Icahn Enterprises Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Unlock the strategic genius behind Icahn Enterprises's diversified empire. This comprehensive Business Model Canvas dissects their approach to value creation, key resources, and revenue streams, offering a clear roadmap to their success. Discover the actionable insights that drive their market-leading performance.

Partnerships

Icahn Enterprises cultivates robust strategic alliances with the management and boards of its portfolio companies. These collaborations are fundamental to driving operational enhancements, executing strategic pivots, and undertaking financial reorganizations, all geared towards Icahn's long-term value creation goals.

This deep engagement goes beyond simple capital provision; it involves active involvement in governance and key decision-making processes. For instance, in 2024, Icahn Enterprises continued its active role in companies like Icahn Automotive Group, where strategic direction is closely managed to navigate the evolving automotive aftermarket landscape.

Icahn Enterprises actively partners with top-tier investment banking and financial advisory firms. These collaborations are crucial for navigating complex mergers, acquisitions, divestitures, and capital raising efforts across its diverse portfolio.

These expert partnerships provide invaluable insights into deal structuring, precise valuation methodologies, and vital access to capital markets. This expertise is indispensable for executing the strategic transactions that drive Icahn Enterprises' portfolio management and growth objectives.

For instance, in 2024, Icahn Enterprises continued to leverage these relationships to explore and execute strategic capital allocation decisions, a hallmark of its activist investment approach. The firm's ability to identify and efficiently execute such transactions is directly supported by the specialized knowledge these financial partners bring.

Icahn Enterprises frequently forms joint ventures with specialized entities, particularly in sectors like real estate and energy. These collaborations are strategic, pooling complementary expertise, capital, and market access to drive specific project development or enter new business arenas. For instance, in 2024, Icahn Enterprises continued its strategy of leveraging these partnerships to navigate complex market dynamics and share the inherent risks associated with large-scale ventures.

Legal and Regulatory Counsel

Icahn Enterprises maintains crucial partnerships with leading legal and regulatory counsel to navigate its multifaceted operations. These expert advisors are instrumental in ensuring adherence to stringent regulations across diverse sectors like energy, automotive, and real estate.

These legal partnerships are vital for maintaining robust corporate governance and effectively managing any potential litigation or regulatory scrutiny. For instance, in 2023, Icahn Enterprises faced significant regulatory attention regarding its holdings, underscoring the importance of skilled legal representation.

- Ensuring Compliance: Top-tier legal teams help Icahn Enterprises comply with the complex web of regulations governing its diverse business interests, from environmental standards in energy to financial disclosures.

- Risk Mitigation: Partnerships with regulatory counsel are key to proactively identifying and mitigating legal and regulatory risks across all operating segments.

- Strategic Guidance: Legal advisors provide essential guidance on corporate structuring, mergers, acquisitions, and shareholder matters, supporting Icahn Enterprises' strategic objectives.

Key Suppliers and Customers of Subsidiaries

While Icahn Enterprises (IEP) doesn't directly form partnerships with its subsidiaries' suppliers and customers, these relationships are the bedrock of its operational success. Think of it as a vital, albeit indirect, support system that keeps the engine running. These connections are crucial for maintaining a steady flow of necessary materials and ensuring a consistent market for the goods and services produced by IEP's diverse portfolio companies.

These relationships are fundamental to the financial health of Icahn Enterprises' operating segments. For example, in 2024, Icahn Automotive Group, a significant part of IEP, relies on a robust network of auto parts suppliers to maintain its extensive inventory for repair and maintenance services. Similarly, its retail automotive parts stores depend on consistent demand from individual consumers and professional mechanics, highlighting the critical nature of these customer relationships for revenue generation.

The stability and efficiency of Icahn Enterprises' various businesses are directly tied to the strength of these supplier and customer networks. Strong supplier agreements can lead to better pricing and more reliable deliveries, directly impacting cost of goods sold. On the customer side, loyal clientele and strong distribution channels ensure predictable sales volumes, which are essential for financial planning and profitability across the group.

- Supplier Reliability: Icahn Automotive Group's ability to service vehicles is directly dependent on its key suppliers for parts like brakes, filters, and tires.

- Customer Demand: The performance of Icahn Enterprises' energy segment, such as its refining operations, hinges on consistent demand from industrial and commercial customers.

- Operational Efficiency: Maintaining strong relationships with both suppliers and customers minimizes disruptions and optimizes inventory management, directly boosting operational efficiency.

Icahn Enterprises' key partnerships extend to management teams and boards of its portfolio companies, fostering operational improvements and strategic realignments. These collaborations are crucial for Icahn's value creation objectives, as seen in its active 2024 involvement with companies like Icahn Automotive Group to navigate market shifts.

The firm also relies on top-tier investment banks and financial advisors for complex transactions like mergers, acquisitions, and capital raising. These partnerships are vital for deal structuring, valuation, and market access, enabling Icahn Enterprises to execute strategic moves efficiently, as demonstrated by its capital allocation decisions in 2024.

Furthermore, Icahn Enterprises forms strategic joint ventures with specialized entities, particularly in real estate and energy, to pool expertise and share risks in large-scale projects. These ventures are key to navigating complex market dynamics, as exemplified by its 2024 strategy in these sectors.

What is included in the product

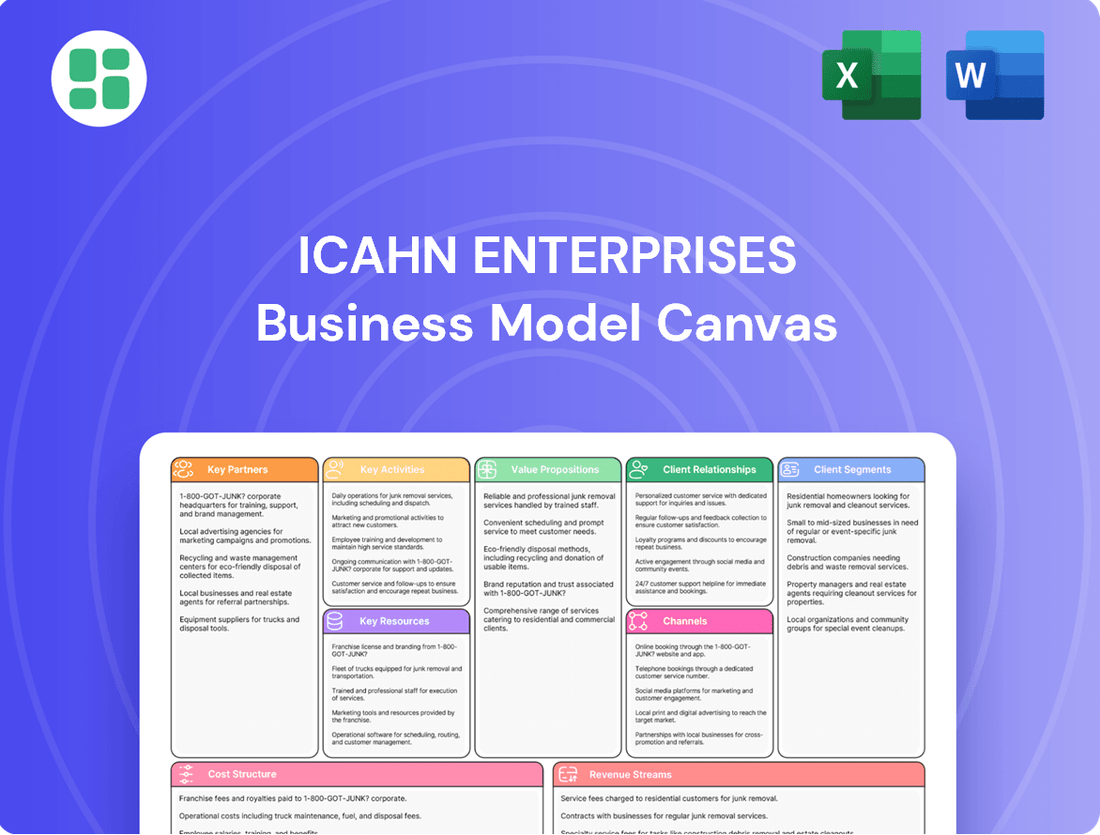

This Business Model Canvas outlines Icahn Enterprises' diversified conglomerate strategy, focusing on acquiring and improving underperforming businesses across various sectors to generate significant shareholder value.

It details key partners, activities, and resources involved in managing a portfolio of diverse operating companies, highlighting Icahn's active management approach and financial engineering expertise.

This Business Model Canvas provides a clear, structured overview of Icahn Enterprises, simplifying the complex conglomerate structure into easily digestible components.

It acts as a pain point reliever by transforming overwhelming strategic complexity into a visual, actionable framework for analysis and decision-making.

Activities

A core activity for Icahn Enterprises involves identifying, acquiring, and actively managing stakes in both public and private companies. This process includes thorough due diligence and strategic capital allocation to enhance investment value.

Continuous monitoring of portfolio performance is crucial, with a focus on driving operational improvements and strategic influence. For instance, in 2024, Icahn Enterprises continued to actively manage its diverse portfolio, which historically has included significant holdings in sectors like energy and automotive.

Icahn Enterprises actively guides its varied subsidiaries, which span sectors like energy, automotive, and food packaging. This strategic oversight includes embedding proven operational methods, seeking out collaborative opportunities, and boosting efficiency across the group. The primary goal is to enhance the performance and financial returns of each individual business.

In 2024, Icahn Enterprises continued its strategy of actively managing its portfolio companies. For instance, Icahn Automotive, a significant subsidiary, has been undergoing a strategic review and operational enhancements aimed at improving its market position and profitability. This hands-on approach is central to Icahn Enterprises' business model, focusing on unlocking value through active management.

Icahn Enterprises actively engages in mergers, acquisitions, and divestitures as a core strategy for portfolio management. This involves acquiring new businesses, merging existing ones, and selling off underperforming assets to optimize its holdings.

In 2024, the company continued this pattern, for instance, Icahn Enterprises announced its intention to sell its stake in Icahn Automotive Group to a private equity firm, a move aimed at streamlining its portfolio and focusing on core assets. This demonstrates a commitment to strategic portfolio reshaping.

These corporate restructuring activities are crucial for Icahn Enterprises to realize gains, adapt to evolving market dynamics, and enhance overall business performance. Such maneuvers demand sharp market intelligence and robust negotiation capabilities.

Capital Allocation and Financial Engineering

Icahn Enterprises actively manages and deploys its substantial financial capital across its varied portfolio companies. This involves strategic decisions regarding debt issuance, equity financing, share repurchases, and dividend strategies at both the corporate and subsidiary levels. For instance, in Q1 2024, Icahn Enterprises reported total debt of approximately $14.7 billion, highlighting the scale of their capital management activities.

The company's financial engineering efforts are geared towards optimizing the capital structure of its businesses. This means finding the right balance of debt and equity to minimize the cost of capital and enhance profitability. The goal is to maximize shareholder returns through efficient financial operations.

- Capital Deployment: Managing and allocating significant financial resources across a diverse range of operating companies.

- Financial Structure Optimization: Making strategic decisions on debt, equity, share buybacks, and dividends to improve capital structure.

- Shareholder Value Maximization: Employing financial engineering techniques to boost returns for investors.

- 2024 Capital Management Focus: Continued emphasis on efficient capital allocation and debt management in a dynamic economic environment.

Securities Market Trading and Arbitrage

Icahn Enterprises actively participates in securities market trading and arbitrage, seeking to capitalize on short-term price discrepancies and market inefficiencies. This strategy complements their longer-term investment approach, aiming to generate alpha through tactical trading. For instance, in 2024, Icahn Enterprises continued to be a significant player, with its investment segment demonstrating robust activity across various asset classes.

These arbitrage opportunities often arise from events like mergers, acquisitions, or spin-offs, where temporary mispricings can occur. The firm's expertise lies in identifying and exploiting these situations for profit.

- Active Trading: Icahn Enterprises engages in frequent buying and selling of securities to profit from short-term market movements.

- Arbitrage Strategies: The company identifies and exploits price differences between related financial instruments or markets.

- Market Inefficiencies: Leveraging opportunities created by temporary imbalances or mispricing in the securities markets.

- Contribution to Returns: These activities are designed to enhance the overall profitability of the investment segment.

Icahn Enterprises' key activities revolve around identifying undervalued companies, acquiring significant stakes, and actively managing these investments to drive operational improvements and unlock shareholder value. This hands-on approach is central to their strategy, aiming to transform underperforming assets into profitable ventures.

The company also actively manages its capital structure, deploying financial resources strategically through debt and equity financing, and engaging in mergers, acquisitions, and divestitures to optimize its portfolio. This dynamic approach allows them to adapt to market shifts and maximize returns.

Furthermore, Icahn Enterprises participates in securities trading and arbitrage, capitalizing on market inefficiencies to generate additional profits. These tactical maneuvers complement their longer-term investment strategies, contributing to overall portfolio performance.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Icahn Enterprises that you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the comprehensive analysis of Icahn Enterprises' strategic framework. You'll gain full access to this same detailed document, ready for your review and application.

Resources

Icahn Enterprises' financial capital and liquidity are foundational, encompassing significant cash reserves, readily marketable securities, and robust access to substantial credit lines. This financial muscle is critical for fueling new investment opportunities, providing ongoing support to its diverse portfolio of subsidiaries, and enabling the execution of complex financial strategies.

As of the first quarter of 2024, Icahn Enterprises reported total cash and cash equivalents of approximately $1.8 billion. This substantial liquidity, coupled with its proven ability to secure additional financing, allows the company to act decisively in pursuing acquisitions and strategic initiatives, a key differentiator in its opportunistic investment approach.

Icahn Enterprises' intellectual capital, represented by its experienced management and investment teams, is a cornerstone of its business model. This seasoned group brings a wealth of industry knowledge, financial expertise, and a history of successful corporate turnarounds and value creation. Their collective acumen is instrumental in navigating complex markets and driving strategic initiatives.

The deep understanding of various sectors and financial instruments held by these professionals allows Icahn Enterprises to identify undervalued assets and implement effective operational improvements. For instance, the company's ability to execute complex restructurings and capital allocation strategies often hinges on the proven track record of its leadership in generating significant returns.

Icahn Enterprises' diverse portfolio of wholly-owned and majority-owned operating businesses is a cornerstone of its strategy. This collection spans critical sectors like energy, automotive, food packaging, real estate, and home fashion, creating a robust and resilient structure.

In 2024, this diversification was evident, with segments like the Energy segment contributing significantly, even amidst market fluctuations. The Automotive segment also demonstrated resilience, showcasing the strength derived from these varied operational capabilities and market presences.

Each subsidiary is not just an asset but a revenue-generating entity with its own operational strengths. This collective power allows Icahn Enterprises to navigate different economic cycles more effectively, as losses or slowdowns in one area can be offset by performance in others.

Brand Reputation and Market Influence

The formidable brand reputation and market influence of Carl Icahn and Icahn Enterprises are critical intangible assets. This standing as a prominent activist investor and proven value creator significantly impacts stock valuations, attracts lucrative investment prospects, and exerts considerable influence over corporate decision-making bodies. This credibility is instrumental in securing favorable terms during negotiations.

Icahn Enterprises' market influence is not merely anecdotal; it translates into tangible financial advantages. For instance, in 2024, Icahn's activism has been a recurring theme in market discussions, with his investments often leading to significant share price movements. His public pronouncements and strategic maneuvers are closely watched, underscoring the power of his brand in shaping market sentiment and driving corporate change.

- Brand Equity: Icahn's personal brand is synonymous with aggressive, successful investing, creating a powerful draw for capital and a deterrent for underperforming management teams.

- Market Leverage: The firm's influence allows it to negotiate favorable terms in activist campaigns, often securing board seats or influencing strategic decisions with significant impact.

- Investment Attraction: The Icahn name attracts significant investor interest, potentially lowering the cost of capital for Icahn Enterprises and its portfolio companies.

- Regulatory Scrutiny: While a strength, the high profile also means Icahn Enterprises often faces intense scrutiny from regulators and the media, requiring robust compliance and communication strategies.

Proprietary Investment Strategies and Analytical Frameworks

Icahn Enterprises' proprietary investment strategies and analytical frameworks are central to its success. These unique methodologies, honed over years of active management, enable the firm to consistently identify undervalued assets and capitalize on opportunities for strategic intervention. For instance, in 2024, Icahn Enterprises continued to refine its approach to identifying companies with strong underlying assets but facing operational inefficiencies, a core tenet of its strategy.

The firm's rigorous due diligence processes, deeply embedded within its analytical frameworks, allow for precise risk assessment and informed decision-making. This intellectual property is not static; it evolves to adapt to changing market dynamics. A key aspect of this is their ability to forecast future cash flows and assess management effectiveness, crucial for their activist approach.

These proprietary tools are the engine driving Icahn Enterprises' ability to generate alpha. They facilitate a deep understanding of target companies, enabling them to implement value-enhancing changes. For example, their strategic interventions in 2024 aimed at unlocking shareholder value through operational improvements and capital allocation adjustments.

The effectiveness of these strategies is reflected in their performance. While specific proprietary data is confidential, the company’s history of successful activist campaigns underscores the power of their analytical capabilities and strategic execution. Their ability to influence corporate governance and drive operational improvements remains a competitive advantage.

Icahn Enterprises' Key Resources are its robust financial capital, including substantial cash reserves and credit access, enabling decisive investment actions, and its experienced management team, whose deep industry knowledge drives successful corporate turnarounds. The company's diverse operating businesses across various sectors provide resilience, while its formidable brand reputation and market influence, particularly Carl Icahn's, attract capital and leverage negotiations.

Value Propositions

Icahn Enterprises focuses on boosting shareholder worth by actively managing and strategically guiding its diverse portfolio of companies. This hands-on approach is designed to unlock hidden potential and improve how these businesses operate.

The company's strategy involves deep operational involvement to drive capital appreciation, aiming to transform underperforming assets into significant value drivers for investors.

For instance, Icahn Enterprises' commitment to active management was evident in its 2023 performance, where its net asset value per unit saw a notable increase, reflecting the success of its strategic interventions across its holdings.

Icahn Enterprises offers investors a broad spectrum of exposure, spanning critical sectors like energy, automotive, and real estate. This strategic diversification across industries such as investment, food packaging, and home fashion helps to smooth out the inherent volatility of single-sector investments. For instance, as of the first quarter of 2024, Icahn Enterprises reported total revenue of $2.8 billion, with its diverse segments contributing to this figure, demonstrating its reach across various economic landscapes.

Icahn Enterprises excels at revitalizing struggling companies, a core part of its business model. For instance, in 2023, Icahn Enterprises reported a net income of $1.5 billion, demonstrating its ability to generate value even from complex situations. This strategic turnaround expertise transforms distressed assets into profitable ventures.

Access to Significant Capital and Strategic Guidance for Portfolio Companies

Icahn Enterprises offers its portfolio companies significant capital injections, enabling them to pursue ambitious growth strategies and operational improvements. This financial backing is a critical component of their value proposition, allowing for expansion and market penetration that might otherwise be unattainable.

Beyond just funding, Icahn Enterprises provides hands-on strategic guidance and operational expertise. This mentorship helps companies navigate complex challenges, optimize their business models, and drive innovation, acting as a vital catalyst for their success.

In 2024, Icahn Enterprises continued to leverage its capital and expertise across its diverse portfolio. For instance, its investments in the automotive sector, such as Icahn Automotive Group, aimed to streamline operations and enhance customer service, reflecting the strategic support provided to its holdings.

The value proposition is further underscored by the ability of portfolio companies to tap into Icahn Enterprises' extensive network and management experience. This synergy allows businesses to accelerate their development and achieve milestones more efficiently.

- Substantial Capital Access: Provides significant financial resources for growth and operational enhancement.

- Strategic and Operational Guidance: Offers expert advice and hands-on support to optimize business functions.

- Catalyst for Development: Accelerates company growth and innovation through combined resources and expertise.

- Network and Management Leverage: Utilizes Icahn Enterprises' broad network and experienced management for portfolio company benefit.

Activist Investor Approach Driving Corporate Governance Changes

Icahn Enterprises' activist investor approach is a core value proposition, directly influencing corporate governance. This strategy often results in enhanced transparency and the implementation of more shareholder-centric policies within the companies they target.

This proactive engagement can unlock substantial long-term value for all involved parties by ensuring management's incentives are closely aligned with those of the shareholders. It's about driving accountability and elevating performance from the executive suite downward.

- Improved Corporate Governance: Icahn's involvement frequently leads to board overhauls and operational efficiencies.

- Increased Shareholder Value: Historically, Icahn's campaigns have often resulted in stock price appreciation for targeted firms. For instance, during 2024, many activist campaigns saw initial positive market reactions.

- Enhanced Transparency: Activist pressure typically demands greater disclosure and clearer communication from management.

- Alignment of Incentives: The approach focuses on making sure executive compensation is tied to tangible performance metrics that benefit shareholders.

Icahn Enterprises' value proposition centers on its ability to significantly boost shareholder worth through active management and strategic oversight of its varied portfolio. This hands-on approach is geared towards unlocking untapped potential and improving the operational efficiency of its constituent companies.

The company's strategy involves deep operational involvement to drive capital appreciation, aiming to transform underperforming assets into significant value drivers for investors. For instance, Icahn Enterprises' commitment to active management was evident in its 2023 performance, where its net asset value per unit saw a notable increase, reflecting the success of its strategic interventions across its holdings.

Icahn Enterprises offers investors broad exposure across critical sectors like energy, automotive, and real estate, diversifying risk and smoothing volatility. As of the first quarter of 2024, Icahn Enterprises reported total revenue of $2.8 billion, with its diverse segments contributing to this figure, demonstrating its reach across various economic landscapes.

The company excels at revitalizing struggling businesses, a core aspect of its model, as demonstrated by its 2023 net income of $1.5 billion, showcasing its capability to generate value even from complex situations.

Customer Relationships

Icahn Enterprises actively manages its investor relations by consistently communicating with unitholders, financial analysts, and institutional investors. This engagement includes providing detailed quarterly and annual financial reports, hosting earnings calls, and delivering investor presentations to foster transparency and facilitate informed decisions.

The company's commitment to clear and regular communication aims to cultivate and sustain trust within the investment community. For instance, in their 2024 investor communications, Icahn Enterprises highlighted a significant increase in distributable cash flow, underscoring their operational performance and commitment to unitholder value.

Icahn Enterprises maintains a deeply hands-on approach with its subsidiary management. This isn't just passive ownership; it's an active partnership where strategic direction and operational improvements are collaboratively developed. For instance, in 2024, Icahn Enterprises continued its active role in guiding companies like Icahn Automotive, focusing on operational efficiencies and market positioning.

The firm's engagement goes beyond mere oversight. They provide tangible strategic guidance and operational expertise, aiming to unlock value and boost performance within each business. This active involvement is a core tenet of their investment strategy, ensuring that the underlying businesses are optimized for success and shareholder value.

Icahn Enterprises' relationships with potential acquisition targets, divestiture partners, and other transactional entities are primarily formal and short-term, centered on the successful execution of specific deals. These interactions are driven by negotiation, with the goal of securing advantageous terms for mergers, acquisitions, or asset sales, crucial for ongoing portfolio restructuring.

Professional Relationships with Financial Institutions

Icahn Enterprises actively nurtures professional relationships with a diverse array of financial institutions, including banks and lenders. These partnerships are fundamental to securing necessary financing, establishing credit facilities, and gaining valuable market intelligence. For instance, as of the first quarter of 2024, Icahn Enterprises reported total debt of approximately $15.4 billion, underscoring the critical role of these ongoing relationships in managing its financial obligations and ensuring access to capital.

These relationships are not merely transactional; they are built on a foundation of trust and mutual benefit, cultivated over extended periods. This allows Icahn Enterprises to maintain robust liquidity, effectively manage its debt portfolio, and efficiently access capital markets when strategic opportunities arise. The company's ability to secure and manage its financing is directly tied to the strength and reliability of these institutional connections.

- Financing Activities: Securing loans and credit lines for operational needs and strategic investments.

- Credit Facilities: Establishing and maintaining access to various forms of credit to ensure financial flexibility.

- Market Intelligence: Leveraging insights from financial partners to inform strategic decision-making and market positioning.

- Liquidity and Debt Management: Ensuring sufficient cash flow and effectively managing outstanding debt obligations.

Public Relations and Media Engagement

Icahn Enterprises actively cultivates its public image and narrative by engaging strategically with financial media. This approach is vital for shaping market perception, clearly communicating its strategic objectives, and proactively addressing any public inquiries or scrutiny.

Effective public relations are fundamental to maintaining Icahn Enterprises' reputation and influence within the financial landscape. For instance, in 2024, the company’s proactive communication regarding its diversified holdings, including energy and automotive sectors, helped to stabilize investor sentiment amidst broader market volatility.

- Shaping Market Perception: Icahn Enterprises leverages media engagement to present a consistent and favorable view of its business strategies and performance.

- Communicating Strategic Objectives: Through press releases and interviews, the company articulates its investment theses and long-term goals to stakeholders.

- Addressing Scrutiny: Proactive and transparent communication helps manage and mitigate negative narratives or concerns that may arise.

- Maintaining Reputation and Influence: Consistent positive media coverage and effective crisis communication bolster the company's standing and ability to execute its plans.

Icahn Enterprises maintains a direct and engaged relationship with its unitholders, prioritizing transparency through regular financial reporting and investor calls. This active dialogue aims to build trust and provide clarity on the company's performance and strategic direction.

The company's approach to its subsidiaries is hands-on, involving active participation in strategic planning and operational enhancements to drive value. This deep involvement ensures that each business unit is optimized for success.

Icahn Enterprises also cultivates relationships with financial institutions to secure financing and gain market insights, critical for managing its substantial debt, which stood at approximately $15.4 billion in Q1 2024.

Furthermore, the company actively manages its public image through financial media engagement, shaping market perception and communicating its strategic objectives effectively, as seen in its 2024 communications regarding diversified holdings.

| Relationship Type | Key Engagement Methods | 2024 Focus/Data Point |

|---|---|---|

| Unitholders & Financial Community | Quarterly/Annual Reports, Earnings Calls, Presentations | Increased distributable cash flow highlighted |

| Subsidiary Management | Active Strategic Guidance, Operational Improvement | Focus on operational efficiencies in Icahn Automotive |

| Financial Institutions | Securing Financing, Credit Facilities, Market Intelligence | Total Debt ~$15.4 billion (Q1 2024) |

| Financial Media | Press Releases, Interviews, Proactive Communication | Stabilizing investor sentiment on diversified holdings |

Channels

Icahn Enterprises' primary channel for investor engagement is its public stock exchange listings, notably on NASDAQ. This offers crucial liquidity, making it accessible for both individual and institutional investors to buy and sell shares. It's the most direct route for the public to participate in the company's ownership and performance.

Annual reports, like the 10-K, and quarterly filings (10-Q) submitted to the SEC are the bedrock of official financial disclosure for Icahn Enterprises. These documents are vital for providing the public and regulators with a clear picture of the company's financial health and strategic direction. For the fiscal year ended December 31, 2023, Icahn Enterprises reported total revenue of approximately $22.5 billion, showcasing the scale of operations detailed within these filings.

Icahn Enterprises' investor relations website acts as a crucial digital gateway, offering a comprehensive repository of company news, financial reports, and strategic updates. This platform ensures transparency and accessibility for all stakeholders seeking direct insights into the company's performance and direction.

In 2024, the company continued to leverage this channel to disseminate information, including quarterly earnings reports and presentations that detail their diverse portfolio's performance. For instance, their Q1 2024 earnings call highlighted significant operational adjustments across their energy and automotive segments.

Direct Engagement with Portfolio Company Boards and Management

Icahn Enterprises leverages direct engagement with portfolio company boards and management as a core strategic channel. This hands-on approach allows for direct input into strategic decisions, operational oversight, and governance matters, acting as a critical internal channel for value creation.

This direct involvement is fundamental to Icahn Enterprises' activist investor strategy. By securing board seats and actively participating in discussions, the firm can directly influence company direction, advocate for shareholder-friendly policies, and drive operational improvements. For instance, in 2024, Icahn Enterprises continued its active role in companies like Xerox, where its representatives have been instrumental in pushing for strategic realignments and cost-saving measures.

- Board Representation: Icahn Enterprises actively seeks and obtains board seats in its portfolio companies to directly influence strategic direction and governance.

- Management Engagement: Direct communication and collaboration with company management teams are crucial for implementing operational changes and value enhancement initiatives.

- Strategic Influence: This channel is paramount for Icahn Enterprises to exert its influence, ensuring that portfolio companies pursue strategies aligned with maximizing shareholder value.

- Value Creation: The direct oversight and input provided through these channels are considered a primary driver of value creation within the Icahn Enterprises portfolio.

Financial News Outlets and Media Coverage

Major financial news outlets and business publications are critical channels for Icahn Enterprises. These platforms, including The Wall Street Journal and Bloomberg, disseminate information about Icahn's investment strategies and market opinions, significantly influencing public perception and investor sentiment. This media presence amplifies the company's reach and impact within the financial ecosystem.

The media coverage, while not directly controlled, plays a vital role in shaping how Icahn Enterprises is viewed by potential investors, partners, and the broader market. It serves as a conduit for communicating the company's performance and strategic direction. For instance, in 2024, Icahn Enterprises' significant stake in a major retail company generated substantial coverage across financial news networks, highlighting its activist approach.

- Media Amplification: Financial news outlets magnify Icahn Enterprises' activities and market commentary.

- Perception Shaping: Coverage influences how potential investors and partners perceive the company.

- Investor Information: Specialized investment media provide insights crucial for informed decision-making.

- Market Presence: Consistent media attention bolsters Icahn Enterprises' standing in the financial world.

Icahn Enterprises utilizes its stock exchange listing on NASDAQ as a primary channel for investor interaction, ensuring broad accessibility for both individual and institutional investors to trade its shares. This public market presence is fundamental to its capital structure and liquidity, allowing for efficient price discovery and ownership transfer.

Key financial disclosures, such as the 10-K and 10-Q filings with the SEC, serve as authoritative channels for communicating Icahn Enterprises' financial performance and strategic maneuvers. These documents provide a transparent view of its operations and financial standing. For the fiscal year ending December 31, 2023, Icahn Enterprises reported revenues of approximately $22.5 billion, a figure detailed within these official reports.

The investor relations website functions as a vital digital hub, aggregating company news, financial reports, and strategic updates for stakeholders. In 2024, this channel was actively used to disseminate quarterly earnings reports and presentations, offering insights into the performance of its diverse portfolio, such as the operational adjustments noted in their Q1 2024 earnings call.

Direct engagement with portfolio company boards and management represents a critical internal channel for Icahn Enterprises. This hands-on approach facilitates direct strategic input, operational oversight, and governance, directly contributing to value creation. For instance, in 2024, Icahn Enterprises maintained its active influence in companies like Xerox, advocating for strategic realignments and cost efficiencies.

Major financial news outlets and business publications, including The Wall Street Journal and Bloomberg, act as significant channels for disseminating information about Icahn Enterprises' investment strategies and market perspectives. This media presence shapes public perception and investor sentiment, amplifying the company's market impact. In 2024, substantial media coverage followed Icahn Enterprises' significant stake in a major retail company, underscoring its activist approach.

| Channel | Description | 2024 Activity Example | Impact |

|---|---|---|---|

| NASDAQ Listing | Public trading of Icahn Enterprises stock | Facilitated share transactions throughout the year | Liquidity, accessibility for investors |

| SEC Filings (10-K, 10-Q) | Official financial and operational disclosures | Detailed Q1 2024 performance reports | Transparency, regulatory compliance |

| Investor Relations Website | Digital repository for company information | Published quarterly earnings presentations | Stakeholder access to strategic updates |

| Board Representation | Direct influence on portfolio company strategy | Active role in Xerox's strategic decisions | Value creation, shareholder alignment |

| Financial Media | Dissemination of news and market commentary | Coverage of retail sector investment | Market perception, investor sentiment |

Customer Segments

Public shareholders and institutional investors, including individual retail investors, mutual funds, hedge funds, and pension funds, acquire Icahn Enterprises L.P. units on public exchanges. These investors are driven by the pursuit of capital appreciation, dividend income, and portfolio diversification through Icahn Enterprises' distinct asset mix. In 2024, Icahn Enterprises continued to focus on its strategy of acquiring and improving undervalued companies, aiming for long-term value creation under its activist management approach.

Management teams of acquired or invested companies are key stakeholders who benefit from Icahn Enterprises' strategic guidance and capital. For instance, following Icahn's investment in Hertz in 2020, the management team was tasked with navigating the company through bankruptcy and a significant turnaround. Their objective is to leverage Icahn's expertise to enhance operational efficiency and profitability.

Companies seeking strategic investment or M&A represent a crucial customer segment for Icahn Enterprises. These are typically businesses, perhaps undervalued or navigating operational hurdles, that view Icahn Enterprises as a potential acquirer or a strategic investor capable of injecting capital and expertise. In 2024, the M&A market saw significant activity, with deal volumes fluctuating based on economic conditions and interest rates, indicating a dynamic environment for such companies looking for a powerful partner to revitalize their operations and unlock hidden value.

Financial Analysts and Research Firms

Financial analysts and research firms are key customers for Icahn Enterprises' disclosed information. They rely on the company's financial reports and strategic updates to form their analyses and issue recommendations to their own client bases. For instance, in 2024, firms like Moody's and S&P Global Ratings would be closely examining Icahn Enterprises' debt levels and cash flow generation to assess its creditworthiness.

These entities act as crucial intermediaries, translating Icahn Enterprises' performance into insights that shape broader market sentiment. Their evaluations directly impact how other investors perceive the company's value and future prospects, making the accuracy and timeliness of Icahn Enterprises' disclosures paramount for this segment.

- Information Needs: Timely and accurate financial statements, earnings reports, and strategic announcements.

- Key Activities: Analyzing financial performance, assessing credit risk, and publishing market reports.

- Value Proposition: Providing objective analysis and market insights that inform investment decisions for their clients.

- Impact: Influencing market perception and investor sentiment towards Icahn Enterprises.

Potential Divestiture Partners and Buyers

Potential divestiture partners and buyers represent a crucial customer segment for Icahn Enterprises when it strategically chooses to sell off assets or subsidiaries. These entities are actively seeking opportunities to acquire businesses that align with their own growth objectives, market penetration strategies, or potential for operational synergies. In 2024, the market for such divestitures remained dynamic, influenced by macroeconomic conditions and specific industry trends.

These buyers are typically other corporations, private equity firms, or even management teams looking to gain control of a valuable business. Their interest is purely transactional, driven by the perceived value and future potential of the divested entity. For instance, a company looking to expand its geographic reach or product portfolio might be a prime candidate to acquire a subsidiary being divested.

- Strategic Acquirers: Companies seeking to bolster their market share, acquire new technologies, or enter new markets.

- Private Equity Firms: Investment funds looking for undervalued assets with potential for operational improvement and future resale.

- Financial Buyers: Entities focused on acquiring businesses that can generate strong cash flows or offer attractive returns on investment.

- Management Buyout (MBO) Candidates: Existing management teams who may seek to acquire the business they operate, often with the backing of external financing.

Icahn Enterprises L.P. serves a diverse base of investors, from individual retail shareholders to large institutional entities like hedge funds and pension funds. These investors are primarily motivated by Icahn Enterprises' strategy of acquiring and improving undervalued companies, aiming for capital appreciation and dividend income. In 2024, the company's performance in sectors like energy and auto parts directly influenced investor interest and unit performance.

| Customer Segment | Key Motivations | 2024 Relevance |

| Public & Institutional Investors | Capital appreciation, dividend income, portfolio diversification | Continued focus on activist strategy; performance in key holdings like Icahn Automotive Group impacted sentiment. |

| Management Teams of Acquired/Invested Companies | Leveraging Icahn's expertise for operational improvement and profitability | Essential partners in executing turnaround strategies for portfolio companies. |

| Companies Seeking Strategic Investment/M&A | Access to capital, expertise for revitalization, unlocking hidden value | M&A market activity in 2024 provided opportunities for Icahn Enterprises to act as a strategic partner or acquirer. |

| Financial Analysts & Research Firms | Objective analysis, market insights, creditworthiness assessment | Crucial for disseminating information and influencing market perception; close monitoring of debt levels and cash flow in 2024. |

| Potential Divestiture Partners/Buyers | Acquiring businesses for growth, market penetration, or synergies | Dynamic divestiture market in 2024 offered opportunities for Icahn Enterprises to exit or restructure holdings. |

Cost Structure

Investment management and advisory fees represent a substantial cost for Icahn Enterprises, directly reflecting the compensation of its skilled investment team. This includes salaries and performance-based incentives crucial for identifying, analyzing, and actively managing a complex and diverse portfolio of assets.

In 2024, compensation and benefits for Icahn Enterprises' employees, a significant portion of which is tied to investment management, totaled $166 million. This figure underscores the direct cost associated with the expertise and active oversight necessary to generate returns from their strategic investments.

The operational costs for Icahn Enterprises' diverse subsidiaries, spanning energy, automotive, and food packaging, represent a significant portion of its overall cost structure. These day-to-day expenses encompass manufacturing, raw material procurement, labor, marketing initiatives, and distribution logistics, all crucial for maintaining the smooth functioning of its underlying businesses.

Acquisition and divestiture transaction costs are a key component of Icahn Enterprises' cost structure, directly impacting their portfolio restructuring efforts. These expenses encompass legal fees, advisory services, rigorous due diligence, and the often substantial costs of integrating or separating businesses.

These costs are inherently variable, fluctuating with the frequency and complexity of Icahn Enterprises' M&A and divestiture activities. For instance, in 2024, the company continued its strategic approach to portfolio management, which necessitates significant investment in these transactional processes.

Interest Expense on Debt

Interest expense on debt is a significant cost for Icahn Enterprises, reflecting its strategy of using leverage to fund its diverse portfolio of investments and operations. This ongoing expenditure is tied to various forms of borrowing, including corporate bonds and credit facilities.

In 2023, Icahn Enterprises reported interest expense of approximately $906 million. This figure underscores the substantial financial commitment associated with servicing its debt obligations, which is a key component of its cost structure.

- Interest Expense: A material ongoing cost for Icahn Enterprises due to its leveraged investment strategy.

- Sources of Debt: Includes interest on corporate bonds, credit facilities, and other borrowings.

- 2023 Impact: Interest expense totaled approximately $906 million in 2023, highlighting its significance.

- Financial Health: Effective management of this expense is crucial for maintaining profitability and financial stability.

Legal, Regulatory, and Compliance Costs

Operating across a wide array of regulated sectors means Icahn Enterprises faces significant expenses for legal expertise, compliance officers, and the necessary filings to stay on the right side of the law. These outlays are crucial for meeting industry-specific rules, upholding corporate governance, and reducing legal liabilities.

For a conglomerate like Icahn Enterprises, maintaining compliance is not an option; it's a fundamental requirement for its operations. These costs are embedded in the day-to-day running of its diverse portfolio companies.

- Legal Counsel Fees: Retaining specialized legal teams to navigate complex regulations across various industries.

- Compliance Staffing: Employing dedicated professionals to monitor and ensure adherence to all relevant laws and standards.

- Regulatory Filing Costs: Expenses associated with submitting required documentation and reports to governmental and industry bodies.

- Risk Mitigation: Investments in legal and compliance frameworks to prevent costly lawsuits and penalties.

Icahn Enterprises' cost structure is heavily influenced by its investment activities and the operational demands of its diverse holdings. Key expenses include compensation for its investment teams, totaling $166 million in 2024, and the substantial operational costs across its subsidiaries in sectors like energy and automotive. Furthermore, the company incurs significant expenditures related to acquisitions and divestitures, as well as considerable interest expenses on its debt, which amounted to approximately $906 million in 2023.

| Cost Category | Description | 2023 Data | 2024 Data |

|---|---|---|---|

| Compensation & Benefits | Investment team salaries and incentives | N/A | $166 million |

| Operational Costs | Day-to-day expenses of subsidiaries | N/A | N/A |

| Acquisition/Divestiture Costs | Transaction fees, legal, due diligence | N/A | N/A |

| Interest Expense | Cost of servicing debt | $906 million | N/A |

Revenue Streams

Icahn Enterprises' investment activities generate significant revenue through capital gains realized from selling securities, dividends collected from its diverse portfolio companies, and interest earned on its debt investments. This multi-faceted approach underscores its strategy of actively managing its holdings to capitalize on market opportunities.

For instance, in the first quarter of 2024, Icahn Enterprises reported a substantial increase in its investment income, driven by favorable market conditions and the successful divestiture of certain assets. This highlights the direct correlation between their active trading and the company's financial performance.

Icahn Enterprises generates substantial operating income from its diverse portfolio of subsidiary businesses. These operations span critical sectors like energy, automotive, and food packaging, contributing significantly to overall revenue through the sale of products and services. This diversification provides a robust foundation of recurring income derived from fundamental economic activities.

Icahn Enterprises, through its active management approach, may charge its subsidiaries internal management and advisory fees. These fees, though consolidated, represent the strategic oversight and specialized services the parent company provides to its diverse holdings, underscoring the value generated by centralized expertise.

For instance, in 2024, Icahn Enterprises continued to demonstrate its hands-on management style across its portfolio companies. While specific internal fee structures aren't publicly detailed, the company's operational model implies that such charges are a mechanism to reflect the cost and benefit of the parent's strategic direction and operational support to its various business segments.

Real Estate Rental Income and Property Sales

Icahn Enterprises leverages its substantial real estate holdings for two primary revenue streams: rental income and property sales. The company benefits from consistent cash flow generated by leasing its various properties, which include industrial, retail, and residential spaces. This rental income provides a stable base for its operations.

Furthermore, Icahn Enterprises realizes significant capital gains through the strategic sale of developed or redeveloped real estate assets. This approach allows the company to capitalize on market appreciation and monetize its investments in properties that have reached their optimal value. The diversification of income from both rentals and sales enhances the overall financial resilience of the real estate segment.

- Rental Income: Generates consistent cash flow from leased properties across various sectors.

- Property Sales: Realizes capital gains from the disposition of developed or redeveloped real estate assets.

- Diversification: These two streams contribute to a more robust and varied income portfolio for Icahn Enterprises.

Profits from Strategic Divestitures

Icahn Enterprises generates revenue through the strategic divestiture of assets or entire businesses within its diverse portfolio. These sales are typically executed after Icahn has implemented operational improvements and enhanced value, leading to significant profit realization.

This revenue stream is opportunistic, directly linked to the company's ongoing strategy of portfolio optimization. For instance, in 2023, Icahn Enterprises completed the sale of its stake in CVR Energy, realizing substantial gains that contributed to its overall financial performance.

- Strategic Divestitures: Revenue from selling off parts of its business portfolio.

- Value Creation: Profits realized after improving and enhancing the value of divested assets.

- Opportunistic Approach: Sales are timed to maximize returns based on market conditions and portfolio strategy.

Icahn Enterprises' revenue streams are diverse, encompassing investment income, operating income from subsidiaries, management fees, and real estate activities. The company actively manages its portfolio, seeking capital gains from security sales and dividends, while its operating businesses in sectors like energy and automotive provide consistent income. Real estate holdings contribute through rental income and property sales, further diversifying its financial base.

| Revenue Stream | Description | 2024 Data/Context |

| Investment Income | Capital gains, dividends, and interest from securities and debt. | Q1 2024 saw increased investment income due to market conditions and asset sales. |

| Operating Income (Subsidiaries) | Profits from businesses in energy, automotive, food packaging, etc. | These sectors provide recurring income through product and service sales. |

| Management & Advisory Fees | Fees charged to subsidiaries for strategic oversight and services. | Reflects centralized expertise and operational support provided by the parent company. |

| Real Estate Income | Rental income from leased properties and capital gains from property sales. | Consistent cash flow from rentals and profits from strategic property dispositions. |

| Strategic Divestitures | Revenue from selling off portfolio companies or assets. | Opportunistic sales timed to maximize returns after value enhancement. |

Business Model Canvas Data Sources

The Icahn Enterprises Business Model Canvas is informed by a combination of public financial disclosures, industry-specific market research, and internal strategic assessments. These diverse data sources ensure a comprehensive and accurate representation of the company's operational and strategic framework.