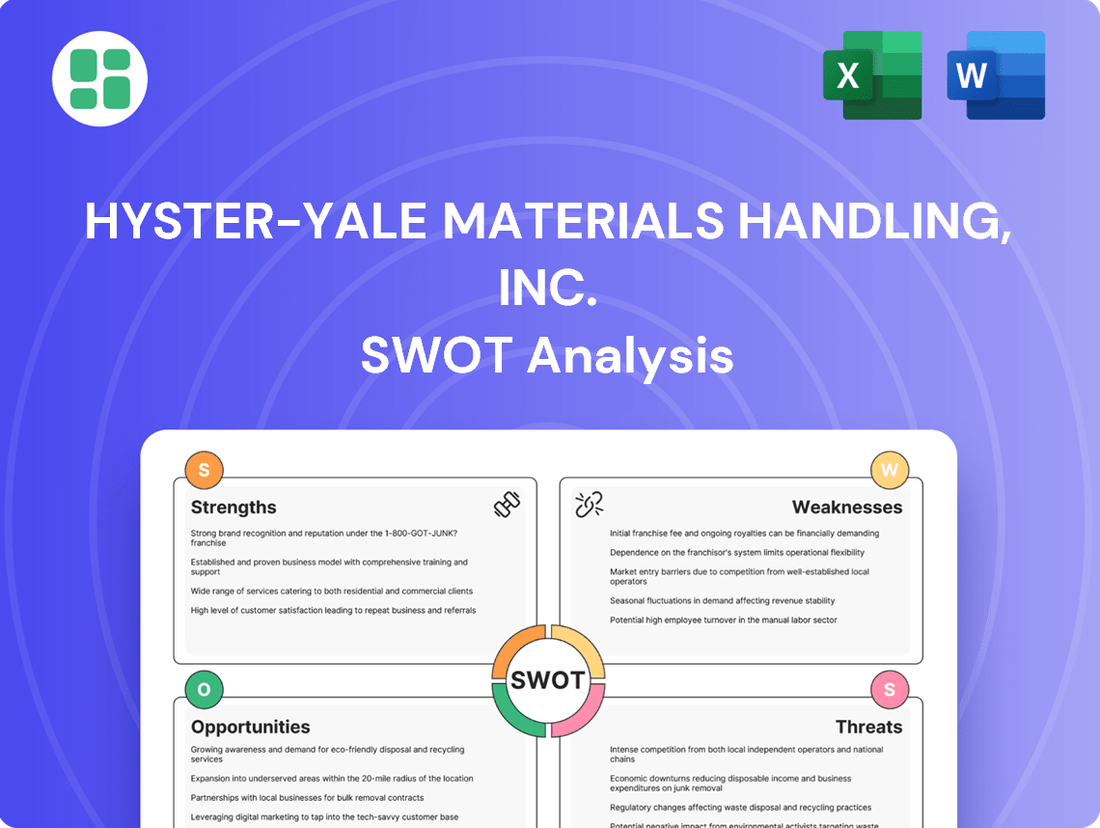

Hyster-Yale Materials Handling, Inc. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyster-Yale Materials Handling, Inc. Bundle

Hyster-Yale Materials Handling, Inc. boasts a strong global presence and a diverse product portfolio, but faces challenges from intense competition and evolving market demands. Understanding these dynamics is crucial for anyone looking to invest or strategize within the industrial equipment sector.

Want the full story behind Hyster-Yale's market position, including detailed insights into their competitive advantages and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Hyster-Yale Materials Handling, Inc. boasts significant strengths stemming from its globally recognized Hyster and Yale brands, synonymous with quality and reliability in the material handling sector. This strong brand equity translates into robust customer loyalty and a distinct competitive edge across various international markets.

The company's extensive global distribution and service network is a critical asset, enabling them to effectively reach and support customers worldwide. This established infrastructure reinforces their market leadership and facilitates consistent brand experience, a key differentiator in the industry.

Hyster-Yale Materials Handling, Inc. boasts a comprehensive product and solutions portfolio that is a significant strength. They offer a wide spectrum of lift trucks, encompassing both internal combustion and electric models, designed to meet the demands of various industrial applications. This breadth ensures they can serve a diverse customer base.

The strategic acquisition of Bolzoni S.p.A. further enhances their offerings by incorporating specialized attachments. This integration allows Hyster-Yale to provide more complete, end-to-end solutions for their customers, moving beyond just the core equipment. For instance, Bolzoni's attachments can improve the efficiency and versatility of Hyster-Yale's forklifts in specific operational environments.

Hyster-Yale is a leader in clean energy through its subsidiary, Nuvera Fuel Cells, LLC. They are actively developing and integrating hydrogen fuel cell technology, not just for their own material handling equipment but also for broader applications. This focus on sustainable energy solutions is a significant differentiator in a market increasingly prioritizing environmental responsibility.

This strategic push into hydrogen fuel cells positions Hyster-Yale to capture growth in the clean energy sector. As of early 2024, the global hydrogen fuel cell market is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% through the end of the decade, driven by decarbonization efforts across various industries. Nuvera's advancements directly tap into this expanding market.

Robust Aftermarket Parts and Service Business

Hyster-Yale's robust aftermarket parts and service business is a significant strength, generating a consistent revenue stream and boosting customer loyalty. This segment ensures ongoing customer interaction through maintenance, repairs, and the provision of genuine parts, solidifying their market position.

This focus on post-sale support not only enhances overall profitability but also cultivates deeper, more enduring customer relationships. For instance, in 2023, Hyster-Yale's aftermarket business played a crucial role in their financial performance, contributing significantly to their total revenue and demonstrating the value of this recurring income source.

- Recurring Revenue: The aftermarket segment provides a stable and predictable income stream, less susceptible to the cyclical nature of new equipment sales.

- Customer Retention: Offering comprehensive service and genuine parts encourages customers to remain with Hyster-Yale for their ongoing material handling needs.

- Profitability Enhancement: Service and parts typically carry higher profit margins compared to new equipment, directly benefiting the company's bottom line.

- Brand Loyalty: Excellent after-sales support fosters trust and satisfaction, strengthening brand loyalty and encouraging repeat business.

Integrated Engineering and Manufacturing Capabilities

Hyster-Yale's integrated engineering and manufacturing capabilities are a significant strength, allowing them to meticulously control the entire lifecycle of their lift trucks. This deep expertise in design and production translates directly into high-quality, innovative products. For example, in 2023, Hyster-Yale reported net sales of $3.48 billion, reflecting the demand for their well-engineered equipment.

This vertical integration provides a crucial competitive edge. By managing everything from initial concept to final assembly, Hyster-Yale can implement stringent quality checks and foster rapid innovation. Their ability to develop advanced material handling solutions in-house is a key differentiator in a market where reliability and performance are paramount.

- Vertical Integration: Full control over design, engineering, and manufacturing processes.

- Quality Control: Ensures high standards from raw materials to finished products.

- Innovation: Facilitates quicker development and implementation of new technologies.

- Cost Efficiency: Streamlined operations can lead to better cost management.

Hyster-Yale's strength lies in its powerful brand recognition, with Hyster and Yale being globally trusted names in material handling, fostering strong customer loyalty. Their expansive global distribution and service network ensures consistent support and market reach worldwide, a critical factor in customer satisfaction and retention.

The company also benefits from a diverse product portfolio, offering a wide range of lift trucks, and has strategically enhanced its offerings through acquisitions like Bolzoni S.p.A. for specialized attachments, enabling more comprehensive customer solutions.

Furthermore, Hyster-Yale is a leader in clean energy through its subsidiary Nuvera Fuel Cells, LLC, actively developing and integrating hydrogen fuel cell technology. This positions them to capitalize on the growing demand for sustainable energy solutions in the material handling sector and beyond, with the global hydrogen fuel cell market projected for significant growth in the coming years.

Their robust aftermarket parts and service business is a key strength, generating consistent revenue and enhancing customer relationships through ongoing support and genuine parts. This focus on post-sale services improves profitability and strengthens brand loyalty. For instance, Hyster-Yale reported net sales of $3.48 billion in 2023, with aftermarket contributing significantly to their overall financial performance.

What is included in the product

Explores the strategic advantages and threats impacting Hyster-Yale Materials Handling, Inc.’s success by analyzing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable SWOT analysis that pinpoints areas for improvement, easing the burden of identifying and addressing strategic challenges for Hyster-Yale Materials Handling.

Weaknesses

Hyster-Yale's significant investment in Nuvera's hydrogen fuel cell technology, while forward-thinking, presents a considerable financial burden. In 2023, the company reported R&D expenses of $106.7 million, a portion of which is allocated to this initiative. This substantial outlay, coupled with capital expenditures for scaling production, can place a strain on near-term profitability.

The ultimate success of hydrogen fuel cell technology hinges on market acceptance and the build-out of necessary infrastructure, factors outside Hyster-Yale's direct control. Until these elements mature, the long-term return on this substantial investment remains uncertain, potentially impacting the company's financial flexibility in the interim.

Hyster-Yale's reliance on industrial sectors makes it susceptible to economic cycles. For instance, a slowdown in global manufacturing, which heavily influences demand for forklifts and other material handling equipment, directly impacts Hyster-Yale's revenue.

The company's performance is closely linked to capital expenditure trends; during economic downturns, businesses often cut back on such investments, leading to reduced sales for Hyster-Yale. This vulnerability was evident in the Q1 2024 results, where a challenging macroeconomic environment contributed to a decline in new equipment orders.

Hyster-Yale operates in a crowded material handling market, facing strong competition from global giants like Toyota Industries Corporation and KION Group, as well as numerous regional manufacturers. This intense rivalry often forces price adjustments, potentially squeezing profit margins. For instance, in 2023, the global forklift market was valued at approximately $50 billion, with significant market share held by several key players, making it challenging for any single company to dominate.

Supply Chain Volatility and Raw Material Costs

Hyster-Yale, as a global player, faces inherent risks from supply chain disruptions. Component shortages and shipping delays, which were particularly acute in 2021 and 2022, continue to pose a challenge, impacting production schedules and order fulfillment. The company's reliance on a complex international network means it's constantly navigating potential bottlenecks.

Fluctuations in the cost of key raw materials, such as steel and electronic components, directly affect Hyster-Yale's manufacturing expenses. For instance, steel prices saw significant volatility in 2023, impacting the cost of goods sold. These price swings can compress profit margins if not effectively managed through pricing strategies or hedging.

- Supply Chain Disruptions: Ongoing global logistics issues and component availability can delay production and increase lead times.

- Raw Material Cost Volatility: Significant price swings in steel, aluminum, and semiconductors directly impact manufacturing costs.

- Managing External Factors: The company must continuously adapt to unpredictable global economic and geopolitical events affecting its supply chain.

Potential Over-reliance on Traditional Lift Truck Sales

Hyster-Yale's continued reliance on traditional lift truck sales, encompassing both internal combustion and electric models, presents a notable weakness. Despite investments in emerging technologies, a significant portion of their revenue stream remains anchored to these established product lines. For instance, in the first quarter of 2024, the company reported that its Lift Trucks segment continued to be the primary revenue driver.

This dependence creates vulnerability. A swift acceleration in market demand for fully automated warehousing solutions or alternative power sources, beyond current electric offerings, could challenge Hyster-Yale if the company's transition to these new paradigms isn't agile. Competitors who are more aggressively pivoting to robotics and advanced automation might gain a competitive edge.

- Revenue Concentration: A substantial percentage of Hyster-Yale's income is still derived from the sale of conventional lift trucks.

- Market Shift Risk: Rapid changes in customer preference towards automation or novel power sources could negatively impact sales if not addressed proactively.

- Competitive Lag: The pace of diversification into robotics and automation may trail that of certain rivals in the materials handling sector.

Hyster-Yale's significant investment in Nuvera's hydrogen fuel cell technology, while forward-thinking, presents a considerable financial burden. In 2023, the company reported R&D expenses of $106.7 million, a portion of which is allocated to this initiative. This substantial outlay, coupled with capital expenditures for scaling production, can place a strain on near-term profitability.

The ultimate success of hydrogen fuel cell technology hinges on market acceptance and the build-out of necessary infrastructure, factors outside Hyster-Yale's direct control. Until these elements mature, the long-term return on this substantial investment remains uncertain, potentially impacting the company's financial flexibility in the interim.

Hyster-Yale operates in a crowded material handling market, facing strong competition from global giants like Toyota Industries Corporation and KION Group. This intense rivalry often forces price adjustments, potentially squeezing profit margins. For instance, in 2023, the global forklift market was valued at approximately $50 billion, with significant market share held by several key players.

Hyster-Yale's continued reliance on traditional lift truck sales, encompassing both internal combustion and electric models, presents a notable weakness. Despite investments in emerging technologies, a significant portion of their revenue stream remains anchored to these established product lines. For instance, in the first quarter of 2024, the company reported that its Lift Trucks segment continued to be the primary revenue driver.

Full Version Awaits

Hyster-Yale Materials Handling, Inc. SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. This comprehensive document details Hyster-Yale Materials Handling, Inc.'s Strengths, Weaknesses, Opportunities, and Threats. The complete version becomes available after checkout, offering an in-depth strategic overview.

Opportunities

The booming e-commerce industry, projected to reach $8.1 trillion globally by 2024, fuels a constant need for efficient material handling solutions. Hyster-Yale is well-positioned to capitalize on this by supplying the forklifts and warehousing equipment essential for managing increased inventory and faster order fulfillment, a critical factor for online retailers.

Global supply chains are becoming more intricate, demanding advanced logistics capabilities. This complexity creates a significant opportunity for Hyster-Yale to offer specialized equipment that optimizes warehousing and distribution, directly addressing the industry's drive for speed and accuracy in 2024 and beyond.

The growing demand for automated solutions in warehouses and manufacturing presents a substantial opportunity for Hyster-Yale. The company can capitalize on this trend by expanding its portfolio of automated guided vehicles (AGVs), autonomous mobile robots (AMRs), and comprehensive automation systems. This strategic move positions Hyster-Yale to secure a greater stake in the rapidly evolving intralogistics sector.

Global environmental regulations and corporate sustainability goals are rapidly increasing the demand for electric and hydrogen fuel cell material handling equipment. Hyster-Yale's strategic investment in Nuvera, a leader in hydrogen fuel cell technology, positions the company to effectively tap into this growing market, providing eco-friendly and energy-efficient solutions that replace traditional internal combustion engines.

Expansion in Emerging Markets

Developing economies are ripe for industrial expansion and infrastructure upgrades, which directly translates to a higher demand for material handling solutions. Hyster-Yale is well-positioned to capitalize on this by strategically growing its footprint and distribution channels in these burgeoning markets.

This expansion offers a significant opportunity for Hyster-Yale to diversify its revenue sources, reducing reliance on established markets and tapping into new customer segments. For instance, in 2024, emerging markets represented a growing portion of global industrial equipment sales, with projections indicating continued robust growth through 2025.

- Untapped Demand: Developing economies often have lower penetration rates for advanced material handling equipment, creating substantial market potential.

- Infrastructure Growth: Increased investment in ports, logistics, and manufacturing facilities in emerging markets directly fuels demand for Hyster-Yale's product lines.

- Revenue Diversification: Expanding into new geographic regions helps mitigate risks associated with economic downturns in any single market.

- Competitive Advantage: Early market entry and established distribution networks can create a lasting competitive edge in these high-growth areas.

Strategic Partnerships and Acquisitions

Hyster-Yale could significantly bolster its competitive edge by forging strategic alliances with cutting-edge technology firms specializing in areas like advanced battery management systems or AI-driven fleet optimization software. For instance, a partnership with a leading electric vehicle component supplier could accelerate the development of next-generation electric lift trucks, aligning with the growing demand for sustainable material handling solutions. In 2024, the global warehouse automation market was projected to reach over $20 billion, highlighting the critical need for technological integration.

Acquiring businesses with complementary product lines or market access presents another avenue for growth. This could involve purchasing companies that offer specialized attachments, advanced telematics solutions, or have established distribution networks in emerging markets. Such acquisitions can rapidly expand Hyster-Yale's service offerings and geographic footprint, allowing it to tap into new customer segments and revenue streams. For example, acquiring a software company focused on warehouse analytics could provide Hyster-Yale with valuable data insights to offer customers.

These strategic moves are designed to enhance Hyster-Yale's product portfolio and market reach. By integrating advanced technologies through partnerships or acquiring businesses with synergistic capabilities, the company can accelerate its growth trajectory and solidify its market position. The company's focus on innovation and expansion through these strategic opportunities is crucial for navigating the evolving landscape of material handling.

- Partnerships with battery technology innovators to enhance electric forklift performance.

- Acquisition of logistics software providers to offer integrated fleet management solutions.

- Collaborations with AI firms for predictive maintenance and operational efficiency in material handling equipment.

- Strategic alliances with companies in autonomous vehicle technology to develop self-driving warehouse solutions.

Hyster-Yale can leverage the expanding e-commerce sector, projected to reach $8.1 trillion globally by 2024, by supplying essential material handling equipment for increased inventory and faster order fulfillment. The growing complexity of global supply chains also presents an opportunity for specialized equipment that enhances warehousing and distribution efficiency. Furthermore, the increasing demand for automation in warehouses and manufacturing, with the global warehouse automation market expected to exceed $20 billion in 2024, allows Hyster-Yale to expand its automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) offerings.

Threats

The material handling industry is seeing a surge of competition from specialized automation firms, moving beyond traditional lift truck makers. These new players often focus on integrated, software-driven robotic and autonomous solutions. This trend could significantly impact Hyster-Yale's market position if the company doesn't accelerate its own automation and digitalization efforts.

For instance, the global automated material handling market was valued at approximately $27.5 billion in 2023 and is projected to grow substantially in the coming years. Companies like Fetch Robotics (now Zebra Technologies) and Locus Robotics have gained traction by offering flexible, scalable autonomous mobile robots, presenting a direct challenge to established manufacturers who may be slower to adopt these advanced technologies.

The material handling sector, including Hyster-Yale's domain, is being reshaped by swift technological evolution. Innovations in areas like advanced battery chemistries, artificial intelligence for optimized logistics, and increasingly sophisticated autonomous vehicles are setting new industry standards. For instance, the global warehouse robotics market alone was projected to reach $14.9 billion in 2024, highlighting the scale of this technological shift.

Hyster-Yale faces a significant threat if it cannot match the pace of these advancements or if its adoption of disruptive technologies lags. Products that don't integrate the latest AI-driven efficiency tools or utilize next-generation battery power could quickly become less appealing to customers prioritizing performance and sustainability. The company's ability to maintain competitiveness hinges on its commitment to integrating these cutting-edge solutions.

A significant global economic slowdown or prolonged geopolitical instability, including trade wars or regional conflicts, poses a substantial threat to Hyster-Yale. Such conditions can severely dampen industrial investment and reduce demand for capital equipment, directly impacting the company's core business. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.0% in 2023, highlighting a challenging macroeconomic environment.

This instability can also disrupt critical supply chains, leading to increased operational costs and a decline in customer confidence. For Hyster-Yale, this could translate into higher raw material prices and logistics expenses, squeezing profit margins. Furthermore, reduced customer confidence often means delayed or canceled capital expenditure plans, directly affecting sales volumes for forklifts and other material handling equipment.

Volatile Regulatory and Environmental Policies

Changes in environmental regulations, such as stricter emissions standards for internal combustion engines or mandates for electric and hydrogen-powered equipment, could significantly increase Hyster-Yale's compliance costs. For instance, the European Union’s ongoing review of its emissions directives for non-road mobile machinery could necessitate substantial investments in new technologies. This also accelerates the market shift towards cleaner alternatives, potentially impacting Hyster-Yale's product mix and sales if adaptation is not swift.

Unfavorable trade policies and tariffs, particularly in key markets like North America or Europe, pose a direct threat to Hyster-Yale's global manufacturing and sales operations. For example, tariffs imposed on imported components or finished goods could raise production costs and reduce the competitiveness of their products. The company's reliance on a global supply chain means that geopolitical shifts and protectionist measures can disrupt operations and impact profitability.

- Compliance Costs: Evolving environmental regulations, especially concerning emissions, may require significant capital expenditure for Hyster-Yale to upgrade its manufacturing processes and product lines.

- Market Shift Acceleration: Mandates for electric or hydrogen adoption could force a faster transition in product development, potentially leaving Hyster-Yale behind if it cannot keep pace with technological advancements and consumer demand.

- Trade Policy Impact: Tariffs and trade barriers can inflate the cost of raw materials and components, as well as increase the price of finished goods for customers, thereby affecting sales volumes and profit margins.

- Adaptation Imperative: Hyster-Yale must remain agile and proactive in monitoring and responding to regulatory changes and trade policy shifts to mitigate risks and capitalize on emerging opportunities in sustainable material handling solutions.

Fluctuations in Currency Exchange Rates

Hyster-Yale Materials Handling, Inc., as a global entity with operations spanning numerous countries, faces significant risks from fluctuating currency exchange rates. These shifts can directly affect the company's financial performance, particularly when converting earnings and expenses from foreign currencies into its reporting currency, the U.S. dollar.

Adverse currency movements can lead to a reduction in reported revenues and an increase in the cost of goods sold, ultimately impacting overall profitability. This inherent volatility introduces a layer of financial uncertainty into the company's strategic planning and operational execution.

For instance, during the first quarter of 2024, Hyster-Yale reported that foreign currency translation adjustments negatively impacted its net sales by $17.5 million. This highlights the tangible effect that currency fluctuations can have on the company's top-line results.

- Impact on Revenue: A stronger USD against other currencies can reduce the reported value of sales made in those foreign currencies.

- Impact on Costs: Conversely, a weaker USD can increase the cost of imported components or raw materials purchased in foreign currencies.

- Profitability Uncertainty: These currency swings create a less predictable earnings environment, making it challenging to forecast financial outcomes accurately.

Intensifying competition from automation-focused firms presents a significant threat, potentially eroding Hyster-Yale's market share if it cannot keep pace with rapid technological advancements. The global automated material handling market's projected growth, with specialized robotic solutions gaining traction, underscores this challenge. Furthermore, economic slowdowns and geopolitical instability can dampen industrial investment, disrupt supply chains, and increase operational costs, directly impacting demand for Hyster-Yale's equipment.

SWOT Analysis Data Sources

This analysis is built upon a foundation of Hyster-Yale's official financial filings, comprehensive market research reports, and insights from industry experts to provide a robust and accurate SWOT assessment.