IAG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAG Bundle

IAG's SWOT analysis reveals a powerful brand and strong market presence, but also highlights potential vulnerabilities in a competitive landscape. Understanding these dynamics is crucial for any investor or strategist looking to navigate the insurance sector.

Want the full story behind IAG's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

IAG commands a robust market position as a premier general insurer across Australia and New Zealand, leveraging a powerful portfolio of recognizable brands. This broad brand presence enables IAG to effectively serve a wide array of customers, boosting market reach and fostering strong customer loyalty.

The inherent trust in IAG's established brands provides a significant competitive edge, underpinning high levels of customer advocacy and retention within its retail operations. For instance, in FY23, IAG reported a strong customer retention rate of 87.5% in its direct consumer businesses, reflecting the enduring appeal of its brand stable.

IAG's financial performance in recent years has been notably strong, with significant increases in net profit after tax. For instance, in the fiscal year ending June 30, 2024, the company reported a net profit after tax of AUD 1.05 billion, a substantial rise from the previous year.

The insurer also boasts a robust capital position, consistently operating well above its target regulatory capital ratios. As of the first half of fiscal year 2025, IAG's Common Equity Tier 1 (CET1) ratio stood at a healthy 165%, providing considerable financial flexibility and resilience.

This solid financial footing empowers IAG to pursue value-enhancing strategies, such as its AUD 250 million share buyback program announced in August 2024, and maintain consistent dividend payouts, reflecting confidence in its ongoing cash generation capabilities.

IAG benefits from robust, long-term reinsurance arrangements that effectively buffer the financial impact of natural disasters, ensuring more stable pricing for policyholders. This strategic risk mitigation is vital given the escalating frequency and severity of climate-driven events.

The company's investment in industry-leading natural perils scientists provides a critical edge in accurately assessing and pricing risk, a key differentiator in managing earnings volatility.

For instance, during the severe Australian hailstorms in early 2023, IAG's reinsurance programs played a significant role in absorbing a substantial portion of the insured losses, demonstrating the tangible benefits of these advanced protections.

Significant Investment in Technology and Digital Transformation

IAG's significant investment in technology and digital transformation is a core strength, evidenced by its ongoing migration of millions of policies to a new Enterprise Platform. This strategic move is designed to elevate the customer experience through enhanced digital touchpoints and bolster pricing sophistication. By prioritizing technological advancement, IAG is positioning itself for future growth and innovation, aiming to unlock greater operational efficiencies and superior service delivery.

This commitment to digital transformation underpins IAG's ability to adapt to evolving market demands and customer expectations. For instance, in the 2024 financial year, IAG reported substantial progress in its digital initiatives, which contributed to a more streamlined policy administration and improved data analytics capabilities. These advancements are crucial for refining underwriting processes and developing more personalized insurance products.

- Enterprise Platform Migration: Millions of policies are being moved to a new platform to modernize operations.

- Enhanced Customer Experience: Focus on improving digital interactions and service accessibility for policyholders.

- Advanced Pricing Capabilities: Leveraging technology to refine pricing models and improve risk assessment accuracy.

- Future Growth Driver: Technology investment is seen as key to fostering innovation and competitive advantage in the insurance sector.

Focus on Sustainability and Climate Resilience

IAG's dedication to sustainability and climate resilience is a significant strength. The company has set ambitious goals, aiming for net-zero insurance operations by 2050, a commitment that resonates with environmentally conscious stakeholders.

This focus is concretely demonstrated through initiatives like their Climate Action Plan and updated emissions reduction targets. IAG actively supports communities in enhancing their ability to withstand climate impacts and collaborates with governments and industry peers to drive the shift towards a low-carbon future.

- Climate Action Plan: Outlines IAG's strategy for reducing its environmental footprint.

- Net-Zero Target: Aiming for net-zero insurance operations by 2050.

- Climate Resilience Support: Investing in programs that help communities adapt to climate change.

- Industry Partnerships: Collaborating to accelerate the transition to a low-carbon economy.

IAG's established brand portfolio, including names like NRMA Insurance and CGU, provides significant market penetration and customer loyalty across Australia and New Zealand. This strong brand equity translates into high customer retention rates, with 87.5% in direct consumer businesses reported in FY23, underscoring their competitive advantage.

The company's robust financial health is a key strength, evidenced by a net profit after tax of AUD 1.05 billion for FY24 and a Common Equity Tier 1 ratio of 165% in H1 FY25, well above regulatory targets. This financial stability supports strategic initiatives like share buybacks and consistent dividend payouts.

IAG's strategic use of reinsurance and investment in natural perils science are crucial for managing earnings volatility. These measures effectively mitigate the financial impact of severe weather events, as demonstrated during the 2023 hailstorms, ensuring more stable pricing for policyholders.

Significant investment in technology, including the ongoing Enterprise Platform migration, enhances customer experience and pricing sophistication. This digital transformation is a key driver for future growth, improving operational efficiency and service delivery.

| Metric | Value | Period |

|---|---|---|

| Net Profit After Tax | AUD 1.05 billion | FY24 |

| Customer Retention (Direct Consumer) | 87.5% | FY23 |

| Common Equity Tier 1 (CET1) Ratio | 165% | H1 FY25 |

What is included in the product

This SWOT analysis maps out IAG's internal capabilities and external market challenges, identifying key growth drivers and operational gaps.

Offers a structured framework to identify and address critical business challenges, transforming potential weaknesses into actionable strategies.

Weaknesses

Despite reinsurance, IAG faces significant exposure to natural perils, especially in Australia and New Zealand. Climate-related insured losses in these regions have surged, with 2023 seeing major events like Cyclone Gabrielle causing billions in damages.

The increasing frequency and severity of extreme weather events present a persistent challenge. This trend directly impacts IAG's profitability through higher claims volumes and escalated operational costs, demanding constant refinement of risk assessment and pricing.

IAG's pursuit of operational efficiency through technology and transformation initiatives, while beneficial long-term, presents a potential weakness in rising operational costs. This is exacerbated by ongoing inflationary pressures, which could push non-fuel unit costs higher. For instance, in 2023, IAG reported that its underlying cost per available seat kilometer (CASK) excluding fuel saw an increase, reflecting these investment and inflationary impacts.

The general insurance market in Australia and New Zealand is highly competitive, which can challenge IAG's capacity to sustain strong profit margins and its existing market share. This intense rivalry often forces insurers to compete on price, potentially eroding profitability.

To counter this, IAG must consistently innovate its product range and enhance customer service to attract new policyholders and retain its current customer base. For instance, in the first half of FY24, IAG reported a gross written premium growth of 5.1%, demonstrating efforts to grow amidst competition, but the overall market remains a significant pressure point.

Dependency on Economic Conditions and Consumer Confidence

IAG's profitability is closely tied to the overall health of the economy. When economic conditions weaken, consumer confidence often dips, directly impacting the demand for insurance. This means fewer people might buy new policies or renew existing ones, and there can be pressure to keep premiums low, affecting IAG's revenue. For example, in 2023, while many economies showed signs of recovery, persistent inflation and interest rate hikes continued to create economic uncertainty, a factor IAG had to navigate.

This sensitivity to economic cycles presents a notable weakness. A significant economic downturn could lead to a contraction in the insurance market, potentially resulting in lower policy sales and increased claims if economic hardship leads to more opportunistic claims. IAG's financial performance, therefore, is not solely within its control but is significantly influenced by external macroeconomic factors.

- Economic Sensitivity: IAG's revenue streams are vulnerable to fluctuations in GDP growth and consumer spending patterns.

- Consumer Confidence Impact: A decline in consumer confidence can directly reduce the uptake of insurance products, IAG's core business.

- Premium Pressure: During economic downturns, IAG may face pressure to lower premiums, impacting its profitability margins.

- Market Volatility: External economic shocks can lead to unpredictable shifts in demand and claims, creating operational challenges.

Challenges in Global Expansion Beyond Core Markets

While IAG boasts a dominant position in Australia and New Zealand, its global expansion beyond these core markets faces considerable hurdles. Replicating its established success in diverse international landscapes is a significant undertaking.

Navigating varied regulatory frameworks, understanding distinct market dynamics, and confronting different competitive pressures in new regions pose substantial challenges to IAG's diversification and growth strategies outside its established strongholds. For instance, in the 2024 financial year, IAG reported that approximately 85% of its gross written premium was generated from its home markets of Australia and New Zealand, highlighting the concentration of its business.

- Regulatory Complexity: Different countries have unique insurance regulations, capital requirements, and consumer protection laws that IAG must meticulously comply with, adding layers of complexity and cost to international operations.

- Market Saturation and Competition: Many international markets are already mature and highly competitive, with established local and global players, making it difficult for IAG to gain significant market share.

- Cultural and Consumer Differences: Understanding and adapting to diverse consumer preferences, risk perceptions, and cultural nuances is critical for product development and marketing effectiveness in new territories.

IAG's significant reliance on its core Australian and New Zealand markets, which accounted for approximately 85% of its gross written premium in FY24, exposes it to concentrated regional risks and limits its global diversification. This focus, while a strength in established markets, becomes a weakness when considering expansion into less familiar territories with their own unique regulatory, competitive, and cultural landscapes.

Preview the Actual Deliverable

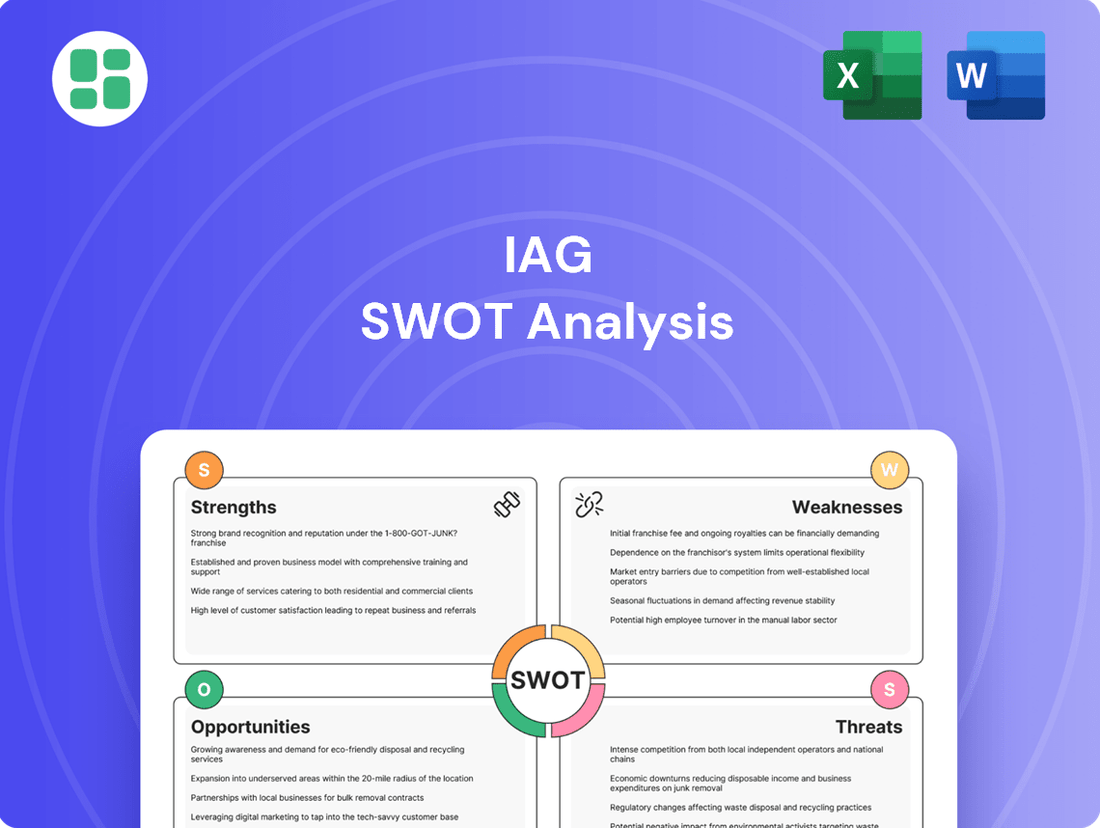

IAG SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing exactly what you'll download, ensuring transparency and value.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing comprehensive insights into IAG's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It showcases the quality and detail of the full IAG SWOT analysis.

Opportunities

IAG has a significant opportunity to broaden its insurance portfolio beyond its current personal and commercial offerings. This expansion could target emerging risks, such as cyber threats or climate-related events, and tap into underserved markets, potentially creating new revenue channels.

By developing specialized insurance products, IAG can cater to evolving customer needs and capture market share that might otherwise be overlooked. For instance, in 2024, the global cyber insurance market alone was projected to reach over $11.5 billion, indicating substantial growth potential for tailored solutions.

IAG’s continued investment in digital platforms, including its 2024 rollout of enhanced online self-service options for policyholders, offers a prime opportunity to elevate the customer experience. Streamlining digital interactions and claims processing can significantly boost satisfaction and loyalty, a critical factor in the competitive insurance landscape.

By refining digital tools and processes, IAG can achieve greater operational efficiency, which in turn supports more accurate and competitive pricing and risk management strategies. This focus on digital transformation is expected to yield tangible benefits in customer retention and market share growth through 2025.

IAG can capitalize on the escalating demand for climate-related risk management. With climate events becoming more frequent and severe, there's a significant opportunity to develop and offer innovative insurance products that protect against these risks. For instance, in 2024, the insurance industry saw a substantial increase in claims related to natural catastrophes, highlighting the market's need for advanced solutions.

The company can also expand into providing advisory services, helping businesses and communities understand and mitigate their climate-related vulnerabilities. This could involve offering expertise on adaptation strategies and resilience building. By doing so, IAG not only addresses a critical societal need but also taps into a burgeoning market for climate risk consulting, a sector projected for strong growth through 2025.

Furthermore, IAG has the chance to forge strategic partnerships with government bodies and non-governmental organizations to co-create resilience initiatives. This collaborative approach can lead to the development of new insurance models and community-based risk reduction programs. Such initiatives are crucial as climate change impacts continue to affect economies globally, with estimates suggesting significant economic losses from climate-related events in the coming years.

Strategic Partnerships and Acquisitions

IAG can enhance its market presence and technological capabilities through strategic partnerships and targeted acquisitions. Collaborating with insurtech firms, for example, could fast-track the integration of innovative solutions, as seen in the broader insurance industry where digital transformation is a key driver.

Such moves are crucial for staying competitive. For instance, in 2024, the global insurtech market was valued at approximately USD 3.5 billion and is projected to grow significantly, indicating substantial opportunities for partnerships that bring cutting-edge technology to established players like IAG.

These strategic alliances or acquisitions can lead to significant operational synergies and a stronger competitive edge.

- Expand Market Reach: Partnerships can open doors to new customer segments and geographic regions, a strategy many insurers explored in 2024 to diversify revenue streams.

- Access New Technologies: Collaborating with or acquiring insurtechs provides access to advanced data analytics, AI, and digital customer service platforms, crucial for modern insurance operations.

- Consolidate Market Position: Strategic acquisitions can strengthen IAG's standing in core markets, potentially leading to economies of scale and improved profitability.

- Drive Innovation: By partnering with agile insurtechs, IAG can accelerate the development and deployment of new products and services, responding faster to evolving customer demands.

Data Analytics and AI for Risk Pricing and Operational Efficiency

IAG can unlock significant advantages by further integrating advanced data analytics and artificial intelligence. This technology can refine risk pricing, making underwriting more precise and profitable. For instance, in 2024, insurers adopting AI for risk assessment saw a reduction in claims leakage by up to 15%, according to industry reports.

AI-powered tools are also crucial for robust fraud detection, a persistent challenge in the insurance sector. Beyond risk, these technologies can dramatically boost operational efficiency. Automating routine back-office tasks, like claims processing or customer service inquiries, can lead to substantial cost savings and quicker turnaround times.

By embracing this data-driven approach, IAG can gain a considerable competitive edge. Consider these specific opportunities:

- Enhanced Underwriting Accuracy: Utilizing AI to analyze vast datasets for more granular risk segmentation, potentially improving loss ratios.

- Streamlined Claims Processing: Automating claims assessment and payout through AI, reducing operational costs by an estimated 10-20% in 2024 for leading insurers.

- Proactive Fraud Prevention: Implementing machine learning models to identify suspicious patterns in real-time, minimizing fraudulent payouts.

- Personalized Customer Experiences: Leveraging data analytics to tailor product offerings and communication, increasing customer retention.

IAG can expand its offerings into specialized insurance products for emerging risks like cyber threats and climate events, tapping into underserved markets. The global cyber insurance market, projected to exceed $11.5 billion in 2024, highlights this growth potential.

By enhancing digital platforms and self-service options, IAG can significantly improve customer experience and loyalty, a key differentiator in the competitive insurance landscape. This digital focus is expected to boost customer retention and market share through 2025.

Addressing the increasing demand for climate-related risk management presents a substantial opportunity, especially given the rise in natural catastrophe claims observed in 2024. IAG can develop innovative products and offer advisory services on resilience, a sector poised for strong growth.

Strategic partnerships and targeted acquisitions, particularly with insurtech firms valued at approximately USD 3.5 billion in 2024, can accelerate technological integration and market reach. These collaborations can lead to operational synergies and a stronger competitive standing.

Further integration of advanced data analytics and AI can refine underwriting accuracy, streamline claims processing, and enhance fraud prevention. Insurers using AI for risk assessment saw up to a 15% reduction in claims leakage in 2024, showcasing the technology's impact.

Threats

The growing intensity and frequency of natural disasters, driven by climate change, present a significant challenge for IAG. These events directly increase claims costs and can strain profitability, even with reinsurance in place. For instance, the 2022 global insured catastrophe losses reached an estimated $125 billion, highlighting the increasing financial impact of such events on the insurance industry.

Changes in insurance regulations, government policies, or taxation could significantly impact IAG's operations and profitability. For instance, in Australia, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (2019) led to increased scrutiny and potential regulatory reforms that could affect all financial institutions, including insurers like IAG. Stricter capital requirements, new consumer protection laws, or increased levies could raise compliance costs and reduce financial flexibility for IAG.

Economic downturns pose a significant threat to IAG by potentially reducing consumer disposable income, which can lead to decreased demand for insurance products or make it harder for customers to afford current premiums. For instance, during periods of economic contraction, individuals may delay purchasing new policies or opt for less comprehensive coverage to save money.

Inflationary pressures are another considerable challenge, as they directly increase the cost of claims. Higher repair costs for vehicles and properties, for example, will likely translate into greater payouts for IAG. This surge in claims expenses, coupled with rising operational costs, can significantly erode profit margins if premiums cannot be adjusted swiftly and sufficiently to compensate.

The current economic climate, characterized by persistent inflation and the risk of recession, creates a highly uncertain operating environment for IAG. For example, global inflation rates remained elevated throughout 2023 and into early 2024, impacting various sectors, including the cost of goods and services relevant to insurance claims.

Intensified Competition from New Entrants and Digital Disruptors

The insurance landscape is increasingly threatened by nimble insurtech startups and established tech giants. These new players are leveraging innovative, digitally-driven business models to offer highly personalized, cost-effective, and convenient insurance products. This influx of competition could significantly impact IAG's market share and challenge its long-standing operational frameworks.

For instance, in 2024, the global insurtech market was valued at approximately USD 10.5 billion, with projections indicating substantial growth. These startups often excel in customer experience and data analytics, areas where traditional insurers like IAG may face adaptation challenges. The potential for these disruptors to capture market segments through specialized offerings, such as on-demand or usage-based insurance, presents a direct threat.

- Digital-First Models: Insurtechs often operate with lower overheads and a focus on seamless digital customer journeys, allowing for more competitive pricing.

- Data Analytics Prowess: Advanced data analytics enable personalized risk assessment and product customization, appealing to a modern consumer base.

- Agile Operations: Startups can pivot quickly to market changes, unlike larger, more established organizations that may have legacy systems and processes.

- Tech Giant Entry: The potential entry of major technology companies into the insurance sector, with their vast customer bases and data capabilities, poses a significant competitive threat.

Cybersecurity Risks and Data Breaches

As a major financial institution, IAG's reliance on digital platforms makes it a prime target for cybersecurity risks. A significant data breach in 2024 could result in substantial financial losses, potentially running into millions due to recovery costs, regulatory fines, and legal liabilities. For instance, the average cost of a data breach for financial services firms in 2023 was reported to be around $5.90 million, a figure likely to persist or increase into 2024.

The consequences extend beyond immediate financial impact. Reputational damage from a cybersecurity incident can be severe, leading to an erosion of customer trust and potentially impacting IAG's market share. Regulatory penalties, such as those under GDPR or similar frameworks, could also add significant financial strain. For example, in 2023, regulatory fines for data protection violations continued to be a major concern for financial institutions globally.

- Cybersecurity Threats: IAG faces ongoing threats from sophisticated cyberattacks, including ransomware, phishing, and advanced persistent threats (APTs).

- Data Breach Impact: A breach could expose sensitive customer data, leading to identity theft and fraud, with recovery costs potentially exceeding $5 million per incident in 2024.

- Reputational and Regulatory Risks: Loss of customer trust and significant regulatory fines are major concerns, as demonstrated by ongoing enforcement actions against financial firms for data security lapses.

The increasing frequency and severity of natural disasters, exacerbated by climate change, present a substantial threat to IAG, leading to higher claims costs and potential profitability impacts. For instance, global insured catastrophe losses in 2022 were estimated at $125 billion, underscoring the growing financial exposure for insurers.

Regulatory changes and evolving government policies pose a significant risk, potentially increasing compliance costs and reducing financial flexibility. For example, the 2019 Australian Royal Commission highlighted increased scrutiny on financial services, which could translate into stricter capital requirements or new consumer protection laws for companies like IAG.

Economic downturns and persistent inflation directly challenge IAG by reducing customer affordability and increasing the cost of claims, as seen with elevated global inflation rates throughout 2023 and into early 2024. This necessitates swift premium adjustments to maintain profit margins.

The competitive landscape is intensifying with the rise of insurtech startups and potential entry of tech giants, leveraging digital models and advanced data analytics. The global insurtech market, valued at approximately $10.5 billion in 2024, demonstrates the disruptive potential of these agile competitors.

Cybersecurity risks remain a critical threat, with a data breach potentially costing financial services firms around $5.90 million in 2024, alongside severe reputational and regulatory consequences.

SWOT Analysis Data Sources

This IAG SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market intelligence, and expert industry commentary to ensure a thorough and actionable assessment.