Icahn Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Navigate the complex external forces shaping Icahn Enterprises with our detailed PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for this diversified conglomerate.

Gain a competitive edge by leveraging our expert insights into the social, environmental, and legal landscapes impacting Icahn Enterprises. This analysis is crucial for investors and strategists looking to make informed decisions.

Don't miss out on critical market intelligence. Download the full PESTLE analysis of Icahn Enterprises now to unlock actionable strategies and secure your future success.

Political factors

Icahn Enterprises, with its broad portfolio and history of activist investing, is under constant watch by government regulators in multiple industries. For example, in 2023, the Federal Trade Commission (FTC) continued its focus on antitrust concerns, which could affect Icahn's acquisition strategies and operational control over its holdings.

Potential shifts in antitrust legislation or more vigorous enforcement by bodies like the Securities and Exchange Commission (SEC) could directly impact Icahn Enterprises' capacity to engage in mergers, sales of assets, or even its influence on the management of the companies it invests in. This means staying ahead of regulatory changes is crucial for their business model.

Global trade policies and tariffs significantly influence Icahn Enterprises' diverse operations. For instance, changes in tariffs on automotive parts or food packaging materials can directly impact the cost of goods sold for subsidiaries like Icahn Automotive Group and the food packaging businesses. In 2024, ongoing trade tensions between major economies continue to create uncertainty, potentially affecting import/export costs and market access for these sectors.

The strategic decisions of Icahn Enterprises are often shaped by these trade dynamics. For example, a sudden tariff increase on steel could raise production costs for manufacturing clients, influencing pricing strategies and potentially shifting sourcing decisions. Conversely, trade agreements that reduce barriers can open new markets or lower input costs, presenting growth opportunities that the company actively monitors.

Icahn Enterprises' significant exposure to the energy sector means its performance is directly tied to government policies. For instance, the Biden administration's Inflation Reduction Act of 2022, enacted in August 2022, provides substantial tax credits for renewable energy projects, potentially benefiting Icahn's investments in that area. Conversely, any future policies that might restrict fossil fuel production or impose stricter environmental regulations could present challenges for its traditional energy holdings.

Taxation and Fiscal Policies

Changes in corporate tax rates, such as the U.S. federal corporate tax rate which stands at 21%, directly influence Icahn Enterprises' net income and the attractiveness of its investments. For instance, a hike in capital gains taxes could reduce the profitability of its asset sales.

Government fiscal policies, including infrastructure spending or shifts towards austerity, can create a ripple effect across Icahn Enterprises' varied portfolio companies. Increased government spending on energy, for example, could benefit its holdings in that sector, while austerity might dampen demand for its manufacturing or retail assets.

- Corporate Tax Rate: The U.S. federal corporate tax rate remains at 21% as of early 2024, a key factor in Icahn Enterprises' profitability calculations.

- Capital Gains Tax Impact: Fluctuations in capital gains tax rates can significantly alter the net proceeds from Icahn Enterprises' divestitures and investment gains.

- Government Spending Influence: Federal and state government spending priorities, such as those directed towards renewable energy or defense, can directly impact the performance of specific Icahn Enterprises subsidiaries.

Political Stability and Geopolitical Risks

Icahn Enterprises' global footprint means political stability in key operating regions, such as the United States, is paramount. Any significant shifts in U.S. policy, like changes in tax laws or regulatory frameworks affecting its diverse holdings, could impact profitability. For instance, the Biden administration's focus on infrastructure spending and potential shifts in corporate tax rates in 2024-2025 are factors Icahn Enterprises would closely monitor.

Broader geopolitical tensions also pose a risk. For example, ongoing trade disputes or conflicts in regions where Icahn Enterprises has investments, like its significant holdings in energy or manufacturing sectors, could disrupt supply chains and affect commodity prices. The company's ability to navigate these complex international dynamics is crucial for mitigating asset devaluation and market access issues.

- U.S. Political Landscape: Continued focus on regulatory changes and potential shifts in economic policy under the current administration could impact Icahn Enterprises' various business segments.

- Geopolitical Tensions: Global conflicts and trade relations, particularly those affecting energy markets and international supply chains, present ongoing risks to asset values and operational continuity.

- Policy Reversals: The possibility of unexpected policy changes in countries where Icahn Enterprises operates or invests necessitates robust risk assessment and mitigation strategies.

Regulatory scrutiny remains a significant political factor for Icahn Enterprises, particularly concerning antitrust matters. For example, the Federal Trade Commission's ongoing focus in 2023 on market concentration could influence the company's acquisition strategies and operational control over its diverse holdings.

Government fiscal policies, including infrastructure spending and corporate tax rates, directly impact Icahn Enterprises' profitability and investment attractiveness. The U.S. federal corporate tax rate of 21% is a key figure, and any changes to capital gains taxes can affect the net proceeds from asset sales.

Global trade policies and geopolitical tensions are critical considerations, influencing supply chains and commodity prices for subsidiaries in sectors like automotive and energy. For instance, ongoing trade disputes in 2024 create uncertainty for import/export costs and market access.

Government spending priorities, such as investments in renewable energy, can benefit specific Icahn Enterprises subsidiaries, while broader policy shifts or austerity measures might dampen demand for other assets.

| Political Factor | Impact on Icahn Enterprises | Relevant Data/Example (2023-2025) |

| Regulatory Scrutiny (Antitrust) | Affects acquisition strategies and operational control. | FTC focus on market concentration in 2023. |

| Corporate Tax Rates | Influences net income and investment attractiveness. | U.S. federal corporate tax rate at 21% (as of early 2024). |

| Trade Policies & Geopolitics | Impacts supply chains, commodity prices, market access. | Ongoing trade disputes affecting energy and manufacturing sectors in 2024. |

| Government Spending | Benefits or challenges specific subsidiaries. | Inflation Reduction Act (Aug 2022) tax credits for renewables. |

What is included in the product

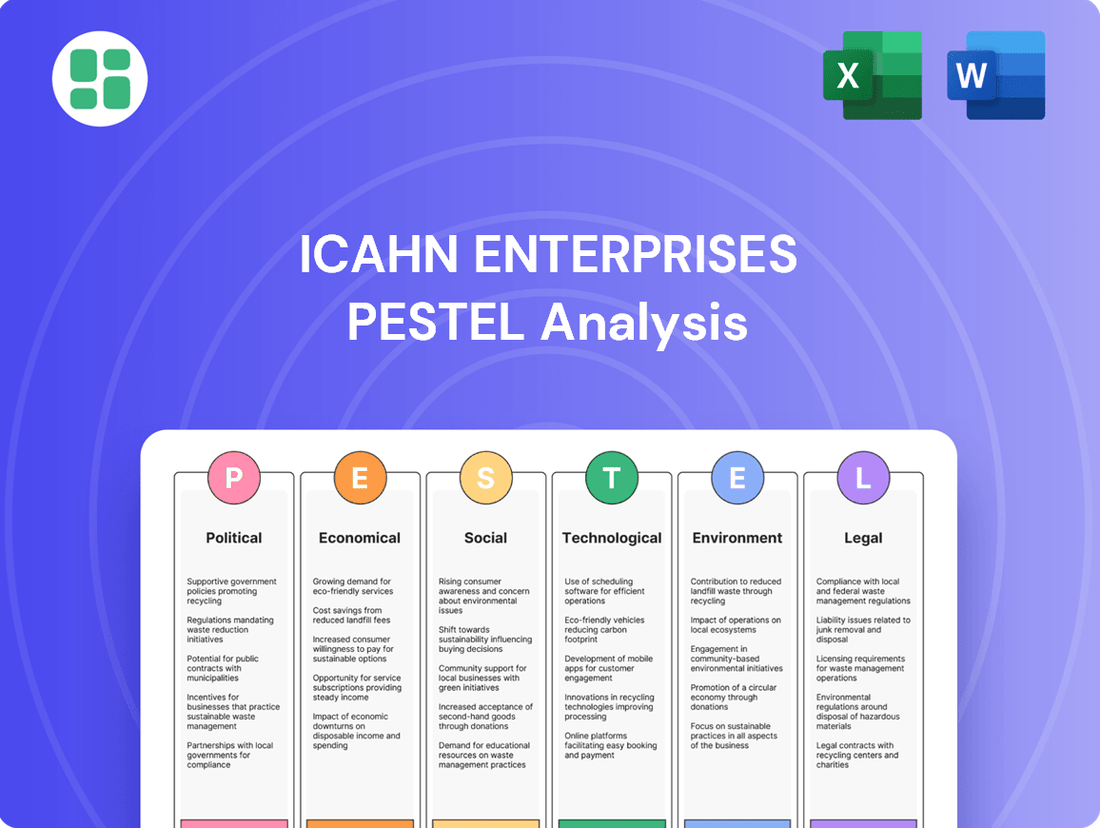

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the strategic landscape for Icahn Enterprises.

It offers actionable insights into emerging trends and potential challenges, empowering stakeholders to make informed strategic decisions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Icahn Enterprises.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal considerations for Icahn Enterprises.

Economic factors

Interest rate fluctuations significantly influence Icahn Enterprises' operational costs and investment strategies. For instance, if the Federal Reserve maintains its benchmark interest rate around the 5.25%-5.50% range observed in early 2024, it directly increases the cost of debt for Icahn's diverse subsidiaries, impacting profitability. This environment can also dampen consumer demand in sectors like automotive and retail, where Icahn has significant holdings, as borrowing becomes more expensive.

The global economic landscape for 2024 and early 2025 presents a mixed picture, with growth projections moderating. The International Monetary Fund (IMF) forecast global growth at 3.2% for 2024, a slight slowdown from 2023. This environment directly impacts Icahn Enterprises' diverse holdings, as robust economic activity typically fuels demand across its various sectors, from energy to automotive and real estate.

However, recession risks remain a significant concern. Factors like persistent inflation, elevated interest rates, and geopolitical tensions could trigger economic contractions in key markets. A downturn would likely translate to decreased consumer spending and lower asset valuations for Icahn Enterprises, potentially impacting profitability and investment returns across its portfolio. The company's performance is therefore intrinsically linked to navigating these cyclical economic shifts.

Inflationary pressures present a significant challenge for Icahn Enterprises. Rising costs for raw materials, labor, and transportation directly impact its manufacturing operations, including those in food packaging and automotive sectors. For instance, the Producer Price Index (PPI) for manufactured goods saw an increase of 0.5% in April 2024, signaling upward cost trends.

While Icahn Enterprises can attempt to pass these increased costs onto consumers, sustained inflation can compress profit margins. Furthermore, reduced consumer purchasing power due to inflation may dampen demand for its diverse range of products and services. The Consumer Price Index (CPI) rose 3.4% year-over-year in April 2024, indicating ongoing inflationary concerns affecting consumer spending.

Effectively managing its cost structures is paramount for Icahn Enterprises to navigate this inflationary landscape. This includes optimizing supply chains and exploring operational efficiencies to mitigate the impact on profitability and maintain competitive pricing.

Consumer Spending and Confidence

Consumer spending and confidence are vital for Icahn Enterprises, particularly influencing its automotive, food packaging, and home fashion divisions. When consumers feel secure about their financial future, they tend to spend more on non-essential goods and services, directly boosting Icahn's revenue streams. For instance, a robust job market and rising wages in late 2024 and early 2025 would likely translate to increased demand for vehicles and home furnishings.

Conversely, a dip in consumer confidence, often triggered by economic uncertainty or inflation fears, can curb discretionary spending. This would impact Icahn Enterprises by potentially slowing sales in its consumer-facing businesses. Economic indicators such as the Conference Board Consumer Confidence Index, which stood at 102.0 in April 2024, offer a snapshot of consumer sentiment and its potential impact on spending patterns.

- Consumer Confidence Impact: Higher consumer confidence generally leads to increased sales for Icahn Enterprises' automotive and home fashion segments.

- Economic Indicators: Key metrics like employment rates and wage growth in 2024-2025 are crucial for predicting consumer spending power.

- Discretionary Spending: A decline in confidence can reduce spending on non-essential items, affecting Icahn's revenue.

- Market Conditions: Consumer sentiment directly influences market conditions for the company's diverse product offerings.

Commodity Price Volatility

Commodity price volatility, particularly in energy and industrial raw materials, presents a significant challenge for Icahn Enterprises. Fluctuations in oil, natural gas, and metals directly impact the profitability of its energy segment and increase operational expenses for its manufacturing and automotive businesses. For instance, the average price of West Texas Intermediate (WTI) crude oil saw considerable swings throughout 2024, impacting energy sector revenues.

These sharp price movements necessitate sophisticated risk management and hedging strategies to mitigate potential losses. Icahn Enterprises must closely monitor global supply and demand trends for key commodities to anticipate market shifts.

- Energy Market Impact: Volatile energy prices directly affect the financial performance of Icahn Enterprises' energy investments, influencing revenue and profitability.

- Operational Costs: Fluctuations in raw material prices, such as metals and chemicals, can significantly increase production costs for subsidiaries in manufacturing and automotive sectors.

- Risk Management Necessity: Robust hedging and risk management protocols are crucial to protect against adverse price movements and maintain financial stability.

- Global Dynamics: Monitoring global supply and demand for commodities like oil, natural gas, and industrial metals is essential for forecasting and strategic planning.

The economic outlook for 2024 and early 2025 indicates a period of moderating global growth, with the IMF projecting 3.2% for 2024. This slowdown directly impacts Icahn Enterprises' diversified portfolio, as slower economic activity typically reduces demand across its various sectors, from energy to automotive. Persistent inflation, as evidenced by a 3.4% year-over-year CPI increase in April 2024, coupled with elevated interest rates, presents ongoing challenges by increasing operational costs and potentially dampening consumer spending power.

Consumer confidence, a key driver for Icahn's automotive and home fashion segments, remains a critical factor. While a robust job market in late 2024 could boost spending, economic uncertainty or inflation fears could curb discretionary purchases, impacting revenue. Commodity price volatility, particularly in energy, also poses a risk, affecting the profitability of its energy investments and increasing production costs for manufacturing and automotive subsidiaries, necessitating strong risk management strategies.

| Economic Factor | 2024/2025 Outlook | Impact on Icahn Enterprises | Key Data Points (as of early-mid 2024) |

| Global Growth | Moderating | Reduced demand across sectors | IMF projects 3.2% global growth for 2024 |

| Inflation | Persistent | Increased operational costs, reduced consumer spending | CPI +3.4% (YoY) April 2024, PPI +0.5% (mfg) April 2024 |

| Interest Rates | Elevated | Higher debt costs, potential dampening of investment | Federal Funds Rate 5.25%-5.50% (early 2024) |

| Consumer Confidence | Variable | Influences discretionary spending (automotive, home fashion) | Conference Board Consumer Confidence Index 102.0 (April 2024) |

| Commodity Prices | Volatile | Impacts energy segment, manufacturing costs | WTI Crude Oil price fluctuations throughout 2024 |

Preview the Actual Deliverable

Icahn Enterprises PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Icahn Enterprises delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping its strategic landscape.

Sociological factors

Consumer preferences are shifting, with a notable increase in demand for sustainable and health-conscious products. This directly affects Icahn Enterprises' food packaging and automotive segments. For example, the global market for sustainable packaging is projected to reach over $400 billion by 2027, highlighting a significant opportunity for companies that can adapt.

The automotive sector, in particular, is seeing a surge in interest in electric vehicles (EVs) and fuel-efficient models. As of early 2024, EV sales continue to climb, with many markets reporting double-digit growth year-over-year. Icahn Enterprises must consider how to align its automotive offerings and supply chains with these evolving consumer desires for greener transportation solutions.

Furthermore, convenience remains a key driver for consumers across various industries. This trend influences demand for ready-to-eat meals, efficient delivery services, and user-friendly product designs. By understanding these evolving preferences, Icahn Enterprises can proactively adjust its product development and marketing strategies to better resonate with today's consumer landscape.

Demographic shifts significantly shape consumer demand for Icahn Enterprises' diverse portfolio. For example, the aging population trend in many developed nations, including the United States, could increase demand for healthcare-related services and products, areas where Icahn Enterprises has interests. As of 2024, the U.S. Census Bureau projects that individuals aged 65 and over will constitute over 20% of the population by 2030, a substantial increase from roughly 17% in 2020.

Urbanization also plays a key role, driving demand for infrastructure, transportation, and potentially smaller, more efficient living spaces. This could benefit Icahn Enterprises' real estate and automotive segments. Furthermore, evolving household structures, such as a rise in single-person households, could alter consumption patterns, favoring smaller product sizes or different service models across various Icahn businesses.

Modern societal shifts, like the surge in remote work, are reshaping how people live and work. This trend directly influences demand in sectors like real estate, favoring residential over commercial spaces. For instance, by late 2024, many companies are solidifying hybrid models, meaning less consistent office occupancy, which could depress commercial property values.

The increased time individuals are spending at home is also fueling a boom in the home improvement and fashion markets. As people invest more in their living environments, demand for renovation products and home décor is rising. Icahn Enterprises must stay attuned to these evolving lifestyle preferences to strategically adjust its investments, perhaps by increasing exposure to consumer discretionary goods or residential real estate.

Social Responsibility and Ethical Investing

Societal pressure for companies to act responsibly is intensifying, impacting how investors view Icahn Enterprises. This means demonstrating a commitment to ethical practices is becoming crucial for attracting and retaining capital. For instance, a significant portion of investors, potentially over 60% by late 2024, are increasingly prioritizing ESG (Environmental, Social, and Governance) factors in their investment decisions, according to various market surveys.

Icahn Enterprises, through its activist approach, needs to be mindful of public perception concerning its operations. This includes how it addresses environmental impact, ensures fair labor practices, and upholds strong corporate governance. A recent study in early 2025 indicated that companies with transparent and positive ESG reporting saw, on average, a 5% higher valuation compared to their peers with less developed ESG strategies.

Activist investors like Icahn Enterprises are navigating a landscape where demonstrating a commitment to social responsibility can directly translate into enhanced reputation and improved access to funding. Companies that proactively address these concerns often find it easier to secure favorable terms on debt financing and attract a broader base of institutional investors. By Q1 2025, the sustainable investment market was projected to exceed $50 trillion globally, highlighting the immense capital pool available to ethically aligned businesses.

- Growing Investor Demand for ESG: By 2024, ESG-focused funds attracted record inflows, with estimates suggesting over $1 trillion invested globally, indicating a clear shift in investor priorities.

- Reputational Impact: Companies with strong CSR initiatives reported a 15% higher brand loyalty among consumers in 2024, directly influencing market share and revenue.

- Activist Investor Scrutiny: Public scrutiny of corporate labor practices and environmental footprints intensified in 2024, with significant media attention on companies failing to meet evolving societal standards.

- Capital Attraction: A 2025 report indicated that companies with clear net-zero emission targets were 20% more likely to secure favorable long-term debt financing compared to those without such commitments.

Health and Wellness Trends

The growing emphasis on health and wellness is reshaping consumer preferences across various industries. For Icahn Enterprises, this translates to a heightened demand for products that align with healthier lifestyles. For instance, the food packaging segment sees a surge in demand for fresh, minimally processed items with clear sourcing information, reflecting a consumer desire for transparency and natural ingredients. This trend is projected to continue, with global wellness market expected to reach $7 trillion by 2025, according to the Global Wellness Institute.

In the automotive sector, health consciousness is driving innovation in vehicle safety features and cabin air quality. Consumers are increasingly seeking vehicles equipped with advanced safety technologies and robust air filtration systems. This shift necessitates that Icahn Enterprises, with its diverse holdings, adapt its product development and manufacturing processes to incorporate these health-centric considerations. For example, advancements in automotive air filtration technology are becoming a key selling point for many manufacturers.

Icahn Enterprises must proactively integrate these evolving consumer demands into its strategic planning. This involves not only adapting existing product lines but also exploring new opportunities in sectors that directly cater to health and wellness trends. The company's ability to respond to this societal shift will be crucial for maintaining competitive advantage and driving future growth.

- Consumer demand for transparency in food sourcing is rising.

- Vehicle safety and air quality are becoming key purchasing factors in the automotive industry.

- The global wellness market is a significant and growing economic force.

Societal expectations are increasingly focused on corporate responsibility and ethical conduct, directly influencing investor sentiment toward Icahn Enterprises. By late 2024, surveys indicated that over 60% of investors consider ESG factors, highlighting a significant shift in capital allocation. Companies demonstrating strong CSR initiatives, such as improved labor practices and environmental stewardship, are seeing tangible benefits, including a 15% increase in brand loyalty in 2024.

Icahn Enterprises' activist approach means navigating heightened public scrutiny regarding its operational footprint. A 2025 report revealed that firms with clear net-zero targets were 20% more likely to secure favorable long-term debt financing, underscoring the financial advantages of environmental commitment. The global sustainable investment market, projected to exceed $50 trillion by Q1 2025, represents a substantial pool of capital accessible to ethically aligned businesses.

| Societal Factor | Impact on Icahn Enterprises | Supporting Data (2024-2025) |

|---|---|---|

| Corporate Social Responsibility (CSR) | Enhanced reputation, improved access to capital, increased brand loyalty | 60%+ of investors consider ESG factors; 15% higher brand loyalty for strong CSR |

| Environmental, Social, and Governance (ESG) | Attractiveness to investors, debt financing opportunities, valuation | 20% more likely to secure favorable debt financing with net-zero targets; $50T+ sustainable investment market by Q1 2025 |

| Public Scrutiny | Need for transparency in labor and environmental practices | Intensified scrutiny on companies failing to meet societal standards in 2024 |

Technological factors

Rapid technological advancements in renewable energy, particularly in solar, wind, and battery storage, are reshaping the energy landscape. For Icahn Enterprises, this presents a dual challenge and opportunity for its energy sector investments. The International Energy Agency reported in 2024 that renewable energy capacity additions are expected to grow by over 30% by 2025, reaching nearly 500 gigawatts globally.

While traditional energy assets may face disruption, Icahn Enterprises can leverage these innovations by investing in new, efficient green technologies. This strategic move can unlock significant growth avenues, potentially diversifying their energy portfolio beyond fossil fuels. For instance, advancements in battery technology are crucial for grid stability, making investments in this area particularly attractive.

The automotive sector is in the midst of a profound shift, with electric vehicles (EVs), self-driving capabilities, and enhanced connectivity at the forefront of this evolution. Icahn Enterprises' automotive divisions need to actively engage with these disruptive forces, whether through dedicated research and development or strategic alliances with pioneering firms.

For instance, the global EV market is projected to reach over $800 billion by 2027, underscoring the urgency for established players to adapt. Ignoring these technological advancements risks significant market share loss for Icahn Enterprises' automotive holdings.

Automation and artificial intelligence are transforming manufacturing, with significant impacts on sectors like food packaging and automotive. These advancements promise to boost efficiency and cut costs. For instance, in 2024, the global industrial automation market was projected to reach over $270 billion, highlighting the widespread adoption of these technologies.

Icahn Enterprises can harness AI and automation to refine operations within its industrial holdings. By integrating these tools, the company can achieve greater cost savings and improve product quality, thereby strengthening its competitive position in 2024 and beyond.

Digital Transformation in Real Estate (PropTech)

The real estate sector is significantly shaped by PropTech advancements, encompassing online listing portals, immersive virtual reality property tours, and sophisticated data analytics for property management and investment decisions. Icahn Enterprises, with its diverse real estate portfolio, stands to gain substantially by integrating these digital tools. This adoption can lead to improved asset utilization, a more engaging tenant experience, and more precise market analysis.

Leveraging technology is crucial for enhancing portfolio value and operational efficiency within the real estate domain. For instance, the global PropTech market was valued at approximately $26.4 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a robust growth trajectory and the increasing importance of digital solutions. Icahn Enterprises can capitalize on this trend by implementing data-driven strategies for property acquisition, leasing, and management.

- Enhanced Operational Efficiency: Implementing AI-powered property management software can streamline maintenance requests, automate lease renewals, and optimize energy consumption, potentially reducing operational costs by up to 15% in early adoption phases.

- Improved Tenant Engagement: Digital platforms offering seamless communication, online rent payment, and virtual amenity booking can boost tenant satisfaction and retention rates, which are critical for long-term portfolio stability.

- Data-Driven Investment Decisions: Utilizing big data analytics for market trend forecasting, rental income prediction, and property valuation can inform more strategic and profitable investment choices, potentially identifying undervalued assets or emerging market opportunities.

- Expanded Market Reach: Online property platforms and virtual tours allow for wider exposure to potential tenants and buyers, transcending geographical limitations and increasing occupancy rates.

Fintech and Investment Technology

Fintech innovations, including AI-driven trading and blockchain, are reshaping how investment firms operate. Icahn Enterprises can leverage these advancements to refine its trading strategies, bolster risk management, and uncover novel investment avenues. For instance, the global Fintech market was projected to reach $33.25 trillion by 2027, highlighting the immense potential. Staying at the forefront of these technological shifts is crucial for maintaining a competitive edge in the securities market.

The integration of sophisticated data analytics and advanced trading algorithms offers Icahn Enterprises the ability to process vast amounts of market data, leading to more informed decision-making. This can translate into improved operational efficiency and a deeper understanding of market trends. The increasing adoption of AI in financial services, with an estimated 80% of financial institutions planning to increase their AI spending in 2024, underscores this trend.

- Enhanced Trading Capabilities: Utilizing algorithmic trading to execute trades faster and more efficiently.

- Improved Risk Assessment: Employing data analytics to better predict and mitigate investment risks.

- Opportunity Identification: Leveraging AI to scan markets for undervalued assets or emerging trends.

- Operational Efficiency: Streamlining back-office processes through fintech solutions.

Technological advancements are significantly impacting Icahn Enterprises' diverse portfolio. In the energy sector, the rapid growth of renewables, with global capacity additions expected to exceed 30% by 2025 according to the International Energy Agency, presents opportunities for investment in green technologies like battery storage.

The automotive industry's shift towards EVs and autonomous driving, with the global EV market projected to surpass $800 billion by 2027, necessitates adaptation. Similarly, automation and AI are transforming manufacturing, with the industrial automation market valued at over $270 billion in 2024, offering Icahn Enterprises avenues for cost savings and quality improvements.

PropTech is revolutionizing real estate, with the market expected to grow from approximately $26.4 billion in 2023 to over $100 billion by 2030, enabling Icahn Enterprises to enhance property management and investment decisions through digital tools.

Fintech innovations, including AI-driven trading, are crucial for Icahn Enterprises to refine strategies and manage risk, especially as the fintech market is projected to reach $33.25 trillion by 2027. The increasing adoption of AI in financial services, with 80% of institutions planning increased spending in 2024, highlights the competitive imperative.

Legal factors

Icahn Enterprises, as a diversified holding company, navigates a complex web of securities and corporate governance regulations. Compliance with the Securities and Exchange Commission (SEC) rules, including rigorous disclosure requirements and regulations pertaining to shareholder activism, is crucial. Failure to adhere can lead to significant legal penalties and erode investor confidence.

For instance, in 2023, Icahn Enterprises faced scrutiny and investigations related to its disclosures and corporate practices, highlighting the constant need for vigilance. The company's investment strategies and operational flexibility are directly influenced by evolving regulatory landscapes, making proactive adaptation essential for maintaining its competitive edge and financial stability.

Icahn Enterprises' diverse operations, particularly in energy, automotive, and manufacturing, face significant scrutiny under environmental protection laws. These regulations cover everything from emissions standards and waste disposal to broader pollution control measures, impacting how the company operates and invests.

The increasing stringency of environmental legislation, a trend expected to continue through 2024 and 2025, directly translates to higher compliance costs. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce regulations like the Clean Air Act, which can necessitate substantial capital expenditures for facility upgrades to meet evolving emissions targets. Failure to comply can result in hefty fines, with penalties for environmental violations often running into millions of dollars, as seen in past cases involving large industrial firms.

Continuous monitoring and proactive adherence to these environmental standards are not just a legal necessity but a strategic imperative for Icahn Enterprises. Staying ahead of regulatory changes, such as potential new mandates on carbon emissions or sustainable manufacturing practices anticipated in the coming years, can mitigate risks and potentially unlock opportunities in greener technologies.

Icahn Enterprises' active investment strategy, often involving substantial stakes and influential positions across diverse sectors, naturally draws attention from antitrust and competition regulators. For instance, the company's significant holdings in industries like automotive parts or energy could trigger reviews if any proposed acquisitions or strategic realignments are perceived to limit market competition.

Regulatory bodies, such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the United States, actively monitor market concentration. The potential for Icahn Enterprises to be challenged under these laws is a constant consideration, requiring meticulous legal and strategic planning for any significant corporate action. Failure to comply could lead to hefty fines or blocked transactions, impacting their growth trajectory.

Labor and Employment Laws

Icahn Enterprises operates across various sectors, necessitating strict adherence to diverse labor and employment laws. These include federal and state regulations concerning minimum wage, workplace safety, collective bargaining, and equal employment opportunities. For instance, in 2024, the federal minimum wage remained at $7.25 per hour, but many states and cities have enacted significantly higher rates, directly impacting Icahn's operational costs for its hourly workers across its subsidiaries like Icahn Automotive or CVR Energy.

Changes in labor legislation, such as potential increases in minimum wage or expanded overtime protections, can directly affect Icahn Enterprises' profitability and human resource strategies. For example, a nationwide push for higher minimum wages could increase payroll expenses substantially. Furthermore, increased scrutiny on union relations and unfair labor practice allegations could lead to costly legal battles and operational disruptions, as seen in past labor disputes within the automotive or energy sectors.

- Compliance Burden: Icahn Enterprises must navigate a complex web of federal, state, and local labor laws, increasing administrative overhead.

- Wage Pressures: Rising minimum wage requirements and demands for better compensation from organized labor can elevate operating expenses.

- Litigation Risk: Non-compliance or perceived unfair labor practices can result in significant fines, lawsuits, and reputational damage.

- Workforce Management: Adapting HR policies to evolving employment laws, including those related to remote work and gig economy workers, is crucial for efficient operations.

Industry-Specific Regulations (e.g., Food Safety, Automotive Safety)

Icahn Enterprises' diverse portfolio means navigating a complex web of industry-specific regulations. For instance, its involvement in food packaging necessitates strict adherence to food safety standards, such as those mandated by the FDA, and accurate labeling requirements. Failure to comply can lead to costly product recalls and damage brand trust.

In the automotive sector, Icahn Enterprises must meet rigorous vehicle safety standards and emissions regulations, which are constantly being updated by bodies like the EPA and NHTSA. Staying ahead of these evolving rules is crucial for market access and avoiding substantial penalties. For example, the 2025 EPA emissions standards are becoming increasingly stringent, requiring significant investment in compliance.

Key regulatory areas impacting Icahn Enterprises include:

- Food Safety Compliance: Adherence to regulations like HACCP (Hazard Analysis and Critical Control Points) for food packaging operations.

- Automotive Safety Standards: Meeting federal motor vehicle safety standards (FMVSS) and emissions control regulations.

- Labeling and Packaging Laws: Ensuring all products, especially food items, have accurate and compliant labeling.

- Environmental Regulations: Managing waste disposal and emissions across all manufacturing facilities.

Icahn Enterprises faces significant legal challenges due to its diverse holdings and activist investment approach. The company must meticulously comply with SEC regulations, including disclosure requirements and rules governing shareholder activism, to avoid penalties and maintain investor trust. For instance, Icahn Enterprises' 2023 disclosures faced scrutiny, underscoring the constant need for regulatory vigilance.

Antitrust and competition laws are also critical, as significant holdings in sectors like automotive parts could trigger reviews by bodies such as the FTC and DOJ if market competition is perceived to be limited. Failure to comply can result in substantial fines or blocked transactions, impacting growth.

Furthermore, labor and employment laws, including minimum wage and workplace safety, directly impact operational costs. For example, varying state minimum wage laws in 2024 affect payroll expenses across subsidiaries. Litigation risk from non-compliance or perceived unfair labor practices remains a constant concern.

Industry-specific regulations, such as FDA food safety standards for packaging and EPA emissions standards for automotive operations, are paramount. The 2025 EPA emissions standards, for example, are becoming increasingly stringent, demanding significant compliance investments.

| Regulatory Area | Key Compliance Aspects | Potential Impact on Icahn Enterprises | Example Data/Fact |

|---|---|---|---|

| Securities Law | SEC disclosures, shareholder activism rules | Fines, reputational damage, investor confidence erosion | Scrutiny on 2023 disclosures |

| Antitrust Law | Market concentration, competition impact | Fines, blocked transactions, strategic limitations | Potential review of automotive parts holdings |

| Labor Law | Minimum wage, workplace safety, union relations | Increased payroll costs, litigation, operational disruption | Varying state minimum wages in 2024 |

| Industry-Specific | Food safety (FDA), emissions (EPA), vehicle safety (NHTSA) | Product recalls, market access issues, compliance costs | Increasingly stringent 2025 EPA emissions standards |

Environmental factors

Global and national climate change regulations, including carbon pricing and emissions caps, are increasingly impacting Icahn Enterprises, particularly its energy and automotive segments. For instance, the EU's Carbon Border Adjustment Mechanism, phased in from October 2023, will eventually affect imports based on their embedded carbon emissions, a factor relevant to companies with international supply chains.

Icahn Enterprises faces pressure to shrink its carbon footprint across its diverse operations. This necessitates strategic investments in cleaner technologies and more sustainable operational practices. Companies are increasingly disclosing their Scope 1, 2, and 3 emissions, with a growing number of investors demanding transparency and action on climate-related risks.

Adapting proactively to these evolving environmental regulations is not just a compliance issue but a strategic imperative for Icahn Enterprises. Early adoption of sustainable practices can lead to cost savings through improved energy efficiency and potentially open new market opportunities in the green economy. For example, the US Inflation Reduction Act of 2022 offers significant tax credits for clean energy production and adoption, incentivizing such transitions.

The availability and sustainable sourcing of critical natural resources, such as water, rare earth minerals essential for the automotive sector, and raw materials for packaging, present significant environmental risks for Icahn Enterprises. For instance, global demand for rare earth minerals, crucial for electric vehicles and renewable energy technologies, has surged, with prices for some elements seeing substantial increases in late 2024 and early 2025 due to geopolitical factors and limited supply.

Any disruptions in these supply chains or escalating costs stemming from resource scarcity directly impact operational efficiency and overall profitability. This necessitates a proactive approach from Icahn Enterprises to investigate and implement robust sustainable sourcing strategies and resource efficiency initiatives across its diverse portfolio.

The increasing global focus on sustainability is significantly reshaping the food packaging and manufacturing industries. Governments and consumers alike are demanding greater accountability for waste, pushing companies towards waste reduction, enhanced recycling programs, and the adoption of circular economy principles. This trend directly impacts Icahn Enterprises, particularly its food-related businesses, by creating pressure to innovate product design for improved recyclability and to actively minimize the amount of waste sent to landfills.

In 2024, the global waste management market was valued at approximately $1.7 trillion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, indicating a substantial economic shift towards sustainable practices. Companies like Icahn Enterprises face growing regulatory scrutiny and evolving consumer preferences that favor environmentally responsible operations. To remain competitive and meet these expectations, strategic investments in advanced waste management solutions and a genuine embrace of circular economy models are becoming essential for long-term viability.

Impact of Extreme Weather Events

The escalating frequency and intensity of extreme weather events, a direct consequence of climate change, present significant physical risks to Icahn Enterprises. These events can directly impact its real estate holdings, disrupt intricate supply chains, and compromise operational continuity. For instance, severe storms or flooding could damage properties, while droughts might affect resource availability crucial for certain operations.

Icahn Enterprises must increasingly focus on robust risk assessment and resilience planning to mitigate these impacts. Investing in climate-resilient infrastructure is no longer optional but a strategic imperative to safeguard assets and ensure business continuity in the face of a changing climate.

- Physical Risk: Extreme weather events, such as hurricanes and floods, can directly damage Icahn Enterprises' physical assets, including real estate and infrastructure.

- Supply Chain Disruption: Weather-related disruptions can halt transportation networks, impacting the flow of goods and materials essential for Icahn Enterprises' diverse businesses.

- Operational Continuity: Adverse weather can lead to temporary or prolonged shutdowns of operations, affecting production, service delivery, and revenue generation.

- Resilience Investment: The company is likely to see increased costs associated with adapting to and mitigating the effects of climate change, necessitating strategic investments in resilient infrastructure and operational adjustments.

ESG Investor Pressure and Reporting

Investor focus on Environmental, Social, and Governance (ESG) factors is significantly shaping capital allocation and how companies are valued. This trend means that businesses are increasingly scrutinized for their environmental impact and sustainability practices. For instance, a 2024 report by Morningstar indicated that sustainable funds globally attracted over $170 billion in net inflows, highlighting investor preference for ESG-aligned companies.

Icahn Enterprises, like its peers, is experiencing heightened pressure from investors and stakeholders to showcase strong environmental performance, maintain transparent reporting, and commit to sustainability benchmarks. This pressure is often manifested through shareholder proposals and engagement with institutional investors who prioritize these criteria in their investment decisions. Companies that fail to adapt risk being excluded from investment portfolios.

Developing and maintaining robust ESG reporting is becoming a critical differentiator. It not only enhances investor confidence but also directly impacts a company's ability to access capital. For example, companies with strong ESG ratings often benefit from lower costs of capital, as demonstrated by studies showing a correlation between high ESG scores and improved financial performance, with some research suggesting a 3-5% reduction in the cost of equity for top-quartile ESG performers.

- Growing Investor Demand: In 2024, assets in ESG-focused funds continued to climb, with significant inflows indicating a clear investor preference for sustainable investments.

- Stakeholder Expectations: Icahn Enterprises faces increasing demands for transparency regarding its environmental footprint and adherence to sustainability goals from a broad base of stakeholders.

- Access to Capital: Strong ESG reporting can lead to better access to capital and potentially lower borrowing costs, as financial institutions increasingly integrate ESG metrics into their lending and investment criteria.

- Valuation Impact: Companies demonstrating strong environmental stewardship and governance practices are often viewed more favorably by the market, potentially leading to higher valuations.

Icahn Enterprises must navigate evolving climate regulations, such as the EU's Carbon Border Adjustment Mechanism, impacting its international supply chains and energy-intensive segments. The company faces pressure to reduce its carbon footprint, necessitating investments in cleaner technologies and sustainable practices, a trend amplified by investor demand for ESG transparency, with sustainable funds attracting over $170 billion in global net inflows in 2024.

The company's operations are also exposed to physical risks from extreme weather events, which can disrupt supply chains and damage assets, requiring investments in climate-resilient infrastructure. Furthermore, the sourcing of critical natural resources, like rare earth minerals, presents challenges due to surging demand and potential supply disruptions, impacting sectors such as automotive and renewable energy.

| Environmental Factor | Impact on Icahn Enterprises | Data/Trend (2024/2025) |

| Climate Change Regulations | Increased compliance costs, potential carbon taxes, need for emissions reduction strategies. | EU's Carbon Border Adjustment Mechanism phased in from Oct 2023; growing global adoption of carbon pricing. |

| Sustainability & ESG Pressure | Investor demand for transparency, potential impact on access to capital and valuation. | Sustainable funds saw over $170 billion in global net inflows in 2024; strong ESG performers may see 3-5% lower cost of equity. |

| Extreme Weather Events | Risk of asset damage, supply chain disruptions, operational interruptions. | Increasing frequency and intensity of events globally, impacting real estate and logistics. |

| Natural Resource Availability | Supply chain vulnerabilities, increased raw material costs. | Surge in demand and price increases for rare earth minerals in late 2024/early 2025 due to geopolitical factors. |

| Waste Management & Circular Economy | Pressure to reduce waste, improve recyclability, and adopt circular models. | Global waste management market valued at ~$1.7 trillion in 2024, with a projected CAGR over 5% through 2030. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Icahn Enterprises is built on a robust foundation of data from reputable financial news outlets, industry-specific publications, and official company filings. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the conglomerate.