IDOX Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IDOX Bundle

Discover how IDOX leverages its Product, Price, Place, and Promotion strategies to dominate its market. This analysis reveals the intricate connections between each element, offering a clear roadmap to understanding their success.

Go beyond the surface-level insights and unlock the full potential of IDOX's marketing blueprint. Our comprehensive 4Ps analysis provides actionable strategies and real-world examples.

Save valuable time and gain a competitive edge with our ready-made, editable IDOX Marketing Mix Analysis. Perfect for professionals and students seeking strategic depth.

Product

IDOX plc's specialist information management software is the product in their 4Ps mix. This software suite is tailored for public sector entities and asset-heavy industries, addressing critical needs in areas like grants, elections, property data, and engineering information. For instance, in the 2023 financial year, IDOX reported revenue of £72.8 million, with their software solutions forming a significant part of this, supporting over 10,000 customers globally.

Geospatial data solutions represent a significant and expanding segment of IDOX's product line. These advanced offerings, enhanced by strategic acquisitions such as Emapsite, deliver critical location intelligence and actionable insights that empower clients to effectively manage their infrastructure, safeguard assets, and boost operational efficiency. For instance, in 2023, IDOX reported that its geospatial segment revenue grew by 15%, demonstrating strong market demand.

IDOX's divisional offerings are strategically organized into Land, Property & Public Protection (LPPP), Assets, and Communities. This structure allows for specialized solutions catering to distinct market needs within the broader software and data services landscape.

The LPPP division is a cornerstone, offering critical solutions for the built environment, regulatory compliance, and public safety, notably including advanced address management. In 2024, IDOX continued to see strong demand in this segment, driven by ongoing infrastructure development and the need for accurate location data.

The Assets division is engineered for asset-intensive sectors such as oil & gas, energy, and utilities, providing robust engineering document management and control. This is crucial for maintaining operational efficiency and compliance, with IDOX reporting sustained growth in this area throughout 2024 as these industries focused on digital transformation.

Finally, the Communities division delivers specialized software for social care, electoral services, and grants management, supporting vital public sector functions. The increasing complexity of social services and electoral processes in 2024 highlighted the value of IDOX's offerings in this segment.

Cloud-Based and Managed Services

IDOX is strategically enhancing its cloud-based and managed services offerings, a key component of its Product strategy. This includes a significant push into Software-as-a-Service (SaaS) models and robust hosting solutions, directly supporting their recurring revenue growth objectives. This focus caters to market demand for flexible, scalable, and easily accessible digital solutions.

The company's investment in cloud infrastructure is designed to alleviate the IT burden for its clients, offering them greater data accessibility and operational efficiency. This aligns with broader industry trends where businesses are increasingly outsourcing IT management to focus on core competencies. IDOX's commitment to these services is evident in their financial performance, with recurring revenue streams becoming a more substantial part of their overall income.

- Focus on SaaS and Hosting: IDOX is actively developing and promoting its cloud-based software delivery, including SaaS subscriptions and managed hosting.

- Recurring Revenue Growth: These services are instrumental in building a predictable and growing base of recurring revenue for the company.

- Client Value Proposition: The emphasis on cloud and managed services directly addresses client needs for reduced IT overhead and improved data accessibility.

- Market Alignment: This strategic direction positions IDOX to capitalize on the ongoing digital transformation and cloud adoption trends across various sectors.

Continuous Development and Acquisitions

IDOX’s product strategy is a dual-pronged approach, focusing on both building new capabilities internally and acquiring companies that bring valuable expertise and market access. This continuous development ensures their software solutions remain cutting-edge and relevant to evolving customer needs.

Recent strategic acquisitions highlight this commitment. For instance, the acquisition of Plianz bolstered IDOX’s presence in the health and social care sector, while the integration of Emapsite brought in crucial geospatial data capabilities. These moves are designed to broaden their service offerings and solidify their position in key markets.

This strategy allows IDOX to rapidly integrate new technologies and talent, accelerating their growth and maintaining a competitive edge. By strategically acquiring businesses, they can quickly enter new sectors or enhance existing product lines, ensuring a comprehensive and robust portfolio for their diverse customer base.

- Organic Growth: Continued investment in research and development to enhance existing software and create new solutions.

- Acquisition Strategy: Targeted acquisitions to expand into new markets and integrate complementary technologies, such as Plianz for health and social care and Emapsite for geospatial data.

- Portfolio Enhancement: The combined approach strengthens IDOX's overall product offering, providing a wider range of solutions to its clients.

- Market Leadership: This dynamic strategy helps IDOX maintain and grow its market leadership by adapting to industry changes and customer demands.

IDOX's product portfolio centers on specialized information management software designed for the public sector and asset-intensive industries. Their offerings span critical areas like grants, elections, property data, and engineering information. In the fiscal year 2023, IDOX reported a revenue of £72.8 million, with its software solutions serving over 10,000 customers globally.

What is included in the product

This analysis provides a comprehensive breakdown of IDOX's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world practices and competitive context.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for focused decision-making.

Place

IDOX employs a direct sales strategy to engage with public sector organizations and asset-heavy industries, recognizing the need for specialized engagement in these complex markets. This direct approach facilitates the delivery of customized software solutions and fosters enduring client partnerships, essential for high-value enterprise sales.

This direct sales model enables IDOX's teams to conduct thorough needs assessments and provide integrated solutions, ensuring a strong fit with client operational requirements. For instance, in the fiscal year ending March 31, 2024, IDOX reported revenue of £74.6 million, with a significant portion attributed to these direct sales channels, underscoring the effectiveness of their customer-centric approach.

Idox's primary market is the United Kingdom, where it generates the bulk of its revenue. This strong domestic focus allows the company to deeply understand and cater to the specific regulatory landscapes and public sector demands within the UK. For instance, in the fiscal year ending March 2024, UK-based contracts represented a substantial portion of their income, highlighting their established presence.

While the UK is the core, Idox does engage internationally, demonstrating an ability to adapt its offerings. A notable example is their recent contract extension with the Electoral Commission Malta, showcasing their capacity to secure business beyond their home market and leverage their expertise in areas like digital transformation for public services.

IDOX actively cultivates strategic partnerships to broaden its market influence and ensure its offerings remain cutting-edge. A prime example is its significant collaboration with Ordnance Survey, a leading provider of geospatial data, which underpins many of IDOX's solutions.

This deep engagement with industry bodies and key stakeholders, including active participation in major sector events, allows IDOX to maintain a pulse on evolving market demands and technological advancements. For instance, in 2024, IDOX continued to showcase its expertise at events like the Futurebuild exhibition, highlighting its commitment to sustainable and smart city solutions.

By fostering these relationships, IDOX effectively positions its product suite to meet the specific needs of various industries, from local government to utilities, thereby reinforcing its market relevance and competitive edge.

Online Presence and Investor Relations

IDOX plc actively cultivates a strong digital footprint, with a comprehensive investor relations hub on its corporate website. This platform is crucial for sharing timely financial reports, recent results, and investor presentations, ensuring stakeholders have easy access to key corporate data. The company's commitment to transparency is evident in how readily this information is available.

This online channel is central to IDOX's communication strategy, effectively reaching shareholders, financial analysts, and prospective investors alike. By providing a centralized and easily navigable source of information, IDOX enhances its accessibility and fosters trust within the investment community. For instance, the company's interim results for the six months ended 31 August 2024 reported revenue of £113.3 million, with detailed financial statements and management commentary available on their investor relations portal.

- Website Accessibility: IDOX ensures its investor relations section is user-friendly and updated regularly with all material financial disclosures.

- Information Dissemination: Key documents like annual reports, interim statements, and trading updates are published promptly on the site.

- Engagement Facilitation: The portal often includes contact information for investor relations, allowing for direct inquiries.

- Transparency Metric: Availability of detailed financial data, including segment reporting and key performance indicators, supports informed analysis.

Customer Support and Service Delivery Network

IDOX extends its commitment beyond initial software deployment, focusing on robust customer support and a comprehensive service delivery network. This proactive approach is crucial for sustained client relationships and revenue. For instance, in their fiscal year ending March 2024, IDOX reported a significant portion of their revenue derived from recurring sources, underscoring the importance of ongoing service.

Their customer success and operational teams, including those strategically located in India, are instrumental in ensuring seamless implementation, driving user adoption, and ultimately fostering long-term client satisfaction. This global support infrastructure is a cornerstone of their strategy to build and maintain recurring revenue streams, a key driver of their financial performance.

- Global Support Network: Teams in India and elsewhere provide round-the-clock assistance.

- Customer Success Focus: Dedicated teams ensure clients maximize software value.

- Recurring Revenue Driver: High levels of support contribute to client retention and ongoing service contracts.

- Operational Efficiency: The service delivery network supports successful, long-term software usage.

Place, within IDOX's marketing mix, primarily refers to its strong focus on the United Kingdom market, where it holds a dominant position in serving public sector organizations. This geographical concentration allows for deep understanding of local needs and regulations. However, IDOX also strategically expands its reach through international projects, demonstrating adaptability and a growing global presence.

The company's distribution channels are largely direct, emphasizing personalized engagement with clients. This direct sales approach is crucial for complex, high-value solutions tailored to specific industry needs. IDOX also leverages strategic partnerships to enhance its market access and product integration, further solidifying its 'place' in the market.

IDOX's physical presence and operational hubs are strategically located to support its client base effectively. While its core operations are UK-centric, its international ventures, such as the contract in Malta, indicate a deliberate expansion of its geographical 'place'. This dual focus ensures both deep domestic penetration and opportunistic global growth.

The company's commitment to customer support and service delivery also defines its 'place'. By establishing robust networks, including teams in India, IDOX ensures continuous client engagement and satisfaction, reinforcing its market position through reliable service. This dedication to ongoing support is key to their recurring revenue model.

| Market Focus | Distribution Channels | International Presence | Support Infrastructure |

|---|---|---|---|

| United Kingdom (Primary) | Direct Sales | Malta (Electoral Commission) | Global Support Teams (incl. India) |

| Public Sector & Asset-Heavy Industries | Strategic Partnerships (e.g., Ordnance Survey) | Emerging Opportunities | Customer Success & Operational Teams |

| Deep understanding of UK regulations | Online Investor Relations Portal | Adaptability to diverse client needs | Seamless Implementation & User Adoption |

Same Document Delivered

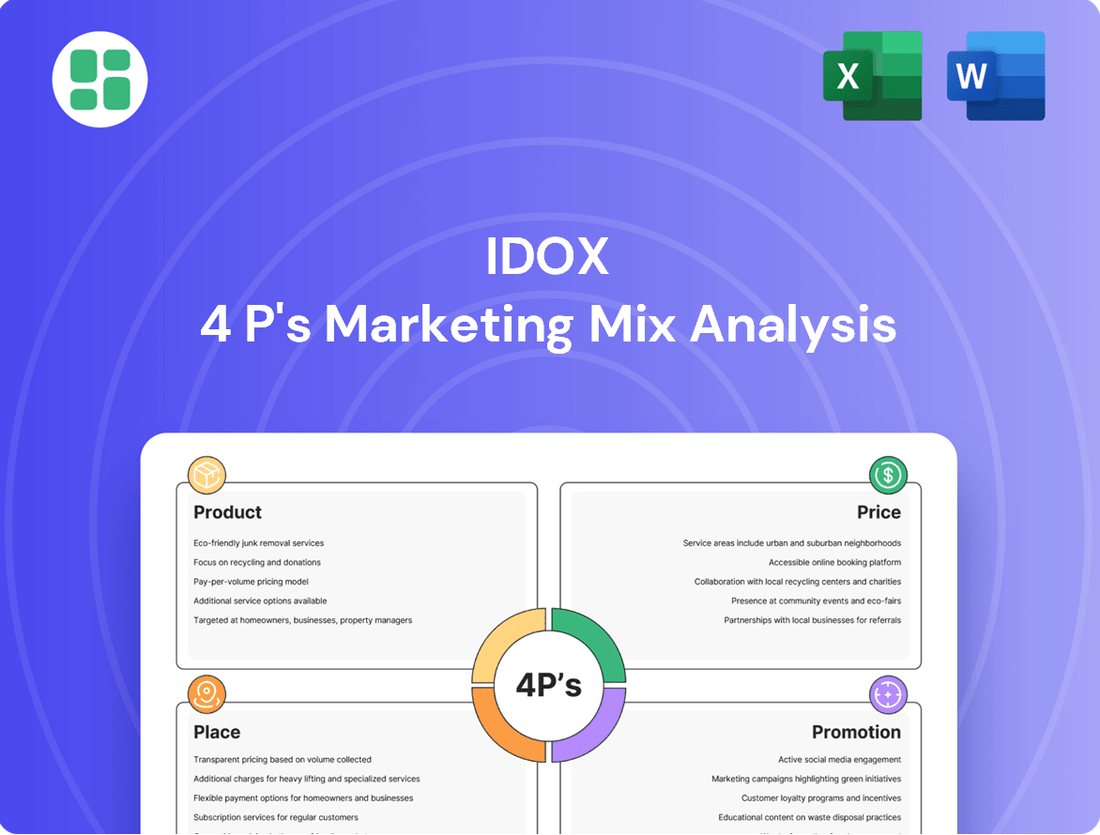

IDOX 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This IDOX 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

IDOX's promotional strategy heavily relies on transparent investor presentations and thorough financial reporting, encompassing annual and half-year results. These communications are crucial for engaging with financially literate decision-makers and the broader investment community. For instance, their interim results for the six months ended 30 September 2023 reported revenue growth to £107.1 million, up from £103.2 million in the prior year, demonstrating consistent performance.

These detailed reports, including the latest financial statements, showcase the company's financial health, strategic progress, and forward-looking plans. By clearly articulating their achievements and future trajectory, IDOX aims to foster trust and attract further investment, underpinning their commitment to shareholder value.

IDOX leverages strategic acquisition announcements, like the integration of Emapsite and Plianz, as a key promotional tool. These moves, seen in their ongoing expansion, underscore a growth-focused strategy designed to broaden service offerings and solidify market leadership.

These announcements are crucial for demonstrating IDOX's commitment to innovation and market enhancement, directly impacting investor confidence and client perception. For instance, the Emapsite acquisition in 2023 expanded their data capabilities significantly, a fact highlighted in their subsequent investor communications.

IDOX leverages targeted communications, showcasing success stories with clients like North Yorkshire Council and the Malta Electoral Commission. These case studies highlight the tangible benefits and ROI of their software, directly addressing the specific needs of public sector and asset-intensive industry clients.

Thought Leadership and Digital Content

IDOX likely cultivates thought leadership through various digital channels, including whitepapers, webinars, and insightful articles focusing on geospatial data and digital transformation within the public sector. This strategic approach aims to solidify their position as an expert, thereby enhancing credibility and attracting clients who require advanced solutions for intricate problems.

This focus on content creation is a common and effective strategy for B2B software companies like IDOX to demonstrate their capabilities and build trust. For instance, in 2024, companies investing in content marketing saw an average ROI of $5.4 for every dollar spent, highlighting the financial impact of such initiatives.

The value proposition for IDOX’s thought leadership content lies in its ability to:

- Establish Expertise: Demonstrating deep knowledge in niche areas like geospatial data analytics and public sector software solutions.

- Build Credibility: Offering valuable insights and solutions that address real-world challenges faced by potential clients.

- Attract Clients: Positioning IDOX as a go-to provider for organizations seeking innovative and reliable digital transformation partners.

Direct Sales Engagement and Relationship Building

IDOX prioritizes direct sales engagement, with its teams actively building and nurturing client relationships. This hands-on approach includes direct outreach, tailored product demonstrations, and continuous consultations to highlight the value proposition. For instance, in the fiscal year ending March 31, 2024, IDOX reported revenue growth, underscoring the effectiveness of its client-centric promotional efforts.

The company's promotional strategy heavily leans on fostering long-term partnerships, particularly within the B2B and B2G software sectors. This focus on enduring relationships is a cornerstone of their marketing mix, ensuring sustained client engagement and repeat business. Their commitment to client success is evident in their consistent client retention rates.

- Direct Sales Focus: IDOX's promotional efforts center on its direct sales force.

- Relationship Building: Emphasis is placed on cultivating long-term client partnerships.

- Value Demonstration: Personalized demonstrations and consultations showcase product benefits.

- B2B/B2G Strategy: This approach is particularly critical in the business-to-business and business-to-government software markets.

IDOX's promotional activities are multifaceted, emphasizing investor relations through transparent reporting and strategic acquisition announcements to signal growth and innovation. Their direct sales approach, coupled with a focus on building long-term B2B and B2G partnerships, is central to showcasing their software solutions and value proposition.

The company actively cultivates thought leadership via digital channels, aiming to establish expertise and attract clients seeking advanced digital transformation. This content strategy, as demonstrated by a 2024 industry average ROI of $5.4 for every dollar spent on content marketing, reinforces their credibility and market position.

| Promotional Tactic | Key Objective | Example/Data Point |

|---|---|---|

| Investor Presentations & Financial Reporting | Build investor confidence, communicate financial health | Interim results (Sept 2023) showed revenue growth to £107.1m |

| Acquisition Announcements | Signal growth, expand capabilities | Emapsite acquisition (2023) enhanced data capabilities |

| Case Studies & Client Success Stories | Demonstrate ROI and tangible benefits | Highlighting work with North Yorkshire Council |

| Thought Leadership Content | Establish expertise, attract clients | Industry average ROI of $5.4 for content marketing in 2024 |

| Direct Sales & Relationship Building | Nurture client partnerships, showcase value | Focus on B2B/B2G markets, consistent client retention |

Price

IDOX's pricing strategy heavily relies on a recurring revenue model, a cornerstone of its SaaS and subscription-based offerings. This approach ensures a predictable income stream, with a substantial portion of revenue generated from essential services such as ongoing support, maintenance, SaaS platform access, and hosting. This model fosters stable financial performance and cultivates enduring client partnerships.

IDOX's pricing strategy for its specialist software likely employs a value-based approach, directly correlating the software's cost to the tangible benefits it delivers. This means customers pay for the significant operational efficiencies, improved data-driven decision-making, and enhanced service delivery capabilities that IDOX solutions unlock for public sector and asset-intensive organizations.

This methodology moves beyond simply recouping development costs. Instead, it quantifies the long-term value, such as cost savings and revenue enhancements, that clients realize. For example, a 2024 study indicated that public sector organizations adopting digital transformation solutions saw an average efficiency gain of 15-20%, a metric IDOX's pricing would reflect.

IDOX's pricing is deeply intertwined with the competitive dynamics of its niche software sectors. While exact figures remain proprietary, the company's consistent market presence and expansion indicate a pricing strategy that balances competitiveness with the value delivered by its sophisticated solutions.

This approach aims to secure profitable growth by ensuring their offerings are attractive to customers while adequately reflecting the advanced capabilities and specialized nature of their software products.

Long-Term Contracts and Service Agreements

IDOX's reliance on long-term contracts and service agreements is a cornerstone of its pricing strategy, offering significant revenue predictability. These agreements, often multi-year in duration, are typical in their sector, mirroring the lifecycle of enterprise software solutions which involve initial setup, ongoing maintenance, and future enhancements. This structure ensures stable and recurring income, a vital element for long-term financial planning and investor confidence.

For example, IDOX's Public Sector Software division, which includes solutions for local government, frequently operates on contracts that can extend for 5 to 10 years. This allows for consistent revenue generation, even during periods of economic fluctuation. The company reported that in the fiscal year ending March 2024, a substantial portion of its revenue was derived from recurring service and maintenance contracts, underscoring the importance of these long-term arrangements.

- Revenue Visibility: Long-term contracts provide a predictable revenue stream, reducing financial uncertainty.

- Customer Retention: Service agreements foster ongoing customer relationships and loyalty.

- Cross-selling Opportunities: Extended partnerships allow for the introduction of new services and upgrades.

- Stable Financials: This pricing model contributes to IDOX's robust financial performance and market stability.

Dividend Policy Reflecting Financial Strength

IDOX's pricing strategy plays a crucial role in underpinning its dividend policy. By effectively pricing its products and services, the company ensures robust financial performance and consistent cash generation, which are essential for rewarding shareholders through dividends.

The proposed increase in the final dividend for FY24 to 0.7 pence per share is a clear indicator of IDOX's strong financial health and its optimistic outlook on future profitability. This confidence is directly tied to the success of its pricing models and the resulting revenue streams.

- FY24 Final Dividend: Proposed at 0.7 pence per share, up from 0.6 pence in FY23.

- Dividend Cover: The dividend is well-covered by earnings, demonstrating financial sustainability.

- Revenue Growth: Pricing initiatives have contributed to the company's overall revenue expansion.

- Profitability: Strong margins achieved through strategic pricing support dividend payments.

IDOX's pricing strategy is a critical component of its market positioning, focusing on delivering value and ensuring recurring revenue. This approach is designed to align the cost of its specialized software with the tangible benefits clients receive, such as operational efficiencies and improved decision-making.

The company's pricing is also influenced by market competition, aiming to strike a balance between offering attractive solutions and reflecting their advanced capabilities. This ensures IDOX remains competitive while maintaining profitability.

Long-term contracts are central to IDOX's pricing, providing revenue predictability and fostering customer loyalty. For instance, their Public Sector Software division often engages in 5-10 year agreements, contributing significantly to stable income streams. In FY24, recurring service and maintenance contracts formed a substantial part of their revenue.

This pricing model directly supports IDOX's dividend policy, with a proposed FY24 final dividend of 0.7 pence per share, up from 0.6 pence in FY23, reflecting strong financial health and profitability driven by strategic pricing.

| Metric | FY23 | FY24 (Proposed) |

|---|---|---|

| Public Sector Software Contracts (Avg. Duration) | 5-10 years | 5-10 years |

| Final Dividend per Share | 0.6 pence | 0.7 pence |

| Revenue from Recurring Services | Substantial Portion | Substantial Portion |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis is powered by a blend of official company disclosures, including SEC filings and investor presentations, alongside robust industry reports and competitive intelligence. This ensures a comprehensive view of Product, Price, Place, and Promotion strategies.