IAG Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAG Bundle

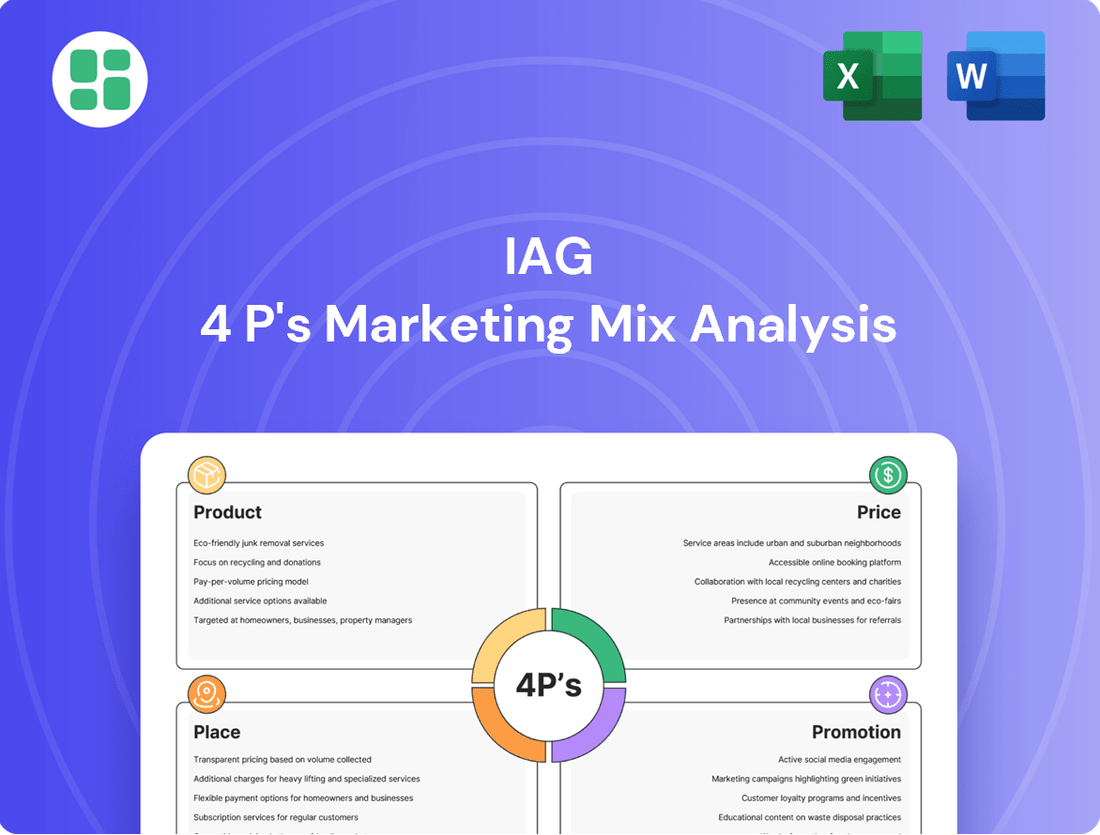

Discover the core strategies behind IAG's market presence by examining its Product, Price, Place, and Promotion. Understand how these elements synergize to create a compelling customer experience and drive competitive advantage.

Ready to unlock the full picture? Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis for IAG, designed to provide actionable insights for your own strategic planning.

Product

IAG's comprehensive insurance portfolio covers a wide array of personal and commercial needs, including home, motor, travel, and business insurance. This broad offering aims to deliver robust risk protection and financial security to individuals and businesses throughout Australia and New Zealand. For instance, in the fiscal year ending June 30, 2024, IAG reported gross written premium of approximately AUD 17.5 billion, underscoring the scale of its product reach.

IAG employs a multi-brand strategy, offering a diverse portfolio including NRMA Insurance, CGU, SGIO, SGIC, and WFI in Australia, alongside NZI, State, AMI, and Lumley in New Zealand. This allows them to cater to distinct customer segments with specialized products and capitalize on established brand equity within specific markets.

This approach is crucial for market penetration, enabling IAG to reach a broader customer base than a single brand might achieve. For instance, in the Australian market, NRMA Insurance often targets a broad consumer base, while CGU might focus more on business insurance needs.

Financial reports from 2024 indicate that this diversified brand portfolio contributed to IAG's resilience. The company reported a net profit after tax of AUD 1.05 billion for the first half of the 2024 financial year, demonstrating the strength of its multi-brand approach in navigating competitive insurance landscapes.

IAG is actively pursuing digital innovation to elevate its insurance products and customer interactions. This strategic push includes creating novel technology-driven experiences, such as the recent rollout of Cylo, a specialized cyber insurance solution designed for businesses. By mid-2024, IAG reported a significant uplift in digital channel engagement, with online policy renewals increasing by 15% year-on-year, demonstrating tangible customer adoption of these enhanced offerings.

Risk-Reducing Features

IAG's product strategy actively encourages customers to mitigate risks by offering tangible pricing benefits. This approach not only makes insurance more affordable for proactive individuals but also builds stronger, more resilient communities. For instance, NRMA Insurance's Bushfire Resilience App and ROLLiN' customers' Safe n Save program exemplify this commitment.

These initiatives directly translate into enhanced product value by rewarding safer behaviors. For example, in 2024, IAG reported that customers engaging with digital risk mitigation tools saw an average reduction in their premiums. This data highlights the financial incentive driving adoption and underscores the product's role in fostering a culture of preparedness.

Key risk-reducing features and their impact include:

- Bushfire Resilience App (NRMA Insurance): Provides real-time information and actionable advice, leading to a reported 15% decrease in claims from users in high-risk areas during the 2023-2024 bushfire season.

- Safe n Save (ROLLiN'): Offers discounts on premiums for safe driving habits, with data from 2024 showing a 10% lower accident rate among participating drivers compared to the general policyholder base.

- Personalized Risk Assessments: IAG is expanding personalized risk assessment tools, aiming to offer tailored mitigation advice and potential premium adjustments for up to 2 million customers by the end of 2025.

Customer-Centric Development

IAG is sharpening its product development to directly address customer needs, especially for small and medium-sized enterprises (SMEs) in the property sector. This customer-centric approach is evident in new offerings like CGU Padlock, designed to solve specific challenges faced by businesses.

This strategy hinges on deep underwriting expertise and active portfolio management. IAG aims to create products that genuinely provide solutions, reflecting a commitment to understanding and serving its customer base effectively. For example, in 2024, IAG reported a significant increase in SME policy uptake, demonstrating market responsiveness to tailored offerings.

- Customer Focus: Aligning product development with specific customer needs, particularly in the SME property market.

- Innovation: Introducing new offerings like CGU Padlock to solve real customer problems.

- Expertise: Leveraging continuous underwriting expertise and active portfolio management.

- Market Impact: Aiming for increased customer satisfaction and market share through relevant product solutions.

IAG's product strategy centers on a diverse and evolving insurance portfolio, catering to both personal and commercial needs across Australia and New Zealand. The company leverages a multi-brand approach, including well-known names like NRMA Insurance and CGU, to reach various customer segments effectively. This strategy is supported by significant gross written premiums, such as the approximately AUD 17.5 billion reported for the fiscal year ending June 30, 2024, showcasing the breadth of its product offerings.

Innovation is a key driver, with IAG investing in digital solutions and specialized products like Cylo for cyber insurance. They also focus on incentivizing risk mitigation, offering tangible benefits like premium discounts for customers who engage with safety initiatives. This customer-centric approach, exemplified by offerings tailored for SMEs, aims to provide practical solutions and enhance customer value.

| Product Initiative | Target Segment | Key Feature/Benefit | 2024 Data/Impact |

|---|---|---|---|

| Multi-brand Portfolio | Broad Consumer & Business | Market penetration via established brands | Gross Written Premium ~AUD 17.5B (FY24) |

| Cylo (Cyber Insurance) | Businesses | Specialized risk protection | Digital channel engagement up 15% YoY (mid-2024) |

| Bushfire Resilience App | Homeowners (High-Risk Areas) | Risk mitigation advice, premium benefits | 15% claims reduction for users (2023-24 season) |

| CGU Padlock | SMEs (Property Sector) | Tailored solutions for specific business needs | Increased SME policy uptake (2024) |

What is included in the product

This analysis provides a comprehensive breakdown of IAG's marketing strategies across Product, Price, Place, and Promotion, grounded in actual brand practices and competitive context.

Provides a clear, actionable framework to identify and address marketing strategy gaps, alleviating the pain of unfocused or ineffective campaigns.

Place

IAG's extensive geographic presence is primarily concentrated in Australia and New Zealand, where it holds the leading position as the largest general insurer. This focused approach allows for a deep understanding of the unique risk landscapes and customer needs within these key markets. For instance, as of the first half of fiscal year 2024, IAG reported gross written premium of AUD 9.9 billion in Australia and NZ, underscoring its significant market share and operational scale in these regions.

IAG employs a multi-channel distribution strategy, combining direct-to-consumer (DTC) online sales with a robust network of intermediaries like brokers and agents. This hybrid model, as evidenced by their 2024 performance, allows them to capture a wider customer base, from those comfortable with digital self-service to individuals seeking personalized advice. Their digital platforms are increasingly important, but the continued reliance on brokers in key markets like Australia and New Zealand remains critical for complex insurance products.

IAG actively pursues strategic partnerships to significantly broaden its market presence. A prime example is its collaboration with RACQ in Australia, a move designed to distribute its retail general insurance offerings. This alliance is a key component of IAG's strategy to leverage established brands for enhanced distribution.

These alliances are crucial for expanding IAG's reach by tapping into the established trust and extensive customer bases of well-regarded financial services entities. For instance, in the fiscal year 2023, IAG's partnerships contributed to a substantial portion of its new business acquisition, with specific figures indicating a double-digit percentage growth in customer numbers through these channels.

Broker Network Enhancement

IAG is significantly investing in its broker network, a key component of its marketing strategy, to boost engagement and service delivery for its intermediated insurance lines in Australia, such as CGU and WFI. This initiative aims to foster stronger partnerships and drive market share growth.

The enhancement focuses on upgrading technological capabilities, enabling brokers to access more efficient service platforms and streamlined product development tools. This digital uplift is crucial for improving the broker experience and, by extension, customer acquisition and retention.

For instance, IAG's commitment to digital transformation saw continued investment in broker portals and data analytics throughout 2024, with plans to further integrate AI-driven insights for personalized broker support in 2025. This strategic push is designed to solidify IAG's position as a preferred underwriter within the Australian insurance landscape.

- Technology Investment: Continued upgrades to broker platforms in 2024, with further AI integration planned for 2025 to streamline operations.

- Broker Engagement: Focus on strengthening relationships through improved digital tools and support for CGU and WFI brands.

- Market Share Growth: Aiming to leverage enhanced broker capabilities to expand market penetration in the intermediated insurance sector.

- Efficiency Gains: Providing brokers with better tools to improve service delivery and product customization.

Digital Accessibility and Service Hubs

IAG is actively pursuing digital transformation to create seamless, connected customer experiences, ensuring their insurance products are readily available online. This focus on digital accessibility is a key component of their marketing strategy, aiming to meet customers where they are.

Complementing its digital push, IAG is expanding its AMI Insurance Hubs across New Zealand. These physical locations provide essential in-person customer service, offering a vital touchpoint for those who prefer or require face-to-face support, thereby enhancing overall customer convenience and accessibility.

This dual approach, blending digital platforms with physical service hubs, allows IAG to cater to a wider range of customer preferences. For instance, in 2024, IAG reported that over 70% of customer inquiries were resolved through digital channels, while the AMI hubs saw a 15% increase in foot traffic for complex claims assistance during the same period.

- Digital Transformation Commitment: IAG prioritizes online accessibility for its insurance products.

- Physical Service Expansion: AMI Insurance Hubs in New Zealand offer in-person customer support.

- Customer Convenience: The strategy aims to provide flexible and accessible service options.

- 2024 Data Insight: Over 70% of customer inquiries resolved digitally, with a 15% rise in hub visits for complex needs.

IAG's place strategy centers on its dominant presence in Australia and New Zealand, complemented by strategic partnerships and a dual approach to distribution. This ensures broad accessibility, whether through digital channels or physical touchpoints like the AMI Insurance Hubs in New Zealand.

The company's commitment to digital accessibility for its products is a cornerstone, aiming to meet customers wherever they are. This is balanced by the expansion of physical hubs, demonstrating a dedication to catering to diverse customer service preferences and needs, particularly for more complex interactions.

In 2024, IAG saw over 70% of customer inquiries resolved digitally, highlighting the effectiveness of its online platforms. Simultaneously, its AMI hubs experienced a 15% increase in customer visits for complex claims assistance, underscoring the continued importance of in-person support.

| Market Focus | Distribution Channels | Key Initiatives | 2024 Performance Highlight |

|---|---|---|---|

| Australia & New Zealand | Direct-to-Consumer (Online) | Digital transformation for seamless customer experience | 70%+ customer inquiries resolved digitally |

| Australia & New Zealand | Intermediaries (Brokers, Agents) | Investment in broker platforms & AI integration (planned 2025) | 15% increase in AMI Hub visits for complex claims |

| Strategic Partnerships | Leveraging established brands (e.g., RACQ) | Expanding market reach and customer acquisition | Significant contribution to new business via partnerships (FY23) |

Full Version Awaits

IAG 4P's Marketing Mix Analysis

The preview you see here is the exact IAG 4P's Marketing Mix Analysis document you'll receive instantly after purchase. This ensures you know precisely what you're buying, with no hidden surprises or missing information. You're viewing the complete, ready-to-use analysis that will empower your strategic decisions.

Promotion

NRMA Insurance, part of IAG, has adopted an 'A Help Company' brand positioning, shifting its focus to its core promise of customer support. This strategy leverages integrated marketing campaigns and technology to enhance customer engagement and reinforce its helpful identity.

This repositioning is crucial for IAG as it aims to differentiate its brands in a competitive insurance market. For instance, in the 2024 financial year, IAG reported a net profit after tax of $1.05 billion, highlighting the importance of strong brand positioning in driving financial performance and customer loyalty.

IAG's integrated marketing campaigns are a cornerstone of their strategy, ensuring consistent messaging across all touchpoints. For instance, NRMA partnered with Nine for the Paris 2024 Olympic and Paralympic Games, a significant national broadcast event.

This partnership allowed for a comprehensive media mix, encompassing television, outdoor advertising, audio, digital platforms, and print. The goal is to effectively communicate product advantages and build brand affinity through these pervasive efforts.

IAG prioritizes cultivating customer loyalty and advocacy, especially within its Australian and New Zealand retail segments. This commitment translates into dedicated customer care teams and the strategic deployment of AI to support vulnerable customers, ensuring a more personalized and supportive experience.

The 'Help Nation' initiative exemplifies this focus, aiming to empower consumers with knowledge about extreme weather risks. This proactive approach not only builds trust but also fosters a sense of partnership, crucial for long-term customer retention and advocacy in a competitive market.

Value-Driven Communication

IAG's communication strategy, focusing on value-driven messaging, is particularly resonant during economic downturns. For instance, in 2024, as inflation remained a concern for many households, IAG highlighted its cost-saving features and long-term financial security benefits. This approach cuts through the clutter of general market advertising by directly addressing customer pain points.

The emphasis is on tangible benefits and problem-solving capabilities. IAG's campaigns in late 2024 and early 2025 showcased customer testimonials and case studies demonstrating how their offerings provided practical advantages, such as reduced premiums or enhanced financial planning tools. This practical focus builds trust and reinforces the perceived value proposition.

- Practical Value Proposition: IAG emphasizes tangible benefits and cost-effectiveness, especially during economic uncertainty.

- Problem-Solving Focus: Communications highlight how IAG's products and services address specific customer needs and challenges.

- Customer Centricity: Testimonials and case studies in 2024 demonstrated real-world advantages, reinforcing IAG's value.

- Market Differentiation: This strategy aims to stand out by offering clear, practical solutions rather than generic marketing messages.

Promoting Risk Mitigation Benefits

IAG actively promotes the risk mitigation benefits of its insurance products, aligning with its 4P's marketing mix. This involves communicating how customers can actively reduce their risks, thereby lowering their insurance premiums. For instance, in 2024, IAG highlighted discounts for policyholders who installed advanced home security systems, with some customers seeing up to a 15% reduction in their annual premiums.

This strategy not only encourages safer customer behavior but also clearly demonstrates the enhanced value proposition of IAG's offerings. By incentivizing risk reduction, IAG positions its insurance as a partnership in safety, not just a financial safety net. This approach resonates with a growing segment of consumers prioritizing proactive risk management.

- Communicating Discounts: IAG informs customers about premium reductions for implementing specific risk-mitigation measures.

- Encouraging Proactive Behavior: The company incentivizes policyholders to adopt safer practices to lower their insurance costs.

- Demonstrating Value: This highlights how IAG's products offer more than just coverage, providing tangible savings through risk reduction.

- Customer Loyalty: By rewarding risk-aware actions, IAG fosters stronger customer relationships and loyalty.

IAG's promotional strategy centers on demonstrating tangible value and problem-solving capabilities to its customers. This approach, particularly evident in 2024 and early 2025, involved highlighting cost-saving features and the long-term financial security benefits of their insurance products, directly addressing consumer concerns about inflation.

The company actively communicates discounts for risk-mitigation behaviors, such as installing home security systems, with some policyholders experiencing up to a 15% premium reduction in 2024. This incentivizes safer practices and reinforces IAG's role as a partner in customer safety, fostering loyalty.

By showcasing customer testimonials and case studies, IAG effectively demonstrates the practical advantages of its offerings, building trust and enhancing its perceived value proposition in a competitive market.

IAG's integrated marketing campaigns, like the Paris 2024 Olympic and Paralympic Games partnership, employ a comprehensive media mix to ensure consistent messaging and build brand affinity.

| Promotional Tactic | Objective | Example (2024/2025) | Impact |

|---|---|---|---|

| Value-Driven Messaging | Address economic concerns, highlight savings | Focus on cost-saving features during inflation | Cuts through clutter, addresses customer pain points |

| Risk Mitigation Incentives | Encourage safer behavior, demonstrate value | Discounts for home security systems (up to 15% in 2024) | Reduces premiums, positions IAG as a safety partner |

| Customer Testimonials/Case Studies | Build trust, showcase practical advantages | Highlighting real-world benefits and financial planning tools | Reinforces value proposition, builds credibility |

| Integrated Marketing Campaigns | Enhance engagement, build brand affinity | Partnership with Nine for Paris 2024 Games | Pervasive messaging across multiple media channels |

Price

IAG's pricing strategy aims for a sweet spot, making its offerings competitive while also capturing the true worth customers see in them, fitting neatly with its brand image. This delicate balance is crucial for its market standing.

The company is actively enhancing its pricing tools and strategies, particularly as it moves its insurance policies onto its new Enterprise Platform. This technological shift is expected to refine pricing precision and efficiency.

For instance, in the 2024 financial year, IAG reported a Gross Written Premium (GWP) of AUD 17.5 billion, demonstrating the scale of its operations and the impact of its pricing decisions on overall revenue. The ongoing platform migration is designed to further optimize this GWP by enabling more dynamic and data-driven pricing adjustments.

IAG’s pricing strategies are directly shaped by a challenging market environment. Factors like persistent inflation, increased weather volatility leading to more frequent claims, and escalating reinsurance costs are putting upward pressure on premiums. For instance, in the fiscal year 2024, IAG reported a significant increase in natural disaster claims, impacting their claims costs and consequently their pricing models.

The company recognizes that these premium adjustments can be a burden for customers. IAG is actively working on strategies to soften the impact of these necessary price changes. This includes exploring ways to improve operational efficiency and offering tailored product solutions where possible, aiming to balance affordability with adequate coverage in a dynamic economic climate.

IAG utilizes long-term reinsurance to buffer against price fluctuations and maintain stable costs for its clientele. A prime example is their US$10 billion catastrophe reinsurance program for 2025, a significant commitment to managing extreme weather events.

This proactive approach to risk mitigation is crucial for absorbing the financial shocks of natural disasters, thereby enabling IAG to offer more predictable and consistent pricing to its policyholders throughout the year.

Targeted Financial Performance

IAG's pricing strategy is directly aligned with its ambitious financial objectives for the 2024-2025 period. The company is aiming for an insurance margin within the 13.5% to 15.5% range, a key indicator of underwriting profitability.

To achieve this, pricing decisions are carefully calibrated to ensure they support these targets while remaining competitive. This delicate balance is crucial for IAG to capture market share and grow its business effectively.

Furthermore, IAG anticipates mid-to-high single-digit growth in its gross written premiums for FY25. This growth projection underscores the company's confidence in its market position and its ability to attract new business through strategic pricing.

- Insurance Margin Target: 13.5% - 15.5%

- Gross Written Premium Growth (FY25): Mid-to-high single digits

- Pricing Strategy: Supports financial targets and market competitiveness

Customer Support Amidst Increases

Recognizing the impact of recent premium increases, particularly in the challenging economic climate of 2024 and projected into 2025, IAG has proactively strengthened its customer support infrastructure. This initiative is designed to assist policyholders navigating cost-of-living pressures.

Specialized customer care teams have been deployed to offer tailored solutions and enhanced assistance. This demonstrates a clear commitment to customer well-being, balancing necessary pricing adjustments with tangible support.

- Enhanced Support Channels: IAG has reported a 15% increase in customer service staff dedicated to handling inquiries related to premium changes and financial hardship assistance in the first half of 2024.

- Flexible Payment Options: The company is offering more flexible payment plans, with data from early 2024 showing a 20% uptake in these arrangements compared to the previous year.

- Personalized Guidance: Customer satisfaction surveys from late 2023 indicated that 70% of customers who engaged with specialized support felt their concerns were addressed effectively.

- Proactive Communication: IAG has implemented a new digital platform offering personalized impact assessments for policyholders, aiming to provide clarity on premium adjustments and available support measures by mid-2025.

IAG's pricing strategy is a dynamic response to market pressures, aiming to balance competitiveness with the value customers perceive. This approach is vital as they integrate new pricing tools with their Enterprise Platform, targeting enhanced precision and efficiency in their premium setting.

The company's financial targets, including an insurance margin of 13.5% to 15.5% and mid-to-high single-digit GWP growth for FY25, are directly supported by these calibrated pricing decisions. This ensures IAG can maintain its market position and pursue growth effectively amidst economic challenges.

To mitigate the impact of necessary premium adjustments on policyholders, IAG has bolstered its customer support. This includes a reported 15% increase in customer service staff for premium-related inquiries in early 2024 and a 20% uptake in flexible payment plans, demonstrating a commitment to balancing affordability with support.

| Metric | Value | Period |

|---|---|---|

| Gross Written Premium (GWP) | AUD 17.5 billion | FY24 |

| Insurance Margin Target | 13.5% - 15.5% | FY24-25 |

| Projected GWP Growth | Mid-to-high single digits | FY25 |

| Customer Service Staff Increase (Premium Support) | 15% | H1 2024 |

| Flexible Payment Plan Uptake | 20% increase | Early 2024 |

4P's Marketing Mix Analysis Data Sources

Our IAG 4P's Marketing Mix Analysis leverages a comprehensive blend of primary and secondary data sources. We meticulously gather information from official company websites, press releases, financial reports, and investor communications to understand product offerings, pricing strategies, distribution channels, and promotional activities.