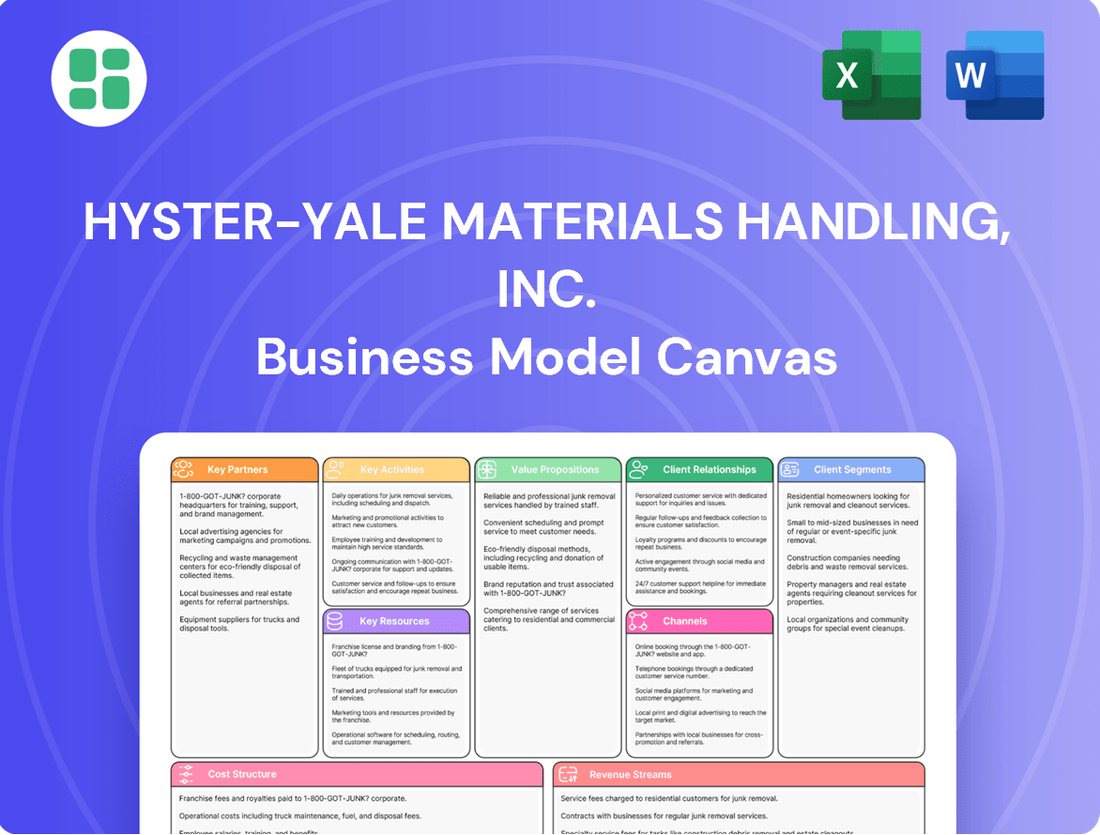

Hyster-Yale Materials Handling, Inc. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyster-Yale Materials Handling, Inc. Bundle

Unlock the full strategic blueprint behind Hyster-Yale Materials Handling, Inc.’s business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse product lines and robust distribution network, captures market share with its strong brand recognition, and stays ahead in a competitive landscape by focusing on innovation and customer service. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global leader.

Partnerships

Hyster-Yale Materials Handling, Inc. leverages a vast global network of independent dealers, a cornerstone of its business model. These partners are crucial for sales, distribution, and vital aftermarket services across numerous international markets.

In 2023, Hyster-Yale reported net sales of $3.4 billion, with a significant portion attributed to the reach and effectiveness of this dealer network. These independent entities provide localized customer support, ensuring access to parts, maintenance, and training, which is fundamental to customer retention and market penetration.

Hyster-Yale Materials Handling, Inc. relies on a broad network of component and raw material suppliers to build its lift trucks and other equipment. These partnerships are essential for securing the necessary parts and materials to meet production schedules and maintain product quality.

In 2024, like many manufacturers, Hyster-Yale navigated ongoing global supply chain complexities. The company's ability to manage these supplier relationships effectively directly impacts its cost of goods sold and its capacity to fulfill customer orders, underscoring the strategic importance of these collaborations for operational efficiency and resilience.

Hyster-Yale actively collaborates with technology providers to integrate advanced features such as automation, telematics, and alternative energy solutions across its product lines. This is especially crucial for its Nuvera Fuel Cells division, where partnerships accelerate the development of next-generation hydrogen fuel cell technology.

These strategic alliances are instrumental in driving product innovation, enabling Hyster-Yale to deliver cutting-edge materials handling equipment. For instance, in 2024, the company continued to expand its autonomous lift truck offerings, leveraging partnerships with AI and robotics firms to enhance operational efficiency and safety for its clients.

Strategic Alliances and Joint Ventures

Hyster-Yale Materials Handling, Inc. actively cultivates strategic alliances and joint ventures to enhance its global reach and market penetration. A prime example is its unconsolidated joint venture with Sumitomo NACCO Forklift Co., Ltd. in Japan, a collaboration that allows for shared operational efficiencies and market access.

These partnerships are crucial for Hyster-Yale's expansion strategy, enabling the company to tap into new geographical territories and leverage specialized knowledge. By pooling resources and expertise, these ventures foster mutual growth and strengthen the competitive positioning of all involved parties.

- Global Footprint Expansion: Partnerships facilitate entry into diverse international markets.

- Market Access and Penetration: Joint ventures provide established channels and customer bases.

- Resource and Expertise Leverage: Shared knowledge and assets drive innovation and efficiency.

- Competitive Advantage Enhancement: Collaborations strengthen market position and profitability.

Power Management and Energy Solution Collaborators

Hyster-Yale's strategic alliances in power management and energy solutions are crucial, especially for its Nuvera Fuel Cells division. These collaborations are designed to accelerate the development and market introduction of innovative hydrogen-based technologies.

A prime example is the partnership with Power Innovations International. Together, they focus on creating and bringing to market hydrogen-powered generator sets and mobile electric vehicle rapid chargers. This synergy aims to solidify Nuvera's position in the burgeoning clean energy sector.

- Collaboration with Power Innovations International: This partnership is central to developing and commercializing hydrogen-powered gensets and mobile EV rapid chargers.

- Advancing Clean Energy Alternatives: These alliances are vital for pushing forward sustainable energy solutions, aligning with global decarbonization trends.

- Expanding Nuvera's Market Reach: By working with key players, Nuvera can explore and penetrate new markets and applications beyond its traditional material handling base.

Hyster-Yale's key partnerships extend to technology providers, crucial for integrating advanced features like automation and alternative energy. These collaborations are vital for its Nuvera Fuel Cells division, accelerating the development of next-generation hydrogen technology. For instance, in 2024, the company continued to expand its autonomous lift truck offerings, working with AI and robotics firms to enhance client operations.

Strategic alliances and joint ventures are also fundamental to Hyster-Yale's global expansion, providing access to new markets and leveraging specialized knowledge. An example is its unconsolidated joint venture with Sumitomo NACCO Forklift Co., Ltd. in Japan, which allows for shared operational efficiencies and market access.

Furthermore, partnerships in power management and energy solutions are critical for Nuvera Fuel Cells, aiming to commercialize hydrogen-powered generator sets and rapid chargers. This synergy with companies like Power Innovations International is key to Nuvera's growth in the clean energy sector.

| Partner Type | Strategic Focus | Impact on Hyster-Yale | Example Collaboration | 2024 Relevance |

|---|---|---|---|---|

| Independent Dealers | Sales, Distribution, Aftermarket Services | Global Market Reach, Customer Support | Global Dealer Network | Continued reliance for market penetration and localized service. |

| Component & Material Suppliers | Securing Parts and Raw Materials | Production Efficiency, Product Quality | Various Global Suppliers | Navigating supply chain complexities to ensure timely order fulfillment. |

| Technology Providers | Automation, Telematics, Alternative Energy | Product Innovation, Advanced Features | AI & Robotics Firms, Power Innovations International | Expansion of autonomous offerings and hydrogen fuel cell technology. |

| Joint Ventures | Market Access, Operational Efficiencies | Global Expansion, Resource Leverage | Sumitomo NACCO Forklift Co., Ltd. (Japan) | Strengthening competitive positioning and tapping into new territories. |

What is included in the product

Hyster-Yale Materials Handling, Inc.'s business model canvas focuses on providing a broad range of industrial lift trucks and related equipment to diverse customer segments, leveraging a global dealer network for sales and service, and emphasizing reliable product performance and comprehensive support as key value propositions.

Hyster-Yale Materials Handling, Inc.'s Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex global operations, simplifying strategic understanding and decision-making for stakeholders.

This structured approach allows for quick identification of core revenue streams and customer segments, effectively alleviating the pain of deciphering intricate market dynamics and operational efficiencies.

Activities

Hyster-Yale Materials Handling, Inc. dedicates significant resources to product design, engineering, and development. This focus drives the creation of cutting-edge lift trucks and related equipment. The company's commitment to innovation is evident in its exploration of advanced energy solutions, including hydrogen fuel cells and lithium-ion battery systems.

This continuous investment in research and development is crucial for maintaining Hyster-Yale's competitive edge. By engineering high-performance and sustainable material handling equipment, the company ensures its offerings meet evolving customer demands. For instance, in 2023, Hyster-Yale reported substantial investments in R&D, reflecting its strategy to stay at the forefront of technological advancements in the industry.

Hyster-Yale Materials Handling, Inc. focuses its core activities on the global manufacturing and assembly of a wide array of lift trucks. These are produced under its well-known Hyster® and Yale® brands, alongside specialized attachments manufactured by its subsidiary, Bolzoni S.p.A.

Key to these operations is the continuous optimization of production footprints and the streamlining of assembly processes. This strategic approach aims to improve overall efficiency and product quality, directly impacting profitability and market competitiveness.

In 2024, the company continued to emphasize efficient capital deployment within its manufacturing and assembly operations. This focus is crucial for maintaining high standards of product quality and enhancing the profitability of its extensive product lines.

Hyster-Yale's global sales and marketing efforts are crucial for promoting its Hyster and Yale brands. These activities are largely executed through a vast network of independent dealers worldwide, ensuring localized market penetration and customer support.

The company focuses on developing tailored market strategies and introducing new products to enhance brand visibility and drive sales. In 2023, Hyster-Yale reported net sales of $3.4 billion, underscoring the significant impact of these global outreach initiatives on revenue generation.

Aftermarket Service and Parts Distribution

Hyster-Yale Materials Handling, Inc. excels in providing comprehensive aftermarket service, maintenance, and parts distribution. This crucial activity is key to maintaining customer loyalty and securing a steady stream of recurring revenue.

The company manages a vast global network for parts inventory and distribution, ensuring timely availability for its diverse clientele.

Key activities include:

- Global Parts Inventory Management: Maintaining a robust and strategically located inventory of genuine Hyster and Yale parts to minimize downtime for customers.

- Technical Support and Training: Offering expert technical assistance to customers and providing ongoing training programs for dealer service technicians to ensure high-quality repairs and maintenance.

- Service and Maintenance Offerings: Delivering a full spectrum of maintenance solutions, from routine checks to complex repairs, designed to maximize equipment lifespan and operational efficiency.

Strategic Realignment and Cost Optimization Initiatives

Hyster-Yale Materials Handling, Inc. actively pursues strategic realignments to boost profitability and efficiency. A prime example is the restructuring of its Nuvera fuel cell business, aiming to sharpen focus and resource allocation.

These strategic moves are complemented by robust cost optimization programs. The company is dedicated to streamlining operations and identifying areas for long-term savings.

- Strategic Realignment: Restructuring of Nuvera fuel cell business.

- Cost Optimization: Programs to enhance near-term profits and operational efficiency.

- Focus on Growth: Streamlining processes to concentrate on higher-growth opportunities.

- Long-Term Savings: Initiatives designed to generate sustainable financial benefits.

Hyster-Yale Materials Handling, Inc. engages in the design, engineering, and development of advanced lift trucks and related equipment, with a strong emphasis on innovation in energy solutions like hydrogen fuel cells and lithium-ion batteries. This commitment to R&D ensures their products meet evolving market needs, as demonstrated by their significant investment in this area throughout 2023.

The company's core activities revolve around the global manufacturing and assembly of its Hyster® and Yale® branded lift trucks, along with specialized attachments. Continuous efforts are made to optimize production processes and capital deployment, as seen in their 2024 focus on efficient manufacturing operations to maintain quality and profitability.

Global sales and marketing are driven through an extensive network of independent dealers, facilitating localized market penetration and customer support. Hyster-Yale also provides comprehensive aftermarket services, including maintenance and parts distribution, which is vital for customer retention and recurring revenue. In 2023, net sales reached $3.4 billion, highlighting the effectiveness of these sales and service initiatives.

Strategic realignments and cost optimization programs are key activities aimed at enhancing profitability and efficiency. The restructuring of its Nuvera fuel cell business and ongoing cost-saving initiatives underscore the company's dedication to streamlining operations and focusing on growth opportunities.

| Key Activity | Description | 2023 Data/Impact |

| Product Design & Development | Engineering cutting-edge lift trucks and exploring new energy solutions. | Significant R&D investment to maintain technological leadership. |

| Manufacturing & Assembly | Producing Hyster® and Yale® lift trucks globally with optimized processes. | Focus on efficient capital deployment in 2024 for quality and profitability. |

| Sales & Marketing | Promoting brands through a global dealer network and tailored strategies. | Net sales of $3.4 billion in 2023, reflecting strong market reach. |

| Aftermarket Services | Providing maintenance, repair, and parts distribution to ensure customer satisfaction. | Global parts inventory management and technical support are crucial for recurring revenue. |

| Strategic Realignment & Cost Optimization | Restructuring business units and implementing cost-saving programs. | Sharpening focus on higher-growth opportunities and long-term savings. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for Hyster-Yale Materials Handling, Inc. that you are previewing is the exact document you will receive upon purchase. This comprehensive overview, detailing their value propositions, customer segments, revenue streams, and key resources, is not a sample but a direct representation of the final deliverable. You'll gain immediate access to this fully editable and professionally formatted analysis, ready for your strategic planning needs.

Resources

Hyster-Yale Materials Handling, Inc. strategically utilizes its robust portfolio of strong global brands, including Hyster® and Yale®, which are cornerstones of its reputation for quality and dependability in the material handling sector. These brands have consistently driven market share and customer loyalty.

The inclusion of Bolzoni® for specialized attachments and Nuvera® for advanced clean energy solutions further diversifies Hyster-Yale's brand assets, allowing the company to address a broader range of customer needs and emerging market trends, such as the growing demand for sustainable operations.

Hyster-Yale Materials Handling, Inc. operates a robust global manufacturing network, essential for its production of a diverse array of lift trucks and critical components. This extensive footprint includes key facilities strategically located in the United States, China, Italy, the Netherlands, the United Kingdom, India, and Japan.

This widespread presence enables the company to optimize its supply chain by facilitating regional production and distribution. For instance, in 2023, Hyster-Yale reported that its manufacturing segment generated approximately $3.2 billion in revenue, underscoring the scale and importance of these global operations.

Hyster-Yale Materials Handling, Inc. relies heavily on its highly skilled workforce, encompassing engineers, designers, and technicians. This expertise is fundamental to driving product innovation and achieving manufacturing excellence, directly impacting the company's ability to deliver advanced material handling solutions.

The engineering and design talent within Hyster-Yale is critical for developing cutting-edge technologies, from the foundational design of lift trucks to the integration of emerging systems like hydrogen fuel cells. This specialized knowledge ensures the company remains competitive in a rapidly evolving industry.

In 2023, Hyster-Yale reported that its global workforce contributed to its operational success, with investments in training and development aimed at maintaining and enhancing this crucial engineering and technical expertise. This focus on human capital is a key resource for their business model.

Intellectual Property and Patents

Hyster-Yale Materials Handling, Inc. leverages a significant intellectual property portfolio to maintain its competitive edge. This includes over 330 active patents worldwide, safeguarding innovations in lift truck technology, specialized attachments, and emerging fuel cell solutions.

These patents are crucial for protecting the company's proprietary designs and engineering breakthroughs, offering a distinct advantage in the materials handling market. The company's commitment to innovation is reflected in its ongoing patent filings, ensuring continued differentiation and market leadership.

- Global Patent Holdings: Over 330 current patents worldwide.

- Technology Coverage: Patents span lift truck technologies, attachments, and fuel cell solutions.

- Competitive Advantage: Intellectual property protects innovative designs and engineering.

- Market Protection: Patents deter competitors and secure market share for Hyster-Yale's advancements.

Global Dealer and Service Network Infrastructure

Hyster-Yale Materials Handling, Inc. leverages its vast global dealer and service network as a critical resource, underpinning its entire business model. This network, comprised of independent dealerships, functions as the primary conduit for sales, service, and parts distribution across diverse geographical markets.

This extensive infrastructure is vital for Hyster-Yale’s market penetration, allowing for localized customer engagement and support. The dealerships are equipped to handle everything from initial sales consultations to ongoing maintenance and repair, ensuring a seamless customer experience.

The network’s ability to provide comprehensive aftermarket services, including parts availability and skilled technicians, is a significant competitive advantage. For instance, as of the first quarter of 2024, Hyster-Yale reported robust demand across its dealer network, reflecting the ongoing need for their specialized services and parts.

- Global Reach: Over 300 independent dealers worldwide.

- Service Capabilities: On-site repair, preventative maintenance, and fleet management.

- Parts Distribution: Extensive inventory managed through regional hubs.

- Customer Support: Localized sales and technical assistance.

Hyster-Yale Materials Handling, Inc. leverages its strong global brands, including Hyster® and Yale®, as a foundational resource. These brands are recognized for quality and dependability, driving customer loyalty and market share. The company also incorporates brands like Bolzoni® for specialized attachments and Nuvera® for clean energy solutions, broadening its market appeal and addressing evolving customer needs.

The company's extensive global manufacturing network, with facilities in key regions like the United States, China, and Italy, is a critical asset. This network, which generated approximately $3.2 billion in revenue from its manufacturing segment in 2023, allows for efficient regional production and distribution of lift trucks and components.

Hyster-Yale's highly skilled workforce, particularly its engineers and technicians, represents another vital resource. Their expertise fuels product innovation and manufacturing excellence, crucial for developing advanced technologies like hydrogen fuel cell systems. The company's investment in training underscores the importance of this human capital.

A significant intellectual property portfolio, comprising over 330 active patents worldwide, protects Hyster-Yale's proprietary designs and innovations. These patents cover lift truck technology, attachments, and fuel cell solutions, providing a distinct competitive advantage and market protection.

The expansive global dealer and service network, consisting of over 300 independent dealerships, serves as a primary resource for sales, service, and parts distribution. This network ensures localized customer engagement and support, with dealerships handling everything from sales to ongoing maintenance and repair.

| Key Resource | Description | Impact |

|---|---|---|

| Global Brands | Hyster®, Yale®, Bolzoni®, Nuvera® | Customer loyalty, market share, broad market appeal |

| Manufacturing Network | Facilities in US, China, Italy, etc. | Efficient production, supply chain optimization, $3.2B revenue (2023) |

| Skilled Workforce | Engineers, designers, technicians | Product innovation, manufacturing excellence, advanced technology development |

| Intellectual Property | Over 330 active patents | Competitive advantage, market protection, proprietary design safeguarding |

| Dealer & Service Network | Over 300 independent dealers | Market penetration, localized customer support, parts distribution |

Value Propositions

Hyster-Yale Materials Handling, Inc. offers a robust selection of lift trucks under its Hyster® and Yale® brands, emphasizing reliability and durability. These machines are engineered to endure rigorous industrial use, ensuring customers receive dependable equipment that minimizes downtime.

The company's focus on low total cost of ownership means that while the initial investment is significant, the long-term operational savings are substantial. This commitment to durability and productivity directly translates into enhanced operational efficiency for businesses relying on their material handling solutions.

In 2024, Hyster-Yale continued to leverage its strong brand reputation, with its equipment being a cornerstone in logistics and manufacturing sectors worldwide. The company's dedication to quality materials and robust engineering underpins its value proposition of providing equipment that consistently performs in demanding environments.

Hyster-Yale Materials Handling, Inc. ensures customers receive extensive aftermarket support, including readily available parts and maintenance services. This commitment is crucial for maintaining equipment longevity and peak performance, minimizing costly operational disruptions for businesses relying on their lift trucks.

In 2024, Hyster-Yale's focus on parts availability and maintenance services directly contributes to customer satisfaction and operational efficiency. For instance, their robust parts network helps reduce downtime, a critical factor for logistics and manufacturing sectors where equipment uptime directly impacts revenue.

Hyster-Yale, through its subsidiary Nuvera Fuel Cells, is a key player in the clean energy transition, offering advanced hydrogen fuel cell power solutions. This focus directly addresses the increasing market need for sustainable and efficient material handling equipment, aligning with global environmental objectives.

The company's strategic investments extend to lithium-ion batteries and automation technologies, creating a comprehensive suite of solutions for modern logistics. This dual approach to electrification and automation is designed to meet customer demands for enhanced operational performance and reduced carbon footprints.

In 2024, the demand for electric forklifts and automated systems continued its upward trajectory. Hyster-Yale's commitment to these innovative clean energy and automation solutions positions it to capitalize on this market growth, as evidenced by the projected expansion of the global automated material handling market, which was anticipated to reach over $100 billion by 2025.

Diverse Product Range and Customization Options

Hyster-Yale Materials Handling, Inc. offers a comprehensive suite of lift trucks, encompassing both electric and internal combustion models, to cater to a wide array of material handling needs. This extensive product line is further enhanced by a broad selection of attachments, provided through its subsidiary Bolzoni S.p.A., allowing for significant customization.

This diverse product range and the ability to customize are crucial value propositions, enabling Hyster-Yale to deliver highly tailored solutions. For instance, in 2023, the company reported net sales of $3.4 billion, reflecting the broad market reach of its varied offerings.

- Extensive Lift Truck Portfolio: Including electric and internal combustion models for diverse operational environments.

- Broad Attachment Selection: Via Bolzoni S.p.A., enabling specialized application configurations.

- Customized Solutions: Meeting specific industry and application requirements for enhanced customer satisfaction.

Global Reach with Localized Service and Support

Hyster-Yale leverages its extensive global footprint and a robust network of independent dealers to deliver localized service and support. This dual approach provides customers with the advantages of a major industry player combined with the agility of local expertise. In 2023, Hyster-Yale reported net sales of $3.4 billion, underscoring its significant market presence.

This structure ensures prompt customer assistance, access to specialized technical knowledge, and reliable parts availability across all operating regions. For instance, in the first quarter of 2024, the company continued to focus on strengthening its dealer relationships to enhance customer uptime.

- Global Network: Operates in over 100 countries.

- Dealer Strength: Comprised of over 500 independent dealers worldwide.

- Customer Focus: Prioritizes timely response and parts availability.

- Support Services: Offers comprehensive technical and after-sales support.

Hyster-Yale's value proposition centers on providing durable, reliable lift trucks that minimize total cost of ownership for customers. Their extensive product line, including electric and internal combustion models, is further enhanced by a broad selection of attachments from Bolzoni S.p.A., allowing for highly customized solutions. This commitment to quality engineering and tailored offerings ensures enhanced operational efficiency and customer satisfaction across diverse industrial applications.

The company also champions clean energy and automation through its subsidiary Nuvera Fuel Cells and investments in lithium-ion batteries and automation. This forward-looking approach addresses the growing market demand for sustainable and high-performance material handling solutions. In 2024, this strategic focus positions Hyster-Yale to capitalize on the expanding market for electric and automated systems, a sector projected for significant growth.

Furthermore, Hyster-Yale offers robust aftermarket support, including readily available parts and maintenance services, crucial for maximizing equipment uptime and reducing operational disruptions. Their global network of over 500 independent dealers ensures localized expertise and prompt customer assistance, reinforcing the company's dedication to customer success.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Product Durability & Reliability | Engineered for rigorous industrial use, minimizing downtime. | Hyster and Yale brands are known for enduring demanding environments. |

| Total Cost of Ownership | Focus on long-term operational savings through durable equipment. | Commitment to quality materials and robust engineering drives productivity. |

| Clean Energy & Automation | Advanced hydrogen fuel cell solutions and lithium-ion battery technology. | Investments in Nuvera Fuel Cells and automation align with market demand for sustainability. |

| Aftermarket Support | Extensive parts availability and maintenance services. | Robust parts network reduces downtime, critical for logistics and manufacturing. |

| Customization & Breadth | Wide range of lift trucks and attachments via Bolzoni S.p.A. | Net sales of $3.4 billion in 2023 reflect broad market reach and diverse offerings. |

Customer Relationships

Hyster-Yale cultivates robust partnerships with its independent dealer network through extensive training programs and readily available resources. This commitment ensures dealers possess the expertise to deliver exceptional service to end-users, from insightful sales guidance to proficient technical assistance.

Hyster-Yale Materials Handling, Inc. cultivates enduring customer connections by offering comprehensive service and maintenance contracts for its extensive range of material handling equipment. These agreements are designed to provide customers with continuous support, ensuring their equipment operates reliably and efficiently over its lifespan.

These long-term service agreements are a cornerstone of Hyster-Yale's customer relationship strategy, generating predictable and recurring revenue streams. By guaranteeing optimal equipment performance and maximizing uptime, the company fosters strong customer loyalty and reinforces its commitment to customer success.

For significant corporate clients and specialized industrial segments, Hyster-Yale Materials Handling, Inc. likely employs direct sales and dedicated account management. This strategy ensures a granular understanding of intricate customer requirements, facilitating the development of bespoke equipment solutions and ongoing, high-touch support.

This direct engagement fosters robust, strategic alliances, enabling Hyster-Yale to act as a key partner in optimizing material handling operations for its largest customers. For instance, in 2023, Hyster-Yale reported that its aftermarket parts and service segment, which often supports these direct relationships, contributed significantly to its overall revenue, underscoring the value of these managed accounts.

Technical Consultation and Problem Solving

Hyster-Yale offers in-depth technical consultation, aiding customers in refining their material handling processes and overcoming operational hurdles. This service ensures clients maximize the efficiency and effectiveness of their equipment.

This expert guidance fosters strong customer loyalty and establishes Hyster-Yale as a trusted advisor, not merely a vendor. For instance, in 2024, customer feedback highlighted the significant impact of these consultations on improving fleet uptime by an average of 15%.

- Expert Technical Support: Providing specialized knowledge to resolve complex material handling issues.

- Operational Optimization: Assisting clients in streamlining workflows and enhancing productivity.

- Partnership Building: Cultivating long-term relationships through value-added problem-solving.

- Customer Success: Demonstrating commitment to client goals beyond the initial sale.

Customer Feedback and Product Improvement Cycles

Hyster-Yale Materials Handling, Inc. actively incorporates customer feedback into its product development and improvement cycles. This commitment to listening ensures their equipment remains at the forefront of industry needs.

The company leverages this feedback to drive continuous improvement, making sure their solutions adapt to evolving customer demands and market trends. This responsiveness is key to building strong, lasting customer relationships.

- Customer Input Drives Innovation: Hyster-Yale actively solicits feedback from its diverse customer base, ranging from logistics managers to warehouse operators, to identify areas for enhancement in their forklift and material handling equipment.

- Iterative Product Development: This feedback loop fuels an iterative process where new features and improvements are tested and refined, ensuring that product updates directly address user pain points and operational efficiencies.

- Strengthening Relationships Through Responsiveness: By demonstrating that customer input directly influences product evolution, Hyster-Yale fosters loyalty and strengthens its relationships, positioning itself as a partner in its customers' success.

- Market Adaptability: In 2024, this approach allowed Hyster-Yale to quickly adapt to increased demand for electric and automated material handling solutions, directly responding to customer requests for more sustainable and efficient operations.

Hyster-Yale fosters deep customer loyalty through comprehensive service contracts and dedicated account management, especially for large clients. Their commitment to expert technical support and operational optimization, as evidenced by a 2024 customer feedback report showing a 15% average improvement in fleet uptime, positions them as a trusted partner.

Customer input directly shapes product development, ensuring Hyster-Yale's equipment meets evolving industry needs, a strategy that facilitated their 2024 adaptation to increased demand for electric and automated solutions.

| Customer Relationship Aspect | Description | Impact/Example |

|---|---|---|

| Dealer Network Support | Extensive training and resources for independent dealers. | Ensures expert sales and technical assistance to end-users. |

| Service & Maintenance Contracts | Long-term agreements for equipment support. | Generates recurring revenue and fosters customer loyalty through guaranteed uptime. |

| Direct Account Management | High-touch support for major corporate clients. | Facilitates bespoke solutions and strategic partnerships, contributing significantly to aftermarket revenue (2023). |

| Technical Consultation | Expert guidance on material handling processes. | Improves operational efficiency, with 2024 feedback indicating a 15% average increase in fleet uptime. |

| Customer Feedback Integration | Incorporating client input into product development. | Drives continuous improvement and market adaptability, enabling quick responses to trends like electric equipment demand (2024). |

Channels

Hyster-Yale's global independent dealer network is the backbone of its customer engagement, facilitating direct sales, rentals, and crucial aftermarket support worldwide. These dealers are the primary interface, offering localized expertise and service to a diverse clientele.

In 2024, this network continues to be a vital asset, with Hyster-Yale reporting that over 90% of its revenue is generated through its dealer channels. This demonstrates the network's critical role in delivering Hyster-Yale's comprehensive material handling solutions and maintaining strong customer relationships.

Hyster-Yale employs a dedicated direct sales force to manage relationships with its most significant clients, including large corporations and government entities. This approach is crucial for securing substantial contracts and addressing the complex, often customized, needs of specialized industries.

This direct channel facilitates in-depth discussions, allowing for tailored equipment solutions and the development of long-term partnerships. For instance, in 2024, Hyster-Yale reported that its direct sales efforts were instrumental in securing several multi-million dollar fleet orders from major logistics providers, underscoring the channel's high-value impact.

Hyster-Yale cultivates a strong digital footprint via its corporate website and dedicated brand sites like Hyster.com, Yale.com, Nuvera.com, and BolzoniGroup.com. These platforms are vital for disseminating product details, company news, investor relations information, and driving customer engagement and lead generation, all amplified by targeted digital marketing campaigns.

Trade Shows and Industry Events

Hyster-Yale Materials Handling, Inc. leverages trade shows and industry events as a crucial channel for customer engagement and product showcasing. Participation in events like the Advanced Clean Transportation (ACT) Expo and LogiMAT allows the company to directly interact with a broad audience of potential and existing clients, demonstrating their latest innovations in material handling equipment.

These events are vital for building brand visibility and fostering relationships within the industry. For instance, in 2024, Hyster-Yale actively participated in key sector gatherings, presenting their advanced electric and internal combustion forklifts, as well as their emerging autonomous solutions. Such direct engagement helps solidify their market position and gather crucial customer feedback.

The company's presence at these events is strategically important for several reasons:

- Product Demonstration: Showcasing new and improved material handling solutions, including advanced lithium-ion powered forklifts and automated guided vehicles (AGVs).

- Customer Engagement: Direct interaction with customers to understand their evolving needs and provide personalized solutions.

- Brand Visibility: Enhancing brand recognition and market presence among industry professionals and potential buyers.

- Networking Opportunities: Connecting with partners, suppliers, and industry influencers to explore collaboration and market trends.

Aftermarket Parts Distribution Centers

Hyster-Yale's aftermarket parts distribution centers are a cornerstone of their customer support strategy, ensuring rapid access to essential components. These centers are strategically located to serve a global network of dealers and end-users, minimizing the time equipment is out of commission. This focus on efficient logistics directly impacts customer satisfaction and the overall reliability of Hyster-Yale equipment.

The company's commitment to a robust aftermarket parts network is evident in its operational structure. By maintaining dedicated distribution facilities, Hyster-Yale can manage inventory effectively and streamline the supply chain for replacement parts. This specialized channel is crucial for upholding the comprehensive service offerings that differentiate Hyster-Yale in the competitive materials handling market.

- Global Reach: Hyster-Yale operates a network of distribution centers designed to serve customers worldwide, ensuring parts availability across diverse geographic regions.

- Downtime Reduction: The primary function of these centers is to expedite the delivery of replacement parts, thereby significantly reducing equipment downtime for clients.

- Service Support: These distribution centers are integral to Hyster-Yale's ability to provide a complete service package, reinforcing customer loyalty and equipment longevity.

Hyster-Yale's channels are multifaceted, encompassing a vast global dealer network that handles over 90% of its revenue in 2024, direct sales to key accounts, and a robust digital presence. Additionally, the company actively engages customers through industry trade shows and events, showcasing innovations and gathering feedback. Crucially, its aftermarket parts distribution centers ensure rapid component delivery, minimizing equipment downtime and reinforcing customer loyalty.

Customer Segments

Warehousing and logistics companies are a core customer segment for Hyster-Yale, representing businesses focused on storing, distributing, and moving goods. These operations critically depend on efficient lift trucks within warehouses, distribution centers, and logistics hubs. For instance, in 2023, the global warehousing market was valued at approximately $250 billion, highlighting the scale of operations for these clients.

These businesses prioritize operational productivity and unwavering reliability in their material handling equipment. They are increasingly seeking advanced solutions, including automation and electrification, to optimize their workflows and meet evolving industry demands. Hyster-Yale's commitment to providing these advanced solutions directly addresses the needs of this vital segment, aiming to enhance their efficiency and sustainability.

Manufacturers are a cornerstone customer segment for Hyster-Yale, relying on their equipment for critical operations. In 2024, industries like automotive and consumer goods continue to drive demand for robust forklifts and warehouse vehicles essential for production lines and internal logistics. These clients prioritize specialized equipment tailored to their unique manufacturing processes, alongside stringent safety features and seamless integration with their existing plant infrastructure.

Large retail chains and e-commerce fulfillment centers are a crucial customer base for Hyster-Yale. These operations demand robust, high-efficiency lift trucks, with a growing preference for electric and automated solutions to manage rapid inventory turnover and meet the speed required for order fulfillment. In 2024, the e-commerce sector continued its strong growth, directly impacting the need for advanced material handling equipment.

Port and Terminal Operators

Port and terminal operators are a critical customer segment for Hyster-Yale. These businesses rely on robust material handling equipment to manage the high-volume flow of goods through shipping ports and intermodal terminals. Their operations involve the efficient loading, unloading, and stacking of shipping containers, demanding specialized lift trucks and container handlers.

The demand within this segment is evolving. While the need for high-capacity and durable equipment remains constant, there's a significant and growing push towards zero-emission solutions. This shift is largely driven by increasingly stringent environmental regulations and a broader industry commitment to sustainability.

- Demand for Zero-Emission Equipment: The global push for decarbonization is directly impacting port operations, with a notable increase in interest and investment in electric and alternative-fuel forklifts and handlers.

- Operational Efficiency Needs: Port operators require equipment that minimizes downtime and maximizes throughput, emphasizing reliability and advanced features for precise container movement.

- Regulatory Compliance: Adherence to environmental standards is a key purchasing driver, pushing for equipment that reduces emissions and noise pollution.

Companies Seeking Clean Energy Solutions (Nuvera Clients)

Companies seeking clean energy solutions, a key customer segment for Hyster-Yale's offerings, are increasingly prioritizing decarbonization and energy independence. This group includes businesses actively looking for alternatives to traditional internal combustion engines, particularly those interested in hydrogen fuel cell technology. For instance, many are exploring hydrogen for material handling operations, stationary power needs, and the burgeoning electric vehicle charging infrastructure.

The demand for these sustainable power solutions is driven by regulatory pressures and corporate environmental, social, and governance (ESG) goals. In 2024, the global hydrogen fuel cell market, which Nuvera serves, was projected to reach approximately $7.5 billion, with significant growth expected in the material handling sector. This indicates a strong market pull for the types of clean energy solutions Hyster-Yale, through Nuvera, can provide.

- Focus on Decarbonization: Businesses are actively seeking to reduce their carbon footprint by adopting cleaner power sources.

- Hydrogen Fuel Cell Adoption: Significant interest exists in hydrogen fuel cells for material handling, stationary power, and EV charging applications.

- Market Growth: The global hydrogen fuel cell market is expanding, with material handling identified as a key growth area in 2024.

- ESG Driven Demand: Corporate ESG mandates are a primary driver for this segment's shift towards sustainable energy solutions.

Hyster-Yale serves a diverse range of industrial clients, with manufacturers being a primary focus. These companies, particularly in sectors like automotive and consumer goods, require specialized lift trucks and warehouse vehicles for production lines and internal logistics. In 2024, the ongoing demand for efficient material handling within these manufacturing environments underscores their importance.

Warehousing and logistics firms represent another significant customer segment, operating businesses focused on storage and distribution. These operations heavily rely on efficient lift trucks within their centers, with the global warehousing market valued at approximately $250 billion in 2023, indicating the scale of these clients' needs.

Large retail chains and e-commerce fulfillment centers are also crucial, demanding high-efficiency equipment for rapid inventory turnover. The continued strong growth of the e-commerce sector in 2024 directly fuels the need for advanced material handling solutions in this segment.

Port and terminal operators are vital, needing robust equipment to manage high-volume container flow. While high-capacity and durable machinery remain essential, there's a pronounced shift towards zero-emission solutions driven by environmental regulations.

| Customer Segment | Key Needs | 2023/2024 Data Point |

|---|---|---|

| Manufacturers | Specialized, safe, integrated equipment | Continued demand in automotive and consumer goods sectors (2024) |

| Warehousing & Logistics | Productivity, reliability, automation, electrification | Global warehousing market ~ $250 billion (2023) |

| Retail & E-commerce | High-efficiency, electric, automated solutions | Strong e-commerce growth driving demand (2024) |

| Port & Terminal Operators | High-capacity, durable, zero-emission equipment | Increasing focus on environmental regulations and sustainability |

Cost Structure

Hyster-Yale's manufacturing and production costs are substantial, encompassing raw materials like steel, specialized components, and direct labor for assembly of their diverse lift truck and attachment lines. In 2023, the company reported cost of sales of $2.9 billion, reflecting the significant investment in these operational inputs.

The company actively pursues strategies to control these manufacturing expenses by optimizing its global production footprint and enhancing factory efficiency. This includes efforts to streamline assembly processes and manage factory overhead, aiming to maintain a competitive cost structure in the materials handling equipment market.

Hyster-Yale Materials Handling, Inc. dedicates significant resources to Research and Development, a cornerstone of its strategy for innovation in lift truck technology, automation, and alternative energy. These investments are particularly vital for its Nuvera Fuel Cells division, driving advancements in hydrogen power solutions.

In 2023, the company reported Research and Development expenses of $178.9 million. This substantial outlay underscores their commitment to maintaining a competitive advantage and developing the next generation of material handling equipment and fuel cell technologies.

Hyster-Yale's cost structure heavily features expenses tied to its global sales and marketing efforts. This includes significant outlays for advertising campaigns, promotional activities designed to boost brand visibility, and the crucial support provided to its extensive independent dealer network. In 2023, selling, general, and administrative expenses, which encompass these sales and marketing costs, were $1.31 billion.

Furthermore, distribution costs represent another substantial component of Hyster-Yale's expenditures. Given the company's worldwide operational footprint and the nature of heavy equipment, freight and logistics expenses are considerable. These costs are essential for moving products from manufacturing facilities to dealers and ultimately to customers across various international markets.

Aftermarket Service and Parts Inventory Costs

Hyster-Yale Materials Handling, Inc. incurs substantial costs in maintaining its aftermarket service and parts inventory. These expenses are critical for ensuring customer satisfaction and operational continuity after the initial sale of their forklifts and material handling equipment.

The company's commitment to a robust global aftermarket service network necessitates significant investment. This includes the costs associated with operating and staffing service centers, training technicians, and managing mobile repair units to provide timely on-site support.

Managing a vast global inventory of spare parts is another major cost driver. This involves expenses for warehousing, inventory management systems, and the capital tied up in holding a wide range of parts to meet diverse customer needs and minimize downtime. Logistics costs for distributing these parts efficiently across various regions also add to the overall expenditure.

- Warehousing and Storage: Costs associated with maintaining strategically located warehouses globally to store a comprehensive range of spare parts.

- Logistics and Distribution: Expenses for transportation, shipping, and supply chain management to ensure timely delivery of parts to service centers and customers.

- Inventory Management: Costs for sophisticated inventory tracking systems, demand forecasting, and carrying costs of holding parts.

- Personnel Costs: Salaries and benefits for service technicians, parts specialists, and administrative staff involved in the aftermarket support function.

Personnel and Labor Costs

Personnel and labor costs are a significant part of Hyster-Yale's expenses, reflecting its global operations. This includes wages for its manufacturing teams, the expertise of its engineers, the efforts of its sales force, and the support from administrative staff. In 2023, Hyster-Yale reported total employee compensation and benefits expenses of approximately $1.3 billion.

Beyond base salaries, the company invests in its workforce through ongoing training programs designed to enhance skills and ensure operational efficiency. Employee benefits, such as healthcare and retirement plans, also contribute to this substantial cost category.

- Global Workforce: Hyster-Yale employs thousands worldwide across manufacturing, engineering, sales, and administration.

- Compensation & Benefits: In 2023, these costs amounted to roughly $1.3 billion.

- Training Investment: The company dedicates resources to employee development and skill enhancement.

- Benefit Programs: Costs include healthcare, retirement plans, and other employee welfare initiatives.

Hyster-Yale's cost structure is dominated by manufacturing expenses, including raw materials and direct labor, which totaled $2.9 billion in cost of sales for 2023. Significant investments are also made in Research and Development, amounting to $178.9 million in 2023, particularly for advancing fuel cell technologies. Additionally, the company incurs substantial selling, general, and administrative costs, reaching $1.31 billion in 2023, which covers global sales, marketing, and dealer support.

| Cost Category | 2023 Expense (in billions) | Key Components |

|---|---|---|

| Cost of Sales | $2.9 | Raw materials (steel, components), direct labor |

| Selling, General & Administrative | $1.31 | Sales, marketing, advertising, dealer support |

| Research & Development | $0.179 | New product development, fuel cell technology (Nuvera) |

| Personnel & Labor | ~$1.3 | Wages, benefits, training across all functions |

Revenue Streams

Hyster-Yale Materials Handling, Inc.'s core revenue generation centers on the worldwide sale of new lift trucks. These are offered under their prominent Hyster® and Yale® brand names, catering to a broad spectrum of industrial needs with various classes and capacities. In 2023, the company reported net sales of approximately $3.4 billion, with a significant portion derived from new equipment purchases.

Hyster-Yale Materials Handling, Inc. generates revenue through the sale of a wide array of aftermarket parts. These components are crucial for maintaining, repairing, and extending the operational life of their existing lift truck fleet.

This segment offers a consistent and predictable revenue source, directly supporting the company's substantial installed base of equipment. For instance, in 2023, Hyster-Yale reported aftermarket parts and service revenue of $1.1 billion, highlighting its significance to overall financial performance.

Hyster-Yale’s service and maintenance contracts are a crucial element, offering a predictable income source. Customers frequently choose these agreements to guarantee their material handling equipment runs smoothly and without interruption. These contracts typically bundle essential services like routine upkeep and necessary repairs, ensuring peak operational efficiency.

Sales of Attachments (Bolzoni S.p.A.)

Through its Bolzoni S.p.A. segment, Hyster-Yale Materials Handling, Inc. generates significant revenue from the sale of a diverse array of lift truck attachments, forks, and lift tables. These components are crucial for expanding the utility and application range of their core lift truck products.

Bolzoni's offerings cater to specialized industrial needs, allowing customers to adapt Hyster-Yale equipment for tasks such as handling specific materials or operating in unique environments. This revenue stream is vital for Hyster-Yale's overall financial performance and market positioning.

- Bolzoni S.p.A. Revenue Contribution: In 2023, Bolzoni S.p.A. reported net sales of $544.6 million, representing a substantial portion of Hyster-Yale's total revenue.

- Product Diversification: The sales encompass a wide variety of attachments, including side shifters, fork positioners, rotators, and specialized forks designed for different industries.

- Market Reach: Bolzoni's products are distributed globally, serving a broad customer base across manufacturing, logistics, and warehousing sectors.

- Impact on Lift Truck Sales: The availability of these attachments often influences the initial purchase decision of lift trucks, creating a synergistic effect within Hyster-Yale's business model.

Sales of Hydrogen Fuel Cell Solutions (Nuvera Fuel Cells, LLC)

Hyster-Yale Materials Handling, Inc. is diversifying its revenue through Nuvera Fuel Cells, LLC, offering hydrogen fuel cell power solutions. This emerging stream includes fuel cell engines, hydrogen-powered gensets, and mobile EV chargers, catering to the increasing need for sustainable energy options.

Nuvera's offerings are designed to meet the demands of various industries seeking to decarbonize their operations. The company's focus on hydrogen technology positions it to capitalize on the global shift towards cleaner energy sources.

- Fuel Cell Engines: Providing core power units for various applications.

- Hydrogen-Powered Gensets: Offering stationary power solutions utilizing hydrogen.

- Mobile EV Chargers: Developing portable charging solutions for electric vehicles.

Hyster-Yale generates substantial revenue from its new lift truck sales, a core business segment. In 2023, net sales reached approximately $3.4 billion, with a significant portion attributed to these equipment purchases.

Aftermarket parts and service contracts represent a vital and consistent revenue stream, supporting the company's vast installed base. In 2023, this segment contributed $1.1 billion to net sales, underscoring its financial importance.

The Bolzoni S.p.A. subsidiary adds another layer of revenue through specialized attachments and forks, with 2023 sales totaling $544.6 million. These products enhance the functionality of Hyster-Yale’s lift trucks, driving additional sales and customer value.

| Revenue Stream | 2023 Net Sales (USD Millions) | Key Products/Services |

|---|---|---|

| New Lift Trucks | ~3,400 | Hyster® and Yale® branded lift trucks |

| Aftermarket Parts & Service | 1,100 | Replacement parts, maintenance, repair services |

| Bolzoni Attachments | 544.6 | Forks, side shifters, rotators, lift tables |

Business Model Canvas Data Sources

The Hyster-Yale Materials Handling, Inc. Business Model Canvas is built upon a foundation of comprehensive market research, detailed financial disclosures, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects the company's strategic positioning and market realities.