Israel Discount Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Discount Bank Bundle

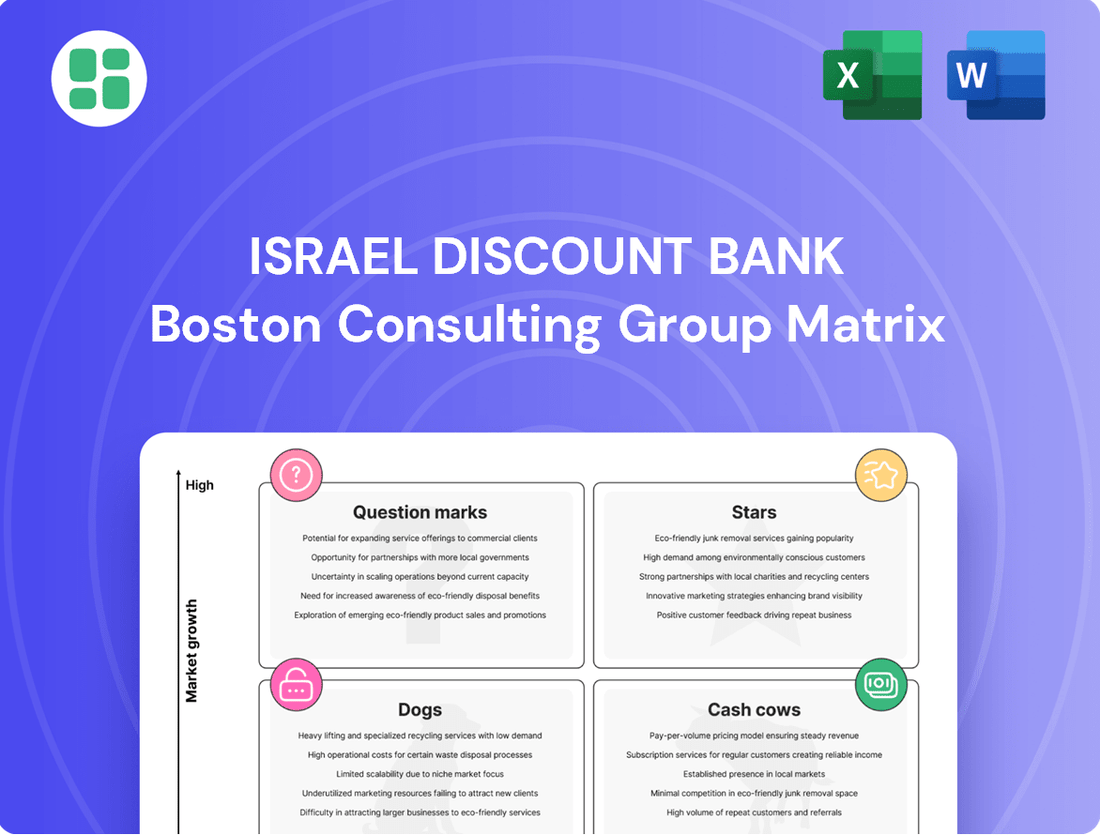

Curious about Israel Discount Bank's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio is performing in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full picture and gain actionable insights to inform your investment decisions.

Don't miss out on a comprehensive analysis of Israel Discount Bank's product portfolio. Purchase the full BCG Matrix for detailed quadrant placements, expert commentary, and strategic recommendations that will empower you to navigate the competitive landscape with confidence.

This isn't just a chart; it's your strategic roadmap. Get the complete Israel Discount Bank BCG Matrix to understand where to invest, where to divest, and how to optimize your capital allocation for maximum impact.

Stars

Digital Banking Solutions are a key "Star" for Israel Discount Bank, reflecting significant investment under its Discount 2030 strategy. The bank's dedication to digital maturity and operational efficiency underscores its push to grow these high-potential channels. This focus is crucial for capturing market share as digital adoption accelerates.

Israel's high-tech sector remains a powerhouse of innovation, and Israel Discount Bank actively supports this growth through its commercial lending. In 2024, the sector continued to attract substantial investment, with Israeli tech companies raising billions, indicating a strong demand for capital. The bank's strategy likely involves offering tailored financial products to these burgeoning firms, from early-stage startups to more mature tech enterprises, aiming to capitalize on this high-growth market.

Israel Discount Bank's US operations, specifically its international commercial banking segment, are a star performer within its BCG matrix. In 2024, this subsidiary saw its net income surge by nearly 40%, demonstrating robust growth.

As the largest Israeli bank in the United States, IDB Bank is strategically positioned in tier-1 markets, catering to a diverse international clientele. This strong presence in the dynamic US market signifies a high-growth area where the bank is actively expanding its global reach and capturing market share, particularly through its focus on commercial real estate and healthcare financing.

Fintech Partnerships and Acquisitions

The Israeli fintech scene is buzzing, known for its quick thinking and advanced technology, creating practical solutions. Israel Discount Bank's decision to fully acquire PayBox, a payment platform, highlights its dedication to using fintech for expansion.

This strategic move, along with other potential partnerships and acquisitions, allows the bank to grab market share in fast-growing fintech areas.

- Acquisition of PayBox: Israel Discount Bank took full ownership of PayBox, a significant step in its fintech strategy.

- Ecosystem Strength: Israel's fintech ecosystem is a powerhouse of innovation, driving real-world applications.

- Market Capture: These strategic fintech integrations position the bank to secure a stronger foothold in digital finance.

- Digital Leadership: By investing in and integrating new technologies, the bank aims to lead the digital finance revolution.

Specialized Commercial Lending

Israel Discount Bank is strategically expanding its commercial lending beyond general corporate finance, focusing on specialized niches like healthcare financing and sponsor & leverage finance within its US operations. This targeted approach allows the bank to cater to high-growth sectors with tailored financial solutions.

The bank's capacity to provide dynamic financing and customized solutions across various commercial industries highlights its focus on lucrative segments. For instance, in the first half of 2024, Israel Discount Bank reported a notable increase in its commercial loan portfolio, with specialized lending contributing significantly to this growth.

- Healthcare Financing: The bank has seen robust demand for its healthcare financing products, supporting acquisitions and operational expansions for medical providers.

- Sponsor & Leverage Finance: Israel Discount Bank is actively involved in providing leveraged financing to private equity sponsors, facilitating buyouts and recapitalizations.

- Higher Margins: These specialized lending activities typically yield higher interest margins compared to traditional corporate lending.

- Deepened Client Relationships: By offering bespoke solutions, the bank fosters stronger, more enduring relationships with clients in these expanding sectors.

Digital banking solutions, the acquisition of PayBox, and the bank's strong presence in the Israeli high-tech and US commercial banking sectors all represent "Stars" for Israel Discount Bank. These areas demonstrate high growth potential and market leadership, requiring continued investment to maintain their competitive edge. The bank's strategic focus on these segments is designed to capture significant market share and drive future profitability.

| Star Segment | Key Activities | 2024 Performance Indicators | Strategic Focus |

|---|---|---|---|

| Digital Banking | Discount 2030 Strategy, Digital Maturity | Accelerated Digital Adoption | Growth, Operational Efficiency |

| US Commercial Banking | International Commercial Lending, Tier-1 Markets | Net Income Surge (~40%) | Global Reach Expansion, Market Share Capture |

| Israeli High-Tech Support | Commercial Lending, Tailored Financial Products | Billions Raised by Tech Companies | Capitalizing on High-Growth Market |

| Fintech Integration (PayBox) | Full Acquisition of Payment Platform | Strengthened Fintech Position | Market Share in Digital Finance |

What is included in the product

This BCG Matrix analysis for Israel Discount Bank details strategic positioning of its business units, offering insights into investment and divestment opportunities.

The Israel Discount Bank BCG Matrix offers a clear, one-page overview, relieving the pain of uncertainty by strategically placing each business unit into its growth/market share quadrant.

Cash Cows

Israel Discount Bank's traditional retail banking deposits represent a strong Cash Cow. Its vast domestic branch network and dedicated customer base are key, providing a reliable and cost-effective funding source. This stability is crucial for the bank's operations.

This mature segment consistently generates net interest income, significantly boosting profitability. The bank benefits from this steady cash flow with minimal need for aggressive promotional spending, highlighting its efficient operational model.

Despite potentially slow market growth, Israel Discount Bank's substantial market share in retail deposits ensures a predictable and substantial cash inflow. These deposits are vital for maintaining the bank's liquidity and supporting its lending activities.

Israel Discount Bank's mortgage lending portfolio is a classic cash cow. In 2024, the bank saw a solid 6.1% growth in its home loan segment, reflecting the stable demand in the Israeli market. This mature product line, a cornerstone of its business, consistently generates predictable interest income, requiring minimal new investment for growth.

Established Large Corporate Commercial Lending represents a significant Cash Cow for Israel Discount Bank. In 2024, credit extended to large corporations saw a robust growth of 11.9%, underscoring the segment's profitability and strength.

These established relationships with major corporations are crucial, typically yielding substantial fee and interest income. Moreover, they often come with lower risk profiles compared to lending to smaller businesses, contributing to stable and predictable revenue streams.

The bank's comprehensive service offerings and strong reputation within this market further solidify its position. This segment acts as a consistent and vital engine for the bank's core financial operations, generating significant profit.

Private Banking Services

Israel Discount Bank's private banking services are a prime example of a Cash Cow within its portfolio. These services cater to high-net-worth individuals, offering a suite of wealth management, investment advisory, and specialized lending solutions. The bank leverages established, long-term client relationships to generate consistent, high-margin revenue.

This segment benefits from relatively low growth but commands a strong market position for Israel Discount Bank, ensuring a steady income. The mature nature of this market means that while expansion might be modest, the profitability per client is substantial, often requiring less aggressive marketing spend once relationships are solidified.

- Stable Revenue: Private banking typically provides a reliable and predictable income stream due to the sticky nature of high-net-worth client relationships.

- High Profit Margins: Fees from wealth management, advisory services, and tailored financial products contribute to strong profitability.

- Established Market Share: In 2024, Israel Discount Bank maintained a significant presence in the domestic private banking sector, underpinning its Cash Cow status.

- Lower Investment Needs: Compared to high-growth segments, private banking requires less capital for expansion, allowing for higher cash generation.

Core Credit Card Services

Israel Discount Bank's core credit card services are a classic example of a Cash Cow. This segment has demonstrated robust performance, with fees seeing a 15.5% year-over-year increase in Q1 2025, underscoring its continued strength.

The Israeli credit card market is mature, meaning it generates consistent revenue through interchange fees, interest income, and annual charges from a substantial and loyal customer base. This stability is a hallmark of a Cash Cow.

Despite advancements in payment technologies, the bank's core credit card offerings maintain a high market share and high transaction volume. This positions them as a reliable and profitable pillar within the bank's consumer financial products.

- Market Position: Dominant market share in a mature, stable Israeli credit card sector.

- Revenue Streams: Consistent generation of interchange fees, interest income, and annual fees.

- Financial Performance: Contributed to a 15.5% year-over-year rise in fees in Q1 2025.

- Strategic Value: Provides steady, predictable cash flow to support other business areas.

Israel Discount Bank's Treasury operations, particularly its management of liquid assets and interbank lending, function as a significant Cash Cow. In 2024, the bank's treasury activities generated substantial income through efficient deployment of funds and prudent risk management. This segment benefits from a stable interest rate environment and the bank's strong credit standing.

The treasury segment leverages the bank's overall financial strength to secure favorable terms in its funding and investment activities. This consistent profitability, driven by effective asset-liability management, provides a reliable cash inflow with predictable returns.

This area requires less capital expenditure for growth compared to other business lines, allowing it to be a net contributor of cash. Its mature and well-established processes ensure operational efficiency and sustained financial performance.

| Business Segment | BCG Category | 2024 Performance Indicator | Key Characteristics |

|---|---|---|---|

| Retail Banking Deposits | Cash Cow | Stable, cost-effective funding source | Vast domestic network, dedicated customer base |

| Mortgage Lending | Cash Cow | 6.1% growth in home loans | Mature product, stable demand, predictable interest income |

| Large Corporate Lending | Cash Cow | 11.9% growth in credit extended | Established relationships, lower risk, substantial fee/interest income |

| Private Banking | Cash Cow | Maintained significant market presence | High-net-worth clients, high-margin revenue, strong relationships |

| Credit Card Services | Cash Cow | 15.5% fee increase (Q1 2025) | Mature market, high transaction volume, consistent revenue streams |

| Treasury Operations | Cash Cow | Generated substantial income | Efficient asset deployment, strong credit standing, stable returns |

Delivered as Shown

Israel Discount Bank BCG Matrix

The Israel Discount Bank BCG Matrix preview you are viewing is the definitive, final document you will receive upon purchase. This comprehensive analysis, detailing the bank's strategic positioning across its product portfolio, is presented in its complete and unwatermarked form, ready for immediate application in your business strategy.

Dogs

Israel Discount Bank's extensive physical branch network, while historically a strength, now presents challenges in areas with declining customer traffic. These underutilized branches can become costly to maintain, especially as digital banking adoption continues to rise. For example, by the end of 2023, the bank reported a significant portion of its transactions occurring through digital channels, highlighting a shift away from traditional branch usage.

Israel Discount Bank, like many established financial institutions, likely possesses a collection of legacy products that have become niche and underperforming. These might include specialized loan structures or investment funds that, while once relevant, now face dwindling customer interest and profitability. For instance, in 2024, many traditional banks reported challenges in revitalizing older product lines, with some indicating that a significant portion of their portfolio consisted of offerings with less than 5% annual growth.

The cost associated with maintaining these outdated products can be substantial. Think about the expense of supporting legacy IT systems, the administrative burden of managing a low-volume product, and the limited marketing effectiveness for offerings that don't align with current consumer needs. This can tie up valuable capital and human resources that could be more effectively deployed in developing and promoting newer, more competitive financial solutions, potentially impacting overall bank efficiency and profitability.

Inefficient back-office processes at Israel Discount Bank, despite ongoing modernization, continue to be a drag on profitability. These can include manual data handling and outdated legacy systems, contributing to higher operating costs and slower customer service. For instance, in 2024, the global banking sector saw operational costs rise, with a significant portion attributed to maintaining older IT infrastructure, a challenge likely faced by Discount Bank.

Non-Performing Loan Management (Inefficient Recovery)

Even with Israel Discount Bank's generally strong risk management, certain segments of non-performing loans (NPLs) can become a 'dog' if recovery is persistently inefficient and costly. These specific problematic debts drain resources due to the disproportionate legal and administrative effort required for their resolution. For instance, in 2023, while the overall NPL ratio for Israeli banks remained low, specific portfolios with complex collateral or borrower situations might exhibit prolonged recovery cycles, impacting capital efficiency.

The inefficiency in recovering these particular NPLs can tie up valuable capital that could otherwise be deployed in more profitable ventures. This situation directly impacts the bank's profitability. Data from the Bank of Israel indicated that while the banking system's NPL ratio was around 1.1% at the end of Q3 2023, the cost of managing and recovering these specific NPLs, especially those involving protracted legal proceedings, can significantly outweigh the recovered amounts.

- Inefficient Recovery Processes: Certain loan types or specific borrower circumstances lead to prolonged and costly recovery efforts.

- Capital Tie-up: Funds allocated to managing these difficult NPLs are unavailable for more productive investments.

- Profitability Drag: Low recovery rates and high associated costs directly reduce the overall profitability of the bank.

- Resource Drain: Legal, administrative, and operational resources are disproportionately consumed by these underperforming assets.

Minority Stakes in Stagnant Ventures

Israel Discount Bank, like many financial institutions, may find itself holding minority stakes in ventures that aren't performing as expected. These can be in financial technology or other related areas where the initial promise hasn't translated into substantial market share or profitability. Such investments, if they remain in low-growth sectors and don't generate returns, can become a drain on capital without offering much strategic advantage.

The strategic implication here is akin to a "cash cow" that has stopped producing. If these stagnant ventures, representing minority stakes, are not contributing to Israel Discount Bank's overall growth objectives or providing a compelling return on investment, it makes strategic sense to consider divesting. This frees up valuable capital that can be reallocated to more promising opportunities that better align with the bank's core competencies and future growth plans.

- Stagnant Ventures: Minority stakes in financial or tech ventures that have failed to achieve significant market traction or growth objectives.

- Capital Tie-up: Investments that do not yield expected returns and operate in low-growth markets, thus tying up capital with little strategic benefit.

- Resource Reallocation: Divesting from such ventures can free up capital for more promising investments aligned with the bank's core growth strategies.

- Strategic Asset Allocation: This consideration is less about a specific product and more about the strategic management of the bank's investment portfolio.

Israel Discount Bank's "Dogs" in the BCG matrix likely encompass legacy products with declining customer interest and underperforming physical branches in low-traffic areas. These segments require significant maintenance costs and offer minimal returns, tying up capital. For example, by the end of 2023, a substantial portion of transactions were digital, indicating a reduced reliance on traditional branches, which are now costly to maintain relative to their usage.

Specific examples of "Dogs" could include niche loan products with very low origination volumes or outdated investment funds that have seen minimal investor uptake in recent years. The operational costs associated with supporting these products, including legacy IT systems and specialized compliance, often outweigh the revenue they generate. In 2024, many banks reported that a significant percentage of their product portfolio consisted of offerings with less than 5% annual growth, a common characteristic of "Dogs."

Inefficient back-office processes and certain non-performing loan (NPL) portfolios also fall into the "Dog" category. These areas consume disproportionate resources due to manual handling, outdated technology, or complex recovery procedures. While Israel Discount Bank maintains strong risk management, specific NPLs with protracted legal or administrative recovery cycles can become a drag. For instance, by Q3 2023, while overall Israeli bank NPL ratios were low, the cost of managing specific difficult NPLs could significantly impact capital efficiency.

The bank may also hold minority stakes in stagnant ventures that have failed to gain market traction or deliver expected returns. These investments, if operating in low-growth sectors, represent tied-up capital with little strategic benefit. Divesting from such ventures, as of 2024, is a common strategy to reallocate resources to more promising growth areas, aligning with broader financial sector trends.

| Category | Description | Challenges | 2023/2024 Data Point |

| Underutilized Branches | Physical locations with declining customer footfall. | High maintenance costs, low transaction volumes. | Digital transactions accounted for a significant majority of customer interactions. |

| Legacy Products | Financial offerings with diminishing customer demand and profitability. | Low growth rates, high support costs, limited market appeal. | Many traditional products had less than 5% annual growth. |

| Inefficient Processes/NPLs | Back-office operations and specific loan portfolios requiring excessive resources. | High operational costs, slow recovery times, capital tie-up. | Cost of managing specific NPLs can outweigh recovery amounts. |

| Stagnant Minority Stakes | Investments in ventures with poor performance and no strategic advantage. | Low returns, capital drain, lack of growth contribution. | Focus on reallocating capital from underperforming assets. |

Question Marks

The fintech world is buzzing with renewed interest in Web 3.0, and blockchain is at the forefront, especially for financial services seeking greater efficiency and transparency in payments. Israel Discount Bank is likely investigating or testing blockchain applications, perhaps for cross-border transactions using distributed ledger technology or for automated agreements via smart contracts.

These blockchain initiatives represent a high-growth, emerging market. While promising, their current market share for Israel Discount Bank is probably quite small, reflecting the early stage of adoption. For instance, global spending on blockchain in financial services was projected to reach over $10 billion in 2024, highlighting the sector's growth potential but also the nascent nature of individual bank contributions.

To transform these pilot projects into substantial revenue streams, Israel Discount Bank will need to commit significant investment and focused strategic development. This involves building robust infrastructure, navigating regulatory landscapes, and fostering user adoption, all crucial steps to scaling these nascent blockchain services into profitable offerings within the competitive financial services industry.

Israel Discount Bank, while having a strong US subsidiary like IDB Bank (a Star in its portfolio), is likely considering expansion into niche international markets. These markets, perhaps in rapidly growing emerging economies or underserved regions, represent significant potential but are currently in their nascent stages for the bank.

These new ventures would initially be Question Marks. They would have a low market share in these specific international niches, demanding substantial capital for entry, navigating complex regulatory landscapes, and establishing brand recognition. For instance, entering a market like Vietnam or parts of Sub-Saharan Africa in 2024 would require significant upfront investment.

The bank's success in these new territories hinges on its ability to gain traction and adapt its offerings to local customer needs and economic conditions. Without effective market penetration strategies, these investments could remain low-performing assets, potentially requiring divestment if they fail to transition towards becoming Stars or Cash Cows.

Israel Discount Bank is likely leveraging AI to enhance personalized financial advisory tools, aiming to improve customer experiences and fortify its financial infrastructure. These AI-driven tools could span automated investment management, hyper-targeted product recommendations, and customized financial planning. The bank's strategic focus on this high-growth area, driven by technological advancements and customer demand for tailored services, positions it for potential future success.

Embedded Finance Solutions

Embedded finance, the integration of financial services into non-financial platforms, represents a significant growth area for fintech. Israel Discount Bank might be looking into collaborations or building its own capabilities to offer banking services directly within other sectors, like e-commerce or real estate, meeting customers at their point of need.

These ventures are entering a fast-growing market, but the bank's initial market share in this space would likely be modest. Success hinges on innovative approaches and robust partnerships to achieve substantial growth and reach. For instance, the global embedded finance market was projected to reach $7.2 trillion by 2030, indicating substantial future potential.

- Market Growth: The embedded finance sector is experiencing rapid expansion, with projections indicating significant future value.

- Strategic Entry: Israel Discount Bank's involvement would likely begin with a smaller market presence, requiring strategic development.

- Partnership Focus: Success in embedded finance often relies on strong collaborations with non-financial companies.

- Innovation Demand: Developing and scaling embedded finance solutions necessitates novel business models and technological integration.

New Digital Lending Platforms (for specific segments)

Israel Discount Bank's new digital lending platforms targeting specific segments like online small businesses and gig economy workers are positioned in a high-growth market. These platforms cater to a demand for fast, easily accessible credit, a trend amplified by the digital transformation of commerce. For instance, the Israeli fintech market saw significant growth, with digital lending solutions becoming increasingly popular among SMEs seeking flexible financing options.

These ventures likely represent a Question Mark in the BCG Matrix for Israel Discount Bank. While the market is expanding, with reports indicating a substantial increase in digital lending adoption among small businesses in Israel, these new platforms would initially have a low market share. For example, in 2024, the digital lending sector in Israel was projected to continue its upward trajectory, driven by innovation and increased customer comfort with online financial services.

- Targeted Segments: Focus on underserved niches like online retailers and freelance workers.

- Market Dynamics: Operating in a high-growth digital lending space with increasing demand for quick credit.

- Competitive Landscape: Facing competition from established fintech players and other new entrants.

- Investment Needs: Requiring substantial investment in marketing and technology to build market share and achieve profitability.

Israel Discount Bank's new digital lending platforms for online businesses and gig workers are classic Question Marks. They operate in a rapidly expanding market, but the bank's initial penetration is likely minimal. Significant investment in technology and marketing is crucial to capture market share and transition these ventures towards profitability.

| BCG Category | Market Attractiveness | Competitive Position | Strategic Implications for IDB |

|---|---|---|---|

| Question Mark | High (Digital Lending Growth) | Low (New Entrant) | Requires significant investment to gain market share; potential for high returns if successful. |

| Example Data (2024 Projections) | Digital lending market in Israel projected for continued strong growth. | IDB's new platforms have a nascent market share. | Focus on targeted marketing and efficient technology to build customer base. |

BCG Matrix Data Sources

Our Israel Discount Bank BCG Matrix is informed by comprehensive financial disclosures, detailed market share analysis, and expert industry forecasts to provide strategic clarity.