IDOX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDOX Bundle

IDOX demonstrates a strong market position and robust operational capabilities, but understanding the nuances of its competitive landscape and potential vulnerabilities is crucial for strategic decision-making. Our comprehensive SWOT analysis delves into these critical areas, offering actionable insights to guide your next move.

Want to fully grasp IDOX's competitive edge, potential threats, and avenues for expansion? Purchase the complete SWOT analysis to unlock a professionally crafted, editable report designed to empower your strategic planning, investor pitches, and in-depth research.

Strengths

IDOX plc enjoys a commanding presence within the UK public sector market, specializing in essential software and services for areas such as land, property, and electoral administration. This deep integration means over 90% of UK local authorities rely on IDOX's offerings.

This extensive customer base, encompassing nearly all UK local authorities, translates into a resilient and predictable revenue stream. It also creates substantial hurdles for potential new entrants looking to challenge IDOX's established market share.

IDOX has demonstrated impressive recurring revenue growth, a significant strength. In FY24, this segment expanded by 20% to £54.5 million, making up a substantial 62% of the company's total revenue. This robust performance highlights the company's ability to secure and retain customers, ensuring a predictable income stream.

The trend of increasing recurring revenue continued into H1 FY25, where it grew by an additional 9% to represent 66% of total revenue. This growing proportion of recurring revenue is a key indicator of financial stability and strong customer loyalty, providing excellent revenue visibility for future planning and investment.

IDOX's strategic acquisition of Emapsite and Plianz in 2024-2025 significantly bolsters its geospatial data and health and social care offerings. These moves have not only expanded its service portfolio but also injected substantial expertise and new avenues for growth, particularly within the burgeoning geospatial market. The company's robust M&A pipeline underscores its commitment to proactive market penetration and capability enhancement.

Robust Financial Performance and Cash Generation

IDOX has showcased impressive financial strength. For the full year of FY24, the company saw a notable 20% increase in revenue. This positive momentum continued into the first half of FY25, with revenue growing by an additional 4%.

The company's profitability also saw a healthy uptick. Adjusted EBITDA rose by 7% in FY24 and a further 6% in H1 FY25, underscoring efficient operations. Crucially, IDOX has significantly improved its cash generation capabilities, transitioning to a net cash position in H1 FY25.

- Robust Revenue Growth: 20% in FY24 and 4% in H1 FY25.

- Increased Profitability: 7% rise in Adjusted EBITDA for FY24 and 6% for H1 FY25.

- Strong Cash Generation: Achieved a net cash position in H1 FY25.

Diversified Service Offerings and Customer Base

IDOX's strength lies in its wide array of specialized software and services, catering to diverse sectors like grants management, elections, property data, and engineering. This broad reach, serving both public sector and asset-heavy industries, significantly mitigates the risk associated with over-dependence on any single market segment or product. Recent contract wins across different business units underscore this widespread appeal and the robustness of its diversified strategy.

The company's service diversification acts as a key competitive advantage, ensuring stability even when specific sectors face downturns. For instance, in the fiscal year ending March 31, 2024, IDOX reported a revenue of £273.3 million, with its Software and Services division demonstrating resilience. This breadth allows IDOX to capture opportunities across various economic cycles.

Key aspects of IDOX's diversified strengths include:

- Broad Sector Coverage: Operations span local government, utilities, and infrastructure, reducing single-sector dependency.

- Multiple Product Lines: Offerings include grants management, electoral services, property information, and engineering data solutions.

- Resilient Revenue Streams: Diversification supports consistent revenue generation, as seen in its FY24 performance.

- Cross-Sector Contract Wins: Recent successes in areas like land registry and environmental services highlight market penetration across its diverse portfolio.

IDOX plc's dominant position in the UK public sector, with over 90% of local authorities using its software, provides a significant competitive moat and a stable revenue foundation. This deep market penetration, coupled with a strong and growing recurring revenue base, which reached £54.5 million (62% of total revenue) in FY24 and grew to 66% in H1 FY25, underscores customer loyalty and predictable income streams.

Strategic acquisitions of Emapsite and Plianz in 2024-2025 have broadened IDOX's service offerings, particularly in geospatial data and health and social care, enhancing its growth potential and market reach. The company's financial performance is robust, with FY24 revenue up 20% and H1 FY25 revenue up 4%, alongside a 7% rise in Adjusted EBITDA for FY24 and 6% for H1 FY25, culminating in a net cash position in H1 FY25.

IDOX's diversified product portfolio, spanning grants management, electoral services, property data, and engineering solutions, mitigates sector-specific risks and ensures consistent revenue generation across various economic cycles. This broad appeal is evidenced by recent contract wins across its diverse business units, reinforcing its resilient revenue streams.

| Metric | FY24 | H1 FY25 |

|---|---|---|

| Total Revenue | £273.3 million | N/A |

| Recurring Revenue | £54.5 million (62%) | 66% of Total Revenue |

| Revenue Growth | 20% | 4% |

| Adjusted EBITDA Growth | 7% | 6% |

| Cash Position | N/A | Net Cash |

What is included in the product

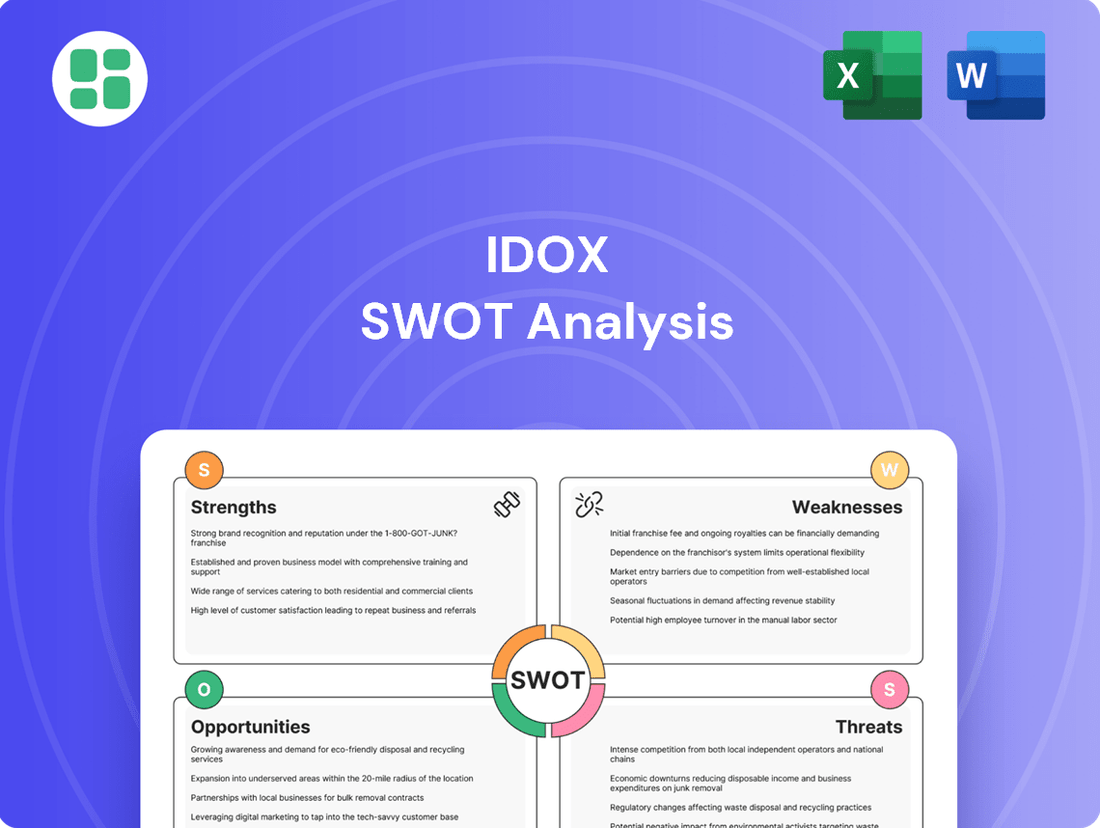

Analyzes IDOX’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework to identify and address strategic challenges, relieving the pain of uncertainty.

Weaknesses

IDOX's significant reliance on public sector spending, while a source of stability, also represents a considerable weakness. Government budgets are inherently susceptible to political shifts, austerity measures, and evolving policy priorities. For instance, a contraction in public sector IT or digital transformation budgets, which can occur with changes in government or economic downturns, could directly curtail IDOX's revenue streams and hinder its growth trajectory.

This dependency can also constrain IDOX's ability to pivot quickly towards opportunities in the private sector. While the company has diversified, its deep roots in public sector contracts mean that swift adaptation to rapidly changing private market demands might be more challenging compared to competitors less tied to government funding cycles. Fluctuations in public sector spending, as seen in periods of fiscal tightening, could therefore disproportionately affect IDOX's financial performance.

While acquisitions are a key growth driver for IDOX, they can introduce temporary margin dilution. For instance, the integration of Emapsite, acquired in 2023, likely involved upfront costs that could impact profitability ratios in the short term. Effectively realizing expected synergies from such deals is vital to mitigate any prolonged pressure on profit margins.

IDOX operates within a highly competitive software sector, contending with established players such as Kainos Group, Learning Technologies Group, and Cerillion. This dynamic environment necessitates constant innovation and aggressive pricing strategies to defend its market position.

While IDOX has carved out a strong presence in specific niches, the broader application software industry is characterized by rapid technological advancements and evolving customer demands. Failure to adapt quickly could result in a loss of market share.

The intense competition poses a significant risk, potentially leading to downward pressure on IDOX's pricing power or requiring substantial increases in research and development expenditure to stay ahead of rivals and maintain its competitive edge.

Sensitivity to Economic and Political Uncertainties

IDOX's reliance on government contracts and investment in asset-intensive sectors makes it susceptible to broader economic and political shifts. For instance, a slowdown in public sector spending, a key revenue driver, could directly impact the company's financial performance. While the company benefits from recurring revenue streams, prolonged periods of economic contraction or significant political instability, such as changes in regulatory frameworks or major infrastructure spending priorities, could present considerable challenges.

The company's exposure to these external factors necessitates robust risk management and strategic foresight. For example, a contraction in the UK construction sector, which is often influenced by government policy and economic sentiment, could indirectly affect IDOX's project pipeline. Staying attuned to geopolitical developments and economic forecasts is therefore crucial for navigating potential headwinds and ensuring continued growth.

- Economic Downturns: A recession could reduce government budgets for services IDOX provides.

- Political Instability: Changes in government or policy direction can alter demand for IDOX's solutions.

- Regulatory Changes: New regulations in sectors like environmental or infrastructure could impact project feasibility.

- Geopolitical Events: International conflicts or trade disputes might indirectly affect supply chains or investment climates relevant to IDOX's markets.

Dependence on Successful Integration of Acquisitions

IDOX's growth hinges significantly on its acquisition strategy, meaning the successful integration of these acquired businesses is paramount. If IDOX falters in merging new technologies, teams, and customer bases, it could result in operational disruptions, the departure of key talent, or alienated customers from acquired entities. This integration process is a continuous operational hurdle for the company.

For instance, during the fiscal year ending March 2024, IDOX completed several acquisitions. The challenge lies not just in the acquisition itself, but in realizing the projected synergies and ensuring smooth operational alignment. Historically, integration failures can manifest as:

- Reduced projected revenue growth from acquired entities.

- Increased operational costs due to duplicated systems or inefficient processes.

- Loss of key management or technical staff from acquired companies.

- Negative impact on customer retention for acquired businesses.

IDOX's substantial reliance on the public sector, while providing a stable base, also presents a significant weakness. Fluctuations in government spending due to political changes or economic pressures can directly impact revenue. For example, a reduction in public sector IT budgets, a common occurrence during fiscal austerity, could curtail IDOX's earnings. This dependency also makes rapid adaptation to private sector shifts more challenging, as seen when government funding cycles tighten.

The company's growth strategy heavily involves acquisitions, which can lead to temporary margin dilution. The integration of businesses like Emapsite in 2023, for instance, likely incurred upfront costs that could affect profitability in the short term. Successfully realizing synergies from these deals is crucial to avoid prolonged pressure on profit margins.

IDOX faces intense competition in the software market from established players. This necessitates continuous innovation and competitive pricing to maintain market share. Failure to adapt to rapid technological advancements could lead to a loss of market position, requiring increased R&D spending to stay ahead.

The company's vulnerability to economic and political shifts is a key weakness. A slowdown in public sector spending, a primary revenue source, could significantly impact financial performance. Prolonged economic contraction or political instability, such as changes in regulatory frameworks, poses considerable challenges to IDOX's operations and growth prospects.

| Weakness Area | Description | Impact Example (2023/2024) | Mitigation Strategy |

|---|---|---|---|

| Public Sector Reliance | High dependence on government spending cycles. | Potential budget cuts in local government digital transformation projects. | Diversification into private sector markets and recurring revenue models. |

| Acquisition Integration | Risk of margin dilution and integration challenges. | Initial costs associated with integrating acquired entities impacting short-term profitability. | Focus on post-acquisition synergy realization and operational alignment. |

| Intense Competition | Operating in a highly competitive software landscape. | Pressure on pricing and need for continuous R&D investment. | Product differentiation and strategic partnerships. |

| Economic & Political Sensitivity | Susceptibility to broader economic and political shifts. | Impact of austerity measures on public sector contracts. | Robust risk management and strategic foresight on policy changes. |

Same Document Delivered

IDOX SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual IDOX SWOT analysis, ensuring transparency and quality. Once purchased, you'll gain access to the complete, in-depth report.

Opportunities

IDOX has strategically bolstered its geospatial data offerings, notably through the acquisition of Emapsite and ongoing investment. This focus is yielding tangible results, with recent new contract wins underscoring the sector's growth potential.

The company is well-positioned to capitalize on this expanding market, with further development of its geospatial capabilities expected to unlock significant new revenue streams and access to previously untapped market segments.

The increasing reliance on cloud-based solutions presents a significant opportunity for IDOX, especially within its Land, Property & Public Protection (LPPP) division. Idox Cloud has already demonstrated robust growth, reflecting strong market demand.

The ongoing digital transformation across the public sector and asset-heavy industries is a key driver. This trend provides a clear path to migrate existing clients to IDOX's cloud platforms and to onboard new customers seeking enhanced efficiency and scalability.

IDOX possesses a robust mergers and acquisitions pipeline, bolstered by enhanced banking facilities. This financial strength positions the company to pursue larger, value-adding acquisitions that can significantly boost its technological capabilities and market presence.

This strategic approach enables IDOX to swiftly broaden its market reach, diversify its offerings, and integrate new technologies or intellectual property. For instance, the acquisition of Plianz in the health and social care sector in 2024 exemplifies this strategy, contributing to substantial growth.

Modernization of Electoral Services

The increasing complexity of electoral administration presents a prime opportunity for technological modernization. IDOX is well-positioned to capitalize on this trend, leveraging its established expertise and recent contract wins, like the five-year agreement in Malta, to deliver secure and efficient digital election management solutions. This includes expanding its eCounting capabilities to meet evolving needs.

Key opportunities in modernizing electoral services include:

- Digital Transformation: Implementing advanced digital platforms for voter registration, ballot management, and results tabulation to enhance efficiency and accessibility.

- Enhanced Security: Developing and deploying robust cybersecurity measures for electoral systems, ensuring the integrity and trustworthiness of the voting process.

- eCounting Solutions: Further innovation and expansion of electronic counting systems, potentially reducing processing times and improving accuracy in vote tallying.

- Global Reach: Expanding service offerings to international markets seeking to upgrade their electoral infrastructure, building on existing successes like the Malta contract.

Growth in International Markets

While IDOX has a strong UK presence, its expertise in areas like engineering information management has clear global appeal. The company's recent contract win in Malta and the ongoing expansion of its Indian operations highlight significant opportunities for international growth. This geographic diversification could effectively mitigate risks associated with over-reliance on any single market, paving the way for new revenue streams and enhanced long-term stability.

- Global Applicability: IDOX's core services, particularly in managing complex engineering information, are transferable to international markets.

- Proven International Traction: Recent contract wins, such as in Malta, and the sustained growth of operations in India demonstrate IDOX's capability to secure and expand in overseas markets.

- Risk Mitigation and Diversification: Expanding internationally reduces dependency on the UK market, offering a more resilient business model.

- New Growth Avenues: International expansion opens up access to different customer bases and emerging markets, potentially driving substantial revenue growth. For example, the Indian market, with its rapidly developing infrastructure sector, presents a considerable opportunity for IDOX's specialized solutions.

IDOX's strategic focus on geospatial data, amplified by acquisitions like Emapsite, is a significant growth avenue, evidenced by recent contract wins. The company's cloud offerings, particularly within the LPPP division, are experiencing robust demand, aligning with widespread digital transformation trends in public and industrial sectors. Furthermore, IDOX's active M&A pipeline, supported by strengthened financial facilities, presents a clear opportunity to acquire complementary technologies and expand market share, as demonstrated by the 2024 Plianz acquisition in health and social care.

The increasing need for modernized electoral administration offers IDOX a prime opportunity to leverage its expertise, as seen in its Malta contract, to provide advanced digital solutions for voter management and vote counting. Global expansion is also a key opportunity, with successful operations in India and the Malta contract highlighting the international applicability of its engineering information management services and the potential for diversification.

| Opportunity Area | Key Drivers | IDOX's Position |

|---|---|---|

| Geospatial Data Expansion | Increased demand for location-based intelligence, acquisition of Emapsite | Bolstered offerings, recent contract wins |

| Cloud Solutions Growth | Digital transformation in public sector and asset-heavy industries | Strong performance of Idox Cloud, migration opportunities |

| Strategic Acquisitions | Robust M&A pipeline, enhanced banking facilities | Potential for acquiring new technologies and market reach |

| Electoral Modernization | Need for digital transformation in elections | Expertise, Malta contract, eCounting expansion |

| International Market Entry | Global appeal of engineering information management | Success in India, Malta contract, risk diversification |

Threats

The software sector is notoriously fast-paced, with both long-standing players and new ventures consistently pushing boundaries through innovation. This dynamic landscape means IDOX faces a constant threat from rivals who might introduce more affordable or sophisticated solutions, potentially eroding IDOX's market share and ability to set prices.

Emerging disruptive technologies or agile startups entering the market with compelling value propositions represent a significant challenge. For instance, the rise of AI-powered document management systems could offer advanced features at a lower cost, directly impacting IDOX's existing product lines and revenue streams. Staying competitive requires substantial and ongoing investment in research and development to anticipate and integrate these technological shifts effectively.

IDOX, as a provider of information management software, particularly to government entities, faces substantial cybersecurity threats. A data breach or system outage could result in significant reputational harm, hefty fines, and a loss of client confidence.

The increasing sophistication of cyberattacks means that even well-defended systems can be vulnerable. For instance, in 2023, the UK public sector experienced a significant rise in cyber incidents, with reports indicating a 40% increase in ransomware attacks targeting local government bodies, a key client base for IDOX.

Maintaining stringent cybersecurity protocols and adhering to evolving data protection laws like GDPR is therefore critical for IDOX's continued success and client retention. Failure to do so could expose the company to substantial financial liabilities and operational disruptions.

Economic downturns and government austerity measures pose a significant threat to IDOX. For instance, during the COVID-19 pandemic's initial impact in early 2020, many public sector projects faced delays or cancellations as governments reallocated resources. This could recur if a broader economic slowdown in 2024 or 2025 leads to reduced public spending, directly impacting IDOX's revenue streams, particularly from its substantial public sector client base.

Talent Acquisition and Retention Challenges

The technology sector, including companies like IDOX, faces intense competition for skilled professionals, especially in high-demand fields such as software engineering and data analytics. This makes it difficult to attract and keep the best people. For instance, in the UK, the average tech salary rose by 8.5% in 2024, reflecting this competitive pressure.

IDOX's ability to innovate and successfully deliver projects could be hampered if it struggles to acquire and retain top talent. This talent shortage can lead to increased recruitment costs and potentially longer project timelines, impacting overall efficiency and market responsiveness.

- High demand for specialized skills: Areas like AI, cloud computing, and cybersecurity are particularly competitive.

- Increased operational costs: Higher salaries and benefits may be necessary to attract and retain talent, impacting profit margins.

- Risk of project delays: A lack of skilled personnel can slow down development cycles and project execution.

- Impact on innovation: Without a strong talent pipeline, IDOX may struggle to develop new solutions and stay ahead of competitors.

Technological Obsolescence and Rapid Innovation Cycles

The software industry is characterized by incredibly fast technological shifts, meaning IDOX's solutions could quickly fall behind if not consistently updated. For instance, the burgeoning field of generative AI is rapidly reshaping customer engagement and data analysis capabilities across sectors. Failure to invest in R&D, potentially missing out on advancements like AI integration or enhanced data analytics, could make IDOX's current offerings less appealing compared to competitors who are embracing these new standards.

This constant evolution necessitates a proactive approach to innovation. Companies in this space often dedicate significant portions of their revenue to R&D to stay ahead; for example, many leading SaaS providers aim for 10-15% of revenue reinvested in R&D. IDOX must ensure its development pipeline is robust enough to incorporate emerging technologies and maintain a competitive edge in the rapidly changing digital landscape.

Key considerations for IDOX include:

- AI Integration: Assessing how AI can enhance existing products or create new service offerings.

- Data Analytics: Ensuring robust and scalable data analytics capabilities are built into solutions.

- Cloud Adoption: Maintaining modern, cloud-native architectures to support rapid deployment and updates.

- Cybersecurity: Continuously updating security protocols to counter evolving threats as technology advances.

IDOX faces significant competition from agile startups and established players introducing more advanced or cost-effective solutions, potentially impacting market share and pricing power. The rapid pace of technological change, particularly with advancements like generative AI, requires continuous R&D investment to prevent offerings from becoming obsolete.

Cybersecurity threats remain a critical concern, with a notable increase in attacks on UK public sector bodies in 2023, a key client segment for IDOX. Economic downturns and government austerity measures could also lead to reduced public spending, directly affecting revenue. Furthermore, the intense competition for skilled tech talent, with UK tech salaries rising by an average of 8.5% in 2024, increases operational costs and risks project delays.

SWOT Analysis Data Sources

This IDOX SWOT analysis is built upon a robust foundation of data, drawing from official company financial filings, comprehensive market research reports, and expert industry commentary to ensure a thorough and accurate assessment.