles or construction challenges, could materialize.

Operational inefficiencies during facility consolidation within its diverse portfolio, a common issue in such large-scale restructuring, could also arise. Furthermore, a failure to achieve the anticipated performance improvements in the automotive segment, perhaps due to unforeseen market shifts or competitive pressures, could directly impact Icahn Enterprises' financial results and erode investor confidence.

- Restructuring Food Packaging: The success of consolidating operations and optimizing supply chains in this segment remains a key execution challenge.

- Automotive Turnaround: Achieving projected cost savings and revenue growth in the automotive division requires seamless integration of new strategies and management.

- Real Estate Development Timelines: Delays in bringing new real estate projects online, as seen in past industry trends, could push back expected returns and cash flows.

Icahn Enterprises is susceptible to intense competition across its varied sectors, including automotive and energy. For example, its refining operations faced a $171 million net loss in Q1 2024 due to pressure from larger, lower-cost competitors. This competitive landscape necessitates continuous investment and innovation, impacting overall profitability and market share across segments like food packaging and automotive aftermarket parts.

| Segment | Q1 2024 Net Loss | Competitive Pressure |

| Energy (Refining) | $171 million | Major integrated oil companies, independent refiners |

| Automotive | N/A | Large, well-funded competitors, smaller specialized players |

| Food Packaging | N/A | Global and regional players, pricing pressures |

SWOT Analysis Data Sources

This Icahn Enterprises SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial filings, comprehensive market research reports, and expert analyses of industry trends to ensure a thorough and informed assessment.