Israel Discount Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Discount Bank Bundle

Israel Discount Bank navigates a competitive landscape shaped by moderate buyer power and the persistent threat of new entrants in the banking sector. Understanding these forces is crucial for any stakeholder looking to grasp the bank's strategic positioning.

The complete report reveals the real forces shaping Israel Discount Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Israel Discount Bank, like many financial institutions, relies heavily on technology. In 2024, the global banking sector saw significant investment in digital transformation, with many banks prioritizing AI for cybersecurity and compliance. This trend is expected to continue into 2025 as banks modernize their infrastructure.

This increasing dependence on specialized technology and infrastructure providers, particularly for advanced solutions like AI and hyperautomation, grants these vendors considerable bargaining power. For instance, the market for AI in financial services is projected to grow substantially, indicating a strong demand for these specialized services.

The availability of highly skilled professionals, especially in cybersecurity, AI, and data analytics, is a crucial input for Israel Discount Bank. A scarcity of this specialized talent can drive up recruitment expenses and salary demands, significantly enhancing the bargaining power of these skilled employees.

The increasing demand for expertise in cutting-edge fields like Generative AI is fundamentally reshaping traditional banking positions. This shift directly elevates the value and leverage of human capital within the organization.

Individual depositors, while numerous, generally possess limited bargaining power regarding interest rates on their savings. However, their collective actions and the broader interest rate landscape, heavily influenced by the Bank of Israel, do shape the bank's funding costs. Recent discussions in Israel have pointed out that banks might not be as quick to raise deposit rates compared to loan rates, indicating a weaker negotiating position for depositors seeking higher returns.

Regulatory Bodies and Government

Government and regulatory bodies, such as the Bank of Israel, function as significant suppliers by providing the essential operating licenses and regulatory framework that shape a bank's activities and financial performance. These entities wield substantial influence, dictating the operational landscape and directly impacting profitability.

For example, the Ministry of Finance's proposed increase in the bank profit tax rate from 17% to 26% for 2024 and 2025 directly impacts Israel Discount Bank's net earnings. Furthermore, adherence to evolving directives, including those concerning environmental risk management and the implementation of open banking, necessitates considerable investment and incurs additional operational costs for the bank.

- Regulatory Framework: The Bank of Israel dictates licensing and operational rules, acting as a key supplier of the legal environment.

- Taxation Impact: Planned tax hikes, like the proposed increase to 26% in 2024-2025, directly reduce bank profitability.

- Compliance Costs: New regulations, such as those for environmental risk and open banking, require significant investment and add to operational expenses.

Data and Information Providers

Data and information providers hold significant bargaining power within the financial sector, especially for institutions like Israel Discount Bank. The increasing reliance on data for risk management, customer analytics, and strategic planning means that access to quality, exclusive data from third-party firms and credit rating agencies is paramount. For instance, in 2024, global spending on big data and business analytics was projected to reach over $300 billion, underscoring the critical nature of these data suppliers.

The quality and uniqueness of data offered by these suppliers can create dependencies for banks. As banks, including Israel Discount Bank, ramp up investments in data management to fuel their artificial intelligence initiatives, the leverage of these data providers grows. This trend is evident as banks aim to enhance AI capabilities for predictive modeling and personalized customer experiences, making the data itself a valuable commodity.

- Data Dependency: Banks rely heavily on external data providers for crucial insights, creating a reliance that can increase supplier power.

- AI Investment Driver: Increased bank investments in AI and data management amplify the importance and bargaining strength of data suppliers.

- Information Exclusivity: The unique or proprietary nature of data offered by providers can limit alternatives and bolster their negotiating position.

Technology providers, especially those offering specialized AI and cloud solutions, exert considerable bargaining power over Israel Discount Bank. The global financial sector's push for digital transformation in 2024, with significant investment in AI for cybersecurity and compliance, highlights this dependency. As banks continue to modernize, the demand for these advanced technological inputs will likely grow, strengthening supplier leverage.

Skilled labor, particularly in areas like cybersecurity and data analytics, represents another critical input where suppliers—in this case, the talent pool itself—hold sway. The increasing demand for expertise in emerging fields like Generative AI further amplifies the bargaining power of these professionals, potentially driving up recruitment and retention costs for the bank.

Data and information providers also possess significant leverage due to the financial industry's increasing reliance on data for risk management and customer insights. With global spending on big data and business analytics projected to exceed $300 billion in 2024, the value and exclusivity of data from third-party firms and rating agencies are paramount, creating dependencies for banks like Israel Discount Bank.

What is included in the product

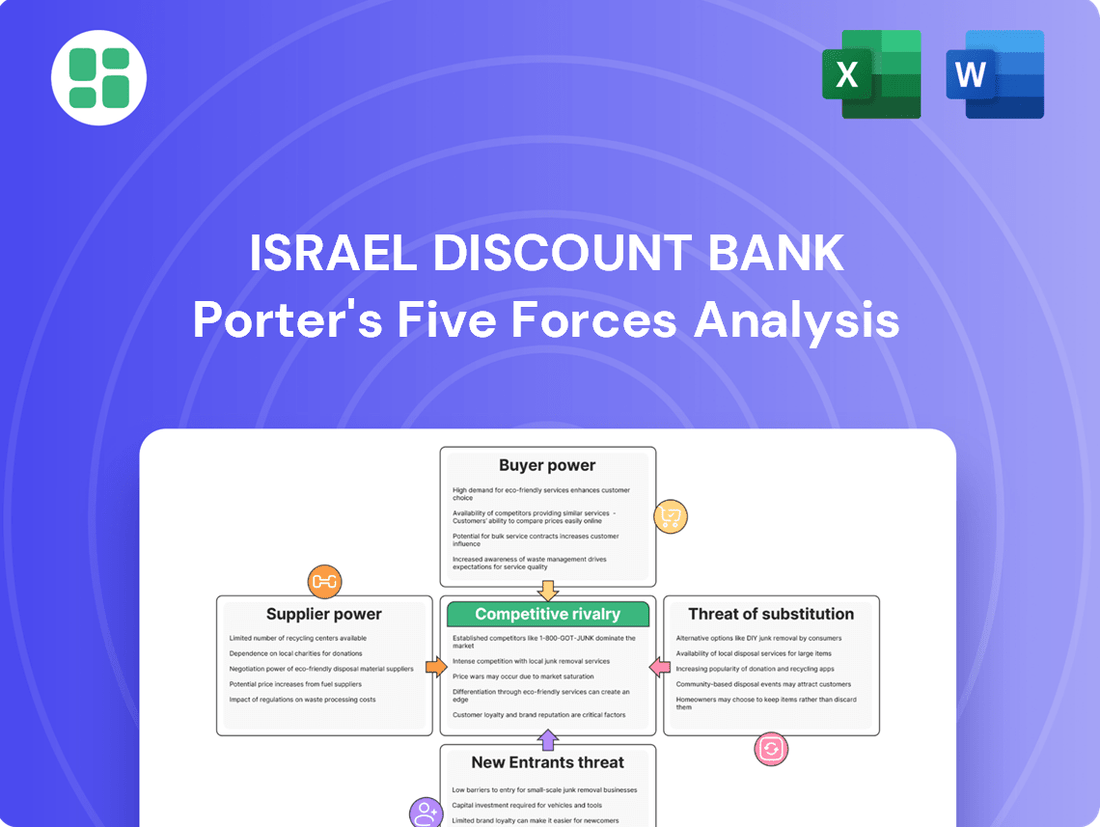

This Porter's Five Forces analysis provides a comprehensive assessment of the competitive landscape for Israel Discount Bank, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and address competitive threats with a visual breakdown of buyer power, supplier power, threat of new entrants, threat of substitutes, and existing rivalry.

Gain strategic clarity on the forces impacting Israel Discount Bank's profitability, allowing for targeted mitigation of competitive pressures.

Customers Bargaining Power

Retail customers, though individually weak in bargaining power due to standardized banking products, are increasingly empowered by digital channels. In 2024, the widespread adoption of mobile banking apps allows for easier comparison of services, shifting leverage.

The Bank of Israel's push for open banking, a trend gaining momentum, further amplifies customer power. This initiative, by facilitating data sharing, enables customers to switch providers more readily, potentially impacting Israel Discount Bank's customer retention strategies.

Small and medium-sized businesses (SMBs) represent a substantial portion of Israel Discount Bank's clientele, and their bargaining power is typically moderate. While these businesses often seek specialized financial products like customized loans and efficient cash management services, their options for alternative financing may be more limited when compared to larger, more established corporations.

This dynamic is reflected in the banking sector's performance; for instance, Israel Discount Bank saw its credit growth to small and very small businesses reach 4.2% in 2024. This figure suggests a continued reliance on conventional banking channels, even as innovative fintech solutions emerge as potential competitors.

Large corporate entities wield considerable bargaining power with banks like Israel Discount Bank. Their substantial transaction volumes and complex financial requirements mean they can negotiate more favorable terms. In 2024, Israel Discount Bank observed an 11.9% growth in credit demand from large corporations, highlighting their leverage.

These major clients often have the capacity to explore financing options beyond traditional banking, including direct access to capital markets. This ability to seek alternative funding sources further strengthens their position when negotiating with any single financial institution.

Digital Sophistication and Switching Costs

Customers today are more digitally savvy than ever, and the banking landscape reflects this. The proliferation of user-friendly digital platforms and innovative fintech solutions significantly lowers the effort and cost associated with switching banks. This digital sophistication directly translates to increased bargaining power for customers.

Traditional banks that lag in meeting these evolving digital expectations risk losing customers to more agile competitors or alternative financial service providers. For instance, a 2024 report indicated that 70% of banking customers prefer digital channels for most transactions, highlighting the critical need for robust online and mobile offerings. This ease of migration empowers customers to demand better services and pricing.

- Digital Literacy: Growing customer comfort with technology reduces barriers to switching.

- Fintech Competition: New entrants offer seamless digital experiences, setting higher customer expectations.

- Switching Costs: Lowered by digital platforms, making it easier for customers to move accounts.

- Customer Retention: Banks must prioritize hyper-convenient digital services to keep pace.

Impact of High Interest Rates

High interest rates have significantly impacted the bargaining power of customers for Israel Discount Bank. For instance, in 2024, the Bank of Israel's key interest rate reached 4.75%, leading to increased monthly payments for individuals with mortgages and other loans. This economic reality has diminished customers' ability to negotiate more favorable terms, as the prevailing market conditions dictate borrowing costs.

The consequence of these elevated rates is a reduced capacity for customers to exert pressure on banks like Israel Discount Bank. With higher repayment obligations, customers are less positioned to demand concessions or switch to more competitive offers, effectively limiting their bargaining leverage. This dynamic has, in turn, contributed to robust profitability for Israeli banks, with reports indicating record profits for the sector in recent periods, underscoring the constrained customer power.

- Increased Loan Repayments: Customers, especially mortgage holders, faced higher monthly payments in 2024 due to rising interest rates.

- Record Bank Profits: This situation contributed to record profits for Israeli banks, including Israel Discount Bank.

- Diminished Customer Leverage: Customers' ability to negotiate loan terms or push back against higher costs has been significantly curtailed.

- Market Influence: The macroeconomic environment and market structure currently favor lenders, limiting customer bargaining power.

The bargaining power of customers for Israel Discount Bank is a multifaceted issue, influenced by digital adoption, regulatory changes, and economic conditions. While individual retail customers may have limited power, collective digital literacy and the ease of switching banks due to fintech advancements are increasing their leverage. Conversely, high interest rates in 2024, with the Bank of Israel's key rate at 4.75%, have diminished customers' ability to negotiate favorable terms due to increased repayment obligations.

| Customer Segment | Bargaining Power Influence | 2024 Data/Trend |

|---|---|---|

| Retail Customers | Increasing due to digital channels and open banking initiatives. | 70% of banking customers prefer digital channels; Open banking adoption is gaining momentum. |

| Small & Medium Businesses (SMBs) | Moderate; seeking specialized products but options may be limited. | Israel Discount Bank's credit growth to small businesses was 4.2%. |

| Large Corporate Entities | High; due to transaction volumes and access to capital markets. | 11.9% growth in credit demand from large corporations; can negotiate favorable terms. |

| Overall Customer Impact (Interest Rates) | Diminished due to higher loan repayments. | Bank of Israel key rate at 4.75% led to increased monthly payments for borrowers. |

Preview the Actual Deliverable

Israel Discount Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Israel Discount Bank's competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive assessment is ready for your immediate use.

Rivalry Among Competitors

The Israeli banking sector is notably concentrated, with a few major institutions, including Israel Discount Bank, holding significant market share. This structure means there are fewer direct rivals offering comprehensive banking services. In 2023, the five largest banks in Israel collectively controlled a substantial portion of the banking market, raising discussions about the intensity of competition and potential for elevated profits.

This concentration can temper aggressive price wars among the dominant banks. For instance, as of late 2023, these top banks managed assets that represented over 70% of the total banking system assets in Israel, indicating a strong consolidation that influences competitive dynamics.

The competitive rivalry within the banking sector is heating up due to a fierce digital transformation and innovation race. Banks are pouring significant capital into artificial intelligence, automation, and sophisticated analytics. This push aims to create better customer experiences and streamline internal operations, directly impacting how banks compete.

A key driver of this rivalry is the need to modernize outdated legacy systems. Banks are investing heavily to shed these costly, inefficient infrastructures. This modernization is crucial to keep pace with agile fintech startups and neobanks that often operate with more flexible, modern technology stacks, intensifying the pressure on established players.

This ongoing technological arms race means substantial financial commitments for all participants. For instance, in 2024, major Israeli banks, including Israel Discount Bank, are expected to continue substantial investments in digital capabilities, with estimates suggesting billions of shekels allocated to technology upgrades and new digital product development to maintain market share and attract new customers.

Competitive rivalry within the Israeli banking sector is intense, with institutions like Israel Discount Bank vying for profitability and market share. Despite economic headwinds, Israeli banks demonstrated robust profitability in 2024. For instance, Israel Discount Bank reported a significant 8% increase in its credit to the public during 2024, a clear strategy to capture a larger slice of the market.

This drive for growth is mirrored by competitors. Bank Hapoalim, another major player, announced record profits and outlined aggressive expansion plans for 2025 and 2026. Such moves underscore the fierce competition for both earnings and overall market dominance among the key banks operating in Israel.

Regulatory Push for Competition

Israel's banking sector is experiencing a significant shift driven by the Bank of Israel's proactive regulatory stance. Initiatives like the implementation of open banking standards are designed to break down traditional barriers, fostering a more competitive and innovative financial ecosystem. This regulatory push compels incumbent institutions, including Israel Discount Bank, to re-evaluate their strategies, potentially leading to improved customer offerings and more competitive pricing to maintain market share.

The objective behind these regulatory interventions is clear: to dilute the market power of the largest banks and create a more fertile ground for new entrants. This increased competition directly impacts existing players by raising customer expectations and demanding greater agility. For instance, the push for open banking aims to allow third-party providers to access customer data (with consent), enabling them to offer specialized financial services, thus intensifying rivalry.

- Open Banking Mandates: The Bank of Israel is actively promoting open banking, encouraging data sharing and interoperability to spur innovation.

- Increased Innovation Pressure: This regulatory environment forces banks to innovate rapidly, potentially through new digital products or service enhancements, to stay ahead.

- Customer Retention Focus: To counter new competitive threats, banks are compelled to focus on customer loyalty through better services and potentially lower fees.

- Market Share Dynamics: The regulatory push aims to reduce the concentration of market share among the top banks, creating opportunities for smaller players and fintech companies.

Non-Bank Financial Institutions

Non-bank financial institutions (NBFIs) are a significant source of competitive rivalry for traditional banks like Israel Discount Bank. These NBFIs, including fintech companies, specialized lenders, and payment processors, often have lighter regulatory oversight, allowing them to be more agile and innovative. For instance, in 2024, the Israeli fintech sector continued its robust growth, with companies offering specialized credit solutions and digital payment services directly challenging banks' established customer bases and product offerings.

This competition intensifies as NBFIs can target specific market segments with tailored products, such as buy-now-pay-later services or peer-to-peer lending platforms. These niche offerings often come with greater flexibility and potentially lower costs for consumers, putting pressure on banks to adapt their own product development and pricing strategies. The increasing adoption of digital channels by NBFIs further diversifies the competitive landscape, moving beyond the traditional banking oligopoly.

- NBFIs offer specialized financial products like credit and payment services.

- Lighter regulatory burdens allow NBFIs to be more agile and innovative.

- Fintech growth in Israel in 2024 highlights increasing competition in specialized lending and payments.

- NBFIs diversify competition beyond traditional banking structures.

Competitive rivalry in Israel's banking sector is characterized by a concentrated market dominated by a few large players, including Israel Discount Bank. While this concentration might suggest limited direct competition, the landscape is actively being reshaped by digital transformation and regulatory changes like open banking. This environment forces incumbent banks to innovate rapidly and focus on customer retention to fend off agile fintechs and non-bank financial institutions (NBFIs).

The intensity of competition is further fueled by a technological arms race, with banks investing heavily in AI and automation. In 2024, major Israeli banks were projected to allocate billions of shekels to digital upgrades. This drive for modernization is essential to counter the agility of fintech startups, which often leverage more flexible technology. For instance, Bank Hapoalim's aggressive expansion plans for 2025-2026 signal a clear intent to capture greater market share, mirroring Israel Discount Bank's own 8% credit growth in 2024.

| Metric | Israel Discount Bank (2024 Projections/Data) | Key Competitors (e.g., Bank Hapoalim) (2024 Projections/Data) | Industry Trend |

|---|---|---|---|

| Digital Investment | Billions of ILS (projected) | Billions of ILS (projected) | Increasing focus on AI, automation, and legacy system modernization. |

| Credit Growth (Public) | 8% increase (reported 2024) | Aggressive expansion plans | Drive to capture market share amidst evolving customer needs. |

| Market Concentration | Top 5 banks control >70% of assets (late 2023) | Significant market share | Regulatory push for open banking aims to dilute market power of large institutions. |

SSubstitutes Threaten

Fintech payment solutions present a substantial threat to traditional banks like Israel Discount Bank. Innovative offerings such as digital wallets, peer-to-peer lending, and sophisticated payment orchestration services provide consumers and businesses with faster, more cost-effective, and user-friendly transaction methods. These alternatives often circumvent established banking infrastructure, directly challenging their market share.

For instance, the rapid adoption of digital payment platforms globally highlights this trend. In 2023, the global digital payments market was valued at over $9 trillion and is projected to grow significantly. This growth is fueled by consumer demand for convenience and the increasing integration of fintech into daily life, creating a direct competitive pressure on banks to adapt or risk losing transaction volume.

Israel Discount Bank's strategic move to acquire a stake in Paybox, a prominent Israeli digital payment app, demonstrates a proactive approach to mitigating this threat. By investing in and developing its own non-banking payment capabilities, the bank aims to capture a share of this evolving market and offer competitive alternatives to its customers, thereby retaining its relevance in the payment ecosystem.

The growing presence of non-bank lenders and alternative financing platforms presents a significant threat of substitutes for Israel Discount Bank. These entities offer businesses and individuals viable alternatives to traditional bank loans, often with more flexible terms or quicker approval processes.

Regulatory shifts that encourage borrowers to explore the non-bank sector further intensify this threat. For instance, by mid-2024, reports indicated a notable increase in fintech lending volumes globally, demonstrating a clear trend of diversification away from traditional banking institutions.

This expanding landscape of alternative financing reduces customer dependency on commercial banks like Israel Discount Bank. As of early 2025, the alternative lending market in Israel was showing robust growth, with new platforms emerging regularly, providing a wider array of financing options.

Online investment platforms, robo-advisors, and direct brokerage services are significant substitutes for traditional bank-offered investment and private banking. These digital alternatives frequently boast lower fees and enhanced accessibility, attracting a wide spectrum of investors, including those who historically depended on banks for such services. For instance, the Israeli fintech sector is rapidly evolving, moving beyond basic transaction tools to offer comprehensive solutions in lending and digital finance infrastructure, further intensifying competitive pressure.

Emerging Digital-Only Banks (Neobanks)

The threat of substitutes for traditional banks like Israel Discount Bank is growing, particularly from digital-only banks, often called neobanks. These institutions operate entirely online, offering a streamlined banking experience with potentially lower fees thanks to their reduced overhead. They present a compelling alternative for customers seeking convenience and cost savings.

Neobanks challenge established players by providing a complete suite of banking services, from checking accounts to loans, all accessible through intuitive mobile apps. This digital-first approach can attract a significant customer base, especially younger demographics accustomed to seamless online interactions. For instance, in Israel, ONE ZERO Digital Bank is a prominent example of a neobank aiming to disrupt the traditional banking landscape.

The competitive pressure from these digital substitutes is forcing traditional banks to accelerate their own digital transformation efforts. This includes enhancing their mobile banking platforms, offering competitive online services, and potentially even launching their own digital-only brands to retain market share. The ongoing innovation in the fintech sector means this threat is likely to persist and evolve.

- Neobanks offer a full range of banking services digitally.

- Their lean operational models often translate to lower customer fees.

- They provide a direct alternative to traditional banking services.

- ONE ZERO Digital Bank is an example of a neobank in Israel.

Blockchain and Cryptocurrency

While blockchain and cryptocurrency adoption in Israel is still in its early stages for widespread use, these technologies pose a potential long-term threat to traditional banking services. They offer alternative methods for currency exchange, international money transfers, and even lending, potentially siphoning off business from established institutions like Israel Discount Bank.

The Israeli fintech scene is showing renewed enthusiasm for early-stage crypto and Web 3.0 ventures, signaling a growing recognition of these disruptive financial infrastructures. For instance, by the end of 2023, the Israeli crypto market saw significant activity, with venture capital funding in blockchain startups reaching hundreds of millions of dollars, indicating a fertile ground for alternative financial solutions.

- Nascent Adoption: Blockchain and cryptocurrencies are not yet mainstream substitutes for most Israeli banking customers.

- Long-Term Threat: These technologies offer potential alternatives for remittances, currency exchange, and lending.

- Growing Interest: The Israeli fintech sector is actively investing in early-stage crypto and Web 3.0 projects.

- Market Indicators: Significant venture capital investment in Israeli blockchain startups by late 2023 highlights this trend.

The threat of substitutes for Israel Discount Bank is multifaceted, encompassing fintech payment solutions, non-bank lenders, online investment platforms, neobanks, and emerging blockchain technologies. These alternatives often provide greater convenience, lower costs, and more flexible terms, directly challenging the bank's traditional revenue streams and customer relationships.

Fintech payment solutions continue to grow, with the global digital payments market valued at over $9 trillion in 2023, indicating a strong consumer preference for faster, cheaper transactions. Similarly, the alternative lending market in Israel showed robust growth in early 2025, with new platforms consistently emerging, offering a wider array of financing options and reducing customer reliance on traditional banks.

Neobanks like ONE ZERO Digital Bank in Israel are also a significant threat, offering a full suite of digital banking services with potentially lower fees due to reduced overhead. This digital-first approach appeals strongly to younger demographics. Furthermore, while still in early stages, blockchain and Web 3.0 ventures, backed by significant venture capital investment in Israeli startups by late 2023, represent a long-term disruptive potential for core banking services.

| Substitute Category | Key Characteristics | Impact on Israel Discount Bank | Examples/Data Points |

|---|---|---|---|

| Fintech Payments | Faster, lower cost, user-friendly transactions | Loss of transaction volume, fee income | Global digital payments market >$9 trillion (2023) |

| Non-Bank Lenders | Flexible terms, quicker approval | Reduced loan origination, market share erosion | Robust growth in Israeli alternative lending (early 2025) |

| Online Investment Platforms | Lower fees, enhanced accessibility | Loss of wealth management and advisory revenue | Israeli fintech sector expanding into comprehensive digital finance solutions |

| Neobanks | Digital-only, lower overhead, competitive fees | Customer acquisition, particularly younger demographics | ONE ZERO Digital Bank (Israel) |

| Blockchain/Crypto | Alternative currency exchange, remittances, lending | Long-term potential disruption of core banking functions | Significant VC funding in Israeli blockchain startups (late 2023) |

Entrants Threaten

The banking sector in Israel, like many developed economies, presents substantial hurdles for potential new entrants. Significant capital requirements are a primary deterrent; establishing a new bank necessitates a substantial initial investment to cover operational costs, technology infrastructure, and regulatory reserves. For instance, new banking licenses often come with minimum capital stipulations that can run into hundreds of millions of shekels.

Furthermore, the regulatory landscape is exceptionally rigorous. Entities wishing to operate as banks must obtain licenses from the Bank of Israel, adhering to strict compliance standards. Laws such as the Supervision of Financial Services Law (2016) clearly define who can offer financial services, ensuring that only approved and well-capitalized institutions can engage in lending activities, thereby protecting consumers and market stability.

Established banks like Israel Discount Bank benefit from decades of built-up customer trust and strong brand recognition. This is a significant barrier for new entrants, as cultivating similar loyalty and perceived stability in the financial sector is both time-consuming and expensive. For instance, in 2024, customer retention rates for incumbent banks often exceed 90%, a testament to this ingrained trust.

The threat of new entrants is amplified by technological disruption from fintechs. These agile companies bypass the need for extensive physical infrastructure, leveraging cloud computing and modern tech stacks to offer specialized financial services. This significantly lowers the traditional barriers to entry, allowing new players to challenge established banks like Israel Discount Bank in specific market segments.

The Israeli fintech scene is vibrant, with numerous startups emerging. While many are still in their nascent stages, their innovative approaches to financial technology present a growing competitive force. For instance, by mid-2024, the number of fintech companies operating in Israel continued to expand, with a particular focus on areas like digital payments and lending, directly impacting how customers access and manage their finances.

Open Banking Initiatives

The Bank of Israel's push for open banking, implemented through new standards, significantly lowers the barrier to entry for new players. By mandating that banks share customer data with authorized third parties, this initiative directly fuels the threat of new entrants. Fintech companies, in particular, can leverage this data access to rapidly develop and offer specialized financial services, directly challenging incumbent banks like Israel Discount Bank.

This regulatory shift empowers new, agile fintech firms by providing them with the foundational customer data needed to innovate. For instance, a new company could offer a highly personalized budgeting app or a niche investment platform by integrating with existing banking infrastructure. The potential for these specialized entrants to capture market share by offering superior user experiences or lower fees is a direct consequence of these open banking mandates.

- Open Banking Mandates: Bank of Israel's regulations require data sharing, fostering competition.

- Fintech Entry: Licensed third parties gain access to customer financial information with consent.

- Innovation Facilitation: New fintech firms can offer specialized, data-driven services.

- Increased Competition: Potential for new, specialized entrants to challenge established banks.

Market Concentration and Economies of Scale

The Israeli banking sector is notably concentrated, with a few major players dominating the market. This concentration presents a significant barrier for new entrants, as they must overcome the established players' substantial economies of scale. For instance, in 2023, the four largest Israeli banks held over 70% of the total banking assets, making it difficult for newcomers to achieve comparable operational efficiencies and offer competitive pricing.

Established banks like Israel Discount Bank leverage their existing infrastructure, extensive branch networks, and large, loyal customer bases. This deep-rooted presence and established trust are hard for new entrants to replicate, requiring substantial capital investment and time to build a comparable market share. The ability to spread fixed costs over a larger volume of transactions is crucial for profitability in banking, a feat that favors larger, incumbent institutions.

- Market Concentration: In 2023, the top four Israeli banks controlled over 70% of total banking assets.

- Economies of Scale: New entrants struggle to match the cost efficiencies and product breadth of established, larger banks.

- Infrastructure Advantage: Incumbents benefit from extensive branch networks and advanced technological infrastructure.

- Customer Base: Existing banks have a significant advantage due to established customer relationships and trust.

The threat of new entrants in Israel's banking sector is moderate, influenced by high capital requirements and stringent regulations. However, the rise of fintechs, empowered by open banking initiatives, is lowering these barriers. For instance, by mid-2024, the number of fintech companies in Israel continued to grow, focusing on digital payments and lending, directly challenging incumbents.

| Factor | Impact on New Entrants | Example/Data Point (as of mid-2024) |

|---|---|---|

| Capital Requirements | High Barrier | New banking licenses often require hundreds of millions of shekels. |

| Regulatory Hurdles | Significant Barrier | Licensing from Bank of Israel and adherence to strict compliance laws. |

| Fintech Innovation | Lowering Barrier | Vibrant fintech scene with agile players leveraging technology. |

| Open Banking | Lowering Barrier | Mandated data sharing facilitates new service development by third parties. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Israel Discount Bank leverages data from annual reports, investor relations disclosures, and financial news outlets to assess competitive dynamics within the Israeli banking sector.