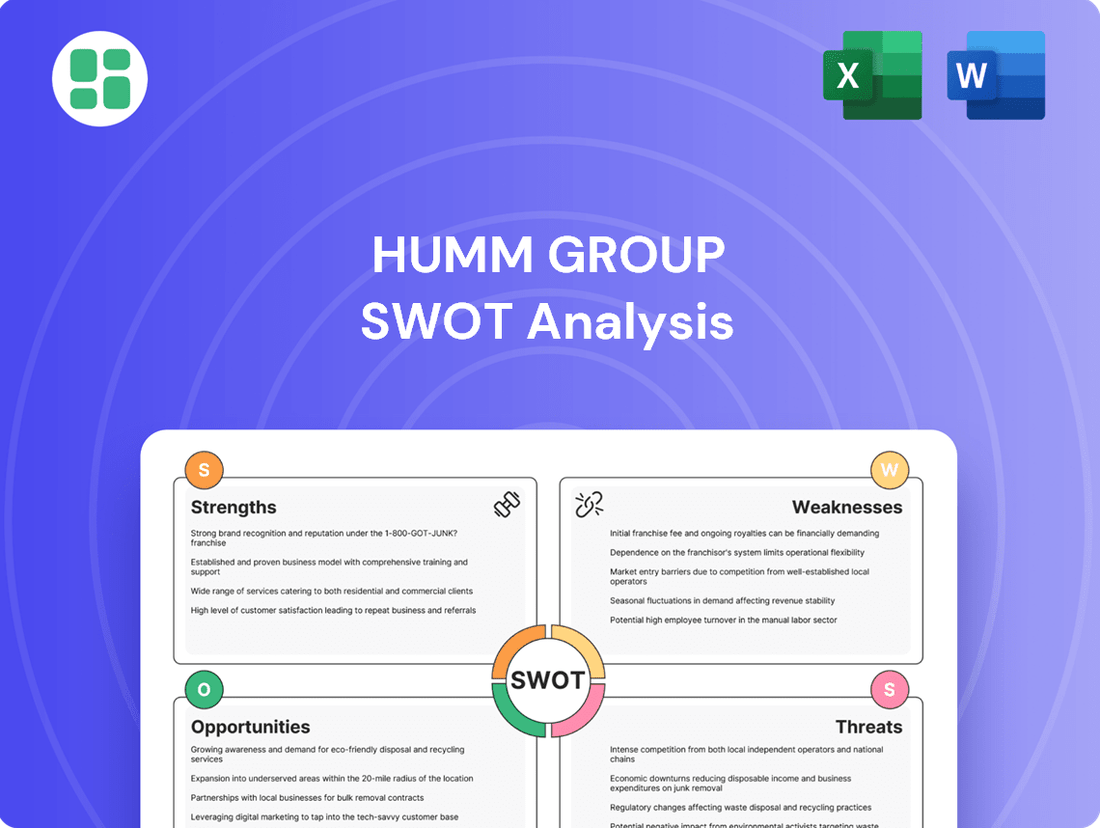

Humm Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Humm Group's market position is shaped by its innovative payment solutions, but also faces challenges from intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within the fintech sector.

Want the full story behind Humm Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Humm Group boasts a diversified product portfolio, encompassing Buy Now, Pay Later (BNPL) services, point-of-sale finance for substantial purchases, and tailored business financing. This breadth across consumer and commercial sectors mitigates risk by lessening dependence on any single revenue stream.

Humm Group's commercial finance arm, flexicommercial, is a standout performer, with receivables experiencing substantial growth. This segment is a key driver of the company's financial health, underscoring robust business-to-business relationships and effective credit risk management.

In the first half of FY24, flexicommercial’s receivables reached $1.09 billion, a notable increase from the previous year. This strong performance highlights the division's significant contribution to Humm's overall profitability and balance sheet strength.

The strategic partnership with MA Financial for a forward flow program is a critical enabler, bolstering flexicommercial's funding capacity. This arrangement allows Humm to expand its lending activities without taking on direct credit loss exposure, a testament to its innovative approach to capital management.

Humm Group has demonstrated a robust financial turnaround, with its cash profit surging by 118% to AUD 69.1 million for the fiscal year ending September 30, 2023. This impressive growth was underpinned by a strategic focus on cost management, leading to a 10% reduction in operating expenses compared to the prior year.

The company's commitment to operational efficiencies has directly translated into improved profitability, evidenced by a stable net interest margin of 8.6% in the same period. These financial enhancements highlight Humm Group's successful strategy in navigating market conditions and optimizing its cost base.

Established Market Presence and Brand Recognition

Humm Group boasts a significant market presence and robust brand recognition, primarily within Australia and New Zealand. This is notably evident through its popular Q Card and Farmers Finance Card offerings in New Zealand, solidifying its position as a trusted financial provider.

The company has carved out a leadership role in the Buy Now, Pay Later (BNPL) sector, especially for larger transaction values. Furthermore, Humm Group is a leading issuer of new credit cards in New Zealand, demonstrating its broad reach and customer engagement in the credit market.

This established market position translates into a distinct competitive advantage. It fosters customer loyalty and provides a strong foundation for continued growth and market penetration.

- Market Leadership: Humm Group is a market leader in BNPL for larger transactions, indicating strong consumer adoption for higher-value purchases.

- Brand Recognition: Strong brand recognition, particularly with its Q Card and Farmers Finance Card in New Zealand, drives customer trust and repeat business.

- Credit Card Issuance: As a leading issuer of new credit cards in New Zealand, Humm Group captures a significant share of the credit market.

- Geographic Focus: Operating primarily in Australia and New Zealand, Humm Group has deep penetration in these key markets.

Strategic Investment in Technology and Product Innovation

Humm Group's strategic investment in technology is a significant strength. The company is actively upgrading its IT infrastructure, notably by migrating to cloud-hosted services and establishing a modern data platform. This modernization is crucial for enhancing operational efficiency and data analytics capabilities.

The launch of a new regulated hybrid loan product in Australia further bolsters Humm Group's market position. This innovative product is designed to broaden the range of services offered to merchants and improve key return metrics, demonstrating a commitment to product development and customer value.

- IT Modernization: Humm Group is investing in cloud migration and a new data platform to improve technology infrastructure.

- Product Innovation: The introduction of a new regulated hybrid loan product in Australia is set to expand merchant offerings.

- Enhanced Competitiveness: These technological and product advancements are aimed at improving customer experience and Humm Group's standing in the market.

Humm Group's diversified product suite, including BNPL, point-of-sale finance, and business financing, reduces reliance on any single revenue stream. Its commercial finance arm, flexicommercial, is a key growth driver, with receivables reaching $1.09 billion in H1 FY24, up from the prior year.

The company has solidified its market leadership in BNPL for larger transactions and benefits from strong brand recognition, particularly with its Q Card and Farmers Finance Card in New Zealand. As a leading credit card issuer in New Zealand, Humm Group effectively captures a significant portion of the credit market.

Humm Group's strategic investment in technology, including cloud migration and a new data platform, enhances operational efficiency and data analytics. The launch of a new regulated hybrid loan product in Australia further strengthens its market position by expanding merchant offerings and improving key return metrics.

| Metric | FY23 (AUD) | H1 FY24 (AUD) |

|---|---|---|

| flexicommercial Receivables | $1.0 billion (approx.) | $1.09 billion |

| Cash Profit | $69.1 million | N/A |

| Operating Expenses Reduction | 10% | N/A |

What is included in the product

Delivers a strategic overview of Humm Group’s internal and external business factors, highlighting its strengths in BNPL, weaknesses in profitability, opportunities in international expansion, and threats from increased competition and regulation.

Streamlines Humm Group's strategy by clearly identifying competitive advantages and areas for improvement, enabling targeted action for growth.

Weaknesses

Humm Group's consumer segment remains heavily influenced by the Buy Now, Pay Later (BNPL) market. This sector is dynamic, facing shifts in consumer behavior and fierce competition, which can impact Humm's performance.

While BNPL continues to expand, its growth is sensitive to economic downturns that curb consumer discretionary spending. For example, in the first half of 2024, some BNPL providers reported slower transaction growth compared to previous periods due to inflationary pressures.

This dependence exposes Humm Group to specific market volatilities within the BNPL industry, potentially affecting revenue streams and profitability if these trends persist.

Humm Group has openly discussed difficulties stemming from its older technology infrastructure, especially within its consumer finance operations. These legacy systems can slow down innovation, limit service enhancements, and negatively affect the customer and merchant experience.

This technological debt poses a significant hurdle to Humm Group's agility, potentially impeding its capacity to respond swiftly to market shifts or introduce new, competitive products. For instance, in the first half of FY24, the company continued its focus on platform modernization, indicating ongoing investment and effort to overcome these limitations.

Humm Group, like other players in the Buy Now Pay Later (BNPL) sector, faces heightened regulatory scrutiny. In Australia and New Zealand, new rules are set to take effect in 2025, reclassifying BNPL agreements as consumer credit.

This shift mandates compliance with stringent certification, disclosure, and lender responsibility obligations. Such regulatory adherence is likely to introduce increased operational costs and complexity for Humm Group, potentially impacting its profitability and growth trajectory.

Competitive Pressure in Consumer Finance

The consumer finance and Buy Now, Pay Later (BNPL) landscape is intensely crowded. Humm Group faces formidable competition from established giants like Afterpay, Zip, and Klarna, alongside a growing influx of traditional financial institutions. This fierce rivalry directly impacts Humm Group's ability to maintain and grow its market share and can squeeze profit margins within its consumer-focused divisions.

To stay relevant and competitive, Humm Group must consistently invest in its product offerings and demonstrate strategic flexibility. This ongoing need for innovation and adaptation represents a significant challenge. For instance, in the 2024 fiscal year, the BNPL sector saw continued aggressive marketing and product development from major players, necessitating substantial expenditure from all participants to retain customer engagement and attract new users.

- Intense competition from established BNPL providers and traditional banks.

- Pressure on market share and profit margins due to aggressive competitor strategies.

- Requirement for continuous investment in product development and marketing to remain competitive.

Potential Impact of Divestment Proposals

Recent non-binding offers to purchase Humm Group's buy-now-pay-later (BNPL) business, like the one from The Abercrombie Group, inject significant uncertainty into the company's future. This potential divestment could reshape Humm Group's operational landscape and strategic path, creating a period of instability.

While these proposals might offer a route to unlocking shareholder value, they simultaneously present challenges. The distraction for management, the potential for operational disruption, and the uncertainty surrounding future strategic decisions are key weaknesses stemming from these divestment discussions.

For instance, the ongoing evaluation of such proposals can divert crucial management attention away from core business operations and innovation, potentially impacting Humm Group's competitive positioning. The financial implications of a sale, including the valuation achieved and the subsequent use of proceeds, remain key variables.

- Uncertainty: Non-binding offers create ambiguity about Humm Group's future business model and strategic direction.

- Management Distraction: Evaluating divestment proposals can divert focus from ongoing business operations and growth initiatives.

- Operational Instability: The process of potential sale or restructuring can lead to internal and external operational disruptions.

- Valuation Risk: The ultimate sale price and the perceived value unlocked for shareholders remain uncertain until a definitive agreement is reached.

Humm Group faces significant headwinds due to its reliance on the volatile Buy Now, Pay Later (BNPL) market, which is susceptible to economic downturns and evolving consumer spending habits. For example, inflationary pressures in early 2024 impacted transaction growth for some BNPL providers, a trend Humm Group is also navigating.

The company's older technology infrastructure presents a notable weakness, hindering innovation and potentially impacting customer and merchant experiences. Humm Group's continued focus on platform modernization in the first half of FY24 underscores the ongoing challenges associated with legacy systems.

Heightened regulatory scrutiny is a growing concern, with new rules in Australia and New Zealand set to reclassify BNPL as consumer credit from 2025. This will necessitate increased compliance, potentially raising operational costs and complexity for Humm Group.

Intense competition within the BNPL sector, from both established players like Afterpay and Zip, and traditional financial institutions, puts pressure on Humm Group's market share and profit margins. The need for continuous investment in product development and marketing to remain competitive is a significant ongoing cost.

The ongoing evaluation of non-binding offers for Humm Group's BNPL business introduces considerable uncertainty regarding its future strategic direction and operational stability. This process can also divert crucial management attention from core business activities.

Same Document Delivered

Humm Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Humm Group's planned launch of a regulated hybrid loan product in Australia during fiscal year 2025 is a key strategic opportunity. This initiative aims to broaden its tailored merchant-specific offerings, creating new avenues for growth and enhancing profitability, particularly for higher-value transactions.

This expansion into regulated point-of-sale finance is well-timed, capitalizing on increasing consumer demand for flexible and compliant financing solutions at the point of purchase. The product is specifically designed to improve return metrics, indicating a focus on sustainable and profitable growth within this segment.

Humm Group's commercial finance sector is a powerhouse for growth, demonstrating substantial increases in receivables. This expansion is particularly notable in key areas such as agriculture and the medical industry, indicating strong demand and market penetration.

The innovative forward flow funding model, established in partnership with MA Financial, is a critical enabler. This arrangement allows Humm Group to grow its asset base considerably without requiring direct capital outlay or taking on credit loss exposure, presenting a highly scalable and capital-efficient growth strategy.

Humm Group's strategic focus on IT modernization, including its move to cloud-hosted services and a modern data platform, presents a significant opportunity. This technological upgrade is designed to boost operational efficiency and enhance the reliability of its offerings. For instance, by mid-2024, many financial services firms are reporting substantial cost savings and improved agility through cloud adoption, with some seeing as much as a 30% reduction in infrastructure costs.

This technological uplift is crucial for improving customer experience and fostering innovation. By streamlining backend processes, Humm Group can accelerate the rollout of new products and services, a key differentiator in the competitive buy now, pay later market. Industry reports from late 2024 indicate that companies prioritizing digital transformation in customer-facing operations are experiencing higher customer satisfaction scores and increased market share.

Potential for International Market Optimization

Humm Group's strategic focus on optimizing its international presence in Canada, Ireland, and the UK presents a significant opportunity. By actively streamlining operations, such as relocating support functions in Canada to curb losses, and by carefully reviewing merchant pricing structures, the company is laying the groundwork for enhanced profitability. The UK business, in particular, is projected to reach breakeven, signaling a strong potential for growth and increased market penetration in these key international markets.

The company's efforts are already showing positive signs. For instance, in the fiscal year 2024, Humm Group reported a reduction in its Canadian segment's net loss, a testament to the effectiveness of its optimization strategies. Furthermore, projections for the UK market indicate a substantial revenue uplift in the coming fiscal year, driven by expanding merchant relationships and a more favorable economic climate for consumer credit.

- Canadian Market Optimization: Humm Group is actively working to reduce losses in Canada by relocating support operations and reassessing merchant pricing strategies.

- UK Market Trajectory: The UK business is on track to achieve breakeven, indicating a strong potential for future profitability and market share growth.

- International Profitability: Successful optimization of these international markets offers a clear path to improved overall financial performance and expanded global reach.

Strategic Partnerships and Acquisitions

Humm Group's diversified funding platform, bolstered by relationships with local and global banks and investment managers, presents a strong opportunity for strategic alliances. In 2024, Humm Group continued to leverage its funding base to expand its reach, particularly in the Australian market, where it reported a significant increase in merchant partnerships.

Further collaborations or targeted acquisitions, especially in under-served sectors or regions, could significantly speed up growth and market penetration. The company's expressed interest in acquiring a Buy Now Pay Later (BNPL) platform in 2024 underscores this strategic direction, aiming to consolidate market share and enhance its product offering.

- Diversified Funding: Humm Group's access to a broad range of funding sources from local and international financial institutions provides stability and capacity for growth initiatives.

- Market Expansion: Strategic partnerships can unlock new customer segments and geographical markets, as seen in their ongoing expansion efforts in Australia.

- Acquisition Potential: The exploration of BNPL platform acquisitions in 2024 indicates a proactive approach to consolidating market position and acquiring new capabilities.

- Synergistic Growth: Collaborations can lead to the development of innovative financial products and services, leveraging the strengths of both Humm Group and its partners.

Humm Group's strategic focus on launching a regulated hybrid loan product in Australia during fiscal year 2025 is a significant opportunity to expand its merchant-specific offerings and boost profitability, particularly for higher-value transactions. This move capitalizes on growing consumer demand for flexible, compliant point-of-sale financing solutions, with the product designed to enhance return metrics.

The company's commercial finance sector is experiencing robust growth, with notable increases in receivables across agriculture and medical industries, demonstrating strong market demand. This expansion is supported by an innovative forward flow funding model with MA Financial, allowing Humm Group to scale its asset base efficiently without direct capital outlay or credit loss exposure.

Technological modernization, including a move to cloud-hosted services and a modern data platform, is set to improve operational efficiency and service reliability. This digital transformation is expected to enhance customer experience and accelerate new product rollouts, a key competitive advantage in the BNPL market. By mid-2024, many financial services firms adopting cloud solutions reported cost savings of up to 30%.

Optimizing international operations in Canada, Ireland, and the UK presents a clear path to improved financial performance. Efforts to streamline Canadian operations and a projected breakeven for the UK business highlight the potential for enhanced profitability and expanded global reach. In fiscal year 2024, Humm Group successfully reduced its Canadian segment's net loss, with UK revenue projected for a substantial uplift.

| Opportunity Area | Key Actions/Developments | Financial/Market Impact |

| New Product Launch (Australia) | Regulated hybrid loan product (FY25) | Broadens tailored merchant offerings, enhances profitability for higher-value transactions. |

| Commercial Finance Growth | Increased receivables in agriculture & medical sectors | Demonstrates strong demand and market penetration. |

| Forward Flow Funding | Partnership with MA Financial | Scalable, capital-efficient growth; asset base expansion without credit loss exposure. |

| IT Modernization | Cloud-hosted services, modern data platform | Boosts operational efficiency, improves customer experience, accelerates new product launches. |

| International Market Optimization | Streamlining Canada, UK breakeven target | Improves overall financial performance, expands global reach. |

Threats

The Buy Now, Pay Later (BNPL) sector is facing increasing regulatory scrutiny in Australia and New Zealand, with contracts now being treated as consumer credit. This shift means companies like Humm Group must adhere to stricter rules regarding certification, disclosure, and consumer responsibility.

Compliance with these new regulations could lead to higher operational costs for Humm Group. Furthermore, it might restrict the flexibility of their product offerings and alter the competitive dynamics within the BNPL market, potentially impacting Humm's market share and profitability.

Persistent economic challenges, such as elevated interest rates and ongoing inflation, pose a significant threat by dampening consumer spending and heightening the risk of loan defaults. While Humm Group has historically maintained low credit losses, a prolonged economic downturn could strain asset quality and profitability, especially for its interest-bearing products and higher-value loans.

Humm Group faces intense rivalry from established buy-now-pay-later (BNPL) giants such as Afterpay and Zip, alongside global players like Klarna. These larger competitors often possess superior financial backing, enabling more aggressive marketing campaigns, advanced technological investments, and broader merchant networks. This can put significant pressure on Humm Group's market share and its ability to negotiate favorable terms.

The increasing involvement of traditional financial institutions and major payment processors, like Visa and Mastercard, further intensifies this competitive landscape. These established entities can leverage their existing customer bases and infrastructure to offer BNPL solutions, potentially diluting Humm Group's unique value proposition. For instance, in 2024, BNPL transaction volumes are projected to continue their upward trajectory, with global spending expected to reach over $3.6 trillion by 2030, highlighting the scale of the market and the resources needed to compete effectively.

Technology Disruption and Cybersecurity Risks

The financial sector, including companies like Humm Group, faces constant threats from rapidly evolving technology. Keeping up with fintech innovations is crucial. For instance, the global fintech market was valued at approximately USD 11.2 trillion in 2023 and is projected to grow significantly, indicating the pace of change Humm Group must navigate.

Cybersecurity risks are also a major concern. A significant breach could severely damage Humm Group's reputation and lead to substantial financial losses. In 2023, the average cost of a data breach globally reached USD 4.45 million, highlighting the financial impact of such events.

- Technological Obsolescence: Humm Group must continuously invest in and adapt its technology to remain competitive against nimble fintech startups and established players.

- Cybersecurity Breaches: A successful cyberattack could compromise sensitive customer data, leading to regulatory fines, loss of trust, and significant operational disruption.

- Data Privacy Regulations: Evolving data privacy laws, such as GDPR and similar frameworks, necessitate robust security measures and compliance protocols, adding to operational complexity and cost.

- Reputational Damage: Any failure in technology or security can quickly erode customer confidence, impacting Humm Group's brand image and market position.

Potential Shareholder Value Erosion from Takeover Attempts

Humm Group has faced ongoing non-binding takeover proposals, notably from Latitude Financial Services and potentially others. While these offers might present an exit for some investors, they introduce significant uncertainty and volatility into the company's share price. For instance, during periods of takeover speculation in early 2024, Humm's stock experienced fluctuations as the market assessed the likelihood and terms of any potential deal.

A protracted takeover process or a bid perceived as undervaluing the company could severely damage shareholder confidence. This uncertainty can distract management, hindering strategic execution and operational focus. If Humm Group were to accept a low-value offer, it would represent a tangible erosion of shareholder value, impacting the company's long-term prospects and investor sentiment.

- Takeover Uncertainty: Ongoing non-binding proposals from entities like Latitude Financial Services create share price volatility.

- Valuation Risk: A low-valuation takeover bid could lead to significant shareholder value erosion.

- Operational Distraction: Protracted negotiations can divert management focus from core business operations.

- Investor Confidence: Uncertainty surrounding potential acquisitions can negatively impact investor sentiment and trust.

Humm Group faces significant threats from escalating regulatory changes, especially in Australia and New Zealand, where BNPL is increasingly treated as consumer credit. This necessitates stricter compliance, potentially increasing costs and limiting product flexibility. Economic headwinds, including high interest rates and inflation, also pose a risk by reducing consumer spending and increasing default probabilities, impacting asset quality.

Intense competition from established BNPL players like Afterpay and Zip, along with global giants and traditional financial institutions entering the market, threatens Humm's market share. The global BNPL market is projected for substantial growth, with spending expected to exceed $3.6 trillion by 2030, underscoring the need for significant investment to remain competitive.

Technological advancements and cybersecurity risks are persistent threats. The global fintech market's rapid expansion, valued at approximately USD 11.2 trillion in 2023, demands continuous innovation. A data breach, with global average costs reaching USD 4.45 million in 2023, could severely damage Humm's reputation and finances.

Ongoing takeover proposals create significant uncertainty and volatility for Humm Group's stock. Such speculation can distract management and lead to a potential undervaluation of the company, eroding shareholder value and impacting long-term strategic execution.

SWOT Analysis Data Sources

This Humm Group SWOT analysis is built upon a foundation of credible data, including Humm Group's official financial statements, comprehensive market research reports, and expert commentary from industry analysts to ensure a thorough and accurate assessment.