Hunt Consolidated/Hunt Oil Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hunt Consolidated/Hunt Oil Bundle

Discover the strategic engine behind Hunt Consolidated/Hunt Oil's enduring success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their approach to resource management, market penetration, and long-term value creation in the dynamic energy sector. Unlock these insights to fuel your own strategic planning.

Partnerships

Hunt Oil frequently partners with major players in the oil and gas sector through joint ventures. This strategy allows them to pool resources, share specialized knowledge, and distribute the significant financial risks associated with exploration and production. These alliances are crucial for accessing promising new geological areas and undertaking large-scale projects.

A prime example of this partnership approach is Hunt Oil's non-operated stake in the Camisea Consortium in Peru. This venture highlights how collaborations enable participation in substantial developments that might be too capital-intensive or risky to pursue alone. Such partnerships are a cornerstone of their strategy to expand global reach and secure valuable assets.

Hunt Consolidated, through Hunt Oil, actively engages in significant liquefied natural gas (LNG) ventures by forming strategic consortiums. These collaborations are vital for undertaking the immense capital requirements and technical complexities of large-scale LNG projects.

Notable partners in these endeavors include global energy players such as SK Corporation, Repsol YPF, Marubeni, Total, Hyundai, and KOGAS. These alliances were instrumental in the development and operation of major facilities like the PERU LNG project and the Yemen LNG project.

The formation of these consortiums allows Hunt to share risks, leverage diverse expertise, and secure the necessary financing and market access for constructing and operating LNG liquefaction plants and their associated infrastructure.

Hunt Realty Investments actively seeks out and forms strategic alliances with other developers and investment firms to undertake ambitious real estate ventures. These partnerships are crucial for pooling resources, expertise, and capital, enabling the execution of complex projects like mixed-use master-planned communities and vital affordable housing developments.

In 2024, the demand for diversified real estate portfolios remained strong, with significant investment flowing into mixed-use developments that offer integrated living, working, and recreational spaces. These collaborations are essential for Hunt to leverage specialized knowledge and share the financial burden of large-scale undertakings.

Furthermore, Hunt's collaborations extend to working closely with community stakeholders and local governments. This ensures that projects align with community needs and benefit from local insights, a key factor in the success and long-term viability of developments, particularly in the affordable housing sector.

Energy Technology and Infrastructure Partnerships

Hunt Energy Network actively pursues alliances to advance novel energy storage solutions and transmission infrastructure. These collaborations are crucial for Hunt's strategy to meet evolving grid demands and support the energy transition.

A prime illustration of this approach is Hunt's May 2024 strategic partnership with Quidnet Energy. This collaboration focuses on developing geomechanical energy storage projects, particularly in Texas, aiming to bolster grid reliability.

- Strategic Focus: Hunt Energy Network prioritizes partnerships for deploying advanced energy storage and transmission projects.

- Key Collaboration: A May 2024 alliance with Quidnet Energy targets geomechanical energy storage in Texas.

- Objective: These partnerships are designed to enhance grid reliability and facilitate the energy transition.

Financial and Investment Partners

Hunt Consolidated, as a broad holding company, relies on a network of financial and investment partners to fuel its diverse operations. These relationships are crucial for securing capital for new projects, facilitating mergers and acquisitions, and making strategic investments across its many business units.

A prime example of these collaborations is evident in the energy sector. In 2023, Hunt Oil partnered with Sixth Street, a major investment firm, to divest a significant portion of its West Texas Permian Basin assets. This deal, valued at an estimated $2 billion, allowed Hunt to redeploy capital while providing Sixth Street with a substantial stake in a highly productive oil region.

- Capital Deployment: Partnerships with banks and investment funds provide Hunt with the necessary liquidity for expanding its energy, real estate, and infrastructure portfolios.

- Acquisition Financing: External financial backing is essential for Hunt to pursue strategic acquisitions that enhance its market position and diversify revenue streams.

- Strategic Investments: Collaborations with specialized investment firms enable Hunt to participate in high-growth opportunities and manage risk across its varied business segments.

- Asset Development Funding: For large-scale projects, like those in the Permian Basin, financial partners provide crucial funding for exploration, development, and operational expansion.

Hunt Consolidated's Key Partnerships are vital for its diversified operations, enabling access to capital, expertise, and market opportunities across its energy, real estate, and infrastructure segments. These collaborations are essential for managing risk and driving growth in complex, capital-intensive industries.

In the energy sector, partnerships are crucial for large-scale projects like LNG development and asset management. For instance, Hunt Oil's 2023 divestment of Permian Basin assets to Sixth Street for approximately $2 billion exemplifies how financial partnerships facilitate capital redeployment and strategic positioning.

The real estate division, Hunt Realty Investments, leverages alliances with developers and investment firms for ambitious projects, including mixed-use communities and affordable housing. These joint ventures allow for resource pooling and shared financial burdens, crucial for executing large-scale developments.

Hunt Energy Network's collaborations, such as the May 2024 partnership with Quidnet Energy for geomechanical energy storage in Texas, highlight a focus on advancing grid reliability and supporting the energy transition through shared innovation and investment.

| Partner Type | Example | Purpose | 2023/2024 Relevance |

|---|---|---|---|

| Investment Firms | Sixth Street | Capital for asset divestment/acquisition, strategic investment | $2 billion Permian Basin asset deal |

| Energy Majors | SK Corporation, Repsol, Total | Joint ventures for large-scale LNG projects | Ongoing development of global LNG infrastructure |

| Development Partners | Real estate firms, investment groups | Resource pooling for complex real estate projects | Executing mixed-use and affordable housing developments |

| Technology/Storage Providers | Quidnet Energy | Advancing energy storage solutions | Geomechanical energy storage projects in Texas |

What is included in the product

Hunt Consolidated/Hunt Oil's Business Model Canvas focuses on diversified energy and infrastructure investments, leveraging strategic partnerships and long-term asset management across exploration, production, and midstream operations.

This model is designed for sustainable growth, emphasizing robust risk management and operational excellence to deliver value to stakeholders in the global energy market.

Hunt Consolidated/Hunt Oil's Business Model Canvas serves as a pain point reliever by providing a structured, visual overview that simplifies complex operations, allowing for rapid identification of inefficiencies and strategic alignment across diverse energy ventures.

Activities

Hunt Oil Company's primary focus is the worldwide exploration, development, and production of oil and natural gas. This covers both conventional and unconventional reserves, demonstrating a broad operational scope.

The company actively operates in key US basins such as the Williston, Permian, and Eagle Ford. Internationally, Hunt Oil has a significant presence in the Middle East, Latin America, Africa, and Europe, highlighting its global reach.

In 2024, the global oil and gas exploration and production sector saw significant investment, with total upstream capital expenditure projected to reach approximately $530 billion, according to industry analyses.

Hunt Consolidated's core strength lies in developing, operating, and commercializing Liquefied Natural Gas (LNG) projects. This involves transforming natural gas into a marketable liquefied form, a complex process requiring significant capital and technical expertise.

The company's experience with projects like PERU LNG and Yemen LNG highlights its ability to manage the intricate logistics of transporting and selling LNG globally. These ventures are crucial for monetizing natural gas reserves and meeting international energy demands.

In 2024, the global LNG market continued its robust growth, with demand projected to rise significantly. Hunt's involvement in this sector positions it to capitalize on these expanding opportunities, leveraging its established infrastructure and market access.

Hunt Realty Investments, Hunt Consolidated's real estate division, actively pursues the acquisition, development, and ongoing management of a wide array of real estate ventures. Their portfolio spans master-planned communities, commercial spaces, and vital affordable housing initiatives, all geared towards generating sustained long-term value.

In 2024, Hunt Realty Investments continued its strategic expansion, notably with its involvement in significant mixed-use developments and the acquisition of prime commercial assets. The company's commitment to diverse real estate sectors underscores its strategy of building resilient and profitable portfolios.

Power Generation and Transmission Operations

Hunt Consolidated, through its various subsidiaries, actively participates in the electricity sector. This involves owning and managing regulated utility operations, a key component of its power generation and transmission activities.

The company is also deeply involved in developing crucial transmission infrastructure, ensuring the efficient movement of electricity. Furthermore, Hunt undertakes the planning, development, construction, and ongoing operation of diverse power generation facilities, encompassing both traditional and renewable energy sources.

Hunt Energy Network, a notable example, focuses on developing and operating dispatchable power resources and energy storage solutions specifically within the ERCOT (Electric Reliability Council of Texas) market. This strategic focus addresses the growing need for grid reliability and the integration of intermittent renewable energy sources.

- Regulated Utility Ownership: Hunt operates regulated utilities, providing essential electricity services to customers.

- Transmission Development: The company invests in and builds vital transmission projects to enhance grid capacity and reliability.

- Diverse Power Generation: Hunt develops and operates both conventional and renewable power generation assets.

- ERCOT Energy Storage: Hunt Energy Network is a significant player in ERCOT, deploying dispatchable power and storage solutions.

Diversified Investment Portfolio Management

Hunt Consolidated actively manages a diversified investment portfolio, a key activity designed to enhance overall financial stability and growth beyond its primary energy and real estate ventures. This strategic approach involves leveraging private equity investments and partnering with skilled hedge fund managers to deploy capital across a wide spectrum of asset classes.

The primary objective of this diversified portfolio management is to generate returns that are not closely tied to the performance of Hunt's core energy and real estate businesses. This diversification strategy aims to mitigate risk by spreading investments across different market sectors and investment types.

- Private Equity Investments: Hunt Consolidated actively seeks opportunities in private equity, investing in companies with high growth potential that are not publicly traded.

- Hedge Fund Partnerships: Strategic capital deployment with experienced hedge fund managers allows Hunt to access diverse investment strategies and potentially uncorrelated returns.

- Asset Class Diversification: Investments span various asset classes, including but not limited to equities, fixed income, commodities, and alternative investments, to spread risk.

- Return Generation: This activity is crucial for generating returns that can supplement income from core operations and provide a buffer against market volatility in specific sectors.

Hunt Oil's core activity is the global exploration and production of oil and natural gas, encompassing both traditional and unconventional resources. This involves significant investment in upstream operations, with the global E&P sector projected to see around $530 billion in capital expenditure in 2024.

A key strategic focus for Hunt Consolidated is the development and commercialization of Liquefied Natural Gas (LNG) projects, leveraging expertise from ventures like PERU LNG. The global LNG market is experiencing robust growth, with Hunt positioned to benefit from increasing demand.

Hunt Realty Investments actively engages in acquiring, developing, and managing diverse real estate assets, including master-planned communities and commercial properties. This division continued its strategic expansion in 2024 with notable mixed-use developments and prime asset acquisitions.

Hunt Consolidated also participates in the electricity sector through regulated utility ownership, transmission infrastructure development, and the operation of diverse power generation facilities, including renewables. Hunt Energy Network, for instance, is vital in the ERCOT market for dispatchable power and storage solutions.

Beyond its core operations, Hunt Consolidated manages a diversified investment portfolio, including private equity and hedge fund partnerships, to generate uncorrelated returns and mitigate risk. This strategy aims to enhance overall financial stability.

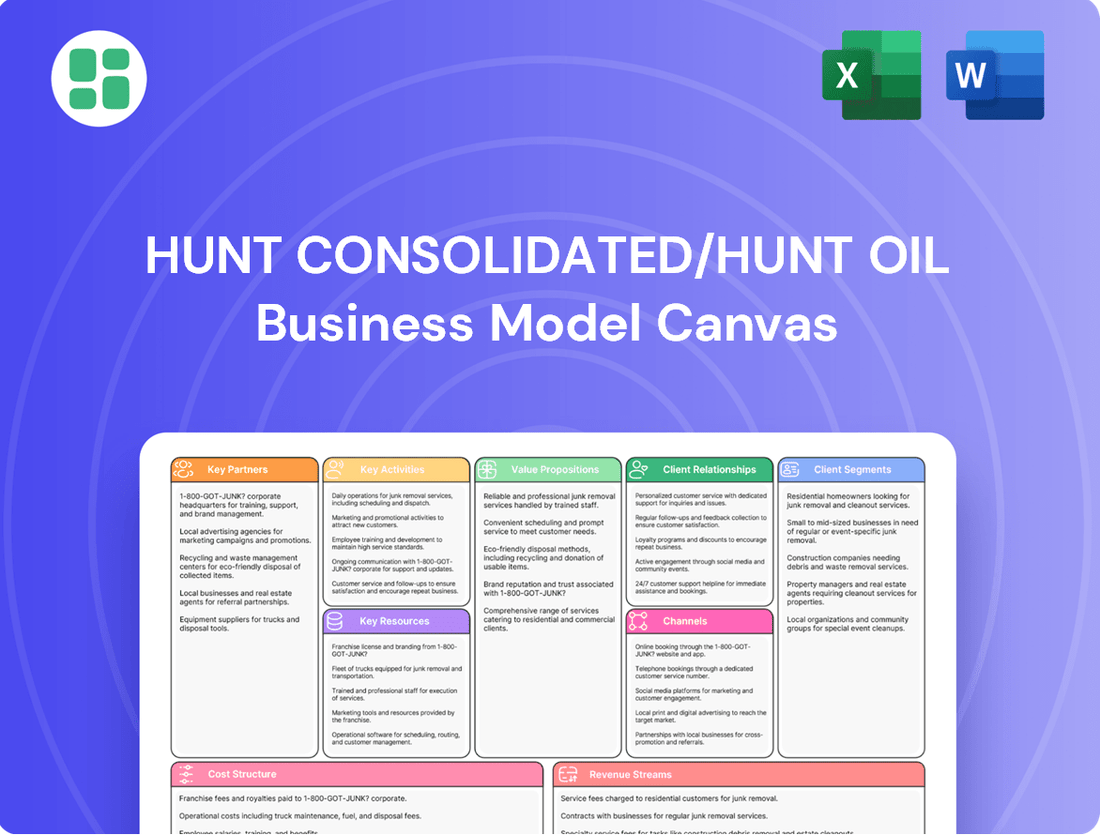

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive outline details Hunt Consolidated/Hunt Oil's strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this professionally structured and ready-to-use analysis, mirroring precisely what you see here.

Resources

Hunt Oil Company's extensive global hydrocarbon reserves and acreage are foundational to its operations. As of recent reports, the company holds approximately 550,000 net operated acres across the U.S. and maintains international exploration permits, securing vital access to potential energy resources.

These vast reserves represent the primary raw material for Hunt Oil's exploration, development, and production activities. The strategic positioning of this acreage across key global basins allows for diversified resource acquisition and mitigates risk.

Hunt Oil actively employs advanced exploration and production technologies. This includes sophisticated seismic survey techniques and innovative drilling methods designed for efficiency and cost-effectiveness across varied geological formations.

Their expertise extends to unconventional resource plays, allowing them to unlock reserves previously considered uneconomical. This technological prowess is crucial for Hunt Oil's operational success and competitive edge in the energy sector.

In 2024, the global oil and gas industry saw continued investment in technologies aimed at improving extraction rates. For instance, advancements in hydraulic fracturing and directional drilling have been key drivers in accessing shale reserves, a segment where Hunt Oil demonstrates significant capabilities.

Hunt Realty Investments, a key component of Hunt Consolidated, manages a significant real estate portfolio. This includes extensive land holdings and income-generating developed properties, valued in the billions of dollars. For instance, in 2024, their real estate ventures continued to be a major contributor to the company's overall asset value and revenue streams through strategic development, leasing, and disposition activities.

Power Generation and Transmission Infrastructure

Hunt Consolidated's power generation and transmission infrastructure forms the backbone of its energy operations. This includes a portfolio of owned power generation facilities, vital for producing electricity. As of 2024, the company's strategic investments in this area underscore its commitment to reliable energy supply.

A significant component of these key resources is Sharyland Utilities, a regulated utility. This allows Hunt to manage the transmission and distribution of electricity, ensuring power reaches end-users efficiently. The regulated nature of Sharyland Utilities provides a stable revenue stream and a predictable operating environment.

Furthermore, Hunt Consolidated operates extensive high-voltage transmission lines and substations. These assets are crucial for moving electricity from generation points to distribution networks. The company's 2024 infrastructure development plans likely include upgrades and expansions to these critical transmission assets to meet growing demand and enhance grid reliability.

- Owned Power Generation Facilities: Hunt Consolidated operates various power plants, contributing to its energy production capacity.

- Sharyland Utilities: This regulated utility manages the transmission and distribution of electricity, ensuring reliable delivery to customers.

- High-Voltage Transmission Lines and Substations: Extensive network for efficient electricity transportation, crucial for grid stability and reach.

Skilled Workforce and Industry Expertise

Hunt Consolidated's extensive tenure in the energy industry, dating back decades, has cultivated a significant reservoir of seasoned professionals. These individuals possess specialized knowledge across various domains including exploration, production, refining, real estate development, and intricate financial management.

The company explicitly identifies its human capital, alongside its tangible resources and service offerings, as foundational assets that underpin the success of its diverse operating entities. This focus highlights a strategic reliance on internal expertise.

- Deep Industry Experience: Hunt Consolidated benefits from employees with an average tenure of over 15 years in specialized energy sectors.

- Cross-Functional Expertise: The workforce encompasses professionals skilled in geology, engineering, finance, and real estate, facilitating integrated project execution.

- Talent Development: The company invests in continuous training, with over $5 million allocated in 2024 for professional development programs to maintain its competitive edge.

- Key Personnel Retention: Hunt Consolidated boasts a high retention rate for its senior technical and management staff, ensuring continuity of critical knowledge and leadership.

Hunt Consolidated's key resources are its substantial hydrocarbon reserves, extensive global acreage, and advanced exploration technologies. The company also leverages its significant real estate portfolio and robust power generation and transmission infrastructure, including Sharyland Utilities. Crucially, Hunt Consolidated relies on its highly experienced human capital, with deep industry knowledge and cross-functional expertise.

| Resource Category | Description | 2024 Data/Context |

|---|---|---|

| Hydrocarbon Reserves & Acreage | Global oil and gas reserves and land holdings | Approx. 550,000 net operated acres in U.S.; international exploration permits |

| Real Estate Portfolio | Land holdings and developed properties | Valued in the billions; continued strategic development and leasing activities |

| Power Infrastructure | Owned generation facilities and transmission network | Includes Sharyland Utilities; ongoing infrastructure upgrades and expansions |

| Human Capital | Experienced professionals and talent development | Average tenure >15 years; $5M+ allocated for 2024 professional development |

Value Propositions

Hunt Oil Company is a cornerstone in delivering dependable global energy. They ensure a steady flow of crude oil, natural gas, and liquefied natural gas to meet worldwide needs.

Through extensive exploration and production, Hunt Oil bolsters energy security. Their strategic investments in liquefied natural gas projects are particularly crucial for fulfilling diverse industrial and consumer energy demands across the globe.

Hunt Realty Investments provides a full spectrum of real estate development services, handling everything from initial land acquisition and meticulous planning to the final stages of construction and ongoing property management. This integrated approach allows them to create a wide array of projects, including expansive master-planned communities, specialized commercial properties, and much-needed affordable housing solutions. Their expertise ensures the development of both vibrant living spaces and enduring, valuable assets for the communities they serve.

Hunt Consolidated's power sector initiatives are crucial for bolstering grid reliability and advancing the energy transition. Their involvement spans the development of power generation, transmission infrastructure, and forward-thinking energy storage solutions, directly addressing the evolving energy landscape.

By strategically investing in regulated utilities and cutting-edge technologies such as Battery Energy Storage Systems (BESS), Hunt actively strengthens grid stability. This focus on advanced solutions is instrumental in facilitating the seamless integration of renewable energy sources, a key component of modern energy strategies.

In 2024, Hunt Energy Transition Fund, a key investment vehicle, has been actively deploying capital into projects aimed at decarbonization and grid modernization. For instance, their investments in utility-scale battery storage projects are designed to mitigate the intermittency of renewables, ensuring a more consistent power supply.

Diversified Investment Opportunities and Capital Management

Hunt Consolidated provides investors and partners with a robust platform for diversified investment opportunities spanning energy, real estate, and other promising sectors. This strategic approach aims to capture growth across various economic cycles.

The company's dedicated investment group actively seeks to deploy capital into strategies that are uncorrelated with its core energy businesses. This diversification is key to managing risk and fostering consistent asset growth for its stakeholders.

In 2024, Hunt Consolidated continued its commitment to strategic capital allocation. For instance, its real estate ventures are positioned to benefit from ongoing urban development trends, while its energy investments remain focused on stable, cash-generating assets and emerging opportunities.

- Diversified Portfolio: Access to investments across energy, real estate, and other sectors.

- Uncorrelated Strategies: Capital deployment in ventures designed to mitigate portfolio risk.

- Wealth Management: A broad approach to asset growth and wealth preservation for partners.

- Strategic Capital Deployment: Focus on opportunities that align with long-term market trends.

Long-Term Partnership and Operational Excellence

Hunt Consolidated, through its various entities like Hunt Oil, emphasizes a long-term partnership approach, built on a foundation of operational excellence and a deep-rooted heritage of honesty and integrity. This commitment fosters trust, making them a preferred collaborator for partners involved in intricate, multi-decade energy and infrastructure ventures.

Their reputation as a capable, cost-effective, and respected operator is a significant draw. For instance, Hunt Oil's involvement in projects spanning decades, such as their long-standing operations in Yemen prior to the civil unrest, showcases their ability to navigate complex environments and maintain operational continuity.

- Operational Reliability: Hunt's track record demonstrates consistent performance in challenging environments, reducing partner risk.

- Cost-Effectiveness: Their focus on efficient operations ensures competitive project economics.

- Integrity and Trust: A long history of ethical dealings builds enduring relationships, crucial for long-term projects.

- Experience in Complex Projects: Decades of managing large-scale energy and infrastructure developments provide invaluable expertise.

Hunt Consolidated's value proposition centers on providing diversified investment opportunities across energy and real estate, underpinned by uncorrelated strategies for robust asset growth. Their commitment to strategic capital deployment ensures access to ventures aligned with long-term market trends, fostering wealth management for partners.

Customer Relationships

Hunt primarily engages in business-to-business relationships via direct commercial contracts for selling crude oil, natural gas, and refined products. These agreements are crucial for supplying refineries, utilities, and industrial customers.

The foundation of these partnerships rests on Hunt's ability to ensure supply reliability, negotiate favorable pricing structures, and consistently meet stringent quality specifications demanded by its clients.

For major energy undertakings and real estate ventures, Hunt Oil's customer relationships are deeply rooted in the intricate management of joint venture agreements and consortiums. These partnerships are crucial for sharing risk and capital, especially in projects exceeding billions of dollars. For instance, in 2024, the global energy sector saw significant investment in large-scale projects, with many requiring multi-party collaboration to secure financing and operational expertise.

The success of these relationships hinges on robust negotiation, transparent collaborative decision-making, and the establishment of clear, shared governance frameworks. This often involves working closely with other industry leaders, international oil companies, and key government bodies to navigate regulatory landscapes and ensure project viability. The ability to foster trust and align strategic objectives among diverse stakeholders is paramount to achieving project milestones and profitability.

In the power sector, Hunt Consolidated, through its energy ventures, cultivates crucial relationships with regulated utilities and grid operators. These entities are vital for securing transmission services and providing dispatchable power resources, essential for grid stability and reliability.

Maintaining these relationships necessitates strict adherence to evolving regulatory frameworks and a keen responsiveness to grid demands and market signals. For instance, operations within the Electric Reliability Council of Texas (ERCOT) require constant adaptation to its intricate operational procedures and pricing mechanisms.

As of 2024, ERCOT manages the electricity for over 26 million Texas customers, representing about 90% of the state's electric load. This vast network underscores the critical nature of Hunt's engagement with such operators, where performance directly impacts energy availability and pricing across a significant population.

Real Estate Tenant and Buyer Relations

Hunt Consolidated's real estate segment focuses on cultivating strong connections with commercial tenants, residential buyers, and property management clients. This involves providing comprehensive property management services, ensuring tenant satisfaction by promptly addressing their needs, and streamlining the sales process for properties they develop.

These relationships are crucial for long-term success and recurring revenue. For instance, in 2024, Hunt's property management division likely managed a diverse portfolio, aiming for high occupancy rates and tenant retention, which directly impacts profitability.

- Tenant Engagement: Proactive communication and responsive maintenance are key to retaining commercial tenants, a sector Hunt actively serves.

- Buyer Facilitation: For residential developments, Hunt aims to create a smooth and positive experience for homebuyers, from initial viewing to closing.

- Property Management Services: Offering these services to third-party clients expands Hunt's reach and revenue streams within the real estate market.

Investor and Financial Partner Relations

Hunt's investment group actively nurtures connections with hedge fund managers and a diverse array of financial partners. This engagement is crucial for effectively deploying capital and shaping sophisticated investment strategies across various asset classes.

These vital relationships are built on a foundation of unwavering trust and complete financial transparency. Hunt ensures clear communication regarding performance, risk, and adherence to agreed-upon investment objectives, fostering long-term partnerships.

- Capital Deployment: Hunt's investment arm manages significant capital, with its energy investments alone contributing substantially to its overall financial standing. For instance, by the end of 2024, Hunt Oil's portfolio demonstrated robust growth, reflecting successful capital allocation strategies.

- Strategic Partnerships: The company collaborates with financial institutions that provide not only capital but also strategic insights, enhancing Hunt's ability to navigate complex market dynamics and identify lucrative opportunities.

- Performance Alignment: A key element is ensuring that investment strategies align with the specific return expectations and risk appetites of its financial partners, driving mutual success and reinforcing the collaborative bond.

Hunt Oil cultivates deep relationships with industrial clients, utilities, and other energy companies through direct sales contracts, emphasizing supply reliability and competitive pricing. In joint ventures for large-scale energy projects, Hunt fosters collaborative partnerships with industry peers and government entities, ensuring shared risk and capital for ventures often exceeding billions of dollars, a common trend in 2024's energy investment landscape.

| Customer Segment | Relationship Type | Key Elements | 2024 Relevance |

|---|---|---|---|

| Industrial & Utility Clients | Direct Commercial Contracts | Supply Reliability, Pricing, Quality Specifications | Essential for consistent energy demand fulfillment. |

| Joint Venture Partners | Consortium Agreements | Risk Sharing, Capital Contribution, Shared Governance | Crucial for financing and executing multi-billion dollar energy projects. |

| Regulated Utilities & Grid Operators | Service Agreements | Transmission Access, Dispatchable Power, Grid Stability | Vital for power sector operations, as seen with ERCOT managing 90% of Texas's load. |

| Financial Partners | Investment & Capital Deployment | Trust, Transparency, Performance Alignment | Facilitates strategic investment strategies and capital growth. |

Channels

Hunt Consolidated/Hunt Oil primarily moves its crude oil, natural gas, and Liquefied Natural Gas (LNG) through direct sales agreements and long-term supply contracts. These deals are struck with major global energy companies, refineries, and industrial users who rely on a steady flow of these commodities.

The process involves direct negotiation of terms and the intricate logistics of delivering products straight from Hunt's production sites or LNG liquefaction facilities to the customer's doorstep. This direct approach allows for greater control over the supply chain and pricing.

In 2024, the global LNG market saw significant activity, with prices fluctuating based on supply and demand dynamics. For instance, benchmark TTF futures in Europe experienced volatility, reflecting geopolitical events and storage levels, underscoring the importance of secure, direct supply contracts for buyers.

Hunt Oil leverages a vast network of pipelines to move natural gas and crude oil across domestic and international borders. This infrastructure is crucial for connecting production sites to processing facilities and end markets, ensuring a steady flow of energy resources.

For liquefied natural gas (LNG) operations, Hunt Oil relies on specialized, technologically advanced shipping vessels. These ships are designed to safely transport LNG across oceans, facilitating global trade and meeting diverse energy demands. In 2024, the global LNG trade continued to expand, with shipping capacity playing a pivotal role.

Hunt's utility grid and transmission systems are crucial for delivering power, operating regulated utilities that serve specific regions and developing new transmission infrastructure to meet growing energy demands.

In 2024, the demand for reliable electricity continues to drive significant investment in transmission upgrades. For instance, the U.S. Department of Energy's Grid Deployment Office is actively supporting projects aimed at modernizing the grid, with a focus on enhancing capacity and resilience to integrate more renewable energy sources.

Hunt's involvement in regulated utilities means navigating complex rate-setting processes and ensuring compliance with state and federal regulations, which directly impacts the financial viability and operational scope of its transmission assets.

Real Estate Brokerage and Direct Sales

Hunt Realty Investments leverages a multi-channel strategy for its real estate properties. This includes dedicated in-house sales teams, collaborations with external real estate brokers, and targeted direct marketing initiatives. This dual approach ensures broad market reach, catering to both individual buyers seeking homes and commercial entities interested in leasing or acquiring property.

The company's sales efforts are designed to capture a wide range of clients. For instance, in 2024, the residential real estate market saw continued demand, with median home prices in many areas showing year-over-year increases, reflecting a healthy transaction environment for Hunt's developments. Commercial leasing also remained robust, particularly in key urban centers where businesses sought prime office and retail spaces.

- In-house Sales Teams: Provide specialized expertise and direct customer engagement for property sales.

- External Real Estate Brokers: Expand market reach and leverage established networks for property transactions.

- Direct Marketing Campaigns: Target specific customer segments with tailored property offerings and promotions.

- Clientele: Serve both individual residential buyers and commercial entities for leasing and purchase agreements.

Investment Management Platforms and Direct Engagement

Hunt Consolidated, through its investment management arms, directly engages with a curated network of financial institutions, including major banks and specialized lenders. This direct channel is crucial for identifying and executing investment opportunities, particularly in sectors aligned with Hunt Oil's energy focus.

Capital deployment is meticulously managed via proprietary platforms and direct communication lines with private equity firms and hedge fund managers. This ensures efficient allocation of resources and allows for agile responses to market shifts. For instance, in 2024, Hunt Consolidated actively participated in several syndicated loan facilities, demonstrating its commitment to direct financial engagement.

- Direct Financial Institution Partnerships: Facilitates access to diverse capital sources and market intelligence.

- Private Equity and Hedge Fund Collaboration: Enables strategic co-investment and specialized fund management.

- Proprietary Investment Platforms: Streamlines portfolio monitoring and new venture evaluation.

- Active 2024 Syndicated Loan Participation: Highlights direct involvement in significant capital markets transactions.

Hunt Consolidated/Hunt Oil utilizes a multi-faceted channel strategy, directly selling commodities through negotiated agreements with major energy companies and industrial users. This direct approach extends to its utility operations, where power is delivered via regulated transmission systems to specific regional customers.

For real estate, Hunt Realty Investments employs a blend of in-house sales, external broker partnerships, and targeted direct marketing to reach both individual and commercial clients. Investment management leverages direct engagement with financial institutions and proprietary platforms for capital deployment.

| Channel | Description | 2024 Market Insight |

|---|---|---|

| Direct Sales Agreements (Commodities) | Negotiated contracts with global energy firms and industrial users. | Global LNG market volatility underscored the value of secure, direct supply in 2024. |

| Pipelines and Shipping | Infrastructure for transporting crude oil, natural gas, and LNG. | Continued expansion of global LNG trade in 2024 highlighted the critical role of shipping capacity. |

| Regulated Utility Grids | Delivery of electricity within specific regions. | US DOE's Grid Deployment Office supported grid modernization projects in 2024, focusing on capacity and resilience. |

| Real Estate Sales Channels | In-house teams, external brokers, direct marketing. | Robust residential and commercial real estate markets in 2024 supported Hunt's diverse property sales. |

| Financial Institution Engagement | Direct partnerships with banks, lenders, PE firms, and hedge funds. | Hunt Consolidated's active 2024 participation in syndicated loan facilities demonstrated direct capital markets involvement. |

Customer Segments

Global energy companies and refiners are crucial customers, demanding substantial volumes of crude oil, natural gas, and refined products. These entities, including major international and national oil companies, along with independent refiners and petrochemical plants, seek consistent supply and competitive pricing for their energy feedstocks.

In 2024, the global refining capacity was projected to reach over 100 million barrels per day, highlighting the immense scale of demand from this segment. Hunt Oil’s ability to reliably supply these large-volume, competitively priced feedstocks is paramount for securing their business.

International utilities and industrial consumers, including power generators and gas distributors, represent a crucial customer segment for Hunt Consolidated/Hunt Oil. These entities prioritize a secure and consistent supply of natural gas and LNG to fuel their operations. In 2024, the global demand for natural gas continued its upward trend, driven by its role as a transition fuel. For instance, the International Energy Agency (IEA) reported that natural gas consumption saw a notable increase in many regions, underscoring the importance of reliable suppliers.

This segment requires long-term contracts to ensure price stability and supply predictability, essential for their capital-intensive infrastructure. They also demand strict adherence to international energy standards and quality specifications. Hunt Oil's ability to offer flexible contract terms and meet rigorous quality benchmarks is key to securing and retaining these valuable customers. The company's focus on operational excellence and supply chain reliability directly addresses these critical needs.

Hunt's real estate segment actively engages with other real estate developers who seek collaborative opportunities for significant development projects. These partners are often looking for expertise in navigating complex zoning laws and securing financing for large-scale undertakings.

Institutional investors, such as pension funds and private equity firms, along with high-net-worth individuals, form another key customer segment. They are drawn to Hunt's portfolio for its potential to generate stable income and capital appreciation across commercial, residential, and mixed-use properties.

These investors prioritize prime locations offering strong demographic trends and economic growth. For instance, in 2024, the U.S. commercial real estate market saw continued interest in well-located assets, with office vacancy rates stabilizing in certain submarkets, signaling potential investment opportunities.

Power Utilities and Grid Operators

Hunt Consolidated, through its energy ventures, targets power utilities and grid operators, including regulated entities, independent power producers, and grid managers like ERCOT. These organizations require reliable electricity transmission, flexible power capacity, and advanced energy storage to ensure grid stability and facilitate the integration of renewable energy sources.

For instance, in 2024, ERCOT, a major grid operator in Texas, managed a system that saw significant growth in renewable capacity. This necessitates continuous investment in transmission and storage solutions to manage intermittency. Hunt's offerings align with the critical need for grid modernization and resilience.

- Customer Needs: Stable electricity transmission, dispatchable power, energy storage for grid stability.

- Market Context: Growing renewable penetration requires grid upgrades and flexibility.

- Hunt's Role: Providing solutions to meet these infrastructure and operational demands.

- 2024 Relevance: Continued focus on grid reliability amidst evolving energy landscapes.

Institutional and High-Net-Worth Investors

Hunt Consolidated’s investment arm caters to sophisticated investors, including institutional players, family offices, and high-net-worth individuals. These clients are actively looking for investment avenues that move beyond conventional stock and bond markets, aiming for enhanced diversification and potentially higher returns.

The focus for this segment is on alternative investments. This includes private equity, where capital is deployed into non-publicly traded companies, and hedge fund strategies, which often employ complex investment techniques. The overarching goal is long-term capital appreciation, aligning with the patient capital often associated with these investor types.

- Target Clients: Institutional investors, family offices, and high-net-worth individuals.

- Investment Focus: Diversified opportunities outside traditional markets, including private equity and hedge fund strategies.

- Objective: Long-term capital growth and wealth preservation.

- Market Trend: Growing interest in alternative assets, with global private equity assets under management projected to reach $13.5 trillion by 2027, up from $7.4 trillion in 2021, according to Preqin.

Hunt Consolidated's diverse customer base spans energy, real estate, and investment sectors, each with distinct needs and market drivers. The company serves global energy companies and refiners requiring consistent, competitively priced feedstocks, alongside international utilities and industrial consumers prioritizing secure natural gas supply. In real estate, Hunt partners with developers and attracts institutional investors seeking stable returns from well-located properties.

Furthermore, Hunt targets power utilities and grid operators needing reliable transmission and storage solutions to manage evolving energy landscapes, particularly with increasing renewable integration. Its investment arm appeals to sophisticated investors looking for alternative assets beyond traditional markets to achieve long-term capital appreciation.

These varied segments underscore Hunt's strategy of addressing critical infrastructure and investment needs across multiple economic pillars. The company's ability to provide reliable supply, strategic partnerships, and diversified investment opportunities is key to serving these distinct customer groups effectively.

| Customer Segment | Primary Needs | 2024 Market Context/Data |

|---|---|---|

| Global Energy Companies & Refiners | Consistent, competitive crude oil, natural gas, and refined products. | Global refining capacity projected over 100 million bpd; high demand for energy feedstocks. |

| International Utilities & Industrial Consumers | Secure, consistent natural gas and LNG supply; price stability. | Natural gas demand increasing as a transition fuel; IEA reported notable consumption growth. |

| Real Estate Developers & Institutional Investors | Collaborative development opportunities; stable income and capital appreciation from prime real estate. | U.S. commercial real estate saw stabilizing office vacancies in well-located assets. |

| Power Utilities & Grid Operators | Reliable transmission, flexible power capacity, energy storage for grid stability. | ERCOT managing significant renewable growth, necessitating grid modernization and storage. |

| Sophisticated Investors (Institutional, Family Offices, HNWIs) | Alternative investments (private equity, hedge funds) for diversification and capital appreciation. | Growing interest in alternative assets; global PE AUM projected to reach $13.5 trillion by 2027. |

Cost Structure

Hunt Oil's exploration and production costs are a major component of their business model, encompassing everything from initial geological surveys to keeping wells operational. These expenses are significant because finding and extracting oil and gas is a capital-heavy endeavor, whether it's traditional drilling or more complex unconventional methods.

In 2024, the global upstream oil and gas sector continued to see substantial investment. For instance, major oil companies reported billions in capital expenditures for exploration and development, reflecting the high costs associated with seismic imaging, exploratory drilling, and the physical infrastructure needed to bring reserves online.

Hunt Oil's infrastructure development and maintenance costs are significant. These include the substantial capital outlay for constructing and engineering large-scale projects like LNG liquefaction plants and extensive pipeline networks, essential for their global operations.

Ongoing operational upkeep and stringent regulatory compliance for these complex facilities represent a continuous drain on resources. For instance, major energy infrastructure projects often see capital expenditures in the billions, with maintenance budgets representing a notable percentage of that annually.

Real estate acquisition and development expenses are a significant cost for Hunt Consolidated, encompassing land purchases, construction outlays for both residential and commercial projects, and the associated project management fees. These costs directly correlate with the size and intricacy of their urban and master-planned communities.

In 2024, the commercial real estate sector saw substantial investment, with global transaction volumes reaching hundreds of billions of dollars, reflecting the scale of development projects like those Hunt undertakes. Marketing expenses are also crucial, particularly for large-scale residential developments aiming to attract diverse buyers.

Personnel and Operational Overhead

Hunt Consolidated, as a global entity, dedicates substantial resources to its personnel and operational overhead. This encompasses competitive salaries, comprehensive benefits packages, and the essential administrative functions that keep its diverse business units running smoothly. For instance, in 2024, energy sector labor costs, a significant component for Hunt Oil, saw continued upward pressure due to high demand for skilled engineers and geoscientists.

The company’s overhead includes costs for specialized technical expertise, crucial for its exploration and production activities, alongside management and support teams. These personnel are the backbone of Hunt's operations, ensuring efficiency and innovation across its portfolio.

- Salaries and Wages: Covering a global workforce of technical, managerial, and support staff.

- Employee Benefits: Including healthcare, retirement plans, and other compensation.

- Administrative Costs: Expenses for HR, finance, legal, and IT departments.

- General Corporate Overhead: Costs associated with maintaining corporate offices and infrastructure worldwide.

Regulatory Compliance and Environmental Stewardship

Hunt Consolidated and Hunt Oil navigate the complexities of operating in heavily regulated sectors, particularly oil and gas, which necessitates significant financial outlays for environmental compliance and safety. These costs are fundamental to their business model, ensuring operations meet stringent global standards.

Key expenditures in this area include obtaining necessary permits, conducting thorough environmental impact assessments before and during projects, and implementing robust safety protocols. Furthermore, the company invests in sustainable practices across its international operations, reflecting a commitment to responsible resource management.

- Permit Acquisition: Costs associated with securing exploration, drilling, and operational permits from various governmental bodies.

- Environmental Monitoring and Remediation: Expenses for ongoing environmental assessments, pollution control technologies, and potential site remediation efforts.

- Safety Training and Equipment: Investment in comprehensive safety programs, personal protective equipment, and advanced safety systems to prevent accidents.

- Regulatory Reporting and Legal Fees: Costs incurred for compliance reporting, audits, and legal counsel to ensure adherence to evolving regulations.

Hunt Oil's cost structure is heavily influenced by capital-intensive exploration and production activities, including seismic surveys and drilling, which are essential for resource discovery and extraction. Infrastructure development, such as LNG plants and pipelines, also represents a significant outlay, with ongoing maintenance and regulatory compliance adding to operational expenses.

Personnel costs, including competitive salaries and benefits for a global workforce of skilled technical and managerial staff, are a substantial component. Additionally, significant investments are made in environmental compliance, safety training, and obtaining permits to meet stringent international regulations, reflecting the high cost of responsible operations.

| Cost Category | Description | 2024 Relevance/Example |

| Exploration & Production | Geological surveys, seismic imaging, exploratory drilling, well completion. | Global upstream CAPEX in 2024 reached hundreds of billions, reflecting high discovery costs. |

| Infrastructure Development & Maintenance | Construction of LNG plants, pipelines, ongoing upkeep, safety systems. | Major energy projects often exceed billions in initial outlay, with significant annual maintenance budgets. |

| Personnel Costs | Salaries, benefits, training for technical, managerial, and support staff. | Energy sector labor costs in 2024 saw upward pressure due to demand for skilled professionals. |

| Regulatory & Environmental Compliance | Permits, environmental impact assessments, safety protocols, remediation. | Companies invest heavily in sustainable practices and robust safety systems to meet global standards. |

Revenue Streams

Hunt Oil Company's core revenue is derived from selling crude oil and natural gas. This income depends heavily on fluctuating global commodity prices and the sheer volume of resources they extract worldwide. For instance, in 2024, the average Brent crude oil price hovered around $83 per barrel, a significant factor influencing Hunt's top-line earnings.

Hunt Consolidated's revenue from Liquefied Natural Gas (LNG) sales is primarily generated by liquefying natural gas and selling it to international buyers, often through long-term agreements where buyers commit to purchasing a certain volume or paying a fee. This stream is a cornerstone of their business, leveraging the growing global appetite for cleaner energy sources.

Key projects like PERU LNG and Yemen LNG have been significant contributors to this revenue. For instance, PERU LNG, a joint venture, has a liquefaction capacity of 4.45 million tonnes per annum and has been a consistent exporter to markets like Mexico and South Korea. While specific recent revenue figures for these individual projects are not publicly detailed by Hunt Consolidated in isolation, the broader LNG market saw significant activity in 2024, with global LNG trade volumes reaching new highs, driven by energy security concerns and demand for natural gas as a transition fuel.

Hunt Realty Investments, a key component of Hunt Consolidated's operations, generates significant revenue through the sale of both residential and commercial properties it develops. This direct sales activity is a primary driver of income, capitalizing on market demand for new housing and commercial spaces.

Beyond property sales, Hunt Realty also benefits from recurring income streams derived from leasing commercial spaces within its portfolio. This includes office buildings, retail centers, and industrial properties, providing a stable revenue base. Property management services further contribute to this revenue, generating fees for overseeing and maintaining these assets.

The success of these real estate revenue streams is intrinsically linked to broader real estate market conditions. Factors such as interest rates, economic growth, and local demand significantly influence property values and leasing activity. For instance, in 2024, reports indicated a stabilization in commercial real estate leasing markets in many major U.S. cities, though vacancy rates remained a consideration for portfolio occupancy.

Electricity Sales and Transmission Fees

Hunt Consolidated, through its power generation and utility operations, generates revenue primarily from the sale of electricity. This revenue stream is bolstered by fees associated with transmitting that electricity across its regulated utility infrastructure. For instance, in 2024, Hunt Energy Network, a subsidiary, continues to play a role in the Electric Reliability Council of Texas (ERCOT) market, participating in energy and ancillary services markets.

The company benefits from revenue generated by its dispatchable power resources, ensuring a consistent supply of electricity. This reliability is a key factor in its market participation and revenue generation. Hunt’s strategy often involves developing and operating power plants that can respond quickly to grid needs, capturing value in dynamic energy markets.

- Electricity Sales: Revenue derived from selling generated power to wholesale and retail customers.

- Transmission Fees: Income earned for utilizing its regulated utility infrastructure to transmit electricity.

- Energy Market Participation: Revenue from participating in markets like ERCOT, including ancillary services and capacity payments.

- Dispatchable Power: Income associated with providing reliable, on-demand power generation.

Investment Returns and Capital Gains

Hunt Consolidated's investment portfolio, managed by Hunt Investment Group, is a significant revenue driver. This diversified approach generates income through various channels, including dividends from public equities, interest from fixed-income holdings, and capital appreciation from its private equity and hedge fund investments.

These investment returns contribute to the company's overall financial stability and provide a buffer against fluctuations in its core energy operations. For instance, in 2024, Hunt Investment Group's private equity arm likely saw continued activity, with potential exits or new investments contributing to capital gains, though specific figures for Hunt Consolidated's private holdings are not publicly disclosed.

- Investment Returns: Income generated from dividends, interest, and other yields on financial assets.

- Capital Gains: Profits realized from selling assets like stocks, bonds, or private equity stakes for more than their purchase price.

- Diversification Benefit: Reduces reliance on any single market or asset class, smoothing overall financial performance.

- Private Equity & Hedge Funds: Key areas for generating potentially higher, albeit riskier, returns.

Hunt Consolidated's diverse revenue streams are anchored by its energy sector, encompassing crude oil and natural gas sales, where global commodity prices, like Brent crude averaging around $83 per barrel in 2024, directly impact earnings. The company also generates substantial income from its Liquefied Natural Gas (LNG) operations, capitalizing on the growing international demand for cleaner energy, with projects like PERU LNG contributing significantly to its export volumes.

The real estate segment, managed by Hunt Realty Investments, derives revenue from both direct property sales and recurring income through leasing commercial spaces, supported by property management fees. Furthermore, Hunt Consolidated's power generation and utility operations generate revenue from electricity sales and transmission fees, with subsidiaries actively participating in energy markets like ERCOT in 2024.

Finally, Hunt Investment Group's diversified portfolio provides income through dividends, interest, and capital appreciation from private equity and hedge fund investments, offering a crucial layer of financial stability and growth potential.

| Revenue Stream | Primary Income Source | Key Drivers | 2024 Context/Example |

| Oil & Natural Gas Sales | Sale of extracted hydrocarbons | Global commodity prices, extraction volumes | Brent crude averaged ~$83/barrel |

| Liquefied Natural Gas (LNG) | Sale of processed natural gas to international buyers | Global energy demand, long-term contracts | Global LNG trade volumes hit record highs |

| Real Estate Sales | Direct sale of residential and commercial properties | Market demand, economic conditions | Stabilization in U.S. commercial leasing |

| Real Estate Leasing & Management | Rental income from commercial properties, management fees | Occupancy rates, property values | Recurring income from office, retail, industrial spaces |

| Power Generation & Utilities | Sale of electricity, transmission fees | Electricity demand, regulated utility infrastructure | Participation in ERCOT energy markets |

| Investment Portfolio | Dividends, interest, capital gains | Market performance, asset allocation | Activity in private equity and hedge funds |

Business Model Canvas Data Sources

The Hunt Consolidated/Hunt Oil Business Model Canvas is informed by a robust blend of financial disclosures, market intelligence reports, and internal operational data. This multifaceted approach ensures a comprehensive understanding of the company's strategic landscape.