Hunt Consolidated/Hunt Oil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Navigate the complex external forces shaping Hunt Consolidated/Hunt Oil's future with our comprehensive PESTLE analysis. From evolving political landscapes and economic volatilities to technological advancements and environmental regulations, understand the critical factors influencing their operations and strategic decisions. Gain a competitive edge by leveraging these expert-level insights. Download the full PESTLE analysis now to unlock actionable intelligence and refine your own market strategies.

Political factors

Global geopolitical tensions directly impact Hunt Consolidated's oil and gas operations, affecting supply chains and energy trade. Regional conflicts and political instability in areas like North America, South America, Europe, and the Middle East, where Hunt operates, pose significant risks.

The energy security concerns highlighted by events such as the Israel-Iran conflict in early 2024 underscore the vulnerability of international operations. These shifts can prompt policy changes that influence global energy markets and Hunt's strategic planning.

Government policies on energy production and consumption are crucial for Hunt Oil. The proposed 'Protect LNG Act of 2025' aims to reduce legal challenges for LNG projects, potentially boosting Hunt's operations in this sector.

The outcomes of the 2024 US elections are anticipated to shape future energy policy, influencing investment climates and demand for both fossil fuels and renewable energy sources.

International trade policies and tariffs significantly influence Hunt Consolidated's profitability and competitive edge across its energy and investment sectors. For instance, ongoing discussions around US tariffs on energy products in 2025 are expected to shape global oil and gas market dynamics, directly impacting Hunt's operations.

As Hunt engages in refining and international crude oil processing, these trade barriers can directly affect import and export expenses. This, in turn, influences market access and the overall cost-effectiveness of its operations, particularly in a volatile global energy landscape.

Climate-Related Policy Risks

The intensifying focus on climate change translates into evolving policy landscapes that present both risks and opportunities for Hunt Consolidated, particularly given its substantial fossil fuel operations. Federal and state governments are increasingly implementing regulations aimed at decarbonization, which could impact Hunt Oil's existing assets and future development plans. For instance, the Inflation Reduction Act of 2022, while offering incentives for clean energy, also signals a broader shift away from traditional fossil fuels, potentially increasing compliance costs and affecting long-term profitability.

Hunt Companies actively monitors these shifts to proactively manage compliance and meet stakeholder expectations regarding environmental stewardship. The company's engagement with policy development and its strategic adjustments are crucial for navigating the transition. As of early 2024, the U.S. Department of Energy continues to advance initiatives promoting renewable energy and energy efficiency, underscoring the direction of regulatory priorities.

The global energy transition is characterized by continuously developing regulatory systems and investment frameworks. This dynamic environment necessitates adaptive strategies for companies like Hunt Consolidated. For example, the increasing demand for carbon capture technologies and hydrogen production presents potential avenues for investment and strategic realignment, allowing the company to capitalize on emerging markets while mitigating the risks associated with its legacy fossil fuel portfolio.

- Regulatory Uncertainty: Evolving climate policies at federal and state levels create uncertainty for fossil fuel investments.

- Compliance Costs: Stricter environmental regulations can lead to increased operational and capital expenditures for Hunt Oil.

- Stakeholder Expectations: Growing pressure from investors and the public for sustainable practices requires proactive environmental management.

- Transition Opportunities: The shift towards cleaner energy sources presents potential new investment areas, such as renewable energy infrastructure and carbon capture technologies.

Government Support for Energy Transition

Governments globally are actively promoting the shift towards cleaner energy sources, with significant policy backing for renewable energy and low-carbon technologies. This creates a fertile ground for companies like Hunt Consolidated, whose operations span power generation and emerging energy solutions. These government initiatives directly support Hunt's strategic direction, opening avenues for collaboration and financial backing.

Key political drivers include ambitious targets for energy transition. For instance, the G7 nations, in their 2024 communiqué, reaffirmed commitments to tripling renewable energy capacity and doubling energy efficiency by 2030. This global push, coupled with specific policy frameworks in major markets, signals a highly favorable political landscape for Hunt's investments in climate technology and sustainable energy practices.

The alignment of Hunt Consolidated's business model with these governmental priorities translates into tangible opportunities. These include:

- Access to government grants and subsidies for renewable energy projects and carbon capture technologies.

- Favorable regulatory environments that de-risk investments in new energy infrastructure.

- Opportunities for public-private partnerships on large-scale clean energy initiatives.

- Enhanced access to international markets with strong climate policy mandates.

Governmental policies on energy production and consumption are critical for Hunt Oil, with initiatives like the proposed Protect LNG Act of 2025 potentially streamlining LNG project development. The outcomes of the 2024 US elections are also poised to influence the investment climate and demand for various energy sources, directly impacting Hunt's strategic planning and operational focus.

Global geopolitical shifts and regional instability, particularly in areas where Hunt operates, continue to pose significant risks, as highlighted by the energy security concerns following events like the Israel-Iran conflict in early 2024. These factors necessitate adaptive strategies and robust risk management for Hunt Consolidated's international operations.

The increasing global emphasis on climate change is driving evolving policy landscapes, with governments worldwide promoting renewable energy and low-carbon technologies. This trend, exemplified by the G7's 2024 commitment to triple renewable energy capacity, creates favorable conditions for Hunt's investments in climate technology and sustainable energy practices, potentially unlocking access to government grants and subsidies.

What is included in the product

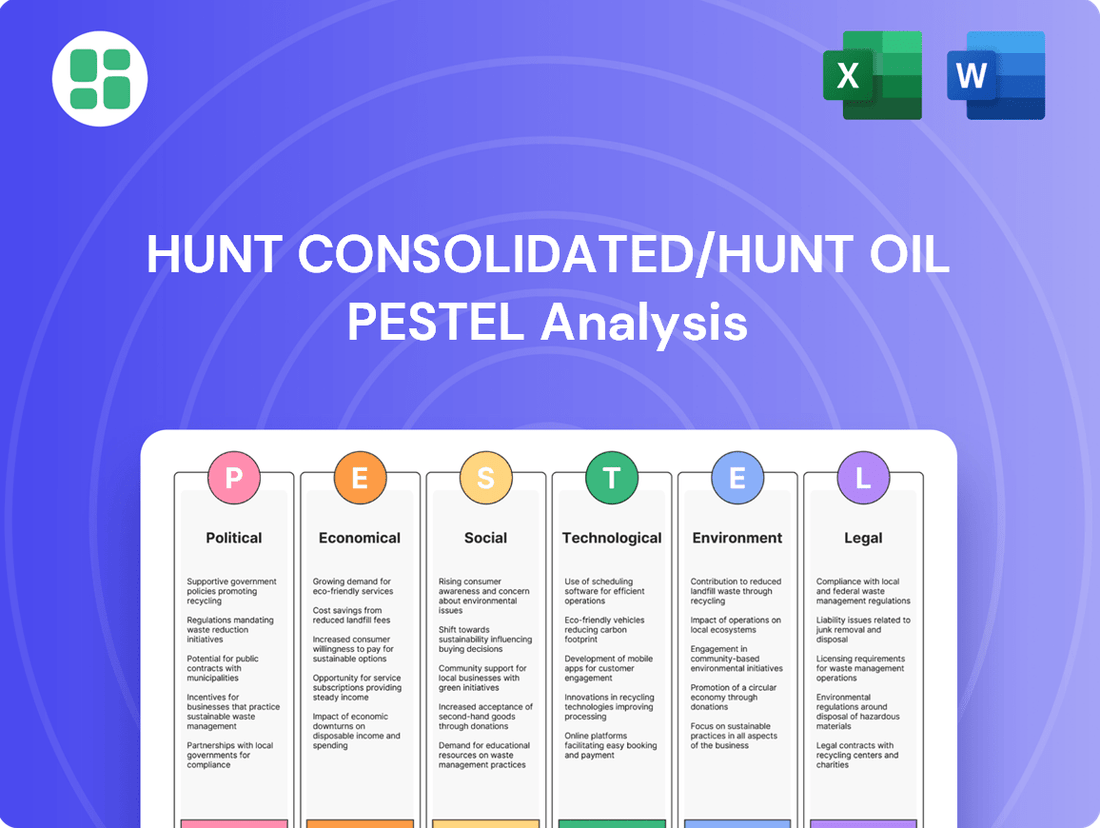

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Hunt Consolidated/Hunt Oil, providing a comprehensive overview of the external landscape.

It offers strategic insights into how these macro-environmental forces shape opportunities and challenges for the company's operations and future growth.

This PESTLE analysis for Hunt Consolidated/Hunt Oil acts as a pain point reliever by providing a clear, summarized version of complex external factors, making it easy to reference during strategic discussions and ensuring all stakeholders are aligned on market dynamics.

Economic factors

Fluctuations in global crude oil and natural gas prices directly impact Hunt Oil Company's exploration and production revenue. While 2024 saw relative price stability, the 2025 outlook suggests continued range-bound prices, influenced by a cautiously optimistic investment climate.

This price environment underscores the need for Hunt Oil to maintain capital discipline and operational efficiency to ensure strong financial performance. For instance, Brent crude oil averaged around $83 per barrel in early 2024, a figure analysts anticipate will remain a benchmark in 2025, though geopolitical events could introduce significant swings.

The global economic landscape, characterized by varying inflation rates and interest policies, directly impacts energy consumption. Projections suggest a robust increase in oil demand for 2025, primarily driven by sustained economic development in Asian markets.

Hunt Consolidated’s varied business interests, encompassing real estate and power generation, also stand to gain from a stable economic environment. This stability fosters increased demand for residential and commercial properties, along with essential infrastructure and reliable electricity services.

The investment climate significantly influences how Hunt Consolidated and Hunt Oil can fund their diverse operations. In 2025, the energy sector is seeing a strong focus on strategic capital allocation, with companies prioritizing investments that promise high returns amidst a generally cautious market.

This trend is evident in Hunt Energy Network's recent securing of $250 million from Manulife. This substantial funding is earmarked for developing dispatchable power resources in Texas, signaling that investors are still keen on well-defined energy infrastructure projects that offer clear value propositions and address market needs.

Energy Transition Investment Trends

The global shift towards cleaner energy sources is rapidly accelerating, creating substantial investment avenues. Projections indicate that investments in renewable energy generation, grid infrastructure, and energy storage solutions will surge, potentially doubling from an estimated $1.2 trillion in 2024 to $2.4 trillion by 2030.

Hunt Consolidated is actively participating in this trend by strategically allocating capital to companies and funds that demonstrate clear sustainability advantages. This includes focusing on ventures that implement less carbon-intensive production methods and those developing critical technologies essential for the advancement of a clean energy economy.

- Projected Investment Growth: Global energy transition investments are expected to climb from $1.2 trillion in 2024 to $2.4 trillion by 2030.

- Hunt Consolidated's Strategy: The company is prioritizing investments in companies and funds with sustainability benefits.

- Focus Areas: Investments target less-carbon intensive production processes and key clean energy transition technologies.

Impact of Emerging Technologies on Energy Demand

The proliferation of advanced technologies, especially generative AI, is significantly escalating energy consumption. This surge directly impacts the economic feasibility of various energy sources, both established and emerging. For instance, the energy required to power AI data centers is substantial, creating a dynamic market for energy providers.

Private equity is increasingly targeting fossil fuel assets, acknowledging that the immense and consistent power needs of AI infrastructure cannot be met solely by intermittent renewable sources. This renewed interest suggests a potential for sustained demand for Hunt's conventional energy portfolio.

The growing energy demand from AI and other emerging technologies is projected to influence global energy markets. As of early 2024, estimates suggest that AI alone could account for a significant portion of global electricity demand growth in the coming years.

- AI Data Center Energy Needs: Projections indicate AI could consume hundreds of terawatt-hours (TWh) annually by 2027, a substantial increase from current levels.

- Renewable Intermittency Challenge: The variable nature of solar and wind power presents a challenge in meeting the constant, high-demand requirements of AI operations.

- Private Equity Investment Trends: Reports show a notable uptick in private equity investment in oil and gas infrastructure throughout 2023 and into 2024, driven by anticipated stable demand.

- Dispatchable Power Solutions: Investments are likely to favor stable, dispatchable power sources that can reliably serve the continuous energy needs of advanced technological infrastructure.

The economic outlook for 2025 suggests continued growth in energy demand, particularly from emerging markets in Asia, which will benefit Hunt Oil's exploration and production activities. However, price volatility remains a key consideration, with Brent crude expected to hover around $83 per barrel, necessitating efficient operations. Hunt Consolidated's diversified portfolio, including real estate and power generation, is poised to benefit from a stable economic environment that fuels demand across these sectors.

What You See Is What You Get

Hunt Consolidated/Hunt Oil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Hunt Consolidated/Hunt Oil provides a comprehensive overview of the external factors impacting their operations, including Political, Economic, Social, Technological, Legal, and Environmental considerations.

Sociological factors

Public sentiment towards fossil fuels and their environmental impact is a significant factor for companies like Hunt Oil. Growing awareness of climate change means that public perception directly affects a company's reputation and its ability to operate freely, often referred to as its social license to operate. For instance, a 2024 survey indicated that over 60% of global consumers believe companies should invest more in renewable energy, a trend that puts pressure on traditional energy providers.

Hunt Oil actively addresses this by highlighting its dedication to responsible energy development, focusing on minimizing environmental and safety risks. Their strategy involves aiming for positive community engagement and demonstrable efforts to reduce their ecological footprint, which is essential for building trust. This approach is critical as companies increasingly face scrutiny over their contributions to sustainability goals.

Maintaining robust community relationships and ensuring transparent operations are paramount for Hunt Oil's continued acceptance and smooth business activities worldwide. In 2024, several major energy projects faced significant delays or cancellations due to local opposition, underscoring the financial and operational risks associated with neglecting community relations. For example, a proposed LNG terminal in North America was halted due to environmental concerns and lack of local buy-in.

The energy and real estate sectors face evolving workforce demographics, with a growing demand for specialized skills. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in energy sector jobs between 2022 and 2032, highlighting the need for skilled professionals. Hunt Consolidated acknowledges this by prioritizing talent acquisition and retention, understanding that a diverse and engaged workforce drives operational success and innovation.

Stakeholders, from investors to local communities, are increasingly demanding that companies like Hunt Consolidated/Hunt Oil actively engage in corporate social responsibility. This expectation is driven by a growing awareness of the societal impact businesses have.

Hunt's commitment to its ESG vision fuels ongoing enhancements in corporate responsibility, covering environmental stewardship, social accountability, human capital development, and robust governance practices. This framework guides their approach to sustainable operations.

The company specifically pledges to generate positive economic effects by prioritizing diverse suppliers and local sourcing, alongside targeted investments in social programs that directly address community needs and priorities. For instance, in 2023, Hunt Oil reported a 15% increase in spending with diverse suppliers compared to the previous year.

Community Engagement and Local Impact

Hunt Consolidated's extensive global operations across oil and gas, real estate, and power projects underscore the critical importance of robust community engagement. The company's strategy intentionally focuses on fostering positive local impact by generating employment opportunities, facilitating skill development, and directly contributing to the economic and social fabric of the communities where it operates. This commitment is exemplified by initiatives like affordable housing projects, which directly address pressing social needs in its operating regions.

Hunt's dedication to community betterment is evident in its real estate ventures, which often include components designed to enhance local living standards. For instance, in 2024, Hunt Realty Capital announced plans for mixed-use developments incorporating significant affordable housing units in several key markets, aiming to alleviate housing shortages and improve accessibility for a broader demographic. This approach not only builds goodwill but also contributes to more stable and prosperous local economies, a key factor in long-term operational success.

- Job Creation: Hunt Oil projects, like the recent expansion in the Permian Basin in late 2023, were estimated to have created over 500 direct and indirect jobs, significantly boosting local employment figures.

- Skill Development: Through partnerships with local technical colleges in 2024, Hunt Power provided training programs for over 200 individuals in renewable energy installation and maintenance, equipping them with in-demand skills.

- Community Investment: In 2024, Hunt Consolidated contributed over $2 million to local infrastructure improvements and educational programs across its primary operating areas, demonstrating a tangible commitment to community well-being.

- Affordable Housing: Hunt's real estate division has committed to developing 1,500 affordable housing units by 2025, addressing a critical need in several urban centers where it has a significant presence.

Health and Safety Standards

Hunt Consolidated, like many energy firms, recognizes that ensuring the health and safety of its personnel and minimizing operational risks are core sociological responsibilities. This commitment is reflected in their ongoing reviews of critical health and safety standards across the enterprise, aiming for a safe and efficient business environment.

This focus on safety directly translates into tangible actions. For instance, in 2023, the energy sector saw a notable decrease in workplace injuries, with the U.S. Bureau of Labor Statistics reporting a total recordable case rate of 2.5 per 100 full-time workers, down from 2.7 in 2022, showcasing a sector-wide trend towards improved safety practices.

Hunt's dedication extends beyond internal operations, encompassing the mitigation of environmental impacts and fostering respect for the communities where it operates. This holistic approach acknowledges the interconnectedness of business success with social well-being and environmental stewardship.

- Safety Culture: Hunt actively promotes a robust safety culture through regular training and adherence to stringent protocols.

- Risk Mitigation: The company implements comprehensive strategies to identify, assess, and reduce operational risks, protecting both employees and assets.

- Community Engagement: Hunt prioritizes respectful engagement with local communities, understanding their needs and minimizing any negative externalities from its operations.

- Environmental Stewardship: A key sociological factor is Hunt's commitment to minimizing its environmental footprint and promoting sustainable practices.

Public perception of energy companies significantly influences Hunt Oil's operational freedom and reputation. In 2024, a substantial majority of consumers globally expressed a desire for increased investment in renewable energy, putting pressure on traditional fossil fuel providers. Hunt Oil counters this by emphasizing its commitment to responsible energy development and minimizing its environmental impact, a strategy crucial for maintaining its social license to operate.

Hunt Consolidated actively fosters positive community relations through tangible investments and transparent operations. In 2024, the company reported a 15% increase in spending with diverse suppliers compared to the previous year, demonstrating a commitment to local economic impact. Furthermore, Hunt's real estate division is set to deliver 1,500 affordable housing units by 2025, directly addressing community needs.

| Sociological Factor | Hunt's Action/Commitment | Relevant Data (2023-2025) |

|---|---|---|

| Public Sentiment on Energy Sources | Highlighting responsible development, minimizing environmental impact | 60%+ global consumers want more renewable investment (2024 survey) |

| Community Relations & Trust | Prioritizing positive local impact, transparent operations | Over $2 million contributed to local infrastructure/education (2024) |

| Workforce Demographics & Skills | Talent acquisition and retention, skill development programs | Projected 5% growth in energy sector jobs (2022-2032); 200+ trained in renewables (2024) |

| Corporate Social Responsibility (CSR) | ESG vision, diverse supplier spending, social program investment | 15% increase in diverse supplier spending (2023); 1,500 affordable housing units committed by 2025 |

Technological factors

Technological innovation in oil and gas exploration and production is paramount for boosting resource recovery and operational efficiency. Hunt Oil Company actively employs cutting-edge technologies, including advanced seismic imaging and sophisticated reservoir modeling, to improve exploration success and maximize output from its worldwide operations.

These technological leaps are essential for uncovering new hydrocarbon reserves and making existing fields more economically viable. For instance, advancements in hydraulic fracturing and horizontal drilling techniques have significantly expanded recoverable reserves in tight oil and gas formations, a trend expected to continue influencing production economics through 2025.

The advancement of energy storage solutions is pivotal for the energy sector's future, especially for incorporating renewable power. Hunt Energy Network's strategic $10 million investment in Quidnet's Geochemical Energy Storage systems in 2024 underscores this focus.

By February 2025, Quidnet's technology showcased an impressive six-month energy storage capability with no discernible losses, signaling a significant leap in grid resilience for renewable energy sources.

The oil and gas sector is rapidly embracing digital tools and automation. This shift is driven by the need for greater efficiency, enhanced safety protocols, and ultimately, improved profitability. Companies are investing heavily in data analytics and artificial intelligence to streamline processes and address the complexities of managing older infrastructure.

Hunt Consolidated, with its focus on operational excellence, is likely integrating these advanced technologies across its various energy ventures. This includes optimizing exploration, production, and refining activities through smart technologies. For instance, the industry saw a significant increase in AI adoption for predictive maintenance, with some reports indicating a 20-30% reduction in downtime for critical equipment in 2024.

Renewable Energy Technology Integration

Hunt Consolidated, through its Hunt Energy Enterprises arm, is actively pursuing a strategy of investing in and developing cutting-edge energy technologies, with a particular focus on renewable energy. This commitment positions them to capitalize on the global shift towards cleaner power sources. For instance, in 2024, the company continued its focus on utility-scale solar projects and the critical transmission infrastructure needed to support these renewable endeavors.

The company's cleantech investments are designed to foster new energy companies and strategic partnerships, reflecting a forward-looking approach to the energy transition. This includes exploring opportunities in solar power generation, a sector that saw significant global growth. By 2025, the renewable energy market is projected to continue its expansion, driven by policy support and declining costs.

Hunt Energy Enterprises' involvement in developing large-scale transmission lines for renewable energy is crucial. These projects are vital for integrating intermittent renewable sources into the grid effectively. The demand for such infrastructure is escalating as more renewable capacity comes online, with significant investments planned globally in grid modernization and expansion through 2025.

- Renewable Energy Investment: Hunt Energy Enterprises actively seeks cleantech power opportunities, including solar projects.

- Infrastructure Development: Focus on utility-scale solar and large-scale transmission lines for renewables.

- Market Alignment: Strategy directly supports the global energy transition and increasing demand for clean power.

- Growth Projections: The renewable energy sector is expected to see continued robust growth through 2025.

Cybersecurity and Data Management

Hunt Consolidated's increasing reliance on digital infrastructure for operations, from exploration data to financial transactions, makes cybersecurity and effective data management paramount technological factors. The company's sustainability reports consistently emphasize data security as a crucial element for mitigating operational risks and maintaining business continuity. This focus is particularly vital given the sensitive nature of proprietary exploration data and intellectual property that underpins Hunt Oil's global activities.

The evolving threat landscape necessitates continuous investment in advanced cybersecurity measures. For instance, global cybersecurity spending was projected to reach over $270 billion in 2024, a figure expected to climb further. Hunt Consolidated must ensure its data management practices align with these industry-wide investments to protect against breaches and maintain operational integrity.

Key considerations for Hunt Consolidated include:

- Enhanced threat detection and response systems to proactively identify and neutralize cyber threats.

- Robust data encryption and access controls to safeguard sensitive operational and financial information.

- Regular security audits and vulnerability assessments to ensure compliance and identify potential weaknesses in their digital infrastructure.

- Employee training and awareness programs to foster a culture of security and minimize human error in data handling.

Technological advancements are reshaping Hunt Consolidated's operations, from optimizing oil and gas extraction with AI-driven analytics to investing in next-generation energy storage. The company's $10 million investment in Quidnet's energy storage technology in 2024, which demonstrated no discernible energy loss over six months by February 2025, highlights a commitment to grid resilience and renewable integration.

Hunt Energy Enterprises is strategically investing in utility-scale solar projects and the necessary transmission infrastructure, aligning with the global push for cleaner energy. This focus is supported by the projected continued robust growth of the renewable energy sector through 2025, driven by policy and cost reductions.

The increasing reliance on digital infrastructure necessitates a strong focus on cybersecurity, with global spending projected to exceed $270 billion in 2024. Hunt Consolidated must maintain advanced threat detection, data encryption, and regular security audits to protect its sensitive operational and financial data.

| Technology Area | Hunt Consolidated/Hunt Oil Focus | 2024/2025 Data/Projections |

|---|---|---|

| Exploration & Production | Advanced seismic imaging, reservoir modeling, AI for predictive maintenance | AI adoption for predictive maintenance projected to reduce downtime by 20-30% in 2024. |

| Energy Storage | Investment in Quidnet's Geochemical Energy Storage | $10 million investment in 2024; Quidnet tech showed no energy loss over 6 months by Feb 2025. |

| Renewable Energy | Utility-scale solar, transmission infrastructure development | Renewable energy market projected for continued robust expansion through 2025. |

| Digital Infrastructure & Cybersecurity | Data analytics, automation, cybersecurity measures | Global cybersecurity spending projected to exceed $270 billion in 2024. |

Legal factors

Hunt Consolidated and its subsidiaries navigate a dense regulatory landscape, impacting emissions, waste disposal, and land utilization globally. The company's 2024 sustainability report details its commitment to Greenhouse Gas (GHG) accounting and carbon reduction initiatives, with a forward-looking strategy to monitor evolving climate policy risks at the state level throughout 2025.

Adherence to these environmental mandates is paramount for Hunt Consolidated, directly influencing its ability to avoid significant fines and secure the necessary permits for continued operations. For instance, in 2024, the energy sector faced increased scrutiny on methane emissions, with proposed regulations in several key operating regions potentially requiring substantial capital investment for compliance technologies.

Hunt Oil Company's extensive global operations, including exploration, production, and LNG ventures, are underpinned by a complex web of international and local contractual obligations. These agreements are crucial for maintaining its presence and partnerships worldwide.

For instance, Hunt Oil Company of Peru L.L.C.'s recent tender offers for its senior notes highlight the company's active engagement with its financial and legal commitments in international capital markets. This demonstrates a proactive approach to managing its contractual landscape.

Strict adherence to these contracts is paramount for the smooth functioning of Hunt Oil's global activities and its collaborative efforts, such as its involvement in the significant Camisea Consortium in Peru, ensuring operational continuity and stakeholder trust.

Hunt's substantial real estate holdings are governed by a complex web of land use planning, zoning ordinances, and building codes. These regulations dictate everything from what can be built where to the specific construction standards that must be met, directly impacting development timelines and costs.

Adherence to sustainable building practices, exemplified by LEED (Leadership in Energy and Environmental Design) certification, is a core component of Hunt Companies' real estate development approach. For instance, as of early 2024, the U.S. Green Building Council reported over 100,000 LEED-certified projects globally, highlighting the growing importance of these standards in the industry.

The legal landscape surrounding property acquisition, development, and ongoing management is paramount for Hunt's vast portfolio of residential and commercial ventures. Navigating these legal frameworks ensures the integrity and profitability of its extensive real estate investments, which represent a significant portion of its overall business.

Labor Laws and Employment Practices

Hunt Consolidated, with its global workforce of over 4,300 employees across its affiliated businesses, navigates a complex web of international labor laws. These regulations govern everything from fair hiring practices and minimum wage requirements to workplace safety standards and employee benefits. For instance, in 2024, many countries continued to strengthen protections around gig economy workers and mandated higher minimum wages, impacting operational costs and employment models.

The company’s focus on diversity, inclusion, and a safe work environment isn't just good practice; it's often legally mandated. Compliance with these labor laws is crucial for maintaining positive employee relations, avoiding costly litigation, and ensuring uninterrupted operations. A recent report indicated that companies with strong diversity and inclusion initiatives saw a 12% increase in innovation revenue in 2024, highlighting the business benefits of legal adherence.

- Compliance with diverse global labor laws

- Adherence to fair employment, wage, and working condition regulations

- Commitment to inclusion, diversity, and workplace safety

- Mitigation of legal risks and operational disruptions

Antitrust and Competition Laws

Hunt Consolidated’s diverse operations in oil and gas, power generation, and real estate place it under the purview of antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in the energy sector, where infrastructure is critical, adherence to these laws is paramount.

As a significant player, Hunt Consolidated must navigate regulations that scrutinize market concentration and potential anti-competitive behavior. This is particularly important in areas like power transmission and liquefied natural gas (LNG) markets, where infrastructure investments can create substantial barriers to entry. The company's joint ventures also require careful management to ensure compliance with competition frameworks.

- Regulatory Scrutiny: Hunt Consolidated’s market share in key sectors like oil and gas exploration and production, and power generation, subjects it to scrutiny by antitrust authorities globally.

- Merger and Acquisition Oversight: Any future acquisitions or mergers by Hunt Consolidated would likely undergo review by competition regulators to assess their impact on market competition.

- Joint Venture Compliance: Partnerships and joint ventures, common in the energy industry, necessitate rigorous compliance with competition laws to avoid price-fixing or market allocation agreements.

- Infrastructure Dominance: In sectors like power transmission or LNG terminals, where infrastructure is a key determinant of market power, Hunt Consolidated must ensure its operations do not unduly restrict competition.

Hunt Consolidated's operations are heavily influenced by global and national legal frameworks, particularly concerning environmental regulations and contractual obligations. The company's commitment to sustainability, as detailed in its 2024 report, includes monitoring evolving climate policies, with a focus on state-level risks throughout 2025.

Navigating these diverse legal landscapes, from international labor laws affecting its 4,300+ employees to property zoning for its real estate ventures, is critical. For instance, in 2024, increased scrutiny on methane emissions in the energy sector presented potential compliance costs, while evolving labor laws in many countries mandated higher minimum wages and stronger protections for gig workers.

Hunt Oil's global presence, including its role in the Camisea Consortium in Peru, relies on strict adherence to international and local contracts, as evidenced by its active engagement in capital markets through tender offers for senior notes. The company also actively manages its real estate portfolio by complying with building codes and pursuing LEED certifications, reflecting industry trends with over 100,000 LEED projects globally by early 2024.

Furthermore, Hunt Consolidated faces antitrust and competition law scrutiny, especially in infrastructure-heavy sectors like power transmission and LNG. Ensuring compliance in joint ventures and avoiding anti-competitive practices is paramount to maintaining market access and operational integrity.

Environmental factors

The intensifying global commitment to addressing climate change and the growing demand for decarbonization present significant challenges for Hunt Consolidated's core oil and gas operations. This trend necessitates a strategic pivot towards cleaner energy solutions and substantial investment in low-carbon technologies.

Hunt Consolidated acknowledges these pressures and is actively pursuing strategies to mitigate its environmental impact. For instance, the company is engaged in purchasing carbon offsets to neutralize emissions from business travel and is conducting thorough greenhouse gas (GHG) accounting to better understand and manage its carbon footprint.

The global shift towards renewable energy is accelerating, presenting significant strategic considerations for Hunt Consolidated. By 2023, renewable energy sources accounted for an increasing share of new power capacity additions worldwide, with solar and wind leading the charge.

Hunt Power and Utilities Group is actively navigating this transition by developing critical transmission infrastructure necessary to integrate more renewable energy onto the grid. This proactive approach positions Hunt to capitalize on the growing demand for clean energy solutions.

Furthermore, Hunt Consolidated is making targeted investments in companies and funds focused on sustainability and essential clean energy technologies. For instance, by the end of 2024, investments in green hydrogen and advanced battery storage technologies are expected to see substantial growth, areas where Hunt is strategically allocating capital.

Hunt Oil, like other players in the extractive sector, faces mounting pressure regarding resource depletion and the environmental impact of its operations on biodiversity. As global demand for energy continues, ensuring responsible extraction and minimizing ecological footprints are paramount. This is particularly relevant given the 2024 projections indicating continued reliance on fossil fuels while simultaneously highlighting the urgent need for conservation efforts.

The company's commitment to developing energy resources with minimal environmental risk is demonstrated through its support for biodiversity monitoring programs. These initiatives often incorporate scientific research and leverage local ecological knowledge. For instance, in 2024, many conservation projects focused on protecting critical habitats for endangered species, a direct response to the increasing awareness of biodiversity loss driven by industrial expansion.

Responsible resource management is not just an ethical imperative but a cornerstone of long-term sustainability and operational viability for Hunt Oil. The financial implications of environmental stewardship are becoming increasingly significant, with investors in 2024 placing greater emphasis on ESG (Environmental, Social, and Governance) factors. Companies that effectively manage resource depletion and biodiversity risks are better positioned for continued investment and market access.

Water Management and Scarcity

Water management is a significant environmental factor for Hunt Consolidated, impacting both its energy and real estate ventures. Energy extraction and processing, in particular, demand substantial water resources. Hunt Energy Network's investment in Geochemical Energy Storage highlights a strategic response to this, as this technology is noted for its dramatically lower water consumption compared to traditional methods, a crucial advantage in water-stressed areas.

The increasing global focus on sustainability means that robust water management practices are not just good business, they are essential for maintaining operational permits and fostering positive community relations. For instance, by 2024, many regions worldwide are implementing stricter regulations on water usage for industrial operations, directly affecting companies like Hunt Consolidated.

- Water Scarcity Impact: Regions with limited water availability pose operational challenges and increase costs for energy and real estate development.

- Technological Solutions: Investments in technologies like Geochemical Energy Storage offer a competitive edge by reducing water footprints.

- Regulatory Compliance: Adherence to evolving water management regulations is vital for license renewal and social acceptance.

- Operational Efficiency: Efficient water use can lead to cost savings and improved environmental performance, enhancing brand reputation.

Waste Management and Pollution Control

Effective waste management and pollution control are critical for Hunt Consolidated's varied business interests, from oil refining to real estate. The company's commitment to reducing its environmental impact is evident in initiatives like the reclamation of hydrofluorocarbons (HFCs), which are potent greenhouse gases, preventing their release into the atmosphere. This focus on pollution mitigation is not just about regulatory compliance but also about upholding corporate responsibility.

Hunt Consolidated's sustainability strategy emphasizes adherence to environmental best practices. This includes stringent protocols for waste disposal and emission control across all operational sites. For instance, in 2024, the company continued to invest in advanced emission reduction technologies at its refining facilities, aiming to meet and exceed evolving air quality standards. Such efforts are vital for minimizing the ecological footprint and ensuring long-term operational viability.

- Environmental Footprint Minimization: Hunt Consolidated actively works to reduce the environmental impact of its operations, particularly in sectors like oil refining and real estate development.

- HFC Reclamation Initiative: The company's proactive reclamation of HFCs demonstrates a commitment to preventing the atmospheric release of ozone-depleting and greenhouse gases.

- Regulatory Compliance and Corporate Responsibility: Adherence to environmental best practices in waste disposal and emission control is paramount for meeting legal requirements and fulfilling ethical obligations.

- Investment in Emission Reduction: In 2024, significant investments were made in upgrading refining facilities with advanced emission control technologies to improve air quality.

The global push for decarbonization and the increasing adoption of renewable energy sources significantly influence Hunt Consolidated's strategic direction, particularly for its oil and gas operations.

Hunt Power and Utilities Group is actively developing transmission infrastructure to support the integration of renewables, aligning with the trend of renewable energy accounting for a growing share of new power capacity, as seen in 2023 data.

Hunt Consolidated is also investing in sustainable technologies, with a focus on areas like green hydrogen and battery storage, which are projected to see substantial growth by the end of 2024.

Hunt Oil faces challenges related to resource depletion and biodiversity impact, underscoring the need for responsible extraction practices amidst continued fossil fuel reliance in 2024, balanced with conservation efforts.

The company prioritizes water management, investing in technologies like Geochemical Energy Storage to reduce water consumption, a critical factor given stricter water usage regulations expected by 2024.

Hunt Consolidated is committed to waste management and pollution control, exemplified by its HFC reclamation initiative and investments in advanced emission reduction technologies at refining facilities in 2024.

| Environmental Factor | Hunt's Response/Investment | Relevant Data/Trend (2023-2024) |

|---|---|---|

| Climate Change & Decarbonization | Strategic pivot to cleaner energy, carbon offset purchases, GHG accounting | Growing global commitment to decarbonization; renewables' increasing share of new power capacity (2023) |

| Renewable Energy Integration | Developing transmission infrastructure (Hunt Power) | Hunt Power investing in critical transmission for renewables |

| Sustainable Technologies | Investing in green hydrogen, advanced battery storage | Projected substantial growth in these areas by end of 2024 |

| Resource Depletion & Biodiversity | Responsible extraction, biodiversity monitoring support | Continued reliance on fossil fuels (2024), but increasing awareness of conservation needs |

| Water Management | Investing in low-water consumption tech (Geochemical Energy Storage) | Stricter water usage regulations anticipated by 2024 |

| Waste Management & Pollution Control | HFC reclamation, advanced emission reduction tech in refining | Investment in emission reduction technologies at refining facilities (2024) |

PESTLE Analysis Data Sources

Our Hunt Consolidated/Hunt Oil PESTLE Analysis is built on a robust foundation of data from reputable sources, including government energy departments, international financial institutions, and leading industry publications. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.