Israel Discount Bank SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Discount Bank Bundle

Israel Discount Bank exhibits notable strengths in its established market presence and diverse product offerings, but also faces challenges from evolving digital banking trends and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Israel Discount Bank's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Israel Discount Bank showcases a strong financial foundation, evidenced by its Q1 2025 net income of NIS 1.04 billion and a healthy return on equity (ROE) of 13.0%. This performance builds on a solid 2024, where the bank achieved a net profit of NIS 4.3 billion, demonstrating sustained profitability and adept financial stewardship.

The bank's revenue streams are also expanding, with notable growth in both net interest income and fee income. This diversification suggests effective strategies in place to capture income from various banking activities, contributing to overall financial resilience.

Israel Discount Bank's strength lies in its diverse business segments and broad client base, operating as a full-service commercial bank. It serves individuals, SMEs, and large corporations, which mitigates risk by not over-relying on any single market.

This diversification proved beneficial in 2024 and early 2025, with the bank reporting robust credit growth across all its client segments. This widespread penetration underscores the bank's ability to attract and serve a wide array of customers, contributing to its overall stability and market reach.

Israel Discount Bank boasts an extensive domestic branch network, providing widespread accessibility and deep market penetration throughout Israel. This robust physical presence is a key strength, allowing the bank to serve a broad customer base across the country.

Further bolstering its reach, the bank's international subsidiaries, notably IDB Bank in the U.S., have demonstrated strong performance and growth throughout 2024. This international expansion diversifies revenue streams and strengthens the group's overall financial standing beyond its domestic operations.

Strategic Focus on Efficiency and Shareholder Value

Israel Discount Bank's strategic focus on efficiency is a notable strength. This is clearly demonstrated by its impressive efficiency ratio, which stood at 53.4% in the first quarter of 2025, a significant improvement from 52.1% recorded at the close of 2024. This ongoing enhancement in operational efficiency suggests effective cost management and streamlined processes.

The bank's commitment to shareholder value is also a key strength. With the announcement of an increased dividend policy, aiming to distribute up to 50% of its net profit starting from the second quarter of 2025, Discount Bank signals strong confidence in its future profitability. This policy directly rewards investors and reflects a strategic effort to bolster shareholder returns.

- Improved Efficiency Ratio: Achieved 53.4% in Q1 2025, down from 52.1% in FY 2024.

- Enhanced Shareholder Returns: New dividend policy targets up to 50% of net profit from Q2 2025.

- Sustainable Profitability Focus: The dividend policy underscores a commitment to long-term financial health and investor rewards.

Proactive Digital Transformation and Innovation

Israel Discount Bank is demonstrating a strong commitment to digital transformation, with significant investments in innovative technologies. A prime example is the planned launch of 'AI Stock Talk' in 2024, an artificial intelligence-powered tool designed to assist with investment management. This proactive approach aims to enhance customer engagement and provide more sophisticated financial advice.

This strategic focus on digital advancement is a core component of their 'Discount 2030' plan, signaling a forward-thinking strategy to remain competitive in the evolving financial landscape. By integrating AI, the bank is positioning itself to offer personalized and efficient services, thereby improving the overall customer experience.

- AI-Powered Investment Tool: Launching 'AI Stock Talk' in 2024.

- Strategic Alignment: Integral to the 'Discount 2030' strategic plan.

- Customer Focus: Enhancing personalized financial solutions and experience.

- Technological Leadership: Embracing advanced technology to stay ahead.

Israel Discount Bank's operational efficiency is a clear strength, evidenced by its Q1 2025 efficiency ratio of 53.4%, an improvement from 52.1% at the end of 2024. This focus on cost management enhances profitability and shareholder value. The bank's commitment to rewarding investors is further highlighted by its new dividend policy, aiming to distribute up to 50% of net profit from Q2 2025, signaling confidence in sustained earnings.

| Metric | Q1 2025 | FY 2024 |

|---|---|---|

| Efficiency Ratio | 53.4% | 52.1% |

| Dividend Payout Target | Up to 50% of Net Profit (from Q2 2025) | N/A |

What is included in the product

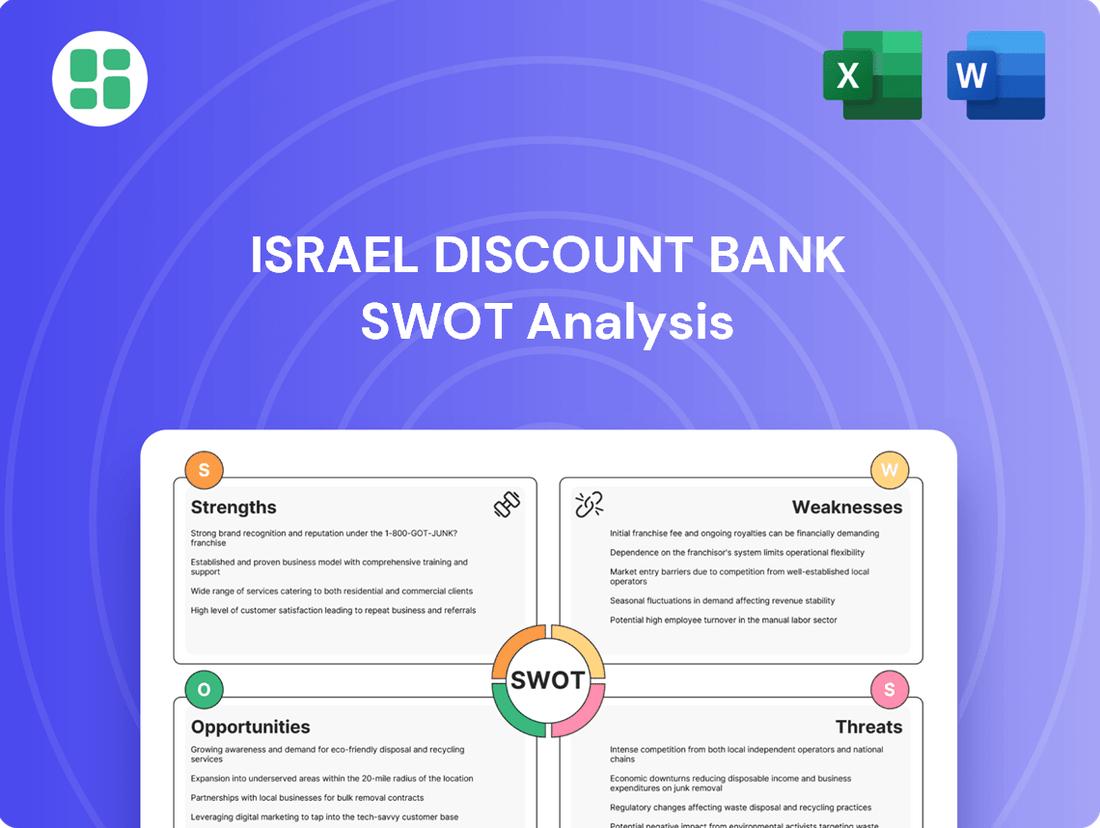

Delivers a strategic overview of Israel Discount Bank’s internal and external business factors, highlighting its strengths in digital transformation and market position, while addressing weaknesses in profitability and opportunities in emerging markets and threats from increased competition and regulatory changes.

Provides a clear, actionable SWOT analysis for Israel Discount Bank, enabling targeted strategies to mitigate weaknesses and capitalize on strengths.

Weaknesses

Israel Discount Bank's significant concentration in its domestic market presents a notable weakness. While the bank operates international subsidiaries, its primary revenue generation and customer base remain firmly rooted in Israel. This reliance makes it particularly vulnerable to shifts in the Israeli economy and any regional geopolitical tensions.

The ongoing regional conflict has a direct bearing on this weakness. Forecasts for Israel's GDP growth have been revised downwards for both 2024 and 2025, a direct consequence of the instability. This economic slowdown directly impacts the bank's core business, potentially affecting loan demand, interest income, and the quality of its loan portfolio.

Israel Discount Bank operates within a highly concentrated banking sector, where five major institutions, including itself, hold a significant market share. This concentration fuels intense competition, forcing banks to vie aggressively for customers and capital. For instance, as of Q1 2024, the four largest Israeli banks collectively held over 70% of total banking assets, highlighting the dominance of these players.

This competitive landscape presents a notable weakness as regulators are actively encouraging greater competition, potentially through new entrants or by encouraging existing players to innovate more rapidly. Such regulatory pushes could exert downward pressure on Israel Discount Bank's profitability margins and challenge its existing market share as new strategies and offerings emerge from rivals.

As a long-standing commercial bank, Israel Discount Bank might encounter difficulties with its older IT systems. These legacy infrastructures can slow down the adoption of new technologies, making it harder to keep pace with agile fintech rivals. For instance, while the bank is focused on digital upgrades, merging these advancements with its current intricate systems requires significant time and financial resources.

Regulatory Pressure on Profitability and Fees

Israel Discount Bank, like its peers, operates under significant regulatory scrutiny regarding profitability and fees. Public and governmental pressure has mounted over high interest rates on loans and mortgages, alongside concerns about potentially excessive service charges.

Regulators are actively considering initiatives to foster greater competition within the financial sector. This includes exploring tiered banking licenses for non-bank entities, a move that could introduce new players and potentially lead to caps or reductions in certain fees, directly impacting the bank's revenue streams.

- Increased Competition: New entrants could erode market share and necessitate competitive pricing adjustments.

- Fee Regulation: Potential caps or reductions on fees could directly reduce non-interest income.

- Profitability Pressure: Heightened scrutiny on interest margins may lead to adjustments in lending strategies and profitability.

Sensitivity to Interest Rate Fluctuations

Israel Discount Bank's profitability has been boosted by the recent high interest rate environment, which has widened its net interest income. For instance, in the first quarter of 2024, the bank reported a net interest income of NIS 2.1 billion, a notable increase year-over-year.

However, this reliance on high rates presents a significant weakness. A shift in monetary policy, such as anticipated interest rate cuts by the Bank of Israel in late 2024 or 2025, could compress the bank's net interest margin. This compression would directly impact its overall profitability, potentially reversing recent gains.

- Increased Net Interest Income: Benefited from high interest rates, as seen in Q1 2024 results.

- Sensitivity to Rate Cuts: Future monetary policy shifts, particularly rate reductions, pose a risk.

- Margin Compression: Lower interest rates could directly reduce the bank's net interest margin.

- Profitability Impact: Overall financial performance is vulnerable to changes in the interest rate landscape.

The bank's heavy reliance on the domestic Israeli market makes it susceptible to local economic downturns and geopolitical instability, as evidenced by revised lower GDP growth forecasts for Israel in 2024 and 2025 due to regional conflicts.

Intense competition within Israel's concentrated banking sector, where the top four banks hold over 70% of assets as of Q1 2024, pressures profitability and necessitates continuous innovation to maintain market share.

Legacy IT systems pose a challenge, potentially hindering the swift adoption of new technologies and making it difficult to compete with more agile fintech firms.

Regulatory scrutiny concerning high interest rates and service fees could lead to mandated adjustments, impacting revenue streams and profitability margins.

Preview the Actual Deliverable

Israel Discount Bank SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of Israel Discount Bank's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis is available immediately after purchase.

Opportunities

Israel Discount Bank has a prime opportunity to accelerate its digital innovation, building on its recent launch of an AI-powered investment tool. This move positions the bank to capitalize on the growing demand for sophisticated digital banking solutions.

By further investing in cutting-edge technologies such as AI, blockchain, and cloud computing, the bank can significantly boost its operational efficiency and enrich the customer experience. These advancements are crucial for developing innovative digital products and services that can challenge established banking norms.

For instance, the global fintech market is projected to reach $332.5 billion by 2027, indicating substantial growth potential for banks that embrace digital transformation. Israel Discount Bank’s strategic focus on AI integration aligns perfectly with this trend, offering a pathway to enhanced competitiveness and market leadership.

Israel Discount Bank can capitalize on its successful international operations, such as IDB Bank in the U.S., to pursue further global expansion. This strategic move could involve increasing its presence in current international markets or venturing into new territories, utilizing its specialized financial service knowledge to serve a wider array of international clients and broaden its revenue sources.

Israel Discount Bank has a significant opportunity to expand its offerings in specialized financial services. The global wealth management market, for instance, was valued at approximately $80 trillion in 2023 and is projected to grow steadily. By enhancing its private banking and wealth management divisions, the bank can tap into this expanding market, catering to high-net-worth individuals seeking personalized financial strategies and investment advice.

Furthermore, the bank can develop tailored commercial lending solutions for emerging or underserved industries. This strategic focus on niche markets allows Discount Bank to build expertise and offer competitive advantages, differentiating itself from larger, more generalized financial institutions. For example, providing specialized financing for the burgeoning Israeli tech or renewable energy sectors could yield higher profit margins and foster strong client relationships.

Expansion of ESG and Sustainable Finance Offerings

Israel Discount Bank can capitalize on the growing global demand for ESG and sustainable finance by broadening its product and service portfolio. This includes developing specialized green loans, launching sustainable investment funds, and offering ESG advisory services, all of which can attract environmentally and socially conscious investors and businesses. For instance, by Q1 2024, the global sustainable investment market reached an estimated $37.4 trillion, indicating a significant opportunity for banks to tap into this expanding sector.

The bank can further enhance its appeal by actively promoting its commitment to sustainability. This includes transparent reporting on its ESG initiatives and the impact of its sustainable finance products.

- Growing Demand: Global ESG investments are projected to exceed $50 trillion by 2025, presenting a substantial market for expansion.

- New Customer Segments: Offering sustainable products can attract a new demographic of investors and businesses prioritizing ethical and environmental considerations.

- Brand Enhancement: A strong focus on ESG can improve the bank's reputation and competitive positioning in the financial market.

Leveraging Data Analytics for Enhanced Personalization

Israel Discount Bank possesses a significant opportunity to harness its extensive customer data through sophisticated analytics. By delving deeper into customer behavior and preferences, the bank can craft highly personalized product offerings and execute more effective marketing campaigns.

This data-driven approach enables proactive customer service, fostering improved loyalty and unlocking cross-selling opportunities. For instance, by analyzing transaction patterns, Discount Bank could identify customers likely to need a mortgage and offer tailored solutions, potentially boosting revenue streams.

- Enhanced Customer Insights: Advanced analytics can reveal granular details about customer needs, allowing for hyper-personalized financial products.

- Targeted Marketing: Data segmentation enables highly specific marketing efforts, increasing campaign effectiveness and reducing wasted spend.

- Proactive Service: Predicting customer needs, such as potential account issues or future financial requirements, allows for preemptive outreach.

- Revenue Growth: Personalization and improved customer engagement directly translate to increased cross-selling and up-selling, driving revenue.

Israel Discount Bank can leverage its digital transformation progress, including its AI investment tool, to capture a larger share of the expanding fintech market, which is expected to reach $332.5 billion by 2027.

Further international expansion, building on the success of IDB Bank in the U.S., presents a clear avenue for growth, tapping into global markets and diversifying revenue streams.

The bank has a prime opportunity to enhance its specialized financial services, particularly in wealth management, a sector valued at approximately $80 trillion in 2023, by catering to high-net-worth individuals.

Expanding into sustainable finance and ESG-focused products is another significant opportunity, as global sustainable investments are projected to surpass $50 trillion by 2025, attracting a growing segment of conscious investors.

Threats

Geopolitical instability in the Middle East presents a substantial threat to Israel Discount Bank. Ongoing regional conflicts and tensions can directly impact the Israeli economy, leading to decreased consumer spending and business investment. For instance, heightened security concerns can deter foreign investment, a crucial driver for economic growth and a source of business for banks.

Such instability directly translates into increased credit risk for the bank. Economic slowdowns and uncertainty can impair the ability of businesses and individuals to repay loans, potentially leading to a rise in non-performing assets within Israel Discount Bank's loan portfolio. This was a concern noted by Moody's in their 2024 outlook for the Israeli banking sector, highlighting the sensitivity to external shocks.

Furthermore, capital outflows and reduced investor confidence are significant risks stemming from geopolitical events. Investors may withdraw funds from the region seeking safer havens, impacting liquidity and potentially increasing the bank's cost of funding. This can constrain lending capacity and profitability, as seen during periods of elevated regional tensions in previous years.

Regulatory shifts in Israel, such as the potential introduction of tiered banking licenses by mid-2024, are poised to significantly boost competition. These changes could empower non-bank entities and fintechs to offer services previously exclusive to traditional banks.

This increased competition poses a direct threat to Israel Discount Bank, particularly in its core retail and small business segments. Fintechs and new entrants may aggressively target deposit-gathering and credit provision, potentially leading to market share erosion and pressure on profit margins.

For instance, by the end of 2023, fintech companies in Israel saw a notable surge in digital payment volumes, indicating a growing consumer preference for non-traditional financial services. This trend suggests that Israel Discount Bank must innovate rapidly to retain its customer base and offer competitive digital solutions.

Despite tentative signs of recovery, the Israeli economy navigates a complex landscape marked by risks of moderated GDP growth and enduring inflation. Central bank projections highlight these persistent inflationary pressures, suggesting a challenging environment for businesses and consumers alike.

An economic downturn could significantly impact Israel Discount Bank by increasing unemployment rates and curbing consumer spending. This reduced economic activity directly translates to a higher likelihood of loan defaults, thereby deteriorating the bank's asset quality and squeezing its profitability margins.

For instance, if inflation remains elevated, the Bank of Israel might continue its tight monetary policy, increasing borrowing costs for both individuals and corporations. This scenario, coupled with slower economic expansion, could see non-performing loans rise above the 3.5% mark observed in late 2023, directly affecting the bank's bottom line.

Evolving Regulatory Landscape and Compliance Costs

The banking industry faces an ever-changing regulatory environment, with new rules frequently introduced to foster competition, enhance consumer protection, and ensure financial stability. Israel Discount Bank, like its peers, must navigate these shifts, which can lead to substantial compliance expenses and operational challenges.

Adapting to evolving regulations, whether concerning capital requirements, data privacy, or fair lending, demands significant investment in technology and personnel. For instance, the Bank of Israel's ongoing efforts to bolster financial sector resilience and consumer rights, particularly in light of global trends, necessitate continuous updates to internal processes and systems. These adjustments directly impact the bank's operational costs and strategic planning, requiring careful resource allocation.

- Increased Capital Adequacy Ratios: Banks must maintain higher capital buffers, impacting lending capacity and profitability.

- Data Privacy Compliance: Strict adherence to data protection laws, like GDPR or local equivalents, requires robust cybersecurity measures and data governance frameworks.

- Consumer Protection Regulations: New rules on transparency, fees, and complaint handling add to operational complexity and potential for fines.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements: These ongoing obligations demand sophisticated monitoring and reporting systems.

Sophisticated Cyberattacks and Data Breaches

The financial services sector in Israel, including institutions like Israel Discount Bank, is a significant target for advanced cyber threats. Reports from 2024 indicate a rise in sophisticated attacks such as ransomware and infostealer malware, aiming to compromise sensitive financial data.

Israel Discount Bank, like its peers, faces a persistent risk of data breaches and system disruptions. Such incidents can result in substantial financial losses due to theft, recovery costs, and regulatory fines, alongside severe reputational damage and erosion of customer confidence.

- Increased Sophistication: Cybercriminals are employing more advanced techniques, making traditional defenses less effective.

- Financial Impact: Breaches can lead to direct financial losses from fraud and indirect costs associated with system recovery and legal liabilities.

- Reputational Risk: A significant data breach can severely damage customer trust, impacting long-term business viability.

- Regulatory Scrutiny: Financial institutions face stringent regulations regarding data protection, with penalties for non-compliance.

The bank faces heightened competition from new tiered banking licenses and agile fintechs, potentially eroding market share in core segments. Elevated geopolitical risks in the Middle East can trigger capital outflows and increase credit risk, impacting liquidity and profitability.

Persistent inflation and moderated GDP growth in Israel pose a threat of increased loan defaults and reduced consumer spending, directly affecting asset quality and margins. Evolving regulatory landscapes, including stricter capital requirements and data privacy laws, necessitate significant investment and operational adjustments.

Advanced cyber threats, such as ransomware, present a substantial risk of data breaches, financial losses, and severe reputational damage. For instance, by late 2023, the Israeli banking sector had already seen a rise in sophisticated cyberattacks, highlighting the need for continuous investment in cybersecurity infrastructure.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Israel Discount Bank's official financial statements, comprehensive market research reports, and expert analyses of the banking sector.