IDOX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDOX Bundle

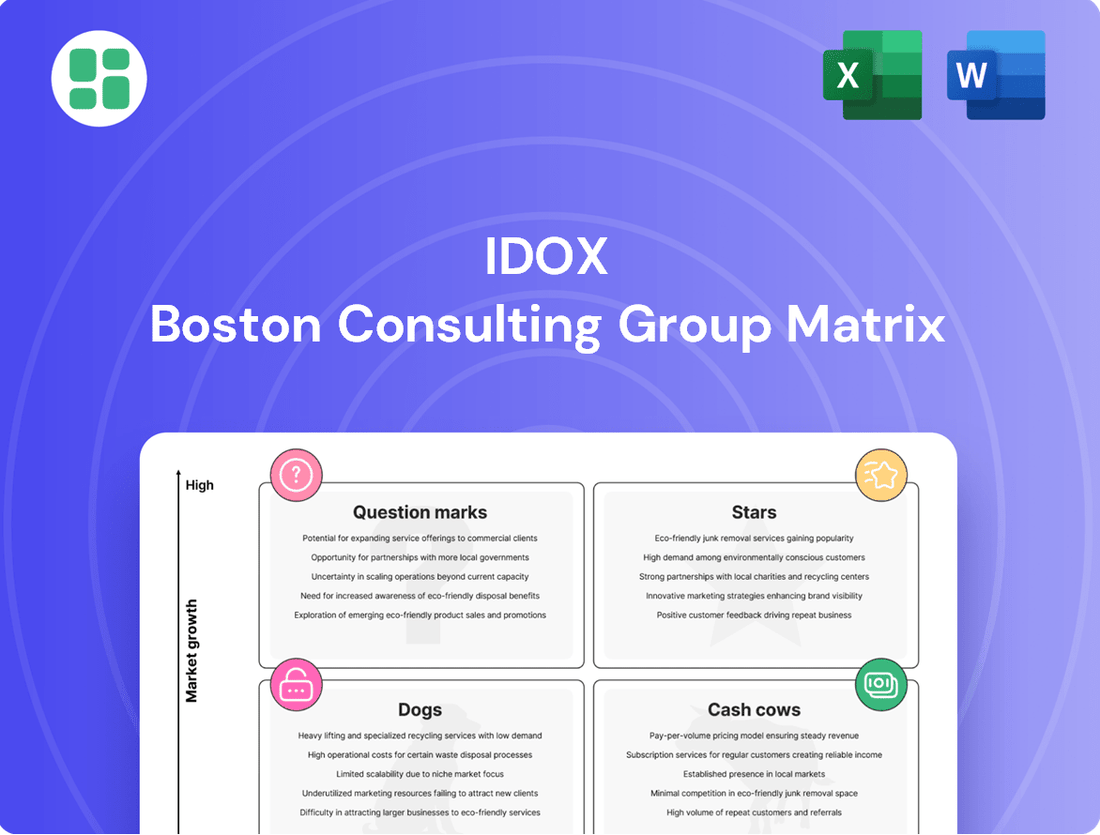

Unlock the strategic potential of your product portfolio with the IDOX BCG Matrix. This powerful framework categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual of their market performance and growth prospects. Don't miss out on the critical insights that will drive your investment decisions and shape your future success.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

IDOX's Geospatial Data Solutions are a prime example of a Star in the BCG Matrix. The company's strategic acquisition of Emapsite in 2023 significantly enhanced its offerings in this high-growth sector. This expansion is a clear indicator of IDOX's strong market position and its belief in substantial future returns from geospatial data.

Further solidifying its commitment, IDOX established a new office in Farnborough specifically to support its expanding geospatial operations. This investment underscores the company's confidence in the sector's potential and its strategic focus on this area for continued growth and market leadership.

Cloud-Based Public Sector Solutions represent a significant growth area for IDOX, aligning with their strategy to boost recurring revenue. The company has experienced robust expansion in its cloud offerings within the Local Government and LPPP divisions.

The public sector's increasing adoption of cloud technology fuels this high-growth market. IDOX's early investment and success in securing customer wins for these solutions underscore their leadership position.

Demand for IDOX's cloud-based solutions remains strong, as these are essential for modernizing public services and improving efficiency. This segment is a key driver of IDOX's overall growth strategy.

IDOX's commitment to modernizing electoral services, exemplified by its Eros Cloud platform, targets a sector ripe for digital transformation. This focus on cloud-based, secure, and accessible solutions addresses a critical public need, positioning the company for significant growth within a market that demands continuous technological advancement.

The electoral services sector, while seemingly established, is experiencing a strong push towards digital solutions, making IDOX's advanced offerings strong contenders for high market share and rapid expansion. This segment represents a potential star in the BCG matrix due to the ongoing need for efficiency and enhanced security in democratic processes.

A clear indicator of this strength is the recent five-year contract renewal for electoral services in Malta, demonstrating sustained demand and successful implementation of IDOX's capabilities. This contract underscores the company's ability to secure long-term partnerships in a vital public service area.

Health and Social Care Software (Post-Plianz Acquisition)

The acquisition of Plianz in May 2025 positions IDOX’s Health and Social Care Software as a significant player in a rapidly expanding sector. This strategic move bolsters IDOX's existing social care capabilities, marking a clear expansion into a market fueled by escalating demand.

IDOX likely views this as an opportunity to rapidly increase its market share by integrating Plianz's established solutions into its wider public sector offerings. The health and social care software market is projected to grow substantially, with some reports indicating a compound annual growth rate (CAGR) exceeding 15% in the coming years, driven by digital transformation initiatives and an aging population.

- Market Position: Strengthened by the Plianz acquisition, IDOX is now better equipped to compete in the burgeoning health and social care software market.

- Growth Potential: The sector's high growth trajectory, estimated to reach billions globally by 2028, presents significant revenue and market share expansion opportunities for IDOX.

- Strategic Integration: Leveraging Plianz's technology and customer base allows IDOX to offer a more comprehensive suite of solutions to public sector clients, potentially increasing cross-selling opportunities.

Integrated Information Management for Local Government

IDOX's integrated information management solutions are a significant contributor to local government operations, especially within the Land, Property & Public Protection (LPPP) sector. This segment demonstrates robust and consistent revenue growth, reflecting the ongoing need for efficient digital processes in councils.

The company's strong market position is further solidified by the accelerating digital transformation initiatives in local authorities. A record order intake in 2024, including a notable contract with North Yorkshire Council, underscores IDOX's success in a high-growth market where it commands a substantial share.

- Consistent Revenue Growth: IDOX's LPPP division consistently drives revenue, showcasing the demand for their information management tools.

- Digital Transformation Driver: The ongoing digital shift within local councils directly benefits IDOX, as they provide essential solutions.

- Strong Market Share: IDOX holds a significant position in the high-growth market for local government information management.

- Record Order Intake: 2024 saw a surge in new and existing customer orders, highlighting market confidence and expansion.

Stars in the BCG Matrix represent business units with high market share in a high-growth industry. IDOX's Geospatial Data Solutions, Cloud-Based Public Sector Solutions, Electoral Services, Health and Social Care Software, and Integrated Information Management Solutions for LPPP all exhibit characteristics of Stars. These segments benefit from strong market demand, IDOX's strategic investments, and successful customer acquisition, positioning them for continued growth and market leadership.

| Business Unit | Market Growth | Market Share | Key Drivers | Recent Performance Indicator |

|---|---|---|---|---|

| Geospatial Data Solutions | High | High | Acquisition of Emapsite, new Farnborough office | Enhanced offerings, strong market position |

| Cloud-Based Public Sector Solutions | High | High | Digital transformation in local government, recurring revenue focus | Robust expansion in cloud offerings |

| Electoral Services | High | High | Digital transformation push, need for efficiency and security | Five-year contract renewal in Malta |

| Health and Social Care Software | High | Growing | Acquisition of Plianz, aging population, digital transformation | Bolstered capabilities, significant market expansion |

| Integrated Information Management (LPPP) | High | High | Accelerating digital transformation in local authorities | Record order intake in 2024, North Yorkshire Council contract |

What is included in the product

The IDOX BCG Matrix provides a strategic framework for analyzing a company's product portfolio, categorizing business units into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment decisions.

IDOX BCG Matrix offers a clear, quadrant-based view to prioritize resources, alleviating the pain of unclear strategic direction.

Cash Cows

The Core Land, Property & Public Protection (LPPP) software division stands as IDOX's primary revenue generator, capturing a substantial 66% of the company's total revenue in the first half of fiscal year 2025. This segment offers specialized information management solutions to both public and private sectors, reflecting its position in a mature market where IDOX has a well-established presence.

This consistent, though moderate, growth, coupled with the stable recurring revenue streams inherent in LPPP's offerings, firmly establishes it as a cash cow for IDOX. Its significant cash flow generation underscores its maturity and strong market standing.

IDOX's Assets division, featuring its established Engineering Information Management (EIM) solutions, acts as a significant cash cow. These offerings are vital for asset-intensive sectors, ensuring a steady stream of income for the Group.

While growth in this segment has been relatively stable, often described as broadly flat in certain periods, it remains a cornerstone of IDOX's financial health. The consistent contribution from EIM solutions fuels strong cash generation, underpinning the company's overall performance.

The critical nature of these EIM solutions for clients translates into high customer retention rates. This predictability, coupled with the maturity of the industry, creates reliable and recurring revenue streams, reinforcing its cash cow status.

IDOX's legacy public sector software systems, especially those still on older infrastructure, are prime examples of cash cows. These established solutions benefit from deep market penetration and substantial customer loyalty, often cemented by the significant switching costs inherent in government IT environments. For instance, IDOX reported in their 2024 annual results that their Public Sector division continues to be a stable revenue generator.

Grants Management Software

IDOX's grants management software serves a crucial, albeit mature, niche within the public sector. This segment is characterized by stable demand for solutions that streamline the often complex and regulated process of grant allocation and administration.

While specific growth rates for IDOX's grants management division are not publicly detailed, the market itself is considered established. This suggests that IDOX's offerings are likely cash cows, generating consistent revenue with high profit margins due to their proven functionality and the sticky nature of government contracts.

- Mature Market: The grants management sector typically exhibits low single-digit growth, reflecting established processes and regulatory frameworks.

- Stable Revenue: Public sector reliance on these systems ensures a predictable revenue stream for IDOX.

- High Margins: Established software solutions in this space often command strong margins due to specialized functionality and integration.

- Market Share: IDOX's long-standing presence suggests a significant and stable market share in this segment.

Information and Document Management Systems

IDOX's core information and document management systems are firmly established within local government and other sectors. These mature offerings are deeply integrated into client workflows, acting as stable revenue streams.

While not experiencing explosive growth, these products command significant market share. The recurring revenue from support and maintenance contracts solidifies their position as reliable cash cows for IDOX.

- Mature Product Line: Deeply embedded in client operations, ensuring stability.

- High Market Share: Dominant presence in its niche markets.

- Recurring Revenue: Significant income from support and maintenance agreements.

- Cash Generation: Reliable profit generators for the company.

The Core Land, Property & Public Protection (LPPP) software division, IDOX's largest revenue contributor, generated 66% of the company's total revenue in the first half of fiscal year 2025. This segment, offering specialized information management solutions, operates in a mature market where IDOX holds a strong, established position. Its consistent, though moderate, growth and stable recurring revenue streams solidify its role as a significant cash cow, underpinning IDOX's financial health with substantial cash flow generation.

IDOX's Assets division, centered on its Engineering Information Management (EIM) solutions, is another key cash cow. These solutions are critical for asset-intensive industries, providing a dependable income stream. While growth in this area has been stable, often described as broadly flat, the consistent contribution from EIM solutions fuels strong cash generation, making it a cornerstone of IDOX's overall performance. High customer retention rates due to the critical nature of these solutions, combined with industry maturity, create predictable and recurring revenue, reinforcing its cash cow status.

Legacy public sector software systems, particularly those on older infrastructure, represent prime examples of IDOX's cash cows. These established solutions benefit from deep market penetration and significant customer loyalty, often reinforced by high switching costs within government IT environments. IDOX's 2024 annual results highlighted the Public Sector division's continued role as a stable revenue generator.

| Division | Key Offerings | Role in IDOX | Revenue Contribution (H1 FY25) | Market Characteristics |

|---|---|---|---|---|

| LPPP Software | Information Management Solutions | Primary Revenue Generator | 66% | Mature Market, Established Presence |

| Assets (EIM) | Engineering Information Management | Significant Cash Cow | N/A (Stable Contribution) | Mature Market, High Retention |

| Public Sector Legacy Systems | Various Software Systems | Established Cash Cow | N/A (Stable Revenue) | Mature Market, High Switching Costs |

Full Transparency, Always

IDOX BCG Matrix

The IDOX BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete, analysis-ready strategic tool. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix you'll obtain for your business planning and decision-making processes. It's designed for immediate application, allowing you to leverage its insights without any further editing or preparation.

Dogs

Outdated on-premise software deployments with declining customer bases are classic examples of "Dogs" in the BCG matrix. These legacy systems, often lacking significant updates or cloud migration paths, are seeing their user numbers dwindle. For instance, a significant portion of the enterprise software market still relies on older versions, but the trend is clearly shifting towards SaaS models, making these on-premise solutions increasingly niche.

These products typically generate very little new revenue and demand ongoing maintenance costs without any real growth potential. In 2024, many software companies are actively divesting or phasing out such offerings to reallocate resources to more promising cloud-based or subscription services. The challenge lies in managing the decline while minimizing resource drain.

Software products targeting extremely specialized industries, like custom-built solutions for a handful of museums, often find themselves in this category. These offerings, while potentially profitable for a select few, struggle to expand their customer base. For instance, a niche accounting software designed solely for artisanal cheese makers might have only a few hundred potential clients globally, limiting revenue growth.

These niche solutions, characterized by their limited scalability, can exhibit stagnant adoption rates. In 2024, many such specialized software providers reported less than 5% year-over-year revenue growth, a stark contrast to the broader SaaS market which saw average growth exceeding 15%. This lack of expansion often means low market share within any accessible market segment.

Companies with such products must carefully evaluate their strategic alignment. If a niche solution does not offer significant cross-selling potential to core business offerings or if its development costs outweigh its current and projected returns, divestiture or discontinuation becomes a viable consideration. For example, a company might decide to sunset a legacy data analysis tool for a defunct scientific field if it consumes disproportionate R&D resources.

Underperforming acquired products that haven't been integrated effectively into IDOX's core business can be classified as Dogs in the BCG Matrix. These products, despite representing past strategic investments, may struggle to gain traction or contribute meaningfully to growth.

For instance, if an acquired software solution, like a niche data analytics tool purchased in 2023 for £5 million, fails to achieve its projected 15% market share within its first two years or shows declining revenue, it could be categorized as a Dog. Such a product would likely consume valuable resources in terms of development, marketing, and support without generating the expected return on investment.

The risk is that these underperforming assets can become a financial drain, diverting capital and management attention away from more promising opportunities within IDOX's portfolio. By 2024, if these products continue to show negative cash flow or negligible market growth, they would solidify their position as Dogs, necessitating a strategic review of their future within the company.

Solutions in Highly Fragmented or Commoditized Markets

Products operating in highly fragmented or commoditized markets, like basic document management software facing numerous low-cost competitors, would likely fall into the Dogs category of the IDOX BCG Matrix. These offerings typically struggle to differentiate themselves, leading to intense price competition and thin profit margins. For instance, in 2024, the global document management market, while growing, is characterized by a vast number of providers, many offering entry-level solutions at very low price points, making it difficult for any single player to capture substantial market share without significant innovation or a unique value proposition.

Companies with IDOX offerings in these segments would face considerable challenges in achieving significant growth or profitability. The commoditized nature means that technology advancements are often incremental and quickly adopted by competitors, negating any early-mover advantage. This often results in a cyclical demand pattern heavily influenced by price rather than features. Data from 2024 indicates that while the broader digital transformation trend fuels demand for document solutions, the lower-end of the market remains highly price-sensitive, impacting average revenue per user.

- Intense Price Pressure: Competitors often engage in price wars, eroding profit margins for all players.

- Low Differentiation: Products offer similar features, making it hard to stand out.

- Limited Growth Potential: Market saturation and lack of innovation restrict expansion opportunities.

- Low Profitability: High competition and price sensitivity lead to reduced earnings.

Non-Recurring Revenue Streams from One-Off Projects

While IDOX focuses on building recurring revenue, significant income from one-off projects that don't foster ongoing contracts can be viewed as 'Dog' components within a BCG matrix framework. These projects, though generating immediate cash, lack the potential for sustained market share or predictable future growth, necessitating constant new business development.

Such non-recurring revenue streams, often tied to specific project implementations, might represent opportunities that are not strategically aligned for long-term growth. For instance, a large, one-time software implementation without a subsequent support or maintenance agreement would fall into this category. This contrasts with IDOX's stated goal of achieving a higher proportion of recurring revenue, which contributes to greater business stability and valuation.

- Non-Recurring Revenue Impact: Projects that generate substantial revenue but don't lead to follow-on contracts or recurring service agreements can be classified as 'Dogs'.

- Strategic Value: These one-off projects contribute to immediate financial performance but do not build sustainable market share or predictable future revenue streams.

- Client Acquisition Effort: Reliance on such projects necessitates continuous efforts to acquire new clients, as they do not inherently foster customer retention or expansion.

Dogs represent products or business units with low market share in low-growth markets. These offerings typically generate minimal profits and may even incur losses, draining resources that could be better allocated elsewhere. For example, in 2024, many companies are divesting legacy software systems that have been superseded by more modern, cloud-based solutions, as these older products often have declining user bases and limited revenue potential.

These products are characterized by their inability to compete effectively, often due to outdated technology or intense competition. A software solution designed for a niche industry with few potential customers, or a product in a commoditized market facing aggressive price wars, would likely fall into this category. In 2024, the average revenue growth for such products was reported to be below 5%, significantly lagging behind market leaders.

| Product/Business Unit | Market Share | Market Growth | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy On-Premise Software | Low | Low | Low/Negative | Divest or Phase Out |

| Niche Industry Software (Limited Scalability) | Low | Low | Low | Evaluate for Divestment or Niche Focus |

| Underperforming Acquired Products | Low | Low | Low/Negative | Divest or Restructure |

| Commoditized Market Offerings | Low | Low | Low | Consider Divestment or Significant Differentiation |

Question Marks

The acquisition of Plianz in May 2025, a health and social care software provider, positions these solutions as potential Question Marks within the IDOX BCG Matrix.

While the global health and social care IT market is projected to reach approximately $100 billion by 2027, IDOX's current market share in this specific niche is relatively small. This means the newly acquired Plianz solutions require substantial investment and strategic focus to capture a larger market presence and transition from a Question Mark to a Star.

IDOX is expanding its geospatial expertise into promising new sectors, notably telecommunications with clients like Vodafone. This strategic pivot taps into high-growth private sector markets, allowing IDOX to establish and grow its market share in these emerging areas.

These new applications in telecoms, for instance, are crucial for network planning, site optimization, and customer analysis, representing significant revenue potential. IDOX's success with Vodafone in 2024 underscores the increasing demand for sophisticated geospatial solutions in the private sector.

To fully leverage these nascent opportunities and mature them into Stars within the IDOX BCG Matrix, substantial investment in technology and talent is essential. This will enable the scaling of these offerings and solidify IDOX's competitive advantage in these dynamic new markets.

IDOX's strategic development of advanced cloud and SaaS solutions targeting underserved public sector niches represents a calculated move into potential "Question Marks" within the BCG matrix. These specialized offerings, designed for areas with high cloud adoption demand but where IDOX currently lacks significant market penetration, necessitate substantial investment in marketing and sales to capture early adopters.

For instance, IDOX's recent expansion into cloud-based solutions for specialized local government functions, such as digital planning permits or environmental compliance tracking, exemplifies this strategy. While the market for these specific digital services is growing rapidly, with some reports indicating a 20% year-over-year increase in cloud migration for public sector administrative tasks in the UK as of late 2024, IDOX's market share in these particular niches is still nascent.

Securing a dominant position in these emerging public sector cloud niches will require aggressive outreach and a clear demonstration of value to potential clients. This means IDOX must actively engage with these segments, perhaps through pilot programs or targeted digital marketing campaigns, to build brand awareness and establish a foothold before competitors fully capitalize on the demand.

AI and Data Analytics Integrations within Existing Products

IDOX is actively integrating AI and data analytics into its existing product suite, aiming to provide clients with deeper insights and more informed decision-making. This push into advanced capabilities for new applications and feature enhancements is a key growth driver.

While the market for these cutting-edge AI-driven features is expanding rapidly, IDOX's specific market penetration and adoption rates are still in their formative stages, necessitating continued investment to capture market share.

- Focus on Data-Driven Insights: IDOX prioritizes leveraging data to improve client decision-making processes.

- High-Growth Potential: Integrating AI and advanced data analytics into existing software for new or enhanced functionalities represents a significant growth avenue.

- Developing Market Adoption: Market uptake for these advanced features is still evolving, indicating a need for ongoing investment.

- Strategic Investment Required: IDOX's position in these nascent, high-potential areas requires further capital allocation to solidify its market presence.

International Expansion Initiatives for Core Products

IDOX's proven success within the UK market, evidenced by consistent revenue growth and a robust financial standing, presents a compelling case for international expansion of its core products. While specific 2024 international revenue figures are not yet fully reported, the company has historically secured contracts in new territories, such as Malta, demonstrating a capability to extend its reach.

These international ventures, while starting with a low initial market share in new geographies, are strategically positioned as Stars within the BCG matrix. This classification acknowledges the significant growth potential inherent in introducing established, high-performing products to untapped markets. The objective is to leverage existing product strength to capture market share and drive future revenue streams.

- Strategic Focus: Expanding proven UK core products into new international markets.

- Market Position: Initially low market share in new geographies, characteristic of a Star.

- Growth Potential: High potential for market share capture and revenue growth if expansion is successful.

- Example: Securing contracts in locations like Malta demonstrates existing international penetration capabilities.

Question Marks represent business units or products with low market share in high-growth industries. For IDOX, these are often new ventures or acquisitions where significant investment is needed to gain traction.

The key challenge for Question Marks is to determine whether to invest heavily to increase market share or divest if the potential is not realized.

IDOX's expansion into new software niches and the integration of AI into existing platforms are prime examples of Question Marks, requiring strategic capital allocation to capitalize on their high-growth potential.

The success of these Question Marks hinges on IDOX's ability to effectively market, sell, and develop these offerings to compete in rapidly evolving markets.

| Product/Service Area | Market Growth | Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Health & Social Care Software (Plianz) | High | Low | Question Mark | Requires significant investment to increase market share. |

| Geospatial Solutions for Telecoms | High | Emerging/Low | Question Mark | Investment needed to establish strong market presence. |

| Specialized Cloud Solutions (Local Gov) | High | Nascent | Question Mark | Aggressive marketing and sales required for adoption. |

| AI/Data Analytics Features | High | Formative | Question Mark | Ongoing investment to drive market penetration. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.