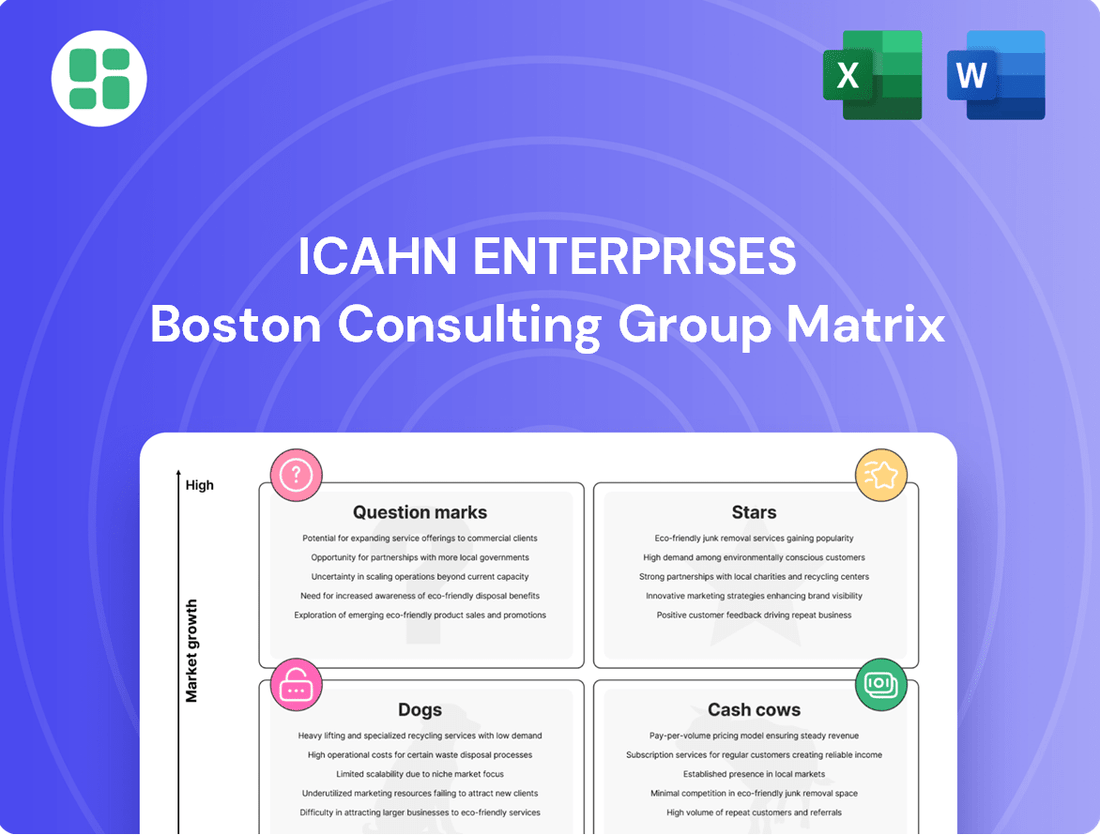

Icahn Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Curious about Icahn Enterprises' strategic positioning? This glimpse into their BCG Matrix reveals the potential of their diverse portfolio, hinting at both robust cash generators and areas ripe for growth.

To truly understand where Icahn Enterprises is investing its future and which segments are fueling its present success, you need the full picture. Purchase the complete BCG Matrix report for a detailed quadrant breakdown, actionable insights, and a clear roadmap for strategic decision-making.

Stars

Icahn Enterprises' investment segment, focusing on strategic activism, fits the profile of a Star within the BCG framework. This segment actively seeks out undervalued companies, taking substantial stakes to implement operational and strategic changes. The goal is to unlock shareholder value and achieve high returns in a competitive market.

In 2024, Icahn Enterprises continued its activist strategy, engaging with several public companies. For instance, its stake in Illumina was a prominent example of this approach, aiming to drive improvements in governance and strategy. This segment thrives on identifying opportunities where its influence can catalyze significant positive change, often leading to substantial capital gains.

Icahn Enterprises' Pharma segment, particularly its VIVUS PAH asset VI-106, is poised for significant growth. This drug is currently in a pivotal trial, and if successful, it could offer a disease-modifying treatment for pulmonary arterial hypertension, a market with substantial unmet needs.

The ongoing investment in research and development for VI-106, a new product with considerable market potential, firmly places this initiative within the Star quadrant of the BCG Matrix. This classification acknowledges the current cash consumption required for its development, balanced against the expectation of high future returns.

Icahn Enterprises' real estate segment, specifically new single-family home sales from the Country Club project slated to begin by the end of 2025, is positioned as a Star due to its high growth potential. This classification is supported by the successful sale of a country club in Q2 2025, which yielded a substantial pre-tax gain, signaling strong market demand for their developments.

The strategy behind this project involves targeting expanding markets with the objective of boosting sales volume. This focus on growth and market receptiveness, as evidenced by the Q2 2025 sale, firmly places the Country Club new development pipeline in the Star quadrant of the BCG Matrix.

Specific Portfolio Holdings with Strong Performance (e.g., CVI)

Icahn Enterprises' portfolio includes specific holdings like CVI (CVR Energy) that have shown remarkable performance. CVI's share price experienced a significant increase, positively impacting Icahn Enterprises' net asset value. This performance highlights CVI as a potential star within the portfolio, given its strong market position in the energy sector, a segment that, while facing broader challenges, still presents growth opportunities.

- CVR Energy (CVI) Share Price Performance: CVI's stock saw a substantial rise, contributing positively to Icahn Enterprises' overall net asset value.

- Market Position: CVI operates in the energy sector, demonstrating high market share and growth potential within its specific niche.

- BCG Matrix Classification: Given its strong performance and market position in a growing segment, CVI can be classified as a 'Star' within Icahn Enterprises' diversified holdings.

Emerging Digital Businesses within controlled companies (e.g., Caesars Digital)

Emerging digital businesses within controlled entities, such as Caesars Digital, represent significant growth opportunities. Caesars Digital, in particular, has demonstrated robust performance, with Q2 2025 revenue climbing 24% and EBITDA soaring 100%. This strong financial uplift positions it as a Star within the BCG Matrix, signifying a high-growth market where the company holds a strong competitive position.

The potential to further enhance value by potentially separating or optimizing this digital segment suggests a clear path to unlocking further market leadership and shareholder value. This strategic consideration is crucial for maximizing the returns from such promising ventures.

- Caesars Digital Q2 2025 Performance: Revenue up 24%, EBITDA up 100%.

- BCG Matrix Classification: Star, indicating high growth and strong market share.

- Strategic Potential: Opportunity to unlock further value through structural optimization.

- Market Position: Demonstrates leadership in a rapidly expanding digital sector.

Icahn Enterprises' pharmaceutical segment, specifically its VI-106 asset for pulmonary arterial hypertension, is a prime example of a Star. This drug is in a critical trial phase, and its potential to offer a disease-modifying treatment in a market with significant unmet needs positions it for high growth and substantial future returns, despite current investment in development.

The real estate development, exemplified by the Country Club project, is also classified as a Star. The successful sale of a country club in Q2 2025, generating a considerable pre-tax gain, underscores strong market demand. The strategy focuses on expanding markets to boost sales volume, further solidifying its Star status.

Caesars Digital, a controlled entity within Icahn Enterprises, demonstrates Star characteristics with its impressive Q2 2025 performance, showing a 24% revenue increase and a 100% EBITDA surge. This strong financial growth in a high-growth digital market, coupled with its leadership position, marks it as a Star.

| Business Segment/Asset | BCG Classification | Key Performance Indicators (2024/2025 Data) | Strategic Outlook |

|---|---|---|---|

| Activist Investment Strategy | Star | Active engagement in companies like Illumina (2024) | Unlocking shareholder value through operational and strategic changes |

| Pharma (VI-106 for PAH) | Star | Pivotal trial ongoing | Potential disease-modifying treatment for a market with unmet needs |

| Real Estate (Country Club Project) | Star | Successful sale in Q2 2025 (substantial pre-tax gain) | Targeting expanding markets for increased sales volume |

| Caesars Digital | Star | Q2 2025: Revenue +24%, EBITDA +100% | Potential for structural optimization to enhance value |

What is included in the product

This BCG Matrix overview provides strategic insights into Icahn Enterprises' portfolio, highlighting which units to invest in, hold, or divest.

The Icahn Enterprises BCG Matrix provides a clear, one-page overview of each business unit's strategic position, alleviating the pain of complex portfolio analysis.

Cash Cows

Icahn Enterprises' established real estate holdings, including land, retail, office, and industrial properties leased to corporate tenants, function as cash cows. These assets are situated in mature markets, consistently generating reliable rental income with minimal need for further investment in promotion or placement. This stability provides a dependable source of cash flow, bolstering the company's overall financial flexibility.

The Home Fashion segment of Icahn Enterprises is a classic Cash Cow. In Q2 2025, its adjusted EBITDA remained flat year-over-year, signaling a mature market where the company holds a steady position.

This stability means the segment reliably generates cash without requiring significant capital infusions for expansion. Its consistent cash flow generation in a low-growth environment firmly places it within the Cash Cow quadrant of the BCG Matrix.

Icahn Enterprises' Pharma segment, specifically its existing approved therapies, functions as a classic Cash Cow. These established drugs, likely operating in mature therapeutic areas, provide a reliable and consistent revenue stream, requiring minimal reinvestment for growth.

These mature products are crucial for Icahn Enterprises, offering a stable financial foundation. For instance, in 2023, Icahn Enterprises reported total revenue of $13.7 billion, with its Pharma segment contributing significantly through these established therapies.

Fertilizer Business within Energy Segment (CVR Partners)

Despite broader challenges in the refining sector, CVR Partners' fertilizer business stands out as a strong performer within Icahn Enterprises' Energy segment. This segment is characterized by sustained high fertilizer prices and robust operational utilization rates, underscoring its position as a cash cow.

The fertilizer segment's resilience is a key factor, demonstrating its ability to generate significant cash flow even amidst industry volatility. This strong market position and consistent demand translate into reliable earnings.

- Fertilizer Segment Performance: CVR Partners' fertilizer operations have benefited from elevated commodity prices and high utilization rates.

- Cash Flow Generation: The segment acts as a significant cash generator, contributing positively to Icahn Enterprises' overall financial health.

- Market Position: Despite being part of a cyclical industry, the fertilizer business maintains a strong footing due to consistent demand.

- Strategic Importance: This segment provides a stable cash flow stream, supporting other ventures within the Icahn Enterprises portfolio.

Managed Investment Funds (for stable, less volatile portions)

Within Icahn Enterprises' broader investment segment, certain managed investment funds that prioritize stable, long-term holdings rather than aggressive activist plays can be considered Cash Cows. These segments are characterized by their consistent, predictable income generation without demanding significant new investment, freeing up capital.

These stable funds are crucial for providing a reliable revenue stream, supporting other, more growth-oriented parts of the business. For instance, if a portion of Icahn Enterprises' managed investments focuses on dividend-paying stocks or bonds with low volatility, it would fit this Cash Cow profile.

- Stable Income Generation: These funds generate consistent returns, contributing reliably to Icahn Enterprises' overall profitability.

- Low Capital Requirement: They require minimal additional investment to maintain their market position and income flow.

- Capital Allocation Support: The profits from these Cash Cows can be reinvested into Stars or Question Marks within the portfolio.

- Reduced Volatility: They offer a ballast against the higher risk associated with activist investing, contributing to portfolio stability.

Icahn Enterprises' established real estate holdings, characterized by mature markets and reliable rental income, function as cash cows. These properties, leased to corporate tenants, generate consistent cash flow with minimal need for further investment, bolstering the company's financial flexibility.

The Home Fashion segment, with its stable market position and flat year-over-year adjusted EBITDA in Q2 2025, exemplifies a cash cow. This stability allows for consistent cash generation without significant capital infusions for expansion.

Icahn Enterprises' Pharma segment, particularly its existing approved therapies, operates as a cash cow. These mature products in established therapeutic areas provide a reliable revenue stream, as evidenced by the Pharma segment's significant contribution to Icahn Enterprises' $13.7 billion total revenue in 2023.

CVR Partners' fertilizer business, benefiting from sustained high prices and robust utilization, is a strong cash cow within the Energy segment. This segment's resilience ensures significant cash flow generation, supporting other ventures.

| Segment | BCG Category | Key Characteristics | Financial Insight (2023/2025) |

|---|---|---|---|

| Real Estate | Cash Cow | Mature markets, reliable rental income, low investment needs | Consistent income generation |

| Home Fashion | Cash Cow | Steady market position, low growth | Flat adjusted EBITDA (Q2 2025) |

| Pharma (Existing Therapies) | Cash Cow | Established products, mature markets | Contributed significantly to $13.7B total revenue (2023) |

| Fertilizer (CVR Partners) | Cash Cow | High commodity prices, robust utilization | Strong cash flow generation |

Preview = Final Product

Icahn Enterprises BCG Matrix

The Icahn Enterprises BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, provides a clear strategic overview of Icahn Enterprises' business units, ready for immediate integration into your planning processes. You can confidently expect the same high-quality, fully formatted report, devoid of any demo content, ensuring you gain instant access to actionable insights for your strategic decision-making.

Dogs

Icahn Enterprises' Automotive Aftermarket Parts business has been classified as a Dog and was strategically exited in Q1 2025. This divestiture was a direct response to significant market headwinds and a consistent decline in revenue, underscoring its poor performance.

The business operated within a stagnant or contracting market segment and held a minimal share, making it an unattractive investment. The decision to exit was driven by the understanding that continued investment would yield negligible returns and drain valuable capital resources.

In 2024, the automotive aftermarket industry faced challenges such as increased competition from online retailers and a shift towards electric vehicles, impacting traditional parts suppliers. Icahn Enterprises' divestiture aligns with a broader trend of portfolio optimization in response to these evolving market dynamics.

The closure of 44 underperforming automotive service locations year-to-date in 2025 indicates these units were likely dogs in Icahn Enterprises' portfolio.

These locations probably held a small market share within the mature and slow-growing automotive service sector, consistently failing to generate profits and instead incurring losses.

This strategic divestment from non-performing assets aligns with the BCG matrix principle of shedding business units that require significant investment for minimal return, freeing up capital for more promising ventures.

Icahn Enterprises' refining business, specifically CVR Energy, has entered the Dog quadrant of the BCG Matrix. This segment experienced a sharp downturn, moving from profitability to a substantial loss in the second quarter of 2025, driven by a collapse in refining margins.

The market for refining is characterized by low growth and intense competition, further solidifying its Dog status. The significant drop in margins means this business is likely a cash drain, failing to generate sufficient returns to justify its continued investment.

Food Packaging Segment (Operational Inefficiencies)

The Food Packaging segment of Icahn Enterprises is currently positioned as a Dog in the BCG Matrix. This is primarily due to a notable decline in adjusted EBITDA, which fell in Q2 2025. This downturn was attributed to a combination of factors, including reduced sales volumes and increased operational inefficiencies within manufacturing processes.

Further exacerbating the segment's performance were disruptive headwinds stemming from ongoing restructuring efforts. These challenges indicate a market that is not experiencing significant growth, and where the company is struggling to maintain or grow its market share and profitability effectively.

- Decreased Adjusted EBITDA: The segment experienced a decline in adjusted EBITDA in Q2 2025.

- Contributing Factors: Lower volume, higher manufacturing inefficiencies, and restructuring disruptions impacted profitability.

- Market Position: The segment operates in a low-growth market and faces challenges with market share and profitability.

- Strategic Implication: As a Dog, this segment requires substantial turnaround initiatives to improve its standing.

Certain Legacy Real Estate Assets (Divested Properties)

Certain legacy real estate assets, identified for divestiture, can be viewed as potential 'Cash Cows' or even 'Dogs' within Icahn Enterprises' portfolio, depending on their market performance and strategic alignment. Properties not integrated into new development initiatives, particularly those in stagnant markets or exhibiting low utilization, are prime candidates for sale. This strategic move aims to unlock capital rather than allow these assets to become persistent drains on resources.

These divested properties might represent holdings that have ceased to be growth drivers. For instance, if a commercial property acquired years ago is now in an area with declining foot traffic and high vacancy rates, its sale would be a logical step. In 2023, Icahn Enterprises reported significant progress in its real estate divestment strategy, aiming to streamline its portfolio and focus on more promising ventures. While specific figures for individual divested properties are not always publicly detailed, the overall strategy reflects a proactive approach to portfolio management.

- Legacy Assets for Divestiture: Properties not central to new development projects.

- Strategic Rationale: Freeing up capital by selling underperforming or stagnant real estate.

- Market Conditions: Often located in markets with low utilization or declining demand.

- Financial Impact: Divestiture aims to prevent these assets from becoming cash traps.

Icahn Enterprises has strategically exited its Automotive Aftermarket Parts business, classifying it as a Dog due to declining revenue and market headwinds. This move aligns with industry trends in 2024, where online competition and the shift to EVs impacted traditional parts suppliers. The closure of 44 underperforming automotive service locations in 2025 further illustrates the shedding of these low-performing assets.

The refining business, CVR Energy, has also entered the Dog quadrant following a significant drop in refining margins in Q2 2025, moving from profitability to a loss. The Food Packaging segment's adjusted EBITDA declined in Q2 2025 due to lower volumes and operational inefficiencies, also placing it as a Dog. Certain legacy real estate assets identified for divestiture are also treated as Dogs if they are in stagnant markets or have low utilization, as seen in Icahn Enterprises' 2023 divestment strategy.

Question Marks

Icahn Enterprises is strategically expanding its automotive service footprint by planning to open 16 new greenfield locations by the close of 2025. These new ventures are categorized as Question Marks in the BCG Matrix. This classification highlights their position in a high-growth market with low relative market share, demanding substantial capital investment to establish a competitive presence.

The significant investment required for these new locations means they are likely to be cash consumers in the short to medium term. Their future trajectory is uncertain; they could evolve into Stars if they successfully capture market share and achieve strong growth, or they might falter and become Dogs if they fail to gain traction in the competitive landscape.

Icahn Enterprises' investment in companies like American Electric Power (AEP) to capitalize on AI-driven data center electricity demand positions it as a Question Mark within the BCG Matrix. This sector is experiencing rapid expansion, driven by the insatiable power needs of artificial intelligence infrastructure. For instance, data center electricity consumption in the US was projected to more than double by 2026, reaching an estimated 220 terawatt-hours annually.

While the market offers significant growth potential, Icahn Enterprises' specific market share and its long-term competitive advantage in this evolving landscape are still being established. The company must continue to invest heavily to secure favorable energy contracts and develop the necessary infrastructure to support these power-intensive facilities. This strategic focus requires careful management to navigate the competitive dynamics and technological advancements inherent in the AI data center boom.

Icahn Enterprises' Food Packaging segment is currently classified as a Question Mark due to its ongoing restructuring initiatives. This plan involves consolidating existing facilities and integrating new manufacturing lines, a move designed to boost efficiency and competitiveness.

However, these efforts are not without their challenges. The restructuring introduces temporary disruptions to operations and demands significant capital outlay. The success of these investments in capturing greater market share and improving profitability within a demanding industry remains uncertain.

Unproven Pharma Product Candidates in Early-Stage Development

Icahn Enterprises' Pharma segment, beyond its more advanced trials, is actively developing product candidates in early-stage research. These represent the classic question marks in a BCG matrix, operating within a sector characterized by rapid growth potential but also significant inherent speculation.

These early-stage assets demand considerable ongoing investment in research and development. The commercial success of these unproven drug candidates remains highly uncertain, placing them in a high-risk category with the potential for substantial future returns if they navigate clinical trials and regulatory approval successfully.

- High R&D Spend: Early-stage pharma development typically involves substantial upfront capital for discovery, preclinical testing, and initial human trials. For instance, the average cost to bring a new drug to market can exceed $2 billion, with a significant portion allocated to the early phases.

- Speculative Market: The biotechnology and pharmaceutical industries are inherently speculative, with a high failure rate for products in early development. Only a small percentage of drugs entering Phase 1 trials ultimately receive FDA approval.

- Uncertain Commercial Viability: The ultimate market acceptance and pricing power of novel therapies are difficult to predict at this stage, making their commercial viability a significant unknown.

New Acquisitions or Ventures in Emerging Sectors (if applicable)

New acquisitions or ventures by Icahn Enterprises in emerging sectors would likely be classified as question marks. These are areas with high growth potential but where Icahn's market share is currently minimal or non-existent. They require substantial investment and careful strategic management to ascertain their long-term success and eventual placement within the BCG matrix.

For instance, if Icahn Enterprises were to invest in a burgeoning artificial intelligence startup in 2024, this would represent a question mark. Such an investment would demand significant capital for research and development, talent acquisition, and market penetration. The company would need to closely monitor market trends and competitive landscapes to determine if this venture can evolve into a star or if it risks becoming a dog.

- High Growth Potential: Emerging sectors offer the promise of substantial future returns.

- Unestablished Market Share: Icahn's presence in these new markets would be nascent.

- Capital Intensive: Significant investment is required to foster growth and market entry.

- Strategic Uncertainty: The long-term viability and market position are yet to be determined.

Question Marks within Icahn Enterprises represent new ventures or business units operating in high-growth markets but currently holding a low relative market share. These entities, such as the planned 16 greenfield automotive service locations by the end of 2025 and the AI data center electricity demand initiatives, require significant capital investment. Their future success is uncertain, with the potential to become Stars if they capture market share or Dogs if they fail to gain traction.

The Food Packaging segment's restructuring efforts also place it in the Question Mark category, demanding capital while facing operational uncertainties. Similarly, early-stage pharmaceutical research assets are classic Question Marks, characterized by high R&D spend and speculative market potential, with a high failure rate for products in development.

Investments in emerging sectors, like a hypothetical AI startup in 2024, exemplify Question Marks due to their high growth potential but unestablished market share and capital intensity. These ventures necessitate careful strategic management to navigate competitive landscapes and determine long-term viability.

| Business Unit/Venture | Market Growth | Relative Market Share | Capital Needs | Strategic Outlook |

|---|---|---|---|---|

| Automotive Greenfield Locations (2025) | High | Low | High | Uncertain (Potential Star or Dog) |

| AI Data Center Electricity Demand | High | Low/Developing | High | Uncertain (Dependent on infrastructure and contracts) |

| Food Packaging (Restructuring) | Moderate | Low/Developing | High | Uncertain (Dependent on restructuring success) |

| Pharma (Early-Stage R&D) | High | Negligible | Very High | Highly Speculative (High risk, potential high reward) |

| Emerging Sector Investments (e.g., AI Startup 2024) | Very High | Negligible | High | Highly Uncertain (Dependent on market adoption and competitive positioning) |

BCG Matrix Data Sources

Our Icahn Enterprises BCG Matrix leverages comprehensive financial disclosures, industry-specific market research, and competitor performance data.