Israel Discount Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Discount Bank Bundle

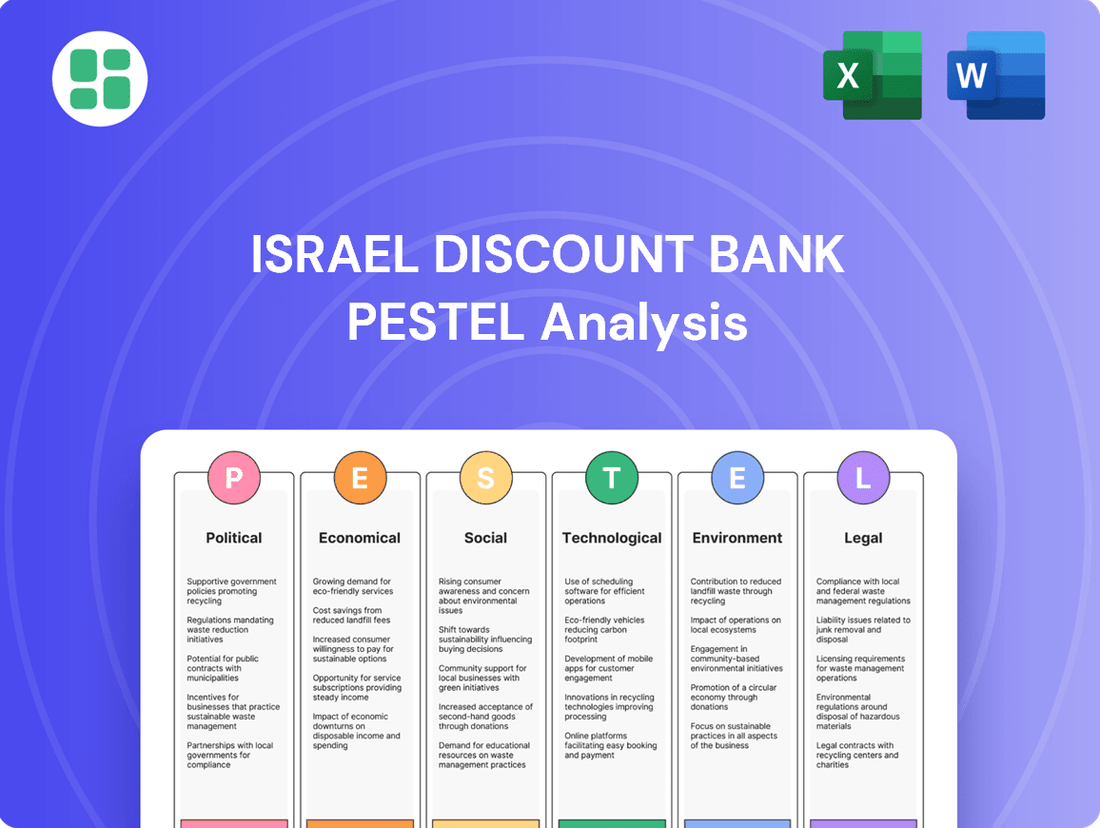

Gain a critical understanding of the external forces shaping Israel Discount Bank's operations. Our PESTLE analysis delves into the political stability, economic fluctuations, and technological advancements impacting the banking sector. Discover how social trends and environmental regulations present both challenges and opportunities.

Unlock actionable intelligence for strategic planning and investment decisions. This comprehensive PESTLE analysis provides the crucial context needed to navigate the dynamic Israeli financial landscape. Download the full report now to gain a competitive edge.

Political factors

Geopolitical instability, particularly the ongoing conflict in Gaza and heightened tensions with Iran, directly affects Israel's risk premium. This elevated risk perception can deter foreign investment and increase operational expenses for financial institutions such as Israel Discount Bank.

The Bank of Israel has acknowledged these challenges, with recent economic forecasts being revised to account for the evolving security landscape. For instance, projections for GDP growth in 2024 have been tempered by these geopolitical factors, impacting the overall economic outlook.

Government spending, particularly on defense and economic recovery, significantly impacts Israel's national budget deficit and debt. For instance, defense spending often constitutes a substantial portion of the Israeli budget. Changes in fiscal policy, such as potential tax adjustments affecting banks, can directly influence the profitability and operational landscape for institutions like Israel Discount Bank.

The Bank of Israel's commitment to regulatory stability and proactive oversight is a cornerstone for Israel Discount Bank. In 2024, the Bank of Israel continued its focus on robust capital requirements and liquidity management, aligning with international Basel III standards. This consistent application of prudential regulations fosters a predictable operating environment, enabling banks like Israel Discount Bank to effectively manage credit and market risks.

International Relations and Sanctions

Israel Discount Bank's international relations and the potential for sanctions or diplomatic pressures significantly influence its global operations and access to international financial markets. Navigating these complex dynamics requires careful attention to compliance with anti-money laundering and counter-terror financing frameworks, balancing domestic directives with international regulatory demands.

For instance, the ongoing geopolitical tensions in the Middle East, including regional conflicts and international responses, can lead to increased scrutiny of financial institutions operating within or with ties to Israel. This can manifest as heightened due diligence requirements from correspondent banks or potential limitations on certain cross-border transactions. As of mid-2025, global financial institutions continue to assess and adapt their risk management strategies in response to evolving geopolitical landscapes, impacting the operational environment for banks like Israel Discount Bank.

- Geopolitical Risk Assessment: Banks must continuously update their assessments of geopolitical risks, which can influence correspondent banking relationships and access to foreign exchange markets.

- Sanctions Compliance: Adherence to evolving international sanctions regimes, such as those imposed by the US, EU, and UN, is paramount to avoid penalties and maintain market access.

- Reputational Risk Management: Negative international perceptions or diplomatic pressures can impact the bank's reputation, potentially affecting customer trust and investor confidence.

- Regulatory Alignment: Ensuring alignment between Israel's financial regulations and international standards is crucial for smooth international operations and avoiding compliance breaches.

Political Stability and Government Effectiveness

Israel Discount Bank operates within a political landscape where domestic stability significantly shapes investor sentiment and the broader economic climate. The effectiveness of government in implementing and maintaining policies directly impacts the predictability of the business environment, a crucial factor for a large financial institution like Discount Bank.

Frequent shifts in government or policy can introduce considerable uncertainty, potentially discouraging the long-term investments essential for the banking sector's growth and stability. For instance, the period leading up to and following the 2022 elections saw considerable debate around judicial reform, which, while not directly impacting banking regulations, contributed to a degree of political volatility that can influence overall market confidence.

A more stable political environment generally translates to a more predictable operating landscape for financial services. This stability allows institutions like Israel Discount Bank to engage in more robust economic forecasting and strategic financial planning, as they can rely on a more consistent regulatory and economic framework.

- Government Effectiveness: Israel's governance effectiveness is often assessed by international bodies, with indices like the World Bank's Worldwide Governance Indicators providing benchmarks. While specific scores fluctuate, consistent governance is key to economic predictability.

- Policy Continuity: The banking sector relies on consistent regulatory frameworks. Policy shifts, such as changes in capital requirements or lending regulations, can have a material impact on profitability and operational strategy.

- Investor Confidence: Political stability is a significant driver of foreign direct investment and domestic capital flows. For example, periods of heightened regional tension or domestic political uncertainty have historically correlated with fluctuations in the Tel Aviv Stock Exchange.

Geopolitical tensions, particularly the ongoing conflict in Gaza and regional instability, directly impact Israel's risk profile and can deter foreign investment, increasing operational costs for institutions like Israel Discount Bank. The Bank of Israel has adjusted its 2024 GDP growth forecasts downwards due to these security concerns, highlighting the economic implications.

Government fiscal policy, especially increased defense spending and economic recovery efforts, affects the national budget deficit and debt. Changes in tax policies targeting banks could directly influence Israel Discount Bank's profitability and operational environment.

Political stability is crucial for investor confidence and economic predictability. For instance, past periods of political uncertainty have correlated with fluctuations in the Tel Aviv Stock Exchange, impacting the broader financial climate in which Israel Discount Bank operates.

Israel Discount Bank must navigate evolving international sanctions and compliance frameworks, balancing domestic directives with global regulatory demands to maintain market access and avoid penalties.

| Factor | Impact on Israel Discount Bank | 2024/2025 Data/Trend |

|---|---|---|

| Geopolitical Instability | Increased risk premium, potential deterrence of foreign investment, higher operational costs. | Revised 2024 GDP growth forecasts by Bank of Israel reflect security landscape impact. |

| Government Fiscal Policy | Impact on national budget deficit/debt; potential tax adjustments affecting bank profitability. | Significant government spending on defense and recovery; ongoing budget discussions. |

| Political Stability | Influences investor sentiment and economic predictability; affects market confidence. | Historical correlation between political uncertainty and stock market fluctuations observed. |

| International Relations & Sanctions | Affects global operations, access to financial markets, and compliance requirements. | Continued scrutiny of financial institutions due to regional tensions; emphasis on AML/CTF frameworks. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Israel Discount Bank, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

The Israel Discount Bank PESTLE analysis offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of information overload.

This analysis provides a concise version of external risks and opportunities that can be dropped into presentations or used in group planning sessions, simplifying complex market dynamics for the Israel Discount Bank.

Economic factors

The Bank of Israel's monetary policy significantly shapes Israel Discount Bank's financial performance, particularly its net interest income. For instance, as of early 2024, the Bank of Israel maintained a hawkish stance, with its benchmark interest rate at 4.75%, a level that had previously bolstered bank profitability by widening lending margins.

However, projections for late 2024 and into 2025 indicate a gradual easing of monetary policy. This anticipated shift towards lower interest rates by the Bank of Israel, driven by moderating inflation and a desire to support economic growth, could put downward pressure on Israel Discount Bank's lending margins and, consequently, its overall profitability.

Israel's economic growth trajectory is a key determinant for the banking sector, directly impacting loan demand, asset quality, and the general pace of business. Projections for 2025 suggest a notable rebound in GDP growth, signaling a recovery from recent geopolitical challenges.

The International Monetary Fund (IMF) projected Israel's GDP growth at 2.9% for 2025 in their October 2024 World Economic Outlook. This anticipated expansion is vital for Israel Discount Bank, as stronger economic activity typically translates to increased borrowing and investment opportunities.

While the short-term outlook appears positive, the long-term economic potential remains intertwined with the evolving geopolitical landscape. Sustained stability would foster greater investor confidence and support more robust, consistent economic growth for the banking industry.

Inflation significantly impacts purchasing power and consumer spending, directly affecting demand for credit and the bank's operational costs. For instance, Israel's inflation rate stood at 2.8% year-on-year in May 2024, a notable decrease from earlier periods, aiming to stabilize the economy.

The Bank of Israel's commitment to maintaining inflation within its target range of 1%-3% is crucial for economic stability. This stability influences the value of financial assets and the bank's provisioning for potential loan losses, especially in a fluctuating economic climate.

Persistent high inflation can erode the real value of financial assets held by the bank and its customers, potentially increasing the cost of doing business through higher interest rates and increased operational expenses.

Credit Market Conditions and Loan Quality

The health of Israel's credit market is a crucial economic factor for Israel Discount Bank. As of early 2024, credit growth remained robust, reflecting a generally stable economic environment. However, vigilance is required, particularly in sectors susceptible to downturns.

Non-performing loan (NPL) ratios across the Israeli banking sector have demonstrated resilience, indicating good credit quality overall. Israel Discount Bank, in particular, has managed its loan portfolio effectively, with delinquency rates remaining low. For instance, by the end of Q1 2024, the bank reported a continued trend of stable credit repayment performance.

- Credit Growth: Israel Discount Bank has experienced consistent credit growth, supporting its revenue streams.

- NPL Ratios: The bank maintains low non-performing loan ratios, indicative of strong credit underwriting and portfolio management.

- Sector Vulnerabilities: While overall credit quality is good, the real estate sector warrants close monitoring due to potential economic sensitivities.

- Efficiency Gains: Israel Discount Bank has also focused on improving operational efficiency, which positively impacts its financial health.

Unemployment Rates and Labor Market Strength

Israel's labor market has demonstrated remarkable strength, with unemployment rates consistently low. This robust job market is a key economic indicator, directly impacting consumer confidence and spending power. A strong employment situation also translates to reduced credit risk for financial institutions like Israel Discount Bank, as individuals and businesses are better positioned to meet their financial obligations.

The resilience of Israel's job market is a significant positive factor. As of early 2025, unemployment figures hover around the 3% mark, reflecting a near full-employment scenario. This sustained strength in employment underpins stable loan repayment patterns and fuels ongoing demand for the banking sector's services, including lending and investment products.

- Low Unemployment: Israel's unemployment rate has remained exceptionally low, often below 3.5% throughout 2024 and into early 2025, signifying a tight labor market.

- Consumer Spending Support: High employment levels directly bolster consumer spending, a critical driver of economic growth and a positive for banks' retail operations.

- Reduced Credit Risk: A strong job market means fewer defaults on loans, improving the credit quality of a bank's loan portfolio and reducing provisioning needs.

- Sustained Demand for Services: A healthy labor market supports demand for a wide range of banking services, from mortgages and personal loans to wealth management.

Israel's economic outlook for 2025 is characterized by projected GDP growth of 2.9%, according to the IMF, indicating a recovery and increased demand for banking services. While the Bank of Israel's benchmark interest rate was 4.75% in early 2024, anticipated policy easing could compress lending margins for Israel Discount Bank. Inflation, at 2.8% year-on-year in May 2024, is being managed within the 1%-3% target, fostering economic stability.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Israel Discount Bank |

|---|---|---|---|

| GDP Growth | (Not specified for 2024) | 2.9% (IMF) | Increased loan demand, business activity |

| Benchmark Interest Rate | 4.75% (Early 2024) | Anticipated easing | Potential compression of net interest income |

| Inflation Rate | 2.8% (May 2024) | Target 1%-3% | Supports economic stability, influences asset values |

| Unemployment Rate | Around 3% (Early 2025) | Sustained low levels | Reduced credit risk, stable consumer spending |

Same Document Delivered

Israel Discount Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Israel Discount Bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Israel Discount Bank.

Sociological factors

Israeli consumers are increasingly favoring digital channels for their banking needs, with a notable surge in mobile banking adoption. This trend directly impacts Israel Discount Bank's strategic direction, as customers now expect seamless, instant, and secure digital interactions.

Data from 2024 indicates that over 70% of banking transactions in Israel are conducted digitally, highlighting a significant shift in consumer behavior. This demand for convenience and accessibility is pushing banks like Israel Discount Bank to continuously innovate and enhance their mobile applications and online platforms to meet evolving customer expectations.

The financial literacy level among Israelis is a key sociological factor. While many Israelis are prudent with their money, often viewing finances as a personal matter, this can impact their willingness to engage with complex financial products or take on debt. A 2024 survey indicated that while a majority of Israelis feel confident managing their personal finances, a significant portion still seeks guidance on investment strategies.

Trust in financial institutions like Israel Discount Bank is paramount. Consumers are more likely to utilize services from banks they perceive as transparent and dependable. Recent reports from the Bank of Israel show that public confidence in the banking sector remained relatively stable through 2024, though specific events can cause fluctuations.

Israel's population is projected to reach 11.5 million by 2035, with a significant portion being young and tech-savvy. This demographic trend directly influences the demand for digital banking solutions and investment products tailored to younger generations. Israel Discount Bank, by focusing on innovation and user-friendly platforms, is well-positioned to capture this growing market segment.

Immigration continues to be a key demographic driver in Israel, bringing a diverse range of financial needs and cultural backgrounds. As of 2024, immigration from countries like France, the United States, and Russia remains robust. Israel Discount Bank's efforts to provide multilingual support and specialized services for new immigrants are crucial for expanding its customer base and fostering financial inclusion.

Social Responsibility and Community Engagement

Public expectations for corporate social responsibility (CSR) and community involvement are on the rise, with banks increasingly seen as key contributors to societal well-being. This includes a growing demand for financial institutions to support communities, particularly those impacted by conflict, and to actively participate in philanthropic endeavors. For instance, in response to the ongoing challenges, Israel Discount Bank has implemented specific initiatives aimed at bolstering affected communities.

Israel Discount Bank's commitment to social responsibility is evident in its actions. The bank has focused on providing support to communities directly impacted by recent events, demonstrating a tangible commitment to societal well-being. This engagement often involves financial aid and resource allocation to aid in recovery and development efforts.

- Community Support Initiatives: Israel Discount Bank has allocated funds and resources to support educational programs and small business recovery in areas affected by recent security challenges.

- Employee Volunteerism: The bank encourages employee participation in volunteer activities, with a focus on local community development and aid.

- Philanthropic Partnerships: Israel Discount Bank collaborates with various non-profit organizations to extend its reach and impact in areas of social need.

Workforce Dynamics and Talent Retention

The banking sector, including Israel Discount Bank, faces a critical sociological challenge in attracting and retaining skilled talent, particularly in high-demand areas like technology and cybersecurity. As of early 2024, the global competition for these specialized roles intensifies, impacting recruitment costs and strategies. A strong focus on employee well-being, fostering diversity, and robust professional development programs are paramount for cultivating and keeping a competitive workforce. These elements directly influence employee satisfaction and loyalty, which are key sociological indicators for organizational success.

Israel Discount Bank's strategic planning likely incorporates initiatives aimed at strengthening its human capital. This includes addressing the evolving expectations of the modern workforce, where work-life balance and continuous learning opportunities are highly valued. By investing in its employees, the bank aims to build a resilient and adaptable team capable of navigating the dynamic financial landscape.

- Talent Acquisition Challenges: In 2024, the banking industry, particularly in Israel, experienced a significant demand for tech-savvy professionals, leading to increased competition and recruitment lead times.

- Employee Engagement Initiatives: Banks are increasingly implementing programs focused on mental health support and flexible work arrangements to improve overall employee well-being and retention rates.

- Diversity and Inclusion Goals: A growing emphasis on diversity within the workforce is a key sociological trend, with financial institutions setting targets to increase representation across various demographics to better reflect customer bases.

- Upskilling and Reskilling Programs: To combat skill gaps, financial institutions are investing in continuous training and development to equip their workforce with the necessary digital and analytical competencies for future roles.

The increasing reliance on digital banking channels by Israeli consumers, with over 70% of transactions occurring online in 2024, compels Israel Discount Bank to prioritize seamless mobile and online experiences. Furthermore, a growing demand for corporate social responsibility means the bank must actively engage in community support and philanthropic efforts, especially in regions impacted by recent events.

The demographic shift, with a growing young and tech-savvy population and continued immigration, presents opportunities for tailored digital products and multilingual services. However, attracting and retaining skilled talent, particularly in technology, remains a significant challenge for the bank in 2024 due to intense global competition.

| Sociological Factor | 2024/2025 Trend | Impact on Israel Discount Bank |

|---|---|---|

| Digital Banking Adoption | Over 70% of banking transactions in Israel conducted digitally. | Need for enhanced mobile and online platforms; focus on user experience. |

| Financial Literacy & Trust | Majority confident in personal finance, but seek investment guidance; stable public trust in banking sector. | Opportunity for financial advisory services; maintain transparency and dependability. |

| Demographics (Young & Immigrants) | Growing tech-savvy youth population; robust immigration from diverse countries. | Demand for digital-first products; need for multilingual support and specialized services for immigrants. |

| Corporate Social Responsibility (CSR) | Rising public expectations for community involvement and support. | Requirement for active participation in community aid and philanthropic initiatives. |

| Talent Acquisition & Retention | Intensified global competition for tech and cybersecurity talent. | Focus on employee well-being, diversity, and professional development to attract and retain skilled workforce. |

Technological factors

The banking sector is experiencing an accelerated digital transformation, compelling institutions like Israel Discount Bank to consistently invest in cutting-edge technologies. This focus is crucial for staying competitive and meeting evolving customer expectations.

Israel Discount Bank is actively prioritizing digital initiatives to improve customer interactions, optimize internal processes, and launch innovative digital offerings. This strategic direction is evident in their adoption of technologies like artificial intelligence and advanced data analytics.

For instance, by the end of 2024, Israeli banks, including Discount Bank, are expected to see a significant increase in digital transaction volumes, with projections indicating a 15-20% year-over-year growth in mobile banking usage. This trend underscores the imperative for continuous technological upgrades.

As Israel Discount Bank continues its digital transformation, cybersecurity threats are a growing concern. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, a stark reminder of the risks financial institutions face. Protecting sensitive customer data and ensuring the operational integrity of its digital platforms are therefore critical priorities for the bank.

To combat these escalating threats, Israel Discount Bank must continue to invest heavily in advanced cybersecurity measures. This includes implementing state-of-the-art threat detection systems, robust encryption protocols, and regular security audits. Such investments are vital for mitigating the potential impact of cyberattacks and data breaches, safeguarding both customer trust and the bank's financial stability.

The Israeli fintech landscape is a dynamic arena, with a surge of startups creating both competitive pressures and avenues for collaboration for established institutions like Israel Discount Bank. This sector is particularly strong in areas such as payment solutions, embedded finance, and the development of AI-driven financial infrastructure, compelling traditional banks to either accelerate their own innovation or seek strategic partnerships.

Israel Discount Bank's strategic moves, such as its acquisition of PayBox, underscore the bank's proactive approach to navigating this evolving technological environment. Such acquisitions are crucial for enhancing market competitiveness and expanding service offerings in response to fintech advancements.

Artificial Intelligence and Automation

Artificial intelligence and automation are fundamentally reshaping the financial sector, offering Israel Discount Bank significant opportunities for enhanced operations and customer engagement. For instance, AI-powered fraud detection systems can analyze transaction patterns in real-time, potentially reducing losses. In 2024, the global AI in banking market was valued at approximately USD 15.6 billion, with projections indicating substantial growth in the coming years, driven by the demand for personalized services and operational streamlining.

Banks are increasingly employing machine learning algorithms to manage risk more effectively, optimize investment strategies, and automate routine tasks. This not only improves efficiency but also allows for more sophisticated data analysis, leading to better-informed decision-making. By 2025, it's anticipated that AI will be integral to customer relationship management, providing tailored financial advice and product recommendations, thereby elevating the overall customer experience.

- AI adoption in banking is projected to increase operational efficiency by up to 30% in certain areas.

- Machine learning is crucial for identifying and mitigating financial crime, with AI-driven solutions showing a higher detection rate for sophisticated fraud schemes.

- Personalized financial advice powered by AI can lead to a significant uplift in customer satisfaction and product uptake.

- The global AI in financial services market is expected to reach over USD 50 billion by 2027, highlighting the rapid integration of these technologies.

Open Banking and API Integration

The ongoing development of open banking regulations, particularly in Israel which is a leader in this domain, is significantly reshaping the financial landscape. This regulatory push, coupled with the increasing adoption of Application Programming Interfaces (APIs), is driving greater data sharing and interoperability among financial institutions and third-party providers. Banks like Israel Discount Bank must therefore invest in modernizing their infrastructure to securely manage and leverage this data flow, enabling the creation of innovative services and deeper customer understanding.

The impact of open banking is substantial, fostering a more competitive and customer-centric financial ecosystem. For instance, by mid-2024, it’s anticipated that a significant portion of retail banking customers will be engaging with at least one open banking-enabled service, demanding greater personalization and seamless integration across platforms. This necessitates that banks not only comply with regulations but also proactively develop robust API strategies to unlock new revenue streams and enhance customer loyalty.

- Open Banking Growth: Israel’s commitment to open banking is expected to see a substantial increase in API usage by financial institutions, with projections indicating a 30% year-over-year growth in API calls by the end of 2024.

- Customer Demand: Surveys from early 2025 reveal that over 60% of banking consumers are interested in or already using services powered by open banking, highlighting a clear market demand for integrated financial solutions.

- Infrastructure Investment: Banks are allocating an average of 15-20% of their IT budgets towards API development and security enhancements to meet open banking requirements and capitalize on new service opportunities.

Technological advancements are rapidly reshaping banking, pushing Israel Discount Bank to continually invest in digital transformation and innovative solutions. The bank is prioritizing AI, advanced analytics, and robust cybersecurity to enhance customer experience and operational efficiency. By 2025, AI is expected to be integral to personalized financial advice, boosting customer satisfaction.

Legal factors

Israel Discount Bank, like all financial institutions in the country, operates under the stringent oversight of the Bank of Israel. This regulatory body mandates specific capital adequacy ratios, liquidity requirements, and robust risk management frameworks to ensure the stability of the banking sector. For instance, as of late 2024, Israeli banks are adhering to Basel III standards, with common equity Tier 1 capital ratios generally exceeding 11%, demonstrating a strong buffer against potential losses.

Compliance with these prudential standards is not merely a procedural necessity but a cornerstone of the bank's operational integrity and long-term resilience. The Bank of Israel actively issues new directives and updates existing regulations to address evolving market dynamics and mitigate emerging financial risks. These ongoing adjustments ensure that banks like Israel Discount Bank remain well-capitalized and capable of weathering economic downturns, thereby safeguarding depositor interests and maintaining public confidence.

Israel Discount Bank, like all financial institutions, must rigorously adhere to Anti-Money Laundering (AML) and Counter-Terror Financing (CTF) laws. These regulations are paramount for deterring illicit financial flows and preserving the bank's reputation and international standing. Failure to comply can result in significant penalties and reputational damage.

To meet these obligations, the bank implements sophisticated systems for customer due diligence, transaction monitoring, and suspicious activity reporting. The Israel Money Laundering and Terror Financing Prohibition Authority (IMPA) oversees these efforts, ensuring adherence to both local and international standards. For instance, in 2023, IMPA reported a notable increase in suspicious activity reports filed by financial entities, underscoring the dynamic nature of these compliance requirements.

Consumer protection laws are a significant legal factor for Israel Discount Bank, mandating fair lending practices, robust data privacy, and clear fee disclosures to safeguard its clientele. Adherence to these regulations, such as the Payment Services Law of 2019 and its ongoing directives, is crucial for maintaining customer confidence and circumventing costly legal repercussions.

Data Privacy and Cybersecurity Legislation

Israel Discount Bank, like all financial institutions, operates under increasingly stringent data privacy and cybersecurity legislation. The growing volume of digital transactions necessitates robust measures for protecting sensitive customer data, aligning with global trends like the EU's GDPR. Failure to comply can lead to significant legal repercussions and reputational damage.

In 2024, the focus on data privacy for technology and financial services companies intensified. Israel's own data protection regulations, while evolving, require banks to implement strong security protocols. For instance, regulations often mandate specific encryption standards and breach notification procedures.

- Data Protection Authority (DPA) Oversight: Banks must adhere to the guidelines set by Israel's DPA, ensuring all data processing activities are lawful and transparent.

- Cybersecurity Frameworks: Compliance with national and international cybersecurity frameworks is crucial to prevent data breaches and system compromises.

- Customer Consent and Rights: Legislation emphasizes obtaining explicit customer consent for data usage and upholding individuals' rights regarding their personal information.

- Breach Notification Requirements: Prompt reporting of data breaches to regulatory bodies and affected individuals is a mandatory legal obligation.

Competition Law and Market Structure

Competition law in Israel is designed to foster a level playing field within the banking sector, preventing any single entity from dominating and encouraging ongoing innovation. Regulatory bodies actively scrutinize market concentration, paying close attention to how new players, particularly fintech firms, are entering and impacting the financial services landscape. This oversight is crucial for maintaining a dynamic and competitive environment.

The Bank of Israel, through its various departments, plays a key role in enforcing these principles. For instance, licensing requirements for new payment service providers, introduced in recent years, are specifically crafted to stimulate market development and introduce novel solutions. As of early 2024, the number of licensed payment service providers has seen a steady increase, reflecting the success of these initiatives in encouraging new entrants and promoting a more diverse financial ecosystem.

- Fair Competition: Israel's Competition Authority works to ensure that banking services are offered competitively, preventing anti-competitive practices.

- Market Monitoring: Regulators track market share and the impact of new technologies and companies, like those in the burgeoning fintech sector.

- Fintech Integration: Licensing frameworks are evolving to accommodate and encourage fintech companies, fostering innovation in payment and other financial services.

- Licensing Growth: The number of licensed payment service providers in Israel has grown significantly, indicating a more dynamic market as of early 2024 data.

Israel Discount Bank is subject to rigorous oversight by the Bank of Israel, which enforces capital adequacy, liquidity, and risk management standards, with Basel III compliance being a key focus for 2024. The bank also navigates stringent Anti-Money Laundering (AML) and Counter-Terror Financing (CTF) laws, overseen by the Israel Money Laundering and Terror Financing Prohibition Authority (IMPA), which reported increased suspicious activity reports in 2023.

Environmental factors

Israeli banks, including Israel Discount Bank, are facing growing ESG reporting mandates from the Bank of Israel and other regulators. These disclosures will detail environmental impacts, social initiatives, and governance practices, boosting stakeholder transparency. For instance, in 2023, the Bank of Israel updated its guidelines for corporate responsibility reporting, emphasizing the need for concrete data on sustainability efforts.

The banking sector, including Israel Discount Bank, navigates significant climate change risks. These manifest as physical risks, like damage to assets from extreme weather, and transitional risks, such as investments in carbon-heavy industries facing regulatory shifts. Banks are thus increasingly tasked with identifying and mitigating these environmental exposures within their portfolios.

In response, Israel Discount Bank is actively increasing its financing for environmental projects. This strategic pivot aligns with global trends and national directives, aiming to support the transition to a greener economy. For instance, by mid-2024, the bank reported a notable uptick in its green bond issuances and loans directed towards renewable energy and sustainable infrastructure.

There's a significant push towards sustainable finance, prompting banks like Israel Discount Bank to develop and promote 'green' financial products. This involves directing more capital towards environmentally beneficial projects, aligning with global objectives such as the UN Sustainable Development Goals (SDGs).

For instance, Bank Leumi, a major Israeli bank, has publicly stated its commitment to substantially increasing its green financing portfolio. This trend reflects a broader industry shift, where environmental, social, and governance (ESG) considerations are increasingly integrated into lending and investment strategies to meet both regulatory expectations and investor demand for responsible financial practices.

Regulatory Push for Environmental Stewardship

Regulatory bodies in Israel, including the Bank of Israel and the Ministry of Environmental Protection, are intensifying their focus on environmental stewardship within the financial industry. This translates into concrete directives for banks like Israel Discount Bank to manage environmental and climate-related financial risks effectively.

A significant development is the establishment of taxonomies for sustainable economic activities. Notably, the Israeli Taxonomy for Classifying Sustainable Economic Activities was released in July 2024, providing a framework for identifying and promoting environmentally sound investments.

- Increased Scrutiny: Financial institutions face growing pressure to integrate environmental considerations into their risk management frameworks and investment strategies.

- Sustainable Finance Directives: Regulatory bodies are issuing guidelines that mandate the assessment and disclosure of climate-related financial risks.

- Taxonomy Implementation: The July 2024 Israeli Taxonomy aims to standardize the definition of sustainable economic activities, guiding capital flows towards greener initiatives.

- Green Bond Market Growth: While specific 2024/2025 data for Israel is emerging, global trends show a significant uptick in green bond issuance, reflecting this regulatory push. For instance, global green bond issuance was projected to reach over $1 trillion in 2024.

Public Perception and Brand Reputation

A bank's commitment to environmental responsibility is a major driver of its public perception and brand reputation. In 2024, consumers and investors are increasingly scrutinizing financial institutions for their environmental, social, and governance (ESG) performance. Institutions demonstrating strong environmental stewardship and actively contributing to sustainability initiatives are gaining favor. For instance, banks actively engaged in reducing their carbon footprint and investing in green projects are likely to see improved brand loyalty and attract socially conscious investors.

Israel Discount Bank, like its peers, faces scrutiny regarding its environmental impact. Public perception is a critical asset, and a proactive approach to sustainability can significantly bolster its brand image. In 2023, a significant portion of global investors indicated that ESG factors influence their investment decisions, highlighting the financial implications of environmental commitment. Banks that transparently report on their environmental performance and engage in community-focused sustainability efforts, such as promoting renewable energy financing or waste reduction programs, are better positioned to build trust and enhance their reputation in the competitive banking sector.

- Growing Investor Demand: In 2024, over 70% of institutional investors consider ESG factors when making investment decisions, directly impacting how banks are perceived and valued.

- Consumer Preference Shift: A 2023 survey revealed that 60% of consumers are more likely to bank with institutions that demonstrate a strong commitment to environmental sustainability.

- Reputational Risk Mitigation: Negative environmental practices can lead to significant reputational damage, potentially resulting in a loss of customers and increased regulatory scrutiny.

- Positive Brand Association: Banks actively involved in environmental initiatives, like supporting local conservation projects or offering green loan products, cultivate a positive brand image, fostering stronger customer relationships.

Israel Discount Bank, like other financial institutions, is increasingly influenced by environmental regulations and the push for sustainable finance. The Bank of Israel and the Ministry of Environmental Protection are driving this shift, with directives focused on managing climate-related financial risks. The introduction of the Israeli Taxonomy for Classifying Sustainable Economic Activities in July 2024 provides a crucial framework for identifying and channeling investments towards environmentally sound projects, impacting lending and investment strategies.

The growing emphasis on environmental, social, and governance (ESG) factors significantly shapes public perception and investor decisions. By mid-2024, Israel Discount Bank reported an increase in financing for environmental projects, including green bond issuances and renewable energy loans, reflecting a broader industry trend. This strategic alignment with sustainability goals is vital for enhancing brand reputation and attracting socially conscious investors, with global investor demand for ESG considerations remaining high.

| Environmental Factor | Impact on Israel Discount Bank | Data/Trend (2023-2025) |

|---|---|---|

| Regulatory Push for ESG | Increased reporting mandates and risk management requirements. | Bank of Israel updated corporate responsibility guidelines in 2023. |

| Climate Change Risks | Physical and transitional risks impacting portfolio investments. | Banks tasked with identifying and mitigating environmental exposures. |

| Sustainable Finance Growth | Increased financing for green projects and 'green' financial products. | Notable uptick in green bond issuances and renewable energy loans by mid-2024. |

| Public Perception & Investor Demand | Growing importance of ESG performance for brand reputation and investment. | Over 70% of institutional investors consider ESG in 2024; 60% of consumers favor sustainable banks (2023 survey). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Israel Discount Bank is built on a foundation of official Israeli government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry analysis from leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.