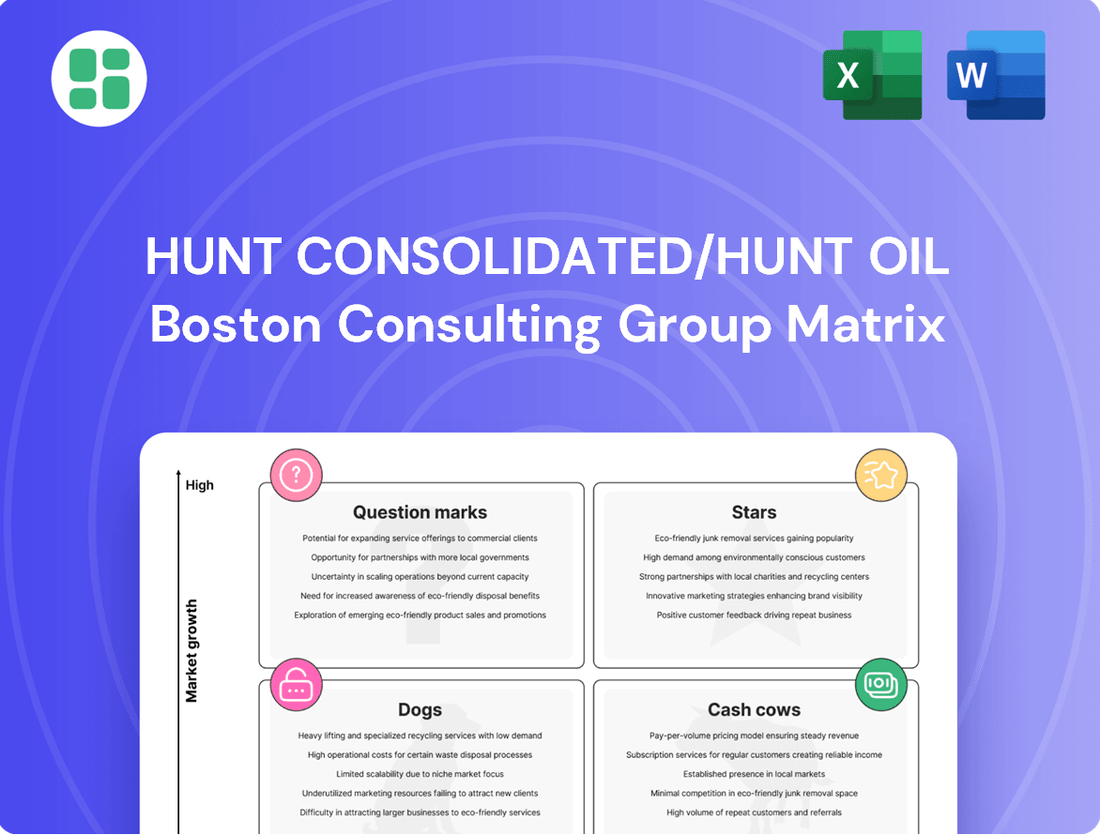

Hunt Consolidated/Hunt Oil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Uncover the strategic positioning of Hunt Consolidated/Hunt Oil with this insightful BCG Matrix preview. See which of their ventures are fueling growth and which might need a closer look.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Hunt Energy Network is making significant strides in the distributed energy resources sector, particularly within the ERCOT market. In August 2024, they secured a notable $250 million funding commitment. This capital infusion is earmarked for expanding their dispatchable power capabilities, a crucial element for grid reliability.

The company's strategy focuses on energy storage assets. Currently, Hunt Energy Network has 270 megawatts of these resources already operational. Furthermore, an additional 80 megawatts are slated for completion by early 2025, demonstrating a rapid growth trajectory.

This aggressive expansion underscores Hunt Energy Network's commitment to addressing Texas's increasing energy needs. Their growing portfolio of distributed energy resources is designed to bolster grid stability and provide reliable power solutions.

Hunt Military Communities is making significant strides in renewable energy, with over 20 megawatts of solar power installed across its properties nationwide. A key project at Hanscom Air Force Base, featuring rooftop solar PV and battery energy storage systems (BESS), is expected to be operational by early 2025. This strategic move positions Hunt Military Communities as a leader in the rapidly expanding sustainable energy sector.

Hunt Realty's Reunion Project redevelopment in Dallas represents a significant investment, with plans for a $5 billion mixed-use district. This ambitious undertaking aims to revitalize a key urban area, incorporating a convention hotel, housing, retail, and office components. The project's scale and location suggest a strategic move to capture substantial market share within a growing downtown core.

Hunt Development Group's Class A Multifamily Ventures

Hunt Development Group is a significant player in the Class A multifamily sector, focusing on high-growth Texas markets like Dallas, Austin, and Houston. These projects are designed to meet the increasing demand for premium housing in areas experiencing robust population and economic expansion.

The company's strategy of developing new, high-density Class A multifamily properties positions it well within a competitive but expanding real estate segment. This focus allows Hunt to capture substantial market share by catering to a demographic seeking quality and modern amenities. For instance, in 2024, the multifamily sector in Texas continued to see strong absorption rates, with cities like Austin and Dallas leading the nation in rent growth and occupancy, indicating a favorable environment for developers like Hunt.

- Focus on Class A Multifamily: Hunt Development Group concentrates on developing premium, high-density apartment complexes.

- Strategic Texas Markets: Investments are concentrated in rapidly expanding urban centers such as Dallas, Austin, and Houston.

- Capitalizing on Growth: Developments leverage strong regional economic growth and a high demand for quality housing.

- Market Share Capture: Consistent investment and delivery in this segment aim to secure significant market presence.

Hunt Oil Company's US Unconventional Resource Plays

Hunt Oil Company is a significant force in U.S. unconventional oil and gas plays, notably the Williston Basin and Permian Basin. Their ongoing rig operations and substantial production history underscore a deep commitment and leadership in these key regions.

Despite the general maturity of the oil and gas sector, these specific resource plays continue to present considerable growth opportunities for companies that operate efficiently.

- Williston Basin Production: In 2024, Hunt Oil maintained active drilling programs, contributing to the basin's overall output, which has seen substantial unconventional production growth over the past decade.

- Permian Basin Investments: The company's presence in the Permian, a cornerstone of U.S. shale production, reflects its strategy to capitalize on high-return unconventional assets.

- Growth Potential: For operators like Hunt Oil, efficient extraction techniques in these basins can still yield significant production increases, even as overall market growth moderates.

Hunt Energy Network is positioning itself as a star in the distributed energy resources sector, particularly within the ERCOT market. Their securing of a $250 million funding commitment in August 2024 to expand dispatchable power capabilities highlights their high growth and market potential. With 270 megawatts of operational energy storage and an additional 80 megawatts nearing completion by early 2025, they are rapidly scaling their operations to meet Texas's energy demands.

Hunt Military Communities is also shining with its commitment to renewable energy, installing over 20 megawatts of solar power nationwide. The project at Hanscom Air Force Base, set for early 2025 completion, featuring solar PV and battery storage, further solidifies their leadership in sustainable energy solutions.

Hunt Development Group is a clear star in the multifamily real estate market, focusing on high-growth Texas cities. Their strategy of developing new, high-density Class A properties in markets like Dallas and Austin, which saw strong absorption rates and rent growth in 2024, positions them for significant market share capture and continued expansion.

Hunt Oil Company is a star in U.S. unconventional oil and gas, with a strong presence and ongoing operations in the Williston and Permian Basins. Their continued investment in these key regions, which are cornerstones of U.S. shale production and offer significant growth potential through efficient extraction techniques, underscores their leadership in the energy sector.

| Business Unit | Category | Key Developments (2024-Early 2025) | Market Position |

|---|---|---|---|

| Hunt Energy Network | Distributed Energy Resources | $250M funding commitment (Aug 2024), 270MW operational storage, 80MW additional by early 2025 | High growth, expanding dispatchable power in ERCOT |

| Hunt Military Communities | Renewable Energy | 20MW+ solar installed nationwide, Hanscom AFB project (solar + BESS) by early 2025 | Leader in sustainable energy for military housing |

| Hunt Development Group | Multifamily Real Estate | Focus on Class A multifamily in Dallas, Austin, Houston; strong 2024 absorption rates in Texas | Capturing market share in high-demand Texas markets |

| Hunt Oil Company | Oil & Gas Production | Active drilling in Williston & Permian Basins; capitalizing on unconventional asset growth | Leading player in key U.S. unconventional plays |

What is included in the product

Hunt Consolidated/Hunt Oil BCG Matrix: Strategic insights for product portfolio management.

Hunt Consolidated/Hunt Oil BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's strategic position to alleviate decision-making paralysis.

Cash Cows

The Peru LNG Project, in which Hunt Oil holds a significant stake through the Camisea Consortium, operates as a prime example of a cash cow within Hunt Consolidated's portfolio. This project, inaugurated in 2010, was South America's first liquefied natural gas (LNG) facility and remains a cornerstone of Peru's energy infrastructure.

As a mature operation, the Peru LNG Project generates substantial and stable cash flows, reflecting its critical role in the nation's energy supply. While its growth prospects are limited due to its established market position, the consistent demand and operational efficiency solidify its status as a reliable generator of profits for Hunt Oil.

The Ain Sifni production, operated by Hunt Oil Middle East Limited in the Kurdistan Region of Iraq, represents a classic Cash Cow for Hunt Consolidated. Having been active in the region since 2007 and declaring commerciality on the Simrit structure in 2013, production began in 2016. The facility's capacity was enhanced in 2017, underscoring its status as a mature, stable producing asset.

This established operation consistently generates substantial cash flow. For instance, by the end of 2023, the Ain Sifni field had consistently met its production targets, contributing significantly to Hunt Oil's overall revenue streams. While its reliable cash generation is a major strength, the asset offers limited avenues for significant new growth, typical of a Cash Cow.

Hunt Refining Company, a seasoned player with seven decades of history, operates its refinery in Tuscaloosa, Alabama. This facility is a key supplier of essential products like diesel, gasoline, and asphalt, serving both the southeastern United States and international customers.

A significant $57 million expansion project is underway, slated for completion by August 2025. The primary goal of this investment is to enhance the refinery's efficiency and optimize its output of liquid fuels.

This strategic investment in a mature, low-growth market solidifies Hunt Refining Company's position as a Cash Cow. The focus on operational optimization ensures sustained high profit margins and robust cash flow generation from this core business segment.

Hunt Realty's Affordable Housing Portfolio Management

Hunt Realty's extensive involvement in affordable housing positions it firmly within the Cash Cows quadrant of the BCG Matrix. The company's status as one of the largest owners, asset managers, and property managers of these communities across the U.S. underscores its significant market share in a well-established sector.

This segment benefits from consistent demand, often bolstered by government subsidies, which translates into predictable, long-term cash flows. While the growth prospects in this mature market may be modest, the stability of income generation is a key characteristic of a Cash Cow.

- Market Leadership: Hunt Realty manages a vast portfolio of affordable housing, making it a dominant player in this niche.

- Stable Cash Flows: The consistent demand and subsidy support in affordable housing create reliable revenue streams.

- Mature Market: While not a high-growth area, its maturity ensures a predictable income base for Hunt.

- Low Growth, High Share: This combination is the defining characteristic of a Cash Cow, generating substantial cash with limited reinvestment needs.

Sharyland Utilities Transmission Business

Sharyland Utilities, a key component of Hunt Energy, operates as a regulated utility managing transmission projects across Texas. This regulated status provides a bedrock of predictable revenue, bolstered by a significant market share within its designated service areas. While the expansion of regulated infrastructure inherently limits rapid growth, Sharyland Utilities reliably generates consistent cash flow, acting as a stable contributor to the overall Hunt Consolidated portfolio.

The transmission business, by its nature, exhibits characteristics of a cash cow. In 2024, the demand for reliable electricity transmission infrastructure continues to be a critical factor in Texas's economic development, supporting the steady revenue generation for Sharyland.

- Regulated Operations: Sharyland Utilities benefits from a regulated framework that ensures stable pricing and demand for its transmission services.

- Market Share: A strong market share within its service territory in Texas reinforces its position as a consistent cash generator.

- Predictable Revenue: The utility sector's inherent stability translates into predictable and reliable cash flows for Hunt Consolidated.

- Slow Growth, High Stability: While growth is modest, tied to infrastructure expansion, the business offers a low-risk, high-stability income stream.

These established operations consistently generate substantial cash flow, solidifying their Cash Cow status within Hunt Consolidated's portfolio. Their mature market positions and operational efficiencies translate into reliable profit generation with limited reinvestment needs.

The Peru LNG Project, Ain Sifni production, Hunt Refining Company, Hunt Realty's affordable housing, and Sharyland Utilities all exemplify this strategy. They represent mature businesses with significant market share in stable or regulated sectors, ensuring consistent income streams for the company.

For instance, by the end of 2023, Ain Sifni consistently met production targets, and Sharyland Utilities' regulated operations in Texas continued to support steady revenue in 2024. Hunt Refining's $57 million expansion, due for completion by August 2025, aims to further optimize its output of essential fuels.

These assets are characterized by low growth but high market share, a hallmark of Cash Cows, providing a stable foundation for Hunt Consolidated's financial performance.

| Business Segment | Status | Key Characteristics | 2023/2024 Highlight |

|---|---|---|---|

| Peru LNG Project | Cash Cow | Mature, stable cash flows, critical energy infrastructure | South America's first LNG facility, consistent demand |

| Ain Sifni Production (Iraq) | Cash Cow | Mature, stable production, significant revenue contributor | Met production targets by end of 2023 |

| Hunt Refining Company | Cash Cow | Decades of operation, essential product supplier, efficiency focus | $57 million expansion by August 2025 to optimize fuel output |

| Hunt Realty (Affordable Housing) | Cash Cow | Large market share, consistent demand, subsidy support | Dominant player in a stable, niche market |

| Sharyland Utilities | Cash Cow | Regulated utility, predictable revenue, strong market share | Steady revenue generation in Texas's critical transmission infrastructure in 2024 |

What You See Is What You Get

Hunt Consolidated/Hunt Oil BCG Matrix

The Hunt Consolidated/Hunt Oil BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This ensures you get a professionally analyzed and formatted strategic tool without any watermarks or placeholder content. You can confidently use this preview as a direct representation of the valuable, ready-to-deploy BCG Matrix analysis that will be yours to implement in your business planning.

Dogs

Hunt Oil Company's Romanian oil exploration venture, spanning 14 years, is concluding due to persistent financial losses and unsuccessful drilling from 2010 to 2023. This divestment signifies an asset characterized by low growth potential and minimal market share, ultimately proving to be a significant drain on resources.

Hunt Consolidated's US oil and gas assets likely include marginal legacy properties. These are older fields or wells that generate very low profits, often barely covering their operating expenses. While they represent a piece of the company's history, their current contribution to overall production is minimal, operating in a market that isn't growing.

These marginal assets are often found in mature basins, where extraction has been ongoing for decades. For instance, the US oil and gas industry saw a significant number of wells reaching the end of their economic life in recent years, with many older fields experiencing declining production rates. In 2023, the average decline rate for mature US onshore wells could range from 5-15% annually, making marginal assets even less attractive.

Given their low profitability and minimal market share, these marginal legacy assets are prime candidates for divestment. Hunt may choose to sell them off to smaller operators who can manage them more efficiently or simply manage them passively to avoid incurring further costs, thereby freeing up capital for more promising ventures.

Hunt Consolidated, as a diversified holding company, likely possesses smaller private equity investments that are currently underperforming. These ventures might represent a low market share within potentially slow-growing niche sectors, acting as cash drains without generating significant returns. For instance, a hypothetical underperforming investment in a niche renewable energy component manufacturer might have seen its market share shrink from 5% to 3% in 2024 due to increased competition and evolving technological standards.

Outdated or Underutilized Real Estate Parcels

Hunt Realty, a significant player in real estate, likely possesses outdated or underutilized parcels within its extensive portfolio. These properties might struggle to attract modern development or buyers due to their age or location. Such assets could be underperforming, generating little income compared to their maintenance expenses and existing in stagnant real estate markets with minimal market presence.

- Underperforming Assets: Parcels not contributing significantly to income relative to holding costs.

- Low-Growth Markets: Properties situated in real estate submarkets experiencing minimal expansion.

- Negligible Market Share: Holdings with a very small presence or demand within their respective areas.

Non-Core Business Ventures with Limited Scale

Hunt Consolidated's portfolio likely includes non-core business ventures that are still in their nascent stages or operate in niche markets. These ventures, by definition, have not yet established a significant market presence or demonstrated substantial profitability. For instance, a small investment in a new renewable energy technology, while strategically important for future diversification, might currently represent a minimal portion of Hunt's overall revenue.

These operations are characterized by their limited scale and operate within sectors that may not be experiencing rapid growth. They consume capital and management attention but do not yet contribute meaningfully to the company's bottom line. Think of a small-scale agricultural project or a pilot program for a new logistics service; these are valuable for learning and potential future expansion but are not current profit drivers.

- Low Market Share: These ventures typically hold a very small percentage of their respective market segments.

- Low Growth Potential: The industries or niches they operate in are often mature or experiencing slow expansion.

- Resource Consumption: They require investment and oversight without generating proportional returns.

- Strategic Experimentation: Often represent efforts to explore new opportunities or technologies for future growth.

Hunt Consolidated's portfolio likely includes "Dog" assets, characterized by low market share and low growth potential. These are ventures that consume resources without generating significant returns, often representing legacy or underperforming segments.

Examples include marginal oil and gas properties with declining production, as seen in the US onshore sector where wells can experience 5-15% annual decline rates in mature basins. Additionally, underperforming private equity investments in niche sectors with shrinking market share, such as a hypothetical renewable energy component manufacturer whose share dropped from 5% to 3% in 2024, also fit this profile.

Hunt Realty's outdated or underutilized real estate parcels in stagnant markets, generating little income relative to holding costs, are further illustrations. These "Dogs" are candidates for divestment or passive management to reallocate capital to more promising opportunities.

| Asset Type | Market Share | Growth Potential | Financial Performance |

|---|---|---|---|

| Romanian Oil Exploration | Minimal | Low | Persistent Financial Losses (2010-2023) |

| Marginal US Oil & Gas Properties | Low | Low (Declining Production) | Very Low Profits, Barely Covering Expenses |

| Underperforming Private Equity | Low (Shrinking) | Low (Niche, Slow-Growing Sectors) | Cash Drains, Minimal Returns |

| Outdated/Underutilized Real Estate | Negligible | Low (Stagnant Markets) | Little Income vs. Holding Costs |

Question Marks

Hunt Oil's ventures in Tunisia and Morocco represent classic frontier exploration plays, characterized by substantial upfront investment and the potential for significant future returns. These regions are considered high-risk due to geological uncertainties and evolving political landscapes, but they also offer the allure of untapped hydrocarbon potential. Hunt has been actively exploring in Tunisia since 2019 and Morocco since 2020, with exploration programs continuing through 2023 and planned for 2025.

These projects are positioned as potential 'Question Marks' within a BCG Matrix framework for Hunt Oil. They are in areas where the company currently holds minimal to no market share in terms of production, necessitating considerable capital expenditure to ascertain their commercial viability. Success in these frontier basins could lead to substantial growth and market expansion for Hunt, but the outcome remains uncertain at this stage.

Hunt Energy Enterprises is strategically positioning itself within the emerging climate technology sector, channeling capital into promising areas like renewable energy generation, advanced battery storage solutions, and innovative sustainable materials. These investments are geared towards high-growth, nascent markets where Hunt is establishing its foothold, aiming to build significant market share in the future.

The company's commitment to these sectors reflects a long-term vision, acknowledging that these technologies, while holding immense potential, necessitate considerable investment to achieve scalability and demonstrate their viability. For instance, the global clean energy investment reached a record $1.1 trillion in 2023, indicating robust market growth and the capital-intensive nature of this transition.

Hunt Energy Network's $250 million investment will fuel the development of new thermal peaking generation facilities within the ERCOT market. This strategic move targets a high-demand sector where Hunt aims to capture substantial market share.

These new thermal peaking units are classified as question marks in the BCG matrix; they represent high-growth potential but require significant upfront capital before yielding considerable returns. The ERCOT market's need for reliable power generation provides the growth opportunity, but the capital intensity positions them as areas for careful strategic evaluation.

Early-Stage International Oil & Gas New Ventures

Hunt Oil Company actively pursues early-stage international new ventures, targeting exploration in frontier basins worldwide. These ventures, while offering substantial upside potential from significant discoveries, currently represent a minimal portion of the global oil and gas market and necessitate considerable initial investment.

These early-stage international ventures align with the characteristics of a Question Mark in the BCG Matrix. They are in high-growth markets but have low relative market share, demanding substantial investment to potentially capture future market leadership. For instance, in 2024, global upstream exploration budgets were projected to increase by approximately 5-7% year-over-year, with a significant portion allocated to frontier regions.

- High Growth Potential: Successful exploration in new international territories can lead to substantial reserves and future production volumes, driving significant revenue growth.

- Low Market Share: These ventures are in their nascent stages, meaning Hunt Oil currently holds a negligible market share in these specific international basins.

- High Investment Requirement: Early-stage exploration is capital-intensive, involving seismic surveys, exploratory drilling, and infrastructure development, often requiring billions in upfront funding.

- Uncertainty and Risk: The success rate in frontier exploration is inherently lower than in established regions, carrying significant geological and political risks.

Future-Focused Infrastructure Development Initiatives

Hunt Companies, through entities like Hunt Transmission Services, is actively involved in developing substantial transmission infrastructure, particularly for renewable energy sources. These projects are crucial for integrating clean energy into the grid and supporting growing urban centers. For instance, in 2024, Hunt was a key participant in the development of new high-voltage direct current (HVDC) lines designed to transport wind power across vast distances, a segment experiencing significant investment due to the global push for decarbonization.

These infrastructure undertakings are characterized by their long gestation periods and substantial capital requirements, often running into billions of dollars. While Hunt is strategically positioning itself in these high-growth sectors, its current market share in operational transmission assets is relatively low. This reflects the early stage of development for many of its projects, which are designed to capture future demand driven by the energy transition and increasing urbanization trends.

- Renewable Energy Transmission: Hunt is investing in large-scale transmission lines to connect new renewable energy generation sites, such as offshore wind farms and large solar arrays, to load centers.

- Urbanization Support: Infrastructure development also targets supporting the energy needs of rapidly expanding metropolitan areas, ensuring reliable power delivery.

- Capital Intensity: These projects require significant upfront investment, with some transmission line developments costing upwards of $1 billion to $2 billion.

- Market Position: Hunt is building its operational footprint in this sector, meaning its current market share is nascent, poised for growth as projects come online.

Hunt Oil's frontier exploration ventures in regions like Tunisia and Morocco, alongside its investments in climate technology and new thermal peaking generation facilities, all fit the profile of 'Question Marks' in the BCG Matrix. These are areas with high growth potential but low current market share for Hunt, demanding significant capital investment to determine their future success.

The company's strategic focus on these emerging sectors underscores a commitment to long-term growth, acknowledging the substantial capital required for scalability and market penetration. For instance, global clean energy investment hit a record $1.1 trillion in 2023, highlighting both the market's expansion and the capital demands of this transition.

Hunt's transmission infrastructure projects, particularly for renewable energy, also fall into this category. While crucial for the energy transition and urban growth, these long-gestation projects are capital-intensive and represent a nascent market share for Hunt, with significant investment needed to realize their potential.

These ventures represent opportunities in high-growth markets with minimal current market share, necessitating substantial investment to potentially achieve future market leadership. Global upstream exploration budgets in 2024 were anticipated to rise by 5-7% year-over-year, with a notable portion directed towards frontier regions.

| Venture Area | BCG Classification | Key Characteristics | Investment Context (2023-2024) | Market Potential |

| Frontier Exploration (Tunisia, Morocco) | Question Mark | High geological risk, low current market share, high upfront capital | Exploration continuing through 2023, planned for 2025; 5-7% global upstream budget increase for frontier regions in 2024 | Untapped hydrocarbon potential, significant future returns if successful |

| Climate Technology (Renewables, Battery Storage) | Question Mark | Nascent markets, high growth potential, establishing market foothold | Global clean energy investment reached $1.1 trillion in 2023 | High-growth, nascent markets with potential for significant future market share |

| Thermal Peaking Generation (ERCOT) | Question Mark | High demand sector, requires significant upfront capital | $250 million investment by Hunt Energy Network for new facilities | Capturing substantial market share in a high-demand sector |

| Transmission Infrastructure (Renewable Integration) | Question Mark | Long gestation periods, substantial capital requirements, low current market share | Key participant in new HVDC lines in 2024; projects can cost $1-2 billion | Supporting energy transition and growing urbanization, poised for future demand |

BCG Matrix Data Sources

Our Hunt Consolidated/Hunt Oil BCG Matrix is built on robust financial statements, comprehensive market research, and internal performance data to provide accurate strategic insights.