ICA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Bundle

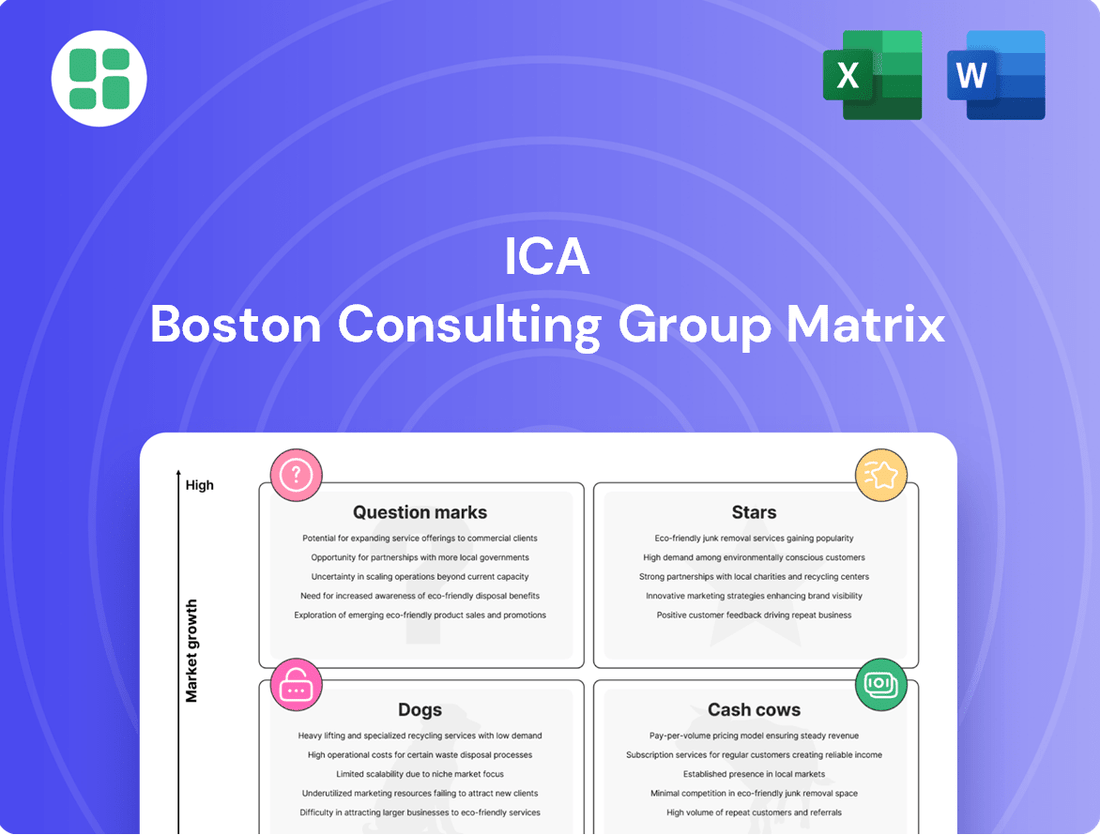

This glimpse into the BCG Matrix highlights how a company strategically manages its product portfolio across Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for optimizing resource allocation and driving future growth. Purchase the full BCG Matrix to unlock detailed analysis, actionable insights, and a clear roadmap for your company's success.

Stars

Empresas ICA's involvement in large-scale transportation projects, like segments of the Maya Train and the Interoceanic Corridor, places them squarely in the Stars category of the BCG Matrix. These are high-growth markets, driven by substantial government investment and Mexico's national development agenda.

ICA's significant market share in these vital transportation initiatives underscores their leadership. For instance, in 2024, the Maya Train project alone was projected to create thousands of jobs and stimulate regional economies, indicating robust demand and growth potential for ICA's services in this sector.

ICA's strategic border infrastructure development, exemplified by projects like a logistics hub in Tamaulipas and new border crossings, positions it favorably within the Stars quadrant of the BCG matrix. This sector is booming due to nearshoring, with companies actively seeking to establish production closer to the U.S. market.

The demand for efficient cross-border trade and logistics is escalating, with U.S.-Mexico trade alone reaching $794.4 billion in 2023, a testament to the growing importance of this infrastructure. ICA's participation in these vital projects underscores its strong market standing and ability to capitalize on this robust growth trend.

Advanced Energy Infrastructure represents a potential Star for ICA within the BCG Matrix, especially considering Mexico's push for energy modernization. Large-scale renewable energy projects and the construction of advanced power plants, where ICA could secure significant contracts, fit this category. For instance, Mexico's energy sector saw significant investment in 2023, with renewable sources like solar and wind contributing a growing share of the energy mix.

Major Urban Development Projects

ICA's involvement in major urban development projects, particularly those incorporating smart city technologies, positions them strongly as a Star within the BCG Matrix. These initiatives tap into the increasing need for modernized living and working environments across Mexico's key urban centers.

The company's proven track record in managing a wide array of construction and infrastructure projects, including significant contributions to Mexico City's transportation network, such as the expansion of Metro Line 1 in 2023, underscores their capability to handle large-scale, complex urban renewal. For instance, ICA's participation in the development of new residential and commercial zones, often driven by public-private partnerships, aligns with the robust growth anticipated in Mexico's construction sector, which was projected to grow by approximately 3.5% in 2024.

- Smart City Integration: Projects focusing on smart infrastructure and sustainable urban planning are key growth drivers.

- Urban Renewal Expertise: ICA's experience in diverse building types and infrastructure is critical for securing and leading these high-value developments.

- Market Demand: The ongoing urbanization trend in Mexico fuels demand for modern living and working spaces, creating a fertile ground for these projects.

Specialized Civil Engineering Projects

Specialized Civil Engineering Projects represent a Star in the ICA BCG Matrix. These are highly complex undertakings like intricate tunnel systems, innovative bridge architectures, or sophisticated water infrastructure. ICA's proven ability to execute such demanding projects, evidenced by their work on the Túnel Emisor Oriente, positions them strongly in this segment.

These projects are characterized by significant technical challenges that naturally limit the number of competitors. Demand is often driven by national infrastructure development goals, making them critical and high-growth areas. For instance, global spending on infrastructure projects, including complex civil engineering, was projected to reach trillions by 2024, highlighting the substantial market size.

- High Complexity: Projects demand unique engineering solutions and advanced technology.

- Limited Competition: Technical barriers to entry create a niche market.

- Critical Infrastructure: Often essential for national development and economic growth.

- Strong Demand: Driven by ongoing global infrastructure investment trends.

ICA's engagement in large-scale transportation projects, such as segments of the Maya Train and the Interoceanic Corridor, firmly places them in the Stars category of the BCG Matrix. These are high-growth markets, fueled by substantial government investment and Mexico's national development agenda.

ICA's significant market share in these vital transportation initiatives underscores their leadership. For instance, in 2024, the Maya Train project alone was projected to create thousands of jobs and stimulate regional economies, indicating robust demand and growth potential for ICA's services in this sector.

ICA's strategic border infrastructure development, exemplified by projects like a logistics hub in Tamaulipas and new border crossings, positions it favorably within the Stars quadrant of the BCG matrix. This sector is booming due to nearshoring, with companies actively seeking to establish production closer to the U.S. market.

The demand for efficient cross-border trade and logistics is escalating, with U.S.-Mexico trade alone reaching $794.4 billion in 2023, a testament to the growing importance of this infrastructure. ICA's participation in these vital projects underscores its strong market standing and ability to capitalize on this robust growth trend.

Advanced Energy Infrastructure represents a potential Star for ICA within the BCG Matrix, especially considering Mexico's push for energy modernization. Large-scale renewable energy projects and the construction of advanced power plants, where ICA could secure significant contracts, fit this category. For instance, Mexico's energy sector saw significant investment in 2023, with renewable sources like solar and wind contributing a growing share of the energy mix.

ICA's involvement in major urban development projects, particularly those incorporating smart city technologies, positions them strongly as a Star within the BCG Matrix. These initiatives tap into the increasing need for modernized living and working environments across Mexico's key urban centers.

The company's proven track record in managing a wide array of construction and infrastructure projects, including significant contributions to Mexico City's transportation network, such as the expansion of Metro Line 1 in 2023, underscores their capability to handle large-scale, complex urban renewal. For instance, ICA's participation in the development of new residential and commercial zones, often driven by public-private partnerships, aligns with the robust growth anticipated in Mexico's construction sector, which was projected to grow by approximately 3.5% in 2024.

- Smart City Integration: Projects focusing on smart infrastructure and sustainable urban planning are key growth drivers.

- Urban Renewal Expertise: ICA's experience in diverse building types and infrastructure is critical for securing and leading these high-value developments.

- Market Demand: The ongoing urbanization trend in Mexico fuels demand for modern living and working spaces, creating a fertile ground for these projects.

Specialized Civil Engineering Projects represent a Star in the ICA BCG Matrix. These are highly complex undertakings like intricate tunnel systems, innovative bridge architectures, or sophisticated water infrastructure. ICA's proven ability to execute such demanding projects, evidenced by their work on the Túnel Emisor Oriente, positions them strongly in this segment.

These projects are characterized by significant technical challenges that naturally limit the number of competitors. Demand is often driven by national infrastructure development goals, making them critical and high-growth areas. For instance, global spending on infrastructure projects, including complex civil engineering, was projected to reach trillions by 2024, highlighting the substantial market size.

- High Complexity: Projects demand unique engineering solutions and advanced technology.

- Limited Competition: Technical barriers to entry create a niche market.

- Critical Infrastructure: Often essential for national development and economic growth.

- Strong Demand: Driven by ongoing global infrastructure investment trends.

| Project Type | Growth Rate | Market Share | ICA's Position | BCG Category |

|---|---|---|---|---|

| Transportation Infrastructure (Maya Train, Interoceanic Corridor) | High | Significant | Leader | Star |

| Border Infrastructure (Logistics Hubs) | High | Strong | Key Player | Star |

| Urban Development (Smart Cities) | High | Growing | Emerging Leader | Star |

| Specialized Civil Engineering (Tunnels, Bridges) | High | Established | Expert | Star |

What is included in the product

Strategic guidance on managing a portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of your portfolio's strengths and weaknesses, simplifying strategic decision-making.

Cash Cows

Empresas ICA's established toll road concessions, such as the Circuito Exterior Mexiquense and Autopista del Sol, represent significant Cash Cows within its portfolio. These mature assets generate consistent, predictable revenue streams from stable traffic volumes, requiring minimal new investment. For instance, in 2023, ICA reported that its infrastructure segment, heavily weighted by these concessions, contributed substantially to its overall financial performance, demonstrating their reliable cash-generating capacity.

ICA's operational airport concessions, like the one in Monterrey, are prime examples of Cash Cows. These operations benefit from consistent passenger traffic and commercial spending, providing a stable income stream.

Given the maturity of these concessions, significant investment in growth or promotion isn't typically required. This allows for exceptionally high profit margins and robust cash flow generation, as seen in the steady revenue streams airports consistently produce.

Long-Term Water Treatment and Supply Systems operate as classic Cash Cows within the ICA BCG Matrix. These ventures manage and run essential water and waste disposal systems, typically under lengthy contractual agreements. This stability is a hallmark of mature, low-growth markets where revenue streams are predictable and often subject to regulatory oversight.

The established infrastructure for these systems means that ongoing expenses are largely confined to maintenance and operational upkeep. This lean cost structure, combined with consistent demand for their services, translates into robust cash generation. For instance, in 2024, the global water and wastewater treatment market was valued at approximately $620 billion, demonstrating its significant scale and stability.

This strong cash flow from water treatment and supply systems is invaluable. It provides a reliable source of capital that can be strategically deployed to fuel growth in other business segments, such as investing in new technologies or expanding into emerging markets. The predictable nature of these revenues allows for confident financial planning and resource allocation across the entire organization.

Maintenance and Rehabilitation Contracts for Existing Infrastructure

Maintenance and rehabilitation contracts for existing infrastructure, like federal highways and bridges, are prime examples of Cash Cows in the ICA BCG Matrix. These are ongoing, long-term agreements that offer a stable and predictable income stream. The market for these services is mature, meaning the demand is consistent for upkeep rather than entirely new builds.

These types of contracts typically feature well-understood costs and generate reliable cash flow. Because the infrastructure already exists, the need for significant growth investment is minimal, allowing these operations to efficiently convert revenue into cash. For instance, the U.S. Department of Transportation's Federal Highway Administration reported that in 2023, over $50 billion was allocated towards highway and bridge maintenance and rehabilitation.

- Stable Income: Long-term contracts for maintaining existing public infrastructure ensure a consistent revenue flow.

- Mature Market: Demand is steady for upkeep and repair, not solely new construction.

- Predictable Cash Flow: Costs are generally well-known, leading to reliable cash generation with low reinvestment needs.

- Significant Investment: In 2023, the U.S. saw over $50 billion invested in highway and bridge maintenance and rehabilitation.

Mature Industrial Plant Operations and Maintenance

Mature industrial plant operations and maintenance (O&M) services, where ICA has a history of involvement, function as classic Cash Cows within the ICA BCG Matrix. These represent a stable, low-growth revenue stream, generating consistent, high-margin cash flow over extended periods, particularly in established sectors like certain power plants and refineries. For example, the global industrial maintenance market was valued at approximately $200 billion in 2023 and is projected to grow at a modest CAGR of around 3.5% through 2030, underscoring the maturity and stability of these operations. ICA's expertise in maintaining these facilities ensures their continued efficient operation, directly translating into predictable and profitable income.

These O&M contracts, even in mature industrial sectors, can offer significant profitability. The margins are often bolstered by the specialized knowledge and long-term relationships ICA cultivates with clients. In 2024, industrial O&M contracts can typically yield operating margins in the range of 15-25%, depending on the specific industry and scope of services. This steady income stream allows ICA to fund other strategic initiatives or investments.

- Stable Revenue: O&M contracts in mature industrial sectors provide predictable, long-term income.

- High Margins: Specialized expertise and established client relationships contribute to healthy profit margins, often between 15-25% in 2024.

- Low Growth Environment: These operations are in established, low-growth markets, fitting the Cash Cow profile.

- Funding Source: Profits generated can be reinvested into other business areas or used for shareholder returns.

Cash Cows are business units or products that generate more cash than they consume, operating in mature, low-growth markets. They are vital for funding other ventures within a company's portfolio. ICA's established toll road concessions, like Circuito Exterior Mexiquense, exemplify this, providing consistent revenue from stable traffic volumes. Similarly, airport concessions, such as Monterrey, benefit from steady passenger traffic and commercial spending, ensuring a reliable income stream with minimal need for new investment.

| Business Unit Example | Market Characteristic | Cash Flow Generation |

|---|---|---|

| Toll Road Concessions (e.g., Circuito Exterior Mexiquense) | Mature, stable traffic volumes | Consistent, predictable revenue |

| Airport Concessions (e.g., Monterrey) | Mature, stable passenger traffic | Reliable income from operations and commercial spending |

| Water Treatment Systems | Mature, essential service with predictable demand | Robust cash generation from long-term contracts |

Delivered as Shown

ICA BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully completed report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; you get the entire, professionally designed strategic tool as is. It's ready for immediate implementation in your business planning, competitive analysis, or investor presentations. You're seeing the exact, high-quality analysis that will be yours to download and utilize without any further modifications needed.

Dogs

Underperforming legacy real estate holdings, such as older office buildings in declining urban centers or undeveloped land parcels with limited access, often fall into the Dogs category of the ICA BCG Matrix. These assets may represent stagnant capital, with limited prospects for appreciation or income generation. For instance, a 2024 report indicated that vacancy rates in some secondary city office markets had climbed to over 20%, making it challenging to lease space profitably.

The primary concern with these Dog assets is their inability to contribute meaningfully to overall portfolio growth or profitability, potentially even incurring carrying costs. For example, a large, aging retail mall acquired in the early 2000s might now be struggling with declining foot traffic and high operational expenses, yielding a negative return on investment. Such holdings can tie up significant capital that could be deployed in more promising ventures.

Strategic decisions for these underperforming assets typically involve divestment or a thorough repurposing strategy to unlock value. Selling these properties, even at a discount, can free up capital. Alternatively, a creative redevelopment, such as converting an underutilized office building into residential units or a mixed-use space, might be considered if market analysis supports a viable turnaround. In 2024, the trend of converting vacant commercial spaces into housing continued, showing potential for revitalizing such assets.

Small-scale, low-margin general building contracts are akin to the Dogs in the BCG Matrix. Companies participating in these highly competitive projects often find themselves with a low market share in a slow-growing segment of the construction industry. The limited scope for differentiation means profit margins are typically thin, barely covering costs.

For instance, in 2024, the general building construction sector, particularly for smaller residential projects, continued to face intense competition. Many small contractors reported operating margins in the low single digits, often between 1-3%, making it difficult to achieve substantial profitability. These projects, while numerous, can drain resources and management focus.

Outdated equipment or underutilized assets represent the Dogs in the ICA BCG Matrix. Think of aging construction machinery that's become inefficient or specialized tools no longer in demand. These items often sit idle, costing money through maintenance and depreciation without generating substantial revenue.

For instance, a construction firm might have a fleet of older excavators that require frequent repairs and consume more fuel than newer models. In 2024, the average maintenance cost for construction equipment can range from 1% to 5% of its initial purchase price annually, a significant drain when the equipment is underused.

Similarly, an underutilized manufacturing facility, perhaps a factory built for a product line that has since declined, falls into this category. Such assets tie up capital and incur property taxes and insurance premiums, hindering the company's ability to invest in more productive ventures.

These 'Dog' assets are prime candidates for disposal or liquidation. Selling off such equipment or facilities can free up cash, reduce ongoing expenses, and allow the company to focus resources on its more promising 'Stars' and 'Cash Cows'.

Non-Strategic Minor Investments or Joint Ventures

These are typically minor equity stakes in older joint ventures or non-core businesses that haven't delivered the anticipated returns and operate within stagnant markets. Such investments often tie up administrative resources without offering substantial strategic benefits or contributing significantly to the company's overall profitability.

For instance, a company might hold a small percentage in a legacy joint venture that produces a niche product with declining demand. In 2024, many companies are actively reviewing portfolios to shed underperforming assets.

The focus is on optimizing resource allocation by divesting from these non-strategic holdings. This allows for a reallocation of capital and management attention towards more promising growth areas.

- Lack of Strategic Alignment: These investments do not align with the core business strategy or future growth objectives.

- Stagnant Market Conditions: The markets in which these ventures operate are characterized by low growth and limited competitive advantage.

- Suboptimal Returns: They generate low or negative returns on investment, failing to meet internal benchmarks.

- Administrative Burden: These holdings consume management time and resources that could be better utilized elsewhere.

Projects Impacted by Protracted Legal Disputes or Delays

Projects entangled in protracted legal battles or facing significant environmental hurdles often become cash traps. These initiatives, which might have started with promise, are now stalled, consuming capital and management attention without yielding any returns. For instance, major infrastructure projects in 2024 have reported an average of a 30% increase in costs due to unforeseen legal challenges and permitting delays.

These "Dogs" in the BCG matrix represent a drain on resources, akin to a business unit that is not growing and is losing money. The prolonged nature of these disputes means that capital is tied up indefinitely, preventing its redeployment into more productive ventures. In 2023, the global average for construction project delays due to legal and regulatory issues was reported to be around 18 months.

- Resource Drain: Projects stuck in legal or environmental quagmires consume significant financial resources and management bandwidth.

- Lack of Progress: These initiatives fail to move towards completion or revenue generation, offering no return on investment.

- Cost Overruns: Protracted disputes invariably lead to substantial cost escalations, further exacerbating the financial burden.

- Opportunity Cost: Capital and attention directed towards these stalled projects could be better utilized in more promising ventures.

Dogs in the ICA BCG Matrix represent assets or business units with low market share in low-growth industries. These often include legacy real estate, underperforming investments, and outdated equipment. For example, in 2024, office vacancy rates in some secondary markets exceeded 20%, highlighting the challenges faced by older commercial properties.

These assets typically consume resources without generating significant returns, acting as a drag on overall portfolio performance. Small-scale construction contracts, for instance, often operate on slim margins of 1-3% in 2024 due to intense competition.

The strategic approach for Dogs usually involves divestment or repurposing to unlock trapped capital. Converting underutilized office buildings into residential units is a trend seen in 2024 that can revitalize such assets.

Selling off underperforming equipment, like aging excavators with higher maintenance costs in 2024, frees up capital. Companies are actively reviewing portfolios to shed non-strategic holdings, allowing for reallocation to more promising growth areas.

| Asset Type | Market Share | Market Growth | Example (2024 Data) | Strategic Implication |

|---|---|---|---|---|

| Legacy Real Estate | Low | Low | Office buildings with >20% vacancy in secondary markets | Divestment or Repurposing |

| Underperforming Investments | Low | Low | Small stakes in niche product joint ventures with declining demand | Divestment |

| Outdated Equipment | N/A (Internal Asset) | N/A (Internal Asset) | Aging excavators with higher fuel consumption and maintenance costs | Liquidation or Disposal |

| Stalled Projects | N/A (Project Specific) | N/A (Project Specific) | Infrastructure projects with 30% cost increases due to legal delays | Exit or Restructure |

Question Marks

ICA is exploring new ventures in smart city infrastructure, integrating technologies like IoT and AI for urban management and digital services. This represents a high-growth market, but ICA's current market share in these emerging, tech-intensive areas is likely low.

Significant capital investment is crucial for ICA to establish a strong foothold and capture substantial market share in these nascent smart city segments. For instance, global smart city spending was projected to reach $187 billion in 2024, indicating a substantial opportunity for growth.

Advanced sustainable and green infrastructure projects, like carbon capture facilities and large-scale green hydrogen production, represent significant growth potential. These are crucial for meeting global sustainability goals. For instance, the global green hydrogen market is projected to reach USD 150 billion by 2030, indicating substantial future investment.

ICA's involvement in these cutting-edge areas might still be in its nascent stages, requiring substantial R&D and pilot programs. The company needs to build a proven track record and secure market share in these rapidly evolving sectors. This strategic focus is essential to leverage the accelerating demand driven by climate action initiatives worldwide.

ICA’s strategic push into new, untapped international markets, particularly in Latin America and other emerging economies, aligns with a 'Question Mark' in the BCG Matrix. These regions exhibit high infrastructure demand, signaling significant growth potential. For instance, the Latin American construction market was projected to reach approximately $240 billion in 2024, with many countries showing robust GDP growth and increased government spending on infrastructure projects.

Entering these markets requires substantial initial investment due to ICA's limited prior presence and expected low initial market share. This includes developing tailored market entry strategies, forging crucial local partnerships, and dedicating resources to competitive project bidding. The high growth potential, however, justifies the investment, as success in these nascent markets can lead to future 'Stars' for ICA.

Development of Modular and Prefabricated Construction Solutions

Modular and prefabricated construction solutions represent a potential Question Mark for ICA within the BCG matrix. Significant investment in advanced techniques and large-scale facilities is required to boost efficiency and speed, catering to the growing demand for faster, more cost-effective building methods. While the market is expanding, ICA's current share in this specific methodology may be modest when contrasted with traditional construction approaches.

- Market Growth: The global modular construction market was valued at approximately USD 140 billion in 2023 and is projected to reach over USD 250 billion by 2030, indicating substantial growth potential.

- Investment Needs: Scaling prefabrication capabilities demands considerable capital for advanced machinery, robotics, and specialized training.

- Efficiency Gains: Prefabrication can reduce construction timelines by up to 50% and material waste by 30% compared to traditional on-site building.

- Competitive Landscape: Established players in traditional construction may pose a challenge, requiring ICA to differentiate through innovation and quality.

Digital Transformation and Construction Technology Adoption

ICA's strategic focus on digital transformation positions it within the "Technology and Innovation" growth area, reflecting the industry's high growth potential driven by advanced construction technologies. The company is actively exploring and implementing solutions like Building Information Modeling (BIM) for end-to-end project lifecycle management and drone-based surveying. This aligns with a broader industry trend where technology adoption is crucial for efficiency and competitive advantage.

However, ICA's internal adoption rate and market share in these tech-driven services might currently be in a nascent stage, placing it in a position that requires significant investment. The high growth potential of these technologies, such as the global construction technology market projected to reach $176.2 billion by 2028, necessitates substantial capital for training personnel and integrating new systems to fully capitalize on this trend.

- Industry Growth: The construction technology market is experiencing rapid expansion, driven by the demand for efficiency and innovation.

- ICA's Initiatives: ICA is investing in technologies like BIM and drone surveying to enhance project delivery.

- Investment Needs: Significant investment in training and new systems is required to fully leverage these technologies.

- Market Position: Despite industry growth, ICA's current market share in tech-driven services may be low, indicating a need to build capacity.

ICA's ventures into smart city infrastructure, green hydrogen, and new international markets are classic examples of Question Marks. These areas offer high growth potential but require substantial investment due to ICA's limited current market share and the nascent stage of these initiatives. Success hinges on strategic capital allocation and market penetration to transform these into future Stars.

| Venture Area | Market Growth Potential | ICA's Current Market Share | Investment Requirement | Strategic Implication |

|---|---|---|---|---|

| Smart City Infrastructure | High (Global spending projected $187 billion in 2024) | Low | High | Requires significant investment to establish presence and capture market share. |

| Green Hydrogen Production | High (Market projected to reach $150 billion by 2030) | Low | High | Substantial R&D and capital needed to build track record and gain market traction. |

| Emerging International Markets (e.g., Latin America) | High (Construction market ~ $240 billion in 2024) | Low | High | Needs tailored strategies, local partnerships, and competitive bidding to build future market leadership. |

| Modular & Prefabricated Construction | High (Global market projected over $250 billion by 2030) | Modest | High | Capital needed for advanced machinery and training to compete effectively. |

| Digital Transformation (BIM, Drone Surveying) | High (Construction tech market projected $176.2 billion by 2028) | Low | High | Investment in training and systems essential to leverage technology for efficiency and competitive edge. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.