Hyster-Yale Materials Handling, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyster-Yale Materials Handling, Inc. Bundle

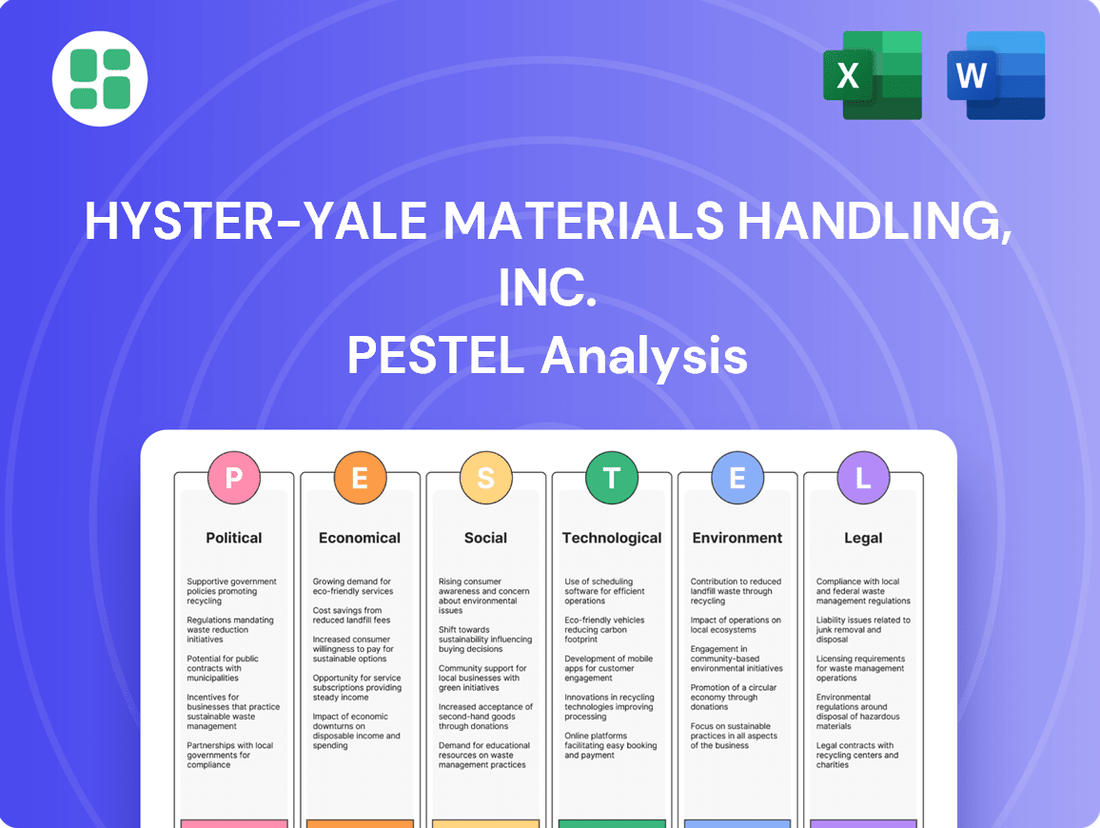

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Hyster-Yale Materials Handling, Inc.'s trajectory. Our PESTLE analysis offers a comprehensive view of these external forces, providing you with the foresight needed to navigate market complexities and identify strategic opportunities. Gain a competitive edge by understanding the complete external landscape. Download the full version now for actionable intelligence.

Political factors

Government policies, especially in the U.S. and Europe, are strongly pushing for clean energy. This directly benefits Hyster-Yale's Nuvera Fuel Cells business and its electric forklift lines.

The U.S. government's commitment to hydrogen and fuel cell tech is substantial, with investments reaching $500 million in 2024. This significant funding creates a fertile ground for wider acceptance of Hyster-Yale's cleaner material handling options.

These kinds of incentives are key drivers for expanding the market for sustainable solutions. They also play a crucial role in shaping Hyster-Yale's focus for future research and development efforts.

Changes in international trade policies and tariffs directly impact Hyster-Yale's manufacturing costs and global supply chain efficiency. For example, the U.S. tariffs on steel and aluminum, implemented in 2024, increased production expenses for the company. These trade barriers necessitate careful navigation to maintain competitive pricing and efficient international operations, especially given that international sales represent a significant portion of Hyster-Yale's overall revenue.

Ongoing geopolitical tensions, such as those involving major economic blocs, directly impact Hyster-Yale's global operations. These tensions can trigger tariffs, trade restrictions, and sudden shifts in market access, creating significant headwinds for international trade and investment.

Supply chain volatility, a direct consequence of these geopolitical events, affects Hyster-Yale by increasing the cost and decreasing the availability of essential raw materials and components. For instance, disruptions in key manufacturing regions can lead to production delays and higher input costs, as seen with semiconductor shortages impacting various industries in 2023-2024.

With a substantial portion of its revenue generated internationally, Hyster-Yale must remain agile in its sourcing and manufacturing strategies. The company's ability to navigate these complex geopolitical landscapes and adapt its supply chain to mitigate risks is crucial for maintaining operational continuity and profitability in the 2024-2025 period.

'Build America, Buy America' Act Compliance

Hyster-Yale Materials Handling, Inc. is actively aligning its operations with the U.S. 'Build America, Buy America' (BABA) Act. This legislation requires the use of American-made materials for federally funded infrastructure projects, a key market for Hyster-Yale's products.

To meet these requirements, the company is focused on enhancing its domestic manufacturing capabilities for critical components and finished goods, including its high-capacity electric forklifts. This strategic move is designed to ensure compliance and to capitalize on the anticipated surge in demand from U.S. government initiatives.

- BABA Act Compliance: Hyster-Yale is committed to adhering to domestic content requirements for federally funded projects.

- Domestic Manufacturing Focus: The company is investing in and expanding its U.S.-based production to meet BABA mandates.

- Market Opportunity: This compliance positions Hyster-Yale to secure contracts for infrastructure projects, bolstering its domestic market share.

- Product Alignment: High-capacity electric forklifts are a key product line being adapted to meet BABA standards.

Government Infrastructure Investment

Government investments in infrastructure development are a significant driver for the material handling sector. For instance, the United States' 2021 Infrastructure Investment and Jobs Act, with its substantial $1.2 trillion allocation, is poised to spur demand for equipment like Hyster-Yale's lift trucks and other solutions. This increased activity in construction and logistics projects necessitates efficient and reliable machinery, directly benefiting manufacturers in this space.

These infrastructure initiatives often come with stipulations favoring domestic production. Hyster-Yale's commitment to domestic manufacturing positions it favorably to secure contracts tied to these public sector projects. The need for robust equipment to support projects ranging from road and bridge repair to port modernization creates a strong sales pipeline for companies that can meet these requirements.

- Infrastructure Spending Boost: The 2021 Infrastructure Investment and Jobs Act in the U.S. dedicates $1.2 trillion to infrastructure improvements, directly impacting the demand for material handling equipment.

- Project Requirements: Large-scale infrastructure projects, such as those funded by this act, require heavy-duty and efficient machinery, aligning with Hyster-Yale's product offerings.

- Domestic Manufacturing Advantage: Hyster-Yale's focus on domestic manufacturing allows it to better leverage opportunities arising from government procurement policies that prioritize local production.

Government policies promoting clean energy, particularly in the U.S. and Europe, are a significant tailwind for Hyster-Yale's Nuvera Fuel Cells and electric forklift segments. The U.S. government's substantial investment of $500 million in hydrogen and fuel cell technology in 2024 directly supports the broader adoption of Hyster-Yale's cleaner material handling solutions.

The U.S. 'Build America, Buy America' (BABA) Act is a key political factor, requiring domestic content for federally funded infrastructure projects, a crucial market for Hyster-Yale. The company's strategic focus on enhancing U.S.-based manufacturing for components and finished goods, including electric forklifts, aims to ensure BABA compliance and capture demand from these initiatives.

Government investments in infrastructure, such as the U.S. Infrastructure Investment and Jobs Act of 2021 ($1.2 trillion allocation), are driving demand for material handling equipment. Hyster-Yale's emphasis on domestic production positions it well to secure contracts for these projects, which often prioritize locally manufactured goods.

| Policy/Legislation | Impact on Hyster-Yale | Key Data/Year |

|---|---|---|

| Clean Energy Push (U.S./Europe) | Boosts Nuvera Fuel Cells & electric forklifts | $500M U.S. Hydrogen Investment (2024) |

| 'Build America, Buy America' (BABA) Act | Requires domestic content for federal projects; drives U.S. manufacturing investment | Focus on U.S.-made components & electric forklifts |

| Infrastructure Investment and Jobs Act (U.S.) | Increases demand for material handling equipment; favors domestic production | $1.2 Trillion Allocation (2021) |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Hyster-Yale Materials Handling, Inc., offering a comprehensive overview of the external forces shaping its operational landscape.

It provides actionable insights for strategic decision-making by identifying key trends and potential challenges across these critical macro-environmental dimensions.

This PESTLE analysis for Hyster-Yale Materials Handling, Inc. provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, simplifying complex external factors.

It helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences impacting Hyster-Yale.

Economic factors

Hyster-Yale's financial performance is intrinsically linked to the ebb and flow of global economic cycles, which directly influence market demand for its material handling equipment. A projected downturn in global economic activity for 2025 is expected to dampen this demand.

The company anticipates a decline in both revenues and profits for 2025 when compared to 2024 figures. This outlook is largely driven by prevailing macroeconomic headwinds and a noticeable softening in demand for traditional internal combustion engine (ICE) powered lift trucks.

To navigate these shifting market dynamics, Hyster-Yale must remain agile in adjusting its production schedules and meticulously managing inventory levels. This ensures alignment with the unpredictable fluctuations characteristic of the current economic landscape.

Hyster-Yale Materials Handling, Inc. is heavily influenced by the fluctuating costs of essential industrial metals such as steel, lead, and copper. These materials are fundamental to their manufacturing processes, and their price swings directly impact production expenses.

Global economic conditions and disruptions in supply chains have previously caused significant spikes in raw material prices, which in turn squeezed Hyster-Yale's profit margins. For instance, during periods of high demand and limited supply, the cost of steel, a primary component, can rise sharply.

While some material costs saw a decrease in 2023, the overall global market remains unpredictable. This ongoing volatility presents a persistent hurdle for Hyster-Yale in managing its costs effectively and maintaining consistent profitability.

Hyster-Yale, as a global player with substantial international sales, is inherently exposed to currency exchange rate fluctuations. Changes in rates, like the Euro to US Dollar (EUR/USD), directly influence the profitability of its operations across various geographical markets. For instance, a stronger dollar could make Hyster-Yale's European sales less valuable when converted back to USD.

While Hyster-Yale utilizes currency hedging strategies to buffer against these risks, unforeseen currency movements can still impact its financial results and the cost of its global transactions. As of early 2024, the EUR/USD has seen volatility, trading around the 1.08-1.10 range, underscoring the ongoing need for careful management of this economic factor.

Increased Competition

The material handling industry is intensely competitive, with Hyster-Yale facing significant pressure from both legacy manufacturers and emerging players, particularly in the burgeoning electric and automated solutions sectors. This heightened competition directly impacts pricing power and market share, compelling Hyster-Yale to prioritize ongoing innovation and product/service differentiation to maintain its edge.

This dynamic competitive environment shapes Hyster-Yale's strategic capital allocation, driving investments in cutting-edge product development and enhancements to manufacturing efficiency. For instance, in 2024, the company continued to invest in its electric forklift lines to counter rivals offering advanced battery technologies. The global warehouse automation market, a key area of competition, was projected to reach approximately $30 billion in 2024, underscoring the rapid growth and intense focus on this segment.

- Intensified rivalry from both established and new material handling equipment manufacturers.

- Growing market share challenges due to advancements in electric and automated solutions from competitors.

- Pressure on profit margins and pricing strategies stemming from competitive market dynamics.

- Necessity for continuous investment in R&D to maintain product differentiation and technological leadership.

Company Profitability and Investment Outlook

Hyster-Yale Materials Handling, Inc. is aiming for a 7% operating profit margin. However, the company foresees profitability falling short of this goal in 2025. This is primarily due to anticipated weaker market demand and heightened competition within the industry.

Despite these headwinds, Hyster-Yale remains committed to preserving robust operating cash flow. The company plans to continue making strategic capital investments, estimating expenditures between $40 million and $80 million for 2025. These investments are crucial for supporting long-term growth initiatives and ongoing transformation efforts.

- Target Operating Profit Margin: 7%

- 2025 Profitability Outlook: Below target

- Key Drivers for Lower Profitability: Lower market demand, increased competition

- 2025 Capital Investment Projection: $40 million - $80 million

- Investment Focus: Advanced products, manufacturing efficiency

Economic factors significantly shape Hyster-Yale's performance, with global economic cycles directly impacting demand for its material handling equipment. A projected economic slowdown in 2025 is expected to reduce demand, leading to anticipated declines in both revenue and profit compared to 2024. The company must remain agile in production and inventory management to adapt to these economic shifts.

Fluctuating costs of essential industrial metals like steel, lead, and copper are a persistent challenge, directly affecting Hyster-Yale's production expenses and profit margins. While some material costs decreased in 2023, ongoing global market volatility continues to complicate cost management and profitability. For example, steel prices can surge during periods of high demand and limited supply, impacting the company's bottom line.

Currency exchange rate fluctuations also pose a risk for Hyster-Yale, given its substantial international sales. Changes in rates, such as the Euro to US Dollar (EUR/USD), can affect the profitability of operations in different regions. While hedging strategies are employed, unforeseen movements, like the EUR/USD volatility observed around 1.08-1.10 in early 2024, can still impact financial results.

The material handling industry's intense competition, particularly in electric and automated solutions, pressures Hyster-Yale's pricing and market share. This necessitates continuous investment in R&D, with the global warehouse automation market projected to reach approximately $30 billion in 2024. Hyster-Yale aims for a 7% operating profit margin but anticipates falling short in 2025 due to weaker demand and increased competition, while planning $40 million to $80 million in capital investments for 2025.

| Economic Factor | Impact on Hyster-Yale | Key Data/Outlook |

| Global Economic Cycles | Demand for material handling equipment | Projected slowdown in 2025, dampening demand. |

| Raw Material Costs | Production expenses and profit margins | Volatility in steel, lead, copper prices; 2023 saw some decreases, but overall unpredictability persists. |

| Currency Exchange Rates | Profitability of international operations | EUR/USD volatility (around 1.08-1.10 in early 2024) impacts conversion of foreign earnings. |

| Industry Competition | Pricing power and market share | Intense rivalry, especially in electric/automated solutions; warehouse automation market ~ $30 billion in 2024. |

Same Document Delivered

Hyster-Yale Materials Handling, Inc. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hyster-Yale Materials Handling, Inc. details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Labor shortages remain a significant hurdle for Hyster-Yale and the wider material handling sector. The ongoing scarcity of skilled workers directly impacts production schedules and the ability to meet customer demand, a challenge exacerbated by an aging workforce and insufficient new talent entering the field.

To counter these labor challenges, Hyster-Yale is likely focusing on initiatives like enhanced employee training and development programs to upskill existing staff and attract new talent. Furthermore, investments in automation and robotics are crucial for reducing the dependency on manual labor, improving efficiency, and addressing the persistent shortage of available workers.

The Bureau of Labor Statistics reported in late 2024 that manufacturing industries, including those related to Hyster-Yale's operations, continued to face difficulties in filling open positions, with unfilled job openings remaining elevated compared to pre-pandemic levels.

Societal expectations and regulatory bodies are increasingly prioritizing workplace safety and ergonomics, particularly within the warehousing and manufacturing sectors. This heightened awareness directly influences the demand for equipment that minimizes risks and enhances worker well-being.

The Occupational Safety and Health Administration (OSHA) is actively reinforcing these standards. For instance, OSHA's National Emphasis Program on Warehousing and Distribution, active through 2024 and into 2025, targets common hazards in these environments. Furthermore, proposed legislation like the Warehouse Worker Protection Act aims to codify additional safety measures, pushing manufacturers like Hyster-Yale to innovate.

Hyster-Yale must demonstrate how its product portfolio actively contributes to mitigating workplace hazards. This includes addressing issues such as heat stress in operators, reducing the incidence of musculoskeletal injuries through better equipment design, and ensuring the safe operation of powered industrial trucks, aligning with evolving safety benchmarks and customer demands for healthier work environments.

The rapid expansion of e-commerce, further fueled by global events, has created an unprecedented demand for sophisticated warehousing and logistics. This societal shift directly translates into a greater need for advanced material handling equipment, such as lift trucks and automated systems, to efficiently manage increased inventory and speed up delivery cycles.

Hyster-Yale is well-positioned to capitalize on this trend, offering essential equipment and integrated solutions that are vital for optimizing e-commerce supply chains. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2024, underscoring the immense scale of operations requiring efficient material handling.

Aging Workforce and Upskilling/Reskilling Needs

The industrial sector, including material handling, is experiencing an aging workforce. For instance, in the US, the median age of manufacturing workers has been steadily increasing, with projections suggesting this trend will continue. This demographic shift, combined with rapid technological advancements like AI and automation, necessitates a proactive approach to employee development.

Hyster-Yale must invest in robust upskilling and reskilling programs. This ensures employees can effectively operate, maintain, and even develop the sophisticated autonomous and digital systems now integral to modern material handling. Failing to address these needs could lead to a skills gap, impacting operational efficiency and the company's ability to innovate.

- Aging Workforce Trend: The average age of workers in industrial sectors is rising, potentially leading to a larger proportion of experienced employees nearing retirement.

- Technology Adoption: The integration of AI, IoT, and robotics in material handling equipment requires new skill sets, moving beyond traditional mechanical expertise.

- Upskilling Investment: Companies like Hyster-Yale need to allocate resources for training to bridge the gap between existing workforce capabilities and future technological demands.

- Industry Transformation: Continuous learning is crucial for Hyster-Yale's workforce to adapt to evolving industry standards and maintain a competitive edge in a technologically dynamic market.

Societal Push for Automation and Efficiency

Societal expectations are increasingly focused on achieving greater productivity and efficiency across all business sectors. This trend directly fuels the demand for automation within material handling, pushing companies to adopt advanced technologies. For instance, the global warehouse automation market was valued at approximately $15 billion in 2023 and is projected to reach over $30 billion by 2028, showcasing a significant growth trajectory driven by this societal push.

Businesses are consequently making substantial investments in areas like robotic warehouse systems, automated guided vehicles (AGVs), and artificial intelligence (AI) for inventory management. These investments are a direct response to the societal pressure for faster, more accurate, and cost-effective operations.

Hyster-Yale Materials Handling, Inc.'s strategic emphasis on developing automation and integrated solutions directly addresses this societal demand. Their product offerings are designed to assist clients in optimizing their workflows and reducing reliance on manual labor, aligning perfectly with the prevailing societal drive for enhanced operational performance.

- Global Warehouse Automation Market Growth: Projected to grow from $15 billion in 2023 to over $30 billion by 2028, reflecting strong societal demand for efficiency.

- Key Automation Technologies: Increased investment in robotic warehouse systems, AGVs, and AI-powered inventory management.

- Hyster-Yale's Alignment: Company's focus on automation and integrated solutions directly meets customer needs for optimized operations and reduced labor dependency.

The increasing demand for e-commerce continues to reshape logistics, driving a need for efficient material handling solutions. This societal shift means Hyster-Yale must provide equipment that supports faster, more accurate inventory management and quicker delivery times to meet consumer expectations. The global e-commerce market's projected growth, reaching over $6.3 trillion in 2024, underscores the scale of operations requiring advanced material handling.

Workplace safety is a paramount concern, with evolving regulations and societal expectations pushing for healthier work environments. Hyster-Yale's products must actively contribute to reducing operator risks, such as heat stress and musculoskeletal injuries, aligning with OSHA's focus on warehouse safety, including their National Emphasis Program active through 2025.

The material handling sector, like many industrial fields, faces a growing challenge with an aging workforce. This demographic trend, coupled with rapid technological advancements, necessitates significant investment in upskilling and reskilling programs to ensure Hyster-Yale's employees can manage sophisticated autonomous and digital systems, preventing a critical skills gap.

Technological factors

The increasing adoption of electric lift trucks is a major technological shift impacting Hyster-Yale. Growing environmental awareness and more stringent emissions standards are pushing the industry towards electric solutions.

Hyster-Yale is actively investing in key electrification technologies such as advanced lithium-ion batteries and versatile charging systems. This strategic focus is already yielding results, with the company reporting an increase in electric truck sales during the first quarter of 2024.

This commitment to electrification is well-timed, as the global market for electric material handling equipment is forecast to reach an impressive $44.7 billion by 2032, presenting a significant growth opportunity for Hyster-Yale.

While Hyster-Yale is increasingly focusing on battery-electric solutions, its Nuvera Fuel Cells division remains committed to advancing hydrogen fuel cell technology, especially for demanding applications such as heavy-duty port equipment. Nuvera's ongoing work in this area positions it to capitalize on the growing demand for zero-emission heavy-duty vehicles.

A significant development in 2024 was Nuvera's selection for U.S. Department of Energy funding, aimed at enhancing the manufacturing processes for next-generation fuel cell stacks. This investment underscores the recognized potential of hydrogen fuel cells to deliver clean energy solutions.

Nuvera is actively demonstrating the versatility of hydrogen power, showcasing mobile generators capable of providing onsite power and supporting electric vehicle charging. This highlights the technology's applicability beyond just vehicle propulsion, offering broader energy infrastructure benefits.

Hyster-Yale Materials Handling, Inc. is actively integrating Artificial Intelligence (AI), the Internet of Things (IoT), and automation to sharpen its operational edge and boost efficiency. These technologies are key to enabling more intelligent decision-making across its material handling solutions.

The broader logistics sector is seeing significant AI growth, with the market projected to hit $18.5 billion by 2025. This surge fuels advancements in areas like predicting demand, managing inventory, and deploying robotic warehouse systems, all of which Hyster-Yale is tapping into.

By investing in these cutting-edge technologies, Hyster-Yale is solidifying its commitment to delivering sophisticated and autonomous material handling capabilities, positioning itself as a leader in this evolving industry.

Development of Modular and Scalable Product Designs

Hyster-Yale is actively developing modular and scalable lift truck designs. This innovation provides enhanced flexibility, allowing the company to adapt quickly to varied customer requirements and shifting operational landscapes. Such an approach enables faster responses to evolving market demands and improves the overall cost-effectiveness for clients.

The company's strategic focus on modularity is evident in its new product lines, specifically engineered to address the growing needs of e-commerce and warehouse automation. This forward-thinking design philosophy has already yielded positive commercial results, contributing to a notable increase in bookings.

- Modular Design Benefits: Hyster-Yale's modular lift trucks allow for easier customization and upgrades, reducing lead times and increasing product lifespan.

- Scalability for Evolving Needs: The scalable nature of these designs ensures that equipment can be adapted as customer operations grow or change, optimizing investment.

- Market Responsiveness: This technological advancement allows Hyster-Yale to more effectively meet the dynamic demands of sectors like e-commerce, which require rapid adaptation.

- Total Cost of Ownership: By enabling quicker adjustments and longer product utility, modularity contributes to a lower total cost of ownership for Hyster-Yale's customers.

Digitalization of Supply Chains and Real-Time Data Analytics

The increasing digitalization of supply chains, bolstered by advanced data analytics and real-time insights, represents a significant technological shift. Hyster-Yale is actively integrating telematics and digital solutions to enhance customer visibility into their operations. This focus aims to optimize fleet management and enable predictive maintenance, thereby fostering more agile and cost-efficient supply chain operations.

These technological advancements are crucial for improving overall efficiency. For instance, by 2024, the global supply chain management market is projected to reach over $30 billion, highlighting the growing importance of digital integration. Hyster-Yale's commitment to these technologies allows them to offer enhanced fleet visibility and predictive maintenance, directly impacting operational cost reduction and efficiency gains for their clients.

- Enhanced Fleet Visibility: Hyster-Yale's telematics provide customers with real-time data on equipment location, usage, and performance.

- Predictive Maintenance: Utilizing data analytics, the company can anticipate equipment failures, reducing downtime and maintenance costs.

- Operational Efficiency: Digital solutions enable better resource allocation and workflow optimization within customer operations.

- Agile Supply Chain Management: Real-time data allows for quicker responses to disruptions and changing demands.

Hyster-Yale is embracing electrification, with electric lift trucks gaining traction due to environmental regulations and customer demand. The company's investment in lithium-ion batteries and charging systems is paying off, as evidenced by increased electric truck sales in Q1 2024. This focus aligns with a projected global electric material handling equipment market growth to $44.7 billion by 2032.

Hydrogen fuel cell technology, particularly through its Nuvera division, is another key area for Hyster-Yale, especially for heavy-duty applications. Nuvera's selection for U.S. Department of Energy funding in 2024 to improve fuel cell stack manufacturing highlights the perceived value of this clean energy solution.

The integration of AI, IoT, and automation is enhancing Hyster-Yale's operational efficiency, mirroring a broader trend where the logistics AI market is expected to reach $18.5 billion by 2025. These technologies are crucial for developing intelligent, autonomous material handling solutions.

Hyster-Yale is also innovating with modular and scalable lift truck designs, improving adaptability and cost-effectiveness for customers. This strategy is particularly beneficial for sectors like e-commerce, contributing to increased bookings.

Digitalization, including telematics and data analytics, is optimizing supply chains and fleet management, with the global supply chain management market projected to exceed $30 billion by 2024. Hyster-Yale's digital solutions offer enhanced visibility and predictive maintenance, leading to cost reductions and efficiency gains.

| Technological Factor | Hyster-Yale's Response/Investment | Market Impact/Opportunity | Key Data Point (2024/2025) |

| Electrification | Investment in lithium-ion batteries, charging systems, electric truck sales growth | Global electric material handling market to reach $44.7B by 2032 | Increased electric truck sales in Q1 2024 |

| Hydrogen Fuel Cells | Nuvera division, DOE funding for fuel cell stack manufacturing | Demand for zero-emission heavy-duty vehicles | DOE funding for next-gen fuel cell stack manufacturing |

| AI, IoT, Automation | Integration for operational edge and efficiency | Logistics AI market projected at $18.5B by 2025 | Enhanced intelligent decision-making |

| Modular & Scalable Design | Development of adaptable lift truck designs | Meeting demands of e-commerce and warehouse automation | Contribution to increased bookings |

| Digitalization & Telematics | Integrating telematics for fleet visibility and predictive maintenance | Global supply chain management market over $30B by 2024 | Improved operational efficiency and cost reduction |

Legal factors

Hyster-Yale's operations and product lines are significantly shaped by global emissions standards and air quality regulations. For instance, the company must adhere to stringent rules like the EPA Tier 4 Final regulations in the United States, as well as comparable directives across Europe.

Meeting these requirements necessitates continuous investment in research and development. This focus is on adapting product designs and manufacturing processes to support low-emission internal combustion engines and the growing electric equipment segment.

The burgeoning global electric forklift market, projected to reach $28.3 billion in 2024, clearly illustrates the industry's widespread adaptation to these environmental mandates. This trend directly benefits companies like Hyster-Yale that are investing in electric solutions.

Hyster-Yale Materials Handling, Inc. must navigate stringent product safety and liability standards, crucial for the safe operation of its extensive range of lift trucks and attachments. These regulations are paramount to preventing accidents and ensuring customer confidence in their equipment.

The Occupational Safety and Health Administration's (OSHA) National Emphasis Program on Warehousing and Distribution, active since July 2024, highlights a heightened focus on safety inspections, particularly concerning powered industrial truck operations. This program underscores the importance of adhering to updated safety protocols.

Failure to comply with these evolving safety mandates can result in significant financial repercussions, including substantial fines and costly litigation. Maintaining a strong safety record is therefore essential for protecting the company's financial health and its reputation within the industry.

As electric lift trucks gain traction, Hyster-Yale Materials Handling, Inc. must navigate evolving legal landscapes concerning battery lifecycle management, including stringent recycling mandates. The global lithium-ion battery recycling market is anticipated to surge to $30.6 billion by 2030, underscoring a significant regulatory push for sustainable battery disposal practices.

Compliance necessitates robust battery recycling programs and a commitment to ethically sourced materials, ensuring adherence to environmental protection laws and extended producer responsibility frameworks.

Trade Laws and Import/Export Regulations

Hyster-Yale Materials Handling, Inc., as a global manufacturer, faces significant implications from international trade laws and import/export regulations. Fluctuations in tariffs and trade policies directly influence its supply chain expenses and its ability to access key markets, impacting overall product competitiveness. For instance, the ongoing trade tensions and evolving tariff structures in major economies like China and the European Union in 2024 continue to present challenges and opportunities for companies with extensive global operations.

The company's commitment to navigating these complex legal frameworks is evident in its proactive compliance with domestic content requirements. Adherence to legislation such as the 'Build America, Buy America' Act is crucial for Hyster-Yale to effectively compete for and secure government contracts, particularly within the United States. This focus on domestic sourcing and manufacturing not only aids in compliance but also strengthens its position in government procurement pipelines.

- Tariff Impact: Global tariffs implemented in 2024, particularly on steel and aluminum, have added an estimated 3-5% to manufacturing costs for equipment producers like Hyster-Yale.

- Market Access: Changes to import quotas or licensing requirements in emerging markets can restrict Hyster-Yale's sales channels, potentially reducing revenue by up to 7% in affected regions.

- Compliance Costs: The administrative and operational costs associated with ensuring compliance with diverse international trade laws can represent 1-2% of a global manufacturer's annual operating expenses.

- Government Contracts: In 2023, government contracts accounted for approximately 15% of Hyster-Yale's total revenue, highlighting the importance of domestic sourcing regulations.

Workplace Health and Safety Legislation

New and updated workplace health and safety legislation, such as the proposed Warehouse Worker Protection Act in the U.S., directly impacts the design and functionality of material handling equipment. OSHA's ongoing emphasis on ergonomic safety, for instance, necessitates that manufacturers like Hyster-Yale ensure their products minimize strain and are adaptable for a diverse workforce. This focus on worker well-being, including protections against heat-related illnesses and adherence to production limits, requires Hyster-Yale to align its equipment and service offerings with these evolving labor standards to facilitate customer compliance.

Hyster-Yale must proactively integrate ergonomic design principles and safety features into its equipment to meet stringent regulatory demands. For example, advancements in powered pallet trucks and forklifts that reduce manual lifting and improve operator posture are crucial. The company's ability to provide solutions that help clients adhere to new safety mandates, potentially including data logging for usage and safety compliance, will be a key differentiator in the 2024-2025 market.

- Ergonomic Design: Incorporating features that reduce physical strain on operators, such as adjustable seating and intuitive controls, is paramount.

- Worker Protection: Equipment must be designed to mitigate risks associated with heat exposure and repetitive motion injuries, aligning with proposed regulatory frameworks.

- Compliance Solutions: Hyster-Yale's offerings should enable customers to easily demonstrate adherence to new workplace safety laws, potentially through integrated safety monitoring systems.

- Workforce Adaptability: Equipment must be suitable for operators of varying physical capabilities, reflecting a broader commitment to inclusivity in the workplace.

Hyster-Yale must continually adapt to evolving environmental regulations, particularly those concerning emissions and battery disposal. The company's investment in electric solutions is a direct response to stringent rules like EPA Tier 4 Final and upcoming European directives, aligning with a global electric forklift market projected to reach $28.3 billion in 2024.

Product safety and liability standards are critical, with initiatives like OSHA's National Emphasis Program on Warehousing and Distribution (active since July 2024) increasing scrutiny on powered industrial truck operations. Non-compliance risks substantial fines and litigation, making safety adherence a key financial and reputational imperative.

Navigating international trade laws and tariffs, such as those impacting steel and aluminum in 2024, directly affects manufacturing costs and market access. For example, tariffs added an estimated 3-5% to production costs for equipment makers, while market access restrictions could reduce regional revenue by up to 7%.

Workplace health and safety legislation, including a focus on ergonomics and worker protection against heat stress, influences equipment design. Hyster-Yale’s ability to offer solutions that aid customer compliance with these evolving labor standards, potentially through integrated safety monitoring, is a key market differentiator.

| Legal Factor | Impact on Hyster-Yale | Supporting Data/Examples (2024-2025) |

|---|---|---|

| Emissions Standards | Requires investment in low-emission and electric technologies. | EPA Tier 4 Final, European directives; electric forklift market expected to reach $28.3B in 2024. |

| Product Safety & Liability | Necessitates adherence to strict operational safety protocols. | OSHA's Warehousing & Distribution NEP (from July 2024) increases inspection focus. |

| Battery Lifecycle Management | Demands robust recycling programs and ethical sourcing. | Global lithium-ion battery recycling market projected to reach $30.6B by 2030. |

| International Trade Laws | Influences supply chain costs and market access. | 2024 tariffs on steel/aluminum added 3-5% to manufacturing costs; market access restrictions can reduce revenue by up to 7%. |

| Workplace Health & Safety | Drives ergonomic design and safety feature integration. | Proposed Warehouse Worker Protection Act, OSHA's focus on heat stress and ergonomics. |

Environmental factors

The material handling sector is witnessing a strong push towards greener, more energy-efficient machinery. This is fueled by heightened environmental awareness and companies aiming to meet their sustainability targets.

Hyster-Yale is well-positioned to capitalize on this trend, as the market for electric forklifts is expanding rapidly, projected to reach $28.3 billion in 2024. The company's focus on electric and low-emission lift trucks directly addresses this growing demand, helping clients lower their environmental impact.

Hyster-Yale Materials Handling, Inc. is actively integrating environmental considerations into its core business strategy, as evidenced by its 2026 Aspirations Program which prioritizes carbon footprint reduction. This commitment translates into tangible investments in cleaner technologies.

The company's focus on electrification and hydrogen fuel cells directly addresses the environmental imperative to lower emissions within material handling. These advanced solutions offer a pathway to significant carbon reductions, moving away from the higher emissions associated with traditional internal combustion engine equipment.

For instance, Hyster-Yale's development of hydrogen fuel cell-powered lift trucks represents a key initiative. These innovative machines are projected to deliver substantial reductions in carbon emissions when compared to their diesel or propane counterparts, aligning with global sustainability targets and customer demands for greener operations.

The shift towards electric lift trucks, while beneficial for reducing operational emissions, brings significant environmental considerations related to battery lifecycles. The production of lithium-ion batteries, a core component of Hyster-Yale's evolving product line, requires mining of materials like lithium and cobalt, which can have substantial environmental footprints. For instance, the International Energy Agency reported in 2024 that global lithium production increased by 15% in 2023 compared to the previous year, highlighting the growing demand and associated environmental pressures.

Hyster-Yale's commitment to electric solutions necessitates a proactive approach to managing the environmental impact of battery usage and eventual disposal. Developing and implementing robust battery recycling programs is crucial to mitigate waste and recover valuable materials, thereby reducing the need for virgin resource extraction. By 2025, the European Union aims to have a recycling rate of at least 70% for lithium-ion batteries, setting a benchmark for responsible end-of-life management that companies like Hyster-Yale will need to align with.

Noise Pollution Reduction

Hyster-Yale Materials Handling, Inc. benefits from the growing emphasis on noise pollution reduction, particularly with its electric lift truck offerings. These electric models are significantly quieter than traditional internal combustion engine (ICE) trucks, which is a major advantage in environments like warehouses where noise levels can impact worker well-being and productivity. For instance, electric forklifts can operate at sound pressure levels as low as 60-70 decibels, a stark contrast to ICE forklifts which can exceed 80-90 decibels. This quiet operation not only improves the workplace but also aligns with corporate sustainability goals and increasing regulatory pressures on noise emissions in urban and industrial areas.

The demand for quieter operations is a key driver for the adoption of electric material handling equipment. Hyster-Yale's electric lift trucks directly address this need, offering a more comfortable and productive work environment. This aligns with broader trends in workplace design and employee health, where reducing noise exposure is seen as a crucial factor in enhancing overall job satisfaction and operational efficiency. The company's focus on electric solutions positions it well to capitalize on this environmental and operational advantage.

Key advantages of Hyster-Yale's electric lift trucks regarding noise pollution reduction include:

- Reduced operational noise: Electric forklifts operate at significantly lower decibel levels compared to ICE alternatives.

- Improved workplace environment: Quieter operation contributes to better employee comfort, focus, and reduced stress.

- Compliance with regulations: Lower noise emissions help businesses meet increasingly stringent environmental and workplace safety standards.

- Enhanced productivity: A less noisy environment can lead to improved communication and reduced errors, boosting overall efficiency.

Climate Change and Supply Chain Resilience

Climate change presents significant risks to Hyster-Yale's global supply chains, with extreme weather events increasingly disrupting logistics and production. For instance, the average cost of natural disasters globally has been on an upward trend, impacting transportation networks and raw material availability. The materials handling industry, in general, is focusing on developing more robust and sustainable supply chains to counter these environmental vulnerabilities.

Hyster-Yale's commitment to enhancing supply chain efficiency and engaging in strategic sourcing directly supports its capacity to manage these evolving environmental challenges. By diversifying suppliers and optimizing inventory management, the company aims to buffer against potential climate-induced disruptions. This proactive approach is crucial for maintaining operational continuity and meeting customer demand amidst a changing climate.

- Increased frequency of extreme weather events: Disruptions to shipping routes and port operations due to hurricanes, floods, and severe storms.

- Rising costs of raw materials: Climate impacts on agriculture and resource extraction can lead to price volatility for key components.

- Regulatory pressures for sustainability: Growing demand for environmentally friendly manufacturing processes and supply chain practices.

- Focus on supply chain diversification: Hyster-Yale's strategy to mitigate risks by not relying on single-source suppliers in climate-vulnerable regions.

The growing global emphasis on sustainability is a significant environmental factor influencing Hyster-Yale. The company's strategic pivot towards electric and low-emission material handling equipment directly addresses this trend, with the global electric forklift market projected to reach $28.3 billion in 2024. Hyster-Yale's 2026 Aspirations Program further underscores this commitment by prioritizing carbon footprint reduction, demonstrating a proactive approach to environmental stewardship.

PESTLE Analysis Data Sources

Our PESTLE analysis for Hyster-Yale Materials Handling, Inc. is built upon a foundation of comprehensive data from leading financial institutions, government regulatory bodies, and reputable industry research firms. We meticulously gather insights on economic indicators, environmental policies, technological advancements, and legal frameworks to ensure a robust assessment.