ICA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Bundle

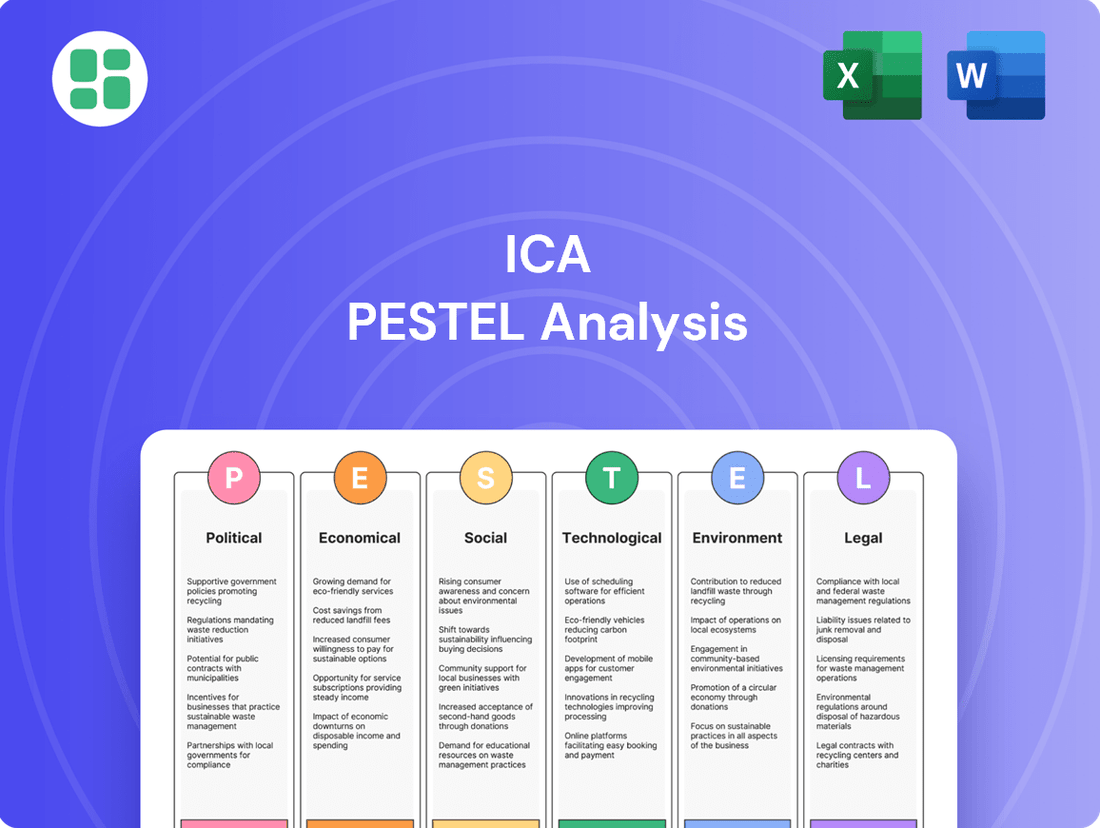

Unlock the critical external factors shaping ICA's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces at play, and how they present both opportunities and threats. Arm yourself with actionable intelligence to refine your strategy and stay ahead of the curve. Purchase the full analysis now for a complete, in-depth understanding.

Political factors

Mexico's new administration, under President Claudia Sheinbaum, is navigating a delicate balance between fiscal responsibility and ongoing infrastructure development. The proposed budget for 2025 signals a notable shift, with an anticipated 18.1% decrease in public investment in infrastructure compared to the final year of the previous administration.

This reduction follows a period of significant infrastructure investment, including the completion of major projects, and reflects real-term cuts exceeding 20% in federal infrastructure spending in recent years. Such fiscal adjustments will likely influence the pace and scale of future infrastructure initiatives.

The Mexican government's reliance on Public-Private Partnerships (PPPs) for infrastructure is projected to grow in 2025, driven by ongoing fiscal pressures. Despite a slight dip in planned PPP projects from 2024 to 2025, the private sector anticipates significant opportunities, especially in critical areas like transportation and energy infrastructure.

Industry bodies like the Mexican Chamber of the Construction Industry (CMIC) are advocating for modernized PPP legislation. They highlight the importance of enhanced transparency and more defined regulatory frameworks to foster robust private sector investment in the nation's development projects.

Regulatory stability and a strong rule of law are fundamental for drawing substantial private investment into Mexico's construction industry, a sector projected to see investments reaching as high as US$295.71 billion during the upcoming six-year presidential term. Any hint of political instability or challenges to the rule of law could significantly dampen both foreign and domestic appetite for large-scale infrastructure and construction projects.

New Administration's Strategic Plan (Plan Mexico)

President Sheinbaum's 'Plan Mexico,' unveiled in January 2025, sets ambitious investment targets across energy, urban mobility, and housing, aiming to foster economic expansion throughout her six-year term. The plan incorporates tax incentives designed to attract significant foreign direct investment, with projections suggesting an annual inflow of billions of dollars. However, concerns have been voiced by some financial analysts regarding a potential reduction in infrastructure spending within the 2025 economic package, which could impact the realization of these growth objectives.

The strategic blueprint emphasizes a commitment to revitalizing key economic sectors through targeted government support and private sector engagement. Key aspects of Plan Mexico include:

- Infrastructure Investment: Focus on energy, urban mobility, and housing sectors to stimulate growth.

- Foreign Direct Investment (FDI): Aiming for substantial annual inflows through attractive tax incentives.

- Economic Growth Targets: Aims to drive economic expansion over the next six years.

- Analyst Concerns: Potential for reduced investment in critical infrastructure areas in the 2025 economic package.

Geopolitical Relations and Nearshoring Policy

Mexico's strategic location and robust trade agreements, particularly the United States-Mexico-Canada Agreement (USMCA), make it a prime destination for nearshoring. This is driving substantial foreign direct investment, especially in manufacturing and industrial real estate. For instance, industrial construction saw significant growth in 2023, with occupancy rates in key markets like Monterrey and Guadalajara reaching over 95%.

However, the construction sector's outlook is intertwined with the evolving political landscape. Political uncertainty, particularly concerning US-Mexican relations, can create hesitations for investors. The upcoming presidential transition in both countries is a critical factor that will influence infrastructure development and the continuation of fiscal incentives designed to bolster nearshoring initiatives.

- Nearshoring Investment Growth: Mexico attracted a record $36 billion in FDI in 2023, with a significant portion directed towards manufacturing and logistics sectors, directly benefiting industrial construction.

- USMCA Impact: The trade agreement continues to facilitate cross-border manufacturing and supply chain integration, underpinning demand for industrial spaces.

- Political Sensitivity: Changes in US-Mexican trade policy or border security approaches could impact the pace and scale of nearshoring projects.

- Infrastructure Focus: Future infrastructure spending and tax incentives tied to nearshoring will be heavily influenced by the policy priorities of the incoming administrations in 2024-2025.

Mexico's political landscape in 2024-2025 is shaped by the new administration's focus on fiscal prudence alongside infrastructure goals. The 2025 budget signals a reduction in public infrastructure investment, potentially impacting project timelines and scale.

The government is increasingly relying on Public-Private Partnerships (PPPs) to bridge funding gaps, with industry groups pushing for regulatory enhancements to attract private capital. Stability and a clear legal framework are crucial for the projected US$295.71 billion in construction investments over the next six years.

President Sheinbaum's 'Plan Mexico' aims to boost economic growth through targeted investments in energy, housing, and urban mobility, supported by tax incentives for FDI. However, concerns linger about the potential impact of reduced infrastructure spending in the 2025 economic package on these ambitious targets.

Mexico's nearshoring advantage, bolstered by the USMCA, is driving significant FDI, particularly in manufacturing and logistics, evident in high industrial occupancy rates. Political stability and consistent trade policies are key to sustaining this momentum.

| Factor | 2024/2025 Outlook | Impact on Construction |

|---|---|---|

| Fiscal Policy | Reduced public infrastructure investment in 2025 budget. | Potential slowdown in government-led projects; increased reliance on PPPs. |

| Regulatory Environment | Advocacy for modernized PPP legislation and transparency. | Improved private sector confidence if reforms are enacted; uncertainty if delayed. |

| Nearshoring Trends | Continued FDI driven by USMCA and manufacturing demand. | Sustained demand for industrial construction; sensitivity to US-Mexico relations. |

| Government Strategy | 'Plan Mexico' targets growth via infrastructure and FDI incentives. | Opportunities in energy, housing, and urban mobility; risk of project delays due to budget adjustments. |

What is included in the product

The ICA PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the ICA, offering a comprehensive understanding of its external operating landscape.

Provides a clear, actionable framework to identify and mitigate external threats, transforming uncertainty into strategic advantage.

Economic factors

The Mexican construction industry saw a strong performance in 2024, with growth estimated at 4.1%, driven by investments in both housing and infrastructure projects. This momentum was largely fueled by significant private sector participation and government initiatives focused on development.

Looking ahead to 2025, the outlook presents a more cautious picture. Projections suggest a potential slowdown, with some forecasts indicating a contraction between 5.9% and 7.1%. This anticipated dip is largely attributed to a decrease in public spending and the winding down of several large-scale infrastructure projects that boosted activity in the preceding year.

Despite these short-term fluctuations, the broader long-term forecast for the Mexican construction market remains positive. Over the period from 2025 to 2029, the industry is expected to achieve a compound annual growth rate of 4.5%, indicating resilience and potential for sustained expansion.

Public investment in construction saw a substantial decline in 2024, with projections indicating a further 14% decrease in spending for 2025 compared to the previous year. This trend reflects a governmental shift in priorities, focusing more on debt servicing than on physical infrastructure development.

Conversely, private construction investment demonstrated robust growth, expanding by 7.2% in 2024. This upward trajectory is expected to continue into 2025, positioning private capital as an increasingly critical driver for the sector's overall activity and performance.

Construction material prices showed signs of stabilization towards the end of 2024, with inflation in the sector settling around 3%. This provided a degree of predictability for budgeting and planning.

However, the outlook for 2025 introduces potential headwinds. International tariffs and ongoing trade disruptions remain significant concerns, capable of disrupting supply chains and inflating the cost of imported materials. For instance, a 5% increase in the price of steel, a key import for many projects, could significantly alter project economics.

These rising input costs directly threaten the profitability and feasibility of new construction projects. Developers may face squeezed margins, forcing them to either absorb costs, pass them onto buyers, or delay commencement, impacting the overall pace of development.

Interest Rates and Credit Availability

Despite the Bank of Mexico's (Banxico) 100 basis point interest rate cut in the latter half of 2024, the construction sector experienced a 3.4% contraction in credit. This suggests that even with more affordable financing options, prevailing market uncertainty is a significant barrier to credit expansion for developers.

The limited credit growth, coupled with a concentrated focus on housing developers, raises questions about its efficacy in spurring overall sector expansion. Access to capital remains a persistent challenge for many in the construction industry.

- Interest Rate Trend: Banxico cut rates by 100 basis points in H2 2024.

- Sector Credit Impact: Construction sector credit contracted by 3.4%.

- Driving Factor: Market uncertainty limits credit growth despite lower rates.

- Challenge: Access to capital remains a key hurdle for developers.

Impact of Nearshoring and Foreign Direct Investment

The ongoing nearshoring trend is significantly boosting demand for industrial construction projects across North America. Companies are actively relocating their manufacturing and logistics operations closer to home, leading to a surge in the development of new industrial parks, warehouses, and production facilities. This shift is directly impacting the construction sector, creating opportunities for growth and investment in these specialized real estate segments.

Foreign Direct Investment (FDI) is anticipated to remain moderate through 2024 and 2025. This is partly due to existing structural challenges and ongoing global power transitions, which can create uncertainty for international investors. Despite these headwinds, governments are setting ambitious targets, aiming to attract approximately US$100 billion in FDI annually. The strategic intent is to channel these investments into critical infrastructure development, supporting broader economic expansion.

Key aspects of this economic factor include:

- Nearshoring Drive: Increased demand for industrial construction as companies relocate production closer to North American markets.

- FDI Targets: Government ambition to attract US$100 billion annually in foreign direct investment.

- Infrastructure Focus: Leveraging FDI to fund essential infrastructure development projects.

- Market Conditions: Moderate FDI expected in 2024-2025 due to structural issues and global power shifts.

Economic factors present a mixed outlook for the Mexican construction sector. While private investment showed robust 7.2% growth in 2024, public spending is projected to decline by 14% in 2025. Despite a 100 basis point interest rate cut by Banxico in H2 2024, sector credit contracted by 3.4%, highlighting market uncertainty as a barrier to capital access.

| Metric | 2024 (Est.) | 2025 (Proj.) | 2025-2029 (CAGR) |

|---|---|---|---|

| Overall Construction Growth | 4.1% | -5.9% to -7.1% | 4.5% |

| Public Investment Change | Significant Decline | -14.0% | N/A |

| Private Investment Growth | 7.2% | Positive Trend | N/A |

| Construction Material Inflation | ~3.0% | Potential Increase (Tariffs) | N/A |

| Sector Credit Change | N/A | -3.4% | N/A |

Preview Before You Purchase

ICA PESTLE Analysis

The preview you see here is the exact ICA PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the ICA, providing valuable strategic insights. You'll get a professionally structured and detailed report, enabling informed decision-making.

Sociological factors

Mexico's rapid urbanization, with a growing population concentrated in cities like Mexico City and Monterrey, fuels a robust demand for housing. This trend is particularly evident in major metropolitan areas, creating consistent opportunities for residential construction and urban renewal projects.

The government's commitment to addressing housing shortages, as outlined in initiatives like 'Plan Mexico,' aims to construct one million homes. This ambitious target underscores the significant societal need and government focus on expanding housing supply to meet the demands of an increasingly urbanized population.

Mexico's construction sector is grappling with a significant deficit of skilled and specialized workers. This shortage directly impacts project timelines and inflates operational expenses, creating a bottleneck for efficient development.

By the close of 2024, the industry saw a 2.5% reduction in its workforce, with states involved in major infrastructure initiatives experiencing the brunt of these job losses. Projections for 2025 indicate a continuation of these losses if new large-scale projects do not materialize, underscoring the urgent need for strategic workforce development initiatives.

Large infrastructure projects, like those undertaken by Empresas ICA, hinge on public buy-in. Without it, delays and cost overruns are almost guaranteed. For instance, in 2024, several major construction projects globally faced significant setbacks due to local community opposition, impacting their financial viability.

Empresas ICA must proactively address concerns about land acquisition, environmental impact, and potential displacement. Effective community engagement, including transparent communication and tangible benefits like local employment or infrastructure improvements, is crucial. This approach helps mitigate resistance and fosters a collaborative environment, essential for project success as seen in successful community partnerships in Latin America during 2024-2025.

Public Health and Safety Standards

Societal expectations and regulatory bodies are increasingly emphasizing robust public health and safety standards within the construction sector and the broader built environment. Companies like ICA are therefore compelled to implement and rigorously follow stringent safety protocols, not only to safeguard their workforce but also to ensure the well-being of the general public. This heightened focus is underscored by recent governmental initiatives, such as the stated commitment to developing 'dignified and decent' homes, which inherently suggests a parallel dedication to fostering healthier living conditions within newly constructed properties.

The implications for ICA are clear: investment in advanced safety equipment, comprehensive training programs, and continuous monitoring of site conditions are paramount. For instance, the UK's Health and Safety Executive (HSE) reported that in the 2023/2024 period, construction remained a high-risk industry, with fatalities still a concern, highlighting the critical need for adherence to established safety frameworks. Furthermore, the growing emphasis on sustainable building practices often intersects with health and safety, as materials and methods that minimize environmental impact can also reduce exposure to hazardous substances for both workers and occupants.

- Worker Safety: Adherence to regulations like OSHA standards in the US or similar national frameworks is non-negotiable, impacting operational costs and project timelines.

- Public Health: Ensuring building materials and designs contribute to healthy indoor environments, reducing risks of respiratory issues or other health concerns, is becoming a key differentiator.

- Regulatory Compliance: Fines for non-compliance with health and safety regulations can be substantial, with significant reputational damage. For example, in 2023, several major construction firms faced penalties for safety breaches.

- Social License to Operate: Demonstrating a strong commitment to health and safety enhances a company's reputation, attracting talent and securing community support for projects.

Demographic Shifts and Regional Migration

Demographic shifts and internal migration within Mexico are significantly reshaping infrastructure and construction demands. Regions experiencing industrial growth, particularly those benefiting from nearshoring trends, are seeing increased labor migration. For example, the Bajío region, a manufacturing powerhouse, has attracted substantial internal migration, driving demand for housing and commercial spaces.

This influx necessitates the development of new residential, commercial, and logistical facilities to accommodate the growing population and workforce. The Mexican government's National Population Council (CONAPO) projects continued urbanization, with a larger percentage of the population residing in urban centers by 2025, further concentrating infrastructure needs.

- Nearshoring Impact: The rise of nearshoring is a key driver, attracting workers to manufacturing hubs like Nuevo León and Jalisco.

- Urbanization Trends: CONAPO data indicates a steady increase in urban populations, requiring expanded urban infrastructure.

- Labor Mobility: Internal migration patterns show a clear movement towards economic opportunity zones, straining existing resources.

- Infrastructure Demand: This migration fuels demand for housing, transportation networks, and logistics facilities.

Societal expectations regarding public health and safety are increasingly influencing construction practices. Companies like ICA must prioritize stringent safety protocols and healthy building environments to meet these evolving demands. This focus is critical for worker well-being, public safety, and maintaining a positive social license to operate, as evidenced by ongoing industry safety concerns globally.

Demographic shifts, particularly internal migration driven by nearshoring, are reshaping infrastructure needs across Mexico. Regions experiencing industrial growth are seeing an influx of workers, creating concentrated demand for housing, transportation, and commercial facilities. This trend, projected to continue through 2025, necessitates strategic urban development and infrastructure expansion to accommodate population growth in key economic zones.

| Sociological Factor | Impact on Construction | Supporting Data/Trends (2024-2025) |

|---|---|---|

| Urbanization & Housing Demand | Drives demand for residential construction and urban renewal. | Mexico's urban population growth continues, with cities like Mexico City and Monterrey experiencing high demand. |

| Skilled Labor Shortage | Impacts project timelines and increases operational costs. | Industry saw a 2.5% workforce reduction by end of 2024; projections for 2025 indicate continued losses without new projects. |

| Public Acceptance of Projects | Essential for avoiding delays and cost overruns. | Global projects in 2024 faced setbacks due to community opposition; proactive engagement is key. |

| Health & Safety Standards | Requires investment in safety equipment, training, and compliance. | Construction remains high-risk; adherence to safety frameworks is critical, as highlighted by UK HSE data (2023/2024). |

| Demographic Shifts & Migration | Increases demand for housing, transport, and logistics in growing regions. | Nearshoring drives labor migration to hubs like the Bajío region; CONAPO projects continued urbanization. |

Technological factors

The Mexican construction sector is actively embracing digital transformation, with significant investments being channeled into advanced technologies aimed at boosting operational efficiency. This shift is crucial for staying competitive in a rapidly evolving market.

Building Information Modeling (BIM) is now virtually a prerequisite for managing construction projects in Mexico, particularly for public tenders. Its widespread adoption enhances project collaboration and significantly minimizes errors, as seen in its increasing use for infrastructure development.

By 2024, it's projected that firms integrating BIM and other digital solutions will solidify their market positions. For instance, a 2023 report indicated that BIM adoption can lead to cost savings of up to 10% and time reductions of 15% on average for complex projects.

Advanced construction management platforms are becoming indispensable tools for companies like ICA, significantly improving project execution. These digital solutions are revolutionizing how communication flows, deadlines are met, and budgets are controlled on complex construction sites. For instance, the global construction management software market was valued at approximately $2.5 billion in 2023 and is projected to reach over $5.5 billion by 2030, indicating widespread adoption and reliance on these technologies.

The integration of these platforms is particularly vital for ICA, given its involvement in large-scale civil and industrial projects that inherently demand meticulous coordination. By centralizing project data and facilitating real-time updates, these systems empower project managers to maintain tighter control over every phase of development, from initial planning to final delivery. This enhanced oversight directly translates to improved operational efficiency and a reduced risk of costly delays or overruns.

Drones and IoT devices are revolutionizing construction by enabling detailed site inspections and real-time progress tracking. This integration enhances project visibility and safety, with the global drone services market projected to reach $40.7 billion by 2026, according to Mordor Intelligence.

These smart technologies optimize resource management and logistics on construction sites, leading to greater efficiency. The IoT in construction market alone was valued at $15.7 billion in 2023 and is expected to see significant growth, facilitating more data-driven and precise decision-making throughout project lifecycles.

Sustainable and Innovative Materials

Technological progress is making sustainable materials like eco-friendly concrete, certified wood, and recycled components increasingly standard in Mexican construction projects. Companies are actively re-engineering their processes to lessen environmental footprints and use resources more efficiently.

This shift is largely fueled by stricter government mandates and a rising consumer preference for buildings with a lower environmental impact. For instance, by 2024, Mexico's National Housing Commission (CONAVI) reported a 15% increase in demand for green building certifications compared to the previous year, directly influencing material choices.

- Advancements in biodegradable and low-carbon concrete formulations are reducing the environmental impact of major infrastructure.

- The adoption of certified sustainable forestry practices for wood sourcing is growing, with a 10% year-over-year increase in certified wood usage reported in 2025.

- Recycled materials, such as plastics and metals, are being integrated into building components, with their market share in construction expected to reach 8% by the end of 2025.

Automation, Robotics, and 3D Printing

The construction industry is increasingly integrating automation, robotics, and 3D printing, aiming to boost productivity and safety. These advanced tools are particularly beneficial for tasks that are repetitive or require high precision. For instance, robotic systems are being deployed for bricklaying and welding, while 3D printing is being explored for constructing building components and even entire structures.

The impact of these technologies is already measurable. In 2024, the global construction robotics market was valued at approximately $3.5 billion and is projected to grow significantly. Companies are seeing efficiency gains of up to 30% in certain applications by using robots for tasks like rebar tying. Furthermore, 3D printing in construction has the potential to reduce material waste by as much as 50% compared to traditional methods.

- Robotic Automation: Enhancing precision and speed in tasks like welding, painting, and bricklaying, reducing human error and improving site safety.

- 3D Printing Applications: Enabling the rapid creation of complex architectural elements and even entire buildings, potentially cutting construction time and costs.

- AI Integration: Optimizing project planning, site management, and resource allocation through intelligent software, leading to greater efficiency and cost savings.

- Productivity Gains: Studies in 2024 indicated that automated processes can lead to a 15-25% increase in output for specific construction activities.

Technological advancements are reshaping the Mexican construction landscape, pushing efficiency and sustainability. The adoption of Building Information Modeling (BIM) is now standard for major projects, with firms integrating it projecting significant cost and time savings. Advanced construction management platforms are also becoming essential for overseeing complex projects, with the global market for these solutions showing robust growth.

Drones and IoT devices are enhancing site inspections and progress tracking, improving visibility and safety. The increasing use of sustainable materials, driven by mandates and consumer preference, is also a key technological trend. Furthermore, automation, robotics, and 3D printing are being integrated to boost productivity and reduce waste, with measurable gains already being reported in various applications.

| Technology | Impact | 2024/2025 Data Point |

|---|---|---|

| BIM | Improved collaboration, reduced errors | Up to 10% cost savings, 15% time reduction |

| Construction Management Software | Enhanced project execution, control | Global market valued at $2.5 billion (2023), projected growth |

| Drones & IoT | Better site inspection, progress tracking | Global drone services market to reach $40.7 billion by 2026 |

| Automation & Robotics | Increased productivity, safety | 15-25% output increase in specific activities |

Legal factors

Environmental permitting in Mexico is a critical hurdle for businesses, especially for construction and operational phases with potential ecological footprints. These permits are essential for managing wastewater, controlling air emissions, and ensuring proper handling of hazardous waste, all governed by laws like the General Law of Ecological Balance and Environmental Protection (LGEEPA).

Compliance demands rigorous monitoring of resource consumption and emissions, with regular reporting to relevant authorities. For instance, in 2023, Mexico's Secretariat of Environment and Natural Resources (SEMARNAT) processed over 15,000 environmental impact authorizations, highlighting the extensive regulatory oversight.

Mexican legislation, including the General Law for Ecological Balance and Environmental Protection, dictates strict protocols for managing both hazardous and non-hazardous waste. These laws are designed to curb environmental contamination and encourage waste reduction and recycling initiatives.

Businesses generating hazardous waste in Mexico can store it on-site for a maximum of 180 days, provided they adhere to specific storage requirements. Subsequent disposal must be handled by authorized transportation firms and processed at government-approved facilities, with a notable increase in the number of certified waste treatment plants in recent years to meet growing demand.

Non-compliance with these waste management laws can result in significant financial penalties, operational disruptions, and reputational damage. For instance, in 2023, Mexico's environmental protection agency, PROFEPA, imposed fines totaling over 50 million Mexican pesos for various environmental infractions, including improper waste disposal.

Construction and land use regulations are a significant legal factor impacting the industry. These include national and local building codes, zoning laws, and land use policies that govern everything from structural safety to urban development. For instance, in 2024, the U.S. Department of Housing and Urban Development continues to enforce stringent building codes, with many states adopting the International Building Code (IBC) as their baseline, ensuring public safety and structural integrity.

Compliance with these intricate legal frameworks is non-negotiable for obtaining project approvals and maintaining legal operational status. Failure to adhere can lead to costly delays, fines, and project cancellations. In 2025, cities nationwide are increasingly focusing on updated zoning laws to promote sustainable development and affordable housing, adding another layer of complexity for construction firms.

Labor Laws and Workforce Safety Regulations

Labor laws in Mexico are quite stringent, dictating everything from working hours and minimum wages to social security contributions and the rights of employees. For instance, the Federal Labor Law (Ley Federal del Trabajo) outlines detailed requirements for employment contracts, termination procedures, and benefits. Companies operating in sectors like construction, where ICA is a major player, must adhere to specific occupational health and safety standards designed to protect workers.

Compliance is paramount. Failure to meet these legal obligations can result in significant penalties. In 2023, Mexico's Ministry of Labor and Social Welfare (Secretaría del Trabajo y Previsión Social) reported issuing fines totaling millions of pesos for non-compliance with labor and safety regulations across various industries. Beyond financial penalties, legal disputes can tie up resources and damage a company's reputation, impacting its ability to secure new projects or attract talent.

Key areas of focus for companies like ICA include:

- Adherence to working hour limits and overtime pay regulations.

- Ensuring all employees are registered with the Mexican Social Security Institute (IMSS).

- Implementing robust occupational health and safety protocols, including regular training and provision of personal protective equipment (PPE).

- Maintaining accurate payroll and benefits records as mandated by law.

Anti-Corruption and Transparency Laws

Mexico's commitment to combating corruption and enhancing transparency is a significant legal factor for Empresas ICA. This focus is particularly evident in public procurement, especially concerning major infrastructure initiatives. For instance, in 2023, Mexico ranked 126 out of 180 countries in Transparency International's Corruption Perception Index, highlighting the ongoing challenges.

Efforts are underway to reform Public-Private Partnership (PPP) laws, aiming to reduce opacity and establish more defined regulations for all parties involved in bidding processes. These legal shifts mean that ethical conduct and clear, open bidding procedures are under increased examination for companies like ICA.

- Increased Scrutiny: Empresas ICA faces heightened government and public scrutiny regarding its bidding practices and adherence to anti-corruption statutes.

- Regulatory Compliance: Strict compliance with evolving anti-corruption legislation and transparency mandates is crucial for maintaining operational licenses and securing new contracts.

- Ethical Business Practices: The company must demonstrate a robust commitment to ethical conduct, including clear whistleblowing mechanisms and due diligence on partners.

- Impact on Bidding: Changes in PPP laws could lead to more competitive and transparent tender processes, potentially affecting ICA's win rates and profit margins.

Legal frameworks in Mexico significantly shape business operations, particularly for infrastructure giants like ICA. Environmental regulations, including the General Law of Ecological Balance and Environmental Protection, mandate strict waste management and emission controls, with SEMARNAT processing thousands of environmental impact authorizations annually. Labor laws, like the Federal Labor Law, dictate employee rights, working hours, and safety standards, underscoring the need for robust compliance to avoid penalties, as evidenced by millions in fines issued by the Ministry of Labor and Social Welfare in 2023.

Environmental factors

Mexico is increasingly adopting sustainable construction practices, a shift fueled by growing environmental concerns and supportive government policies. These initiatives focus on enhancing energy efficiency, encouraging the use of recycled and eco-friendly materials, and integrating more green spaces within urban developments.

The market for green buildings in Mexico is showing robust growth. For instance, the number of Leadership in Energy and Environmental Design (LEED) certified buildings has seen a steady rise, with projections indicating continued expansion. This trend highlights a commitment to reducing the environmental footprint of the construction sector.

By 2024, it's anticipated that a greater percentage of new construction projects will incorporate recycled materials, aligning with global sustainability benchmarks. This focus positions Mexico to become a significant player in promoting green building standards across Latin America, attracting investment and fostering innovation in the sector.

Mexico's commitment to climate change mitigation is evident in its national strategy, targeting a significant shift towards cleaner energy and emission reductions, particularly in the building sector which contributes 40% of energy-related CO2 emissions. This focus is amplified by a new mandatory sustainability-reporting framework set to commence in 2025, compelling businesses to reveal their environmental and social footprints.

This intensifying regulatory landscape, pushing for decarbonization, creates both hurdles and avenues for construction firms. Companies that proactively integrate sustainable practices and green building technologies are likely to find themselves at a competitive advantage as compliance becomes increasingly stringent and market demand for eco-friendly solutions grows.

Water scarcity is a growing concern in Mexico, prompting significant policy shifts and increased regulatory oversight for businesses. Companies are now facing stricter mandates for managing and reporting their water consumption, a trend expected to intensify with new government initiatives and infrastructure projects aimed at improving water resource management.

These evolving regulations, particularly those concerning water infrastructure and reuse, will directly impact how industries, especially construction, approach water usage. For instance, the Mexican government has allocated significant funds towards water infrastructure development, with projects like the El Cuchillo II aqueduct aiming to bolster water supply in Monterrey, a key industrial hub. This focus on efficiency and conservation means large-scale construction projects will need to integrate advanced water management strategies to comply and operate sustainably.

Biodiversity Protection and Environmental Impact Assessments

Construction projects, especially large infrastructure ones, can significantly affect local ecosystems and biodiversity. Environmental impact assessments are crucial for identifying and reducing these impacts, pushing companies to adopt biodiversity protection measures. Regulatory frameworks outline the necessary procedures and studies for environmental authorization.

For instance, in 2024, the European Union continued to emphasize biodiversity protection within its Green Deal initiatives, with member states implementing stricter environmental impact assessment (EIA) requirements for new developments. Projects exceeding certain thresholds often require detailed studies on their potential effects on protected species and habitats. Failure to comply can result in significant fines and project delays.

- EIA Requirements: Many jurisdictions mandate EIAs for projects likely to impact biodiversity, covering aspects like habitat fragmentation and species displacement.

- Mitigation Measures: Companies are often required to implement strategies such as habitat restoration, wildlife corridors, or species relocation programs.

- Regulatory Oversight: Environmental agencies monitor compliance with regulations, ensuring that mitigation plans are effectively executed.

- Financial Implications: Non-compliance with environmental regulations can lead to substantial financial penalties and reputational damage, impacting project feasibility.

Circular Economy and Waste Reduction in Construction

The construction sector is increasingly embracing circular economy principles, driving innovation in material recycling and reuse. This focus aims to significantly minimize waste and reduce the industry's environmental impact. For instance, by 2025, the European Union is targeting a 70% recycling rate for construction and demolition waste, a substantial increase from previous years.

Companies are actively exploring and implementing strategies for material revaluation, optimizing resource utilization across project lifecycles. This not only helps in meeting stringent regulatory requirements, such as those mandating waste reduction targets, but also aligns with broader corporate sustainability goals. The global market for construction waste management is projected to reach over $300 billion by 2028, reflecting this growing emphasis.

- Innovation in Recycling: Development of new technologies to process construction debris into usable materials.

- Material Revaluation: Emphasis on reusing components like bricks, timber, and steel from demolition sites.

- Waste Reduction Targets: Companies are setting internal goals and adapting to external regulations for minimizing landfill waste.

- Lifecycle Optimization: Designing projects with deconstruction and material recovery in mind from the outset.

Mexico's construction sector is increasingly prioritizing sustainability, driven by environmental concerns and government support for green building practices. This includes a focus on energy efficiency, recycled materials, and urban green spaces, with LEED certifications showing a consistent rise.

By 2024, a greater adoption of recycled materials in construction is expected, aligning Mexico with global sustainability standards and positioning it as a leader in green building within Latin America.

Mexico's commitment to climate action, particularly in reducing the building sector's 40% contribution to energy-related CO2 emissions, is reinforced by a new mandatory sustainability reporting framework set for 2025.

The intensifying regulatory environment for decarbonization presents both challenges and opportunities, favoring companies that proactively integrate green technologies and sustainable practices.

Water scarcity is a growing concern, leading to stricter regulations on water management and reporting for businesses, with significant government investment in water infrastructure projects like the El Cuchillo II aqueduct to improve supply.

Construction projects must now integrate advanced water management strategies to comply with evolving regulations and ensure sustainable operations, especially large infrastructure developments.

Environmental impact assessments are crucial for construction projects to identify and mitigate effects on local ecosystems and biodiversity, with regulatory frameworks guiding necessary studies and procedures for environmental authorization.

The European Union's Green Deal initiatives in 2024 have led to stricter environmental impact assessment requirements for new developments, including detailed studies on protected species and habitats, with non-compliance resulting in significant penalties.

| Environmental Factor | Description | Impact on Construction Sector | Key Trends/Data (2024-2025) |

|---|---|---|---|

| Climate Change & Emissions | Focus on reducing greenhouse gas emissions, particularly CO2. | Increased demand for energy-efficient buildings, low-carbon materials, and sustainable construction methods. | Mexico's building sector contributes 40% of energy-related CO2 emissions; mandatory sustainability reporting framework starting 2025. |

| Water Scarcity & Management | Growing concern over water availability and responsible usage. | Stricter regulations on water consumption, reporting, and mandates for water reuse and efficient infrastructure in projects. | Government allocation of funds for water infrastructure development, e.g., El Cuchillo II aqueduct. |

| Biodiversity & Ecosystems | Protection of natural habitats and species from development impacts. | Mandatory Environmental Impact Assessments (EIAs), implementation of mitigation measures like habitat restoration, and stricter regulatory oversight. | EU's Green Deal emphasizing biodiversity protection; projects requiring detailed studies on species and habitats. |

| Circular Economy & Waste Management | Emphasis on recycling, reuse, and waste reduction in construction. | Innovation in material recycling, revaluation of construction components, and adherence to waste reduction targets. | EU target of 70% recycling rate for construction and demolition waste by 2025; global construction waste management market projected over $300 billion by 2028. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of publicly available data from government agencies, international organizations, and respected market research firms. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive overview.