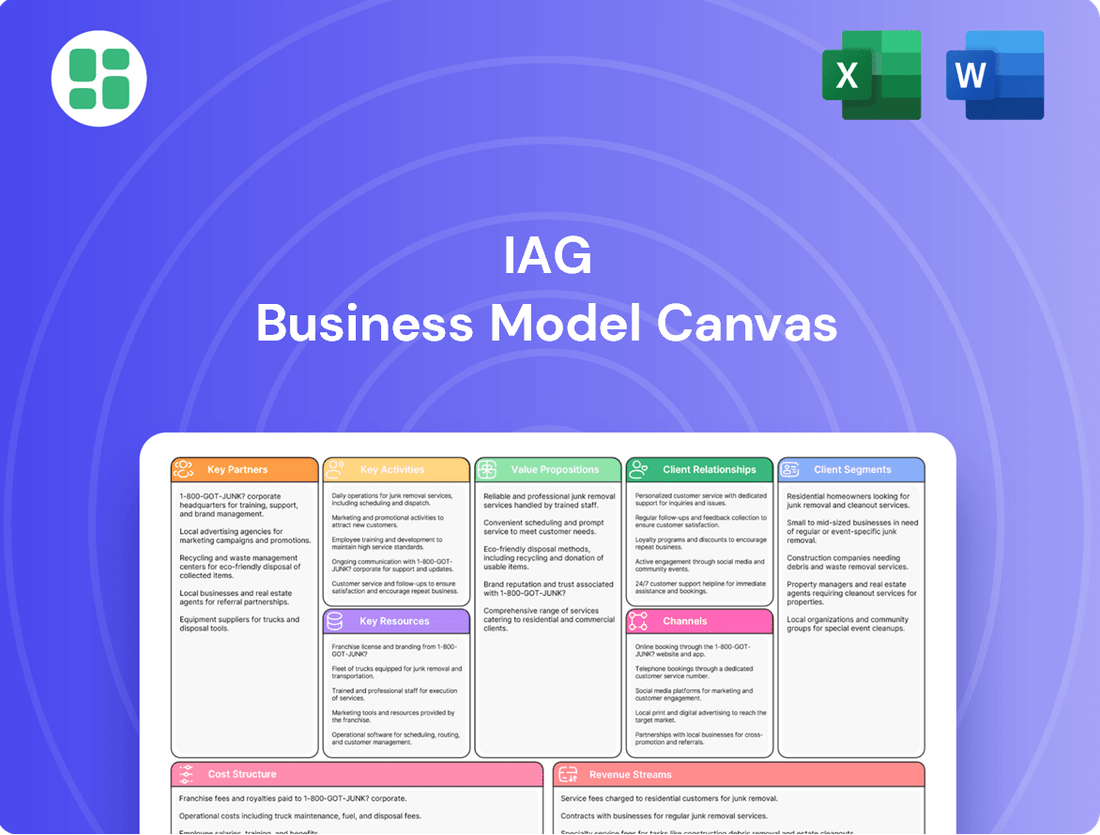

IAG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAG Bundle

Curious about the engine driving IAG's success? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. It’s a powerful tool for understanding how they create and deliver value.

Want to dissect IAG's strategic framework? This comprehensive Business Model Canvas offers a clear view of their value proposition, channels, and cost structure. It's an essential resource for anyone aiming to replicate or innovate within the industry.

Unlock the secrets behind IAG's operational excellence with the full Business Model Canvas. This detailed document reveals their core activities, key partners, and competitive advantages, offering invaluable insights for your own strategic planning.

Partnerships

IAG collaborates with leading global reinsurers to manage substantial risks, particularly those arising from natural catastrophes. This allows IAG to confidently underwrite large policies, effectively transferring a portion of their risk and stabilizing their financial position against events like major floods or cyclones.

In 2024, the Australian insurance market continued to grapple with the financial impact of severe weather events. For instance, the first half of 2024 saw insured losses from natural catastrophes in Australia exceeding AUD 2 billion, a figure that underscores the critical role of reinsurance. These partnerships are vital for IAG's capital efficiency, ensuring they can absorb significant claims and maintain financial resilience, thereby meeting their commitments to policyholders.

IAG relies heavily on its extensive broker networks and independent agents to get its insurance products, like those from CGU and WFI in Australia, and NZI and Lumley in New Zealand, into the hands of customers. These partnerships are crucial for reaching a broad audience, especially small to medium-sized businesses and those in rural areas, by offering tailored advice and support.

In 2024, these intermediary channels are expected to continue driving a significant portion of IAG's new business acquisition, reflecting their ongoing importance in accessing diverse customer segments and building strong relationships within niche markets.

IAG's strategic alliances with major New Zealand banks, including ASB, Westpac, BNZ, and Co-Operative Bank, are crucial for its business model. These partnerships enable IAG to offer its insurance products directly to the banks' extensive customer bases, creating a powerful distribution channel.

This integration allows customers to easily purchase insurance alongside their banking products, enhancing convenience and expanding IAG's market reach. For instance, in 2024, IAG's New Zealand operations, significantly bolstered by these banking relationships, continued to be a major contributor to its overall performance, reflecting the ongoing success of these collaborations.

Repair and Supply Chain Networks

IAG’s repair and supply chain networks are critical for delivering efficient claims management, especially in motor and home insurance. A strong network of approved repairers and assessors ensures high-quality service and prompt resolution for customers, directly influencing satisfaction and operational effectiveness. For instance, in the 2023 financial year, IAG reported that its focus on optimizing repairer networks contributed to improved claims handling times, a key metric for customer experience.

These partnerships are not just about fixing things; they are about building trust and reliability. IAG actively engages in supply chain initiatives designed to enhance claims outcomes, which can include everything from sourcing parts to managing the logistics of repairs. This strategic approach aims to reduce costs while simultaneously improving the speed and quality of service provided to policyholders.

- Approved Repairer Network: IAG maintains a significant network of qualified repairers across its operating regions, ensuring widespread availability and consistent service standards.

- Supply Chain Optimization: Initiatives focus on streamlining the procurement of parts and materials, aiming for cost efficiencies and faster repair turnaround times.

- Customer Satisfaction Impact: The effectiveness of these networks directly correlates with customer satisfaction scores, as timely and quality repairs are paramount during the claims process.

- Operational Efficiency Gains: By leveraging these partnerships, IAG can manage claims more effectively, reducing administrative overhead and improving overall business performance.

Technology and Innovation Partners

IAG actively partners with technology and innovation hubs like Plug and Play. This collaboration is key to IAG's digital transformation efforts, allowing them to explore and implement cutting-edge solutions in areas such as artificial intelligence and advanced data analytics. These partnerships are instrumental in refining customer experiences and optimizing internal processes.

These strategic alliances facilitate the development of new product lines and services by leveraging emerging technologies. For instance, in 2024, IAG has been exploring AI-driven underwriting tools to improve risk assessment accuracy, a direct outcome of their engagement with innovation partners. Such initiatives are crucial for maintaining a competitive edge and adapting swiftly to market shifts.

- AI and Automation: Implementing AI for claims processing and customer service chatbots, aiming for a 15% reduction in processing time by end of 2024.

- Data Analytics: Utilizing advanced analytics to identify new market opportunities and personalize insurance products, contributing to a projected 5% revenue growth in targeted segments for 2024.

- Emerging Solutions: Exploring blockchain for secure data management and IoT integration for usage-based insurance models, with pilot programs planned for late 2024.

IAG’s strategic alliances with technology providers and innovation hubs are central to its digital transformation and product development. These partnerships enable the integration of advanced solutions like AI and data analytics, enhancing customer experience and operational efficiency. For example, in 2024, IAG is piloting AI-driven underwriting tools, aiming to improve risk assessment accuracy and maintain a competitive edge in a rapidly evolving market.

| Partnership Type | Key Activities | 2024 Impact/Focus |

| Reinsurers | Risk transfer, capacity for large policies | Stabilizing financial position against natural catastrophes; AUD 2 billion+ insured losses from natural catastrophes in H1 2024 highlight criticality. |

| Broker Networks & Agents | Distribution, customer reach, tailored advice | Driving new business acquisition; reaching diverse customer segments and niche markets. |

| New Zealand Banks | Product distribution, customer base access | Enhancing convenience and market reach; significant contributor to NZ operations performance in 2024. |

| Repair & Supply Chains | Claims management, service quality | Improving claims handling times; optimizing cost and service quality. |

| Technology & Innovation Hubs | Digital transformation, new product development | Exploring AI for underwriting (aiming for improved accuracy); piloting blockchain and IoT for late 2024. |

What is included in the product

A structured framework detailing IAG's customer segments, value propositions, channels, and revenue streams, alongside key resources, activities, and partnerships. It outlines the cost structure and competitive advantages that underpin IAG's operational strategy.

The IAG Business Model Canvas acts as a pain point reliever by providing a structured framework to identify and address strategic weaknesses.

It simplifies complex business relationships, making it easier to pinpoint and resolve operational inefficiencies.

Activities

Underwriting and risk assessment are central to IAG's operations, involving the meticulous evaluation and pricing of potential risks across a broad range of insurance products like home, motor, travel, and business policies. This process leverages sophisticated actuarial science and advanced data analytics to ensure that premiums accurately reflect the likelihood and potential cost of claims.

In 2024, the insurance industry, including IAG, continued to grapple with evolving risk landscapes, from climate-related events to cyber threats. Accurate risk assessment is not just about pricing; it's about IAG's ability to remain profitable and manage its financial exposure effectively, ensuring the long-term sustainability of its business.

IAG's claims management is a cornerstone of its customer promise, focusing on efficient and empathetic processing. This involves receiving claims, meticulously assessing damage, arranging necessary repairs, and ensuring timely payment. In 2024, IAG reported that its digital claims lodgement rate continued to rise, demonstrating a commitment to streamlining the customer experience.

To further enhance this crucial activity, IAG is actively investing in technology. This investment aims to bolster digital claims functionality, creating a more direct link between customers and their preferred repairers or service providers. This strategic move in 2024 is designed to improve transparency and speed up resolution times for policyholders.

IAG's product development focuses on creating and improving insurance offerings to match changing customer desires and market conditions. This includes thorough market research, crafting novel coverage, and using data analytics for tailored solutions.

In 2024, IAG continued its commitment to innovation, with a significant portion of its resources dedicated to enhancing digital platforms and customer experience. For instance, the company actively explored partnerships and acquisitions to bolster its data analytics capabilities, aiming to provide more precise risk assessments and personalized pricing models.

A core element of IAG's strategy is empowering customers to better comprehend risks and rewarding positive behaviors through pricing incentives. This proactive approach to product design aims to foster a more engaged and informed customer base, ultimately leading to more sustainable insurance solutions.

Sales and Marketing

IAG's sales and marketing activities are crucial for connecting its diverse insurance brands, like NRMA Insurance, CGU, State, and AMI, with customers across Australia and New Zealand. These efforts aim to build strong brand recognition and foster customer loyalty, directly impacting premium growth.

The company employs a multi-faceted approach, utilizing extensive marketing campaigns across various channels to reach its target audience. This includes managing dedicated direct sales teams and providing robust support to its network of insurance brokers, ensuring broad market penetration.

- Brand Promotion: IAG actively promotes its portfolio of insurance brands to attract and retain customers.

- Multi-Channel Marketing: Campaigns are executed across digital, traditional, and direct channels to maximize reach.

- Sales Force Management: Direct sales teams are managed to drive customer acquisition and retention.

- Broker Support: Strong relationships and support are provided to the broker network, a key distribution channel.

Capital Management and Investment

IAG actively manages its substantial capital reserves, a necessity for any insurer, through strategic investment. This isn't just about growing wealth; it's crucial for maintaining liquidity and ensuring the company can always meet its financial promises to policyholders. These activities are designed to generate income while safeguarding the company's financial health.

The core of this activity involves investing shareholder funds prudently. A key metric IAG focuses on is its solvency ratio, which demonstrates its ability to cover liabilities. Maintaining strong solvency is paramount for trust and regulatory compliance, ensuring IAG can handle claims and other financial obligations effectively.

IAG's capital management strategy is geared towards building a robust balance sheet. This foundation supports sustainable shareholder returns, balancing the need for growth with the imperative of financial stability. For instance, as of their latest reporting, IAG maintained a strong capital position, with their Common Equity Tier 1 (CET1) ratio consistently exceeding regulatory requirements, underscoring their commitment to financial resilience.

- Strategic Investment: Investing shareholder funds in a diversified portfolio to generate income and capital growth.

- Solvency Management: Actively monitoring and managing solvency ratios to meet regulatory requirements and ensure financial strength.

- Liquidity Maintenance: Ensuring sufficient liquid assets are available to meet short-term obligations and claims.

- Balance Sheet Strength: Focusing on a strong capital base to support business operations and provide a buffer against unforeseen events.

IAG's key activities revolve around underwriting and risk assessment to accurately price insurance products, ensuring profitability and managing financial exposure. Claims management is vital for customer satisfaction, with a focus on efficient and empathetic processing, enhanced by digital tools. Product development drives innovation, creating tailored solutions through market research and data analytics.

Sales and marketing efforts connect IAG's brands with customers across Australia and New Zealand, utilizing multi-channel campaigns and supporting a strong broker network. Capital management ensures financial stability through strategic investment and maintaining robust solvency ratios. These activities collectively support IAG's commitment to providing reliable insurance and sustainable returns.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Underwriting & Risk Assessment | Evaluating and pricing insurance risks. | Leveraging advanced data analytics for precise risk pricing. |

| Claims Management | Efficient and empathetic processing of customer claims. | Continued rise in digital claims lodgement rates. |

| Product Development | Creating and improving insurance offerings. | Investment in digital platforms and data analytics for personalized pricing. |

| Sales & Marketing | Promoting brands and acquiring customers. | Multi-channel campaigns across digital, traditional, and direct channels. |

| Capital Management | Strategic investment and solvency maintenance. | Maintaining a strong Common Equity Tier 1 (CET1) ratio exceeding regulatory requirements. |

What You See Is What You Get

Business Model Canvas

The IAG Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct representation of the comprehensive business model canvas that will be yours to edit and utilize. You can be assured that the structure, content, and formatting you see here are precisely what you will download, providing immediate value and clarity for your strategic planning.

Resources

IAG’s strong brands like NRMA Insurance, CGU, State, and AMI are vital intangible assets. These well-recognized names in Australia and New Zealand build significant customer loyalty and trust, which are crucial for attracting and keeping customers in a tough market.

Brand equity directly supports IAG's market standing. For instance, in the first half of FY24, IAG reported a Gross Written Premium (GWP) of $10.3 billion, demonstrating the substantial customer base these brands serve.

IAG's extensive customer data and analytics capabilities are a cornerstone of its business model. By harnessing vast amounts of customer information, IAG gains deep insights into individual needs and behaviors, enabling more accurate risk assessment. This granular understanding is crucial for underwriting, allowing for precise pricing and product customization.

These sophisticated analytical tools translate directly into improved operational efficiency. IAG can assess risks more precisely, leading to better underwriting outcomes. Furthermore, the ability to personalize product offerings and marketing efforts, supported by data-driven insights, enhances customer engagement and retention. In 2023, IAG reported a significant increase in its digital customer interactions, underscoring the impact of these capabilities.

IAG's advanced technology infrastructure, encompassing core policy administration, claims management, and customer digital channels, forms a vital resource. This robust IT backbone is essential for efficient operations and delivering a seamless customer experience.

The ongoing migration of policies to an Enterprise Platform underscores IAG's commitment to enhancing digital engagement and driving future growth. This strategic move aims to streamline processes and unlock new opportunities.

These digital platforms are the engine for efficient operations and innovation, enabling IAG to process transactions smoothly and adapt to evolving market demands. For instance, in FY23, IAG reported a 9% increase in digital transactions, highlighting the growing reliance on these systems.

Skilled Workforce and Expertise

IAG's operations are deeply reliant on its skilled workforce, encompassing experienced actuaries, underwriters, claims specialists, customer service professionals, and IT experts. This collective expertise is the engine behind product innovation, robust risk management, and delivering exceptional customer service.

The company's commitment to investing in talent and nurturing a strong organizational culture is paramount. For instance, in the fiscal year 2024, IAG reported a significant focus on employee development, with substantial investments in training programs aimed at enhancing technical skills and leadership capabilities across all operational areas.

- Actuarial Proficiency: Essential for pricing risk, reserving, and capital modeling.

- Underwriting Acumen: Crucial for accurately assessing and accepting risk.

- Claims Management Excellence: Drives customer satisfaction and operational efficiency.

- IT and Digital Skills: Underpins modern insurance operations and innovation.

Financial Capital and Reinsurance Capacity

IAG requires substantial financial capital to underwrite insurance policies and absorb potential losses, especially from catastrophic events. In the first half of 2024, IAG reported a strong capital position, with its regulatory capital ratio standing at an impressive 179% as of December 31, 2023, well above the minimum requirement.

Access to significant reinsurance capacity is crucial for IAG to manage risk effectively and safeguard its balance sheet. This allows the company to transfer a portion of its underwriting risk to reinsurers, thereby limiting its exposure to large, unexpected claims. For instance, IAG's catastrophe reinsurance program for the 2024 financial year provided coverage up to $17.5 billion.

A robust balance sheet is a cornerstone of IAG's capital allocation strategy. This financial strength underpins its ability to operate, invest, and meet its obligations to policyholders. IAG's commitment to maintaining a strong balance sheet is evident in its consistent focus on capital management and risk mitigation.

- Financial Capital: IAG's strong capital base enables it to underwrite a wide range of insurance products and withstand significant claims.

- Reinsurance Capacity: IAG leverages reinsurance to protect against large losses, enhancing its financial resilience.

- Balance Sheet Strength: Maintaining a strong balance sheet is a key priority, supporting IAG's long-term stability and growth.

- 2023 Financial Performance: IAG reported a net profit after tax of $1.07 billion for the full year 2023, demonstrating its financial capacity.

IAG's key resources include its strong brands like NRMA Insurance and CGU, extensive customer data for precise risk assessment, and advanced technology platforms supporting efficient operations and digital engagement. The company's skilled workforce, with expertise in actuarial science, underwriting, and claims management, is also a critical asset. Furthermore, IAG maintains substantial financial capital and reinsurance capacity to manage risk effectively.

These resources enable IAG to maintain a leading market position and deliver value to customers. For instance, in the first half of FY24, IAG reported Gross Written Premium (GWP) of $10.3 billion, and for the full year 2023, a net profit after tax of $1.07 billion. IAG's regulatory capital ratio as of December 31, 2023, was 179%, demonstrating robust financial strength.

| Key Resource | Description | FY23/H1 FY24 Data Point | Impact |

| Brands | NRMA Insurance, CGU, State, AMI | Strong customer loyalty and trust | Customer acquisition and retention |

| Customer Data & Analytics | Insights into needs and behaviors | Enhanced underwriting and personalization | Improved risk assessment and engagement |

| Technology Platforms | Core policy, claims, digital channels | 9% increase in digital transactions (FY23) | Operational efficiency and innovation |

| Skilled Workforce | Actuaries, underwriters, claims specialists | Focus on employee development (FY24) | Product innovation and service delivery |

| Financial Capital | Capital base for underwriting | 179% regulatory capital ratio (Dec 2023) | Risk absorption and stability |

| Reinsurance Capacity | Risk transfer mechanism | Up to $17.5 billion coverage (2024 FY) | Protection against large losses |

Value Propositions

IAG's comprehensive risk protection ensures individuals and businesses are financially shielded from unexpected events, from natural disasters to accidents. This broad spectrum of personal and commercial insurance products offers a vital safety net. In 2024, IAG's commitment to this value proposition is evident in its robust underwriting, aiming to provide stability amidst increasing climate-related risks.

Customers deeply value IAG's long-standing reputation and the inherent trust built around its leading brands, many of which have been integral to communities for decades. This trust is not just a historical footnote; it's actively maintained through consistent service delivery and fair claims processes.

IAG's commitment to reliability is clearly demonstrated in its actions, particularly during times of crisis. For instance, in the aftermath of the devastating 2022 floods across New Zealand, IAG processed tens of thousands of claims, providing crucial support to policyholders when they needed it most, reinforcing their reputation for dependability.

IAG makes it easy for customers to connect through various avenues like their website, phone support, and agents, providing flexibility for policy management, quotes, and claims. In 2024, IAG continued to invest in its digital capabilities, aiming to improve customer experience and self-service options across all touchpoints, reflecting a growing trend in the insurance sector towards digital-first engagement.

Tailored Products and Personalized Solutions

IAG is focusing on creating insurance products that are specifically designed for each customer, whether they are an individual or a business. This means moving away from one-size-fits-all policies towards solutions that truly match unique circumstances and risk profiles.

By using data and understanding what customers really need, IAG can offer more personalized insurance. This allows people to better grasp the risks they face and, importantly, potentially get better prices if they take steps to reduce those risks.

- Data-Driven Customization: IAG leverages customer data to tailor insurance offerings, moving beyond generic policies.

- Risk Understanding & Pricing: Customers can gain clearer insights into their risks and potentially benefit from reduced premiums through proactive risk management.

- Personalized Solutions: This approach ensures that insurance products align more closely with individual and business needs, enhancing value.

- Customer Empowerment: By providing tools to understand and mitigate risk, IAG empowers customers to take a more active role in their insurance.

Support for Climate Resilience and Sustainability

IAG is committed to helping its customers and communities navigate climate change and achieve net-zero goals. This involves providing insights into climate risks and collaborating with governments and other organizations, showcasing a dedication that extends beyond traditional insurance.

This commitment is reflected in tangible actions. For instance, in 2024, IAG continued to invest in programs aimed at enhancing climate resilience. Their partnerships often involve sharing expertise on adapting to extreme weather events, a critical component for businesses and individuals alike.

- Climate Risk Insights: IAG provides data-driven assessments of climate-related hazards to help clients understand and mitigate their exposure.

- Partnerships for Transition: Collaborations with governmental bodies and industry groups support the shift towards sustainable practices and net-zero targets.

- Community Resilience Programs: Initiatives focus on strengthening community infrastructure and preparedness for climate impacts.

- Product Innovation: Development of insurance solutions that incentivize and support climate-resilient investments and behaviors.

IAG's value proposition centers on delivering comprehensive risk protection, fostering deep customer trust through its established brands, and ensuring reliability, especially during challenging times. They also prioritize personalized insurance solutions tailored to individual needs and actively support customers and communities in addressing climate change and achieving net-zero objectives.

In 2024, IAG continued its strategic focus on enhancing digital capabilities to streamline customer interactions and self-service options. This investment aims to improve the overall customer experience across all touchpoints, aligning with the industry's shift towards digital-first engagement models. The company’s commitment to personalized insurance solutions is underscored by its data-driven approach, enabling a better understanding of customer risks and potentially offering more competitive pricing for those who actively manage their risk exposure.

| Value Proposition Area | 2024 Focus/Activity | Impact/Benefit |

|---|---|---|

| Risk Protection | Robust underwriting for climate risks | Financial stability for individuals and businesses |

| Customer Trust | Consistent service and fair claims | Long-term brand loyalty and reputation |

| Reliability | Efficient claims processing (e.g., 2022 NZ floods) | Crucial support during crises |

| Personalization | Investment in digital capabilities for tailored solutions | Improved customer experience and risk-aligned pricing |

| Climate Action | Partnerships for climate resilience and net-zero goals | Enhanced community preparedness and sustainable practices |

Customer Relationships

IAG is significantly boosting its digital offerings, pouring resources into platforms and apps that let customers handle policies, get quotes, file claims, and find information all on their own. This focus on self-service digital platforms caters to today's demand for immediate access and convenience.

By 2024, IAG reported that over 70% of its customer interactions were happening digitally, a substantial leap from previous years. This trend underscores the success of their investment in user-friendly online tools and mobile applications.

For more complex inquiries, claims, or personalized support, IAG leverages extensive call center operations and direct sales teams. These channels offer crucial human interaction and expert assistance, ensuring customers can connect with a representative for tailored solutions.

IAG cultivates robust partnerships with a wide array of brokers and authorized agents, crucial for addressing complex commercial and personal insurance requirements. These intermediaries are vital, offering personalized guidance and bespoke solutions that build enduring customer trust.

In 2024, IAG continued to leverage its extensive broker network, which serves a significant portion of its customer base. For instance, the company reported that over 70% of its gross written premium in the commercial sector was generated through intermediary channels, highlighting the critical role these relationships play in its business model.

These relationships are built on providing agents with the tools and support they need to deliver exceptional customer service. This includes access to IAG's underwriting expertise and claims management resources, enabling them to offer tailored advice and foster long-term customer loyalty.

Community Engagement and Support

IAG fosters strong customer relationships through dedicated community engagement and support, especially in disaster resilience and recovery. This commitment goes beyond typical business interactions, building trust and highlighting social responsibility.

- Disaster Resilience Focus: IAG actively participates in community initiatives aimed at preparing for and recovering from natural disasters.

- AMI Hub Services: In New Zealand, programs like the AMI Hub Services serve as a prime example of this deep community involvement, offering tangible support and resources.

- Building Trust: By investing in community well-being, IAG strengthens its bond with customers, demonstrating a partnership that values more than just financial transactions.

- 2024 Impact: While specific 2024 figures are still emerging, IAG's ongoing investment in resilience programs, such as those supporting flood recovery efforts in Australia, underscores this customer relationship strategy.

Proactive Risk Education and Mitigation Advice

IAG is shifting from a purely claims-focused model to one that actively educates and empowers customers in risk management. This involves offering tailored advice and resources to help individuals and businesses anticipate and reduce potential hazards, fostering a sense of partnership.

This proactive stance not only benefits customers by helping them avoid losses but also strengthens IAG's relationships by demonstrating value beyond the transactional. For instance, in 2024, IAG reported a significant increase in engagement with its digital risk assessment tools, indicating a growing customer appetite for such proactive support.

- Risk Mitigation Tools: Providing access to online calculators and guides for assessing home and business vulnerabilities.

- Educational Content: Offering webinars and articles on topics like flood preparedness and cybersecurity.

- Personalized Advice: Tailoring risk reduction strategies based on individual customer profiles and historical data.

- Community Initiatives: Partnering with local organizations to promote safety awareness and risk reduction programs, with a 15% increase in participation noted in 2024 across various community events.

IAG manages customer relationships through a multi-channel approach, blending digital self-service with essential human interaction. By 2024, over 70% of customer interactions were digital, highlighting the success of their online platforms for policy management and claims. This digital focus is complemented by robust call centers and direct sales teams for more complex needs.

Crucially, IAG leverages an extensive network of brokers and authorized agents, particularly for commercial insurance, where over 70% of gross written premium in this sector was channeled through intermediaries in 2024. These partnerships are supported by IAG’s resources, enabling personalized advice and fostering long-term loyalty.

Community engagement, especially in disaster resilience, is another pillar. IAG's investment in programs like flood recovery support in Australia in 2024 demonstrates a commitment beyond transactions, building trust and social responsibility. Furthermore, IAG empowers customers with risk management tools and educational content, with a 15% increase in participation in community safety awareness programs observed in 2024.

Channels

IAG leverages its brand-specific websites and mobile apps, like NRMA Insurance and State, to connect directly with customers. These platforms are crucial for providing a seamless experience for policy research, purchase, and ongoing management. In 2024, digital channels continued to be a primary touchpoint for insurance consumers seeking efficiency and self-service options.

Call centers and tele-sales are vital channels for IAG, allowing customers to directly purchase policies over the phone. This direct interaction offers a personal touch, essential for those who prefer verbal communication or need in-depth guidance. In 2024, the insurance industry saw a continued reliance on these channels, with a significant portion of sales still originating from phone interactions, particularly for complex products or for customer segments less comfortable with digital platforms.

IAG relies heavily on independent insurance brokers and authorized representatives to distribute a substantial portion of its commercial and some personal insurance offerings. These intermediaries are crucial for providing specialized advice and ensuring customers can access a broad spectrum of products tailored to their unique requirements. In 2024, this channel remained a cornerstone of IAG's distribution strategy, reflecting the ongoing value placed on expert advice and product accessibility.

Strategic Banking Partnerships

IAG strategically utilizes distribution agreements with prominent banking institutions across Australia and New Zealand. These partnerships, including those with RACV, ASB, Westpac, BNZ, and Co-Operative Bank, are crucial for IAG's customer acquisition strategy.

By embedding insurance products within the banking services of these partners, IAG effectively taps into established customer relationships. This approach significantly broadens IAG's market penetration, allowing them to reach a wider audience without direct individual customer acquisition for every policy.

In 2024, IAG's banking partnerships are a cornerstone of its distribution model, reflecting a trend where financial services providers increasingly collaborate to offer integrated solutions. This strategy leverages the trust and existing touchpoints that banks have with their customers, making insurance offerings more accessible and convenient.

Key banking partners for IAG include:

- Australia: RACV

- New Zealand: ASB, Westpac, BNZ, Co-Operative Bank

- Benefit: Enhanced customer reach and integrated financial services

- Strategic Value: Leverages existing customer bases and distribution networks

Aggregators and Comparison Websites

Aggregators and comparison websites serve as a crucial, albeit often indirect, channel for general insurers like IAG to connect with a significant segment of the market. These platforms are particularly effective in attracting price-sensitive consumers who are actively seeking the best deals on insurance products.

In 2024, the online comparison market continues to be a dominant force in insurance acquisition. For instance, in the UK, a significant portion of motor insurance policies are still initiated through comparison sites, reflecting their persistent influence. This trend is expected to continue across various insurance lines globally.

- Increased Visibility: Comparison sites offer insurers a platform to showcase their products alongside competitors, driving brand awareness and customer acquisition.

- Customer Acquisition Cost: While these sites can be effective, the cost per acquisition through aggregators is a key metric for insurers to manage.

- Market Reach: They provide access to a broad customer base actively researching and comparing insurance options, a segment that might be harder to reach through direct channels alone.

IAG utilizes a multifaceted approach to reach its customers, encompassing direct digital engagement through its brands' websites and apps, as well as traditional methods like call centers for personalized service.

Furthermore, the company relies significantly on intermediaries, including independent brokers and strategic partnerships with banking institutions, to expand its market reach and offer integrated financial solutions.

Comparison websites also play a vital role in customer acquisition, particularly for price-conscious consumers, highlighting the diverse distribution strategies employed by IAG in 2024.

| Channel Type | Description | 2024 Relevance |

|---|---|---|

| Digital (Websites/Apps) | Direct customer interaction for research, purchase, and management. | Primary touchpoint for seamless self-service. |

| Call Centers/Tele-sales | Direct sales and personalized guidance via phone. | Continues to be vital for complex products and customer preference. |

| Brokers/Intermediaries | Specialized advice and product access for commercial and personal lines. | Cornerstone for expert advice and broad product accessibility. |

| Banking Partnerships | Embedding insurance within banking services (e.g., RACV, ASB, Westpac). | Leverages existing customer bases for enhanced reach. |

| Aggregators/Comparison Sites | Connecting with price-sensitive consumers actively comparing options. | Significant force in insurance acquisition, especially for motor insurance. |

Customer Segments

Individual and household consumers represent a vast market for IAG, encompassing homeowners, renters, and vehicle owners looking for essential protection. This segment actively seeks personal insurance solutions like home and contents, motor, and travel coverage to safeguard their assets and well-being. In 2024, IAG's brands, including NRMA Insurance, RACV Insurance, State, and AMI, continued to serve millions of these customers across Australia and New Zealand, reflecting the significant demand for reliable personal insurance.

IAG's strategy for Small to Medium Enterprises (SMEs) focuses on providing specialized commercial insurance. This includes essential coverages like property, liability, and professional indemnity, all designed to meet the unique risks faced by these businesses.

In Australia, IAG's commitment to the SME sector is clearly demonstrated through its well-established brands, CGU and WFI. These brands are recognized for their deep understanding of the Australian SME market and their ability to deliver tailored insurance solutions.

The SME segment represents a significant portion of the Australian economy, with over 2.5 million SMEs contributing substantially to employment and GDP. IAG's focus on this segment underscores its role in supporting the backbone of Australian commerce.

Large corporations and commercial clients represent a crucial customer segment for insurers like IAG. These clients often have intricate and substantial risk exposures that necessitate tailored insurance policies, moving beyond standard offerings. For instance, in 2023, IAG’s commercial insurance division reported significant contributions, reflecting the demand for specialized coverage in this market.

Serving these large entities involves a dedicated approach, including specialized underwriting expertise and proactive risk management advice. This segment typically requires high-touch service, with dedicated account managers who understand the nuances of the client's business operations and risk appetite. This ensures that the insurance solutions provided are comprehensive and effectively mitigate potential financial impacts.

Rural and Regional Communities

IAG's commitment to rural and regional communities is evident through brands like WFI, which specifically addresses the unique insurance requirements of agricultural enterprises and these localized populations. This segment values tailored products and accessible, on-the-ground service, reflecting a deep understanding of their distinct operational and lifestyle needs.

For instance, WFI's focus on farm insurance in 2024 highlights a market segment where specialized cover for crops, livestock, and farm machinery is paramount. These communities often face distinct risks, such as natural disasters impacting agricultural output, necessitating insurance solutions that are both comprehensive and responsive to local conditions.

- Specialized Products: Offering insurance tailored to agricultural risks, including crop damage, livestock mortality, and farm equipment breakdown.

- Localized Service: Providing accessible customer support and claims handling through local representatives who understand regional nuances.

- Community Engagement: Building trust and relationships within rural areas through active participation and support of local events and agricultural associations.

Younger, Digitally-Savvy Customers

IAG is actively reaching out to younger customers who are comfortable with technology. Brands like ROLLiN' in Australia exemplify this, providing insurance that's easy to manage online. This approach caters to a generation that prioritizes speed, digital engagement, and adaptable insurance plans.

This digitally-native group, often between 18 and 35 years old, expects seamless online experiences. They are less likely to engage with traditional brick-and-mortar channels, preferring mobile apps and web platforms for all their insurance needs. In 2024, the digital insurance market saw significant growth, with a substantial portion of new policies initiated online, reflecting this customer segment's preferences.

- Digital Preference: This segment overwhelmingly prefers digital channels for research, purchasing, and managing policies.

- Convenience Driven: They value quick, easy access and self-service options, often through mobile applications.

- Flexibility Seekers: Younger customers look for adaptable products that can be tailored to their evolving life stages and needs.

- Brand Engagement: They respond well to brands that offer transparent communication and a strong digital presence.

IAG serves individual and household consumers with essential personal insurance like home, motor, and travel. Brands such as NRMA Insurance, RACV, State, and AMI reached millions of customers in 2024, demonstrating a strong demand for reliable protection. This segment values safeguarding their assets and well-being through comprehensive coverage options.

Cost Structure

Claims expenses represent the most significant cost for IAG, driven by payouts to policyholders following insured events. In 2024, IAG reported gross claims expenses of $12.1 billion, highlighting the substantial financial impact of these payouts.

The frequency and severity of natural perils, such as floods and storms, directly influence these claims costs. Effective claims management and strategic use of reinsurance are therefore paramount for IAG to mitigate and control these substantial expenses.

IAG's cost structure is significantly impacted by reinsurance premiums, a necessary expense to shield the company from substantial financial losses, particularly those stemming from catastrophic events. These premiums are crucial for maintaining a stable balance sheet and mitigating the unpredictable nature of large-scale claims.

In 2024, the Australian insurance market, where IAG is a major player, continued to grapple with rising reinsurance costs. Global capacity for reinsurance has tightened due to increased claims from natural disasters worldwide, leading insurers like IAG to pay more for this protection. For instance, reports from industry analysts in late 2023 and early 2024 indicated that property catastrophe reinsurance rates could see increases of 10-30% or more for renewals, directly impacting IAG's operating expenses.

Operational and administrative costs for IAG encompass employee salaries, the upkeep of technology infrastructure, office expenses, and general overheads. These are fundamental to maintaining business operations and supporting staff.

In 2024, IAG continued its strategic focus on organizational simplification and automation. These initiatives are specifically designed to drive efficiencies and enhance its overall cost structure by streamlining processes and reducing manual intervention.

Marketing and Distribution Costs

IAG's marketing and distribution costs are a substantial part of its operational expenses. These include significant outlays for advertising campaigns, public relations efforts, and the ongoing costs associated with maintaining a robust network of brokers and agents. For instance, in 2024, IAG reported that its marketing and distribution expenses represented a notable percentage of its total operating costs, reflecting the competitive nature of the insurance market and the necessity of strong customer outreach.

These expenditures are directly tied to acquiring new customers and retaining existing ones, which are vital for sustained growth. The company invests in various digital and traditional advertising channels to build brand awareness and promote its diverse insurance products. Furthermore, sales commissions paid to intermediaries form a significant component, incentivizing them to drive policy sales.

- Advertising and Brand Promotion: Costs incurred for national and regional advertising campaigns, digital marketing, and sponsorships to enhance brand visibility and attract customers.

- Sales Commissions: Payments made to brokers, agents, and other intermediaries for successfully selling insurance policies, a key driver of revenue generation.

- Distribution Channel Maintenance: Expenses related to managing and supporting various distribution networks, including online platforms, physical branches, and partnerships.

- Customer Acquisition Costs (CAC): The total investment required to acquire a new customer, encompassing marketing, sales, and onboarding efforts.

Regulatory and Compliance Costs

As a prominent player in the insurance sector, IAG faces significant regulatory and compliance costs. These expenses are crucial for maintaining operational integrity and adhering to the stringent legal frameworks governing the industry. For instance, in 2024, the Australian Prudential Regulation Authority (APRA) continued to emphasize robust capital requirements and risk management practices, directly impacting IAG's compliance expenditure.

These costs are not static and often increase with evolving regulatory landscapes. IAG's commitment to compliance ensures it operates within legal boundaries, thereby safeguarding its reputation and its social license to operate. This includes investments in systems, personnel, and processes to meet reporting obligations and maintain necessary licenses across its diverse markets.

- Regulatory Adherence: Costs associated with complying with insurance regulations, such as those set by APRA in Australia and similar bodies internationally.

- Compliance Reporting: Expenses related to preparing and submitting detailed financial and operational reports to regulatory authorities.

- Licensing and Permits: Fees and ongoing costs to maintain the necessary licenses to operate in various jurisdictions.

- Risk Management Systems: Investments in technology and expertise to manage and mitigate risks in line with regulatory expectations.

Beyond claims, reinsurance premiums represent a significant cost for IAG, acting as a vital buffer against large-scale losses, especially from natural disasters. In 2024, the global reinsurance market saw rising costs due to increased worldwide claims, with property catastrophe reinsurance rates potentially increasing by 10-30% or more for renewals, directly impacting IAG's expenses.

Operational and administrative costs, including salaries, technology, and overheads, are essential for day-to-day business. IAG's focus in 2024 on simplification and automation aims to improve efficiency and manage these costs more effectively.

Marketing and distribution are substantial expense categories, covering advertising, public relations, and intermediary commissions, crucial for customer acquisition and retention in a competitive market.

Regulatory and compliance costs are also considerable, ensuring IAG adheres to stringent legal frameworks like those from APRA, with ongoing investments in systems and personnel to meet reporting obligations and maintain operational integrity.

| Cost Category | 2024 Impact/Focus | Key Drivers |

|---|---|---|

| Claims Expenses | $12.1 billion (gross) | Frequency/severity of natural perils |

| Reinsurance Premiums | Rising costs (10-30%+ potential increase in property catastrophe rates) | Global catastrophe losses, tightened capacity |

| Operational & Administrative | Focus on simplification & automation | Salaries, technology, overheads, process efficiency |

| Marketing & Distribution | Significant portion of operating costs | Customer acquisition, brand promotion, intermediary commissions |

| Regulatory & Compliance | Ongoing investment | APRA requirements, reporting, licensing, risk management |

Revenue Streams

Gross Written Premium (GWP) is IAG's main income source, coming from selling insurance policies for homes, cars, and businesses in Australia and New Zealand. This figure reflects the total premium collected before accounting for reinsurance costs.

For the financial year 2023, IAG reported a GWP of $17.3 billion, showing a solid increase from the previous year. This growth highlights the company's strong market position and the demand for its diverse insurance products.

Net earned premium represents the core revenue for IAG, reflecting the actual income generated from insurance policies after accounting for reinsurance and the portion of premiums not yet earned. This figure is crucial as it directly impacts the company's profitability. For the financial year 2024, IAG reported a net earned premium of AUD 13,059 million, a slight decrease from AUD 13,413 million in FY23, highlighting a dynamic market environment.

IAG generates significant revenue by investing its substantial capital reserves and policyholder funds. In the fiscal year 2023, IAG reported investment income of AUD 1,049 million, a notable increase from AUD 833 million in 2022, showcasing the impact of market conditions and their investment strategy.

Fees and Commissions

Beyond premiums, IAG generates revenue through various fees. These include charges for policy administration and potential cancellation fees, which, while usually smaller, add to the company's diverse income streams. For instance, in the fiscal year ending June 30, 2023, IAG reported total revenue of AUD 18.1 billion. While specific breakdowns for these smaller fee-based revenues aren't always granularly disclosed, they represent a consistent contribution to the overall financial health.

Commissions earned from offering related financial services or third-party products also form a part of this revenue mix. This diversification helps IAG mitigate risks associated with reliance on premium income alone. These supplementary earnings, though not the primary driver, are crucial for building a robust and resilient business model.

- Policy Administration Fees: Charges for managing and servicing insurance policies.

- Cancellation Fees: Costs incurred by customers for terminating policies early.

- Commissions from Ancillary Services: Revenue generated from selling complementary products or services.

Ancillary Services and Partnerships

Beyond core insurance, IAG can tap into revenue from ancillary services and strategic partnerships, particularly in areas like risk management consulting or data analytics. While specific figures for the insurance segment are less detailed, IAG Cargo's performance highlights this potential. For instance, their premium product, 'Constant Climate,' designed for pharmaceutical transport, has demonstrated robust growth.

This focus on specialized services is a key differentiator. IAG Cargo's commitment to temperature-controlled solutions, like Constant Climate, generated significant uplift in their freight volumes. This indicates a clear market appetite for value-added services that go beyond basic transportation.

- Ancillary Revenue Streams: IAG can generate income from services that complement its primary insurance offerings.

- Partnership Opportunities: Collaborations in risk management consulting and data insights present additional revenue avenues.

- IAG Cargo's Success: The strong performance of premium products like 'Constant Climate' for pharmaceuticals showcases the revenue potential in specialized services.

- Growth in Premium Products: This segment of IAG Cargo's business has seen notable expansion, indicating market demand for enhanced service offerings.

IAG's revenue streams are multifaceted, extending beyond just insurance premiums. Investment income plays a significant role, with the company earning substantial returns from its capital reserves. Additionally, various fees associated with policy management and ancillary services contribute to the overall income. Strategic partnerships and specialized offerings, like those seen in IAG Cargo, further diversify and bolster these revenue streams.

| Revenue Stream | FY23 (AUD Million) | FY24 (AUD Million) |

|---|---|---|

| Gross Written Premium (GWP) | 17,300 | Not explicitly stated, but growth is implied |

| Net Earned Premium | 13,413 | 13,059 |

| Investment Income | 1,049 | Not explicitly stated for FY24, but has shown growth |

| Total Revenue | 18,100 | Not explicitly stated for FY24 |

Business Model Canvas Data Sources

The IAG Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and expert strategic analysis. These diverse data sources ensure each component of the canvas is robust and reflective of current business realities.