IDOX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDOX Bundle

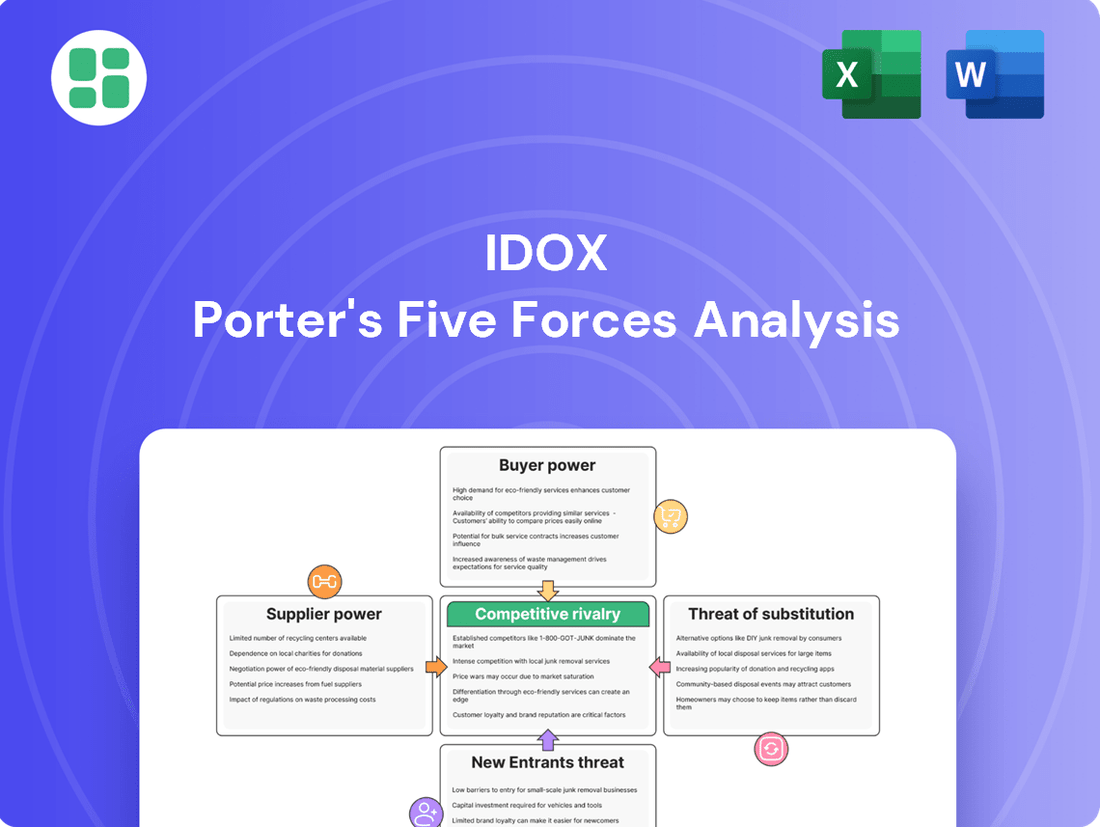

Understanding the competitive landscape is crucial for any business, and IDOX is no exception. Our Porter's Five Forces analysis delves into the core dynamics shaping its market, revealing the interplay of buyer power, supplier leverage, and the threat of substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IDOX’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of highly skilled software developers, especially those with deep knowledge of public sector regulations and asset-intensive industries, is a critical factor for IDOX. A restricted supply of these specialized professionals directly translates into higher salary expectations and increased recruitment expenses for IDOX, thereby amplifying the bargaining power of these individuals.

This scarcity of specialized talent can impede IDOX's capacity for innovation and efficient operational expansion. For instance, in 2024, the global shortage of cybersecurity experts, a field often requiring specialized public sector knowledge, saw average salaries rise by an estimated 15% year-over-year, illustrating the financial pressure such talent gaps create.

IDOX's increasing reliance on major cloud infrastructure providers like Amazon Web Services (AWS) and Microsoft Azure for hosting its software solutions presents a potential area of supplier bargaining power. This dependence, common in the tech industry, means that changes in pricing or service terms by these providers could directly impact IDOX's operational costs and capabilities.

The trend towards cloud-first strategies, particularly within the public sector where IDOX operates significantly, amplifies this reliance. As of late 2023 and into 2024, cloud spending by governments globally has continued to rise, with many public sector organizations mandating cloud-based solutions. This widespread adoption limits IDOX's flexibility in switching providers without incurring substantial transition costs and potential service disruptions, thereby strengthening the leverage of dominant cloud suppliers.

The bargaining power of suppliers for IDOX's third-party software components and data is a key consideration. If IDOX relies on proprietary software components or specialized data services from a limited number of providers, these suppliers can wield significant influence. This power often manifests through their ability to dictate licensing fees, negotiate contractual terms, and control the release and availability of updates and critical patches.

The strategic acquisition of Emapsite by IDOX in 2020, for instance, significantly bolstered its geospatial data offerings. This move underscores the intrinsic value and potential supplier power associated with such specialized data. Should these data sources become concentrated among fewer providers or require exclusive licensing, IDOX could face increased costs or operational dependencies, impacting its overall cost structure and service delivery.

Intellectual Property and Licensing

Suppliers who possess critical intellectual property, such as patents for unique software functionalities, can exert significant bargaining power over IDOX. This allows them to potentially charge higher licensing fees or impose stringent usage terms, especially in specialized software markets where proprietary algorithms are key. For example, in 2024, companies in the specialized data analytics sector saw licensing costs increase by an average of 8% due to patented advancements.

IDOX's ability to secure uninterrupted service delivery hinges on its strategic navigation of these intellectual property landscapes. Failure to manage these relationships effectively could lead to increased operational costs or disruptions if key software components are suddenly subject to new licensing restrictions or price hikes. This is a crucial consideration for maintaining the integrity and cost-effectiveness of IDOX's service offerings.

- Patented Software Functionalities: Suppliers holding patents for core software elements used by IDOX can dictate terms.

- Niche Market Relevance: This power is amplified in specialized software markets with unique, patented technologies.

- Licensing Fee Impact: Increased licensing fees directly affect IDOX's cost of goods sold and profit margins.

- Service Delivery Risk: Restrictions or price changes can jeopardize the continuity and affordability of IDOX's services.

Hardware and Generic IT Services

For IDOX, the suppliers of generic hardware, office software, and standard IT services exert a baseline level of bargaining power. While not as significant as specialized talent or critical data, these vendors can still influence costs and availability. The commoditized nature of these products, however, generally limits their leverage, as IDOX can often source these from a competitive market.

The bargaining power of suppliers in the hardware and generic IT services sector for a company like IDOX is relatively low. This is primarily due to the widespread availability and standardization of these offerings. For instance, in 2024, the global IT hardware market saw continued competition among major manufacturers, leading to stable pricing for many standard components. Similarly, the market for general office productivity software remains dominated by a few large players, but the availability of alternative solutions and subscription models provides customers with options.

- Low Bargaining Power: Generic hardware and standard IT services are largely commoditized, meaning many suppliers offer similar products and services.

- Competitive Market: The presence of numerous vendors in these sectors allows IDOX to switch suppliers if pricing or terms become unfavorable.

- Cost Sensitivity: While essential, the cost of these generic IT inputs is a smaller portion of IDOX's overall operational expenses compared to specialized software or talent.

- Vendor Consolidation Impact: Any significant consolidation among suppliers of generic IT could potentially increase their bargaining power in the future, though this is not the current dominant trend.

Suppliers of specialized software components and critical data can exert significant bargaining power over IDOX. This leverage stems from proprietary intellectual property, such as patents for unique functionalities, which can lead to higher licensing fees and stringent usage terms. In 2024, the specialized data analytics sector saw an average 8% increase in licensing costs due to patented advancements, directly impacting companies like IDOX.

The increasing reliance on major cloud infrastructure providers, like AWS and Microsoft Azure, also amplifies supplier power. As public sector organizations, a key market for IDOX, continue to adopt cloud-first strategies, their demand for these services grows. Global government cloud spending saw continued increases into 2024, limiting IDOX's flexibility and increasing switching costs, thereby strengthening the position of dominant cloud suppliers.

| Supplier Type | Bargaining Power Level | Key Factors | 2024 Impact Example |

|---|---|---|---|

| Specialized Software/Data Providers | High | Proprietary IP, Patents, Niche Market | 8% increase in licensing costs (Data Analytics) |

| Cloud Infrastructure Providers | High | Market Dominance, High Switching Costs | Increased reliance due to public sector cloud adoption |

| Highly Skilled Software Developers | High | Talent Scarcity, Specialized Knowledge | 15% rise in cybersecurity expert salaries |

| Generic Hardware/IT Services | Low | Commoditization, Market Competition | Stable pricing due to competitive IT hardware market |

What is included in the product

This analysis dissects the competitive forces impacting IDOX, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes. It provides strategic insights into IDOX's market position and potential for sustained profitability.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

IDOX's primary customers are public sector entities, and their procurement processes are notoriously lengthy and complex. These government bodies often operate under strict regulations and competitive bidding frameworks, which inherently grants them considerable bargaining power. For instance, in the UK, public sector procurement is governed by regulations like the Public Contracts Regulations 2015, designed to ensure fairness and value for money, often leading to extended tender periods and detailed evaluation criteria.

This significant customer bargaining power directly influences IDOX's sales cycles and pricing flexibility. The emphasis on long-term value and adherence to tight budget constraints within public sector contracts means that IDOX must often navigate protracted negotiations. This can impact revenue recognition timelines and the ability to achieve premium pricing, as demonstrated by the competitive landscape in UK local government software solutions where price is a key decision factor.

When public sector organizations adopt IDOX's specialized software for crucial tasks such as managing grants or handling electoral processes, the costs associated with switching to a competitor become prohibitively high. These substantial switching costs encompass the complex process of data migration, the necessity of retraining personnel on new systems, and the significant risk of disrupting essential public services during the transition. This inherent difficulty in changing providers significantly diminishes the bargaining power of these customers once they are integrated with IDOX's solutions, fostering strong customer lock-in.

Public sector clients, a significant customer base for IDOX, are frequently constrained by tight budgets. This financial pressure makes them highly cost-sensitive, leading to rigorous negotiations on pricing for software licenses and ongoing maintenance. For instance, in 2024, many local government bodies reported increased pressure to demonstrate value for money, directly impacting their willingness to absorb price hikes.

This cost sensitivity can directly limit IDOX's pricing power. Clients often demand more economical solutions or push for enhanced value from existing services, particularly as governments prioritize cost savings in their digital transformation initiatives. The drive for efficiency in public sector IT spending is a persistent theme influencing contract terms.

Demand for Customization and Integration

Public sector clients often demand extensive customization to align with their specific regulatory frameworks, existing IT systems, and operational necessities. This need for bespoke solutions, alongside the requirement for smooth integration into current infrastructures, amplifies customer leverage. They can then dictate precise specifications and service level agreements, influencing supplier pricing and terms.

The increasing complexity of public sector IT projects means that clients who require significant customization and integration often hold greater bargaining power. For example, in 2024, many government bodies were upgrading legacy systems, necessitating deep integration with specialized, often outdated, software. This requirement meant that solution providers had to be more flexible on pricing and delivery terms to secure these contracts, as the switching costs for the client were exceptionally high.

- High Customization Needs: Public sector clients frequently require bespoke software to comply with unique regulations and operational workflows.

- Integration Challenges: Seamlessly integrating new solutions with existing, often aging, IT infrastructure is a critical and complex demand.

- Increased Customer Leverage: These demands empower customers to dictate terms, influencing pricing and service level agreements.

- Supplier Adaptability: Vendors must demonstrate flexibility and a capacity for deep integration to win and retain public sector business.

Consolidation of Public Sector Entities

Consolidation within the UK public sector, particularly in local government, directly impacts the bargaining power of customers for companies like IDOX. As entities merge, the resulting larger organizations possess greater purchasing power and can negotiate more favorable terms. This trend is evident in ongoing digital transformation initiatives across local authorities, where the drive for efficiency often involves consolidation.

When multiple smaller councils or public bodies combine, they form a single, larger client. This consolidated entity can then leverage its increased scale to demand better pricing, volume discounts, or more tailored service agreements from IDOX. For instance, a single merged county council will have a significantly larger budget and a more unified procurement process than the individual district councils it replaced, amplifying its negotiating leverage.

- Increased Purchasing Power: Merged public sector entities represent larger contract values, giving them more sway in negotiations.

- Demand for Volume Discounts: Larger customer bases allow for greater volume purchases, enabling customers to request significant discounts.

- Streamlined Procurement: Consolidation often leads to more centralized and efficient procurement processes, which can be used to exert pressure on suppliers for better terms.

- Focus on Digital Transformation: UK local government's ongoing digital transformation efforts often involve consolidating services and IT systems, creating opportunities for larger, more demanding clients.

The bargaining power of customers for IDOX is substantial, primarily driven by the public sector's procurement processes and cost sensitivity. Public sector entities, often operating under strict regulations, demand value for money, leading to competitive bidding and lengthy negotiations that limit IDOX's pricing flexibility. For example, in 2024, many UK local authorities faced budget constraints, intensifying their focus on cost savings and impacting their willingness to accept price increases.

| Factor | Impact on IDOX | Supporting Data/Trend (2024) |

|---|---|---|

| Public Sector Procurement Regulations | Grants significant customer leverage through competitive bidding and detailed evaluation criteria. | UK Public Contracts Regulations 2015 emphasize fairness and value, prolonging sales cycles. |

| Cost Sensitivity | Limits pricing power and necessitates focus on economical solutions. | Many local government bodies reported increased pressure to demonstrate value for money in 2024. |

| Switching Costs | High costs for data migration, retraining, and service disruption reduce customer bargaining power post-implementation. | Complex integration with legacy systems in 2024 often meant higher switching costs for government clients. |

Preview Before You Purchase

IDOX Porter's Five Forces Analysis

This preview showcases the complete IDOX Porter's Five Forces Analysis, offering a thorough examination of competitive pressures within the industry. What you see here is the exact, professionally formatted document you will receive immediately after purchase, ensuring no surprises. This detailed analysis is ready for your immediate use, providing actionable insights to inform your strategic decisions.

Rivalry Among Competitors

IDOX operates in specialized software niches, particularly within the UK public sector for areas like electoral services and asset management in industries such as utilities. While the broader software market is crowded, the number of direct competitors for these highly specific solutions can be limited, leading to intense rivalry among the players that do exist.

Key competitors for IDOX include established firms like Kainos Group and Civica, alongside a range of other smaller, specialized software providers who also target these niche segments. For instance, in the local government software space, companies like Idox PLC reported revenues of £66.8 million for the year ended 31 March 2023, indicating a significant market presence for established players.

Competitive rivalry in the public sector software market, particularly for IDOX, is significantly shaped by differentiation through specialized solutions and deep domain expertise. Companies that can offer tailored software for complex government functions, such as managing geospatial data or public protection services, often outcompete those focusing purely on price.

IDOX's strategy of concentrating on these niche areas allows it to build a reputation for quality and a precise fit for client needs. This specialization is a key competitive advantage, as evidenced by their strong market position in areas like planning and land registry software, where deep understanding of regulatory frameworks is paramount.

For instance, in the UK, IDOX's software solutions are integral to many local authority functions. The company's continued investment in developing and refining these niche capabilities, such as their geospatial platforms, is vital for maintaining this competitive edge and attracting clients who prioritize functionality and compliance over cost alone.

The public sector's typically lengthy sales cycles and multi-year contracts mean that deep-seated client relationships and a solid reputation are paramount. Competitors aren't just chasing new business; they're actively seeking contract renewals and opportunities to expand services with existing public sector entities, where trust and consistent service delivery are key differentiators.

IDOX's business model thrives on this dynamic, evidenced by its substantial recurring revenue streams, which underscore the value placed on its long-term partnerships. For instance, in the fiscal year ending March 31, 2024, IDOX reported continued strong performance in its public sector software and services, reflecting the stickiness of its client base.

Impact of Mergers and Acquisitions (M&A)

Mergers and acquisitions (M&A) are a potent force shaping the competitive rivalry within IDOX's operating environment. When larger entities absorb smaller, niche companies, it often leads to a concentration of market share and a broader range of integrated services. This dynamic can intensify competition for remaining independent players.

IDOX actively participates in this consolidation trend. For instance, its strategic acquisitions of Emapsite and Plianz demonstrate a clear intent to bolster its product portfolio and strengthen its standing in the market. This M&A activity signals a dynamic sector where companies are strategically expanding their reach and capabilities through inorganic growth.

- Market Consolidation: M&A activity leads to fewer, larger competitors, potentially increasing pricing pressure and reducing differentiation opportunities for smaller firms.

- IDOX's Strategic Acquisitions: IDOX's purchases of Emapsite and Plianz in recent years exemplify this trend, aiming to expand its data offerings and software solutions.

- Enhanced Capabilities: Acquired companies often bring specialized expertise or technology, allowing the acquiring entity to offer more comprehensive solutions, thereby raising the competitive bar.

- Increased Barriers to Entry: Successful M&A can create larger, more resource-rich companies, making it harder for new entrants to compete effectively.

Innovation and Technology Adoption

The competitive rivalry within the document management and workflow solutions sector is intensifying, driven by a relentless pursuit of innovation. Companies are heavily investing in areas like cloud-based platforms, artificial intelligence (AI) for process automation, and broader digital transformation capabilities. Those that can deliver more efficient, intuitive, and secure software solutions, such as cloud-native offerings and AI-enhanced governance tools, are securing a significant market advantage.

The public sector's growing embrace of cloud technologies and digital service delivery further fuels this competitive dynamic. For instance, in the UK, the government's digital transformation agenda, aiming to modernize public services, creates a strong demand for advanced, integrated digital solutions. This push means that providers demonstrating superior technological adoption and offering features like AI-powered data analysis or automated compliance checks are better positioned to win contracts and market share.

- Cloud-Native Solutions: Companies are prioritizing cloud-native architectures for scalability and agility.

- AI Integration: AI is being embedded for tasks like intelligent document processing, data extraction, and workflow optimization.

- Digital Transformation Focus: The ability to support end-to-end digital workflows is a key differentiator.

- Security and Compliance: Enhanced security features and robust compliance management are critical for public sector adoption.

The competitive rivalry for IDOX is characterized by a mix of direct competitors in its niche software markets and the broader impact of market consolidation. Companies like Kainos Group and Civica are prominent rivals, but the specialized nature of IDOX's offerings, such as electoral services and asset management software for UK local government, means competition is often focused among a select group of domain experts.

The intensity of this rivalry is amplified by the public sector's demand for specialized, compliant solutions, pushing competitors to differentiate through deep expertise and tailored functionalities. For example, IDOX's strength in planning and land registry software stems from its ability to meet complex regulatory needs, a factor that often outweighs price considerations for public sector clients.

Market consolidation through mergers and acquisitions further shapes the competitive landscape. IDOX's own strategic acquisitions, such as Emapsite and Plianz, highlight this trend, aiming to broaden its capabilities and strengthen its market position against increasingly integrated competitors. This M&A activity can lead to fewer, larger players with enhanced offerings, raising the bar for all participants.

Innovation, particularly in cloud-native platforms and AI integration for document management and workflow solutions, is a key battleground. The UK government's digital transformation agenda fuels demand for advanced solutions, making providers with superior technological adoption, like AI-powered data analysis, better positioned for success.

| Competitor | Key Niche Areas | Recent Financial Data (Example) |

|---|---|---|

| Kainos Group | Digital services, HealthTech, Public Sector Software | Reported revenue of £367.9 million for the year ended 31 March 2024. |

| Civica | Digital solutions for Public Sector and Utilities | Reported revenue of £1.1 billion in 2023. |

| IDOX PLC | Local Government Software, Asset Management, Electoral Services | Reported revenue of £71.7 million for the year ended 31 March 2024. |

SSubstitutes Threaten

For simpler tasks, public sector bodies might use common software like spreadsheets or stick with manual, paper-based methods instead of specialized systems. These options, though less efficient, pose a basic threat, particularly for smaller organizations or less crucial operations. For instance, a 2024 survey indicated that while digital transformation is accelerating, approximately 15% of local government departments still rely on paper-based workflows for certain administrative functions.

Public bodies, particularly larger government agencies and local councils, represent a significant threat of substitution. These entities may possess the internal capacity and financial wherewithal to develop their own bespoke software solutions, effectively bypassing the need to procure services from commercial providers like IDOX. This in-house development, while often incurring higher upfront costs and ongoing maintenance responsibilities, allows for tailored functionality and greater control over data and processes.

For instance, in 2024, some UK local authorities have been exploring or implementing in-house digital transformation initiatives, aiming to reduce reliance on third-party software for citizen services and administrative functions. This trend indicates a growing capability and willingness among public sector organizations to become self-sufficient in their technology development, directly impacting the market for external software vendors.

Public sector organizations might opt to outsource specific functions to consultancies or business process outsourcing (BPO) providers instead of adopting IDOX's software. These external service providers can utilize their proprietary tools or manual methods, thereby acting as substitutes for IDOX's software solutions, particularly for project-based engagements. For example, the global BPO market was valued at approximately $232 billion in 2023, indicating a significant appetite for outsourced services.

Open-Source Alternatives

The rise of open-source software presents a notable threat of substitutes for IDOX. For many common functionalities, particularly in areas like document management or workflow automation, robust open-source options are readily available. These can offer a significantly lower upfront cost compared to proprietary solutions.

While open-source software can be appealing to budget-conscious public sector clients, it’s crucial to acknowledge the associated challenges. The total cost of ownership can increase due to the need for extensive customization, specialized in-house expertise, or third-party support. For instance, a 2024 survey indicated that while 70% of public sector IT leaders are exploring open-source solutions, over 50% cite integration complexity as a major hurdle.

Furthermore, security and ongoing maintenance are significant concerns for government entities adopting open-source alternatives. Ensuring compliance with stringent data protection regulations and maintaining system integrity requires dedicated resources and expertise, which may not always be readily available or cost-effective. This often leads to a higher perceived risk compared to established, supported commercial offerings.

- Availability of Open-Source Software: Numerous open-source platforms offer comparable functionalities to IDOX's core offerings.

- Cost as a Differentiator: Budget constraints in the public sector make lower-cost open-source solutions attractive.

- Customization and Support Needs: Open-source adoption often requires significant investment in customization and ongoing support.

- Security and Maintenance Risks: Government clients face heightened concerns regarding the security and long-term maintenance of open-source software.

Hybrid Solutions and Partial Substitution

Customers are increasingly exploring hybrid solutions, blending IDOX's core offerings with more accessible or cost-effective alternatives for specific tasks. This means a client might use IDOX for critical document management but opt for simpler, perhaps in-house, solutions for less complex workflows.

This partial substitution directly impacts IDOX's ability to achieve deep market penetration within a single client. For instance, if a company adopts IDOX for its planning application portal but uses a different provider for internal HR document workflows, IDOX's footprint is limited.

The growing trend towards modular digital services makes this easier. Companies can pick and choose best-in-class solutions for each function, rather than seeking an all-encompassing platform. This modularity directly facilitates the threat of partial substitution.

For example, in the UK's local government sector, while IDOX is a significant player in planning and regulatory software, other providers are emerging with specialized solutions for areas like environmental health or licensing. This allows councils to integrate best-of-breed applications, potentially reducing reliance on a single vendor for all digital needs.

The threat of substitutes for IDOX stems from various alternatives that public sector bodies might adopt. These range from in-house development and outsourcing to the growing availability of open-source software. Furthermore, the trend towards modular solutions allows organizations to mix and match best-of-breed applications, potentially limiting IDOX's market penetration.

Public sector organizations are increasingly capable of developing their own software solutions, reducing reliance on external vendors. For instance, in 2024, several UK local authorities were actively exploring or implementing in-house digital transformation projects. This trend highlights a growing self-sufficiency in technology development, directly impacting the demand for commercial software providers.

The cost-effectiveness of open-source software is a significant draw for budget-conscious public sector clients, despite potential challenges. While 70% of public sector IT leaders were exploring open-source solutions in 2024, over half cited integration complexity as a major hurdle. Security and maintenance remain key concerns, often increasing the total cost of ownership.

| Alternative | Description | 2024 Trend/Data Point |

| In-house Development | Public bodies developing bespoke software internally. | UK local authorities exploring in-house digital transformation initiatives. |

| Outsourcing (BPO) | Engaging third-party providers for specific functions. | Global BPO market valued at ~$232 billion in 2023. |

| Open-Source Software | Utilizing freely available software platforms. | 70% of public sector IT leaders exploring open-source; 50%+ cite integration issues. |

| Hybrid/Modular Solutions | Combining IDOX with other specialized software. | UK councils integrating best-of-breed applications for specific functions. |

Entrants Threaten

Developing specialized software for the public sector demands substantial upfront capital for research, development, and navigating intricate regulatory landscapes. For instance, in 2024, the average cost for developing a robust, government-compliant enterprise software solution can easily exceed $1 million, a significant hurdle for newcomers.

Entering the public sector software market, like that served by IDOX, necessitates profound domain expertise in intricate government processes and a rigorous adherence to complex regulatory compliance. Newcomers must navigate a steep learning curve, often requiring significant investment in understanding the unique operational demands and legal stipulations inherent in public sector engagements.

Building trust and credibility is paramount in this sector, which is highly sensitive to risk management and robust data security protocols. For instance, in 2024, government IT spending globally was projected to reach over $600 billion, with a significant portion allocated to software solutions, underscoring the market's appeal but also the high stakes for new entrants to demonstrate reliability and compliance.

The public sector, a significant market for many companies, presents a formidable barrier to new entrants due to its notoriously long sales cycles. These can extend for months, even years, as procurement processes involve extensive vetting and approvals. For instance, in the UK government's digital services procurement, it's not uncommon for contracts to take over 18 months from initial tender to award.

Established relationships are another major hurdle. Public sector organizations often favor vendors with a proven track record and existing trust, making it difficult for newcomers to gain a foothold. This preference for the familiar means new entrants must invest heavily in building credibility and demonstrating reliability over extended periods, a challenge compounded by the lengthy sales cycles.

Data Security and Certification Requirements

The public sector handles incredibly sensitive data, meaning any company wanting to enter this market needs to invest significantly in robust security measures and often secure specific government certifications. This isn't a small undertaking; it requires substantial upfront capital for advanced cybersecurity infrastructure and the lengthy, expensive process of obtaining necessary accreditations.

For instance, in 2024, the average cost for a company to achieve ISO 27001 certification, a common benchmark for data security, can range from $5,000 to $15,000 or more, not including the ongoing maintenance and audit costs. Additionally, specific government contracts might require compliance with frameworks like NIST (National Institute of Standards and Technology) or FedRAMP in the US, which involve even more rigorous and costly security protocols and audits.

- High Cybersecurity Investment: New entrants must allocate substantial funds to build and maintain secure data handling systems.

- Certification Hurdles: Obtaining government-specific security certifications is a time-consuming and expensive process, acting as a significant barrier.

- Ongoing Compliance Costs: Beyond initial certification, continuous investment in security updates and audits is mandatory, adding to operational expenses.

Network Effects and Switching Costs for Customers

Existing providers like IDOX benefit significantly from strong network effects. As more public sector organizations adopt IDOX's software and integrate it into their workflows, the platform becomes more valuable due to enhanced data sharing capabilities and interoperability. For instance, in 2024, the UK government continued to emphasize digital transformation in local authorities, a trend that amplifies the benefits of integrated systems like those offered by IDOX, making them more attractive to new users within the network.

Furthermore, the threat of new entrants is significantly mitigated by the substantial switching costs faced by public sector clients. Migrating complex data systems, retraining staff, and the potential for operational disruption during a transition represent considerable barriers. In 2024, local government IT budgets remained under pressure, making large-scale system overhauls a less appealing prospect, thereby reinforcing the sticky nature of existing contracts and software solutions.

- Network Effects: IDOX's value proposition strengthens as more public sector bodies join its ecosystem, facilitating data exchange and process standardization.

- High Switching Costs: Public sector clients face significant expenses and operational risks when attempting to change software providers, including data migration and retraining.

- Customer Retention: These combined factors create a strong retention mechanism for incumbent players like IDOX, making it challenging for new entrants to gain market share.

- Market Inertia: The perceived stability and integration benefits of established solutions contribute to market inertia, further deterring new competition.

The threat of new entrants in the public sector software market, particularly for companies like IDOX, is significantly dampened by substantial barriers. These include the immense capital required for development and regulatory compliance, with 2024 estimates suggesting over $1 million for robust government-grade software. Furthermore, the need for deep domain expertise in public sector processes and strict adherence to evolving regulations presents a steep learning curve for any newcomer.

Building trust and navigating lengthy sales cycles, often exceeding 18 months in UK government procurement, are critical challenges. New entrants must also overcome the established relationships and proven track records that incumbent providers like IDOX already possess. The high stakes associated with sensitive data also mandate significant investment in advanced cybersecurity infrastructure and costly government certifications, such as ISO 27001, which in 2024 could cost upwards of $15,000 initially.

Network effects, where the platform's value increases with user adoption, and high switching costs for public sector clients, including data migration and retraining, further solidify the position of existing players. These factors create strong customer retention and market inertia, making it exceptionally difficult for new companies to penetrate the market.

| Barrier Type | Description | Estimated 2024 Cost/Timeframe |

|---|---|---|

| Capital Requirements | R&D, regulatory navigation, software development | $1M+ for robust solutions |

| Domain Expertise & Regulation | Understanding public sector processes, compliance | Significant investment in training and legal counsel |

| Trust & Credibility | Demonstrating reliability and security | Extended sales cycles, proven track record |

| Cybersecurity & Certification | Secure data handling, government accreditations | $5k-$15k+ for ISO 27001, plus ongoing costs |

| Sales Cycles | Vetting and approval processes | 18+ months common in UK government |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, drawing from industry-specific market research reports, company financial statements, and government economic indicators to provide a comprehensive view of competitive dynamics.