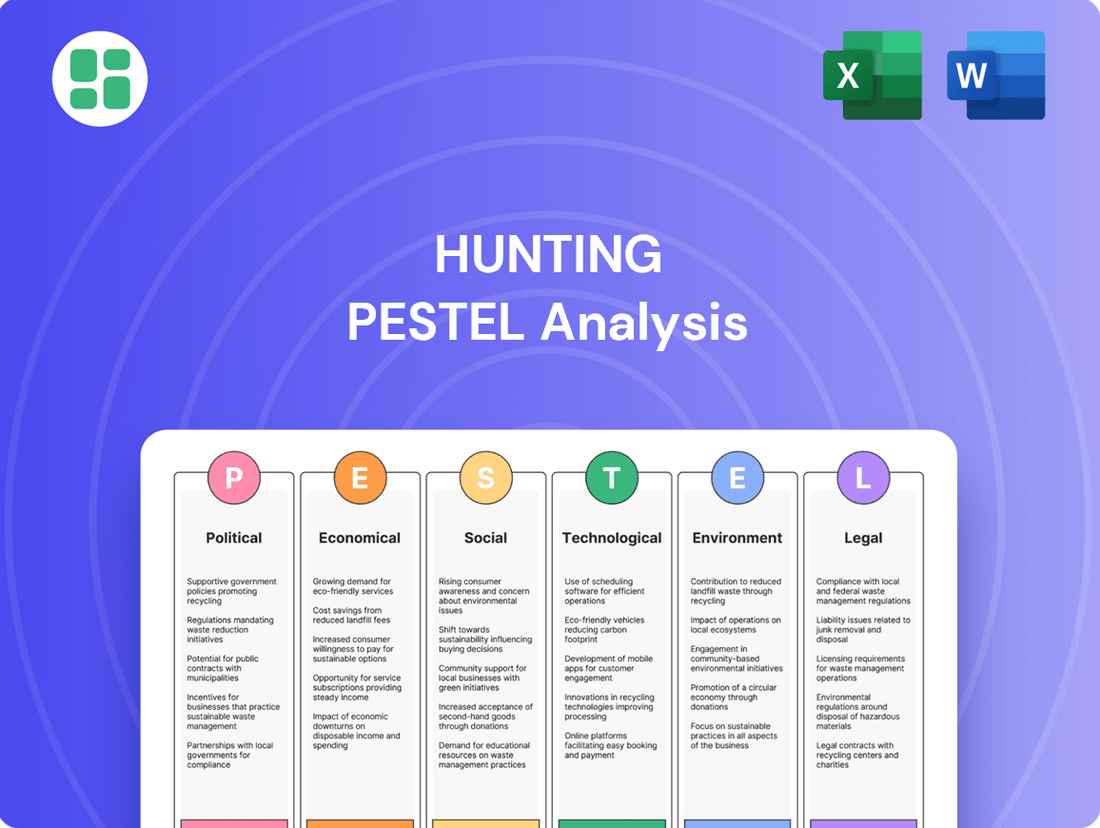

Hunting PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunting Bundle

Uncover the intricate web of external forces shaping the hunting industry with our comprehensive PESTLE analysis. From evolving political landscapes and economic shifts to technological advancements and environmental concerns, understand how these factors impact hunting businesses. Gain actionable intelligence to navigate challenges and seize opportunities. Download the full report now for an unparalleled strategic advantage.

Political factors

Government energy policies are a major driver for the upstream oil and gas sector. For companies like Hunting PLC, these policies can either create opportunities or pose challenges. For instance, governments that continue to support fossil fuel production through subsidies or tax breaks can bolster the operating environment.

In 2024, many nations are still navigating the energy transition, with some maintaining support for traditional energy sources while others accelerate decarbonization efforts. For example, the United States' Inflation Reduction Act of 2022, which includes significant incentives for clean energy, also provides tax credits for carbon capture, utilization, and storage (CCUS), a technology relevant to oil and gas operations.

Conversely, policies focused on rapid phase-outs of fossil fuels, such as bans on new exploration licenses or stricter emissions regulations, can create headwinds. The European Union's Green Deal, aiming for climate neutrality by 2050, exemplifies a policy direction that necessitates strategic adaptation for companies operating within or supplying to that market.

Geopolitical tensions, particularly in regions like the Middle East and Eastern Europe, directly impact global oil and gas markets. For instance, the ongoing conflict in Ukraine has led to significant supply chain disruptions and price volatility. In 2023, Brent crude oil prices experienced fluctuations, often exceeding $80 per barrel due to these geopolitical events, affecting demand for services like those provided by Hunting PLC.

Hunting PLC, with its extensive global operations, is inherently exposed to these geopolitical risks. A conflict in a major oil-producing region can not only disrupt the supply of crude oil, thereby influencing the demand for Hunting's exploration and production services, but also potentially impact its operational safety and logistics. The company's 2023 annual report noted that geopolitical instability was a key risk factor affecting its performance.

The relationship dynamics between oil-producing nations and major consumers are vital for market predictability. For example, the stability of OPEC+ decisions and the diplomatic relations between the US and Iran, a significant oil producer, directly influence global supply. A stable geopolitical climate fosters consistent investment in the energy sector, which benefits companies like Hunting by ensuring a steadier demand for their specialized products and services.

Changes in international trade relations, including the imposition of tariffs or trade barriers, can significantly impact the cost of materials and equipment for Hunting PLC. While the company anticipates minimal direct impact from potential U.S. trade tariffs, these policies can still disrupt global supply chains and affect the competitiveness of its products on an international scale.

For instance, a 2024 report indicated that global trade growth slowed to an estimated 0.9%, down from 2.7% in 2023, highlighting the sensitivity of businesses like Hunting to shifts in trade policy and geopolitical stability.

Conversely, free trade agreements and stable import/export policies are crucial enablers for Hunting's global operations, facilitating smoother transactions and potentially reducing overall operational costs.

Regulatory Environment for Oil and Gas Exploration

The regulatory landscape for oil and gas exploration significantly impacts companies like Hunting. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to refine methane emission standards for the oil and gas sector, potentially increasing compliance costs for operators and their service providers. Similarly, Canada's federal carbon pricing system, which impacts upstream oil and gas operations, saw adjustments in 2024, affecting operational expenses.

Stricter environmental regulations and lengthy permitting processes are recurring challenges. In Europe, the EU's Green Deal initiatives continue to push for reduced fossil fuel reliance, influencing exploration rights and investment sentiment. These factors can extend project timelines and elevate operational expenditures, directly affecting demand for specialized equipment and services.

Conversely, supportive regulatory frameworks can spur activity. For example, the U.S. Inflation Reduction Act of 2022, with its provisions for clean energy tax credits and incentives for domestic energy production, could indirectly benefit the oil and gas services sector by fostering a more stable investment climate. In regions actively seeking to boost domestic energy production, streamlined regulations can accelerate development and, consequently, the demand for Hunting’s offerings.

- The U.S. EPA's ongoing efforts to regulate methane emissions in the oil and gas sector present a key compliance challenge for 2024.

- Canada's carbon pricing mechanism directly influences the operating costs for upstream oil and gas activities.

- EU environmental policies are shaping investment decisions and operational scope within the European energy market.

- U.S. federal incentives, like those in the Inflation Reduction Act, can create a more favorable environment for energy sector investments.

Energy Security Agendas

National energy security agendas are a significant political driver for companies like Hunting. Concerns about reliable energy supplies and a desire for independence often prompt governments to boost domestic oil and gas production. This political imperative translates into sustained demand for Hunting's core services, such as well construction and intervention, as nations aim to secure their own energy futures.

Countries that prioritize energy self-sufficiency frequently champion long-term upstream development projects. For instance, the U.S. Energy Information Administration (EIA) reported that in 2024, domestic crude oil production was projected to reach an average of 13.2 million barrels per day, a slight increase from 2023. This focus on domestic production directly benefits companies providing essential services to the oilfield sector.

- Increased Investment: Government policies supporting domestic energy production can lead to higher capital expenditure in the upstream oil and gas sector.

- Demand for Services: National energy security goals directly stimulate demand for Hunting's well construction and intervention services.

- Long-Term Stability: Countries committed to energy independence tend to foster a more stable and predictable market for upstream oilfield services.

Government policies on energy production and environmental regulations continue to shape the landscape for companies like Hunting. In 2024, the U.S. Inflation Reduction Act's incentives for carbon capture, alongside evolving methane emission standards from the EPA, are key political considerations. Conversely, the EU's Green Deal pushes for decarbonization, impacting investment in traditional energy sectors.

Geopolitical stability, particularly in oil-producing regions, directly influences global supply and demand dynamics. Fluctuations in crude oil prices, often exceeding $80 per barrel in 2023 due to events like the conflict in Ukraine, create market volatility that affects Hunting's operational environment.

National energy security agendas remain a significant driver, encouraging domestic production and thus sustained demand for upstream services. For instance, projected U.S. crude oil production averaging 13.2 million barrels per day in 2024 underscores this focus, benefiting companies like Hunting.

| Policy Area | 2024/2025 Impact on Hunting | Example/Data Point |

|---|---|---|

| Energy Production Incentives | Potential for increased investment in upstream activities. | U.S. Inflation Reduction Act tax credits for CCUS. |

| Environmental Regulations | Increased compliance costs and operational adjustments. | EPA's evolving methane emission standards for oil and gas. |

| Geopolitical Stability | Market volatility and supply chain disruptions. | Brent crude oil prices exceeding $80/barrel in 2023 due to regional conflicts. |

| Energy Security Agendas | Sustained demand for upstream services. | Projected U.S. crude oil production of 13.2 million bpd in 2024. |

What is included in the product

This comprehensive PESTLE analysis of the Hunting industry examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations and strategic direction.

The Hunting PESTLE Analysis offers a structured approach to identifying and understanding external factors, thereby alleviating the pain of uncertainty and enabling more informed strategic decisions.

Economic factors

Global oil and gas prices are a major economic force for Hunting PLC, directly impacting how much oil and gas companies spend on exploring, developing, and producing resources. When prices are low, these companies tend to cut back on their spending, which can mean less demand for Hunting's equipment and services. Conversely, higher prices encourage more investment, boosting business for Hunting.

Looking ahead, forecasts suggest a dip in oil prices for 2025. For instance, Brent crude is expected to average around $75 per barrel in 2025, a decrease from an estimated average of $80 per barrel in 2024. This downward trend could potentially lead to further price declines, impacting Hunting's revenue streams if exploration and production budgets are scaled back by clients.

The global economy's trajectory directly influences industrial demand for energy, a key driver for the upstream oil and gas sector. Robust economic expansion, as seen with projections for around 3.1% global GDP growth in 2024 according to the IMF, typically translates into higher energy consumption. This increased demand stimulates investment in oil and gas exploration and production.

Conversely, periods of economic contraction or slowdown, such as the 2.7% global GDP growth anticipated for 2025, can dampen energy demand. This often leads to reduced capital expenditure by oil and gas companies as they respond to lower anticipated revenues and potentially falling commodity prices.

Capital expenditure in the upstream oil and gas sector is a key indicator for companies like Hunting. When exploration and production companies invest more in finding and extracting oil and gas, it directly translates to higher demand for the specialized products and services Hunting provides, such as their advanced drilling tools and completion equipment.

Forecasts for 2024 and 2025 indicate a positive trend for upstream capital expenditures. For instance, Rystad Energy projected global upstream investments to reach $590 billion in 2024, a notable increase from previous years, signaling a robust environment for oilfield services providers. This upward trajectory suggests sustained demand for Hunting's offerings.

This anticipated rise in upstream investment, driven by factors like energy security concerns and the need to replenish reserves, means oilfield services companies are likely to see increased activity. The continued need for efficient and advanced solutions in drilling, completion, and production operations bodes well for Hunting's revenue streams.

Interest Rates and Access to Capital

Interest rates significantly impact the cost of capital for oil and gas firms like Hunting PLC. Higher rates increase borrowing expenses, potentially hindering investment in new projects and reducing demand for equipment and services. Conversely, lower rates make financing more accessible, encouraging expansion and boosting the sector.

The prospect of interest rate cuts in 2025 offers a more favorable environment for capital-intensive industries. For instance, the US Federal Reserve signaled potential rate reductions in 2024, and further cuts are anticipated in 2025, which could alleviate financing burdens for companies undertaking major capital expenditures.

- Lower borrowing costs: Reduced interest rates directly decrease the expense of debt financing for oil and gas companies.

- Increased investment: More affordable capital encourages investment in exploration, production, and infrastructure projects.

- Equipment demand: Expansionary investment typically translates to higher demand for drilling equipment and related services, benefiting firms like Hunting.

- 2025 outlook: Market expectations point towards potential interest rate easing in 2025, providing a clearer path for strategic financial planning.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for global companies like Hunting PLC, which reports its financial results in U.S. dollars. Fluctuations in exchange rates directly influence the reported value of revenues and costs derived from international operations, potentially impacting overall profitability.

These shifts can also alter the competitive positioning of Hunting's products in various global markets. For instance, a strengthening USD could make its offerings more expensive for overseas buyers, while a weaker USD might boost the translated value of earnings from abroad.

- Impact on Revenue: For example, in fiscal year 2024, a significant appreciation of the US Dollar against currencies where Hunting operates could lead to a reported decrease in revenue, even if local currency sales remain stable.

- Cost Fluctuations: Conversely, if Hunting sources materials or labor in countries with weaker currencies, a depreciating USD could increase its operational costs when translated back into dollars.

- Competitiveness: Exchange rate movements can affect pricing strategies and market share. A stronger pound sterling, for instance, might make Hunting's UK-manufactured products more competitive in the European market.

- Foreign Earnings Translation: The value of profits earned in foreign subsidiaries is subject to translation risk. A weaker Euro in 2025, for example, would reduce the USD equivalent of profits generated within the Eurozone.

Economic factors significantly shape Hunting PLC's operating environment. Global oil and gas prices directly influence client spending, with lower prices in 2025 potentially reducing demand for Hunting's services. Global GDP growth, projected at 3.1% for 2024 and slowing to 2.7% in 2025, impacts energy consumption and thus upstream investment. Interest rate trends, with anticipated cuts in 2025, could lower borrowing costs for clients, encouraging capital expenditure and benefiting Hunting.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on Hunting PLC |

|---|---|---|---|

| Brent Crude Oil Price | $80/barrel (est.) | $75/barrel (est.) | Lower prices may reduce client E&P spending. |

| Global GDP Growth | 3.1% | 2.7% | Slower growth can dampen energy demand and investment. |

| US Interest Rates | Potential cuts | Anticipated further cuts | Lower rates can stimulate client investment and reduce financing costs. |

What You See Is What You Get

Hunting PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Hunting PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the hunting industry, providing valuable insights for strategic planning.

Sociological factors

Public sentiment regarding fossil fuels is rapidly shifting, with a growing demand for cleaner energy sources. This evolving perception directly impacts the oil and gas industry, influencing investment decisions and operational strategies.

Surveys in 2024 indicate a significant portion of the global population supports transitioning to renewable energy, with many willing to pay more for sustainable options. This societal pressure can lead Hunting's clients, who primarily serve traditional energy, to curtail exploration and production, thereby affecting the demand for their services.

For instance, a 2025 report highlighted that over 70% of consumers in developed nations now consider environmental impact when making purchasing decisions, extending to energy providers. This trend could force energy companies to diversify their portfolios, potentially reducing their reliance on traditional exploration, which directly affects companies like Hunting.

The oil and gas sector, including companies like Hunting PLC, is grappling with an aging workforce, with a significant portion of experienced professionals nearing retirement. This demographic trend, coupled with a declining interest from younger generations who often perceive the industry as less appealing than tech or other sectors, creates a looming talent shortage. For instance, in 2024, industry reports indicated that over 50% of the skilled workforce in some regions were aged 50 or older.

Addressing this challenge is crucial for maintaining operational efficiency and driving future innovation. Hunting PLC, therefore, must focus on robust recruitment and retention strategies. This includes investing in training programs and apprenticeships to build a pipeline of new talent, while also ensuring knowledge transfer from experienced employees. By 2025, the industry anticipates a need to fill tens of thousands of specialized roles globally, underscoring the urgency of these initiatives.

Societal expectations are increasingly demanding robust health, safety, and environmental (HSE) performance from all industries, including oil and gas. This pressure directly impacts companies like Hunting PLC and its suppliers, who must demonstrate a commitment to responsible operations to meet public and regulatory scrutiny.

Adherence to high HSE standards is not merely a compliance issue for Hunting PLC; it's a critical factor in maintaining its reputation and securing future business. Clients, particularly major energy corporations, are prioritizing suppliers with proven track records in safety and environmental stewardship, making strong HSE credentials a competitive advantage. For instance, in 2024, many large oil and gas operators integrated specific HSE performance metrics into their supplier selection criteria, impacting contract awards.

Community Engagement and Local Impact

Hunting's social license to operate, especially for its onshore oil and gas support services, is heavily reliant on robust community engagement and diligent management of local impacts. Failure to address community concerns can directly impede project approvals and disrupt ongoing operations, as seen in various energy infrastructure projects globally. Positive community relationships are not just beneficial but essential for sustained operational success and reputation management.

For instance, in 2024, several onshore drilling projects faced significant delays due to local opposition stemming from environmental and social impact concerns. Companies that proactively invested in community development programs and transparent communication often experienced smoother project lifecycles. Hunting's commitment to local employment and stakeholder dialogue is therefore a critical factor in securing and maintaining its operational footprint.

- Community Relations: Hunting's onshore business relies on maintaining strong ties with local communities to ensure project acceptance and operational continuity.

- Local Impact Management: Effectively addressing concerns regarding noise, traffic, and environmental stewardship is paramount for securing and retaining the social license to operate.

- Stakeholder Dialogue: Proactive engagement with local residents, indigenous groups, and regulatory bodies fosters trust and mitigates potential conflicts that could delay or halt operations.

- Economic Contribution: Demonstrating a positive economic impact through local job creation and supply chain utilization can significantly enhance community support for Hunting's activities.

Employee Well-being and Diversity Initiatives

The oil and gas industry, including companies like Hunting PLC, is seeing a significant shift towards prioritizing employee well-being and diversity. This isn't just about corporate social responsibility; it's becoming a critical factor in attracting and retaining talent in a competitive market. For instance, a 2024 survey by Deloitte found that 70% of employees consider a company's commitment to diversity, equity, and inclusion when choosing an employer. This focus helps foster a more inclusive culture, which in turn can boost innovation and overall organizational performance.

Hunting PLC needs to actively implement and promote robust diversity and inclusion programs. This involves not only ensuring fair representation across all levels of the organization but also creating an environment where all employees feel valued and respected. Initiatives like mentorship programs, unconscious bias training, and flexible work arrangements can be instrumental in this regard. Data from 2024 indicates that companies with higher levels of diversity in their leadership teams often outperform their less diverse counterparts by as much as 21% in terms of profitability.

Key aspects of these initiatives include:

- Enhanced Employee Assistance Programs: Providing comprehensive mental health and well-being support services.

- Inclusive Hiring Practices: Implementing strategies to attract candidates from underrepresented groups.

- Diversity Training and Awareness: Educating the workforce on the importance of DEI and fostering an inclusive workplace.

- Pay Equity Audits: Regularly reviewing compensation to ensure fairness across all demographics.

Societal expectations are increasingly demanding robust health, safety, and environmental (HSE) performance from all industries, including oil and gas. This pressure directly impacts companies like Hunting PLC and its suppliers, who must demonstrate a commitment to responsible operations to meet public and regulatory scrutiny.

Adherence to high HSE standards is not merely a compliance issue for Hunting PLC; it's a critical factor in maintaining its reputation and securing future business. Clients, particularly major energy corporations, are prioritizing suppliers with proven track records in safety and environmental stewardship, making strong HSE credentials a competitive advantage. For instance, in 2024, many large oil and gas operators integrated specific HSE performance metrics into their supplier selection criteria, impacting contract awards.

Hunting's social license to operate, especially for its onshore oil and gas support services, is heavily reliant on robust community engagement and diligent management of local impacts. Failure to address community concerns can directly impede project approvals and disrupt ongoing operations, as seen in various energy infrastructure projects globally. Positive community relationships are not just beneficial but essential for sustained operational success and reputation management.

The oil and gas industry, including companies like Hunting PLC, is seeing a significant shift towards prioritizing employee well-being and diversity. This isn't just about corporate social responsibility; it's becoming a critical factor in attracting and retaining talent in a competitive market. For instance, a 2024 survey by Deloitte found that 70% of employees consider a company's commitment to diversity, equity, and inclusion when choosing an employer.

Technological factors

Continuous innovation in drilling techniques, seismic imaging, and exploration technologies is significantly boosting efficiency and minimizing the environmental impact of oil and gas extraction. For instance, advancements in horizontal drilling and hydraulic fracturing have unlocked previously inaccessible reserves, a trend expected to continue shaping the energy landscape through 2025.

Hunting PLC's strategic advantage hinges on its capacity to supply advanced equipment and services that complement these technological leaps. This includes offerings like AI-powered seismic data interpretation, which promises to accelerate discovery timelines, and sophisticated drilling automation systems designed to enhance safety and precision in operations.

The oil and gas sector is rapidly embracing digitalization and automation, with the global industrial IoT market in oil and gas projected to reach $33.4 billion by 2025, up from $17.1 billion in 2020. This trend, including the adoption of industrial IoT (IIoT), presents significant opportunities for enhanced operational efficiency, improved safety protocols, and robust remote monitoring capabilities. Hunting PLC can capitalize on these advancements by focusing on intelligent well completion and infrastructure support solutions that seamlessly integrate with emerging digital ecosystems.

The advancement of Carbon Capture, Utilization, and Storage (CCUS) is paramount for the sustained relevance of fossil fuels amidst global decarbonization efforts. CCUS technologies are evolving rapidly, with significant investment flowing into research and deployment. For instance, the International Energy Agency (IEA) reported in its 2024 outlook that global CCUS capacity is projected to reach over 200 million tonnes per annum by 2030, a substantial increase from current levels.

Hunting PLC is well-positioned to leverage this technological shift by supplying essential equipment and services for the burgeoning CO2 transport and storage infrastructure. This strategic alignment taps into the escalating demand for effective emissions reduction solutions, as companies worldwide seek to meet net-zero targets. Hunting's expertise in pipeline components and specialized handling equipment directly addresses the needs of CCUS projects, potentially boosting revenue streams in this critical growth area.

Emerging Energy Transition Technologies

The global shift towards cleaner energy sources is spurring innovation in technologies like green hydrogen production and advanced renewable energy integration. These developments present both challenges and opportunities for companies like Hunting PLC, which traditionally operates within the oil and gas sector.

Hunting PLC is actively pursuing diversification strategies, aiming to capitalize on the growing low-carbon energy transition market. This strategic pivot leverages their established expertise in precision engineering, a skill set highly transferable to the manufacturing and maintenance of new energy infrastructure. For instance, the company has highlighted its capabilities in producing components for hydrogen electrolyzers and fuel cells, demonstrating a tangible step towards this new energy landscape.

The market for energy transition technologies is experiencing significant growth. By 2030, the global green hydrogen market is projected to reach over $50 billion, with significant investment flowing into renewable energy projects. Hunting's proactive approach positions them to benefit from these expanding markets:

- Hydrogen Production: Developing advanced manufacturing processes for components used in electrolysis and fuel cell technology.

- Renewable Energy Integration: Exploring opportunities in supplying precision-engineered parts for wind turbine components or solar energy systems.

- Low-Carbon Solutions: Investing in research and development for technologies that reduce emissions in existing energy operations and enable new, cleaner energy pathways.

- Market Diversification: Actively seeking partnerships and contracts within the renewable and hydrogen sectors to broaden revenue streams beyond traditional oil and gas services.

Additive Manufacturing (3D Printing)

Additive manufacturing, or 3D printing, is transforming the energy services sector by enabling faster prototyping, localized on-demand production of specialized parts, and the creation of complex components previously impossible to manufacture. This technology streamlines supply chains and reduces lead times for critical equipment.

Hunting PLC recognizes the strategic value of additive manufacturing, having invested in its capabilities to enhance future product development and boost operational efficiency. This commitment positions them to leverage 3D printing for custom solutions and quicker responses to market demands.

- Market Growth: The global 3D printing market is projected to reach approximately $62.5 billion by 2030, indicating significant adoption across industries, including energy services.

- Hunting's Investment: While specific figures for Hunting's additive manufacturing investments are not publicly detailed, their strategic focus on advanced manufacturing technologies signals a commitment to integrating this capability.

- Efficiency Gains: Companies adopting 3D printing for spare parts can see reductions in inventory costs by as much as 80% and decrease lead times by over 50% for certain components.

- Material Innovation: Advancements in printing materials, such as high-strength alloys and polymers suitable for harsh environments, are expanding the applicability of additive manufacturing in oil and gas operations.

Technological advancements are profoundly reshaping the oil and gas industry, driving efficiency and sustainability. Innovations in areas like AI-driven seismic analysis and automation are accelerating discovery and improving operational safety. The global industrial IoT market in oil and gas is expected to reach $33.4 billion by 2025, highlighting the significant digital transformation underway.

Hunting PLC is strategically positioned to benefit from these technological shifts. The company supplies advanced equipment and services that integrate with these new technologies, such as AI-powered data interpretation and automated drilling systems. This focus on advanced solutions allows Hunting to capitalize on the industry's move towards greater digitalization and efficiency.

The increasing adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies represents another key technological factor. Global CCUS capacity is projected to exceed 200 million tonnes per annum by 2030, according to the IEA. Hunting's expertise in pipeline components and specialized handling equipment makes them a vital supplier for the growing CCUS infrastructure.

Furthermore, the energy transition is spurring innovation in areas like green hydrogen production, with the market projected to exceed $50 billion by 2030. Hunting is actively diversifying into these low-carbon sectors, leveraging its precision engineering skills for components in electrolyzers and fuel cells.

| Technology Area | Projected Market Size (approx.) | Key Impact on Oil & Gas | Hunting's Relevance |

|---|---|---|---|

| Industrial IoT (Oil & Gas) | $33.4 billion by 2025 | Enhanced efficiency, safety, remote monitoring | Supplying integrated digital solutions |

| Carbon Capture, Utilization, and Storage (CCUS) | 200+ million tonnes per annum capacity by 2030 | Emissions reduction, sustained fossil fuel relevance | Providing CO2 transport and storage infrastructure components |

| Green Hydrogen Production | Over $50 billion by 2030 | Shift to cleaner energy sources, new market opportunities | Manufacturing components for electrolyzers and fuel cells |

| Additive Manufacturing (3D Printing) | $62.5 billion by 2030 | Faster prototyping, on-demand parts, complex component creation | Investing in capabilities for custom solutions and efficiency |

Legal factors

Environmental regulations are tightening globally, impacting the oil and gas sector. For instance, the EU's Emissions Trading System (ETS) saw carbon prices average around €65 per tonne in early 2024, a significant increase that pressures operators to reduce their carbon footprint. This necessitates companies like Hunting PLC to offer solutions that help their clients meet increasingly stringent limits on greenhouse gas emissions and methane leakage.

The push for greater transparency in emissions reporting, including Scope 1, 2, and 3 disclosures, is a key trend. By mid-2024, many major oil and gas companies were enhancing their reporting frameworks to align with evolving investor and regulatory expectations. Hunting's ability to provide products and services that facilitate this compliance directly influences its market position and client relationships in this evolving landscape.

Hunting PLC operates under stringent health and safety legislation across its global locations, requiring adherence to rigorous standards for safe working environments and practices. Compliance is not just a legal necessity; it's fundamental to preventing workplace incidents, safeguarding employee welfare, and mitigating the risk of significant legal repercussions and damage to the company's reputation.

In 2023, the company reported a reduction in its Lost Time Injury Frequency Rate (LTIFR) to 0.37, demonstrating a commitment to improving safety performance. This focus on robust quality assurance and strong health and safety protocols is a critical element of Hunting's operational strategy, directly impacting its ability to maintain business continuity and stakeholder trust.

International sanctions can significantly impact Hunting PLC's global operations, potentially limiting access to key markets and affecting revenue streams. For instance, sanctions targeting energy sectors, such as those impacting Russian oil exports, directly influence global trade dynamics and create complex compliance hurdles for companies like Hunting.

Contractual and Liability Frameworks

The contractual and liability frameworks significantly shape Hunting PLC's operations. Robust contract management is vital, as evidenced by the company's reliance on agreements for its various service lines, from oil and gas exploration support to aerospace manufacturing. In 2024, for instance, the successful execution of long-term supply contracts for critical components in the defense sector underpins revenue stability.

Intellectual property protection is paramount, especially given Hunting's involvement in specialized technologies. Safeguarding patents and proprietary designs prevents competitors from replicating their innovations, a key factor in maintaining market advantage. Product liability considerations, particularly in highly regulated industries like aviation and energy, necessitate stringent quality control and risk mitigation strategies to avoid costly recalls or legal challenges.

- Contractual Compliance: Ensuring all client and supplier agreements adhere to relevant international and national laws, minimizing the risk of breach of contract claims.

- Intellectual Property Defense: Actively protecting patented technologies and trade secrets through legal means, as demonstrated by ongoing patent filings in advanced materials.

- Liability Management: Implementing comprehensive product safety and quality assurance protocols to reduce potential product liability claims, a critical aspect for their aerospace division.

Anti-Corruption and Bribery Laws

Hunting PLC, operating globally, faces a complex web of anti-corruption and bribery legislation. Key among these are the UK Bribery Act and the U.S. Foreign Corrupt Practices Act (FCPA), which carry significant penalties for violations. For instance, in 2023, the U.S. Department of Justice secured over $2.5 billion in penalties related to FCPA enforcement, highlighting the substantial financial risks involved.

Strict compliance with these laws is not merely a legal obligation but a strategic imperative for Hunting. Failure to adhere can result in severe financial penalties, reputational damage, and even debarment from certain markets, impacting future revenue streams. The UK Bribery Act, for example, allows for unlimited fines, and companies can be held liable for the actions of their associated persons.

- Global Reach, Local Laws: Hunting's international operations necessitate navigating diverse anti-corruption frameworks, including the UK Bribery Act and the U.S. FCPA.

- Enforcement Trends: In 2023, U.S. FCPA enforcement alone resulted in over $2.5 billion in penalties, underscoring the financial risks of non-compliance.

- Reputational and Financial Safeguard: Adherence to these laws protects Hunting from substantial fines, legal action, and preserves investor confidence and market access.

- Ethical Foundation: Robust compliance programs are crucial for maintaining ethical business practices and mitigating the risk of corrupt activities, which can severely damage a company's standing.

Hunting PLC must navigate evolving environmental regulations, particularly those concerning emissions and sustainability. The EU's Emissions Trading System, with average carbon prices around €65 per tonne in early 2024, pressures companies to invest in cleaner technologies and reporting. This regulatory landscape directly influences the demand for Hunting's products and services that aid in environmental compliance and emissions reduction.

The company's commitment to health and safety is underscored by its 2023 Lost Time Injury Frequency Rate (LTIFR) of 0.37, reflecting adherence to stringent global safety standards. This focus is critical for maintaining operational continuity and mitigating legal risks associated with workplace incidents.

International sanctions, such as those impacting energy markets, create complex compliance challenges and can restrict market access, directly affecting revenue. Hunting's ability to manage these geopolitical legalities is crucial for sustained global operations.

Contractual obligations and intellectual property protection are paramount. In 2024, long-term supply contracts for defense components highlight the importance of robust contract management, while safeguarding patented technologies remains key to competitive advantage.

| Legal Factor | Impact on Hunting PLC | 2023/2024 Data/Trend |

|---|---|---|

| Environmental Regulations | Drives demand for emissions reduction solutions; necessitates compliance investments. | EU ETS carbon prices averaged ~€65/tonne (early 2024). |

| Health & Safety Legislation | Ensures safe operations; mitigates legal liability and reputational damage. | LTIFR reduced to 0.37 in 2023. |

| International Sanctions | Can limit market access and affect revenue streams; requires careful navigation. | Sanctions on energy sectors create global trade complexities. |

| Contractual & IP Law | Underpins revenue stability; protects competitive advantage through innovation. | Long-term contracts for defense components secured in 2024. |

Environmental factors

Global initiatives like the Paris Agreement, aiming to limit warming to well below 2 degrees Celsius, and national net-zero targets are fundamentally reshaping the energy landscape. For instance, the European Union's Fit for 55 package aims to cut emissions by 55% by 2030 compared to 1990 levels.

This mounting pressure on fossil fuels directly impacts companies like Hunting PLC, which must navigate a sustained transition to lower-carbon energy. This necessitates strategic investment in technologies and services that facilitate emissions reduction, potentially including carbon capture, utilization, and storage (CCUS) or hydrogen production capabilities.

Environmental factors, particularly the growing prominence of ESG considerations, significantly impact capital access and investor sentiment for oil and gas companies. As of early 2025, a substantial portion of global assets under management, estimated to be over $37 trillion, are now influenced by ESG mandates, underscoring a clear shift in investor priorities.

Hunting PLC must proactively showcase robust ESG performance and embed sustainability into its core strategy. This is crucial for attracting and retaining investors who increasingly favor companies demonstrating responsible business practices, with many institutional investors now divesting from or actively avoiding those with poor environmental track records.

The persistent depletion of resources in established oil and gas fields necessitates a continuous drive for new exploration and the implementation of enhanced oil recovery (EOR) methods. Hunting PLC's operations are intrinsically linked to the industry's success in locating and extracting hydrocarbons, meaning fresh discoveries and sophisticated recovery techniques are crucial for maintaining market demand.

In 2023, global proved oil reserves stood at an estimated 1.76 trillion barrels, yet the declining output from mature fields underscores the urgency for innovation. EOR techniques, such as chemical injection and thermal methods, are becoming increasingly vital, with projects employing these methods aiming to boost recovery rates by an additional 10-20% in some cases.

Biodiversity and Ecosystem Protection

Environmental concerns extend beyond climate change, with biodiversity loss and ecosystem degradation posing significant operational challenges. These factors can lead to stricter regulations and operational limitations for companies like Hunting PLC, especially when activities occur in ecologically sensitive regions.

Hunting PLC's offshore operations, in particular, necessitate careful consideration and robust mitigation strategies to minimize potential impacts on both marine and terrestrial ecosystems. The company's commitment to environmental stewardship is crucial for maintaining its social license to operate and avoiding costly remediation efforts or project delays.

- Ecosystem Impact: The potential for habitat disruption and species disturbance is a key environmental consideration for oil and gas activities.

- Regulatory Scrutiny: Increased global focus on biodiversity means tighter regulations are likely, impacting exploration and production in vulnerable areas.

- Mitigation Strategies: Implementing advanced technologies and best practices to reduce the ecological footprint of operations is paramount.

- Biodiversity Reporting: Companies are increasingly expected to report on their biodiversity impact, with initiatives like the Taskforce on Nature-related Financial Disclosures (TNFD) gaining traction, influencing investor decisions.

Water Management and Waste Disposal

The oil and gas sector's significant water consumption and waste generation, particularly produced water and drilling fluids, face heightened environmental oversight and stricter regulations. Hunting PLC must navigate these evolving standards to meet client needs for responsible water management and secure waste disposal.

This environmental focus directly impacts the demand for Hunting's offerings. For instance, as of early 2024, the global produced water treatment market was valued at approximately $20 billion and is projected to grow, indicating a strong demand for innovative solutions in this area.

- Regulatory Pressure: Stricter environmental laws worldwide are compelling oil and gas companies to invest more in advanced water treatment and waste management technologies.

- Client Demand: Hunting's clientele increasingly prioritize suppliers who can demonstrate robust environmental compliance and offer sustainable solutions for water reuse and waste minimization.

- Market Opportunity: The growing emphasis on ESG (Environmental, Social, and Governance) factors presents a significant market opportunity for companies like Hunting that provide efficient and compliant water and waste management services.

- Operational Costs: Inefficient water management and waste disposal can lead to substantial fines and increased operational costs, driving demand for cost-effective and compliant solutions.

Environmental regulations are tightening globally, pushing companies like Hunting PLC to adapt. For example, the EU’s Emissions Trading System (ETS) is expanding, impacting carbon costs for industries. This shift necessitates investments in cleaner technologies and operational efficiencies to meet compliance targets and maintain competitiveness.

Investor focus on ESG performance is intensifying, with over $37 trillion in global assets under management influenced by ESG mandates as of early 2025. Companies demonstrating strong environmental stewardship, such as reduced emissions and effective waste management, are more attractive to capital, influencing stock valuations and access to funding.

The drive for sustainability creates new market opportunities in areas like carbon capture and hydrogen production. As the world transitions to lower-carbon energy sources, companies that can provide innovative solutions for emissions reduction and resource efficiency will likely see increased demand for their products and services.

PESTLE Analysis Data Sources

Our Hunting PESTLE Analysis is informed by a diverse range of data sources, including government wildlife management reports, conservation organization publications, and academic research on ecological trends. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting hunting.