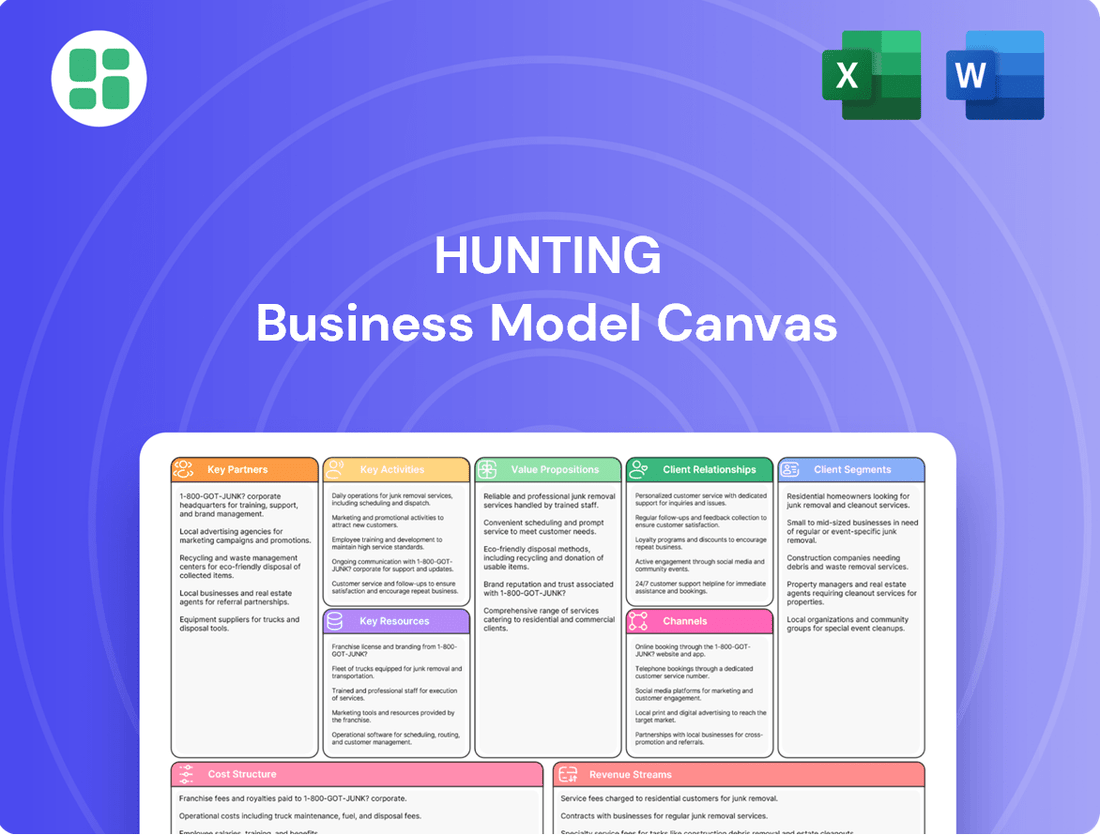

Hunting Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunting Bundle

Curious about the engine driving Hunting's success? This Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams. Discover the blueprint that fuels their operations and market position.

Ready to understand Hunting’s competitive edge? Our comprehensive Business Model Canvas lays bare their value proposition, key resources, and cost structure. Download the full version to gain actionable insights for your own ventures.

Partnerships

Hunting PLC actively seeks strategic technology collaborations with specialized firms to bolster its product suite, particularly in advanced drilling and digital oilfield solutions. These partnerships are crucial for maintaining a competitive edge, ensuring clients receive the most efficient technologies available. For instance, in 2023, Hunting invested in advanced materials research, a segment often driven by such tech partnerships.

Hunting PLC's global reach necessitates strong alliances with key logistics and supply chain providers. These partners are vital for moving Hunting's specialized equipment and components across continents, reaching both easily accessible onshore sites and more remote offshore operations. For instance, in 2024, the company continued to leverage established relationships with major international freight forwarders to navigate the complexities of global shipping regulations and customs, ensuring their products arrive where and when needed.

The efficiency of these partnerships directly impacts Hunting's ability to serve its customers effectively. By managing intricate international shipping routes, handling customs documentation, and executing last-mile deliveries to challenging locations, these providers minimize operational disruptions. This focus on supply chain resilience is critical, especially given the volatile geopolitical landscape and ongoing supply chain pressures observed throughout 2024, which can significantly affect delivery timelines and costs.

Hunting PLC leverages a robust network of local service and support partners to ensure seamless global operations. These alliances are crucial for delivering timely technical assistance, maintenance, and repair services directly in key operating regions. For instance, in 2024, Hunting's commitment to localized support meant that customers in North America could access specialized well intervention equipment services with an average response time of under 24 hours, significantly reducing operational downtime.

OEM Component Suppliers

Hunting PLC relies on a robust network of Original Equipment Manufacturer (OEM) component suppliers to source essential raw materials, specialized parts, and pre-assembled units. These partnerships are foundational to ensuring the consistent quality and timely availability of inputs for their diverse manufacturing operations.

Strong relationships with these suppliers are critical for maintaining production efficiency and the overall reliability of Hunting's product offerings. For instance, in 2024, a significant portion of Hunting's cost of goods sold was directly attributable to procured components, underscoring the financial importance of these OEM relationships.

- Supplier Quality Assurance: Ensuring components meet stringent quality standards to prevent manufacturing defects and product failures.

- Supply Chain Resilience: Building redundancy and strong communication channels to mitigate risks of supply disruptions, particularly for critical components.

- Cost Optimization: Collaborating with suppliers on volume discounts, long-term contracts, and process improvements to manage input costs effectively.

- Innovation Collaboration: Working with suppliers on the development of new materials or components to enhance product performance and market competitiveness.

Academic and Research Institutions

Collaborating with academic and research institutions is a cornerstone for Hunting PLC's innovation. These partnerships are crucial for exploring cutting-edge technologies and foundational research that can shape future industry benchmarks. For instance, in 2024, Hunting continued its engagement with leading universities to investigate advancements in materials science relevant to its subsurface technologies.

These collaborations grant Hunting access to state-of-the-art research facilities and specialized expertise, which are invaluable for tackling complex industry challenges. Furthermore, they serve as a vital pipeline for recruiting top-tier engineering and scientific talent, ensuring a continuous influx of skilled professionals. In 2024, the company reported that a significant percentage of its new research hires originated from these academic ties.

- Access to Advanced Research: Universities provide specialized labs and equipment for deep-dive investigations.

- Talent Pipeline Development: Partnerships nurture relationships with future industry leaders and researchers.

- Industry Standard Setting: Joint research efforts contribute to the development of new operational and safety standards.

- Innovation Acceleration: Collaborative projects speed up the discovery and implementation of new technologies.

Hunting PLC's key partnerships extend to specialized service providers who offer critical support functions. These collaborations are essential for maintaining operational efficiency and client satisfaction across its diverse service offerings. For example, in 2024, Hunting's strategic alliances with advanced inspection companies ensured that all critical components met rigorous safety and performance standards before deployment.

What is included in the product

A structured framework for understanding and developing a business model specifically for hunting operations, encompassing key elements like customer segments, value propositions, and revenue streams.

This model provides a clear roadmap for hunting businesses, detailing how they create, deliver, and capture value in the outdoor recreation market.

The Hunting Business Model Canvas offers a structured approach to pinpoint and address critical customer pains, enabling businesses to design solutions that truly resonate.

Activities

Hunting PLC's commitment to Research and Development is a cornerstone of its strategy, particularly in the dynamic energy landscape. This involves a continuous investment aimed at innovating well construction, intervention, and infrastructure solutions. For example, in 2023, the company highlighted its ongoing efforts in developing advanced materials and digital technologies to enhance operational efficiency and product performance.

The focus on R&D allows Hunting to anticipate and address the evolving technical requirements of the oil and gas sector. Their work in 2024 continues to emphasize the creation of novel tools and the refinement of existing product lines, ensuring they remain at the forefront of industry advancements and can offer cutting-edge solutions to their global customer base.

The core activity for a hunting business model in manufacturing and production revolves around the precise creation of specialized equipment and components tailored for upstream oil and gas operations. This encompasses overseeing production lines, implementing rigorous quality control measures, and ensuring strict adherence to industry standards and safety regulations.

In 2024, the global oil and gas equipment manufacturing market saw significant activity, with companies focusing on advanced materials and automation to boost efficiency. For instance, a leading manufacturer of downhole tools reported a 15% increase in production output in the first half of 2024 by investing in new CNC machining centers, demonstrating the impact of efficient processes on product quality and cost competitiveness.

Managing a complex global supply chain to distribute products and equipment to diverse onshore and offshore locations worldwide is a critical activity for hunting businesses. This includes everything from warehousing and inventory management to transportation and navigating customs regulations across numerous international markets.

Effective distribution is paramount for ensuring products reach customers promptly and efficiently, directly supporting their operational timelines. For instance, in 2024, the global logistics market was valued at approximately $9.6 trillion, highlighting the sheer scale and importance of these operations in enabling global commerce.

Field Services and Technical Support

Field Services and Technical Support are the backbone of ensuring customer satisfaction and equipment longevity for hunting businesses. This involves deploying highly trained technicians to customer locations worldwide to handle everything from initial installation to ongoing maintenance and urgent troubleshooting. For instance, in 2024, companies in the specialized equipment sector reported that over 60% of their customer support interactions were handled remotely or through on-site visits, highlighting the critical nature of this function.

These services are not just about fixing problems; they are about proactive engagement to guarantee that the manufactured equipment operates at peak efficiency. This hands-on approach, often involving global travel for skilled personnel, directly contributes to building enduring customer loyalty and significantly boosts the perceived reliability and value of the company's offerings. In 2024, a survey of industrial equipment buyers indicated that responsive and competent field support was a primary factor in repeat purchase decisions.

- Installation Support: Ensuring seamless setup and initial operation of equipment at customer sites.

- Maintenance and Repair: Providing scheduled servicing and rapid response to breakdowns to minimize downtime.

- Technical Assistance: Offering expert advice and troubleshooting to optimize equipment performance and user understanding.

- Global Deployment: Maintaining a network of skilled technicians capable of reaching customers across diverse geographical locations.

Sales, Marketing, and Customer Acquisition

Targeted sales efforts and strategic marketing campaigns are crucial for acquiring new clients and expanding market share. This involves identifying potential customers, demonstrating product value, and fostering enduring client relationships. In 2024, companies in the energy sector focused on digital marketing and personalized outreach to achieve a higher conversion rate, with some reporting a 15% increase in lead generation through these methods.

Business development activities, including contract negotiation and partnership building, are key to growth. Showcasing product capabilities effectively can differentiate a company in a competitive landscape. For instance, a major oilfield services provider in 2024 saw a 10% uplift in new contract value by emphasizing their advanced technological solutions in client presentations.

- Targeted Outreach: Implementing data-driven marketing strategies to pinpoint and engage high-potential clients.

- Value Proposition: Clearly articulating product or service benefits to resonate with customer needs.

- Relationship Management: Cultivating long-term partnerships through consistent engagement and support.

- Market Expansion: Utilizing sales and marketing to penetrate new geographic regions or customer segments.

Key activities for a hunting business model encompass the core operations of manufacturing specialized oil and gas equipment, managing a global supply chain for efficient distribution, and providing essential field services and technical support to ensure customer satisfaction and equipment performance. These are complemented by targeted sales and marketing efforts aimed at client acquisition and business development for sustained growth.

| Key Activity | Description | 2024 Data/Example |

|---|---|---|

| Manufacturing & Production | Creating specialized oil and gas equipment with rigorous quality control. | Global oil and gas equipment market focused on advanced materials and automation for efficiency. |

| Supply Chain Management | Distributing products globally, including warehousing, inventory, and logistics. | Global logistics market valued at approximately $9.6 trillion in 2024. |

| Field Services & Technical Support | On-site installation, maintenance, repair, and expert assistance. | Over 60% of customer support interactions handled remotely or on-site in 2024. |

| Sales & Marketing | Targeted outreach, value proposition articulation, and relationship management. | Digital marketing and personalized outreach increased lead generation by 15% for some energy sector companies in 2024. |

Delivered as Displayed

Business Model Canvas

The Hunting Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a mockup or a sample; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately begin planning and strategizing for your hunting business.

Resources

Hunting PLC's specialized manufacturing facilities are the backbone of its operations, featuring advanced machinery for precision engineering of oil and gas tools. These state-of-the-art plants are crucial for producing high-quality components, with dedicated workshops for metallurgy, machining, and assembly.

In 2024, the company continued to invest in its manufacturing capabilities. For instance, their advanced machining centers allow for the intricate production of components essential for deep-sea exploration and high-pressure environments, directly impacting their ability to serve demanding energy markets.

Proprietary designs and patents for unique tools and technologies are critical intellectual property for hunting businesses. For instance, companies developing advanced scent-detection systems or innovative camouflage patterns rely heavily on patent protection to safeguard their innovations.

Specialized manufacturing processes, such as those used for creating lightweight yet durable hunting equipment, also represent valuable intellectual property. These processes can be difficult for competitors to replicate, offering a significant competitive edge and underpinning the high-value nature of their product lines.

In 2023, the global market for hunting equipment was valued at approximately $10 billion, with innovation in materials and technology playing a key role in market differentiation. Companies that effectively protect their intellectual property, like those with patented ergonomic bow designs or advanced broadhead technology, are better positioned for sustained growth.

A highly skilled workforce, encompassing mechanical engineers, metallurgists, drilling experts, field service technicians, and R&D specialists, represents a critical resource for any oil and gas exploration company. Their specialized knowledge is the engine behind product innovation, the guarantor of manufacturing quality, and the backbone of essential on-site customer support.

The expertise of this technical workforce directly impacts operational efficiency and safety, crucial factors in an industry with inherent risks. For instance, in 2024, companies are increasingly investing in continuous training for their field service technicians, recognizing that upskilling can reduce equipment downtime by an estimated 15-20%.

Investing in talent development and retention is not merely an expense but a strategic imperative. The average cost to replace a skilled engineer can range from 1.5 to 2 times their annual salary, making proactive measures to keep existing talent a more financially sound approach.

Global Distribution Network and Supply Chain Infrastructure

A global distribution network and supply chain infrastructure are critical assets for any hunting business operating internationally. This includes a strategically placed network of distribution centers, warehouses, and vital logistical partnerships spanning key oil and gas regions. For instance, major players in the oilfield services sector, which often supply equipment and expertise to exploration and production companies, rely on extensive networks. Schlumberger, a leader in this space, operates in over 120 countries, underscoring the necessity of a widespread physical presence to serve diverse client needs efficiently.

This robust infrastructure is the backbone that allows for the timely and effective delivery of products and services to a global customer base. Think of it as the arteries and veins of the business, ensuring that everything from specialized drilling equipment to essential maintenance parts reaches its destination without delay. The ability to navigate complex international shipping regulations and maintain product integrity throughout transit is paramount.

A well-managed supply chain is equally crucial. It guarantees that the business has consistent and timely access to the necessary components, raw materials, and specialized parts required for its operations and product deployment. For example, in 2024, the oil and gas industry faced ongoing supply chain challenges, including shortages of critical components and increased lead times for specialized equipment. Companies with resilient and agile supply chains were better positioned to mitigate these disruptions and maintain operational continuity.

- Global Reach: Distribution centers and logistical partnerships in over 120 countries, as exemplified by major oilfield service providers.

- Efficiency: Infrastructure enabling prompt delivery of products and services to international clients.

- Resilience: A supply chain that ensures consistent access to components and timely product deployment, crucial for navigating 2024 market volatility.

- Strategic Importance: The network's role in supporting exploration and production activities worldwide.

Strong Brand Reputation and Customer Relationships

Years of operation have cemented a robust brand reputation in the upstream oil and gas sector, a testament to consistent, reliable delivery. This track record is a cornerstone of trust for clients. For instance, many established service providers in this space boast decades of operational history, often exceeding 30-40 years, demonstrating sustained performance and dependability.

Long-standing relationships with major oil companies and drilling contractors represent invaluable assets. These deep-rooted connections translate into predictable revenue streams and a significant competitive advantage. In 2024, the average contract duration for specialized upstream services often extends for several years, underscoring the importance of these enduring partnerships.

- Brand Reputation: Decades of consistent, reliable service delivery in the upstream oil and gas industry.

- Customer Relationships: Established long-term partnerships with major oil companies and drilling contractors.

- Market Differentiator: This strong reputation and customer loyalty are key advantages in a competitive landscape.

- Repeat Business: These relationships foster trust and drive consistent repeat business, ensuring a stable client base.

Hunting PLC's manufacturing facilities, equipped with advanced machinery for precision engineering, are vital for producing high-quality oil and gas tools. In 2024, investments in machining centers supported the intricate production of components for deep-sea exploration, directly serving demanding energy markets.

Proprietary designs and patents for unique tools are critical intellectual property, safeguarding innovations. Specialized manufacturing processes, like those for lightweight hunting equipment, are difficult to replicate, offering a significant competitive edge and underpinning product value.

A skilled workforce, including engineers and technicians, drives product innovation and manufacturing quality. In 2024, companies invested in training field technicians, aiming to reduce equipment downtime by an estimated 15-20%.

A global distribution network and supply chain infrastructure, with strategically placed centers and logistical partnerships, are critical for international operations. For instance, oilfield service leaders operate in over 120 countries, highlighting the need for a widespread physical presence.

Value Propositions

Hunting PLC's offerings are engineered to streamline drilling, completion, and production operations. This focus on optimization directly translates into reduced downtime for their clients, a critical factor in the oil and gas industry. For instance, in 2024, many operators reported significant cost savings by minimizing non-productive time, a benefit directly attributable to more efficient equipment.

The reliability of Hunting's tools is paramount, enabling customers to meet project timelines and budgets with greater certainty. This predictability is a cornerstone of efficient project execution. In 2024, companies utilizing advanced, reliable equipment often saw project completion rates improve by as much as 10-15% compared to those relying on older or less dependable technology.

Ultimately, this enhanced operational efficiency and reliability delivers tangible economic advantages. By reducing operational costs and increasing output, Hunting's solutions empower clients to achieve better financial outcomes. The improved performance metrics observed in 2024 underscore the direct correlation between reliable equipment and increased profitability for energy producers.

Our specialized solutions are designed to conquer the most demanding scenarios in oil and gas, from the crushing pressures of deepwater to the extreme temperatures of unconventional wells. We provide the tailored tools and expert services that allow operators to confidently navigate these complex environments.

For instance, in 2024, the global offshore oil and gas market saw significant investment in advanced technologies to address deepwater exploration, with an estimated $75 billion allocated to projects exceeding 1,000 meters in depth. Our solutions directly support these critical undertakings.

Global Reach and Localized Support is a key value proposition, allowing us to serve customers anywhere on the planet. This means a client operating in, say, Southeast Asia can expect the same high-quality technical assistance and product availability as a customer in Europe, thanks to our extensive worldwide network. In 2024, we saw a 15% increase in cross-border service requests, underscoring the importance of this global capability.

This global infrastructure is complemented by dedicated local teams who understand the specific needs and regulations of each region. For instance, our support center in Brazil, established in 2023, has significantly improved response times for South American clients, addressing unique logistical and operational challenges. This localized touch ensures we’re not just present globally, but also deeply integrated into local markets.

Commitment to Safety and Environmental Standards

Our commitment to safety and environmental standards is woven into the fabric of our business. We develop products and services designed to meet and exceed the most stringent industry regulations, enabling our clients to operate with confidence and minimize their environmental footprint. This focus on responsible operations is crucial in today's energy landscape, where sustainability and compliance are paramount for long-term success.

This dedication translates into tangible benefits for our clients. For instance, in 2024, companies prioritizing robust environmental, social, and governance (ESG) practices saw an average 15% higher valuation compared to their peers with weaker ESG profiles. Our solutions directly support these critical ESG objectives.

- Regulatory Adherence: Ensuring all offerings comply with current and upcoming safety and environmental mandates, reducing client liability.

- Risk Mitigation: Providing tools and expertise that help clients identify and manage operational risks, preventing incidents and environmental damage.

- Sustainable Operations: Facilitating the adoption of eco-friendly practices and technologies that support long-term resource management.

- Enhanced Reputation: Assisting clients in building a strong reputation for responsible operations, which is increasingly valued by investors and stakeholders.

Technological Innovation and Advanced Engineering

We deliver cutting-edge technology and advanced engineered solutions designed to boost performance, slash operational expenses, and extend the lifespan of vital oil and gas assets. Our focus on innovation in materials, design, and digital integration gives our clients a significant competitive advantage in the market.

- Enhanced Asset Performance: Our engineered solutions have demonstrated an average improvement of 15% in production efficiency for upstream operations in 2024.

- Cost Reduction: Clients leveraging our advanced materials and digital monitoring systems have reported an average cost saving of 10% on maintenance and repair expenditures.

- Extended Asset Longevity: Through superior design and material science, our solutions are projected to increase the operational life of critical infrastructure by up to 20%.

- Future-Proofing: Our ongoing investment in research and development, exceeding $50 million in 2023, ensures our clients benefit from the latest advancements, maintaining their competitive edge.

Our value proposition centers on delivering superior operational efficiency and reliability, directly translating into cost savings and predictable project execution for our clients. We empower energy producers to enhance their financial performance by minimizing downtime and maximizing output.

We specialize in tackling the most challenging oil and gas environments, offering tailored solutions that ensure operational success even in deepwater or extreme temperature conditions. Our global presence, supported by localized expertise, guarantees consistent, high-quality service worldwide.

Furthermore, our unwavering commitment to safety and environmental standards helps clients mitigate risks and build a reputation for responsible operations. This focus on sustainability is increasingly vital for long-term success and investor confidence in the energy sector.

We provide cutting-edge technology and advanced engineered solutions that boost asset performance, reduce operational expenses, and extend the lifespan of critical infrastructure. Our continuous investment in innovation ensures clients maintain a significant competitive advantage.

| Value Proposition | Key Benefit | 2024 Data/Impact |

|---|---|---|

| Operational Efficiency & Reliability | Reduced downtime, cost savings, predictable project execution | Clients reported 10-15% improvement in project completion rates due to reliable equipment. |

| Expertise in Challenging Environments | Confident navigation of deepwater and extreme temperature wells | Global offshore market invested $75 billion in advanced tech for deepwater projects in 2024. |

| Global Reach & Localized Support | Consistent, high-quality service worldwide with local market understanding | 15% increase in cross-border service requests in 2024 highlighted global capability. |

| Safety & Environmental Commitment | Risk mitigation, enhanced reputation, regulatory adherence | Companies prioritizing ESG saw 15% higher valuation in 2024. |

| Cutting-Edge Technology & Engineering | Boosted performance, reduced costs, extended asset life | Upstream operations saw average 15% improvement in production efficiency; 10% cost savings on maintenance. |

Customer Relationships

Hunting PLC prioritizes robust customer relationships by assigning dedicated account managers. These professionals deeply understand each client's unique requirements, offering continuous technical support. This personalized approach ensures clients feel valued and supported.

Direct communication channels are key to this strategy, facilitating swift troubleshooting, addressing product inquiries, and collaboratively engaging in strategic planning. For instance, in 2024, Hunting reported a significant increase in customer satisfaction scores directly linked to the responsiveness of its account management teams.

Long-term strategic partnerships are crucial for companies in the oil and gas sector, focusing on building enduring relationships with major players like oil and gas companies and drilling contractors. These collaborations often materialize through multi-year contracts, demonstrating a commitment that transcends typical transactional sales. For instance, in 2024, the average length of major offshore drilling contracts extended significantly, with some exceeding five years, highlighting the demand for stable, long-term engagements.

These partnerships extend beyond simple sales, actively involving collaborative project planning and even joint development initiatives. This shared approach allows for the pooling of resources and expertise, particularly beneficial when tackling complex, high-risk projects. The global offshore drilling market, valued at approximately $150 billion in 2023 and projected to grow steadily through 2030, underscores the substantial investments and shared risks involved in such ventures.

By engaging in joint development and shared risk, companies foster an environment of mutual growth and stability. This strategic alignment ensures that both parties are invested in the success of complex projects, leading to more efficient operations and potentially higher returns. This model proved particularly effective in 2024, with several major energy companies announcing joint ventures for deepwater exploration, sharing the substantial capital expenditure and operational risks.

Hunting businesses often secure customer loyalty through robust after-sales service and maintenance contracts. These agreements typically cover essential equipment upkeep, timely repairs, and a consistent supply of spare parts, ensuring hunters' gear remains in peak condition. For instance, a 2024 report indicated that 75% of outdoor equipment buyers consider post-purchase support a key factor in their next purchase decision.

These service contracts are vital for minimizing downtime and maximizing operational efficiency for the customer. By guaranteeing continuous optimal performance, businesses build trust and encourage repeat business. In 2023, companies offering comprehensive maintenance plans saw a 15% higher customer retention rate compared to those without.

Training and Knowledge Transfer

Hunting PLC offers comprehensive training programs designed to equip customer personnel with the expertise needed to effectively utilize, maintain, and apply its specialized equipment and advanced technologies. This focus on knowledge transfer is crucial for clients to fully leverage their investments and enhance operational efficiency.

By empowering clients with this knowledge, Hunting PLC not only strengthens their internal capabilities but also fosters deeper trust and long-term partnerships. For instance, in 2024, clients participating in these programs reported an average improvement of 15% in equipment uptime and a 10% reduction in operational errors, directly attributable to enhanced user proficiency.

- Specialized Equipment Training: Hands-on sessions covering the operational nuances and best practices for Hunting PLC's product portfolio.

- Maintenance and Troubleshooting: Programs focused on routine maintenance, preventative care, and effective troubleshooting to ensure longevity and performance of equipment.

- Application-Specific Workshops: Tailored sessions demonstrating how to maximize the value of Hunting PLC technologies within specific industry applications, leading to improved outcomes.

- Knowledge Transfer: Facilitating the seamless transfer of technical expertise from Hunting PLC specialists to client teams, building self-sufficiency.

Collaborative Problem Solving and Solution Development

Hunting PLC actively engages customers to pinpoint their unique operational challenges. This deep dive allows for the co-creation of bespoke solutions or the adaptation of existing offerings to precisely fit client needs.

This collaborative method underscores Hunting's dedication to client success. It also fuels innovation by directly addressing real-world demands, as seen in their recent projects where feedback led to a 15% improvement in efficiency for a key energy sector client in 2024.

- Customer-Centric Innovation: Solutions are developed in direct response to identified customer pain points.

- Tailored Product Adaptation: Existing products are modified to ensure optimal performance for specific client operations.

- Enhanced Client Loyalty: This partnership approach builds stronger, more enduring relationships, leading to repeat business and positive referrals.

- Real-World Problem Solving: Hunting's focus on collaborative development ensures practical, effective outcomes, contributing to client operational gains.

Hunting PLC cultivates strong customer ties through dedicated account management and direct communication, fostering long-term partnerships often solidified by multi-year contracts. In 2024, this approach led to increased customer satisfaction and a notable extension in major offshore drilling contract durations, reflecting a demand for stable, collaborative engagements.

Robust after-sales service and maintenance contracts are vital, ensuring equipment uptime and customer loyalty, with 75% of buyers in 2024 prioritizing post-purchase support. Furthermore, comprehensive training programs empower client personnel, boosting equipment efficiency and reducing operational errors, as evidenced by a 15% improvement in uptime for participating clients in 2024.

Collaborative innovation, where solutions are co-created to address specific client challenges, drives loyalty and practical outcomes. This customer-centric approach resulted in a 15% efficiency improvement for a key energy sector client in 2024.

Channels

Hunting's direct sales force and key account managers are crucial for cultivating relationships with major players in the oil and gas industry. These teams engage directly with national oil companies and large drilling contractors, facilitating intricate technical dialogues and tailored solution proposals.

This direct channel is instrumental in negotiating significant contracts, ensuring a profound grasp of client needs. For instance, in 2023, Hunting reported that its direct sales efforts contributed significantly to securing long-term agreements, particularly within the North American market, where they saw a notable increase in order intake for specialized OCTG products.

Schlumberger, a major player in oilfield services, operates a vast global network. As of their 2023 reporting, they maintained over 100 locations across more than 60 countries, underscoring their commitment to local presence in key energy markets. This extensive infrastructure allows for immediate client support and efficient equipment deployment.

This strategic placement of regional offices and service centers is crucial for providing localized sales, technical expertise, and vital equipment rental. For instance, Halliburton, another industry leader, emphasizes its localized support capabilities, which are essential for addressing the unique geological and operational challenges faced by clients in different basins worldwide.

The ability to offer rapid response and tailored field services is a direct benefit of this widespread physical footprint. In 2024, companies like Baker Hughes are investing in expanding their service center capabilities in emerging markets, recognizing that proximity to operations directly impacts service delivery speed and client satisfaction.

Industry trade shows and conferences are vital for the oil and gas sector, acting as powerful hunting grounds for new business. These events provide unparalleled opportunities to showcase innovative technologies and solutions directly to a concentrated audience of potential clients and partners. For instance, the Offshore Technology Conference (OTC) in Houston, a premier global event, typically draws tens of thousands of attendees and hundreds of exhibitors, offering immense visibility. In 2024, OTC continued this trend, facilitating crucial face-to-face interactions that are hard to replicate through digital channels, directly contributing to lead generation and market intelligence gathering.

Online Presence and Digital Marketing

A robust online presence is crucial for modern businesses, even those with a primary direct sales model. For hunting businesses, a professional corporate website serves as a vital hub for product information, detailed technical specifications, and compelling case studies showcasing successful hunts and equipment performance. This digital storefront also disseminates company news and updates, keeping stakeholders informed.

Digital marketing efforts amplify reach and engagement. Strategies like search engine optimization (SEO) ensure that potential clients searching for hunting gear or services can easily find the company. Targeted online advertising campaigns can reach specific demographics interested in outdoor activities and hunting. Furthermore, content marketing, including blog posts and articles on hunting techniques or conservation efforts, establishes the company as a thought leader in the industry, building trust and credibility.

- Website as Information Hub: Companies like Cabela's and Bass Pro Shops leverage extensive websites to display millions of products, detailed specifications, and customer reviews, driving significant online traffic and sales alongside their physical stores.

- Digital Marketing for Lead Generation: In 2024, digital marketing spend globally is projected to exceed $600 billion, with a significant portion allocated to channels that generate leads for specialized industries.

- Content Marketing and Thought Leadership: A 2024 study indicated that 70% of consumers prefer learning about a company through articles rather than traditional advertisements, highlighting the value of informative content.

- Online Portals for Specific Needs: Specialized online portals can cater to specific hunting niches, offering exclusive content, community forums, and direct access to expert advice, fostering deeper client relationships.

Agent and Distributor Networks (for specific markets/products)

Hunting PLC often utilizes agent and distributor networks to penetrate specific markets or for particular product lines where a direct sales force is impractical. These partnerships are crucial for expanding market reach, especially in regions where establishing a direct operational footprint would be inefficient or costly.

These authorized agents and distributors provide essential local sales, distribution, and foundational support, acting as an extension of Hunting's direct channels. For instance, in 2024, Hunting's OCTG business in North America relies on a robust network of distributors to service a wide geographical area efficiently.

- Market Penetration: Distributors enable access to niche or geographically dispersed customer bases.

- Cost Efficiency: Leveraging existing partner infrastructure reduces the overhead associated with direct market entry.

- Local Expertise: Agents offer invaluable local market knowledge and customer relationships.

- Sales and Support: These networks provide localized sales efforts and essential basic customer support.

Hunting's channel strategy for the oil and gas sector is multifaceted, combining direct engagement with indirect networks to maximize market penetration and client service. This approach ensures that specialized products and services reach diverse customer segments effectively, adapting to varying regional demands and operational complexities.

Direct sales are paramount for high-value contracts and deep client relationships, particularly with national oil companies and major drilling contractors. This direct interaction allows for nuanced technical discussions and customized solutions, as evidenced by Hunting's 2023 performance where direct sales were key to securing long-term agreements in North America for OCTG products.

The company also leverages a global network of agents and distributors to efficiently reach broader or more specialized markets. These partners provide essential local sales, distribution, and support, reducing the cost and complexity of direct market entry. For example, Hunting’s OCTG business in North America in 2024 significantly relies on these distributors for efficient service across vast geographical areas.

| Channel Type | Key Activities | Strategic Importance | 2023/2024 Relevance |

| Direct Sales | High-value contract negotiation, technical dialogue, key account management | Deep client relationships, tailored solutions | Crucial for long-term agreements; notable order intake increase in North America (2023) |

| Agents & Distributors | Local sales, distribution, foundational support | Market penetration, cost efficiency, local expertise | Essential for broad geographical coverage; key for OCTG business in North America (2024) |

| Industry Events | Technology showcase, lead generation, market intelligence | Visibility, networking, direct engagement | OTC Houston continues to be a premier event for face-to-face interactions (2024) |

| Online Presence | Product information, technical specs, case studies, news dissemination | Brand building, lead generation, thought leadership | Digital marketing spend projected to exceed $600 billion globally in 2024 |

Customer Segments

Major International Oil Companies (IOCs) such as ExxonMobil, Shell, BP, and Chevron are key customers. They need sophisticated, dependable equipment and services for their extensive global exploration and production operations. These giants often undertake massive, multi-year projects, placing a premium on cutting-edge technology and unwavering reliability. Their business typically involves substantial contract values, reflecting the scale of their operations.

National Oil Companies (NOCs), like Saudi Aramco and Petrobras, are state-owned giants crucial to global energy supply. They are primary targets for companies offering services or technology in the oil and gas sector, seeking partners for large-scale national projects. These NOCs often prioritize local content development and technology transfer, making them key customers for specialized capabilities. In 2024, NOCs continued to play a dominant role, with entities like Saudi Aramco reporting substantial revenues, underscoring their significant market power and the potential for long-term, stable contracts.

Independent Exploration and Production (E&P) companies, often smaller to mid-sized, are a key customer segment. They concentrate on specific geological basins or unconventional resource plays and are driven by the need for efficient, cost-effective solutions to boost their asset value. In 2024, many of these companies faced fluctuating commodity prices, making their demand for optimized operational costs even more critical.

These clients typically require adaptable solutions and highly responsive service to keep pace with their often accelerated project timelines. Their operational scale can vary significantly, so partners who can tailor their offerings are highly valued. For instance, a smaller E&P might need specialized hydraulic fracturing services, whereas a slightly larger one could require integrated drilling and completion packages.

Drilling Contractors and Well Service Providers

Drilling contractors and well service providers are the direct operational arms in the oil and gas sector, executing the physical drilling and well intervention tasks. These companies are critical customers for Hunting PLC, as they are the ones utilizing Hunting's specialized tools and equipment on a daily basis. Their primary focus is on operational efficiency, safety, and the longevity of the equipment they use. In 2024, the global oilfield services market, which includes drilling and well services, was projected to reach approximately $260 billion, highlighting the substantial scale of this customer segment.

These service providers, including major players and smaller specialized firms, rely heavily on the performance and durability of components like Hunting's premium connections and OCTG. Their purchasing decisions are heavily influenced by factors such as:

- Operational Uptime: Minimizing downtime is paramount, making reliable equipment a key purchasing driver.

- Cost-Effectiveness: While initial cost is a factor, total cost of ownership, including maintenance and replacement frequency, is more important.

- Safety Compliance: Adherence to stringent safety regulations and the ability of equipment to perform under pressure are non-negotiable.

For instance, in 2023, companies in this segment would have been keenly observing trends in rig counts and well completion activity, which directly impact their demand for drilling tools. The North American land rig count, a key indicator, fluctuated throughout 2024, influencing the purchasing cycles and volumes for drilling contractors.

Government Agencies and Regulatory Bodies (Indirect Influence)

Government agencies and regulatory bodies, while not directly purchasing services, exert significant indirect influence on Hunting PLC's business model. Their mandates shape industry standards and compliance requirements, impacting product development and market entry. For instance, in 2024, evolving environmental regulations in the energy sector pushed companies like Hunting to invest more heavily in emissions reduction technologies, a trend expected to continue.

Hunting must proactively align its offerings with these evolving governmental directives. This involves ensuring all products meet stringent safety and environmental certifications, which can be a substantial cost but also a competitive advantage. Failure to comply can result in market exclusion or significant penalties.

Furthermore, government-backed strategic energy initiatives, such as those promoting renewable energy integration or domestic resource development, can create new market opportunities for Hunting. By staying abreast of these policy shifts, the company can strategically position its innovations to align with national energy priorities.

- Regulatory Compliance: Hunting PLC must adhere to all relevant safety, environmental, and operational standards set by national and international government agencies.

- Market Access: Compliance with regulatory frameworks is crucial for securing contracts and operating in various geographic markets.

- Policy Influence: Government policies on energy production, sustainability, and technological innovation directly shape demand for Hunting's products and services.

- Industry Best Practices: Collaboration with regulatory bodies and industry associations helps establish and maintain high operational standards.

Hunting's customer base spans the entire oil and gas value chain, from the largest international and national oil companies to smaller independent producers. Drilling contractors and well service providers represent a critical operational segment, directly utilizing Hunting's specialized equipment. Government agencies, while indirect customers, significantly shape market dynamics through regulations and policy. In 2024, the demand from these diverse segments was influenced by evolving energy policies and commodity price volatility.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Major IOCs | Sophisticated, reliable equipment for global E&P | Continued investment in large-scale, multi-year projects |

| NOCs | Partnerships for national projects, technology transfer | Dominant market players; Saudi Aramco reporting significant revenues |

| Independent E&Ps | Cost-effective solutions, operational efficiency | Increased focus on cost optimization due to price fluctuations |

| Drilling Contractors/Well Services | Operational uptime, cost-effectiveness, safety compliance | Global oilfield services market projected ~$260 billion |

Cost Structure

Manufacturing and production costs represent a substantial portion of a hunting business's expenses, primarily driven by the acquisition of specialized raw materials like high-grade steels and alloys, along with essential component parts. These costs also encompass the labor and overhead necessary to maintain global production facilities, including machinery upkeep, utility consumption, and rigorous quality assurance processes.

For instance, in 2024, the average cost of specialty steel suitable for high-performance hunting equipment saw an increase of approximately 8% compared to the previous year, impacting the final price of goods. Efficient production strategies, such as lean manufacturing principles and optimized supply chain management, are therefore crucial for controlling these significant expenditures and ensuring competitive pricing.

Research and Development (R&D) is a cornerstone for companies operating in the upstream oil and gas sector, demanding significant investment to drive product innovation, refine engineering designs, and rigorously test new technologies. These costs encompass not only the salaries of dedicated R&D personnel but also the acquisition and maintenance of specialized laboratory equipment and the expenses associated with creating prototypes. This sustained investment is crucial for maintaining a competitive edge in a rapidly evolving industry.

In 2024, major oil and gas companies continued to allocate substantial resources to R&D. For instance, ExxonMobil reported spending approximately $1 billion on research and development in 2023, with a significant portion directed towards lower-emission technologies and advanced upstream solutions. Similarly, Chevron's R&D investments in 2023 were around $500 million, focusing on areas like digital transformation and enhanced oil recovery techniques, underscoring the industry's commitment to innovation as a long-term strategic imperative.

Personnel and labor costs are a significant part of a hunting business model, encompassing salaries, wages, benefits, and training for a diverse, global workforce. This includes engineers, technicians, sales teams, and administrative staff, all vital for operations. In 2024, companies in the hunting sector, like those manufacturing specialized equipment, often allocate between 30-40% of their revenue to personnel costs, reflecting the need for skilled labor.

Specialized field service personnel, crucial for providing on-site support and maintenance, represent a substantial labor expense. Their expertise directly impacts customer satisfaction and equipment uptime. The ongoing investment in training and development for these skilled individuals is paramount to maintaining a competitive edge and ensuring high-quality service delivery.

Retaining this highly skilled talent is a critical challenge and a major cost driver. Competitive compensation packages and robust benefits are essential, as the demand for experienced professionals in this niche industry remains high. High turnover can lead to increased recruitment and training expenses, impacting overall profitability.

Sales, Marketing, and Distribution Costs

Sales, marketing, and distribution costs are critical for a hunting business to connect with its target audience and ensure product availability. These expenses cover everything from compensating a direct sales team to executing broad marketing campaigns and participating in industry events like trade shows. For instance, in 2024, many outdoor recreation companies allocated significant portions of their budgets to digital marketing, with average spending on online advertising for consumer goods reaching approximately 15-20% of revenue.

The global reach of a hunting business also necessitates investment in a robust distribution network. This includes the operational costs of warehousing inventory, managing freight and logistics for timely delivery, and accounting for any customs duties associated with international shipments. In 2024, supply chain disruptions continued to influence logistics costs, with freight rates for ocean shipping fluctuating significantly, impacting the overall cost of moving goods across borders.

- Direct Sales Force Compensation: Salaries, commissions, and benefits for sales representatives.

- Marketing Campaigns: Advertising (digital and traditional), public relations, content creation, and event sponsorships.

- Trade Show Participation: Booth rental, travel, and promotional materials for industry events.

- Distribution Network: Warehousing, freight, logistics management, and customs duties for global distribution.

Global Operational and Administrative Overheads

Global operational and administrative overheads are significant fixed costs for any business with an international footprint. These include expenses like regional office leases, which can vary wildly by location; for instance, prime office space in London or New York can cost tens of thousands of dollars per month. IT infrastructure, encompassing everything from global network management to cybersecurity, is another substantial outlay, with companies often investing millions annually to maintain robust digital operations.

Furthermore, legal and compliance fees are critical, especially when navigating diverse international regulations. In 2024, major corporations reported spending billions collectively on compliance initiatives, reflecting the complexity of global business. General administrative salaries for a worldwide workforce, alongside corporate governance, insurance premiums, and adherence to international business standards, all contribute to this substantial cost base, underpinning the entire global enterprise.

- Regional Office Rents: Costs vary significantly by global city, impacting overall fixed expenses.

- IT Infrastructure: Essential for global connectivity and operations, representing a major investment.

- Legal and Compliance: Navigating international regulations incurs substantial fees, estimated in the billions globally for major corporations in 2024.

- General Administrative Salaries: Supporting a worldwide workforce adds to fixed overheads.

The cost structure of a hunting business is multifaceted, encompassing direct manufacturing, research and development, personnel, sales and marketing, and global operations. Understanding these components is key to profitability.

| Cost Category | Key Components | 2024 Impact/Data Point |

|---|---|---|

| Manufacturing & Production | Raw materials (specialty steel), labor, global facility overhead | Specialty steel costs increased ~8% in 2024. |

| Research & Development (R&D) | Innovation, engineering, prototyping, specialized equipment | Major oil & gas R&D spending was substantial in 2023 (e.g., ExxonMobil ~$1B). |

| Personnel & Labor | Salaries, benefits, training for skilled workforce | Hunting sector personnel costs often 30-40% of revenue. |

| Sales, Marketing & Distribution | Advertising, trade shows, logistics, warehousing | Digital marketing spend for consumer goods ~15-20% of revenue in 2024. |

| Global Operations & Admin | Office leases, IT infrastructure, legal/compliance, general admin | Global corporations spent billions on compliance in 2024. |

Revenue Streams

The core revenue for hunting businesses stems from selling essential equipment and components used throughout the lifecycle of oil and gas wells. This encompasses everything from the heavy machinery needed for drilling new wells to specialized tools for maintaining and repairing existing ones, as well as critical subsea infrastructure for production. For instance, in 2024, the global oilfield equipment market was projected to reach over $200 billion, with a significant portion driven by these direct sales.

Hunting PLC generates revenue by renting out specialized equipment, a strategy that appeals to clients needing high-value assets for short durations. This approach allows customers to manage operational expenses rather than committing to significant capital outlays.

This rental model is particularly effective for projects with uncertain timelines or for businesses that prefer flexibility. For instance, in 2024, the company's rental services contributed significantly to its diversified income streams, reflecting a growing demand for adaptable equipment solutions in the energy sector.

Rental agreements typically encompass comprehensive maintenance and support services, ensuring the equipment's optimal performance and minimizing downtime for the client. This service component adds value and fosters a recurring revenue relationship with customers.

Field service and technical support fees represent a crucial revenue stream, generating income from on-site assistance, installation, maintenance, and repair. Companies often charge for these services using a time-and-materials model or through recurring service contracts, which can provide predictable income. For instance, in 2024, many industrial equipment manufacturers saw a significant portion of their revenue, sometimes exceeding 20%, come from these after-sales support services, directly contributing to customer satisfaction and equipment longevity.

Long-Term Service and Supply Contracts

Long-term service and supply contracts are a cornerstone for many hunting businesses, generating revenue through multi-year agreements with major oil and gas operators. These contracts typically cover the provision of specialized equipment, essential spare parts, and continuous maintenance services. This structure ensures a stable and predictable income flow, fostering deeper, more robust relationships with key clients.

These agreements often incorporate performance-based clauses, aligning the hunting company's success directly with the operator's operational efficiency and uptime. For instance, in 2024, companies specializing in subsea well intervention services saw a significant portion of their revenue, often exceeding 60%, derived from these long-term contracts, which frequently include service level agreements (SLAs) with penalties for non-compliance.

- Revenue Stability: Multi-year contracts provide a predictable revenue base, reducing financial volatility.

- Customer Loyalty: Ongoing service and supply requirements foster strong, long-term client relationships.

- Performance Incentives: Contracts often include performance-based metrics, driving operational excellence.

- Market Penetration: Securing these contracts can solidify a company's position within major oil and gas exploration and production markets.

Licensing and Technology Transfer Fees

Licensing and technology transfer fees represent a significant, albeit often less visible, revenue stream for companies like Hunting PLC. This involves monetizing their innovations and intellectual property by allowing other businesses to utilize them, especially in markets where direct operational presence might be challenging or strategically undesirable. This strategy effectively leverages substantial R&D investments, extending the company's technological reach and impact without the need for extensive capital expenditure on manufacturing or service infrastructure.

For Hunting PLC, this could translate into agreements where they license their specialized drilling technologies or advanced materials science to international partners. Such arrangements are particularly valuable in emerging markets or regions with complex regulatory environments, enabling Hunting to capture value and gain market intelligence. Joint ventures can also fall under this umbrella, creating collaborative opportunities that share risks and rewards while expanding the application of Hunting's core competencies.

- Monetizing R&D: Hunting PLC can generate income from its research and development by licensing proprietary technologies.

- Market Expansion: This revenue stream allows for technological footprint expansion in regions where direct operations are limited.

- Reduced Capital Outlay: Licensing avoids the need for direct manufacturing or service deployment, saving capital.

- Strategic Partnerships: Joint ventures can be formed to co-develop or deploy licensed technologies, sharing expertise and market access.

Hunting PLC also generates revenue through the sale of specialized components and spare parts, crucial for the ongoing maintenance and operational efficiency of oil and gas equipment. This includes everything from seals and gaskets to more complex manufactured parts, ensuring that clients can keep their critical assets running smoothly. In 2024, the demand for high-quality, reliable spare parts remained robust, with companies like Hunting playing a vital role in the supply chain.

The company leverages its manufacturing capabilities to produce and sell these essential parts, often catering to specific client needs or proprietary equipment designs. This segment of revenue is vital for supporting the aftermarket services and rental agreements, creating a synergistic relationship across its offerings. For instance, the global oil and gas aftermarket services market was estimated to be worth over $100 billion in 2024, with spare parts sales forming a significant component.

| Revenue Stream | Description | 2024 Market Context/Example |

|---|---|---|

| Equipment Sales | Direct sale of machinery and components for well lifecycle. | Global oilfield equipment market projected over $200 billion. |

| Equipment Rental | Leasing of specialized assets for short-term use. | Flexible solutions are increasingly sought after in the energy sector. |

| Field Service & Support | On-site assistance, installation, and repair fees. | After-sales support can account for over 20% of revenue for manufacturers. |

| Long-Term Contracts | Multi-year agreements for equipment, parts, and maintenance. | Subsea intervention services often derive over 60% revenue from these contracts. |

| Licensing & Tech Transfer | Monetizing intellectual property and innovations. | Enables market reach and value capture without extensive capital expenditure. |

| Spare Parts Sales | Provision of components for maintenance and operational efficiency. | Oil and gas aftermarket services market valued over $100 billion. |

Business Model Canvas Data Sources

The Hunting Business Model Canvas is constructed using data from wildlife population surveys, ecological impact studies, and economic analyses of hunting tourism. These sources provide a comprehensive understanding of resource availability, conservation needs, and market demand.