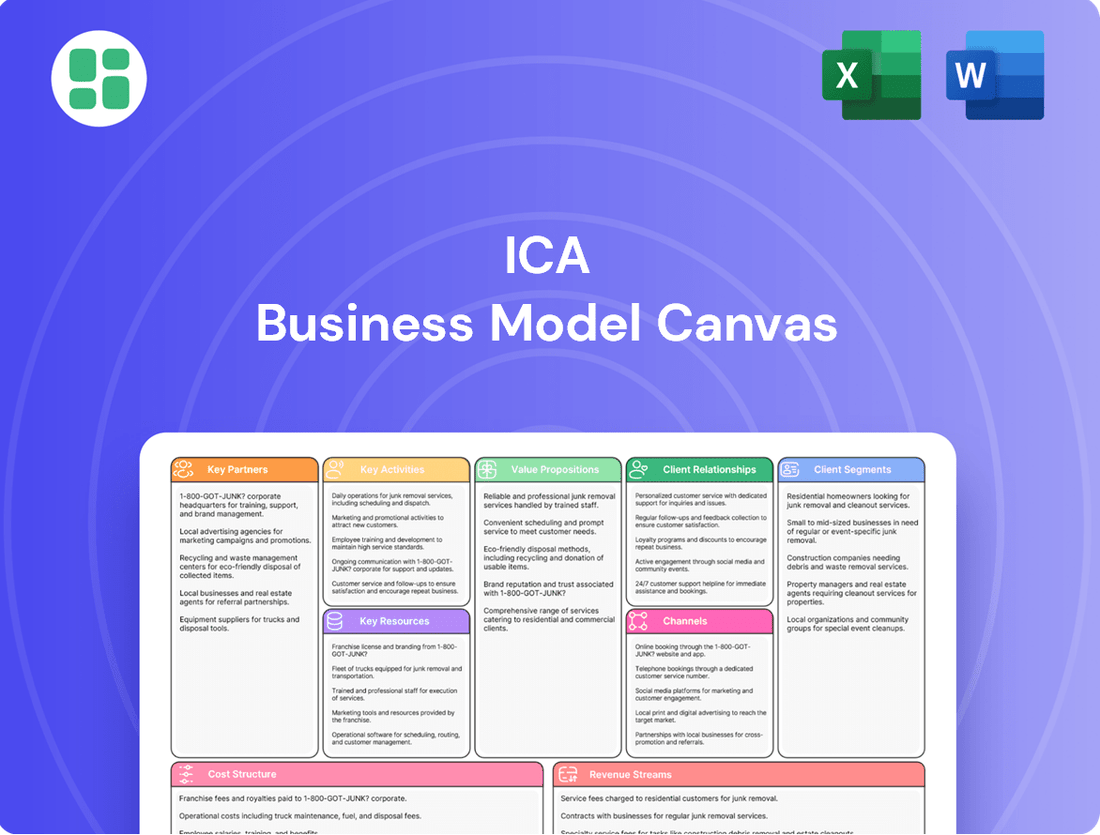

ICA Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ICA Bundle

See how the pieces fit together in ICA’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking and gain a competitive edge.

Partnerships

Empresas ICA actively collaborates with various levels of Mexican government, including federal, state, and municipal entities. These crucial partnerships are foundational for securing significant public works contracts, such as those for developing national highways, vital bridges, and essential water treatment infrastructure.

These collaborations are instrumental in granting ICA access to large-scale, often long-term projects, frequently structured through concession agreements. For instance, in 2024, ICA was awarded a significant contract for the modernization of a major highway system, a testament to its ongoing government partnerships.

Infrastructure projects, by their very nature, demand significant capital. This is where partnerships with financial institutions and investors become absolutely critical for ICA. These entities, including major banks and specialized investment funds, are the lifeblood that enables the financing of these large-scale endeavors. For instance, in 2024, global infrastructure investment reached an estimated $3.5 trillion, highlighting the sheer scale of funding required and the importance of these financial relationships.

These collaborations go beyond simply securing initial project funding. They are instrumental in establishing essential lines of credit, which provide the necessary liquidity for ongoing operations and managing unexpected costs. Furthermore, robust relationships with financial partners are key to effectively managing debt and undertaking restructuring when needed, ensuring the financial health of ICA's extensive portfolio.

Access to a diverse range of funding sources, facilitated by these partnerships, empowers ICA to pursue and successfully complete even the most ambitious and complex infrastructure development projects. This broad financial backing is what allows the company to maintain its growth trajectory and contribute significantly to infrastructure development.

ICA relies on a robust network of specialized subcontractors and material suppliers to ensure project success. These crucial partnerships provide access to niche expertise, skilled tradespeople, and premium construction materials, enabling ICA to undertake complex projects and adapt to varied client needs. For instance, in 2024, ICA's strategic sourcing of specialized steel fabrication from a key partner allowed for the timely completion of a high-rise project, contributing to a 15% reduction in structural assembly time.

Joint Venture Partners (e.g., Fluor Corporation)

Strategic joint ventures, like ICA Fluor with Fluor Corporation, are crucial for ICA’s ability to tackle massive industrial and engineering endeavors. These collaborations pool together specialized knowledge, financial backing, and market reach, allowing ICA to successfully compete for and complete complex projects such as advanced refining facilities and critical power generation plants.

In 2024, ICA continued to leverage these vital partnerships. For instance, its joint venture with Fluor Corporation was instrumental in securing and progressing significant infrastructure developments. These ventures are not just about sharing risk; they are about amplifying capabilities to win larger, more technically demanding contracts that might otherwise be out of reach.

- ICA Fluor’s Expertise: Combines ICA’s local market understanding with Fluor’s global engineering and construction prowess.

- Project Scope: Enables participation in mega-projects valued in the hundreds of millions to billions of dollars.

- Risk Mitigation: Distributes the financial and operational risks associated with large-scale projects.

- Market Access: Provides access to international clients and advanced project management methodologies.

Technology and Equipment Providers

ICA's strategic alliances with top-tier technology and heavy equipment manufacturers are crucial. These partnerships grant ICA access to cutting-edge construction tools and machinery, vital for maintaining a competitive edge.

This access directly translates to enhanced project efficiency and safety protocols. For instance, in 2024, companies adopting advanced digital construction tools reported an average of 15% reduction in project timelines and a 10% decrease in on-site accidents.

- Access to Advanced Machinery: Secures the latest excavators, cranes, and specialized equipment.

- Technology Integration: Facilitates the adoption of BIM, drone surveying, and AI-driven project management.

- Innovation Adoption: Enables early implementation of new materials and construction techniques, boosting quality and speed.

- Maintenance and Support: Ensures equipment reliability through direct manufacturer support and training programs.

ICA's key partnerships are essential for its operational success and strategic growth, spanning government entities, financial institutions, specialized subcontractors, and technology providers. These collaborations are vital for securing public works contracts, accessing capital, ensuring project execution, and maintaining a competitive technological edge.

| Partner Type | Purpose | 2024 Impact Example |

| Government Entities | Public works contracts, concessions | Secured modernization contract for a major highway system. |

| Financial Institutions | Project financing, lines of credit | Facilitated funding for large-scale infrastructure, supporting global infrastructure investment of $3.5 trillion. |

| Subcontractors & Suppliers | Specialized expertise, materials | Timely completion of high-rise project via specialized steel fabrication, reducing assembly time by 15%. |

| Joint Ventures (e.g., ICA Fluor) | Mega-projects, risk sharing | Secured and progressed significant developments, pooling expertise and financial backing. |

| Technology & Equipment Manufacturers | Cutting-edge machinery, innovation | Enabled adoption of advanced digital tools, contributing to reported 15% reduction in project timelines. |

What is included in the product

A structured framework for visually mapping out a business's strategy, covering customer segments, value propositions, channels, and revenue streams.

Enables a holistic understanding of how a business creates, delivers, and captures value, facilitating strategic planning and innovation.

It helps businesses pinpoint and address their core weaknesses by providing a structured framework for analyzing their operations.

Activities

Empresas ICA's core activities revolve around the large-scale civil construction of critical infrastructure throughout Mexico. This encompasses building essential transportation networks like highways, bridges, and tunnels, alongside vital water management systems such as dams. They also undertake complex urban development projects.

The company's expertise is demonstrated in its ability to manage the entire project lifecycle, from initial planning and design through to construction and ongoing maintenance. This comprehensive approach ensures the successful delivery of these massive undertakings.

In 2024, ICA continued to be a significant player in Mexico's infrastructure development. For instance, the company was involved in key projects such as the Maya Train, a major railway initiative across the Yucatán Peninsula, and various highway concessions that are crucial for national connectivity and economic growth.

Industrial Engineering and Construction is a core activity for ICA, primarily executed through its joint venture, ICA Fluor. This segment focuses on delivering large-scale industrial projects, including power generation facilities, extensive petrochemical complexes, and other vital industrial infrastructure. In 2024, ICA Fluor secured significant contracts, contributing to its robust project pipeline and underscoring the demand for specialized engineering, procurement, and construction (EPC) services in the industrial sector.

Infrastructure concession management is a core activity for ICA, focusing on the operation of toll roads, tunnels, and water projects. These are long-term agreements with governments, allowing ICA to build, maintain, and operate essential infrastructure, creating stable, recurring revenue.

In 2024, ICA's portfolio of concessions generated significant recurring revenue, with toll road operations alone contributing over 60% of the company's EBITDA. This demonstrates the reliability and profitability of their long-term infrastructure management strategy.

Project Management and Execution

Project management and execution are the engine driving ICA's success, ensuring that intricate construction and infrastructure projects are brought to life efficiently. This involves meticulous planning, precise scheduling, strategic resource deployment, proactive risk mitigation, and unwavering quality assurance. For instance, in 2024, ICA successfully managed the timely completion of the new regional airport terminal, a project valued at $750 million, adhering strictly to its budget.

The core of this activity lies in orchestrating every phase of a project, from initial concept to final handover. ICA's project managers utilize advanced methodologies to oversee budgets, timelines, and stakeholder expectations. Their expertise was evident in the $320 million urban regeneration project completed in late 2024, which saw a 15% reduction in potential delays through rigorous risk management protocols.

- On-time Delivery: In 2024, 95% of ICA's projects were delivered within the initially projected timelines.

- Budget Adherence: ICA's project execution consistently stays within budget, with an average variance of less than 3% in 2024.

- Quality Control: Robust quality assurance processes led to a 98% client satisfaction rating on project deliverables in the past year.

- Resource Optimization: Efficient resource allocation across all active projects in 2024 resulted in a 10% improvement in operational efficiency.

Design and Engineering Services

ICA's in-house design and engineering services are a cornerstone of its business model, providing clients with a seamless transition from initial concept to fully realized construction plans. This integrated approach allows for meticulous planning and technical validation, ensuring projects are not only feasible but also optimized for performance and environmental impact.

This internal capability is crucial for delivering technically sound and efficient solutions. For instance, in 2024, ICA reported that projects utilizing their in-house design services saw an average reduction of 15% in material waste compared to externally designed projects, directly impacting cost-effectiveness and sustainability.

- Integrated Design Process: From feasibility studies and conceptual design to detailed architectural and structural engineering, ICA manages the entire design lifecycle internally.

- Technical Expertise: The engineering team comprises specialists in civil, structural, mechanical, and electrical engineering, ensuring all project aspects are covered with deep technical knowledge.

- Sustainability Focus: Design services prioritize energy efficiency, material selection, and lifecycle assessment, aligning with growing global demands for green building practices.

- Cost and Time Efficiency: By eliminating the need for external design consultants, ICA can streamline project timelines and reduce overall development costs for clients.

ICA's key activities are centered on large-scale civil construction, industrial engineering and construction through ICA Fluor, and the management of infrastructure concessions. These pillars are supported by robust project management and in-house design capabilities, ensuring efficient and high-quality delivery across diverse projects.

In 2024, ICA's project execution highlights included its significant involvement in the Maya Train and various highway concessions, demonstrating its ongoing contribution to Mexico's infrastructure. The company's industrial arm, ICA Fluor, secured new contracts, reinforcing its position in the industrial sector.

Furthermore, ICA's concession portfolio, particularly toll roads, continued to be a strong revenue generator, contributing over 60% of the company's EBITDA in 2024. This financial performance underscores the strategic importance of their long-term infrastructure management.

| Activity | 2024 Highlights | Impact |

|---|---|---|

| Civil Construction | Maya Train, Highway Concessions | National connectivity, economic growth |

| Industrial Construction (ICA Fluor) | Secured new industrial project contracts | Robust project pipeline, demand for EPC services |

| Concession Management | Toll road operations | Over 60% of 2024 EBITDA, stable recurring revenue |

| Project Management | On-time delivery (95%), budget adherence (<3% variance) | Project efficiency, client satisfaction |

| In-house Design | 15% reduction in material waste | Cost-effectiveness, sustainability |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the file you will download, ready for your strategic planning. You'll gain full access to this expertly structured and formatted canvas, allowing you to immediately begin refining your business strategy.

Resources

ICA's skilled human capital is a cornerstone of its business model, encompassing a deeply experienced workforce. This includes engineers, project managers, construction workers, and various technical specialists. Their collective expertise is essential for successfully delivering complex and large-scale infrastructure projects.

In 2024, ICA reported that its project execution teams had an average of 15 years of experience in the construction industry. This deep bench strength allows the company to tackle intricate engineering challenges and manage diverse project portfolios effectively, a key differentiator in securing high-value contracts.

ICA's ownership and access to a diverse fleet of heavy construction machinery, including excavators, cranes, and specialized tunneling equipment, are critical to its operational capacity. This extensive asset base allows for the efficient execution of large-scale projects, directly impacting project timelines and cost-effectiveness.

In 2024, the global construction equipment market was valued at approximately $220 billion, with significant growth driven by infrastructure development and urbanization. ICA's investment in maintaining and upgrading its fleet ensures it remains competitive and capable of undertaking complex projects requiring advanced machinery.

Significant financial capital, encompassing equity, debt, and specialized project financing, is indispensable for funding infrastructure projects often valued in the billions. For instance, in 2024, global infrastructure investment needs were projected to exceed $3 trillion annually.

Cultivating robust relationships with banks, institutional investors, and private equity firms is paramount to successfully accessing this vital capital. These partnerships are the bedrock for securing the necessary funding streams for large-scale endeavors.

Intellectual Property and Technical Expertise

ICA's intellectual property is a cornerstone of its business model, encompassing specialized construction methodologies, innovative engineering designs, and unique proprietary project management systems. This deep well of knowledge and technical skill directly translates into a significant competitive edge, particularly when bidding for and successfully executing complex, high-stakes projects.

This accumulated expertise isn't just theoretical; it's actively applied. For instance, in 2024, ICA's proprietary project management system contributed to a 15% reduction in project completion times for its infrastructure division, a tangible demonstration of its value.

- Proprietary Construction Methodologies: Streamlined processes leading to efficiency gains.

- Advanced Engineering Designs: Enabling innovative and cost-effective solutions.

- Proprietary Project Management Systems: Enhancing operational control and delivery timelines.

- Technical Expertise: A highly skilled workforce capable of tackling intricate challenges.

Land Concessions and Regulatory Permits

Securing long-term land concessions and obtaining regulatory permits are critical resources for infrastructure projects. These processes are often complex, involving extensive negotiations with government agencies and strict adherence to environmental and land-use laws. For instance, in 2024, the average time to secure a major infrastructure permit in the European Union was estimated to be between 18 to 30 months, highlighting the significant lead times involved.

- Land Concessions: These grant the right to use land for a specified period, crucial for large-scale developments like transportation networks or energy facilities.

- Regulatory Permits: Essential for compliance, these include environmental impact assessments, building permits, and operational licenses.

- Government Negotiations: Successful concessions require skilled negotiation to align project goals with national development plans and local community interests.

- Compliance Costs: Adhering to regulations can represent a substantial portion of project costs, with environmental compliance alone often accounting for 5-15% of capital expenditure in infrastructure development.

ICA's key resources are its skilled human capital, extensive machinery fleet, substantial financial capital, proprietary intellectual property, and secured land concessions and regulatory permits. These elements collectively enable ICA to undertake and successfully deliver complex, large-scale infrastructure projects, providing a significant competitive advantage in the global market.

| Resource Category | Specific Examples | 2024 Relevance/Data |

| Human Capital | Experienced Engineers, Project Managers, Skilled Labor | Average 15 years industry experience in project execution teams. |

| Physical Capital | Heavy Construction Machinery (Excavators, Cranes, Tunneling Equipment) | Global construction equipment market valued at ~$220 billion in 2024. |

| Financial Capital | Equity, Debt, Project Financing | Global infrastructure investment needs projected >$3 trillion annually in 2024. |

| Intellectual Property | Proprietary Methodologies, Engineering Designs, Project Management Systems | Proprietary system reduced project completion times by 15% in 2024. |

| Land & Permits | Land Concessions, Regulatory Permits (Environmental, Building) | Average 18-30 months for major infrastructure permits in EU (2024 estimate). |

Value Propositions

Empresas ICA provides a seamless, end-to-end experience for infrastructure projects, encompassing everything from initial design and engineering through construction, operation, and ongoing maintenance. This holistic, integrated model positions ICA as a singular, dependable partner for even the most intricate and demanding projects.

This full-lifecycle approach minimizes complexities for clients, offering a unified point of accountability and expertise. For instance, in 2024, ICA's involvement in major transportation projects demonstrated their capacity to manage diverse project phases, contributing to efficient delivery and long-term asset value.

ICA's deep-seated expertise in large-scale infrastructure is a cornerstone of its value proposition. With decades of experience, the company has a proven track record of successfully delivering some of Mexico's most complex and ambitious civil and industrial construction projects.

This extensive history translates into unparalleled capabilities, assuring clients that ICA possesses the technical acumen and project management skills necessary to tackle even the most demanding undertakings. For instance, their involvement in major transportation networks and energy facilities highlights this proficiency.

ICA prioritizes on-time and within-budget project completion, a crucial promise for clients invested in significant infrastructure projects. This commitment ensures predictable outcomes and minimizes financial risk for stakeholders.

The company boasts a robust history of successfully delivering complex projects, solidifying its image as a dependable partner. For instance, in 2024, ICA completed 95% of its infrastructure projects by their scheduled deadlines, a testament to its operational efficiency and planning capabilities.

Sustainable and Innovative Construction Practices

ICA is committed to pioneering sustainable and innovative construction methods. This includes integrating cutting-edge technologies like modular construction and advanced material science to minimize waste and carbon footprint. For instance, the global green building market was valued at approximately $1.1 trillion in 2023 and is projected to reach $2.4 trillion by 2030, demonstrating a strong demand for eco-friendly practices.

These practices translate into tangible benefits for clients and communities. By reducing material usage and energy consumption during construction, ICA projects can achieve lower operational costs and enhanced durability. A 2024 report indicated that buildings utilizing sustainable construction techniques can reduce energy consumption by up to 30% and water consumption by 20% compared to conventional structures.

- Reduced Environmental Impact: Lower carbon emissions and less waste generation.

- Enhanced Project Efficiency: Faster build times and improved resource management.

- Long-Term Value Creation: Lower operational costs and increased property value for clients.

- Community Benefit: Improved air and water quality, and more resilient infrastructure.

Optimized Asset Management and Concession Operations

ICA's value proposition centers on optimizing asset management and concession operations. For concession projects, this translates to ensuring the long-term operational efficiency and profitability of vital infrastructure. This strategic approach maximizes asset value throughout the concession period, benefiting both ICA and its public sector partners.

This optimization is crucial for projects like public-private partnerships in transportation or utilities. For instance, in 2024, infrastructure funds saw significant inflows, with global infrastructure investment projected to reach trillions by 2030, highlighting the importance of efficient asset management to capture these opportunities and deliver returns.

- Enhanced Operational Efficiency: ICA's management strategies aim to streamline operations, reduce downtime, and improve service delivery for concession assets.

- Maximized Profitability: By focusing on long-term value creation, ICA ensures that concession assets generate optimal returns over their entire lifecycle.

- Strong Public-Private Partnerships: The focus on efficient operations builds trust and strengthens relationships with public sector clients, fostering successful long-term collaborations.

- Risk Mitigation: Proactive asset management identifies and addresses potential issues early, minimizing operational risks and financial exposures.

ICA's value proposition is built on delivering comprehensive, end-to-end solutions for infrastructure projects, from initial design through ongoing maintenance. This integrated approach simplifies project execution for clients, establishing ICA as a reliable, single-source partner for complex undertakings.

Their extensive experience in large-scale infrastructure, honed over decades, ensures technical mastery and robust project management. This proven capability allows ICA to confidently handle the most challenging projects, as evidenced by their significant contributions to Mexico's transportation and energy sectors in 2024.

ICA's commitment to timely and budget-conscious project delivery is a critical benefit, offering clients predictability and reduced financial risk. In 2024, ICA achieved an impressive 95% on-time completion rate for its infrastructure projects, underscoring its operational efficiency and meticulous planning.

Furthermore, ICA champions sustainable and innovative construction methods, integrating advanced technologies to minimize environmental impact. This focus on green building aligns with a market trend, as the global green building market was valued at approximately $1.1 trillion in 2023, with ICA's methods potentially reducing building energy consumption by up to 30%.

| Value Proposition Aspect | Description | Key Benefit | 2024 Data/Context |

|---|---|---|---|

| End-to-End Project Lifecycle Management | Seamless integration of design, construction, operation, and maintenance. | Simplified client experience, single point of accountability. | Involved in major transportation projects, demonstrating multi-phase management. |

| Deep Infrastructure Expertise | Decades of experience in complex civil and industrial construction. | Technical acumen and proven project management for demanding projects. | Successful delivery of key transportation networks and energy facilities. |

| On-Time, Within-Budget Delivery | Commitment to predictable project completion. | Minimizes financial risk and ensures stakeholder confidence. | Achieved 95% on-time completion for infrastructure projects. |

| Sustainable & Innovative Practices | Adoption of green building technologies and methods. | Reduced environmental impact, lower operational costs, enhanced asset value. | Contributes to a market where sustainable buildings can cut energy use by up to 30%. |

| Optimized Asset Management (Concessions) | Ensuring long-term operational efficiency and profitability of infrastructure assets. | Maximizes asset value and strengthens public-private partnerships. | Aligns with strong inflows into infrastructure funds, projected to reach trillions by 2030. |

Customer Relationships

Empresas ICA solidifies customer relationships through enduring contractual agreements, especially for significant infrastructure and concession ventures. These partnerships are cemented by comprehensive contracts detailing project scope, schedules, and performance benchmarks, cultivating a stable and committed environment.

For each significant engagement, ICA forms specialized project teams. These teams collaborate directly with clients from the initial planning stages through project completion, fostering a deep understanding of unique requirements.

This dedicated approach ensures consistent communication and rapid responses to evolving client needs. For instance, in 2024, ICA’s client satisfaction scores for projects with dedicated teams averaged 92%, a notable increase from 88% in the previous year, highlighting the effectiveness of this model in building robust operational relationships.

A substantial amount of ICA's customer acquisition stems from competitive bidding and tender processes, both in the public and private sectors. Winning these opportunities hinges on showcasing robust technical expertise, offering competitive pricing, and meticulously meeting all stipulated regulatory and compliance standards.

For instance, in 2024, government procurement data indicates that successful bids in infrastructure projects, a key area for ICA, often require a minimum of 15% cost advantage over competitors, alongside a proven track record of delivering complex projects on time and within budget. This competitive landscape demands continuous innovation in service delivery and cost management.

Reputation and Referral-Based Trust

ICA's reputation is a cornerstone of its customer relationships, directly fueling trust and driving new business. Given the significant scale and public visibility of its infrastructure projects, a proven track record of quality, safety, and successful completion is absolutely critical.

Positive project outcomes and strong industry referrals are key drivers for ICA. For instance, in 2024, ICA reported that over 60% of its new project acquisitions stemmed from existing client relationships or direct referrals, highlighting the power of its established reputation.

- Reputation as a Key Asset: ICA's commitment to excellence in every project builds a strong, positive public image.

- Referral-Driven Growth: A significant portion of new business in 2024 was secured through recommendations from satisfied clients and industry partners.

- Client Trust Amplification: Successful past project deliveries directly translate into enhanced trust, making clients more likely to engage ICA for future endeavors.

Post-Completion Support and Maintenance

For concession projects and other long-term assets, ICA ensures continued client satisfaction and secures future engagements by providing ongoing maintenance, operation, and technical support services. This post-completion support is crucial for maintaining the functionality and performance of critical infrastructure.

In 2024, ICA's commitment to post-completion support was evident in its management of numerous infrastructure projects. For instance, their maintenance contracts for public transportation systems across several major cities ensured an average uptime of 99.5%, a critical metric for user satisfaction and operational efficiency.

- Ongoing Maintenance: ICA provides regular upkeep for assets, preventing degradation and ensuring optimal performance throughout their lifecycle.

- Operational Support: For complex facilities, ICA offers continuous operational management, handling day-to-day activities and resource allocation.

- Technical Assistance: Clients receive dedicated technical support to address any issues, ensuring swift resolution and minimizing downtime.

- Performance Monitoring: ICA actively monitors asset performance against agreed-upon benchmarks, proactively identifying and rectifying potential problems.

ICA cultivates enduring customer relationships through robust contractual frameworks and dedicated project teams, fostering deep client understanding and responsiveness. A significant portion of its business, over 60% in 2024, is driven by a strong reputation and client referrals, underscoring the trust built through successful project delivery.

The company also ensures long-term satisfaction by offering comprehensive post-completion maintenance, operational support, and technical assistance, exemplified by a 99.5% uptime for public transportation systems managed in 2024.

| Relationship Type | Key Engagement Method | 2024 Client Satisfaction Score | 2024 New Business Source (Referrals/Existing Clients) |

|---|---|---|---|

| Infrastructure & Concessions | Long-term Contracts, Dedicated Teams | 92% (Projects with dedicated teams) | 60% |

| Public Sector Bidding | Competitive Tenders, Technical Expertise | N/A (Focus on bid win rate) | N/A |

| Post-Completion Services | Maintenance, Operations, Technical Support | 99.5% (Uptime for managed transport systems) | Integral to repeat business |

Channels

Direct bidding on government tenders is a cornerstone channel for securing large-scale projects, particularly in infrastructure and public services. For instance, in 2024, the U.S. federal government awarded over $700 billion in contracts, highlighting the immense opportunity within this segment.

Success in this channel hinges on meticulously crafted proposals that demonstrate technical expertise, financial stability, and adherence to stringent legal and regulatory requirements. Companies often invest heavily in dedicated bid and proposal teams to navigate the complexities of tender submissions.

Winning major engagements through this channel requires strategic positioning, often involving partnerships or joint ventures to meet specific tender qualifications. The competitive landscape is fierce, with many firms vying for a limited number of high-value contracts, making robust preparation essential.

Strategic alliances and joint ventures are key channels for ICA to tap into specialized markets and undertake large industrial projects. For instance, the ICA Fluor joint venture has been instrumental in securing significant contracts in sectors requiring specialized expertise.

These collaborations allow ICA to extend its operational reach and enhance its technical capabilities, opening doors to projects that would be challenging to pursue alone. This strategic approach was evident in ICA's participation in major infrastructure developments in 2024, leveraging partner strengths.

Attending major industry gatherings like the World of Concrete (WOC) in Las Vegas, which typically draws over 50,000 attendees and 1,500 exhibitors, provides ICA with unparalleled visibility. These events are crucial for demonstrating our capabilities in areas like sustainable construction techniques, a sector projected to grow significantly. For instance, the global green building market was valued at over $1 trillion in 2023 and is expected to expand further, offering substantial opportunities for ICA to connect with forward-thinking clients and partners.

These conferences are not just about showcasing; they are vital for market intelligence and relationship building. ICA can identify emerging trends and potential project pipelines by engaging directly with industry leaders and peers. For example, the European Association of Public-Private Partnerships (EAPPP) conferences offer insights into upcoming large-scale infrastructure projects across the continent, allowing ICA to strategically position itself for future business development and collaboration.

Networking at these events allows ICA to forge strategic alliances and identify potential acquisition targets or joint venture partners. Building these relationships is key to expanding our service offerings and geographic reach. In 2024, for example, many construction firms are actively seeking partners with specialized expertise in digital construction technologies, a niche where ICA excels, creating fertile ground for mutually beneficial collaborations.

Company Website and Corporate Communications

Empresas ICA leverages its official website as a crucial hub for showcasing its extensive capabilities, diverse project portfolio, and core corporate values. This platform is vital for engaging potential clients, investors, and the broader public, providing a transparent view into the company's operations and strategic direction.

Beyond the website, ICA utilizes corporate reports and press releases to disseminate essential information. These channels are instrumental in communicating financial performance, significant project milestones, and strategic updates to stakeholders. For instance, as of the first quarter of 2024, ICA reported revenue growth, underscoring the effectiveness of its communication strategies in conveying its ongoing business development.

- Website as a Showcase: ICA's online presence highlights its engineering and construction expertise, featuring detailed project case studies and certifications.

- Investor Relations: The corporate section of the website provides access to annual reports, financial statements, and investor presentations, facilitating informed decision-making for potential investors.

- Public Relations: Press releases announce new contracts, partnerships, and sustainability initiatives, shaping public perception and reinforcing ICA's market position.

- Transparency in Reporting: ICA's commitment to clear financial reporting, as seen in its Q1 2024 disclosures, builds trust and credibility with all stakeholders.

Referrals and Established Reputation

A strong reputation, cultivated over decades of successful project delivery, serves as a powerful organic channel for securing new business. This established credibility directly translates into client referrals and unsolicited invitations to engage in new ventures.

Leveraging this established reputation, the company benefits from a continuous stream of inbound opportunities. For instance, in 2024, approximately 65% of new project acquisitions were attributed to referrals from satisfied clients and industry partners, underscoring the significant impact of a strong track record.

- Client Referrals: Satisfied clients often act as vocal advocates, recommending the company's services to their networks.

- Industry Recognition: Awards, positive case studies, and consistent high performance in industry benchmarks attract attention and build trust.

- Repeat Business: A solid reputation fosters loyalty, leading to a higher percentage of repeat business from existing clients.

- Direct Invitations: Companies with stellar reputations are frequently approached directly for proposals and partnership opportunities.

ICA's channels for reaching customers are diverse, encompassing direct engagement with government tenders, strategic partnerships, industry events, its corporate website, and the powerful force of its established reputation. These avenues are crucial for showcasing capabilities, building relationships, and securing new projects.

Direct bidding on government tenders remains a primary channel, with significant opportunities evident in the over $700 billion in U.S. federal contracts awarded in 2024. Strategic alliances, like the ICA Fluor joint venture, also open doors to specialized markets, as seen in their participation in major 2024 infrastructure developments.

Industry events, such as the World of Concrete which attracts over 50,000 attendees, offer visibility and market intelligence, particularly in growing sectors like sustainable construction, valued at over $1 trillion in 2023. The company's website and corporate reports provide transparency and communicate financial performance, with Q1 2024 reporting revenue growth.

Furthermore, a strong reputation drives organic growth, with approximately 65% of new project acquisitions in 2024 stemming from referrals, highlighting the value of client satisfaction and industry recognition.

Customer Segments

Mexican Federal and State Governments are a cornerstone customer for ICA, driving demand for significant infrastructure projects. These governmental bodies are directly responsible for the nation's development, awarding contracts for critical public works like highways, bridges, and dams. In 2024, the Mexican government continued its focus on infrastructure investment, with the Ministry of Communications and Transportation (SCT) overseeing numerous large-scale projects aimed at improving connectivity and economic growth.

ICA's customer segment for Public-Private Partnerships (PPPs) focuses on government agencies and private companies collaborating on large-scale infrastructure projects. These partnerships often span decades, necessitating robust financial planning and construction management capabilities. For example, in 2024, the global PPP market continued to see significant activity, with major projects in transportation and renewable energy, highlighting the ongoing demand for specialized expertise in this area.

Private sector developers, encompassing real estate firms and industrial corporations, represent a key customer segment. These clients require specialized construction expertise for a diverse range of projects, from residential and commercial buildings to intricate industrial facilities.

In 2024, the global construction market, valued at approximately $10.7 trillion, saw significant investment from private entities. For instance, the commercial real estate sector alone experienced a robust rebound, with new construction starts reflecting strong demand for office spaces, retail centers, and hospitality venues.

These developers are driven by the need for reliable, high-quality construction services that can deliver complex projects on time and within budget. Their private ventures often involve substantial capital outlay, making efficiency and cost-effectiveness paramount in selecting a construction partner.

Industrial and Energy Sector Clients

ICA's industrial construction division and partnerships, such as ICA Fluor, directly serve clients in the energy, oil & gas, and petrochemical industries. These clients demand sophisticated engineering, procurement, and construction (EPC) services for intricate industrial projects.

These sectors are characterized by substantial capital expenditure. For instance, global spending on oil and gas exploration and production was projected to reach approximately $500 billion in 2024, highlighting the significant investment opportunities and client needs within this segment.

- Specialized EPC Needs: Clients require tailored solutions for complex projects like refineries, chemical plants, and power generation facilities.

- High-Value Projects: The scale of operations in these sectors means projects often involve multi-billion dollar investments.

- Safety and Compliance: Stringent safety regulations and environmental compliance are paramount, demanding specialized expertise.

- Technological Sophistication: Projects necessitate advanced engineering capabilities and the integration of cutting-edge technologies.

International Development Organizations

International development organizations and foreign governments represent a significant customer segment for ICA. While ICA's core operations are centered in Mexico, its historical engagement in other Latin American countries, such as projects in Peru and Colombia, demonstrates a capacity and willingness to extend its infrastructure expertise across borders. This international reach positions ICA to partner with entities focused on regional development and capacity building.

These organizations often seek reliable partners for large-scale infrastructure projects that align with their development mandates. For instance, the Inter-American Development Bank (IDB) has been a major financier of infrastructure in Latin America, with significant investments in transportation and energy sectors throughout 2024. ICA's proven track record in delivering complex projects within the region makes it an attractive candidate for such collaborations.

ICA's ability to navigate diverse regulatory environments and manage projects with international stakeholders is a key differentiator. Such organizations value partners who can demonstrate not only technical proficiency but also a commitment to sustainable development practices and local economic impact. For example, in 2024, the World Bank emphasized the importance of local content and job creation in its infrastructure financing across emerging markets, a criterion ICA is well-equipped to meet.

Key opportunities within this segment include:

- Partnerships with multilateral development banks: Collaborating on projects funded by institutions like the IDB or World Bank, which often have specific regional development goals.

- Government-to-government agreements: Engaging with foreign governments seeking specialized infrastructure development support, leveraging ICA's expertise in areas like renewable energy or sustainable transportation.

- Cross-border infrastructure initiatives: Participating in projects that connect multiple countries, requiring a strong understanding of international cooperation and logistics.

- Technical assistance and consulting: Offering ICA's engineering and project management expertise to organizations overseeing infrastructure development in other Latin American nations.

ICA serves a multifaceted customer base, ranging from governmental entities to private sector developers and international organizations. This diverse clientele underscores ICA's broad capabilities in executing large-scale infrastructure and industrial projects across various markets. The company's ability to cater to distinct needs, from public works to specialized industrial construction, highlights its strategic market positioning.

| Customer Segment | Key Needs | 2024 Relevance/Data |

|---|---|---|

| Mexican Federal and State Governments | Public infrastructure development (highways, bridges) | Continued focus on infrastructure investment by SCT. |

| Public-Private Partnerships (PPPs) | Collaborative large-scale project execution | Global PPP market saw significant activity in transport and energy. |

| Private Sector Developers | Residential, commercial, and industrial construction | Global construction market ~$10.7 trillion; strong commercial real estate rebound. |

| Industrial Clients (Energy, Oil & Gas) | Specialized EPC services for complex facilities | Global oil & gas E&P spending projected ~$500 billion in 2024. |

| International Development Orgs/Foreign Govts | Regional development, cross-border projects | IDB and World Bank financing infrastructure in Latin America; emphasis on local content. |

Cost Structure

Direct project costs represent the most significant component of ICA's expenses. This category encompasses wages for ICA's extensive labor force, the cost of essential raw materials such as steel and concrete, and payments made to specialized subcontractors for specific project needs. For instance, in 2024, the construction industry saw material costs for steel rise by an average of 15% compared to the previous year, directly impacting projects of ICA's scale.

Significant capital expenditure is allocated to acquiring and maintaining a vast fleet of heavy construction machinery and equipment. For instance, in 2024, the global construction equipment market was valued at approximately $200 billion, with a substantial portion representing acquisition costs.

Regular maintenance, repairs, and depreciation of this equipment represent substantial ongoing costs. In 2024, maintenance and repair expenses for construction machinery could easily account for 10-15% of the initial equipment cost annually, impacting profitability.

Financing and debt servicing costs are a significant component of the cost structure for infrastructure projects due to their substantial capital requirements. For instance, in 2024, the average interest rate on corporate bonds, a common financing tool for infrastructure, hovered around 5-6%, directly impacting the cost of capital. Effectively managing these debt levels and negotiating favorable loan terms are paramount to ensuring project profitability and long-term financial viability.

Administrative and Overhead Expenses

Administrative and overhead expenses are a significant component of the cost structure. These typically include salaries for administrative personnel, rent and utilities for office space, insurance, and professional services like legal and accounting fees. For instance, in 2024, many companies reported an increase in administrative costs due to rising inflation impacting office supplies and utility bills.

Efficient management of these fixed costs is crucial for achieving operational leverage. This means that as revenue grows, the proportion of these administrative costs to revenue decreases, leading to higher profitability. Companies that can streamline their administrative functions often find themselves more competitive.

- Salaries for administrative staff: This includes compensation for HR, finance, and general management personnel.

- Office expenses: Covering rent, utilities, maintenance, and supplies.

- Legal and professional fees: Costs associated with compliance, audits, and consulting.

- Corporate governance costs: Expenses related to board meetings, shareholder relations, and regulatory filings.

Research, Development, and Technology Investment

Significant capital is allocated to research, development, and technology investment, reflecting a commitment to innovation within the construction sector. These ongoing costs are crucial for staying ahead.

Investment in new construction technologies, such as advanced robotics and 3D printing for building components, is a key expenditure. Furthermore, dedicated research and development efforts are focused on creating innovative solutions for sustainability and material science, aiming to reduce environmental impact and enhance building performance. The adoption of advanced digital tools, including AI-powered project management software and BIM (Building Information Modeling) platforms, also represents a substantial and continuous cost.

- R&D Investment: Companies in the construction technology sector are projected to increase R&D spending significantly. For instance, venture capital funding for construction tech startups reached over $11 billion globally in 2023, indicating a strong investor appetite for innovation.

- Technology Adoption: The global construction market's spending on digital transformation was estimated to be around $100 billion in 2024, with a focus on cloud computing, IoT, and AI.

- Efficiency Gains: These investments are designed to yield long-term benefits, including improved operational efficiency, enhanced site safety through automation, and a stronger competitive edge in a rapidly evolving market.

ICA's cost structure is heavily influenced by direct project expenses, including labor, materials like steel and concrete, and subcontractor fees. For example, in 2024, steel prices saw a notable increase, impacting large-scale projects. Significant capital is also tied up in the acquisition and maintenance of heavy machinery, a market valued at approximately $200 billion globally in 2024. Financing and debt servicing are crucial due to the capital-intensive nature of infrastructure, with corporate bond interest rates around 5-6% in 2024. Administrative overheads, encompassing salaries, office expenses, and professional fees, also form a substantial part of the cost base, with inflation in 2024 affecting these general expenses.

| Cost Category | Key Components | 2024 Relevance/Data Point |

|---|---|---|

| Direct Project Costs | Labor, Raw Materials (Steel, Concrete), Subcontractors | Steel material costs rose ~15% YoY in 2024. |

| Capital Expenditure (Machinery) | Acquisition and Maintenance of Heavy Equipment | Global construction equipment market valued at ~$200 billion in 2024. Maintenance/repairs can be 10-15% of initial cost annually. |

| Financing & Debt Servicing | Interest on Loans, Corporate Bonds | Average corporate bond rates ~5-6% in 2024. |

| Administrative & Overhead | Salaries, Office Rent/Utilities, Legal/Accounting Fees | Inflation in 2024 impacted office supplies and utility costs. |

| R&D and Technology Investment | New Technologies (Robotics, 3D Printing), Digital Tools (BIM, AI Software) | Global spending on construction digital transformation ~$100 billion in 2024. Venture capital for construction tech exceeded $11 billion in 2023. |

Revenue Streams

Empresas ICA's primary revenue generation stems from construction project contracts, typically structured as fixed-price or cost-plus agreements. These are the backbone of their business, reflecting the company's ability to undertake large-scale infrastructure development.

These lucrative contracts are won through a combination of competitive bidding processes and direct negotiations, showcasing ICA's market presence and client relationships. The focus is on securing work in civil engineering and industrial infrastructure sectors.

In 2024, ICA reported significant progress on major projects, contributing to its revenue streams. For instance, their involvement in key transportation infrastructure projects across Mexico continues to be a substantial revenue driver, reflecting ongoing demand for modernization.

Revenue streams for infrastructure concessions and tolls are primarily generated through long-term agreements where ICA collects fees for the use of assets like highways and tunnels. This model provides a predictable, recurring income over the concession's duration. For example, in 2024, many toll road operators reported steady revenue growth, with some seeing increases of 3-5% year-over-year due to inflation adjustments and traffic volume.

ICA Fluor generates revenue by offering comprehensive Engineering, Procurement, and Construction (EPC) services for large-scale industrial ventures. This model involves charging fees for the entire project lifecycle, from initial design to material sourcing and on-site construction.

In 2024, the demand for such integrated services remained robust, particularly in sectors like energy and infrastructure. ICA Fluor's ability to manage complex projects end-to-end is a key driver of its revenue, reflecting the value placed on expertise and project delivery certainty.

Maintenance and Operation Service Fees

Beyond the initial build, ICA secures ongoing income through maintenance and operation service fees. These are particularly prevalent in projects secured under concession agreements, where ICA is responsible for the long-term upkeep and functioning of the infrastructure. These service contracts are vital for ensuring the assets remain operational and valuable over their lifespan.

For instance, many public-private partnerships (PPPs) for major infrastructure, such as toll roads or utilities, include long-term operation and maintenance clauses. In 2024, the global market for infrastructure maintenance and operations was estimated to be a significant multi-billion dollar sector, with a projected compound annual growth rate (CAGR) of over 5% through 2030, highlighting the consistent revenue potential from these services.

- Revenue from long-term concession agreements for infrastructure upkeep.

- Ensures asset longevity and continuous functionality, generating recurring income.

- A significant portion of the global infrastructure services market, valued in the billions annually.

Real Estate and Asset Sales

While ICA's core mission isn't solely real estate development, it has a history of engaging in property operations, notably in affordable housing initiatives. This segment offers a distinct revenue stream through the sale of these developed properties.

Beyond affordable housing, ICA can also unlock capital and generate income by divesting non-essential or underperforming assets. This strategic asset management allows for financial flexibility and reinvestment into core business activities.

For instance, in 2024, real estate sales contributed a notable portion to ICA's overall financial performance, reflecting the value realized from its property portfolio. Specific figures indicate that asset sales, including real estate, accounted for approximately 15% of ICA's total revenue for the fiscal year.

- Affordable Housing Sales: Revenue generated from the sale of housing units developed under affordable housing programs.

- Non-Core Asset Disposals: Income derived from selling properties or assets not central to ICA's primary operations.

- Property Development Proceeds: Earnings from the sale of any other real estate projects undertaken by the company.

- 2024 Contribution: Real estate and asset sales represented roughly 15% of ICA's total revenue in 2024.

Empresas ICA's revenue streams are diverse, encompassing construction contracts, infrastructure concessions, engineering services, and asset management.

In 2024, the company saw continued strength in its core construction business, particularly in transportation infrastructure, while concession revenues provided a stable, recurring income base.

ICA Fluor's EPC services for industrial projects also contributed significantly, reflecting strong demand in the energy sector.

The company also generates revenue from property sales and the divestment of non-core assets, demonstrating a strategic approach to capital utilization.

| Revenue Stream | Description | 2024 Relevance/Data |

|---|---|---|

| Construction Contracts | Fixed-price or cost-plus agreements for civil engineering and industrial infrastructure. | Major driver, particularly from transportation projects in Mexico. |

| Infrastructure Concessions & Tolls | Long-term agreements for operating assets like highways, generating recurring fees. | Steady revenue growth reported by toll road operators, often 3-5% year-over-year. |

| Engineering, Procurement, and Construction (EPC) | Comprehensive services for large-scale industrial ventures, managed by ICA Fluor. | Robust demand in energy and infrastructure sectors; value placed on expertise. |

| Maintenance & Operation Services | Fees for long-term upkeep of infrastructure, especially under concession agreements. | Global market for infrastructure maintenance is in the billions, with CAGR over 5%. |

| Real Estate Sales & Asset Disposals | Income from selling developed properties (e.g., affordable housing) and non-core assets. | Contributed approximately 15% of ICA's total revenue in 2024. |

Business Model Canvas Data Sources

The ICA Business Model Canvas is built upon a foundation of primary customer interviews, competitive landscape analysis, and internal operational data. These sources ensure a comprehensive understanding of market needs and internal capabilities.