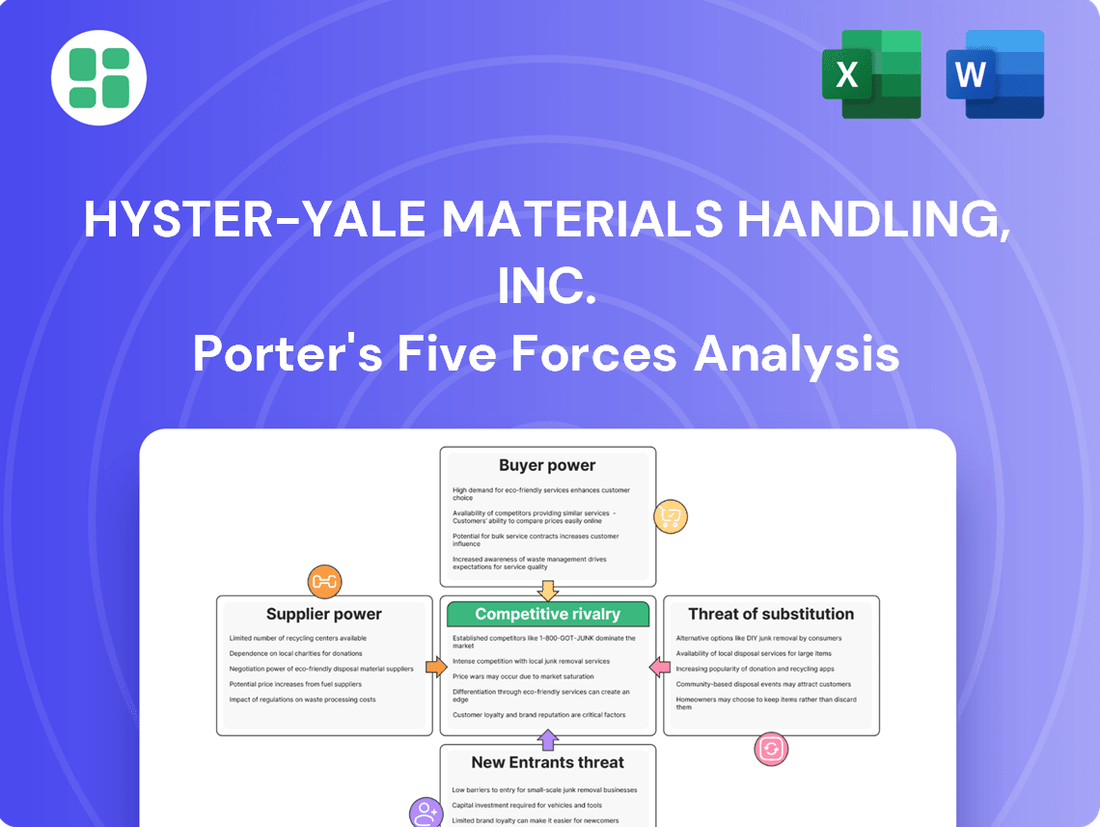

Hyster-Yale Materials Handling, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyster-Yale Materials Handling, Inc. Bundle

Hyster-Yale Materials Handling, Inc. navigates a landscape shaped by moderate buyer power and intense rivalry, with the threat of new entrants posing a significant challenge. The company also contends with the influence of powerful suppliers and the potential disruption from substitute products.

The complete report reveals the real forces shaping Hyster-Yale Materials Handling, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in the material handling industry, where companies like Hyster-Yale depend on various components from engines and hydraulics to steel and advanced electronics. When a few suppliers dominate the market for critical, specialized parts, such as those for emerging hydrogen fuel cell technology, their bargaining power significantly increases. This concentration can limit Hyster-Yale's options and potentially drive up costs for essential inputs.

Hyster-Yale faces substantial bargaining power from suppliers when it comes to highly integrated or proprietary components. The costs associated with switching suppliers for these critical parts can be immense, encompassing redesigning products, retooling manufacturing equipment, and undergoing rigorous re-certification and testing processes. This intricate web of dependencies significantly strengthens the position of existing suppliers, particularly when their components are vital for Hyster-Yale's equipment performance or adherence to industry regulations.

Suppliers who provide unique, patented, or technologically advanced components, like the specialized fuel cell components for Nuvera, possess significant bargaining power. This uniqueness makes it difficult for Hyster-Yale to find readily available substitutes.

Hyster-Yale's strategy to lessen this supplier leverage involves diversifying its supply chain and creating modular products. For instance, in 2023, the company continued investments in its supply chain resilience, aiming to reduce dependence on any single supplier for critical technologies.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into lift truck manufacturing or related equipment could significantly bolster their bargaining power against Hyster-Yale. This is particularly relevant if suppliers of complete sub-systems or cutting-edge technologies perceive an opportunity to capture greater value by moving up the supply chain.

While not a prevalent concern for basic component suppliers, the potential for forward integration by those providing advanced technological solutions or integrated modules presents a tangible risk. Such a move would directly challenge Hyster-Yale's core business, potentially leading to increased input costs or reduced control over product development.

- Supplier Capability: Assess if key suppliers possess the technical expertise, capital, and market access to launch their own lift truck lines.

- Market Incentives: Evaluate if suppliers see higher profit margins or strategic advantages in directly competing with Hyster-Yale rather than supplying it.

- Technological Dependence: Identify critical sub-systems or technologies where Hyster-Yale relies heavily on a few suppliers, increasing the risk of their forward integration.

- Industry Trends: Monitor for any industry shifts or supplier strategies that indicate a move towards vertical integration in the materials handling equipment sector.

Impact of Supplier's Input on Product Quality/Cost

The quality and cost of components sourced by Hyster-Yale Materials Handling, Inc. directly shape the reliability and pricing of its lift trucks. Suppliers of essential parts that influence performance, safety, or overall cost of ownership can wield significant leverage, impacting Hyster-Yale's market standing.

For instance, if a key supplier of advanced hydraulic systems or high-strength steel increases prices significantly, Hyster-Yale may face a difficult choice: absorb the cost, potentially reducing profit margins, or pass it on to customers, risking a loss of price competitiveness. In 2023, the industrial machinery sector, which includes Hyster-Yale, saw input costs rise due to global supply chain disruptions and inflationary pressures, highlighting the sensitivity to supplier pricing.

- Critical Components: Suppliers of engines, transmissions, and advanced control systems hold substantial power due to the direct impact on lift truck functionality and durability.

- Supplier Concentration: A limited number of suppliers for specialized components can increase their bargaining strength.

- Switching Costs: High costs associated with qualifying and integrating new suppliers for critical parts can lock Hyster-Yale into existing relationships, strengthening supplier leverage.

- Impact on Total Cost of Ownership: Suppliers whose inputs affect fuel efficiency, maintenance needs, or lifespan directly influence Hyster-Yale's value proposition to end-users.

Suppliers of specialized components, particularly those related to advanced powertrain technologies like hydrogen fuel cells, exert significant bargaining power over Hyster-Yale. This is due to high switching costs and the critical nature of these inputs for product performance and differentiation.

The concentration of suppliers for essential, high-tech parts, such as sophisticated hydraulic systems or proprietary electronic controls, further amplifies their leverage. This limited supplier base restricts Hyster-Yale's options and can lead to increased input costs, impacting overall profitability and pricing strategies.

Hyster-Yale's efforts to mitigate this power include supply chain diversification and modular product design, as seen in its 2023 investments aimed at reducing reliance on single suppliers for key technologies.

The potential for suppliers of integrated systems or cutting-edge technologies to move into lift truck manufacturing poses a threat, directly challenging Hyster-Yale's market position and potentially increasing input expenses.

| Supplier Factor | Impact on Hyster-Yale | 2023 Context/Example |

|---|---|---|

| Supplier Concentration (Critical Parts) | Increased leverage, potential cost hikes | Limited suppliers for advanced fuel cell components |

| Switching Costs (Proprietary Tech) | Lock-in effect, strengthens supplier position | Redesign, retooling, and recertification for new suppliers |

| Input Quality & Cost Impact | Affects product reliability and pricing | Rising costs for steel and hydraulics due to inflation |

| Forward Integration Threat | Direct competition, reduced control | Suppliers of advanced modules considering own equipment lines |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hyster-Yale Materials Handling, Inc.'s position in the global forklift and material handling equipment market.

Streamline competitive analysis by instantly visualizing Hyster-Yale's Porter's Five Forces, highlighting key strategic pressures for informed decision-making.

Gain a clear, actionable understanding of Hyster-Yale's competitive landscape, transforming complex market dynamics into easily digestible insights.

Customers Bargaining Power

Hyster-Yale caters to a wide array of clients, from major logistics providers to smaller enterprises. Customers making substantial lift truck purchases or managing large fleets, like those in extensive warehouse operations, often wield more influence. This allows them to negotiate for preferential pricing, tailored equipment, or more advantageous contract conditions.

Customer switching costs for Hyster-Yale are a key factor in managing their bargaining power. While the initial forklift purchase is a substantial outlay, the ongoing investments customers make in operator training, specialized maintenance facilities, and ensuring seamless integration with their existing warehouse operations can create moderate to high switching costs. This means that once a fleet is established with Hyster-Yale equipment, moving to a competitor becomes more complex and expensive, thereby strengthening Hyster-Yale's position.

Hyster-Yale effectively combats customer bargaining power through robust product differentiation. Its well-established Hyster and Yale brands carry significant weight, fostering trust and loyalty among buyers. This brand equity allows Hyster-Yale to command premium pricing, as customers perceive greater value and reliability compared to less recognized competitors.

Technological innovation further strengthens Hyster-Yale's position. The company's investment in advanced solutions like Nuvera fuel cells and a wide range of electric options appeals to customers seeking efficiency and sustainability, reducing their reliance on price as the primary purchasing factor. For instance, Hyster-Yale's commitment to electric lift trucks aligns with growing industry demand for reduced emissions, a key differentiator in 2024.

Moreover, comprehensive aftermarket services, including parts, maintenance, and training, create switching costs for customers. This integrated support system enhances customer stickiness, diminishing their ability to negotiate lower prices or demand more favorable terms. The company’s 2023 annual report highlighted continued investment in expanding its service network, reinforcing this customer retention strategy.

Availability of Substitutes for Customers

Customers are increasingly exploring options beyond traditional forklifts, such as automated guided vehicles (AGVs) and advanced warehouse automation systems. This diversification of material handling solutions directly enhances their bargaining power.

The growing adoption of these substitutes, fueled by a desire to mitigate rising labor expenses and boost operational efficiency, presents customers with more alternatives. For instance, the global warehouse automation market was projected to reach over $30 billion in 2024, indicating a significant shift in available solutions.

- Increased Choice: Customers can select from a wider array of material handling technologies, reducing reliance on any single supplier.

- Cost Pressure: The availability of substitutes allows customers to negotiate better pricing with Hyster-Yale, as they can leverage competitive offers.

- Technological Advancements: Innovations in AGVs and robotics offer comparable or superior performance in certain applications, creating viable alternatives.

- Efficiency Demands: As businesses seek to optimize workflows, they may opt for integrated automation solutions that offer end-to-end efficiency, potentially bypassing traditional forklift purchases.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Hyster-Yale. In industries like logistics and manufacturing, where competition is fierce, buyers of standard lift truck models often prioritize cost. This can put pressure on Hyster-Yale's profit margins.

Economic headwinds and the potential impact of tariffs can amplify this price sensitivity. For instance, if tariffs increase the cost of imported components, Hyster-Yale may face difficult choices regarding passing those costs to customers or absorbing them, impacting profitability.

- Customer Price Sensitivity: Buyers in sectors like logistics and manufacturing are highly attuned to price, especially for common lift truck models.

- Economic Impact: Uncertain economic conditions and tariffs can intensify customer focus on price, forcing strategic pricing decisions.

- Competitive Landscape: Hyster-Yale operates in a market where competitors' pricing strategies directly influence customer purchasing behavior.

The bargaining power of Hyster-Yale's customers is influenced by several factors, including their size, the availability of substitutes, and their price sensitivity. Large customers or those managing extensive fleets can negotiate better terms due to their purchasing volume. The increasing availability of alternative material handling solutions, such as automated guided vehicles, also empowers customers by providing more choices and potentially driving down prices.

Customer price sensitivity remains a key consideration, particularly in cost-competitive sectors like logistics and manufacturing. Economic uncertainties and potential tariffs can further amplify this sensitivity, forcing Hyster-Yale to make strategic pricing decisions to remain competitive.

Hyster-Yale mitigates this power through product differentiation, brand loyalty, and a comprehensive suite of aftermarket services that increase switching costs. Their investment in innovative technologies, like electric lift trucks and fuel cell solutions, also appeals to customers seeking efficiency and sustainability, reducing the emphasis on price alone.

| Factor | Impact on Hyster-Yale | Mitigation Strategies |

| Customer Size & Volume | High for large fleet buyers | Volume discounts, tailored solutions |

| Availability of Substitutes | Increasing due to automation | Product innovation, integrated solutions |

| Price Sensitivity | High in certain sectors | Value-based pricing, cost management |

| Switching Costs | Moderate to high (training, maintenance) | Aftermarket services, brand loyalty |

Preview Before You Purchase

Hyster-Yale Materials Handling, Inc. Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces analysis of Hyster-Yale Materials Handling, Inc. you'll receive immediately after purchase—no surprises, no placeholders. It comprehensively details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This document is ready for download and use the moment you buy, offering a thorough understanding of the strategic forces impacting Hyster-Yale.

Rivalry Among Competitors

The global material handling equipment and forklift market is a crowded space, with major players like Toyota Material Handling, KION Group, Crown Equipment, Jungheinrich, and Mitsubishi Logisnext holding significant sway. These established companies, along with numerous smaller regional competitors, create a highly competitive landscape for Hyster-Yale.

In 2023, the global forklift market was valued at approximately $50 billion, with these top companies collectively accounting for a substantial portion of that revenue. This intense competition means Hyster-Yale must constantly innovate and manage costs to maintain its market position.

The material handling equipment market is experiencing robust growth, with projections suggesting a compound annual growth rate (CAGR) of around 6.5% to 7.5% from 2024 through 2030. This expansion, fueled by the surge in e-commerce and increasing adoption of automation, generally offers ample room for multiple competitors. However, short-term shifts in demand and regional economic variations can still lead to heightened competitive pressures among industry players.

Competitors in the materials handling industry actively differentiate their offerings through advanced technology like automation, AI, and IoT integration, alongside a growing emphasis on sustainability via electric and fuel cell solutions. Robust service networks and specialized product lines tailored to specific industry needs also play a crucial role in setting companies apart.

Hyster-Yale Materials Handling, Inc. is strategically enhancing its competitive standing by focusing on modular product designs, which offer greater flexibility and customization for customers. Furthermore, the company's investment in clean energy solutions, notably through its subsidiary Nuvera, positions it to capitalize on the increasing demand for environmentally friendly material handling equipment.

Exit Barriers

The forklift industry, including players like Hyster-Yale, faces substantial exit barriers due to the immense capital required for manufacturing plants, specialized machinery, and established distribution channels. These high fixed costs mean that exiting the market is exceptionally costly, often forcing companies to continue operating and competing even when market conditions are unfavorable, thereby fueling intense rivalry.

These significant investments lock companies into the industry, making it difficult and expensive to divest assets or reallocate capital. For instance, Hyster-Yale's substantial investment in its global manufacturing footprint, which includes facilities in places like Berea, Kentucky, and Craigavon, Northern Ireland, represents a considerable commitment that discourages withdrawal.

- High Capital Investment: The need for specialized manufacturing equipment and extensive R&D in areas like battery technology for electric forklifts creates a high barrier to entry and exit.

- Specialized Assets: Forklift manufacturing involves highly specific machinery and tooling that have limited alternative uses, increasing the cost of exiting.

- Distribution Networks: Building and maintaining a global dealer and service network is a costly, long-term investment that is difficult to recoup upon exit.

- Brand Reputation: Years of building brand trust and a service infrastructure also represent an intangible but significant investment that is hard to abandon.

Strategic Objectives of Competitors

Competitors in the materials handling sector are driven by distinct strategic aims. These often include expanding their market share, achieving technological superiority, and broadening their global footprint to serve a wider customer base. For instance, KION Group has consistently focused on consolidating its market position through strategic acquisitions, aiming to enhance its product portfolio and geographic reach.

The competitive landscape is significantly shaped by the rise of Chinese manufacturers. These companies are increasingly challenging established players through aggressive pricing models and a strong emphasis on developing electrified product lines. This trend is particularly evident in key markets like Europe and North America, where Hyster-Yale also operates.

For example, in 2023, Chinese forklift exports saw substantial growth, with countries like Germany and the United States being major destinations. This influx of competitively priced, often technologically advanced, electric forklifts puts pressure on traditional manufacturers to innovate and maintain their pricing strategies.

- Market Share Ambitions: Competitors aim to capture a larger portion of the global materials handling market, which was valued at approximately $190 billion in 2023.

- Technological Advancement: A key objective is to lead in areas like automation, electrification, and data analytics within warehouse and logistics operations.

- Global Expansion: Companies are actively seeking to establish or strengthen their presence in emerging markets and key developed regions.

- Impact of Chinese Manufacturers: The growing market penetration of Chinese brands, offering advanced electric models at lower price points, is a significant competitive pressure point, especially in Europe and North America.

The competitive rivalry within the material handling equipment sector is intense, characterized by the presence of numerous global and regional players like Toyota Material Handling and KION Group. This vigorous competition necessitates continuous innovation and cost management for Hyster-Yale to maintain its market standing.

The market's growth, projected at a 6.5% to 7.5% CAGR from 2024 to 2030, generally supports multiple competitors, but regional economic shifts can intensify competitive pressures. Differentiation strategies heavily rely on advanced technology, electrification, and robust service networks.

Chinese manufacturers are a growing force, challenging established players with aggressive pricing and a focus on electrified models, particularly impacting markets like Europe and North America where Hyster-Yale operates.

| Key Competitor | 2023 Market Share (Estimated %) | Key Focus Area |

|---|---|---|

| Toyota Material Handling | 15-20% | Broad product range, reliability, automation |

| KION Group | 12-17% | Acquisitions, electrification, digitalization |

| Crown Equipment | 8-12% | Electric forklifts, warehouse solutions, innovation |

| Jungheinrich | 7-10% | Intralogistics, automation, sustainability |

| Mitsubishi Logisnext | 6-9% | Global presence, diverse product lines, electric options |

SSubstitutes Threaten

The threat of substitutes for traditional lift trucks, a core product for Hyster-Yale, arises from alternative material handling methods. These can range from automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) to advanced conveyor systems and overhead crane solutions. For instance, in a large distribution center, a highly integrated conveyor system might handle a significant portion of goods movement, reducing the reliance on forklifts for certain tasks. The increasing sophistication and decreasing cost of these automation technologies present a notable substitute threat, especially for repetitive or high-volume operations.

The increasing sophistication and adoption of automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) present a growing threat of substitution for traditional forklifts. These automated systems are becoming more capable, performing tasks that previously required human operators, directly impacting the demand for Hyster-Yale's core products.

Factors like rising labor costs globally, coupled with the relentless pursuit of operational efficiency, are accelerating the adoption of these robotic alternatives. For instance, in 2024, many warehousing and logistics operations are investing heavily in automation to mitigate labor shortages and improve throughput, directly challenging the market share of human-operated forklifts.

The increasing market adoption of electric and hydrogen fuel cell technology presents a significant substitute threat to Hyster-Yale's traditional internal combustion engine (ICE) lift truck business. This shift is largely propelled by stringent environmental regulations and corporate sustainability mandates globally.

For instance, in 2024, several major economies announced accelerated targets for electrifying industrial equipment fleets, directly impacting demand for ICE alternatives. Hyster-Yale's own expansion into electric and hydrogen offerings acknowledges this trend, but the broader market's embrace of these cleaner power sources could erode the market share of their legacy products.

Changes in Warehouse Design and Logistics

Evolving warehouse designs, such as those prioritizing vertical storage or smaller footprints, directly impact the demand for Hyster-Yale's traditional forklift products. This shift can introduce substitute equipment, like automated guided vehicles (AGVs) or very narrow aisle (VNA) trucks, which may offer greater efficiency in specific, space-constrained environments.

The rise of direct-to-consumer fulfillment models further complicates this. These models often require faster throughput and different material handling approaches, potentially favoring automated picking systems or specialized robots over standard forklifts. For instance, in 2024, the e-commerce logistics sector saw significant investment in automation, with some reports indicating a 15% year-over-year increase in the adoption of robotic solutions in fulfillment centers.

- Reduced Reliance on Traditional Equipment: Warehouse automation and new designs can lessen the need for standard forklifts.

- Emergence of Specialized Substitutes: AGVs, VNAs, and robotic systems offer alternative solutions for material handling.

- Impact of E-commerce: Direct-to-consumer models drive demand for faster, more automated logistics, potentially bypassing traditional equipment.

- Investment in Automation: The logistics industry's increasing investment in automation (e.g., 15% YoY in 2024) highlights the growing threat of substitute technologies.

Outsourcing of Logistics and Third-Party Logistics (3PL)

The growing trend of companies outsourcing logistics to Third-Party Logistics (3PL) providers presents a significant threat of substitutes for traditional material handling equipment manufacturers like Hyster-Yale. As more businesses rely on 3PLs, the purchasing power for logistics infrastructure can consolidate among a few dominant 3PL players.

These large 3PLs, in turn, may invest heavily in advanced, integrated, and automated solutions. These could include robotic systems, automated guided vehicles (AGVs), and sophisticated warehouse management systems that reduce the need for traditional forklift fleets. For instance, the global warehouse automation market was valued at approximately $15 billion in 2023 and is projected to grow substantially, indicating a shift in how goods are handled.

- Consolidation of Purchasing Power: A few major 3PL providers can dictate terms and influence equipment specifications due to their scale.

- Investment in Automation: 3PLs are increasingly adopting automated solutions that can replace manual or semi-automated material handling equipment.

- Shifting Equipment Demand: This trend directly impacts the volume and type of traditional forklift equipment that Hyster-Yale might sell, potentially favoring specialized automation components.

The threat of substitutes for Hyster-Yale's traditional lift trucks is substantial, driven by advancements in automation and evolving logistics strategies. Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are increasingly capable of performing material handling tasks, directly competing with forklifts, especially in high-volume, repetitive operations. For instance, in 2024, the global market for AGVs and AMRs saw significant growth, with many companies investing to improve efficiency and address labor shortages.

Furthermore, the shift towards cleaner energy sources presents another substitute threat, with electric and hydrogen-powered equipment gaining traction over traditional internal combustion engines. This is fueled by environmental regulations and corporate sustainability goals, leading to accelerated adoption of these technologies in industrial fleets. The increasing demand for these alternatives directly impacts the market for legacy forklift models.

The rise of Third-Party Logistics (3PL) providers also contributes to this threat. Large 3PLs often invest in integrated, automated solutions, potentially reducing their reliance on traditional forklift fleets and consolidating purchasing power for specialized automation. This trend is supported by the substantial growth in the warehouse automation market, which was valued at approximately $15 billion in 2023.

| Substitute Technology | Key Drivers | Impact on Hyster-Yale |

|---|---|---|

| AGVs & AMRs | Labor shortages, efficiency gains, automation investment (e.g., 15% YoY in 2024 for robotic solutions in fulfillment centers) | Direct competition for repetitive tasks, potential displacement of traditional forklifts. |

| Electric & Hydrogen Powertrains | Environmental regulations, sustainability mandates, corporate ESG goals | Erosion of market share for ICE-powered lift trucks, necessitates investment in alternative technologies. |

| Outsourced Logistics (3PLs) | Consolidation of purchasing power, investment in advanced integrated solutions | Reduced direct sales volume for traditional equipment, shift towards specialized automation components. |

Entrants Threaten

The material handling equipment industry, especially for lift truck manufacturing, demands significant capital for research and development, state-of-the-art manufacturing plants, and extensive global distribution systems. This substantial upfront investment acts as a formidable barrier, deterring many potential new competitors from entering the market.

Hyster-Yale Materials Handling, Inc. benefits significantly from its established brand recognition, with Hyster® and Yale® being highly respected names in the industry. This strong brand equity, coupled with decades of cultivated relationships with its extensive dealer network and key enterprise clients, presents a formidable barrier to new entrants. For instance, in 2023, Hyster-Yale reported net sales of $3.2 billion, indicating the scale of its operations and customer base that new competitors would need to replicate.

New companies entering the materials handling market would face immense challenges in replicating the trust and loyalty that Hyster-Yale has built over many years. The intricate web of long-term partnerships with dealers, who provide essential sales, service, and support, is not easily duplicated. Furthermore, securing the same level of access and commitment from major industrial customers requires substantial time and investment, hindering the ability of newcomers to gain significant market share quickly.

Hyster-Yale and its rivals hold significant intellectual property, including patents and manufacturing expertise in areas like lift truck design and automation. This proprietary technology, particularly in emerging fields like fuel cell technology through its subsidiary Nuvera, creates a substantial hurdle for newcomers aiming to match existing product performance and innovation.

Access to Distribution Channels

Hyster-Yale's established global distribution and service network, built through independent dealers and direct sales, presents a formidable barrier. Newcomers must invest heavily to replicate this extensive reach, a significant hurdle in penetrating the materials handling market. In 2023, Hyster-Yale reported that its global dealer network played a vital role in its revenue generation, underscoring the importance of this channel.

Building or acquiring a comparable distribution infrastructure requires substantial capital and time, deterring many potential entrants. The costs associated with establishing sales teams, service centers, and parts inventory across diverse geographic regions are immense. This makes it difficult for new players to compete effectively on accessibility and customer support from day one.

- High Capital Investment: New entrants need significant funds to build or acquire a global distribution and service network.

- Time to Market: Establishing such a network takes considerable time, delaying market penetration.

- Customer Support Gap: Without an established network, new entrants struggle to offer the same level of customer service and parts availability.

- Brand Reputation: Hyster-Yale's long-standing presence and dealer relationships build trust, which new entrants lack.

Regulatory Requirements and Safety Standards

The manufacturing and operation of lift trucks face rigorous safety, environmental, and quality regulations worldwide. For instance, in 2024, the European Union continued to emphasize stricter emissions standards for industrial vehicles, pushing for greater electrification, which requires substantial R&D investment. These complex compliance demands, including obtaining certifications like ISO 9001 for quality management, create a significant barrier for newcomers looking to enter the market.

New entrants must navigate a labyrinth of international and regional safety standards, such as OSHA requirements in the United States and similar bodies in other major markets. Meeting these stringent safety protocols, which often involve extensive product testing and design modifications, necessitates considerable capital outlay and specialized engineering knowledge. This high compliance cost can deter potential competitors, making it difficult for them to establish a foothold against established players like Hyster-Yale.

- Regulatory Hurdles: Compliance with global safety standards (e.g., ANSI B56.1 for forklifts) and environmental mandates (e.g., EPA emissions standards) requires significant upfront investment.

- Electrification Mandates: Growing pressure for zero-emission vehicles, particularly in regions like Europe and California, necessitates substantial R&D into battery technology and electric powertrains.

- Quality Certifications: Achieving and maintaining certifications such as ISO 9001 is crucial for market access and demonstrates a commitment to quality, adding to the cost of entry.

- Capital Intensity: The need for advanced manufacturing facilities capable of meeting these standards represents a considerable capital requirement for any new participant.

The threat of new entrants into the material handling equipment industry remains moderate for Hyster-Yale. While the industry demands substantial capital investment for R&D, manufacturing, and distribution, and requires navigating complex regulatory landscapes, established players benefit from strong brand loyalty and extensive dealer networks.

Newcomers face significant hurdles in matching Hyster-Yale's established global distribution and service infrastructure, which is crucial for customer support and parts availability. For example, in 2023, Hyster-Yale's extensive dealer network was a key contributor to its $3.2 billion in net sales, highlighting the challenge of replicating this reach.

Furthermore, proprietary technology and patents, especially in areas like automation and fuel cell technology through its subsidiary Nuvera, create a substantial barrier. Companies must also overcome the high cost of compliance with global safety and environmental regulations, such as the increasing emphasis on electrification in Europe in 2024, which requires significant R&D investment.

The established brand reputation and long-standing customer relationships also act as a deterrent. Building the necessary trust and loyalty, akin to Hyster-Yale's decades of experience, takes considerable time and resources, making it difficult for new entrants to gain immediate market traction.

| Barrier Category | Specific Hurdle | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Establishing global distribution and service networks | Requires immense upfront investment and time, hindering rapid market penetration. |

| Brand & Relationships | Replicating Hyster-Yale's brand equity and dealer/customer loyalty | Difficult to achieve quickly; requires sustained investment in marketing and relationship building. |

| Technology & IP | Matching existing product innovation and manufacturing expertise | Requires significant R&D investment and access to specialized knowledge. |

| Regulatory Compliance | Adhering to safety, environmental, and quality standards | Adds substantial costs and complexity, especially with evolving mandates like electrification. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hyster-Yale Materials Handling, Inc. is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also incorporate insights from industry-specific market research reports and trade publications to capture competitive dynamics and market trends.