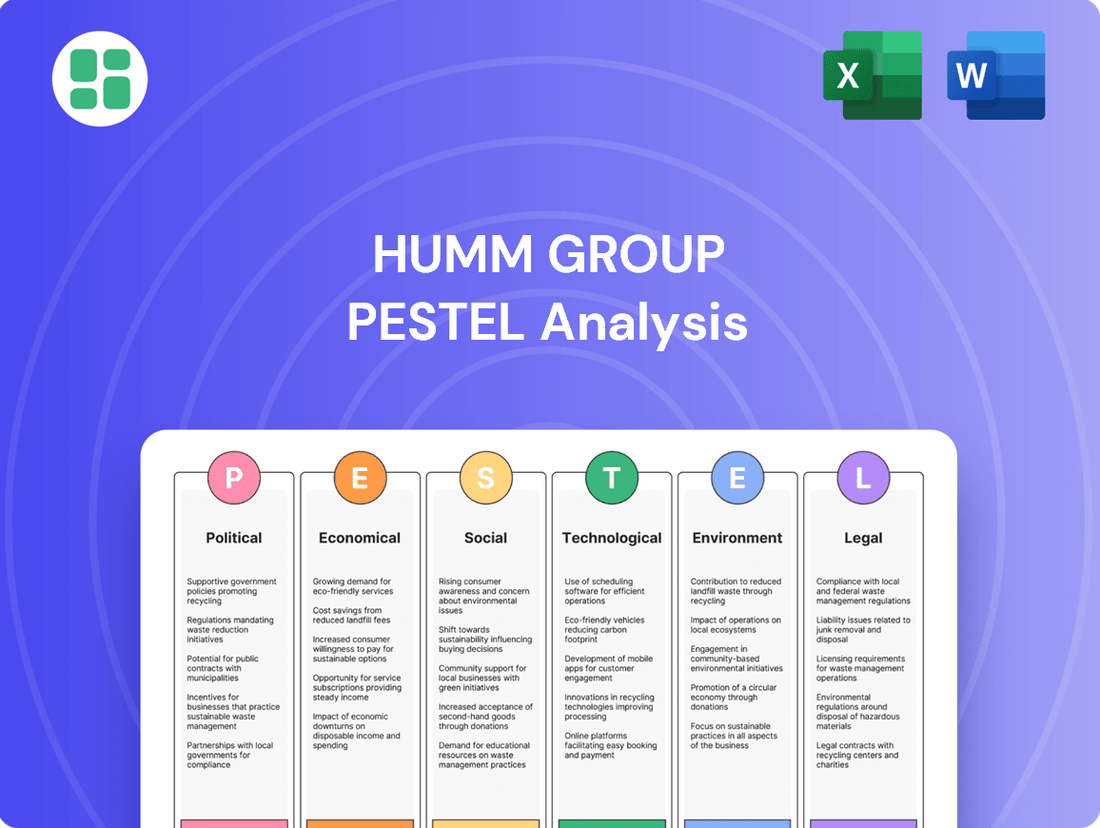

Humm Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Humm Group Bundle

Navigate the complex external forces shaping Humm Group's trajectory with our meticulously crafted PESTLE analysis. Uncover critical political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Equip yourself with actionable intelligence to refine your strategy and gain a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

Governments in Australia and New Zealand are tightening their grip on the Buy Now, Pay Later (BNPL) industry, signaling a shift towards treating these services more like traditional credit providers. This increased regulatory focus is a significant political factor impacting companies like Humm Group.

In Australia, a new legislative framework effective from June 2025 mandates that BNPL providers must obtain an Australian Credit Licence. This means they will need to adhere to the same stringent requirements as established banks and lenders under the existing credit act, a substantial change from previous lighter regulations.

Similarly, New Zealand introduced its own BNPL regulations in September 2024. These rules are designed to bolster consumer protection and demand greater transparency from BNPL operators, reflecting a broader regional trend towards safeguarding consumers engaging with these payment methods.

Government bodies, including the Reserve Bank of Australia, are actively promoting digital payment infrastructure. Initiatives like the New Payments Platform (NPP) and the upcoming PayTo service are designed to create a more efficient and accessible digital payment ecosystem, directly benefiting companies like Humm Group by encouraging the use of digital financial services.

The Australian economy is increasingly moving away from cash transactions, a trend accelerated by technological advancements. This shift is evidenced by the declining use of physical currency; for instance, cash transactions accounted for only 13% of all payments in Australia in 2022, down from 30% in 2019, highlighting a strong consumer preference for digital alternatives that Humm Group can leverage.

Consumer protection laws are increasingly shaping the Buy Now, Pay Later (BNPL) landscape, directly affecting companies like Humm Group. Regulators are scrutinizing affordability assessments and dispute resolution mechanisms to safeguard consumers from excessive debt. For instance, proposed changes in Australia, such as mandating partial credit checks instead of relying solely on self-declared income, aim to foster more responsible lending practices.

Economic Stimulus and Monetary Policy

Central banks in Australia and New Zealand are anticipated to lower interest rates in 2025, a move aimed at boosting private sector spending and fostering economic recovery. This potential reduction in borrowing costs could directly benefit Humm Group by decreasing its own funding expenses.

Furthermore, lower interest rates often encourage consumers to utilize installment payment options, which is a core offering for Humm Group. This could lead to increased uptake of their services as financing becomes more accessible and attractive to a wider customer base.

However, the economic outlook suggests only moderate growth, with a delicate balance between maintaining stable inflation and achieving higher potential growth. This environment means the positive impact of rate cuts might be tempered by broader economic constraints.

- Interest Rate Outlook: Expected rate cuts by RBA and RBNZ in 2025.

- Funding Cost Impact: Potential reduction in Humm Group's borrowing expenses.

- Consumer Behavior: Increased likelihood of consumers opting for installment plans.

- Economic Context: Moderate growth forecast with stable inflation and low potential growth.

Cross-Border Regulatory Alignment

While Humm Group's core operations are in Australia and New Zealand, a significant global trend towards harmonizing financial services regulations is underway. This could simplify Humm's potential expansion into new international markets by creating more uniform compliance requirements. For instance, initiatives like the Financial Stability Board's work on cross-border regulatory cooperation aim to reduce friction for financial institutions operating globally.

This alignment could also mean Humm Group might need to adapt its existing practices to meet emerging, broader global standards, even within its current operating regions. The company's established presence in regulated financial sectors provides a strong foundation for navigating these evolving international frameworks, potentially allowing it to leverage its experience in one jurisdiction to more easily comply with similar regulations elsewhere.

- Global Regulatory Harmonization: Efforts by bodies like the OECD and IOSCO are pushing for greater consistency in financial regulations worldwide.

- Impact on Expansion: Aligned regulations could lower barriers for Humm Group's future international growth.

- Adaptation Needs: Humm may need to adjust current operations to meet evolving global compliance benchmarks.

- Competitive Advantage: Humm's experience in regulated markets positions it to adapt effectively to these changes.

Governments in Australia and New Zealand are increasing oversight of the Buy Now, Pay Later (BNPL) sector, treating it more like traditional credit. This regulatory shift, with Australia implementing an Australian Credit Licence requirement from June 2025 and New Zealand introducing its own consumer protection rules in September 2024, directly impacts Humm Group's operational landscape.

The push for enhanced consumer protection is a key political driver, with regulators focusing on affordability checks and dispute resolution. For example, Australia is considering mandating partial credit checks, moving away from reliance solely on self-declared income to promote responsible lending.

Initiatives supporting digital payments, such as Australia's New Payments Platform and PayTo, are politically favored, encouraging digital financial service adoption. This aligns with the declining use of cash in Australia, which fell to 13% of all payments in 2022 from 30% in 2019, benefiting companies like Humm Group.

Global efforts to harmonize financial regulations, supported by bodies like the Financial Stability Board, could simplify Humm Group's international expansion. However, this also necessitates adapting current practices to meet evolving global compliance standards.

| Regulatory Change | Jurisdiction | Effective Date | Impact on BNPL Providers |

|---|---|---|---|

| Mandatory Australian Credit Licence | Australia | June 2025 | Adherence to stringent credit lending requirements |

| Consumer Protection Regulations | New Zealand | September 2024 | Increased transparency and consumer safeguards |

| Focus on Affordability Checks | Australia | Ongoing (proposed changes) | Potential shift to partial credit checks |

| Digital Payment Infrastructure Support | Australia | Ongoing | Encouragement of digital financial services |

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Humm Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a comprehensive understanding of how these elements create both challenges and strategic advantages for Humm Group's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling the Humm Group's PESTLE analysis into actionable insights.

Economic factors

Anticipated interest rate cuts by the Reserve Bank of Australia and New Zealand in 2025 could significantly benefit Humm Group by reducing its cost of capital. This easing of monetary policy is expected to translate into lower funding expenses, a crucial factor for a company operating in the buy-now-pay-later and consumer finance sectors.

Humm Group has demonstrated resilience in the recent high-interest rate environment, maintaining a stable net interest margin. This stability is partly attributed to its diversified funding platform, which allows access to capital across various market conditions, a key advantage in navigating economic uncertainties.

Consumer credit demand in Australia presented a nuanced picture in early 2024, with a notable decrease in Buy Now Pay Later (BNPL) applications contrasting with an uptick in credit card applications. This suggests some consumers are experiencing financial pressures, potentially shifting their borrowing preferences.

Despite these fluctuations, the broader Australian consumer credit market demonstrated resilience, expanding to reach an impressive AUD 2406.01 billion by June 2025. This sustained growth underscores the ongoing importance of accessible credit for households.

Humm Group's core offering of flexible finance solutions remains highly pertinent in this evolving landscape. Adapting to shifting consumer borrowing behaviors is key for Humm Group to maintain its market position and cater to diverse financial needs.

Persistent inflation in Australia and New Zealand is squeezing household budgets, with the Australian Bureau of Statistics reporting a 3.6% annual increase in the Consumer Price Index (CPI) for the year ending March 2024. This rising cost of living directly impacts disposable incomes, making it harder for consumers to manage everyday expenses.

This economic climate can actually boost demand for Buy Now, Pay Later (BNPL) services like those offered by Humm Group, especially among younger consumers who often prioritize flexible payment options to manage their cash flow. For instance, BNPL usage in Australia saw significant growth, with transaction volumes increasing by an estimated 15% in 2023.

However, this increased reliance on BNPL also introduces a notable risk for Humm Group. As consumers face mounting financial pressures, the likelihood of them struggling to meet their repayment obligations rises, potentially leading to higher credit losses for the company. This is a critical factor to monitor in their risk management strategies.

BNPL Market Growth and Competition

The global Buy Now, Pay Later (BNPL) market is experiencing robust expansion, with projections indicating it will reach an impressive $560.1 billion by 2025. Australia, in particular, has seen substantial uptake of these payment solutions.

This significant market growth is naturally drawing in a higher level of competition. Notably, traditional financial institutions, such as banks, are increasingly venturing into the BNPL sector, presenting new challenges for established players like Humm Group.

To sustain its growth trajectory, Humm Group needs to focus on several key areas:

- Continued Innovation: Developing unique product features and customer experiences that set Humm apart from emerging competitors.

- Strategic Partnerships: Collaborating with merchants and other businesses to expand reach and offer integrated BNPL solutions.

- Leveraging Data: Utilizing customer data to personalize offerings and improve risk management, thereby enhancing customer loyalty and operational efficiency.

- Market Differentiation: Emphasizing Humm's established market presence and understanding of the Australian consumer landscape as a competitive advantage.

Overall Economic Growth and Stability

Australia and New Zealand are projected to experience moderate GDP growth in 2025. This growth is expected to be accompanied by stable inflation, though overall growth prospects remain somewhat subdued. This economic environment directly influences consumer spending and business investment, key drivers for Humm Group's operations.

The banking sector outlook is generally stable, but potential headwinds exist. Challenges like housing affordability and uncertainties in global trade could temper credit growth. For Humm Group, this means a potentially tighter lending environment and a need to carefully manage risk.

Humm Group's financial performance is intrinsically linked to the economic health of Australia and New Zealand. Factors influencing this include:

- GDP Growth: Forecasts suggest modest expansion for 2025, providing a baseline for consumer confidence and spending.

- Inflation: Stable inflation rates are anticipated, which generally supports predictable consumer purchasing power.

- Credit Conditions: While the banking sector is stable, potential impacts from housing affordability and global trade could influence the availability and cost of credit, affecting Humm Group's lending activities.

Economic factors significantly shape Humm Group's operating environment. Anticipated interest rate cuts in 2025 by the RBA and RBNZ could lower Humm's funding costs, directly benefiting its profitability. Despite consumer credit demand shifts, the broader Australian credit market's resilience, reaching AUD 2406.01 billion by June 2025, highlights the continued need for flexible finance solutions like those Humm provides.

| Economic Factor | Data Point (2024-2025) | Impact on Humm Group |

|---|---|---|

| Interest Rate Outlook | Anticipated cuts in 2025 | Lower funding costs, improved profitability |

| Australian Credit Market Size | AUD 2406.01 billion (June 2025 est.) | Indicates sustained demand for credit products |

| Inflation (Australia) | 3.6% annual increase (March 2024) | May increase demand for BNPL, but also credit risk |

Preview the Actual Deliverable

Humm Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Humm Group. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It's designed to provide actionable insights for stakeholders.

Sociological factors

Consumers in Australia are increasingly moving away from cash, embracing digital and contactless payment methods for their speed and ease of use. This shift is a significant sociological trend impacting how businesses operate and engage with customers.

The adoption of digital wallets is particularly notable, with projections indicating they will handle over $130 billion in transaction value in Australia by 2025. This growing reliance on digital payment infrastructure presents a clear opportunity for companies like Humm Group, which are positioned to capitalize on this evolving consumer behavior by providing accessible, digital-first payment solutions.

Younger consumers, particularly Millennials and Gen Z, are leading the charge in adopting Buy Now, Pay Later (BNPL) services. These demographics, often digital-native, appreciate the flexibility and interest-free nature of BNPL, aligning perfectly with their spending habits and financial preferences. For Humm Group, understanding and catering to these younger consumers is paramount for sustained growth and market relevance.

In 2023, data indicated that over 60% of BNPL users in major markets were under the age of 35, highlighting the significant sway of Millennials and Gen Z. Humm Group's strategy to offer accessible, tech-driven payment solutions directly taps into this trend, positioning them to capture a substantial share of this expanding market segment.

The proliferation of Buy Now, Pay Later (BNPL) services, including those offered by Humm Group, has amplified societal concerns regarding consumer financial literacy. As of early 2024, reports indicated a growing number of consumers managing multiple small BNPL accounts, raising alarms about potential debt accumulation and financial instability. This trend necessitates a strong emphasis on responsible lending and clear communication regarding repayment obligations to safeguard consumers from over-indebtedness.

Demand for Personalized Financial Services

Consumers are increasingly seeking financial services tailored to their unique needs, a trend amplified by technological progress. This demand for personalization means that generic offerings are becoming less effective, pushing companies to adopt more sophisticated approaches.

Humm Group can capitalize on this by utilizing advanced data analytics and artificial intelligence. These tools allow for the creation of highly customized payment plans and product offers, directly addressing individual customer preferences and financial situations. For instance, by analyzing spending habits and payment histories, Humm can proactively suggest flexible repayment schedules or relevant financing options, thereby fostering stronger customer relationships and loyalty.

- Personalization Driver: 70% of consumers expect companies to understand their unique needs and expectations (Salesforce, 2023).

- Data Utilization: Over 80% of financial institutions plan to increase their investment in AI and machine learning for customer service and personalization by 2025 (Deloitte, 2024).

- Loyalty Impact: Personalized experiences can increase customer loyalty by up to 80% (Epsilon, 2024).

Trust and Brand Reputation

In today's financial markets, trust is a significant currency. Humm Group's established presence and history of handling regulated financial products are crucial for fostering this trust. A positive brand reputation, built on reliable service, directly impacts customer loyalty and acquisition.

Humm Group's commitment to customer experience plays a vital role in reinforcing its brand. For instance, in 2023, customer satisfaction scores for Humm Group's buy now, pay later services in Australia and New Zealand remained a key performance indicator, with the company investing in digital tools to streamline onboarding and support.

- Customer Trust: Humm Group's long operational history and experience with regulated financial products contribute to a perception of reliability.

- Brand Reputation: A focus on customer experience, including responsive support and transparent terms, is essential for maintaining a positive brand image in the competitive fintech sector.

- Market Perception: In 2024, industry analysts noted Humm Group's efforts to differentiate itself through responsible lending practices, aiming to build long-term customer relationships rather than solely focusing on transaction volume.

Sociological factors highlight a significant shift towards digital and contactless payments in Australia, with digital wallets projected to handle over $130 billion in transaction value by 2025. Younger demographics, particularly Millennials and Gen Z, are driving the adoption of Buy Now, Pay Later (BNPL) services, with over 60% of BNPL users in major markets being under 35 in 2023. This trend, coupled with growing concerns about consumer financial literacy and potential over-indebtedness from managing multiple BNPL accounts, underscores the need for responsible lending practices and clear communication from providers like Humm Group.

| Trend | Description | Impact on Humm Group | Supporting Data |

|---|---|---|---|

| Digital Payment Adoption | Consumers increasingly favor digital and contactless payment methods. | Opportunity for Humm Group's digital-first solutions. | Digital wallets to handle over $130B in Australia by 2025. |

| Younger Consumer Preferences | Millennials and Gen Z lead BNPL adoption due to flexibility. | Focus on catering to these demographics is crucial for growth. | Over 60% of BNPL users in major markets were under 35 in 2023. |

| Financial Literacy Concerns | Societal concerns about potential over-indebtedness from multiple BNPL accounts. | Necessitates responsible lending and transparent communication. | Growing number of consumers managing multiple small BNPL accounts (early 2024). |

Technological factors

The evolution of digital payment infrastructure, particularly the rollout of Australia's New Payments Platform (NPP) and the upcoming PayTo service, is a significant technological factor for Humm Group. These advancements facilitate instant, data-rich transactions, offering Humm opportunities to embed its buy now, pay later (BNPL) services directly at the point of payment. For instance, the NPP saw a 60% increase in real-time payments in 2023, reaching over 1.7 billion transactions, highlighting the growing consumer preference for speed and convenience.

Artificial intelligence is transforming Australian financial services, enhancing customer personalization and operational efficiency. Humm Group, for instance, is heavily investing in AI, anticipating significant growth in 2025 driven by its adoption for improved credit risk assessment and customer experience.

Embedded finance, the integration of financial services into non-financial platforms, is a significant driver in the Buy Now Pay Later (BNPL) sector. This trend allows BNPL providers like Humm Group to offer their services within diverse customer journeys, such as at the point of sale for travel bookings or educational courses.

This seamless integration opens up substantial partnership opportunities across various industries, including healthcare and retail. By the end of 2024, the global embedded finance market was projected to reach $7.2 trillion, demonstrating the immense scalability of this model for companies like Humm Group.

Cybersecurity and Data Privacy

As financial services increasingly move online, strong cybersecurity is paramount for Humm Group to protect transactions and sensitive customer data. The company must consistently upgrade its security infrastructure to prevent breaches and retain client trust in the digital realm.

The escalating threat landscape necessitates significant investment. For instance, in 2024, global spending on cybersecurity is projected to reach over $200 billion, highlighting the critical nature of these expenditures for companies like Humm Group to maintain operational integrity and customer confidence.

- Data Breach Costs: The average cost of a data breach in the financial sector in 2023 was $5.90 million, underscoring the financial implications of inadequate cybersecurity for Humm Group.

- Regulatory Compliance: Increasingly stringent data privacy regulations, such as GDPR and similar frameworks globally, demand robust security protocols, impacting Humm Group's operational framework.

- Customer Trust: A single significant cybersecurity incident could severely damage Humm Group's reputation and erode customer loyalty, impacting its market position.

Digital Wallets and Contactless Payments

The increasing use of digital wallets like Apple Pay and Google Pay is fundamentally changing how Australians pay for things. For Humm Group, this means their buy now, pay later (BNPL) services need to seamlessly integrate with these platforms to stay relevant and accessible to a wide customer base.

Contactless payment technology, now a standard for many, further emphasizes the need for Humm Group to offer convenient and quick transaction options. In 2024, a significant portion of Australian retail transactions are expected to be contactless, highlighting a critical area for Humm Group's technological strategy.

- Digital Wallet Penetration: Reports indicate that by the end of 2023, over 70% of Australian smartphone users had adopted at least one digital wallet.

- Contactless Growth: Contactless payments accounted for an estimated 85% of all card transactions in Australia in early 2024.

- Humm Integration: Humm Group's ability to partner with or integrate into these popular payment ecosystems will be crucial for maintaining transaction volume and customer engagement.

- Consumer Preference: A growing segment of consumers, particularly younger demographics, express a strong preference for digital and contactless payment methods over traditional ones.

The rapid advancement of AI and machine learning presents a significant opportunity for Humm Group to refine its credit assessment models and personalize customer experiences. By leveraging these technologies, Humm can expect to see improved risk management and a more tailored service offering, potentially boosting customer retention and acquisition in 2025.

The ongoing development of embedded finance, allowing financial services to be integrated into non-financial platforms, is a key technological trend. This trend enables Humm Group to offer its BNPL solutions directly within various customer journeys, such as during travel bookings or educational course registrations, thereby expanding its reach and accessibility.

The increasing prevalence of digital wallets and contactless payment methods necessitates seamless integration for Humm Group to remain competitive. With an estimated 85% of Australian card transactions being contactless in early 2024, Humm's ability to integrate with these payment ecosystems is vital for maintaining transaction volume and customer engagement.

| Technology | Impact on Humm Group | Data/Projection |

|---|---|---|

| New Payments Platform (NPP) & PayTo | Facilitates instant, data-rich transactions, enabling direct BNPL integration at point of payment. | NPP saw a 60% increase in real-time payments in 2023 (over 1.7 billion transactions). |

| Artificial Intelligence (AI) | Enhances credit risk assessment and customer personalization. | Humm anticipates significant growth in 2025 driven by AI adoption. |

| Embedded Finance | Integrates BNPL services into non-financial platforms, expanding customer reach. | Global embedded finance market projected to reach $7.2 trillion by end of 2024. |

| Cybersecurity | Crucial for protecting transactions and customer data, maintaining trust. | Global cybersecurity spending projected over $200 billion in 2024. Average data breach cost in finance was $5.90 million in 2023. |

| Digital Wallets & Contactless Payments | Requires seamless integration for accessibility and competitiveness. | Over 70% of Australian smartphone users adopted a digital wallet by end of 2023. Contactless payments were ~85% of Australian card transactions in early 2024. |

Legal factors

Australia is set to significantly alter the regulatory landscape for Buy Now Pay Later (BNPL) services, classifying them as credit products starting June 2025. This means companies like Humm Group will need to secure an Australian Credit Licence (ACL). This regulatory change is a major legal factor impacting BNPL providers.

Obtaining an ACL will require Humm Group and similar entities to adhere strictly to responsible lending obligations, ensuring consumers are not overburdened with debt. Furthermore, they must comply with detailed disclosure requirements, providing customers with clear information about their payment plans. Membership in the Australian Financial Complaints Authority (AFCA) will also become mandatory, offering a dispute resolution mechanism for consumers.

New regulations are tightening responsible lending obligations, pushing for more thorough affordability checks that go beyond what customers simply state as their income. This means Humm Group will likely need to enhance its credit assessment procedures to confirm borrowers can genuinely manage repayments, avoiding over-indebtedness.

For instance, in Australia, the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry highlighted significant shortcomings in responsible lending, leading to increased scrutiny. By mid-2024, financial regulators are expected to have implemented revised guidelines, potentially impacting Humm Group's operational costs and product offerings as they adapt to these stricter standards.

Humm Group must closely watch evolving fee and charge regulations in the Buy Now, Pay Later (BNPL) sector, particularly in Australia. Discussions around potential fee caps are ongoing, and any new legislation could directly impact Humm’s revenue streams.

While New Zealand has provided some exemptions for BNPL providers concerning unreasonable fees, Humm Group’s Australian operations will need to be agile. Adapting fee structures to comply with potential new legislative requirements, such as fee caps or disclosure rules, will be crucial for continued operation and profitability.

Data Privacy and Consumer Data Right (CDR)

The expansion of Australia's Consumer Data Right (CDR) is significantly reshaping how financial institutions like Humm Group handle customer information. This framework, designed to give consumers greater control over their data, is pushing for more open banking practices. As of early 2024, over 100 accredited data recipients are active within the CDR ecosystem, demonstrating its growing reach.

For Humm Group, this legal shift necessitates robust security for data sharing and absolute transparency in how data is managed. While compliance is key, the CDR also unlocks potential for Humm to develop innovative services by leveraging this consented data, potentially enhancing customer offerings and competitive positioning.

- CDR empowers consumers: Grants individuals more control over their financial data.

- Open banking drive: Encourages secure data sharing between institutions.

- Humm's obligations: Requires secure mechanisms and transparent data handling.

- Opportunity: Potential for new data-driven services and improved customer experiences.

Mandatory Climate-Related Disclosures

New Australian legislation, commencing from July 2024 or January 2025, mandates climate-related financial disclosures for large corporations and financial institutions. This significant regulatory shift requires companies to report on their environmental impact and governance practices, aligning with global Environmental, Social, and Governance (ESG) standards.

As a financial services provider, Humm Group will be directly impacted by these ESG reporting requirements. The company will need to enhance its transparency regarding its climate-related risks and opportunities, providing stakeholders with a clearer understanding of its sustainability performance.

- Mandatory Disclosures: Australian entities must comply with new climate-related financial disclosure laws starting in mid-2024 or early 2025.

- ESG Focus: Humm Group, as a financial services firm, faces increased scrutiny and reporting obligations on its environmental, social, and governance performance.

- Transparency Enhancement: These regulations aim to improve corporate transparency and accountability concerning climate change impacts and strategies.

- Industry Alignment: The move positions Australia in line with international trends towards mandatory climate reporting for listed companies and financial institutions.

The Australian government's move to regulate Buy Now Pay Later (BNPL) as credit products from June 2025 necessitates Humm Group obtaining an Australian Credit Licence (ACL). This will enforce stringent responsible lending obligations and detailed disclosure requirements, with mandatory membership in the Australian Financial Complaints Authority (AFCA) for dispute resolution.

Stricter affordability checks are being implemented, requiring Humm Group to enhance its credit assessment processes beyond self-reported income to prevent consumer over-indebtedness, a direct response to concerns raised by the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Humm Group must also navigate potential changes to fee and charge regulations in the BNPL sector, with ongoing discussions in Australia about possible fee caps that could directly impact revenue streams.

The expansion of Australia's Consumer Data Right (CDR) from early 2024, with over 100 accredited data recipients, requires Humm Group to ensure robust data security and transparency in data management, while also presenting opportunities for new data-driven services.

Environmental factors

New Australian legislation, effective from July 2024 for large entities and January 2025 for financial institutions like Humm Group, mandates climate-related financial disclosures. This means Humm Group must now report on its greenhouse gas emissions, starting with Scope 1 and 2, and eventually including Scope 3.

This regulatory shift is a significant environmental factor, requiring Humm Group to invest in data collection and reporting infrastructure to comply with these mandatory ESG reporting requirements. Failure to comply could lead to reputational damage and potential penalties.

The Australian Sustainable Finance Institute's (ASFI) 2025-2027 Action Plan is a significant development, aiming to embed sustainability across Australia's financial sector. This strategic roadmap, launched in early 2024, highlights a growing imperative for financial institutions like Humm Group to integrate Environmental, Social, and Governance (ESG) principles into their core operations and product offerings.

This industry-wide push towards sustainable finance means Humm Group will likely face increasing expectations from regulators, investors, and consumers to demonstrate its commitment to sustainable practices. This could influence everything from lending criteria to the development of new financial products, potentially impacting Humm Group's market position and competitive advantage.

Regulatory bodies and consumers are increasingly demanding genuine sustainability efforts, putting a spotlight on companies making misleading environmental claims, often called greenwashing. This trend means financial institutions like Humm Group must be extra careful about how they present their environmental initiatives.

Ensuring the truthfulness of environmental claims and the effectiveness of carbon offsetting programs presents a significant hurdle for financial service providers. For instance, the Australian Securities and Investments Commission (ASIC) has been actively monitoring greenwashing in financial products, with several enforcement actions anticipated or underway in 2024.

Humm Group needs to prioritize accuracy and transparency in all its environmental statements and activities. This includes clearly substantiating any claims about eco-friendly practices or carbon reduction targets to maintain trust and avoid potential regulatory penalties.

Demand for Green Finance Products

The growing emphasis on environmental, social, and governance (ESG) factors is significantly shaping consumer preferences and regulatory landscapes. This trend presents a clear opportunity for financial service providers to develop and promote 'green finance' products, offering incentives for environmentally conscious purchasing decisions. For instance, a growing number of consumers are actively seeking out financial solutions that align with their sustainability values.

Humm Group, while not currently prioritizing green finance, could strategically explore integrating such offerings into its existing Buy Now Pay Later (BNPL) or other lending products. This could involve partnerships with sustainable brands or offering preferential rates for eco-friendly purchases. The market for green finance is expanding rapidly, with global sustainable finance assets projected to reach $50 trillion by 2025, according to various industry reports, indicating substantial potential for growth.

- Growing Consumer Demand: Surveys in 2024 indicate that over 60% of consumers consider a company's environmental impact when making purchasing decisions.

- Regulatory Push: Governments worldwide are implementing stricter environmental regulations, encouraging financial institutions to offer sustainable financing options.

- Market Opportunity: The global green bond market alone exceeded $500 billion in 2023, demonstrating a strong appetite for ESG-aligned financial products.

- Potential for Humm Group: Integrating green finance could enhance Humm Group's brand reputation and attract a new segment of environmentally conscious customers.

Operational Environmental Footprint

Even though Humm Group operates primarily in financial services, its day-to-day activities generate an environmental footprint. This stems from energy used in offices and data centers, waste generated by operations, and the environmental impact of its supply chain. For instance, many financial institutions are increasingly scrutinizing their Scope 1, 2, and 3 emissions, with a growing emphasis on reducing energy consumption in digital infrastructure.

As environmental, social, and governance (ESG) frameworks become more prevalent and stakeholder expectations rise, Humm Group's commitment to managing its operational impact will be crucial. Companies are expected to demonstrate tangible efforts in sustainability. For example, many financial firms aim to achieve net-zero emissions by specific dates, often detailing their plans for energy efficiency and renewable energy sourcing.

To address this, Humm Group could focus on several key areas:

- Energy Efficiency: Implementing measures to reduce electricity consumption in its physical and digital infrastructure.

- Waste Reduction: Minimizing waste through recycling programs and digital-first approaches to documentation.

- Sustainable Procurement: Evaluating and selecting suppliers based on their environmental performance and practices.

- Reporting and Transparency: Publicly disclosing its environmental performance and setting clear reduction targets, aligning with global reporting standards.

New Australian legislation from July 2024 and January 2025 requires Humm Group to disclose climate-related financial information, focusing initially on Scope 1 and 2 emissions. This regulatory shift necessitates investment in data infrastructure for mandatory ESG reporting, with non-compliance risking reputational damage and penalties.

The Australian Sustainable Finance Institute's 2025-2027 Action Plan, launched in early 2024, signals a strong push for sustainability integration within the financial sector. Humm Group faces increasing expectations from stakeholders to embed ESG principles, potentially influencing product development and market competitiveness.

Growing consumer demand for genuine sustainability and regulatory scrutiny of greenwashing, as highlighted by ASIC's 2024 enforcement actions, means Humm Group must ensure transparency in its environmental claims. Accurate substantiation of eco-friendly practices is vital for maintaining trust and avoiding penalties.

The global green finance market is expanding rapidly, projected to reach $50 trillion by 2025, presenting a significant opportunity for Humm Group to introduce sustainable financial products. Consumer surveys in 2024 show over 60% consider environmental impact in purchasing decisions, indicating a strong market for eco-conscious financial solutions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Humm Group is built on a robust foundation of data from reputable financial institutions, market research firms, and government publications. We incorporate economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.