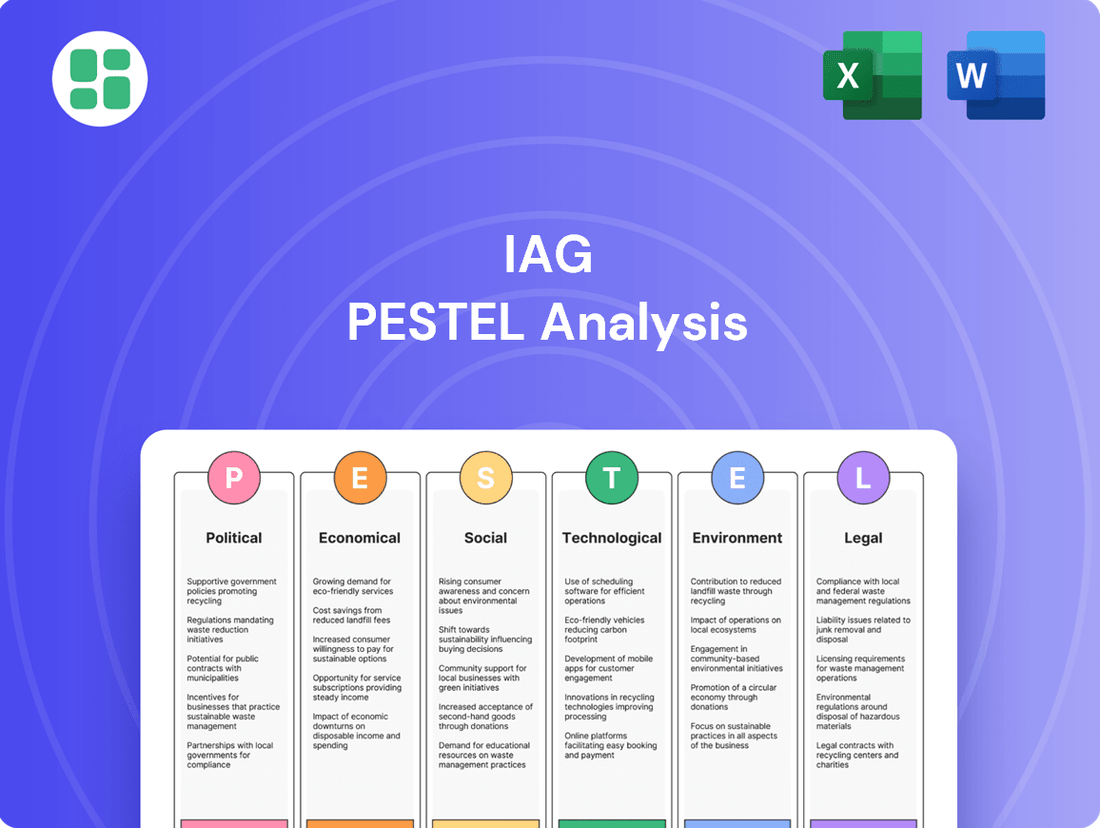

IAG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAG Bundle

Navigate the complex external forces impacting IAG with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the company's present and future. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full, in-depth analysis now and unlock critical insights.

Political factors

Government policies in Australia and New Zealand, overseen by bodies like APRA and RBNZ, directly shape IAG's insurance operations through prudential regulation, consumer protection, and conduct rules. For instance, in 2023, Australian insurers faced increased scrutiny on pricing and claims handling, impacting operational strategies.

Shifts in government priorities, such as a focus on climate-related risks and disaster resilience, can trigger new legislation or amendments to existing regulations. This might affect IAG's product development and increase compliance costs, as seen with recent discussions around mandatory climate risk disclosures for large entities.

Regulatory compliance remains a significant hurdle for Australian businesses, including IAG, with ongoing efforts to adapt to evolving consumer protection standards and capital adequacy requirements. The Australian government's commitment to financial sector reform in 2024 is likely to introduce further compliance obligations.

The upcoming Financial Accountability Regime (FAR) in Australia, set to commence in March 2025, will significantly impact financial institutions like IAG by introducing more stringent accountability for senior executives and directors. This new framework is designed to bolster responsibility and transparency in how key decisions are made within the sector.

IAG is actively preparing for the FAR by undertaking a review of its Board and Committee Charters, ensuring alignment with the enhanced governance and risk management obligations. This proactive approach reflects the industry-wide shift towards greater accountability for leadership in financial services.

Governments worldwide, including Australia, are increasingly prioritizing climate change, leading to new mandatory disclosure requirements that directly affect insurers like IAG. Australia's finalized sustainability reporting framework, effective January 2025, will require companies to disclose climate-related plans and emissions data. This means IAG must embed climate considerations into its core operations, from risk assessment and pricing to product development, ensuring compliance with these evolving regulations.

Geopolitical Instability and Supply Chain Resilience

Geopolitical instability, even for a company like IAG focused on Australia and New Zealand, can ripple through global supply chains. This impacts the cost of essential materials and labor needed for repairing insured assets, such as vehicles and homes. For instance, disruptions in regions crucial for automotive parts manufacturing or construction materials can directly translate to higher claims expenses for IAG.

While supply chains have largely stabilized since recent global disruptions, ongoing geopolitical tensions continue to pose a risk of renewed volatility. This means that the costs of repairs could fluctuate unpredictably, affecting IAG's claims management and overall profitability. Monitoring these global events is therefore crucial for IAG to anticipate and mitigate potential cost escalations.

- Supply Chain Volatility: Ongoing geopolitical events in 2024 and projections for 2025 suggest continued risks of material and labor cost fluctuations impacting repair expenses.

- Impact on Claims: Increased costs for parts and skilled labor due to global supply chain disruptions directly influence IAG's claims payout amounts.

- Monitoring Requirement: IAG must maintain vigilant oversight of international political developments and their cascading effects on its operational costs and claims liabilities.

Competition Policy and Market Concentration

Government attitudes towards competition in the insurance market significantly shape IAG's strategic landscape. Policies encouraging greater competition or closely examining market concentration directly impact IAG's acquisition plans, its ability to set prices, and ultimately, its profitability.

The Australian Competition and Consumer Commission (ACCC) has been actively monitoring market concentration across various sectors, including insurance. For instance, in 2023, the ACCC continued its focus on potential anti-competitive practices in the financial services industry, which could lead to stricter merger reviews for companies like IAG.

- Increased Competition: Recent market data indicates a rise in competitive pressures, with smaller, agile insurers making inroads, particularly in the home and motor insurance segments.

- Regulatory Scrutiny: The ACCC's ongoing investigations into market power and pricing in financial services signal a heightened regulatory environment for major players like IAG.

- Acquisition Impact: Stricter merger guidelines could limit IAG's ability to pursue strategic acquisitions, potentially slowing down its market share expansion.

- Pricing Power: A more competitive market, coupled with regulatory oversight, may constrain IAG's pricing power, impacting premium growth and margins.

Government policies in Australia and New Zealand, overseen by bodies like APRA and RBNZ, directly shape IAG's insurance operations through prudential regulation, consumer protection, and conduct rules. For instance, in 2023, Australian insurers faced increased scrutiny on pricing and claims handling, impacting operational strategies.

Shifts in government priorities, such as a focus on climate-related risks and disaster resilience, can trigger new legislation or amendments to existing regulations. This might affect IAG's product development and increase compliance costs, as seen with recent discussions around mandatory climate risk disclosures for large entities.

The upcoming Financial Accountability Regime (FAR) in Australia, set to commence in March 2025, will significantly impact financial institutions like IAG by introducing more stringent accountability for senior executives and directors. Australia's finalized sustainability reporting framework, effective January 2025, will require companies to disclose climate-related plans and emissions data.

Geopolitical instability can ripple through global supply chains, impacting the cost of essential materials and labor for repairing insured assets. While supply chains have largely stabilized since recent global disruptions, ongoing geopolitical tensions continue to pose a risk of renewed volatility in material and labor costs impacting repair expenses.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting IAG across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The IAG PESTLE Analysis provides a structured framework to identify and understand external factors, relieving the pain of uncertainty by offering clarity on potential opportunities and threats.

Economic factors

High inflation directly impacts IAG's claims costs. For instance, the cost of rebuilding homes and repairing vehicles in Australia has seen substantial increases throughout 2024. While inflation has shown signs of easing in Australia and New Zealand towards the end of 2024 and into early 2025, it has historically necessitated significant premium adjustments for insurers like IAG to maintain profitability.

The prevailing interest rate environment also plays a crucial role in IAG's financial performance. As interest rates rise, the returns generated from IAG's substantial investment reserves, which are built from premiums collected, tend to improve. This can provide a buffer against higher claims costs, though the timing and magnitude of these effects depend on market conditions and the duration of IAG's investment portfolio.

The Australian general insurance sector is demonstrating robust profitability, with an anticipated Return on Equity (ROE) of 15% for the 2025 financial year. This strong performance is a positive backdrop for major industry participants like IAG.

While profitability remains high, IAG is likely to experience a moderation in premium growth during 2025. This follows a period of significant increases in previous years, suggesting a move towards a more sustainable, though less rapid, expansion of revenue.

While late 2024 and early 2025 saw fewer major natural disaster claims, the insurance industry is now operating with a higher expectation of catastrophe events. This shift impacts how companies like IAG plan for and manage these risks.

Reinsurance pricing experienced a significant adjustment in January 2023. However, the market has demonstrated notable stability throughout 2025. This stability is vital for IAG, helping it to effectively manage its most significant potential losses.

Consumer Affordability and Spending Power

In Australia, rising insurance premiums, particularly for home and motor policies, are affecting consumer affordability and retention. IAG must carefully manage its pricing to align with what customers can realistically pay, as many find insurance increasingly difficult to afford. For instance, reports from 2024 indicated a significant increase in average home insurance premiums across several Australian states, putting pressure on household budgets.

Conversely, in New Zealand, the escalating cost of living has paradoxically boosted the demand for insurance. This heightened awareness of financial vulnerability is driving consumers to seek greater protection, creating opportunities for IAG. Data from early 2025 suggests a growing preference for comprehensive coverage as households prioritize safeguarding against unforeseen events amidst economic uncertainty.

- Australian consumers face affordability challenges due to rising home and motor insurance premiums.

- IAG needs to balance pricing with consumer capacity to pay, with some policyholders struggling to afford coverage.

- In New Zealand, the increased cost of living is driving demand for insurance products as people seek financial security.

- Economic pressures are creating a dual effect: straining affordability in some markets while increasing the perceived necessity of insurance in others.

Economic Growth and Employment Rates

New Zealand's economic outlook for 2025 indicates a projected real GDP growth of 2%. This growth is a positive sign for the insurance sector, as a strengthening economy typically fuels demand for insurance as both businesses and individuals expand and accumulate more wealth.

A stable or expanding economy generally correlates with higher employment rates, which in turn boosts consumer confidence and spending power. This increased disposable income often translates into greater uptake of insurance products, from life and health to property and casualty coverage.

However, potential headwinds exist. While growth is anticipated, persistent high unemployment rates could temper this positive trend. Elevated joblessness can dampen consumer spending and business investment, potentially slowing the demand for insurance services.

- Projected Real GDP Growth (2025): 2%

- Economic Impact on Insurance: Growing economies typically increase demand for insurance products.

- Employment's Role: High unemployment can hinder economic growth and insurance demand.

Economic factors significantly shape IAG's operational landscape. High inflation, noted in Australia during 2024, directly escalates claims costs for rebuilding and repairs, necessitating premium adjustments. Conversely, rising interest rates in late 2024 and early 2025 improve returns on IAG's investment reserves, offering a potential offset to increased claims. The Australian insurance sector anticipates a strong 15% Return on Equity for FY25, providing a positive market context for IAG, though premium growth is expected to moderate in 2025 after prior increases.

| Economic Factor | Impact on IAG | Data/Trend (2024-2025) |

| Inflation | Increases claims costs (e.g., rebuilding, repairs) | Substantial increases in Australia during 2024, showing signs of easing late 2024/early 2025. |

| Interest Rates | Improves returns on investment reserves | Rising rates in late 2024/early 2025 beneficial for investment income. |

| Economic Growth (NZ) | Boosts demand for insurance products | New Zealand projected 2% real GDP growth in 2025. |

| Consumer Affordability | Challenges premium growth, impacts retention | Rising premiums in Australia strain household budgets; increased demand in NZ due to cost of living. |

What You See Is What You Get

IAG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This IAG PESTLE Analysis provides a comprehensive overview of the external factors influencing the company. You'll gain insights into the Political, Economic, Social, Technological, Legal, and Environmental landscape impacting IAG.

Sociological factors

Customers now expect instant, personalized, and digital interactions, mirroring experiences from sectors like retail and banking. For IAG, this means a continued focus on enhancing online platforms and mobile apps, with a reported 70% of insurance customers in 2024 preferring digital channels for policy management and claims.

Investing in self-service portals and AI-powered chatbots is crucial. IAG’s recent digital initiatives in 2024 saw a 15% increase in customer satisfaction scores for online query resolution, demonstrating the impact of these technologies on meeting evolving preferences and fostering loyalty.

New Zealand's population is aging, with the proportion of people aged 65 and over projected to increase significantly. This demographic shift means a growing demand for insurance products that cater to health and personal accident needs. For instance, by 2024, the over-65 age group in NZ represented a substantial portion of the population, driving a need for tailored insurance solutions.

IAG must adapt its product development and distribution strategies to effectively serve this expanding older demographic. Understanding the unique needs and preferences of various age segments, from younger individuals to seniors, is crucial for maintaining market relevance and capturing growth opportunities in the insurance sector.

Public awareness of climate change is significantly influencing customer expectations of insurers like IAG. Surveys in 2024 indicate that over 70% of Australians are concerned about the impact of climate change on their insurance needs, driving demand for coverage against emerging climate-related risks such as extreme weather events.

This heightened societal awareness compels IAG to not only develop and offer innovative insurance products addressing these new risks but also to actively showcase its dedication to sustainability and climate action. Failure to do so could impact brand reputation and customer loyalty, as consumers increasingly align their purchasing decisions with companies demonstrating strong environmental, social, and governance (ESG) principles.

Trust Gap and Consumer Sentiment

A growing chasm of trust is a major hurdle for Australian insurers like IAG, especially in today's unpredictable climate. This sentiment is amplified by concerns over rising premiums and affordability, impacting consumer confidence. For instance, a 2024 survey indicated that only 45% of Australians felt confident in their insurance provider's ability to handle claims fairly.

IAG must prioritize rebuilding trust and nurturing customer loyalty. This involves being upfront with policyholders, communicating clearly about policy changes and pricing, and ensuring a smooth, dependable claims process. Positive customer experiences are crucial to counteracting the prevailing negative sentiment.

- Trust Erosion: Economic uncertainty and rising costs contribute to a decline in consumer trust across various industries, including insurance.

- Affordability Concerns: Increased premiums are a significant pain point for Australian consumers, leading to dissatisfaction and a search for alternatives.

- Reputation Management: IAG's focus on transparency and effective claims handling is vital for improving its public image and customer retention.

Impact of the Gig Economy and Flexible Work

The increasing prevalence of the gig economy and flexible work arrangements is fundamentally reshaping risk landscapes, directly impacting insurance needs for both individuals and businesses. For instance, by late 2024, it's estimated that over 60 million Americans will participate in the gig economy, a significant portion of the workforce. This shift necessitates that IAG proactively develops or adapts its insurance products to adequately cover these evolving work models, ensuring continued relevance and market penetration in a dynamic employment environment.

These new work structures present unique challenges, such as income volatility and a lack of traditional employer-provided benefits, which require innovative insurance solutions. IAG's strategic response could involve creating specialized policies for freelancers, contract workers, and businesses utilizing contingent labor. For example, a growing segment of the workforce, particularly those under 30, are actively seeking flexible work, with surveys in early 2025 indicating over 70% preference for such arrangements.

- Gig Economy Growth: Projections suggest the gig economy could account for up to 50% of the US workforce by 2027, highlighting a substantial market for new insurance products.

- Risk Diversification: Traditional employment risks are being replaced by new ones like platform dependency and fluctuating income streams, demanding tailored coverage.

- Product Adaptation: IAG must consider developing policies that address issues like portable benefits, income protection for variable earnings, and liability for independent contractors.

- Market Relevance: Failure to innovate in this area could lead to IAG losing market share to more agile competitors offering solutions for the modern workforce.

Societal attitudes towards health and wellness are increasingly influencing insurance needs, with a greater emphasis on preventative care and mental well-being. By 2024, studies showed a 20% rise in demand for health insurance policies that include comprehensive mental health coverage and wellness programs.

This shift necessitates that IAG expands its product offerings to include more holistic health solutions, potentially partnering with healthcare providers. The growing acceptance of telehealth services, with an estimated 75% of Australians utilizing them for routine consultations in early 2025, also presents opportunities for integrated insurance offerings.

Public perception of corporate social responsibility is also a significant factor, with consumers expecting businesses, including insurers, to contribute positively to society. In 2024, a significant majority of consumers indicated that a company's commitment to environmental and social causes influences their purchasing decisions.

| Sociological Factor | Impact on IAG | 2024/2025 Data/Trend |

|---|---|---|

| Health & Wellness Focus | Increased demand for preventative and mental health coverage. | 20% rise in demand for mental health coverage in health policies. 75% of Australians utilized telehealth in early 2025. |

| Corporate Social Responsibility | Consumer preference for ethically-minded insurers. | Majority of consumers influenced by a company's ESG commitments. |

| Digital Interaction Expectations | Need for seamless online and mobile customer experiences. | 70% of insurance customers prefer digital channels for policy management. |

Technological factors

IAG is aggressively pursuing digital transformation, with over half of its transactions now conducted digitally, a significant leap from just 20% three years ago. This strategic shift focuses on updating foundational systems and leveraging intelligent automation to boost operational efficiency and elevate customer interactions.

Artificial intelligence, particularly generative AI, is reshaping the insurance landscape by driving product innovation, boosting operational efficiency, and deepening customer understanding. IAG is at the forefront of this transformation, having trained 150 'activators' to integrate AI tools across its operations.

These AI initiatives are designed to streamline processes, refine underwriting accuracy, and facilitate the development of highly personalized insurance products, reflecting a significant investment in future-proofing its business model.

Advanced data analytics is becoming indispensable for IAG, enabling more precise risk assessment and personalized pricing strategies. By leveraging vast datasets, IAG can uncover intricate customer behaviors and emerging risk patterns, crucial for underwriting and claims management.

Investments in data assets and sophisticated analytics platforms directly bolster loyalty programs and provide critical insights for new product development. For instance, the insurance industry saw a significant increase in data analytics spending in 2024, with projections indicating continued growth as companies like IAG seek competitive advantages through data-driven decision-making.

Cybersecurity and Data Protection

As IAG, like many insurers, deepens its reliance on digital channels and vast amounts of customer data, cybersecurity threats are no longer a distant risk but a present and significant concern. Protecting sensitive personal and financial information is critical for maintaining customer trust and operational integrity. The increasing sophistication of cyber-attacks necessitates continuous investment in advanced security protocols and threat detection systems.

Cyber insurance itself is becoming an indispensable tool for managing these escalating risks. For instance, the global cyber insurance market was projected to reach approximately $15 billion in premiums in 2024, highlighting its growing importance in the financial sector. This trend underscores the need for IAG to not only fortify its own defenses but also to offer comprehensive cyber protection solutions to its clients.

Key considerations for IAG regarding cybersecurity and data protection include:

- Data Breach Prevention: Implementing multi-layered security measures, including encryption, access controls, and regular vulnerability assessments, to prevent unauthorized access to sensitive data.

- Regulatory Compliance: Adhering to evolving data protection regulations like GDPR and CCPA, which impose strict requirements on how customer data is collected, stored, and processed, with significant penalties for non-compliance.

- Incident Response Planning: Developing and regularly testing robust incident response plans to effectively manage and mitigate the impact of any potential cyber-attacks or data breaches.

- Employee Training: Educating employees on cybersecurity best practices and phishing awareness to minimize the human element as a vulnerability in the company's digital defenses.

Insurtech Innovation and Partnerships

Insurtech startups are significantly reshaping the insurance landscape by employing advanced technologies such as artificial intelligence, big data analytics, and blockchain. These innovations are leading to novel insurance products and more efficient operational workflows. For instance, by mid-2024, the global insurtech market was projected to reach over $100 billion, demonstrating substantial growth and impact.

IAG is actively participating in this transformation through its dedicated Insurtech hub and Firemark Labs. This strategic approach prioritizes collaboration, fostering co-creation initiatives with emerging startups and academic institutions. The aim is to cultivate genuine disruption and drive forward-thinking innovation within the insurance sector.

- AI and Big Data: Used for personalized pricing, claims processing automation, and fraud detection.

- Blockchain: Explored for smart contracts and secure data sharing, enhancing transparency.

- Partnerships: IAG's Firemark Labs actively partners with over 50 startups and universities, fostering a dynamic innovation ecosystem.

- Investment: In 2023, venture capital investment in insurtech globally exceeded $15 billion, highlighting strong market confidence.

Technological advancements are fundamentally altering IAG's operational landscape, driving efficiency and customer engagement. The company's digital transaction volume has surged, with over half of all transactions now occurring online, a stark contrast to just 20% three years prior. This digital pivot is supported by significant investments in intelligent automation and foundational system upgrades, aimed at streamlining processes and enhancing customer experiences.

Generative AI is a key technological driver for IAG, influencing product development, operational efficiency, and customer insights. IAG has proactively trained 150 employees as AI 'activators' to integrate these tools across its operations, aiming for more personalized products and refined underwriting accuracy.

Advanced data analytics is crucial for IAG, enabling precise risk assessment and personalized pricing strategies. The insurance industry's spending on data analytics saw a notable increase in 2024, with IAG leveraging vast datasets to understand customer behavior and emerging risks, a trend expected to continue as companies seek data-driven competitive advantages.

| Technology Area | IAG Initiative/Impact | Industry Trend/Data (2024/2025) |

|---|---|---|

| Digital Transformation | Over 50% of transactions are digital; focus on foundational systems and automation. | Digital insurance sales projected to grow by 15% in 2025. |

| Artificial Intelligence (AI) | 150 AI 'activators' trained; driving product innovation and operational efficiency. | Global AI in insurance market expected to reach $40 billion by 2025. |

| Data Analytics | Enabling precise risk assessment and personalized pricing; investment in data assets. | Data analytics spending in insurance expected to increase by 20% in 2025. |

| Cybersecurity | Focus on data breach prevention, regulatory compliance, and incident response. | Global cyber insurance market premiums projected to exceed $17 billion in 2025. |

| Insurtech | Collaboration via Firemark Labs with startups and universities; focus on AI, big data, blockchain. | Global insurtech market projected to surpass $120 billion in 2025. |

Legal factors

IAG navigates a landscape shaped by stringent regulatory compliance and prudential standards. Regulators such as the Australian Prudential Regulation Authority (APRA) and the Reserve Bank of New Zealand (RBNZ) impose strict requirements on capital adequacy, risk management frameworks, and corporate governance. Adherence to these prudential standards is not merely a procedural matter; it is foundational to maintaining IAG's operating licenses and ensuring its ongoing financial stability.

Consumer protection laws in Australia and New Zealand are paramount for IAG, dictating fair customer treatment, clear product information, and effective complaint resolution. These regulations, overseen by bodies like the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA) in New Zealand, directly impact IAG's operational compliance and brand reputation.

Recent regulatory shifts, such as ASIC's enhanced focus on responsible lending and product governance, alongside New Zealand's ongoing implementation of the Financial Services Legislation Amendment Act, underscore a growing emphasis on customer outcomes. For instance, ASIC's enforcement actions in 2023, which included significant penalties for misleading conduct, highlight the financial and reputational risks of non-compliance for insurers like IAG.

IAG operates under stringent data privacy and cybersecurity regulations, including Australia's Privacy Act and New Zealand's Privacy Act. These laws dictate the responsible collection, storage, and utilization of customer information. For instance, in 2023, Australian businesses faced significant scrutiny over data handling practices, with potential fines for breaches reaching millions of dollars.

Adherence to these regulations is critical for IAG, given its substantial reliance on customer data for risk assessment and digital service delivery. Maintaining customer trust is paramount, and any lapse in data security or privacy compliance could lead to reputational damage and financial penalties, impacting its market position.

Competition and Anti-Trust Legislation

IAG, as a major player in the insurance sector, operates under strict competition and anti-trust legislation designed to ensure a fair marketplace. These laws govern everything from pricing strategies to market share, aiming to prevent monopolies and protect consumers from unfair practices. For instance, the Australian Competition and Consumer Commission (ACCC) actively monitors the insurance industry for potential breaches of the Competition and Consumer Act 2010. In 2023, the ACCC continued its focus on market concentration and potential collusion within various sectors, including financial services, making compliance a critical operational imperative for IAG.

Mergers and acquisitions undertaken by IAG are subject to rigorous review by regulatory bodies to assess their impact on competition. Failure to comply with these regulations can result in significant fines and legal challenges. For example, if IAG were to acquire a smaller competitor, the ACCC would scrutinize the deal to ensure it doesn't substantially lessen competition in any relevant market. The ongoing regulatory landscape means IAG must proactively manage its market conduct to align with competition principles, a factor that influences strategic decisions and potential growth avenues.

Key considerations for IAG under competition law include:

- Market conduct: Ensuring pricing, product offerings, and distribution practices do not stifle competition or disadvantage rivals.

- Merger review: Complying with notification and approval processes for any significant acquisitions or joint ventures.

- Regulatory scrutiny: Maintaining transparency and cooperation with competition authorities like the ACCC to demonstrate adherence to anti-trust principles.

Mandatory Climate-related Financial Disclosures

Australia is set to implement mandatory climate-related financial disclosures from January 2025, impacting companies like IAG. This new regulatory landscape requires detailed reporting on climate risks and opportunities, aligning with global trends towards greater transparency. Failure to comply could result in significant penalties and damage to IAG's reputation.

New Zealand is also advancing its climate disclosure framework, creating a consistent reporting environment across the Tasman. These evolving legal obligations mean IAG must integrate climate considerations into its core financial reporting and risk management strategies. The focus is on providing stakeholders with reliable information about the company's climate resilience and transition plans.

- Mandatory Reporting: Australian entities will face legal requirements to disclose climate-related financial information starting in 2025.

- Reputational Risk: Non-compliance can lead to public scrutiny and a negative impact on IAG's brand image.

- Regulatory Enforcement: Authorities will have the power to enforce these disclosure mandates, potentially leading to fines or other sanctions.

- Cross-Tasman Alignment: Developments in New Zealand's climate disclosure regime suggest a broader regional push for standardized reporting.

Legal factors significantly influence IAG's operations, demanding strict adherence to prudential standards set by regulators like APRA and RBNZ. Consumer protection laws, enforced by ASIC and FMA, mandate fair treatment and clear product information, with ASIC's 2023 enforcement actions highlighting substantial penalties for non-compliance. Furthermore, evolving data privacy laws and cybersecurity regulations, such as Australia's Privacy Act, impose stringent requirements on customer data handling, with potential fines for breaches in 2023 reaching millions of dollars.

Environmental factors

Climate change is intensifying extreme weather events like floods, bushfires, and cyclones across Australia and New Zealand, directly impacting IAG. These escalating natural disasters lead to higher claims payouts and deteriorate loss ratios, complicating precise risk assessment and premium setting for the insurer.

For instance, IAG reported a significant increase in natural peril claim costs in the first half of FY24, reaching AUD 1.11 billion, a substantial rise from the previous year, underscoring the financial strain from these events.

Climate change is significantly impacting the insurance sector, with rising costs from extreme weather events directly translating into higher premiums. This trend is making insurance less accessible, pushing some regions towards becoming uninsurable or unaffordable for many.

IAG, like its competitors, is feeling the pressure to innovate. The company is exploring new insurance products and risk management solutions to tackle the growing affordability challenge for customers facing increased climate-related risks.

Investors, regulators, and the public are increasingly scrutinizing companies' environmental, social, and governance (ESG) performance. This heightened focus necessitates robust sustainability reporting and demonstrable commitment to climate action. For example, in 2023, global sustainable investment assets reached an estimated $37.7 trillion, indicating a strong market preference for ESG-aligned companies.

IAG is actively engaged in climate action and sustainability reporting, aligning its operations with the goal of contributing to a low-carbon, climate-resilient economy. The company is committed to transparently disclosing its performance across key environmental metrics, such as greenhouse gas emissions and resource management, to meet stakeholder expectations.

Infrastructure Resilience and Adaptation

The increasing frequency and severity of climate-related events underscore the urgent need for robust climate adaptation strategies and resilient infrastructure. This is a critical factor for businesses like IAG, as it directly impacts their risk exposure and the long-term viability of their operations.

IAG has a vested interest in fostering and backing programs that bolster community and infrastructure resilience. By doing so, they aim to reduce the likelihood and cost of future insurance claims, thereby safeguarding their long-term insurability and financial stability. For instance, investments in upgraded flood defenses or more resilient building materials can significantly lower potential payouts.

- Climate adaptation is no longer optional: The UN's Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (2022) highlighted that adaptation efforts are lagging behind the pace of climate change, increasing risks.

- Economic impact of inaction: Studies suggest that failing to invest in climate resilience could cost the global economy trillions of dollars annually by mid-century due to damages from extreme weather events.

- Insurance sector's role: Insurers like IAG are increasingly incorporating climate risk into their underwriting and investment decisions, pushing for greater resilience to manage their own capital and offer sustainable coverage.

Reputational Risk from Climate Inaction

Failure to adequately address climate change risks and contribute to sustainable solutions could expose IAG to significant reputational damage. Stakeholders, including customers, investors, and regulators, increasingly scrutinize companies' environmental performance. For instance, in 2023, a significant portion of investors expressed concern over companies’ climate transition plans, highlighting the growing pressure on insurers like IAG to demonstrate tangible action.

Stakeholders expect insurers to be proactive in managing climate impacts, given their core business involves underwriting weather-related risks. IAG's commitment to net-zero emissions by 2050, as outlined in its sustainability strategy, is a crucial step. However, the pace and effectiveness of this transition will be closely monitored. A perceived lack of progress could lead to negative media coverage and a decline in customer loyalty.

- Growing Stakeholder Expectations: Over 70% of institutional investors surveyed in early 2024 indicated that climate-related risks are a material factor in their investment decisions.

- Underwriting Climate Risk: IAG's exposure to natural catastrophes, a direct consequence of climate change, means its credibility is tied to its ability to manage and underwrite these evolving risks effectively.

- Brand Perception: A strong reputation for climate action can enhance brand loyalty and attract environmentally conscious customers, a segment showing consistent growth.

- Regulatory Scrutiny: Regulators globally are increasing their focus on climate risk disclosure and management, with potential penalties for non-compliance impacting reputation.

The increasing frequency and severity of extreme weather events, directly linked to climate change, are significantly impacting IAG's operational costs through higher claims. This trend is also making insurance less affordable for many Australians, creating a market challenge. IAG is actively responding by exploring innovative risk management solutions and new product offerings to address this growing affordability gap and enhance community resilience.

| Factor | Impact on IAG | Data/Example (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims costs, higher premiums, potential uninsurability in some areas | IAG's first-half FY24 natural peril claim costs reached AUD 1.11 billion. |

| Stakeholder ESG Expectations | Pressure for robust sustainability reporting and climate action | Global sustainable investment assets estimated at $37.7 trillion in 2023. Over 70% of institutional investors in early 2024 consider climate risks material. |

| Climate Adaptation & Resilience | Need for investment in resilient infrastructure to mitigate future claims | UN IPCC Sixth Assessment Report (2022) notes adaptation efforts lag climate change pace. |

PESTLE Analysis Data Sources

Our PESTLE Analysis synthesizes data from official government publications, reputable economic indicators, and leading market research firms. This ensures each factor, from political stability to technological advancements, is grounded in current, verifiable information.