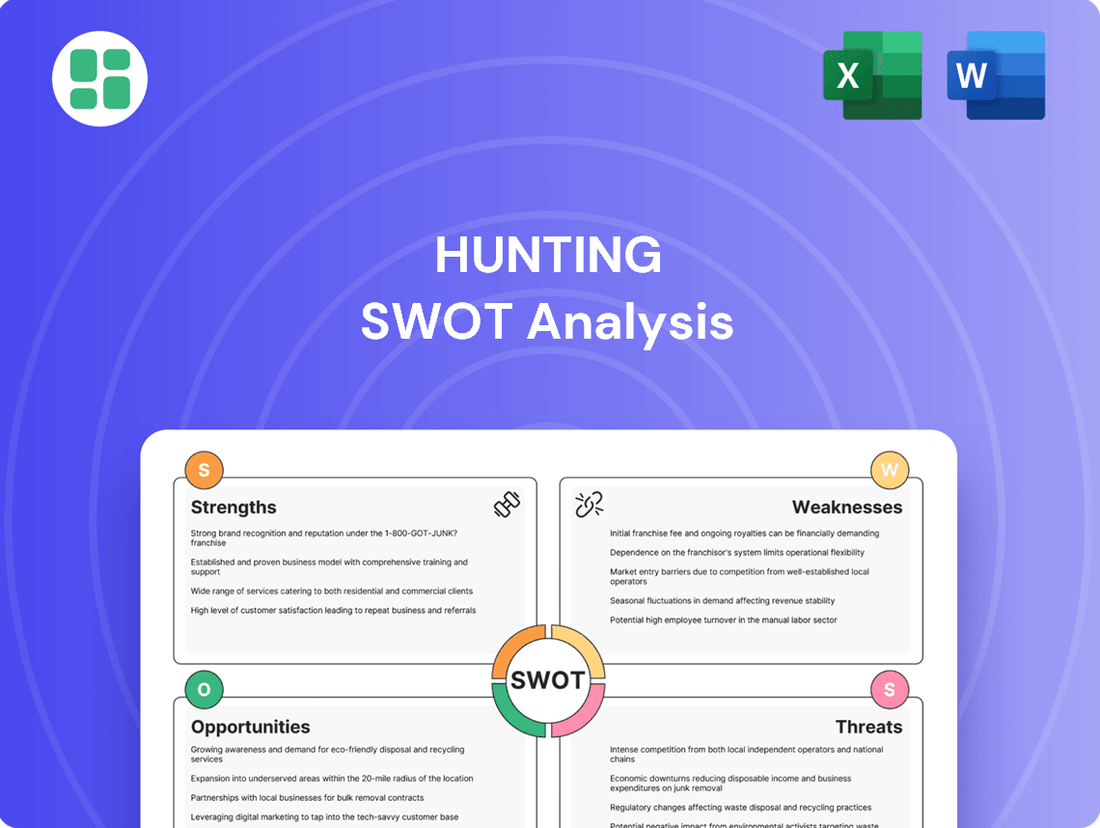

Hunting SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunting Bundle

Uncover the hidden advantages and potential pitfalls within the hunting industry. Our comprehensive SWOT analysis provides a deep dive into the market's dynamics, revealing critical factors for success.

Ready to transform insights into action? Purchase the full SWOT analysis to access detailed breakdowns, expert commentary, and actionable strategies designed to give you a competitive edge in the hunting sector.

Strengths

Hunting PLC boasts a significant global presence, operating in crucial oil and gas hubs like the Middle East, South America, Australia, and North Africa. This extensive international reach, as of early 2024, diversifies revenue streams and mitigates risks associated with localized market downturns.

The company's portfolio is equally varied, featuring specialized products such as Oil Country Tubular Goods (OCTG) and advanced Subsea technologies. This strategic product diversification allows Hunting to serve multiple segments of the oil and gas lifecycle, from exploration to production, enhancing its market penetration and resilience.

Hunting PLC showcased impressive financial strength in 2024, with revenues climbing 13% to surpass $1 billion. This growth was accompanied by a substantial 23% increase in EBITDA, highlighting operational efficiency and market demand.

The company's ability to generate free cash flow was particularly noteworthy, reaching $139.7 million. This marks a significant positive shift from prior periods and provides a solid foundation for future strategic initiatives and capital allocation.

Hunting concluded 2024 with a robust sales order book valued at roughly $500 million. This backlog provides significant revenue visibility, extending into 2025 and 2026, offering a stable foundation for future earnings.

Key to this strength are substantial contracts, including a record $231 million order from the Kuwait Oil Company and an additional $60 million from Organic Oil Recovery technology. These wins highlight strong customer confidence and successful market penetration.

Strategic Focus on High-Value Segments

Hunting's strategic focus on high-value segments, particularly Oil Country Tubular Goods (OCTG) and Subsea technologies, is a key strength. The company's Hunting 2030 Strategy explicitly targets growth in these areas, which have demonstrated robust performance and increasing order backlogs. This strategic direction is supported by recent acquisitions designed to bolster capabilities in these crucial markets.

The acquisition of Flexible Engineered Solutions (FES) in 2023, for instance, significantly enhanced Hunting's offering in the subsea sector, a market projected for sustained growth. Similarly, investments in Organic Oil Recovery (OOR) technology position the company to capitalize on evolving production techniques. These moves are not merely opportunistic but are aligned with long-term industry trends favoring sophisticated offshore solutions and specialized equipment.

This deliberate emphasis on high-value segments is already yielding tangible results. For example, Hunting reported a substantial increase in its OCTG order intake in the first half of 2024, reflecting the market's demand for its specialized products. This strategic clarity allows for efficient resource allocation and a more targeted approach to market penetration, ultimately driving profitability and market share in key growth areas.

- OCTG and Subsea Focus: Hunting 2030 Strategy prioritizes growth in these high-value segments.

- Acquisition Impact: FES acquisition bolstered subsea capabilities; OOR technology enhances production solutions.

- Market Alignment: Strategy aligns with long-term industry trends for complex offshore and specialized solutions.

- Performance Indicators: Strong order intakes in OCTG in H1 2024 demonstrate market demand.

Commitment to Shareholder Returns

Hunting PLC demonstrates a robust commitment to rewarding its shareholders. The company's strong cash generation capabilities and a solid balance sheet provide the financial flexibility to pursue strategic acquisitions while simultaneously enhancing shareholder returns. This dual approach underscores a dedication to both growth and investor value.

For 2024, Hunting PLC proposed a notable 15% increase in its total dividends, reflecting confidence in its financial performance and future prospects. This move directly benefits investors by increasing their income from holdings.

Further solidifying its commitment, the company announced a share buyback program targeting up to $40 million for 2025. Such programs reduce the number of outstanding shares, potentially boosting earnings per share and increasing the value of remaining shares.

- Dividend Growth: Proposed 15% increase in total dividends for 2024.

- Share Buybacks: Announced up to $40 million share buyback program for 2025.

- Financial Strength: Supported by strong cash generation and a healthy balance sheet.

- Investor Confidence: Commitment signals financial stability and enhances investor appeal.

Hunting's strategic focus on high-value segments like OCTG and Subsea technologies, as outlined in its Hunting 2030 Strategy, is a significant strength. This focus is reinforced by strategic acquisitions, such as FES in 2023, which bolstered its subsea offerings, and investments in Organic Oil Recovery technology, aligning with long-term industry trends for sophisticated offshore solutions. The company demonstrated this market alignment through strong order intakes in OCTG during the first half of 2024.

Hunting's financial performance in 2024 was robust, with revenues increasing by 13% to over $1 billion and EBITDA growing by 23%. The company generated $139.7 million in free cash flow, a substantial improvement from previous periods. This financial strength is further evidenced by a sales order book of approximately $500 million at the end of 2024, providing clear revenue visibility into 2025 and 2026, supported by key contracts like the $231 million order from Kuwait Oil Company.

The company's commitment to shareholder returns is a key strength, supported by its strong cash generation and healthy balance sheet. In 2024, Hunting proposed a 15% increase in total dividends and announced a $40 million share buyback program for 2025, signaling financial stability and enhancing investor appeal.

| Metric | 2024 (Approx.) | Impact |

|---|---|---|

| Revenue Growth | 13% | Exceeded $1 billion |

| EBITDA Growth | 23% | Indicates operational efficiency |

| Free Cash Flow | $139.7 million | Foundation for growth and returns |

| Sales Order Book | ~$500 million | Revenue visibility into 2025-2026 |

| Dividend Increase | 15% | Enhanced shareholder returns |

| Share Buyback Program | Up to $40 million (2025) | Potential EPS boost |

What is included in the product

Analyzes Hunting’s competitive position through key internal and external factors.

Offers a structured framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

Hunting PLC's significant reliance on the upstream oil and gas sector exposes it directly to the inherent volatility of energy markets. Fluctuations in crude oil and natural gas prices, driven by geopolitical events, supply-demand imbalances, and economic conditions, can materially impact Hunting's revenue and profitability. For instance, the average Brent crude oil price saw considerable swings throughout 2023 and is projected to remain volatile in 2024, directly affecting the demand for Hunting's products and services.

The Hunting Titan segment, crucial for the US onshore shale market, encountered significant headwinds in 2024. This resulted in a substantial non-cash impairment charge of $109.1 million.

This financial impact stemmed directly from a declining US onshore rig count and the volatility of natural gas prices, creating an unfavorable operating environment.

In response, the company is actively implementing restructuring measures to better align its cost structure with the prevailing market conditions and future outlook.

Technological advancements and industry consolidation have notably improved drilling and production efficiencies for exploration and production (E&P) operators. This means fewer rigs are now needed to achieve production targets. For instance, in 2024, the average rig count for U.S. land operations has been significantly lower compared to peak periods, reflecting this enhanced efficiency.

This trend presents a potential weakness for oilfield service companies like Hunting. While operational efficiency is positive for the E&P sector, it can directly translate into reduced demand for certain services and equipment. This could dampen revenue growth prospects for Hunting in segments heavily reliant on overall rig activity, even as individual rig performance improves.

Profitability Challenges Despite Revenue Growth

Hunting experienced a statutory pre-tax loss in 2024, despite reporting robust revenue and EBITDA growth. This loss was primarily attributed to a non-cash impairment charge, highlighting that top-line expansion doesn't automatically guarantee net profitability.

An AI analyst pointed out ongoing profitability challenges and bearish technical trends for Hunting's stock, suggesting deeper concerns about the company's ability to consistently generate net earnings. This indicates a disconnect between revenue generation and actual profit realization.

- Revenue Growth vs. Profitability: While revenue increased, a pre-tax loss was recorded due to impairment charges.

- Analyst Concerns: AI analysis flagged 'profitability challenges' and 'bearish technical trends'.

- Underlying Issues: The data suggests top-line growth is not consistently translating into bottom-line success.

Geographical Concentration Risks in Restructuring

Hunting's restructuring, announced in early 2025, focuses heavily on its EMEA operations, particularly in response to reduced North Sea activity driven by the UK's decarbonization goals. This geographical concentration of the restructuring effort, while intended to streamline costs, introduces significant execution risks. For instance, the company might face unforeseen operational disruptions or challenges in managing the workforce impact across a specific region.

The reliance on a single geographic segment for such a substantial restructuring program amplifies potential weaknesses. If the assumptions underpinning the cost savings or the market outlook for the EMEA region prove inaccurate, the entire restructuring's effectiveness could be jeopardized. This concentration means that any localized economic downturn or regulatory shift within that specific area could disproportionately affect the company's overall recovery efforts.

Furthermore, large-scale regional restructuring programs can negatively impact employee morale and productivity. In 2024, companies undertaking similar workforce adjustments often reported challenges in retaining key talent and maintaining operational continuity during the transition periods. Hunting's 2025 program, targeting significant cost reductions, will need careful management to mitigate these human capital risks.

The specific financial impact of this concentration remains to be fully seen, but similar restructuring efforts in the energy sector have historically involved substantial one-time charges. For example, in 2024, several oilfield service companies reported restructuring charges ranging from tens to hundreds of millions of dollars, impacting their short-term profitability.

Hunting's substantial non-cash impairment charge of $109.1 million in 2024 for its Hunting Titan segment underscores a significant weakness tied to the declining US onshore rig count and volatile natural gas prices.

This trend, where improved drilling efficiencies mean fewer rigs are needed, directly translates to reduced demand for certain services, potentially dampening revenue growth. The company's statutory pre-tax loss in 2024, despite revenue and EBITDA growth, highlights an ongoing struggle to consistently convert top-line performance into net profitability.

Furthermore, the company's 2025 restructuring efforts concentrated on EMEA operations introduce execution risks, as any localized downturn or regulatory shift could disproportionately impact overall recovery. This geographic concentration amplifies the potential for unforeseen operational disruptions and challenges in managing workforce impacts, as seen in similar industry restructurings in 2024 that incurred substantial one-time charges.

| Segment | 2024 Impairment Charge | Key Driver |

|---|---|---|

| Hunting Titan (US Onshore) | $109.1 million | Declining US onshore rig count, volatile natural gas prices |

| EMEA Operations | N/A (Restructuring Focus) | Reduced North Sea activity due to decarbonization goals |

What You See Is What You Get

Hunting SWOT Analysis

The preview you see is the same document the customer will receive after purchasing—no surprises, just professional quality. This Hunting SWOT Analysis is meticulously crafted to provide actionable insights. You're getting a genuine look at the comprehensive report you'll download.

Opportunities

The global oil and gas sector is experiencing robust activity in its international, subsea, and offshore segments, with key growth areas including the Gulf of Mexico, Black Sea, Middle East, and Asia Pacific. Hunting PLC is strategically positioned to leverage these expanding markets through its specialized product offerings and services.

In the United States, recent developments such as new licensing rounds and the permitting of additional LNG capacity are creating significant offshore opportunities. These initiatives are expected to drive demand for the kind of advanced subsea and offshore technologies that Hunting provides.

Hunting is strategically expanding its focus beyond traditional oil and gas, investing in emerging energy transition technologies. The company anticipates approximately $60 million in revenue from its Organic Oil Recovery (OOR) technology, showcasing a tangible financial commitment to this area. This move into OOR, geothermal, and carbon capture aligns with the global shift towards sustainability.

Furthermore, Hunting is leveraging its core competencies in precision engineering to penetrate non-oil and gas markets. Sectors like aviation, commercial space, and defense are key targets for this diversification. This strategy capitalizes on existing manufacturing strengths to create new revenue streams, demonstrating adaptability to evolving market demands.

Hunting's robust financial position, evidenced by its healthy balance sheet and substantial liquidity, provides a strong foundation for pursuing strategic acquisitions. The company is particularly focused on bolt-on acquisitions that are earnings-accretive, with a keen interest in subsea technologies and intelligent well completions, areas poised for growth.

Strategic partnerships are also a cornerstone of Hunting's growth strategy, exemplified by its API threading license in India and a manufacturing agreement with Chevron in the Gulf of Mexico. These collaborations are instrumental in expanding market access and bolstering operational capabilities, directly supporting the company's long-term objectives outlined in the Hunting 2030 Strategy.

Increased Demand for Natural Gas and LNG

Market indicators suggest continued growth in the natural gas sector, with the Henry Hub price showing strength as 2024 concludes. This upward trend is underpinned by robust global demand for natural gas as a cleaner energy alternative, particularly in Asian markets.

The expansion of Liquefied Natural Gas (LNG) export capacity further fuels this demand, creating a favorable environment for increased drilling activity and related services. These dynamics present a significant growth opportunity for Hunting's product offerings, aligning with the company's core business.

- Henry Hub Natural Gas Price: Strengthening towards the end of 2024.

- Global Demand Driver: Natural gas as a cleaner energy source, especially in Asia.

- Capacity Expansion: Rising LNG export capacity supports increased drilling.

- Growth Avenue: Significant opportunity for Hunting's products and services.

Leveraging Advanced Manufacturing and Technology

Hunting's Advanced Manufacturing product group is experiencing robust growth, with significant opportunities emerging in high-potential sectors such as space and aviation. The company's strategic investment in 3D manufacturing, notably through its stake in Cumberland Additive, positions it to capitalize on the increasing demand for complex, high-performance components in these industries.

Continued investment in cutting-edge technologies, including advanced digital solutions and automation, is crucial for enhancing operational efficiency and broadening Hunting's service portfolio. For instance, the aerospace industry's adoption of additive manufacturing is projected to grow significantly; a 2024 market report estimates the global aerospace 3D printing market will reach $6.5 billion by 2028, up from approximately $2.9 billion in 2023.

- Space and Aviation Growth: Capitalizing on the expanding aerospace and defense markets, which are increasingly adopting advanced manufacturing techniques.

- 3D Manufacturing Investment: Leveraging the Cumberland Additive partnership to gain a competitive edge in the additive manufacturing space, a sector poised for substantial growth.

- Digitalization and Automation: Implementing digital solutions and automation to streamline production, reduce costs, and improve the quality of manufactured goods.

- Service Expansion: Utilizing technological advancements to offer new and enhanced services, thereby increasing revenue streams and market share.

Hunting is well-positioned to capitalize on the global energy transition, with significant opportunities in emerging technologies like Organic Oil Recovery (OOR), geothermal, and carbon capture. The company anticipates $60 million in revenue from its OOR technology alone, demonstrating a clear financial commitment to these growth areas.

Diversification into non-oil and gas sectors such as aviation, commercial space, and defense presents a substantial avenue for revenue growth, leveraging Hunting's core precision engineering capabilities. The aerospace industry's adoption of additive manufacturing, projected to reach $6.5 billion by 2028, highlights the potential in these new markets.

Strategic acquisitions and partnerships, like its API threading license in India and manufacturing agreement with Chevron, are key to expanding market access and operational expertise. These collaborations are vital for executing Hunting's long-term growth strategy, including its focus on subsea technologies and intelligent well completions.

The strengthening natural gas market, driven by global demand and expanding LNG export capacity, creates a favorable environment for Hunting's core products and services. This trend, coupled with growth in advanced manufacturing for sectors like aerospace, offers multiple avenues for increased revenue and market share.

Threats

Fluctuations in crude oil and natural gas prices, heavily influenced by OPEC+ production decisions and ongoing geopolitical tensions in regions like Ukraine and the Middle East, present a substantial threat to the oilfield services sector. For instance, Brent crude oil prices have seen significant swings, trading in a range that could impact exploration and production budgets throughout 2024 and into 2025.

These unpredictable price movements directly affect the capital expenditure plans of exploration and production companies, which in turn dictates the demand for Hunting's specialized products and services. A sharp decline in oil prices, for example, could lead to project deferrals and reduced spending, directly impacting Hunting's revenue streams.

The accelerating global shift towards renewable energy and decarbonization presents a significant threat to Hunting. For instance, the UK government's Net Zero Strategy, aiming for a substantial reduction in carbon emissions by 2050, directly impacts North Sea oil and gas operations, which form a core part of Hunting's market. This could translate to a sustained decrease in demand for traditional oilfield services.

While Hunting is actively pursuing diversification into areas like advanced manufacturing and energy transition technologies, a faster-than-anticipated move away from fossil fuels could still pose a considerable challenge to its established business model. The International Energy Agency's (IEA) 2024 projections indicate continued investment in oil and gas, but with a clear emphasis on lower-emission production, suggesting a potential squeeze on services not aligned with this trend.

Increased tariffs and trade disruptions pose a significant threat to Hunting PLC. The company has explicitly warned of 'unforeseen challenges' and potential disruption across its international markets due to these factors. For instance, ongoing trade tensions, particularly between major economies, could directly impact the cost of raw materials and finished goods, thereby squeezing profit margins.

Trade wars and protectionist policies can escalate operational costs and introduce complexities into supply chains. This can lead to delays, increased logistics expenses, and reduced access to key markets. In 2023, global trade growth slowed, reflecting these geopolitical uncertainties, which could translate into lower demand for Hunting's products and services in affected regions.

Intensifying Competition and Industry Consolidation

The oilfield services sector is intensely competitive, with major players increasingly leveraging automation to gain an edge. This trend is further amplified by a wave of industry consolidation as larger companies seek strategic acquisitions to expand their capabilities and market reach. For instance, Schlumberger (now SLB) has been actively investing in digital technologies and automation, and the broader industry saw significant M&A activity in 2023 and early 2024, with deals valued in the billions, aiming to create more integrated service providers.

This dynamic environment directly translates into significant pricing pressures for all participants. Companies must continuously innovate and invest in new technologies to differentiate themselves and avoid being undercut on price. The imperative to keep pace with competitors' technological advancements, particularly in areas like digital oilfield solutions and emissions reduction technologies, is critical; failure to do so risks losing market share and becoming less relevant.

- Intensifying Competition: The oilfield services market is characterized by a few dominant global players and numerous smaller, specialized firms, creating a complex competitive landscape.

- Industry Consolidation: Larger companies are actively pursuing mergers and acquisitions to enhance their service offerings, achieve economies of scale, and gain greater market power.

- Pricing Pressures: Increased competition and the drive for efficiency often lead to downward pressure on service pricing, impacting profitability.

- Technological Advancements: Staying competitive requires significant investment in automation, digitalization, and sustainable technologies, with laggards facing substantial risks.

Cybersecurity Risks and Critical Infrastructure Targeting

Hunting PLC, as a key player in the energy services sector, is particularly vulnerable to escalating cybersecurity threats. These risks are amplified by the potential involvement of sophisticated actors like hacktivists and nation-state sponsored groups targeting critical infrastructure. A breach could cripple operations, leading to significant downtime and revenue loss. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved.

The consequences of a successful cyberattack extend beyond immediate operational disruption. Hunting PLC could face the compromise of highly sensitive operational data and customer information. This not only jeopardizes competitive advantage but also carries severe regulatory and legal ramifications. The reputational damage from such an incident could erode customer trust and investor confidence, impacting long-term market valuation and business relationships.

The potential financial and operational fallout is substantial. A significant cyber incident could necessitate costly remediation efforts, system overhauls, and potential compensation payouts. For example, in 2023, the average cost of a data breach reached $4.45 million globally, a figure that could be considerably higher for critical infrastructure operators like Hunting.

- Increased Sophistication of Threats: Hacktivist and nation-state actors are continuously developing more advanced attack methods.

- Operational Disruption: Cyberattacks can halt essential services, leading to immediate revenue loss and supply chain issues.

- Data Breach Impact: Compromised sensitive data can result in regulatory fines, legal action, and severe reputational damage.

- Financial Repercussions: Remediation, legal costs, and lost business can significantly impact profitability and market standing.

The oilfield services sector faces significant headwinds from the accelerating global transition to renewable energy. Government policies, such as the UK's Net Zero Strategy, are actively reducing reliance on fossil fuels, directly impacting demand for traditional oil and gas services. While Hunting is diversifying, a rapid shift away from fossil fuels could still challenge its core business model, especially as the IEA's 2024 outlook suggests a focus on lower-emission oil and gas production.

Geopolitical instability and trade disputes present ongoing threats through tariffs and market disruptions. These factors can increase operational costs and complicate supply chains, potentially reducing demand in key regions. For instance, global trade growth slowed in 2023 due to these uncertainties.

Intense competition and industry consolidation exert considerable pricing pressure. Companies like SLB are heavily investing in automation and digital solutions, forcing others to innovate rapidly or risk losing market share. The need to keep pace with technological advancements, particularly in digital oilfield solutions, is paramount for survival.

Cybersecurity threats, often from sophisticated actors, pose a substantial risk to operations and data integrity. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, with the average cost of a data breach reaching $4.45 million in 2023, underscoring the financial and reputational damage a breach could inflict.

SWOT Analysis Data Sources

This hunting SWOT analysis is built upon a foundation of diverse and credible data sources, including government wildlife surveys, hunter-submitted harvest reports, and ecological impact studies. These resources provide a comprehensive understanding of game populations, habitat conditions, and regulatory frameworks, ensuring an accurate and informed assessment.